Click Here for this Week's Full Letter - April 30, 2015

Greetings,

This week at the Milken Institute Global Conference the question on everyone’s mind was: Which way is oil going? Hedge funds seem convinced oil is headed above $80/barrel, and they’re placing big bets to back up their conviction. Exchange data show long exposure to Brent crude oil through futures and options is at an all-time high, worth 265 million barrels – enough for three days of global consumption.

At the same time, oil producers have hedged more than 500 million Brent barrels in order to protect against further declines. Rex Tillerson, CEO of ExxonMobil, the world’s largest oil company, recently said the industry should expect lower prices for “at least a couple of years.” In order to comfort investors many energy companies have slashed capital expenditures.

According to Baker Hughes, the number of oil rigs operating in the United States has fallen 53% YTD to 703 – the fewest since 2010. And yet, despite the massive cutbacks, the oil supply keeps growing. US crude inventories stand at the highest level in 80 years and have now risen for 15 consecutive weeks.

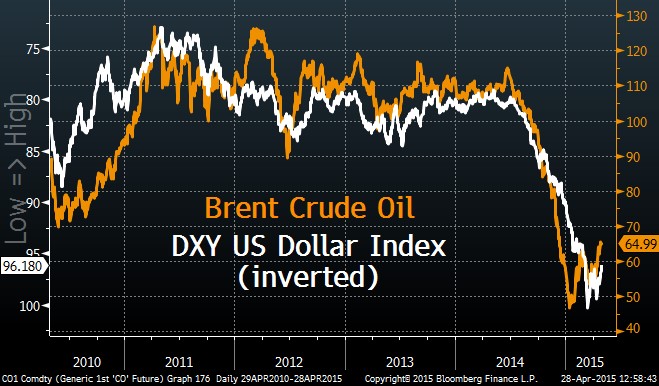

Despite a 40% rally from the bottom in January the oil market seems impervious to developments in the supply/demand fundamentals. Instead, it appears as though the US dollar, which precipitated oil’s collapse last June, is still the biggest driver of prices. Unfortunately, oil investors are forced to become Fed watchers like the rest of us.

The market has now pushed back the timing of the Fed’s first hike to early 2016. While the US economy is showing signs of momentum, it’s incredibly difficult for the Fed to raise rates when the rest of the world is cutting. No fewer than 27 central banks around the world have eased monetary policy to some extent this year, notably China – the world’s second largest economy.

As long as the Fed seems hesitant to tighten there’s a good chance oil will move higher as USD weakens. However, Janet Yellen will inevitably have to face the music and raise rates for the first time since 2004. USD is likely to see a strong rally leading up to that announcement, at which point oil will face strong headwinds. It’s very telling that forward prices, which are less susceptible to fast money and a good gauge of future demand in the real economy, remain depressed. The December 2019 Brent oil contract has rallied a mere 5% from the lows. Oil looks like it’s improving but it’s too soon to say the bottom is in place.

The Cup & Handle Fund is now up +1.0% on the year, and +15.5% since August (inception). I heavily reduced risk in the fund after some early losses to start the year, but now that we’re back in positive territory it’s time to be more aggressive. I’ve added two new “themes” (positions expressed via multiple stocks) this week. One is an extremely attractive risk/reward trade. The other is a position I’m willing to be patient with and hold for at least the next few months. It helps that my monthly investment selections have shot the lights out this year. My letter for May should be available in the next few weeks. If you’d like to start receiving these letters click here.

Today’s letter will cover several topics, including:

- Buyback For What?

- The United States of Renters

- Too Close To Call

- Chart of the Week

With that, I give you this week's letter:

April 30, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member