Weekly Wrap-Up (up +114% in 2 months!) + Market Forecast + Sector Watch: SPX, Nasdaq, FAS, FDN, TAN, OIH, XLE

Last weekend, in my Market Forecast, I wrote:

" For the new week, I think the markets will be volatile again. Although we saw a solid bounce on Friday, both SPX and Nasdaq closed below their respective daily MAs (The Dow looks a bit stronger, closing above its 20-day MA). If SPX and Nasdaq fall below the support levels again, I don't think they will hold this time. Below 1980, SPX has support around 1950, while for Nasdaq, below 4500, it has support between 4400 and 4350."

Once again, things happened as discussed in the forecast. On Monday and Tuesday, the markets negotiated with the support levels, ie SPX 1980 and Nasdaq 4500. Wednesday morning brought a quick drop, and the support levels were broken. It was like the flood gate was open, and the "water level" kept going lower. The sell-off continued on Thursday morning, and SPX went briefly below 1930, while Nasdaq fell below 4370. Buyers quickly came in. By the time, market closed on Thursday, SPX came back up and tested 1950! Friday was a positive day after jobs report came in better than expected. For the week, SPX still closed below 1980 and Nasdaq closed below 4500.

We had a really nice week, catching nice trades on both sides. 100% of our closed trade were profitable. These 15 trades gave our portpolio another big boost of over $25,000. My Ecstatic Plays Portfolio is now up +114% after just 2 months!

| GS Options Sell to close 10.00 (2.46%) of GS Oct 18 2014 Call 185.0 at 5.00000 | 6.38% ($300.00) Profit |

| ALXN Options Sell to close 5.00 (2.69%) of ALXN Oct 18 2014 Call 165.0 at 10.80000 | 111.76% ($2,850.00) Profit |

| BIDU Options Sell to close 5.00 (2.58%) of BIDU Oct 18 2014 Put 215.0 at 10.36000 | 48.00% ($1,680.00) Profit |

| AAPL Options Sell to close 30.00 (3.97%) of AAPL Oct 18 2014 Put 100.0 at 2.70000 | 5.88% ($450.00) Profit |

| POT Options Sell to close 30.00 (2.83%) of POT Oct 18 2014 Put 35.0 at 1.88000 | 9.37% ($2,310.00) Profit |

| POT Options Sell to close 20.00 (1.65%) of POT Oct 18 2014 Put 35.0 at 1.66000 | 49.55% ($1,100.00) Profit |

| BIDU Options Sell to close 10.00 (3.50%) of BIDU Oct 18 2014 Put 212.5 at 7.20000 | 2.86% ($200.00) Profit |

| BIDU Options Sell to close 20.00 (8.65%) of BIDU Oct 10 2014 Put 220.0 at 9.00000 | 68.22% ($7,300.00) Profit |

| CTRP Options Sell to close 15.00 (2.61%) of CTRP Oct 18 2014 Put 59.0 at 3.35000 | 21.82% ($900.00) Profit |

| LNKD Options Sell to close 10.00 (2.17%) of LNKD Oct 03 2014 Put 210.0 at 4.35000 | 2.35% ($100.00) Profit |

| GS Options Sell to close 10.00 (1.69%) of GS Oct 10 2014 Put 185.0 at 3.35000 | 26.42% ($700.00) Profit |

| CTRP Options Sell to close 15.00 (2.32%) of CTRP Oct 18 2014 Put 59.0 at 3.00000 | 9.09% ($375.00) Profit |

| CLVS Options Sell to close 10.00 (2.24%) of CLVS Oct 18 2014 Call 45.0 at 4.30000 | 30.30% ($1,000.00) Profit |

| BIIB Options Sell to close 10.00 (4.52%) of BIIB Oct 18 2014 Put 330.0 at 8.90000 | 13.38% ($1,050.00) Profit |

| TIBX Options Sell to close 60.00 (8.31%) of TIBX Oct 18 2014 Call 21.0 at 2.60000 |

52.94% ($5,400.00) Profit |

If your not a member yet, you can get more details from my product page: please click here. If you are already a member, you can access full trade history under the "Portfolio" section.

For the week, the Dow was down 103.46 points; SPX dropped 14.95 points; Nasdaq fell 36.56 points. Gold fell below $1190/ounce while oil (WTI) tumbled below $90/barrel! At the time of this writing, Asian markets were up. Here's how the US markets closed on Friday:

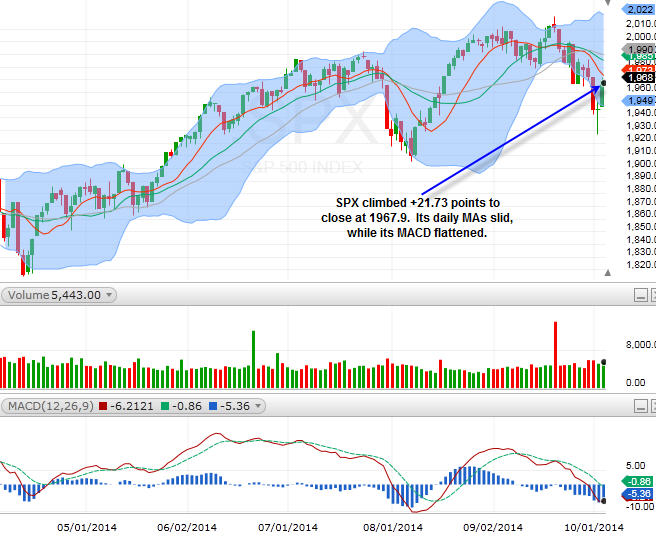

SPX

SPX climbed +21.73 points to close at 1967.9. Its daily MAs slid, while its MACD flattened.

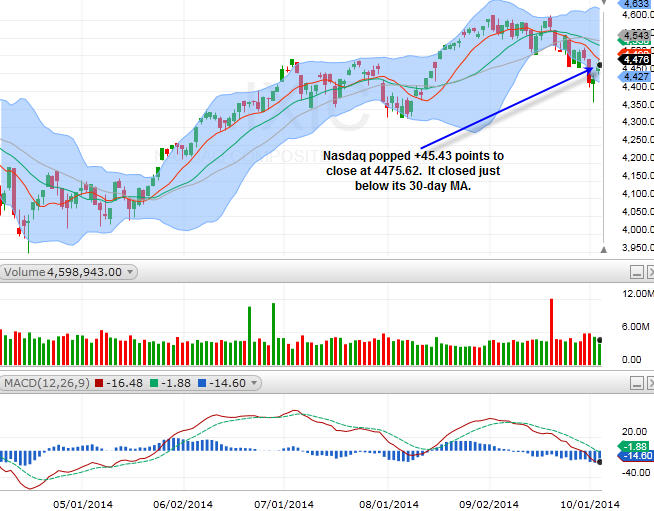

Nasdaq

Nasdaq popped +45.43 points to close at 4475.62. It closed just below its 30-day MA.

Although both SPX and Nasdaq got a solid bounce on Friday, both indices still closed below their respective daily MAs. For the new week, earnings season is starting, but, next week is still a light week. I think stocks are looking for a quick bounce. For SPX, resistance lies between 1980 and 1990. Nasdaq has resistance between 4500 and 4550. Financials are particularly strong. Energy sectors remain weak, as the dollar keeps climbing. But, I'm interested in solars. Let's take a look.

Sector Watch

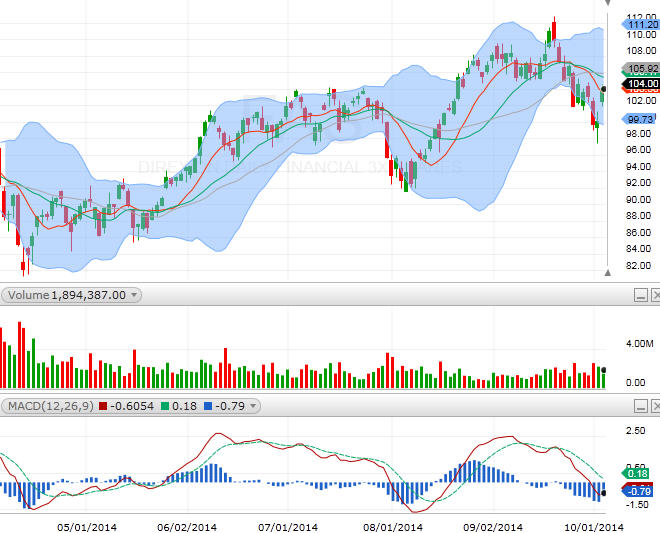

FAS (financial)

FAS courageously closed above its 10-day MA. GS and BAC were particularly strong. WFC and JPM are not too bad either. V and MA are still under pressure.

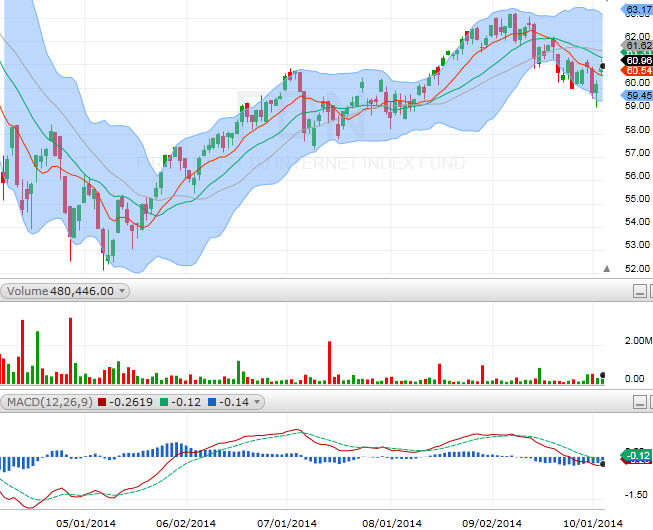

FDN (internet)

FDN also closed above its 10-day MA. TWTR popped to a new multi-month high on Friday, touching $54. NFLX was very strong as well, as its business keeps expanding. FB is hanging. AMZN is working hard to establish a base. PCLN and YELP are still weak.

TAN (solar)

TAN's chart is by no means 'positive'. But, have you noticed that global warming is catching more and more attention? There may be a million reasons why coal and oil are all falling, but, have you considered that perhaps central governments around the world are already secretly working on a plan to switch the energy paradigms to alternative, green energies? Is where you living getting hotter every year? I'm going to be watching solar stocks very closely. I think this sector is waiting for a pop. Let's pay attention to FSLR, SPWR, SCTY, TSL, JKS.

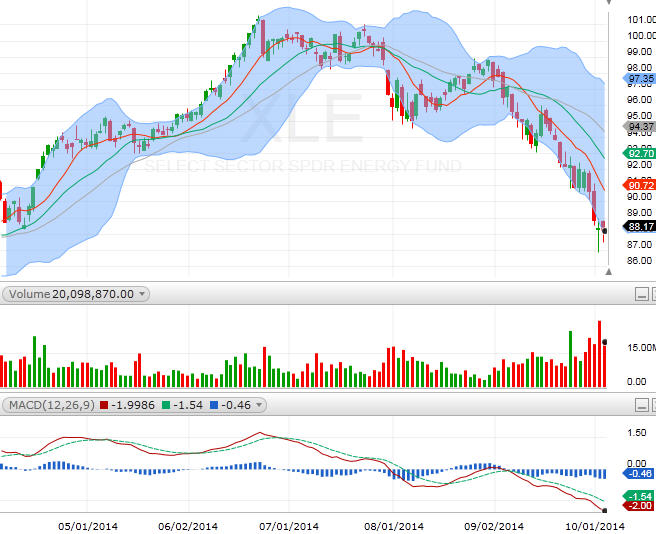

OIH/XLE (oil services/energy)

Both OIH and XLE are testing important support levels: OIH 48; XLE 88. I think we'll see some bounces. OXY seems to keep on finding buyers. APA and NOV were really weak. APC, SLB, and EOG should lead the sector if it bounces.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member