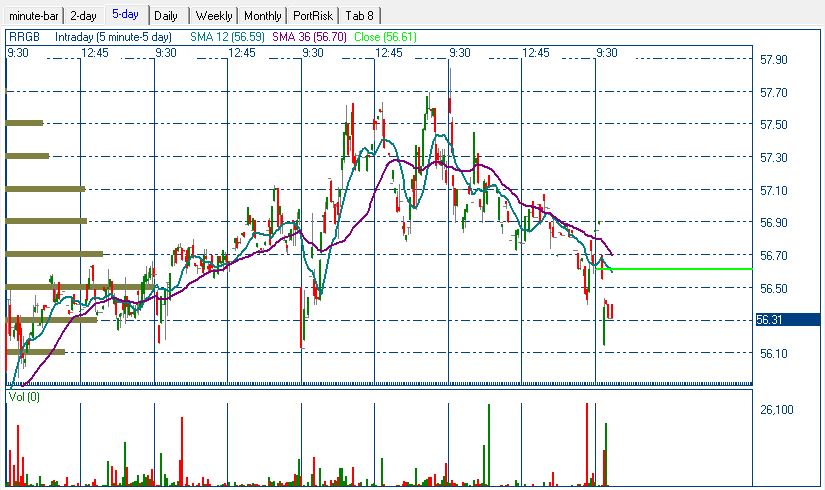

This isn't an ideal set-up, as the stock left a gap today, but RRGB has been flying on pure PE expansion this year - the estimates for 2014 haven't really changed. The stock is now expensive in my view at 24X and is certainly extended. Restaurants in general have been strong. RRGB is up about 60% YTD and ripe for profit-taking. The trade expires 6/27 with a target of 50.55 and a stop-loss of 57.55. With an entry price of 56.33, this represents up/down of 4.7X.

We see here that the 10dma last touched the 50dma in November. The stock has had a series of runs followed by consolidations, but none have been significant yet. After a report that was merely in line with expectations, the stock shot up from 49 less than a month ago. Our target is set at the top of the trading going into that number and should be still above the rising 50dma, currently near 49. It's above the close on earnings day and above the bottom of the candle two days later. Our trade, then, just gets us back to where we were a few weeks ago.

Looking at the 5-day, the entry isn't optimal, as it is near the lows and we left a gap in the trading this morning. I see signs of profit-taking - look at the large volume sell near the close yesterday. Also, since posting the multi-year high two days ago, the stock has been experiencing a controlled sell-off with lower highs and lower lows. I can see a quick test of 56.75, but given the negative tone of the market I was willing to enter here. Still, given the bullish trend for the stock, the stop-loss is tight. It is set in line with the bottom of that candle from trading early yesterday when it posted a new 52-week high and reversed.

Recent free content from Cannabis Analyst

-

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

-

Long Trade 08/14/13

— 8/14/13

Long Trade 08/14/13

— 8/14/13

-

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

-

Short Trade 07/03/13

— 7/03/13

Short Trade 07/03/13

— 7/03/13

-

Webinar Slides

— 6/21/13

Webinar Slides

— 6/21/13

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member