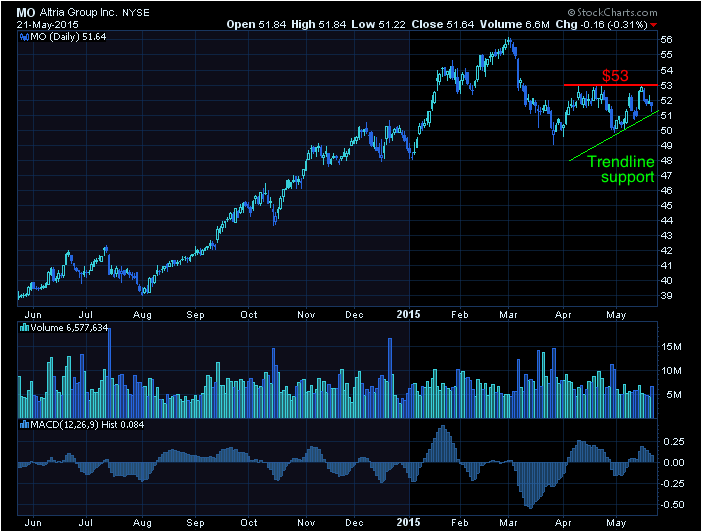

MO ascending

MO has formed a clear resistance at $53 (red) over the last 2 months

In addition, the stock has been climbing a short-term, trend line of support (green) since the end of April. These two levels combined had MO stuck within a common chart pattern known as an ascending triangle. Eventually, the stock will have to break one of those levels.

The Tale of the Tape:

MO is trading within an ascending triangle. A long trade could be made at the trendline support or on a break above $53. A break below trendline would be an opportunity to enter a short trade.

Before making any trading decision, decide which side of the trade you believe gives you the highest probability of success. Do you prefer the short side of the market, long side, or do you want to be in the market at all? If you haven’t thought about it, review the overall indices themselves. For example, take a look at the S&P 500. Is it trending higher or lower? Has it recently broken through a key resistance or support level? Making these decisions ahead of time will help you decide which side of the trade you believe gives you the best opportunities.

No matter what your strategy or when you decide to enter, always remember to use protective stops and you’ll be around for the next trade. Capital preservation is always key!

Good luck!

The Biotech Trader

@TraderBiotech

Recent free content from Christian Tharp, CMT

-

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

Biotech Breakdown: Positive Signs Are Building (11/25/15)

— 11/25/15

-

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

Biotech Breakdown: Market Still Pulling Back (11/12/15)

— 11/12/15

-

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

Biotech Breakdown: Market Pullback Before New Highs (11/6/15)

— 11/06/15

-

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

Biotech Breakdown: Market Correction Over? (10/22/15)

— 10/23/15

-

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15

Biotech Breakdown: Markets Up, Biotechs Finally Take Part (10/16/15)

— 10/16/15