Click Here for this Week's Letter

Greetings,

I trust everyone survived the most hyped Fed meeting in recent memory. Yellen kicked the can a little further down the road with no seismic market swings, but there were some important takeaways. In the press conference, the chairwoman clearly indicated the FOMC has its eyes on China and even took a dig at the PBoC saying there were concerns about, “the deftness in which (Chinese) policymakers were addressing (growth) concerns.” The Chinese slowdown must have factored into the FOMC’s less optimistic growth projections. They now project the economy will grow at a rate between 1.8% and 2.2% per year in the long-run, down from a 2.0% to 2.3% estimate in June.

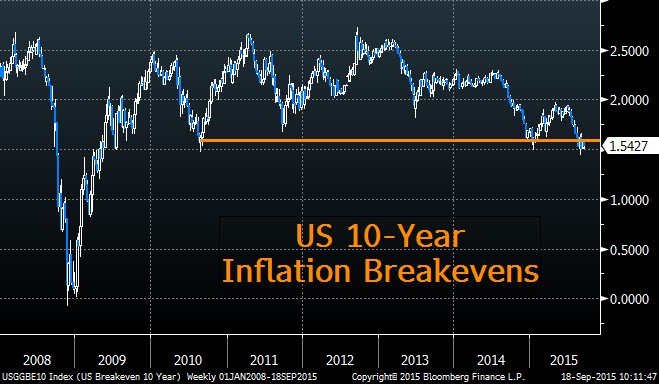

Yellen pointed out the need for more data, but avoided acknowledging the degree to which financial market volatility impacted the FOMC’s decision. This was likely to avoid leaving the impression that investors should expect a Yellen Put, like the Greenspan and Bernanke Put before it. But there’s still this issue of falling prices. It was referenced in the statement and it’s without a doubt the only data holding the Fed back from one, or even multiple, rate hikes. However, looking at a chart of US inflation breakevens, it’s clear this issue won’t go away anytime soon. It’ll probably even get worse.Perhaps that was the rationale behind one participant forecasting a rate cut sometime this year. Yellen says every meeting going forward is potentially “live,” meaning there’s a chance they’ll hike. Let’s do a thought exercise. Say it’s October 27, one day before the next Fed meeting, and everything is where it stands today. S&P 500 at 1975, DXY at 95, 10Y yields at 2.15%, and Chinese PMI at 47.3 with employment and inflation at their current levels. Does the Fed hike? I sure don’t think so, and neither does the market – currently pricing in an 18% chance of an October hike.

If the Fed thinks the probability is higher than 18%, they’re doing a bad job of communicating. If they intend on hiking, they’ll have to correct the market’s assumptions, or risk getting boxed into a corner where they can’t hike without triggering a major sell-off. Conversely, if the data deteriorates from here, investors will force the Fed’s hand by selling assets until there’s a sense policymakers are considering more accommodation – not less. Again, watch gold. On Tuesday night we’ll get our first glimpse at September data from China with flash PMI.

This meeting also sent a clear message to other central banks that the Fed, home of the world’s strongest economy, is far from confident. Not surprisingly, there were articles overnight speculating that the ECB and BoJ will both step up their stimulus programs to prevent any further currency gains. But the clearest signal came from Britain, less than 24 hours after the Fed release, where the BoE’s chief economist said the bank may need to cut interest rates to get inflation back on target. If these banks back up their words with action, expect a stronger USD, lower inflation and a Fed without options. Round and round we go, where this stops… nobody knows.

The Cup & Handle Fund is up around 5.5% YTD, and +20% Y/Y. The base effect is still hitting Y/Y returns and probably will for a while. We’re starting to shift around the portfolio a little bit, and wait for some new “post-Fed” trends to develop. Having said that, our thesis hasn’t really changed at all. I hope to have the October investor letter out early next month, but too soon to tell. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

September 18, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member