One of the stocks that I have been warning folks about for several months is AVT, Inc. (AVTC). So far, I believe that my warnings have been not only helpful but for the right reasons. Here is the chart:

I am on the record as suggesting that the stock will trade below $1. Ask Pot$tocker. The issues include a failure to file quarterly (or annual) reports, auditor changes, risky borrowing with a mercenary lender, insider dealing, felony conviction, yada yada yada.

Tonight, I want to show you something you already know: If it's on the internet, that doesn't make it true! I just ran across this website: http://www.investorprofessional.com/

Sounds like a legitimate potential source of information, right? Wrong.

Let's see how this works. First, there is the press release by the company:

http://finance.yahoo.com/news/investorprofessional-com-forecasts-growth-automated-130500495.html

InvestorProfessional.com Forecasts Growth in Automated Retailing Industry

AVT Given "Strong Buy" 5-Star Rating

CORONA, Calif., Oct. 17, 2013 /PRNewswire/ -- AVT, Inc. (OTC Markets: AVTC) (www.autoretail.com), a leader in automated retailing systems, micro-stores and kiosk was featured in a research report on the Automated Retailing Industry by InvestorProfessional.com (www.investorprofessional.com).

The independent research group highlighted industry leaders Outerwall and AVT, and gave AVT a "Strong Buy" recommendation and a 5-star rating.

The report noted that AVT is involved in multiple markets and revenue streams. "AVT has a diverse clientele, including penetration into the healthcare, coffee, equipment rental and exchange, and retail channels. Their new Propane Exchange could completely change the industry within a short time."

"AVT has carved a niche at creating new, exciting automated retailing systems, and their investment in R&D is second to none," the report stated. "We believe that they have most of their growth still in front of them, and that the stock is a bargain at today's prices."

The report noted that the automated retailing industry is still in its infancy and will see growth over the next decade.

"Just as Apple changed the way people obtain and listen to music and use a phone, automated retailing will change the way people purchase products of all types," the report stated. "Within 10 years, you won't recognize a typical retail store... it will be a conglomeration of automation, self-service and interactivity."

InvestorProfessional.com is an independent stock analysis group, and accepts no payments for research or recommendations.

To read the report, visit www.investorprofessional.com

Nice the way they compared themselves to Apple. Great - this research group is independent (allegedly)..

Next, you click on the website at the bottom, and it takes you here:

Looks professional enough, but if you click on the buttons to "subscribe" or "contact", they don't even work. I called the phone and there is a recorded message that picks up.

The "About" button at the top takes you here:

There is nothing here except generic information - no real names, mention of a location, references etc.

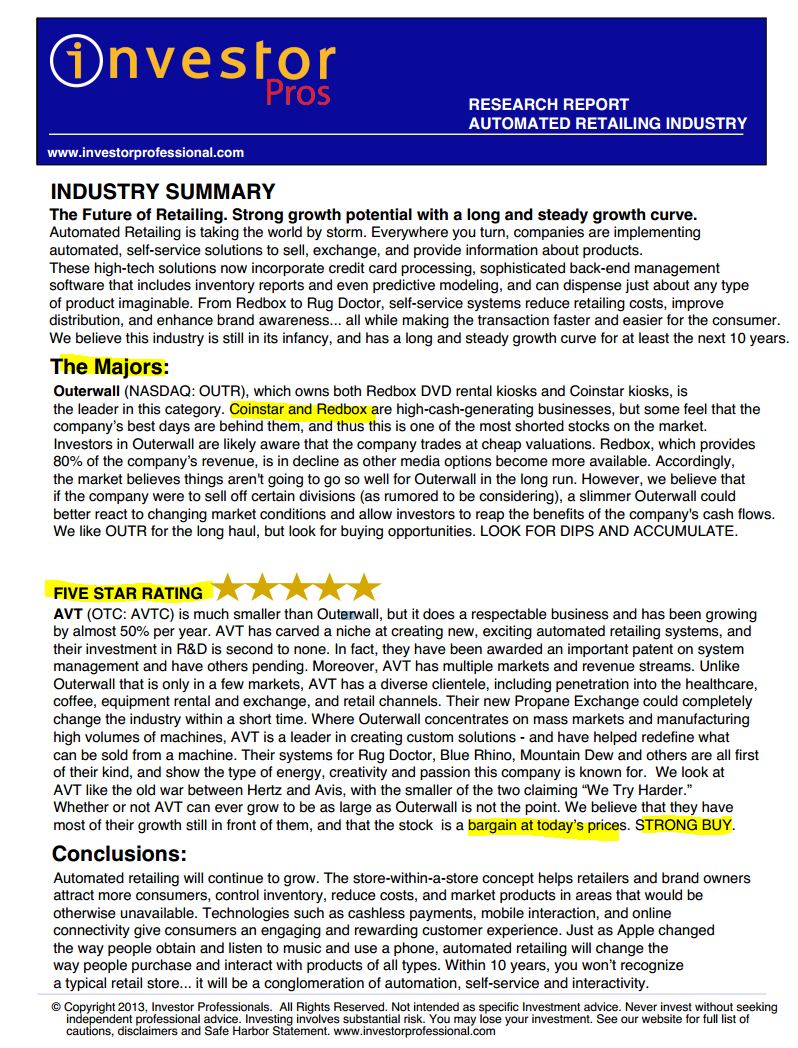

Next, we get to the fun stuff: Coverage

Great companies, right? You have probably heard of all of them or at least most of them except for that one right smack dab in the middle. Ironically, it's the only one that clicks through to anywhere. This is what is known as "Affinity Fraud". If the company can be associated subconsciously with these other known brands, success to the promoter. In case logo doesn't get you (it takes you to the website), you know that "Featured Report" will draw almost all. Let's take a look:

The report isn't dated, compares to a well known company, they give it "5 stars" and call it a "bargain" and a "STRONG BUY".

Sadly, people fall for this crap. It shows up all over the internet.

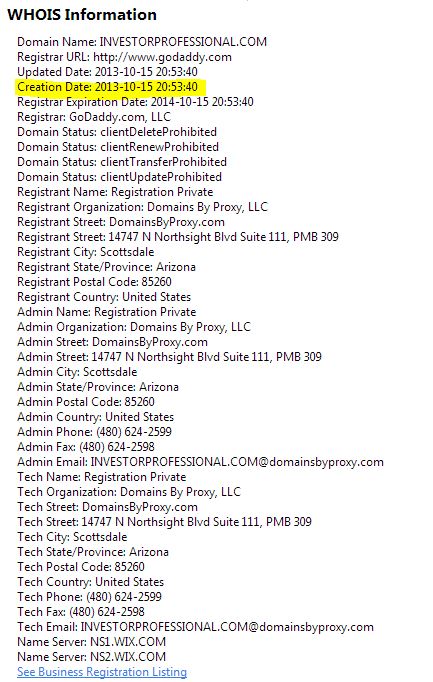

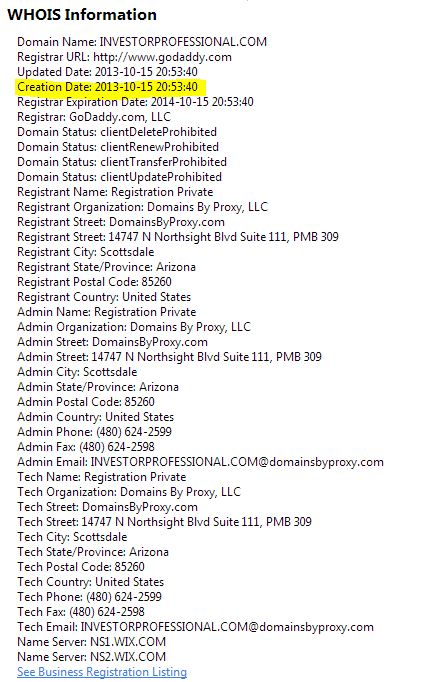

Now, for the final straw, in case you think that there is a shred of truth here. You check the "Whois" on it, and this is what we learn:

That's right: The website was created two days before the press release.

AVTC has already sicked a lawyer on me (nothing ever resulted). I am extremely confident that the company promotes itself fraudulently. Another example I have seen is that they write an "instablog" on Seeking Alpha (anyone can do this - it's free and easy to use). The company will then put out a press release and link to it, calling this "instablog" an "article", giving it credibility.

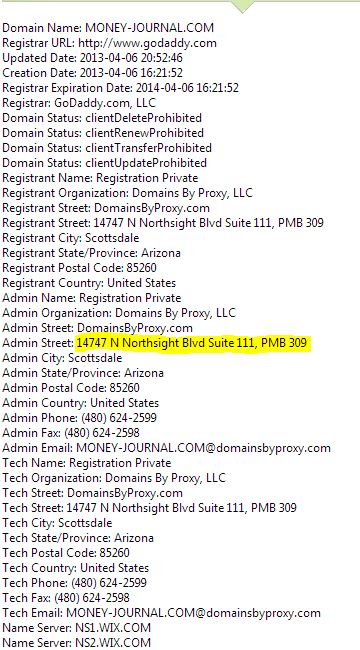

So, that ends our lesson, but I want to share a bonus. You can run the "Whois" on some other websites like this fake one that was just born and you find that they are all in Scottsdale, AZ. Here is one: http://www.money-journal.com/

Look familiar??? Need a hint?

Let's check the "Whois":

Same address, same phone number too. Same server...

So, just because it's on the internet doesn't make it true...

Have a nice weekend,

Alan

Recent free content from Cannabis Analyst

-

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

Marketfy Has Evolved - We're Moving to a New Platform!

— 3/06/24

-

420 Investor Weekly Review 12/23/22

— 12/26/22

420 Investor Weekly Review 12/23/22

— 12/26/22

-

420 Investor Weekly Review 12/16/22

— 12/16/22

420 Investor Weekly Review 12/16/22

— 12/16/22

-

420 Investor Weekly Review 12/09/22

— 12/09/22

420 Investor Weekly Review 12/09/22

— 12/09/22

-

420 Investor Weekly Review 12/02/22

— 12/02/22

420 Investor Weekly Review 12/02/22

— 12/02/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member