Click Here for this Week's Full Letter - December 16, 2014

Greetings,

Call me juvenile, but “Bill & Ted’s Excellent Adventure” still ranks as one of my all-time favorite movies. It has everything: history lessons, adolescent humor and Keanu Reeves in his prime. Early in the film, when the main characters are mystified by a time-traveling George Carlin, Ted delivers the infamous line, “Strange things are afoot at the Circle-K, my friend.” That’s exactly how I feel about global economics today.

Market developments over the past six months have created an environment where a “crisis” seems all but inevitable. The world’s reserve currency, USD, is now 11% stronger than it was in June. Crude oil, an input cost for virtually every company on earth, has fallen 42% since June. Europe and Japan, the world’s largest and fourth largest economies, are in recession, while China, the third largest economy, is getting ready to lower growth forecasts.

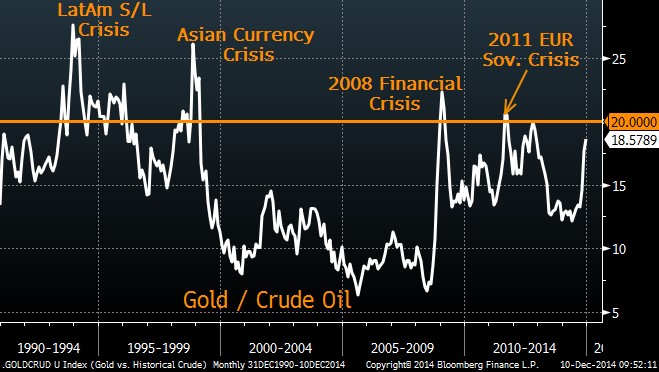

Several metrics indicate the market is headed for major volatility. For instance, since 1990, every time 1oz. of gold bought more than 20 barrels of crude oil, there was some form of “crisis” – usually emanating from abroad. At the moment, that metric is just below 19 but it’s rallying quickly.

This doesn’t necessarily mean US stocks will get dragged into the turmoil. The European sovereign debt crisis in 2011 triggered an -18% correction, but the S&P 500 finished +15% higher on the year. The same thing happened in 1998 when the Asian currency crisis led to a significant decline, but the US market finished the year +27% higher.

Getting back to oil, I want to be clear that while lower prices benefit consumers in the US, it’s hardly a bullish development. In fact, policymakers are extremely nervous about the decline. The Saudi’s are purposely oversaturating the market, but supply is just one half of the equation. Even though prices are falling, OPEC slashed their 2015 demand forecast last week by 70k barrels per day, which would be the weakest figure in 12 years. At the moment, oil is a deflationary headwind for a global economy already shaky on its feet. Strange things are afoot in these markets.

It’s too early to say how this crisis will play out, but I have some theories. Investors seem alarmingly complacent despite the warning signs. I haven’t entirely re-positioned my portfolio for this “crisis” scenario yet because stocks will probably drift higher into year end, but I’m staying alert for opportunities. My December Investment Letter will almost surely touch upon these theories– if you’d like to start receiving these letters click here. It’s $8.25/month, which would buy you more than 3 gallons of gas. Except that gasoline won’t boost your portfolio.

Today’s letter will cover several topics, including:

- Junk-Stocks

- 2014’s #1 Performer

- Tumbling Tesla

- Chart of the Week

With that, I give you this week's letter:

December 16, 2014

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member