There are plenty of ways to determine whether an uptrend is sustainable going forward. Some of the more effective among these are:

- is the average valuation of large cap companies in line with historical averages?

- are the volume balance and money flow indicators showing that new money is coming into the market?

- are the key growth sectors of the economy -- technology, smallcap, financial -- outperforming the overall market?

- are price momentum indicators staying up with the price itself, or showing negative divergence?

1. Valuation = "0"

Let's take each of these and assign a value to them of either +1, 0, or -1. We'll give a +1 to any indicator that is supportive an uptrending market. We'll give a 0 to any indicator that is not supportive, but not necessarily bearish. And we'll give a -1 to any indicator that supports a downtrending market.

There are a number of ways to calculate the valuation of the overall market. I prefer using Schiller's "P/E 10" method, which itself is built on ideas made popular by Benjamin Graham. The P/E 10 method uses a 10 year average of the price-to-earnings ratio, but one that uses inflation-adjusted earnings (IAE) of the S&P instead of actual earnings. This 10-year average gives us a mean that is then used to calculate buy and sell signals based on where the IAE is today relative to that mean.

Acorrding to the P/E 10, the S&P is currently trading at 41% above its P/E 10 mean. This is worrisome in and of itself, but not yet definitive of an impending selloff. Only when it gets to 50% do we get a sell signal. We aren't there yet, so we'll give this indicator a "0".

2. Volume Balance and Money Flow = "0"

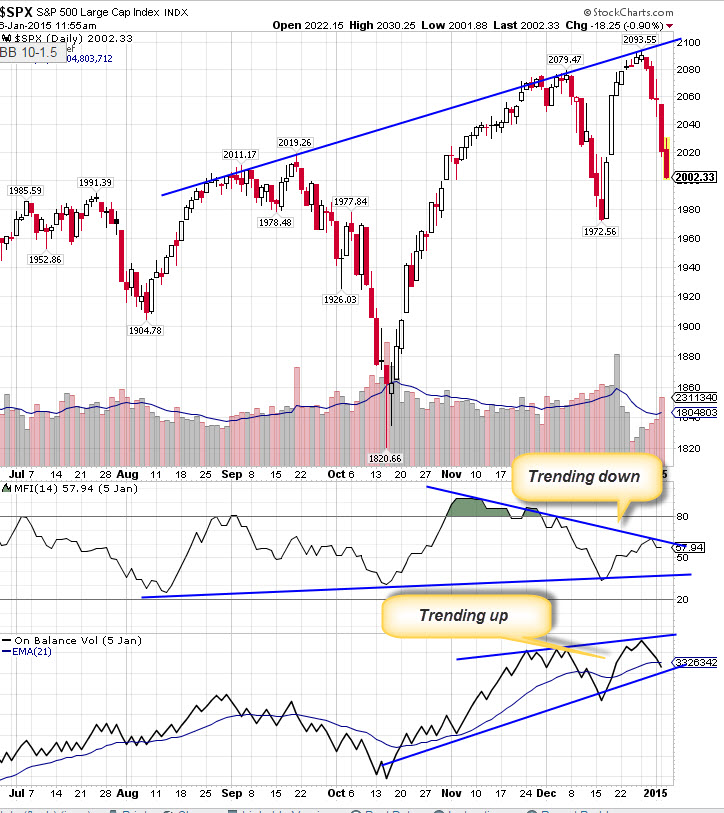

As the chart below shows, we get a mixed report from these two indicators. As the price of the S&P 500 was making new highs, we can see that the Money Flow Index (MFI) failed to hit new highs, while the On Volume Balance (OBV) did reach new highs. This is a mixed reaction and so cannot confirm either an uptrending or downtrending market, thus we'll give this one another "0" score.

3. Key Growth Sectors = "+1"

Using the ETF's to represent our key growth sectors, I compared by monthly and quarterly returns of the SPY vs. the technology index (XLK), the smallcap index (IWM), and the financial index (XLF). Only the technology stocks lagged the general market. Both financials and (especially) the smallcap stocks were outperforming in both time frames. This bodes well for more upside ahead for the S&P.

Here are the monthly and quarterly numbers, respectively as of today's trading:

- S&P 500: -2.4% and +3.2%

- Technology: -3.1 and +3.2

- Smallcaps: +0.4 and +7.4

- Financials: -1.0 and +4.5

4. Momentum Indicators = "-1"

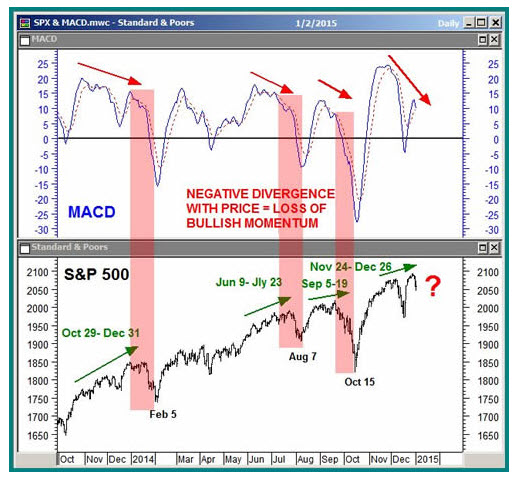

This may be the most important indicator of them all. As the old saying goes, "if it ain't happening with the price, it ain't happenin'!" Here we can use the MACD momentum indicator to determine whether the market is maintaining or losing momentum.

The chart below clearly shows a loss of momentum following December's Fed-induced relief rally. Looking back from there, we can see that divergence from price in this key indicator tends to forewarn of future weakness in the index:

The end result of our 4 tests? Perfect neutrality on the question whether the current pullback marks the end of the bull, or yet another buying opportunity. With that in mind, it is great idea to be "market neutral" as much as possible.

Speaking of which, can I take a very self-serving moment to recommend the best book I know -- in fact, it's the only book I know -- on how to build a market-neutral portfolio? It's written by my favorite author (!!) and is strongly recommended by a number of well-known finance professionals whose endorsements appear in the book. You can buy it here.

Blessings to all, TC

Recent free content from Dr. Thomas Carr

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member