Click Here for this Week's Full Letter - January 27, 2015

Greetings,

Former US Treasury Secretary Larry Summers perfectly summed up my thoughts on the recent spate of monetary stimulus saying, “I think we need to realize the era of central bank improvisation as the world’s principal growth strategy is coming to an end.” Last Thursday, investors cheered the ECB’s commitment to flood the market with more than 1 trillion EUR over the next two years, but I’m taking a more skeptical approach.

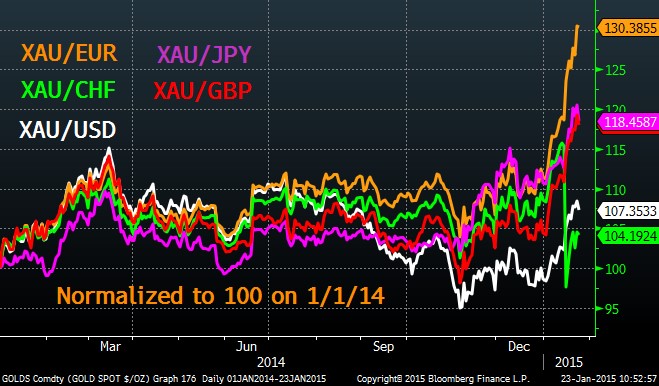

The ECB’s decision has been thoroughly dissected in the financial press, and I’ll give my thoughts below, but few have mentioned the incredible move in gold/EUR. Denominated in EUR, gold has rallied nearly 20% YTD. Contrary to popular perception, gold was actually the second best performing currency of 2014, bested only by the US Dollar. Obviously the Swiss Franc is leading so far in 2015, but gold is right on its heels.

Real 10-year interest rates in Germany, which have dropped 40bps this month, to -0.6%, are driving gold higher. Sentiment is improving, but positioning remains light. Over 2013 and 2014, total ETF demand for gold fell by more than 34 million ounces; equal to $45 billion at current prices.

Higher prices are giving a much-needed shot in the arm to gold miners. The GDX Senior Gold Miner ETF is up more than 20% YTD, even though several miners have issued fresh equity. Gold companies in North America, where more than half of the industry is based, have announced more than $800 million of stock sales this month - already the highest total since October 2013. It makes sense that these firms, which still trade like distressed assets, are raising capital, but it reinforces my belief that the ETF’s offer the best exposure to gold miners – namely GDX and GDXJ.

Another under the radar development that caught my attention last week was the continued exodus from junk bonds. Sovereign yields across the globe are still trading with negative nominal yields, yet investors pulled $523 million from global high-yield funds and ETFs in the week ended January 21. Ray Dalio, who runs the $160 billion Bridgewater Associates, said in Davos last week, “We have a deflationary set of circumstances, which makes it appealing to just stuff your money under a mattress.” Perhaps investors are starting to realize that QE isn’t that panacea academics make it out to be.

The Cup & Handle Fund had its largest setback to date last week, losing -2.5%. Since launching in August I’ve either been directionally right with poorly sized positions or directionally wrong with good risk management. The fund is still up 10.5% from inception, so considering that I’m not meeting my own standards, things could be worse. I still feel good about the positions though, and we’re in a bull market for global imbalances, so the future is bright. Thank you for all the feedback on my January investment pick, and I hope everybody can get in at attractive levels – if you’d like to start receiving these letters click here. It’s $8.25/month or .04 Bitcoins.

Today’s letter will cover several topics, including:

- The Jobs Problem

- Canadian Bacon

- QE in Practice

- Chart of the Week

With that, I give you this week's letter:

January 27, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member