Click Here for this Week's Letter

Greetings,

On Sunday, Donald Trump sought to burnish his foreign policy credentials on Meet The Press, and added Saudi Arabia to his list of frenemy countries that already includes Mexico, Japan and China. Trump said, “The primary reason we were with Saudi Arabia is because (the US) needed oil. Now we don't need the oil so much, and if we let (oil drillers) really go, we wouldn't need the oil at all and we could let everybody else fight it out."

There are two easy rebuttals to his statement. First, aside from New York State and national parks, the US has let drillers max out production. And second, Saudi Arabia is already “fighting it out.” The Middle East has become a battlefield between the Sunni and Shia sects of Islam. Saudi Arabia is the primary financial backer of Sunni militias, while Iran fills the coffers of Hezbollah, Houthi rebels, and other Shia factions. The Saudi vs. Iran struggle is being played out in several proxy wars taking place in Syria, Lebanon, Yemen and especially Iraq – among others.

Defense spending in the Kingdom is growing faster than any other country, reaching 10.5% of GDP; compared to 3.5% in the US. However, they are losing their most important battle against frackers.

The Kingdom’s financial largess comes from oil, which accounts for more than 90% of government revenue. In 2014, Saudi blew off OPEC and ramped up production to try and bankrupt US drillers with lower prices. The US shale industry has not followed the script by obediently cutting back production as prices have fallen. On the contrary, costs have been cut and production this year will be higher than in 2014. Saudi Arabia needs oil at $105 per barrel in order to balance their budget, but that won’t happen any time soon. The IMF estimates the budget deficit will hit 20% of GDP this year.

The Kingdom has $675 billion in reserves to cushion their economic fall, but they’re burning through cash at a rapid pace. In fact, the royal family issued $5 billion worth of sovereign debt last week and may seek $20 billion more by the end of this year. Of course, they could cut subsidies but that would upset citizens that are increasingly allured to the siren call of ISIS. For example, gasoline costs 16 cents a liter, which means an estimated $80 billion a year foregone in export revenue.

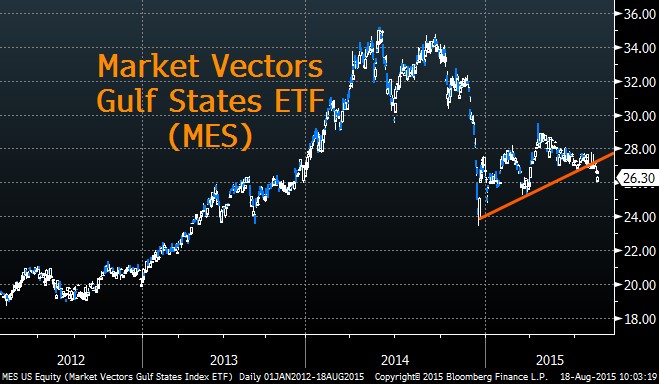

On June 15, the Saudi stock market was opened up to foreigners for the first time. BlackRock is in the process of creating an ETF but it doesn’t trade yet. If you’re looking to short this market, which seems like a reasonable proposition considering the circumstances, the Market Vectors Gulf States ETF (MES) looks like your best bet. Enemies surround Saudi Arabia on all sides, radical ideologues are infecting the population internally, and political heretics from its longstanding ally are calling for an end to the “oil for weapons” deal that underscored the Nixon Doctrine. The collapse of oil only adds fuel to the flame.

The Cup & Handle Fund is still up around 7.0% on the year, and +22% since August 2014 (inception). Directionally everything has worked out pretty well, I’d just like the execution to be better. My investment pick for August is already +8% in our favor, and shows no sign of slowing down. If you’d like to start receiving these letters click here.

Today’s letter will cover several topics, including:

- Stagnation in Japan

- Empire State of Decline

- Tesla in 2029

- Chart of the Week

With that I give you this week's letter:

August 19, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member