Overview

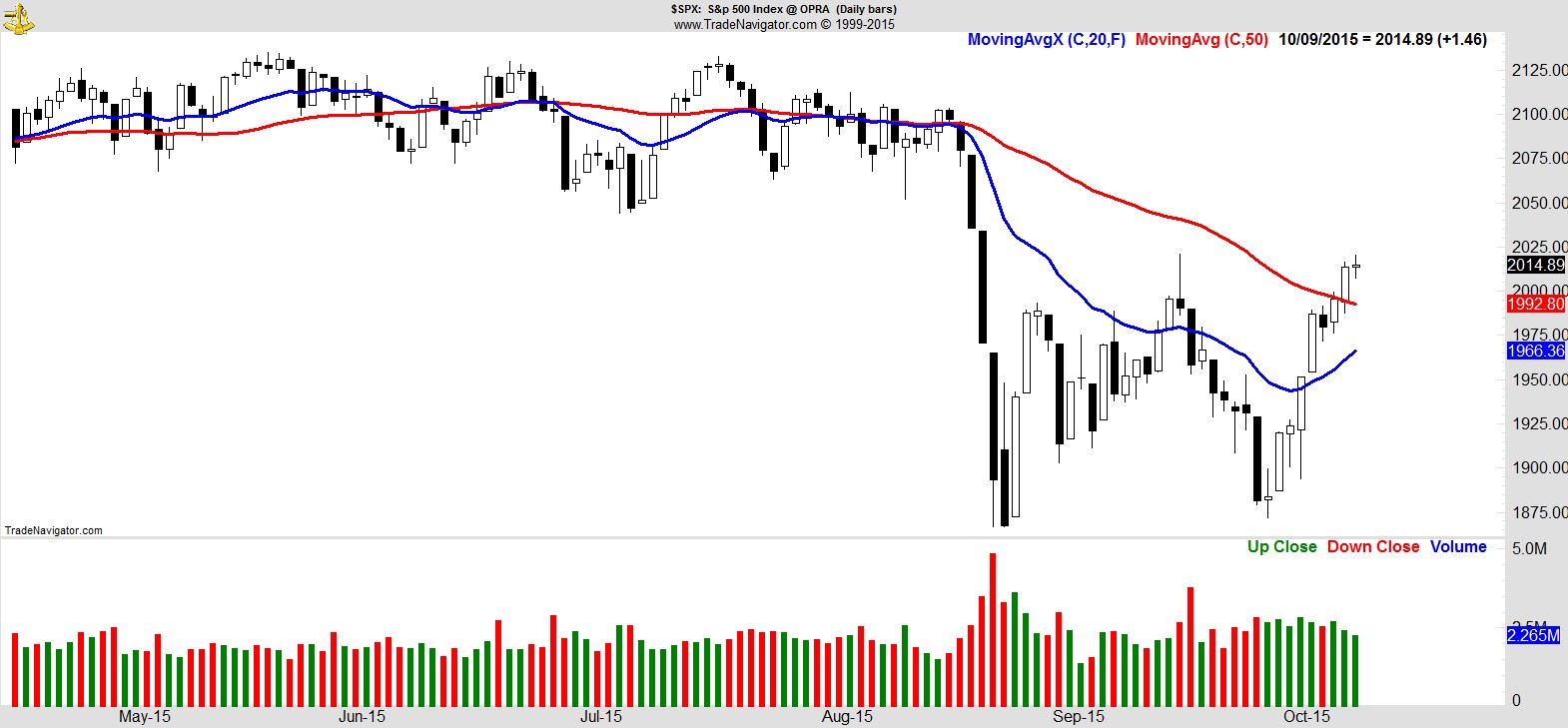

Stocks continued their recovery this week with the S&P gaining 3.3%, led by a surge in Energy and Materials. The S&P is now just 5.4% below its highs, having risen for 8 of the last 9 sessions, finishing the week above its 50-day MA for the first time since 8/18.

.

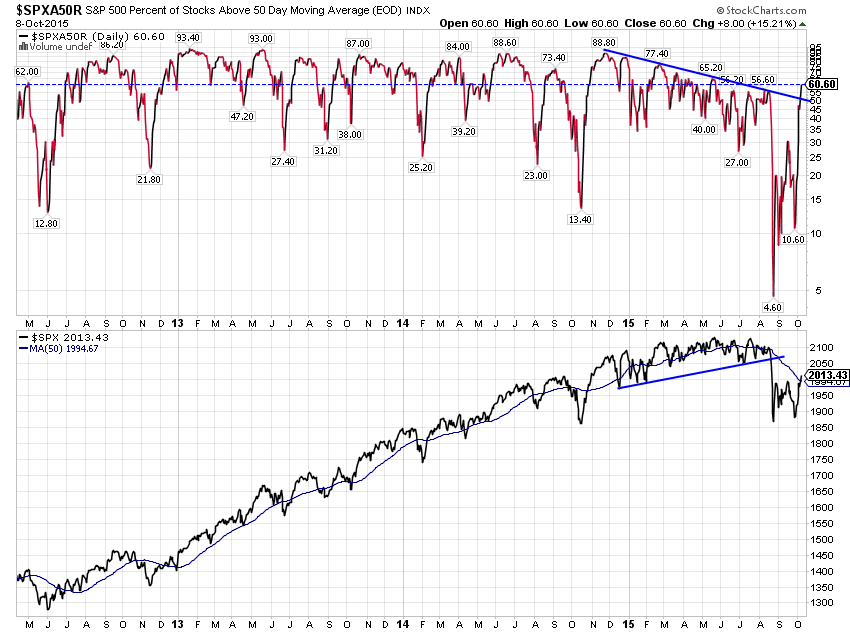

It wasn't just an advance in oversold sectors however.

This chart from Charlie Bilello, CMT @MktOutperform perfectly demonstrates the change that's taken place, showing the percentage of stocks above their 50-day MA has moved to over 60%, the most since May.

.

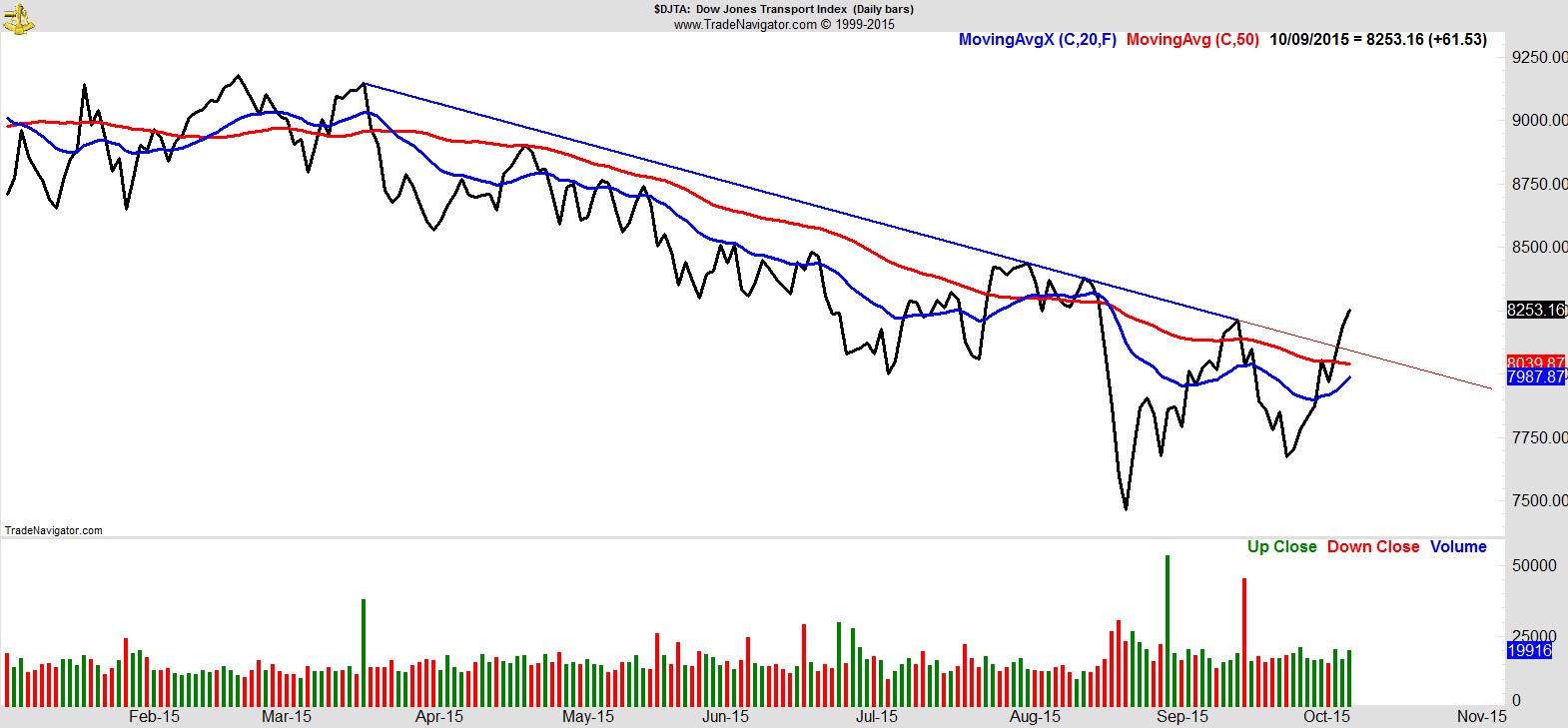

Another notable area of strength this week was in the Transports index, posting its highest close since 8/19, and overcoming a descending trendline of lower highs from March 2015.

.

Overall, the market went a long way towards putting in some of the work I've thought would be necessary for my timeframe before actionable ideas could again present themselves.

.

Alpha Capture Portfolio

Our portfolio was again relatively quiet, gaining 0.6% on the week vs 3.3% for the S&P.

It's now -1.7% YTD vs -2.1% for the S&P.

Not surprisingly, given the changing market landscape, we had two new entries trigger this week, but with only three positions and over 80% in cash, on a relative basis the lead we had over the index for most of the year is rapidly narrowing against a resurgent market. Barring a swift reversal, it's likely we'll have additional entries and trade ideas in the coming days, reflecting the recent strength and number of individual names hitting fresh highs.

.

Sector Overview

The nascent recovery in Energy ($XLE) gathered pace this week, and although for anyone with a longer timeframe there's still a lot of work to be done, for shorter-term players there's already a higher low and higher high in place, and perhaps a 'fear of missing out' on the bargains to be had.

.

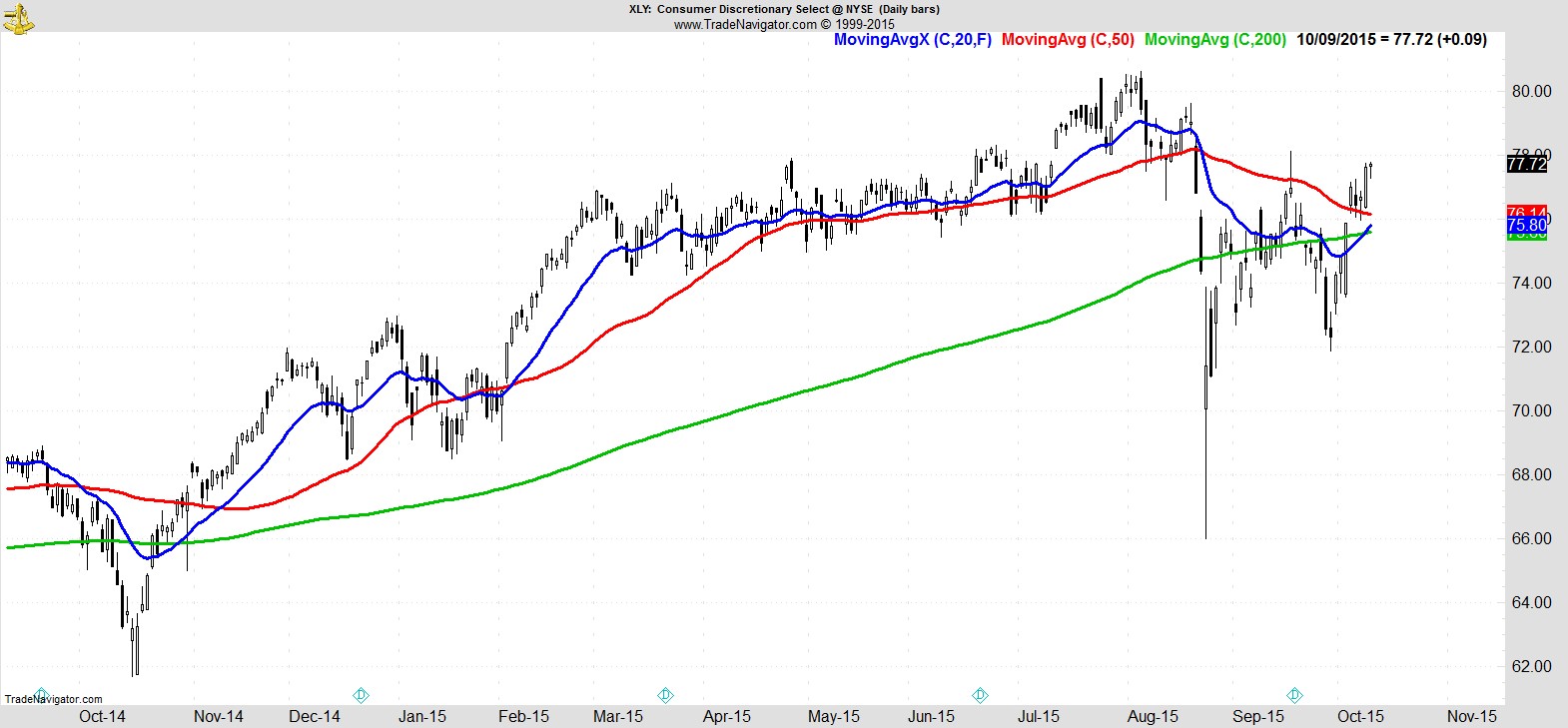

Longer-term the leading sector remains Consumer Discretionary ($XLY), spending every day this week above its 20, 50, and 200-day MA's, and looking like it's ready to resume its longer-term uptrend.

.

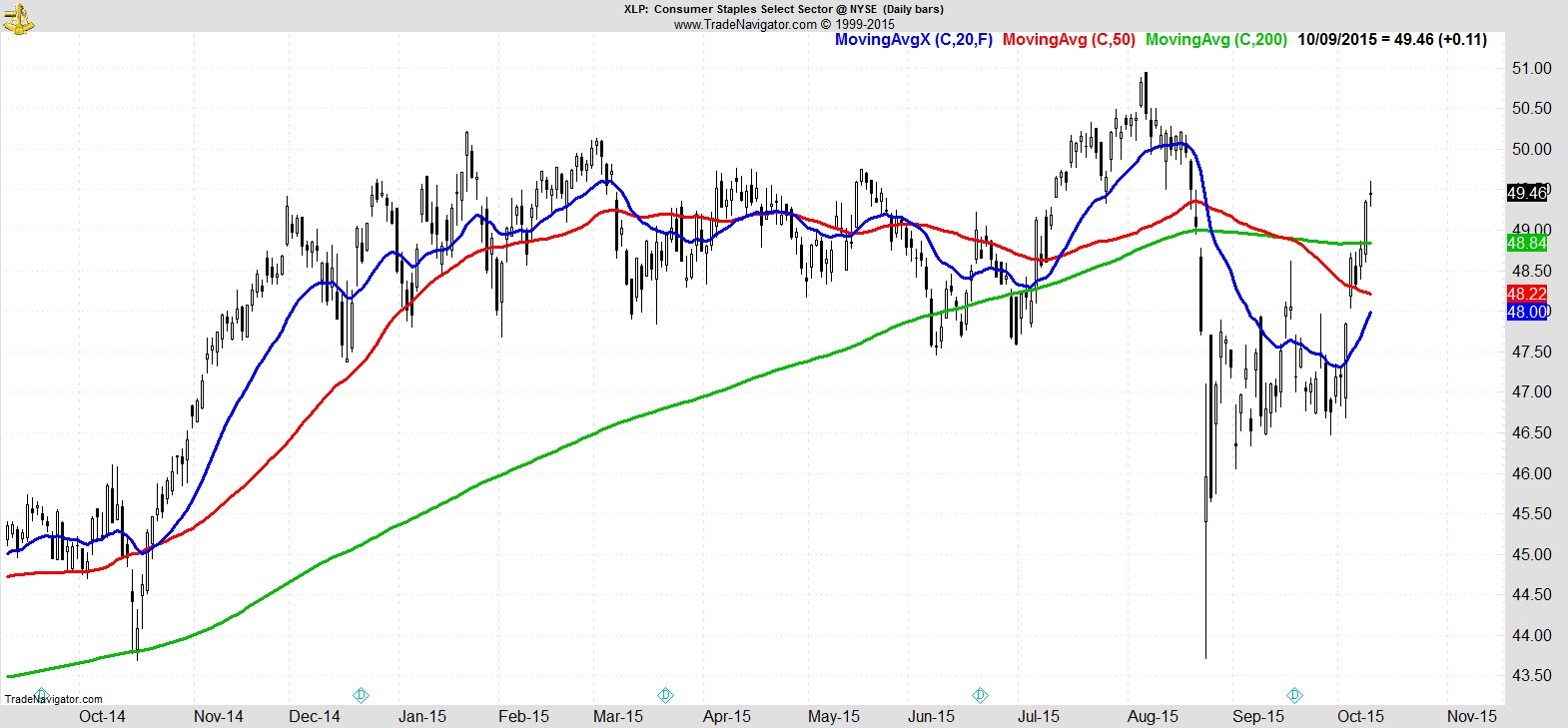

Consumer Staples ($XLP) also continued to recover, and is the only other sector SPDR above its 200-day.

.

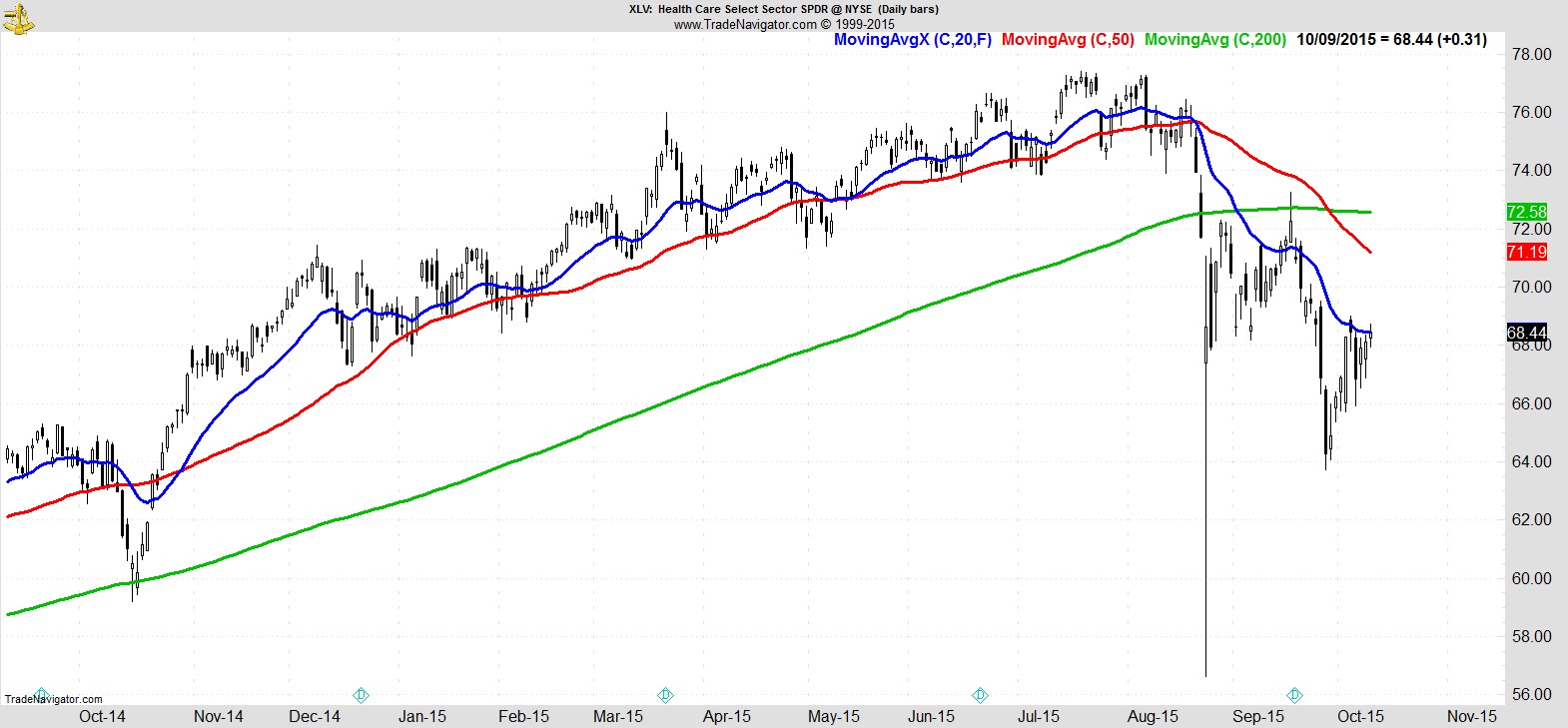

Incredibly, Healthcare ($XLV) now finds itself at the bottom of the heap, below its 20EMA and barely positive on the week.

.

Watchlist

Consumer-related stocks still dominate our list, but we're starting to see representation from other areas now, a welcome development if this recent market upswing is to become sustainable longer-term.

Here's a sample of 8 names from the full list of 30:-

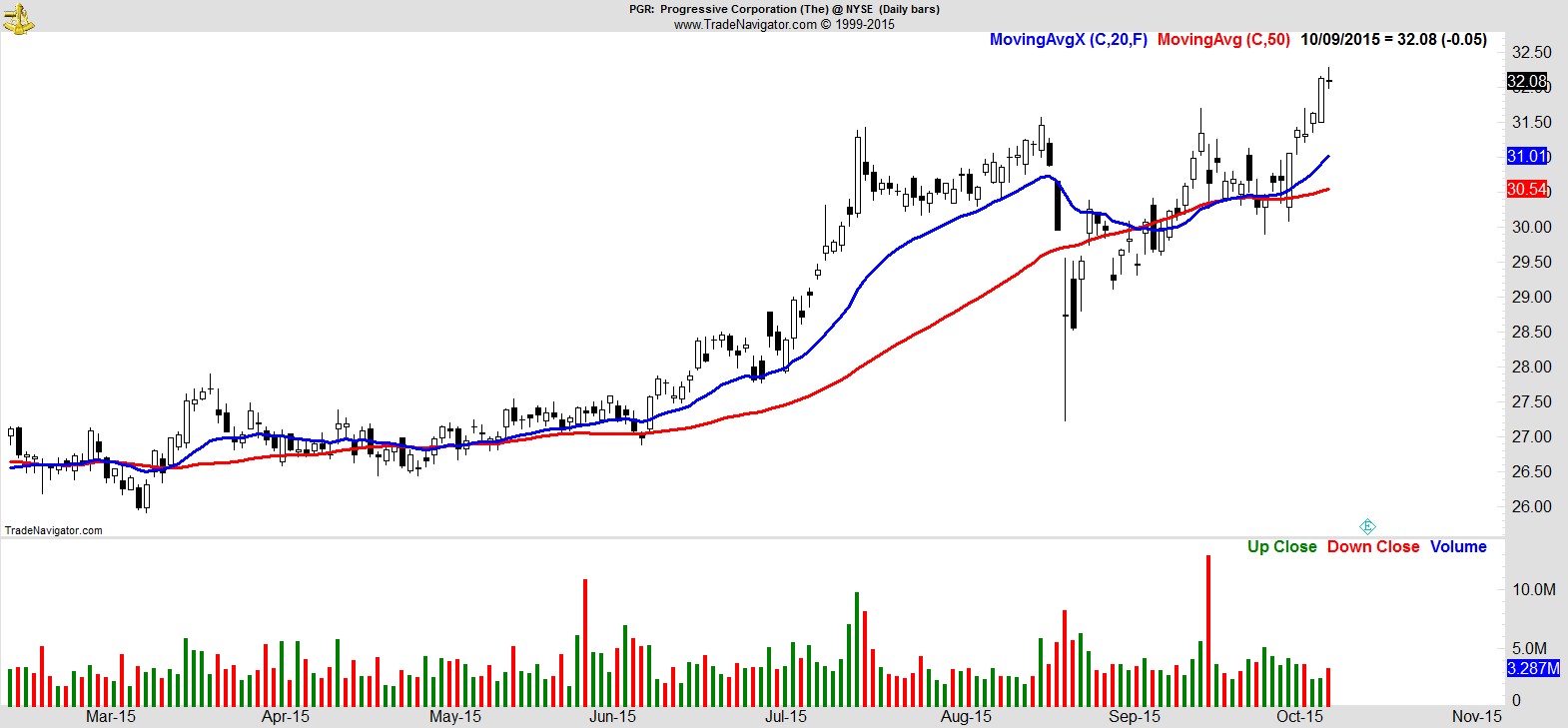

$PGR

.

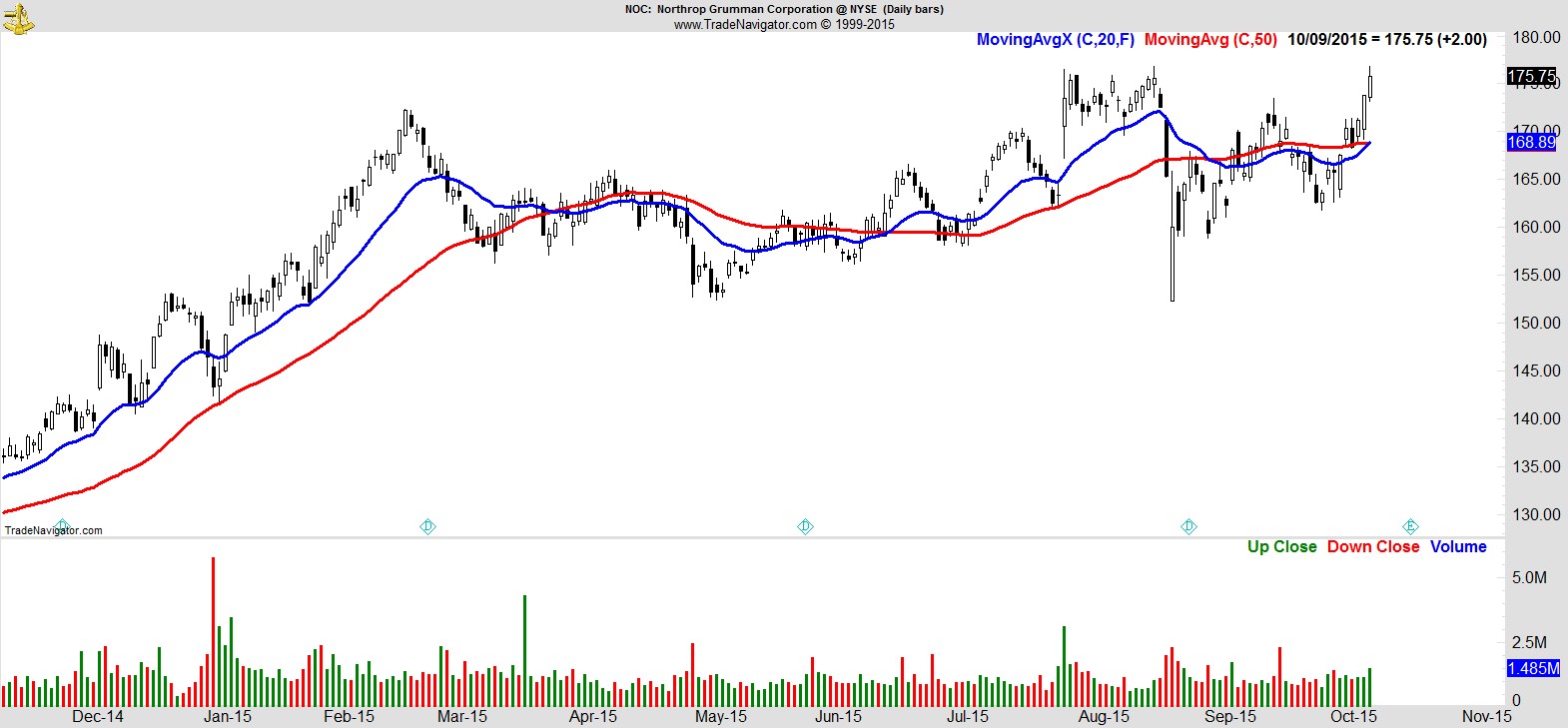

$NOC

.

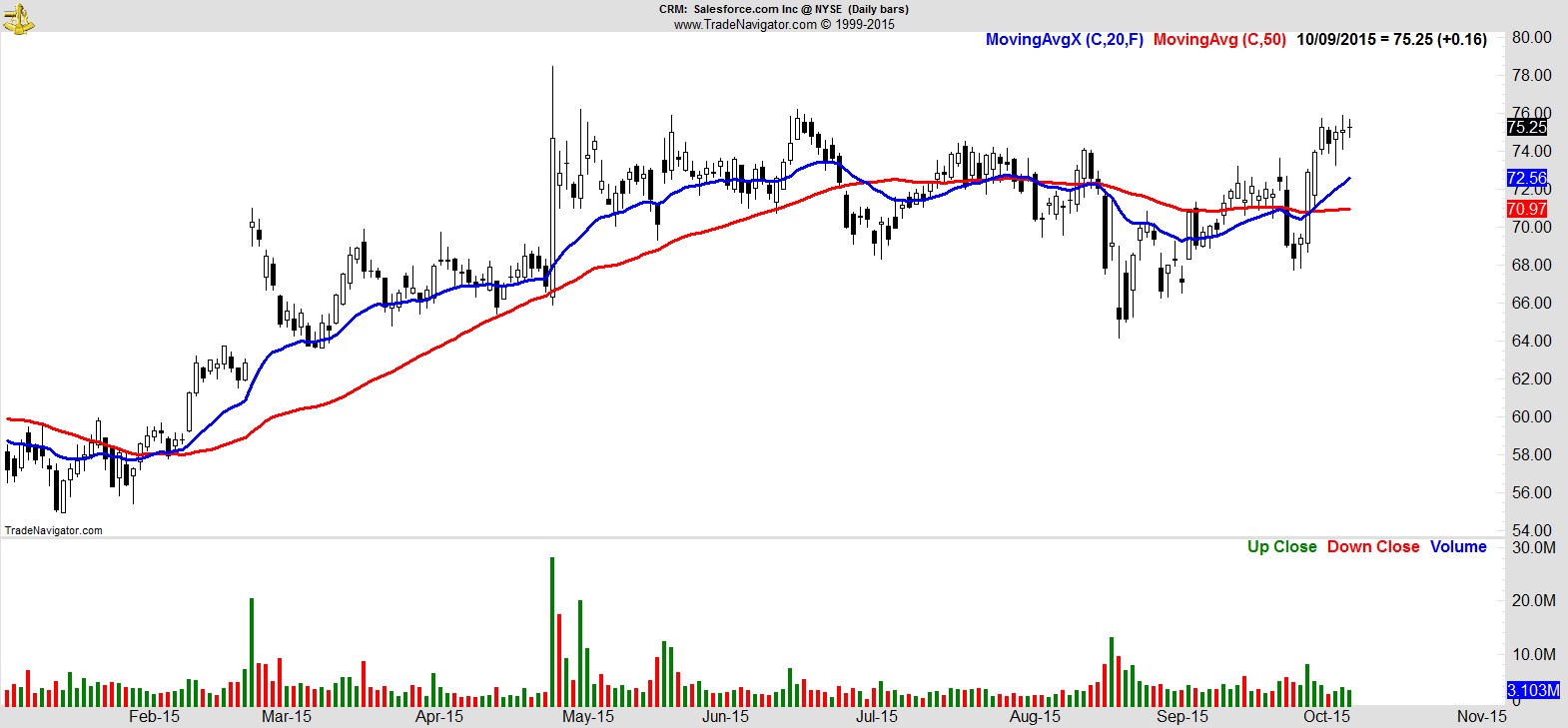

$CRM

.

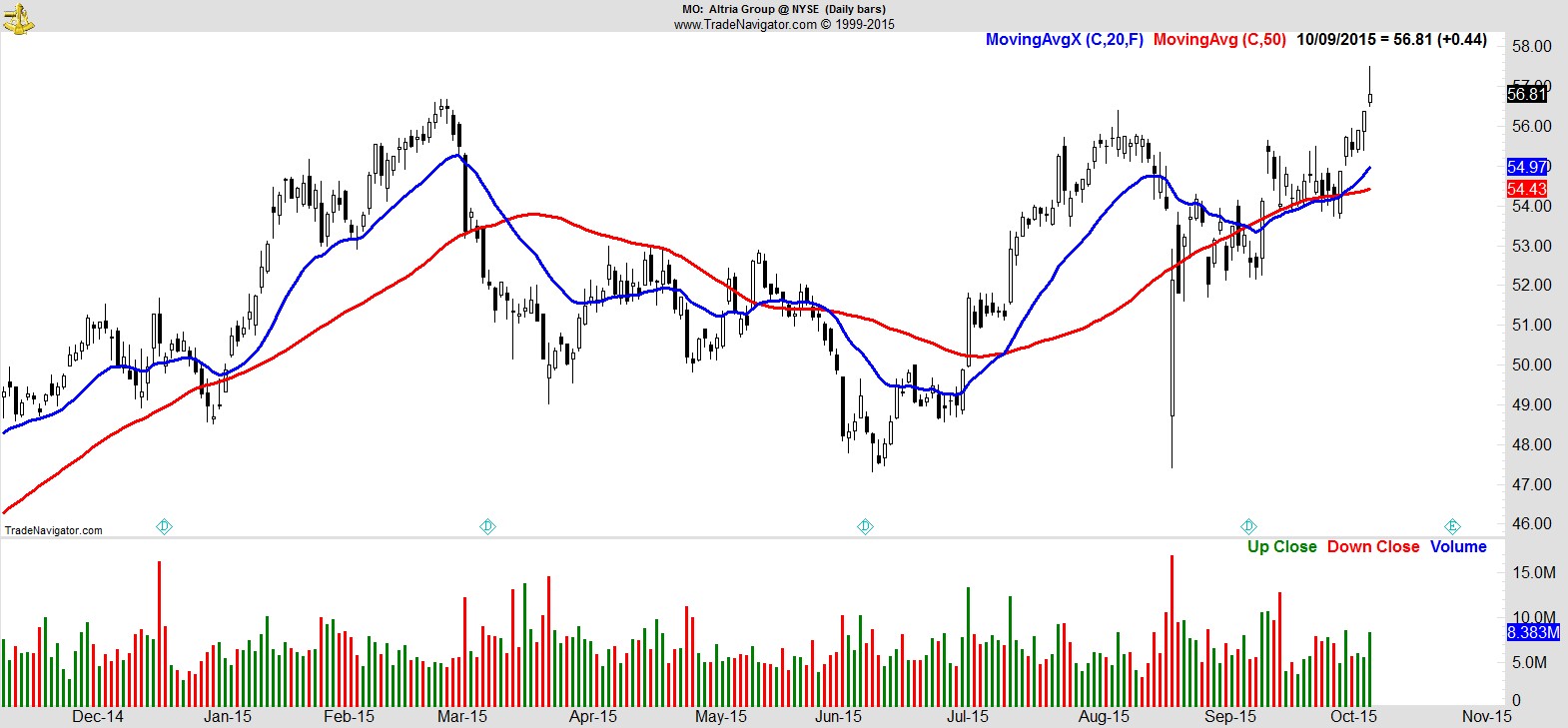

$MO

.

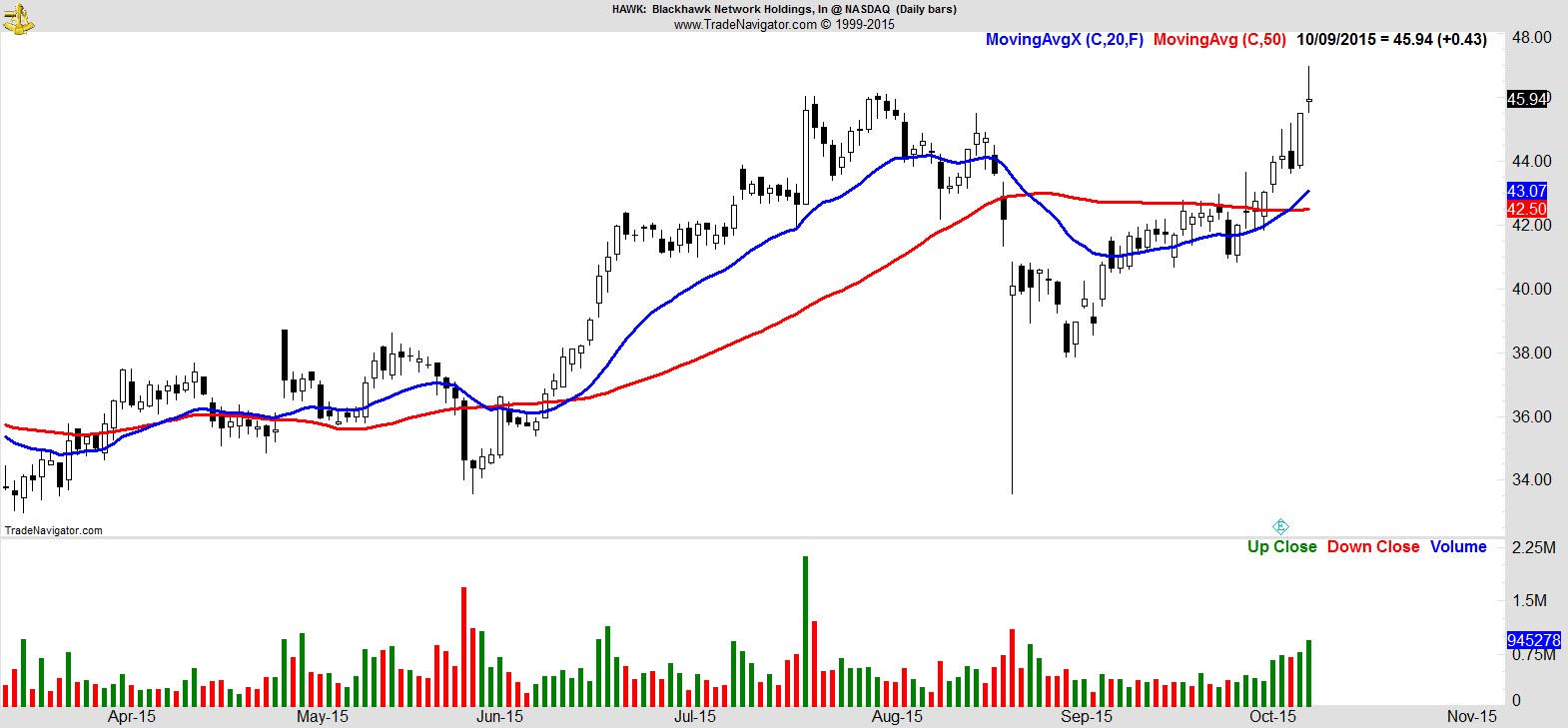

$HAWK

.

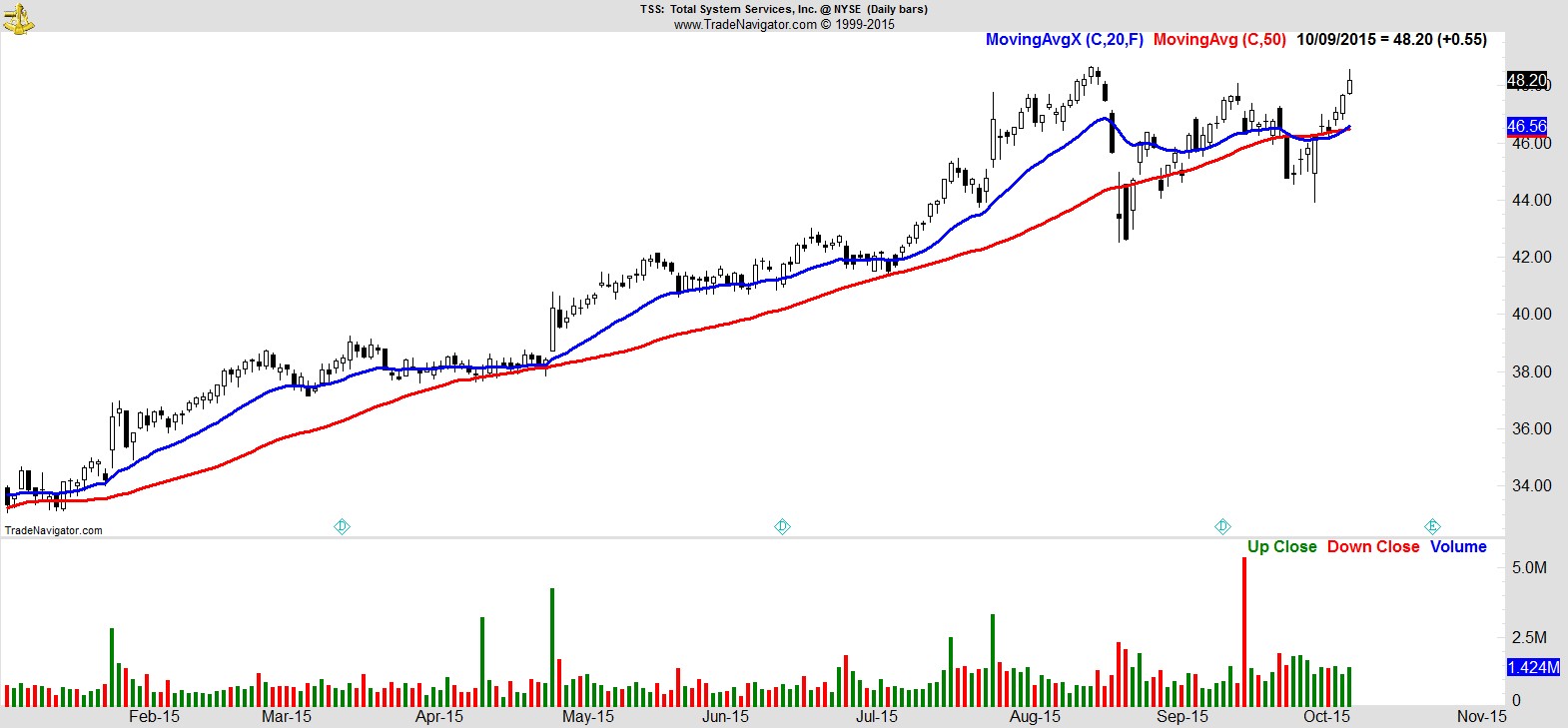

$TSS

.

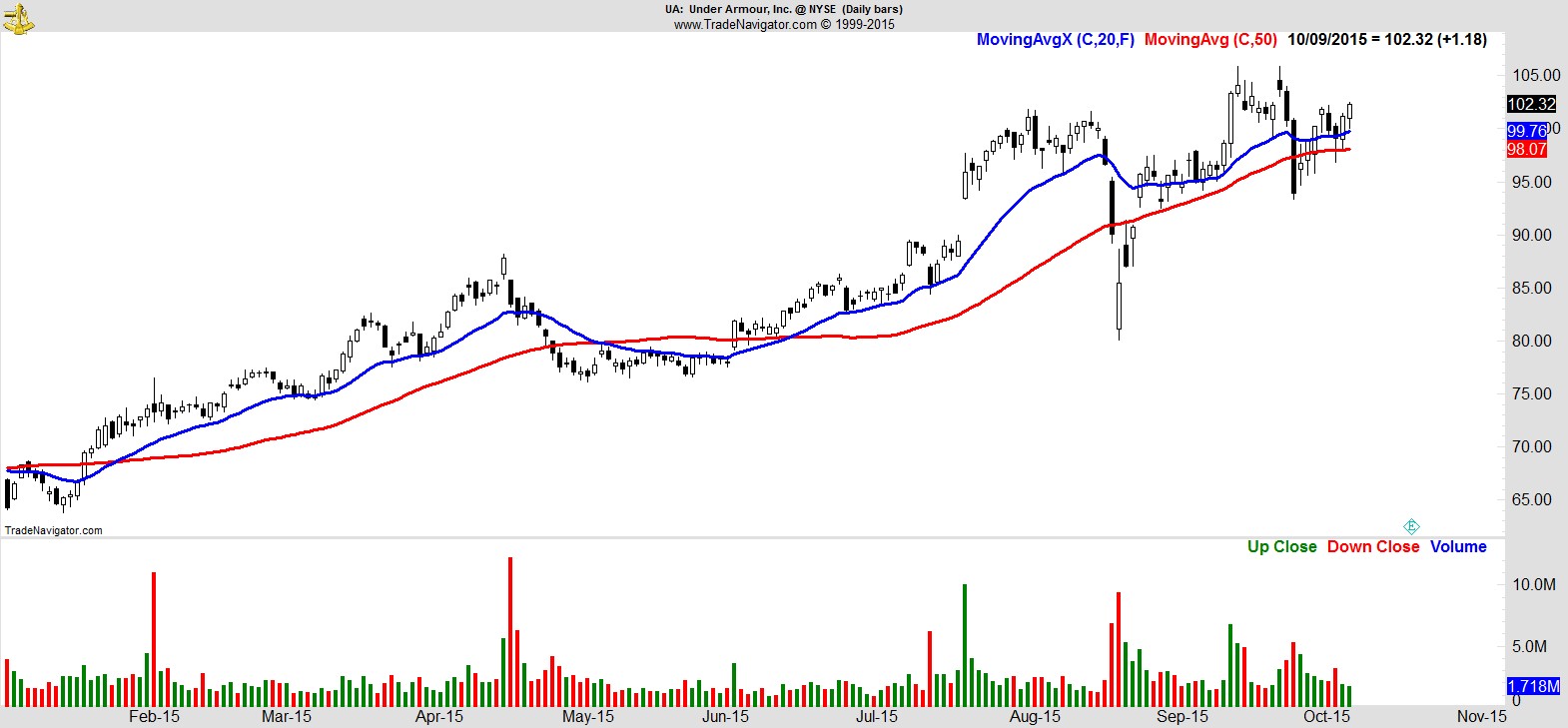

$UA

.

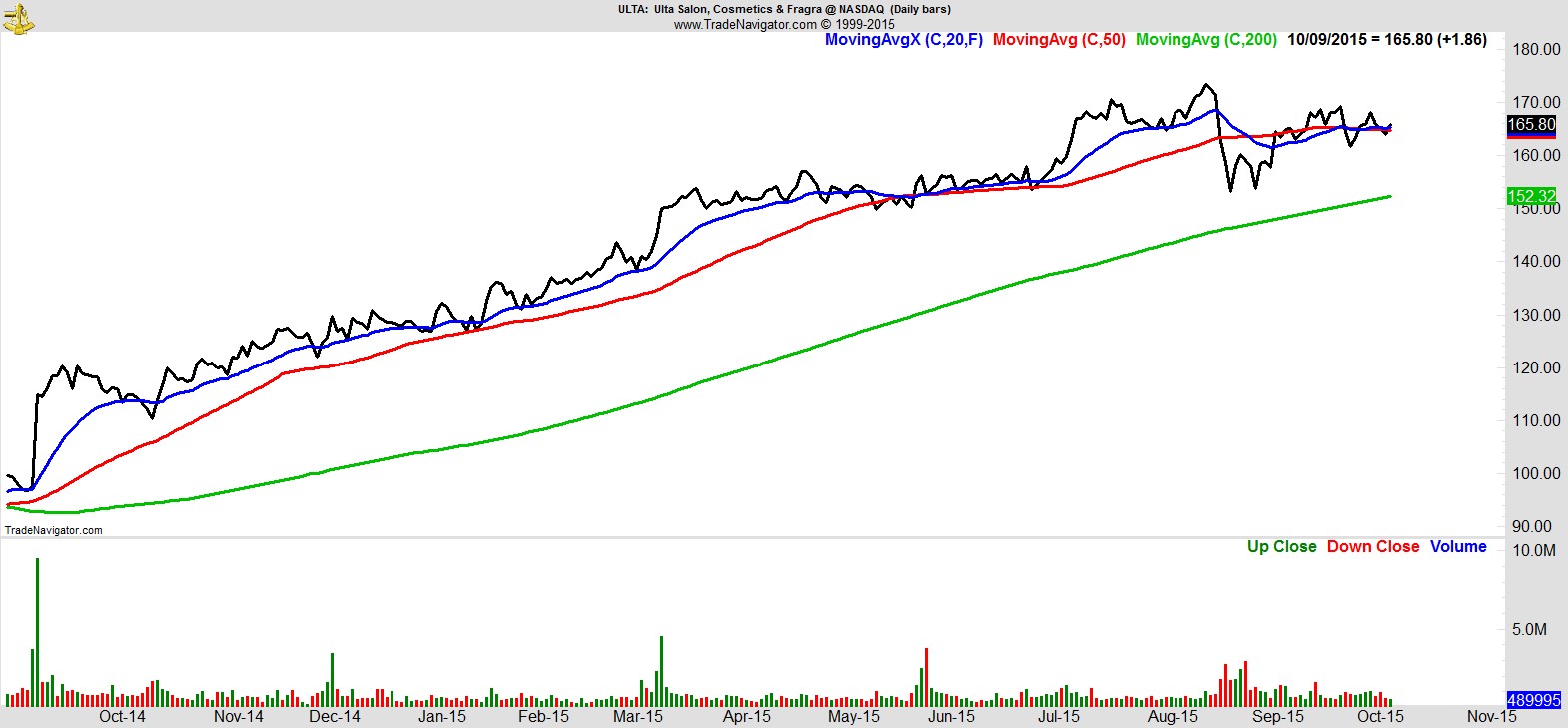

$ULTA

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17