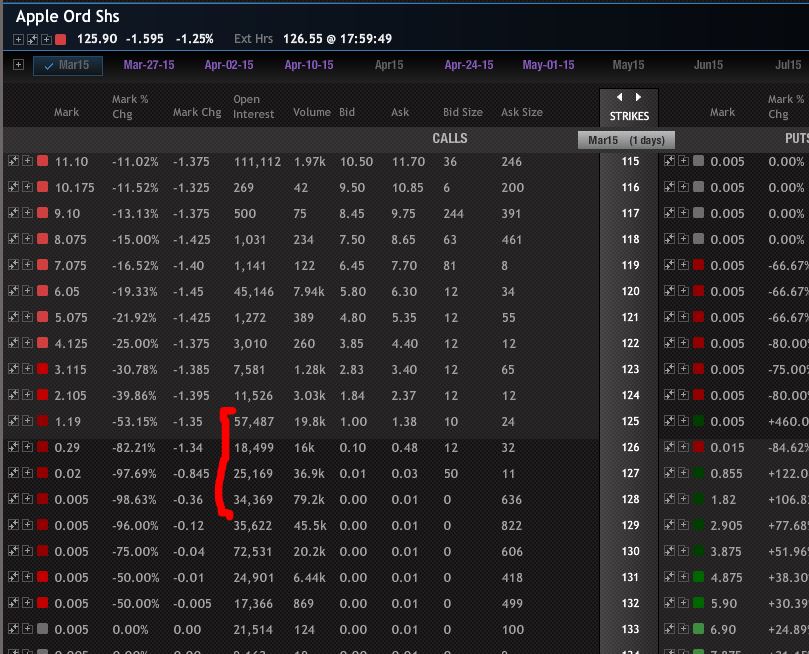

Today on a big up market day, Apple closed down -1.25%. What is not obvious is that with minute to spare, Apple was still green on the day. Then out of nowhere, the bottom fell out from under Apple with an incredible mini flash crash in minutes.

- Luckily I was in the chat room and we had the scenario on our radar. This is only important to active traders who need intra-day levels so don't feel left out that you weren't in the chat room. Here is a snap of my note of the possibility about 25 minutes before the closing bell:

- Although I enjoy knowing that we didn't get blindsided, the purpose of this write up is to reinforce my message that we shouldn't try to squeeze every penny of every trade. How does this apply here? There were millions lost that were sure winds just minutes they were lost. I think it's about a 9 billion drop in market cap on the drop. Here are actual options holders that were big winners then poof all gone. Tough luck to those who didn't cash them in:

So like I always say: Leaving money on the table is part of being a successful trader. You hear it said in other ways like: 'they don't ring bells at tops and bottoms,' etc.

This is what pros do and where most retail traders falter.

Nic

Teaching traders make money from a relatively safe distance: Create Income with Options Spreads, a large community of Options Traders looking to create extra income by trading credit spreads. For just about the cost of a cup of coffee per day, you can get all the benefits of the CIWOS subscription, including analysis, alerts, trade recommendations, chats & video updates.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member