Click Here for this Week's Full Letter - November 11, 2014

Greetings,

Much to the chagrin of European leaders, Russia continues to antagonize its neighbors. This is a tactic Russian leaders have used regularly for over a century, and yet it seems different this time. The Soviets historically push their influence from a position of strength. Today, Russia’s economy is in shambles and there is genuine concern over a currency crisis.

Last week, the Central Bank of Russia announced it will stop intervening in currency markets and let the Ruble free-float. FX reserves are almost depleted and capital continues to race out of the country. It’s only a matter of time until even stronger stagflationary winds start to blow, as the Ruble is down more than 25% in trade-weighted terms.

Something will have to give in the next few months. Putin’s forces continue to stir the pot in Ukraine, and other Baltic nations are starting to lose their patience. The Estonian defense minister says that while he does not see outright military conflict as likely, Russia has returned to Cold War tactics by stepping up incursions. NATO fighter jets around the Baltic States were scrambled 86 times through the first two weeks of October – double the amount from all of last year.

Even Mikhail Gorbachev says the world is “on the brink of a new Cold War.” While Russia is clearly the aggressor in terms of military incursions, I do believe that the US and Saudi Arabia are colluding to undermine the Russian economy via lower oil prices. It’s not as conspiratorial as you might think. Oil and gas make up more than 50% of Russia’s revenue, and every $1 drop in oil costs $2.3 billion in budget revenue. The Saudi’s have a major bone to pick with Putin in Syria, and oil is their most potent weapon.

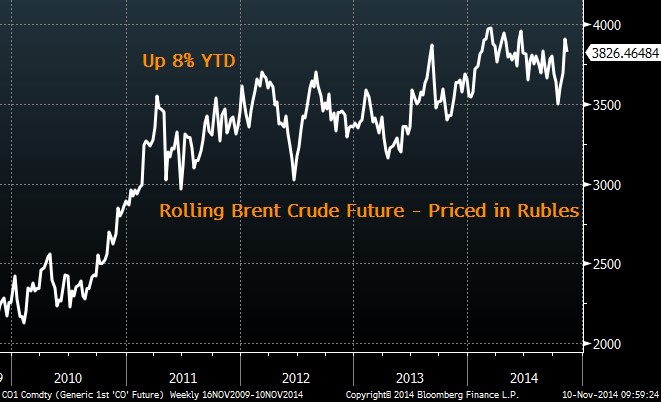

I published a piece on this subject last month (Read Here) and the conclusion was to buy crude oil priced in Ruble – which is up 8% YTD versus -25% in USD. My thought process is that lower oil prices will bankrupt Russia and ultimately force a major currency devaluation. It may seem counterintuitive to buy oil while the world’s largest exporter actively pushes prices lower, but at the very least this portfolio hedge has a fantastic risk/reward profile. Without a prime brokerage account selling the Ruble might be difficult these days. As an alternative, shorting the Market Vectors Russia ETF (ticker: RSX) should be a decent proxy.

I still have cash in the Cup & Handle portfolio and have started looking into oversold and overbought sectors (more on this below). The portfolio was up ~4% last week after some big gains in my favorite uranium miners. It finally sounds like the Japanese realize the importance of nuclear energy, and they could start putting reactors back online soon. As I’ve said before, uranium is a sector we intend to be involved in for a long time. If you’d like to be involved yourself please click here for more info. Your subscription will pay for itself in no time.

Today’s letter will cover several topics, including:

- Alibonanza

- Souring on Blue Chips

- Opportunities in Oil

- Chart of the Week

With that, I give you this week's letter:

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member