Last week, markets managed to push higher, propelled by the strength in the semiconductors and a late rally by the financials. Semiconductors have been drawing speculators searching for the next deal, ADI and MXIM being the latest in merger talks. SNDK remains on the radar as a takeover target.

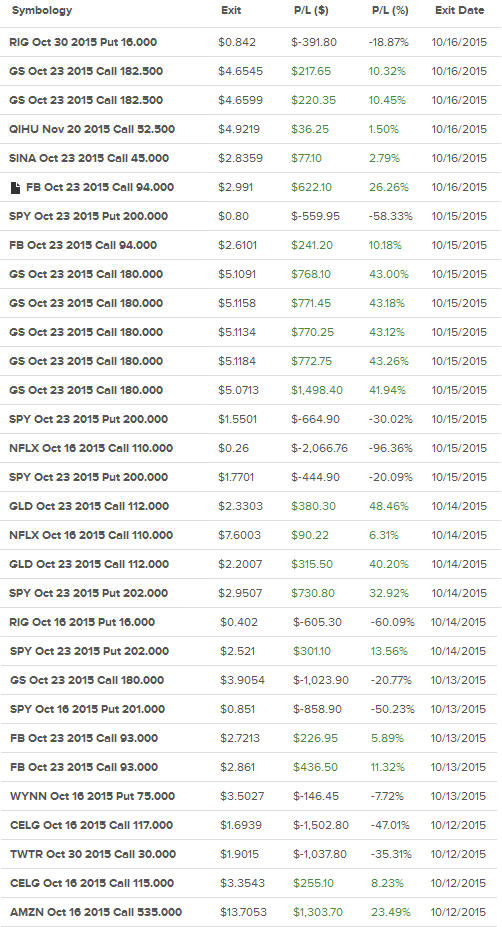

Financials were sluggish to start the week, as earnings from JPM, WFC, and GS were not very inspiring. But, buyers came in in full force on Thursday. We caught most of that surge with our GS calls, which brought in profits as high as +43%. Our GLD calls also scored an intraday +48% gain! Here are the closed trades for the week:

To subscribe or to find out more about this product, please CLICK HERE. Come see what Ecstatic Plays offers and what we are trading next!

For the week, the Dow was up +131.48 points; SPX added +18.22 points; Nasdaq gained +56.22 points. Gold continued to push higher, trading above $1170/ounce (see my latest analysis on gold). Oil was flat, trading above $47/barrel. At the time of this writing, Asian markets were mixed. Let's see where the US markets stood after Friday's close:

SPX

Nasdaq

Markets experienced some weakness on Tuesday and Wednesday last week, but, were able to finish higher with the help of a rally from the financials. For the new week, lots of earnings are coming in:

Monday: (AM) HAL, MS, VRX, HAS; (PM) IBM, STLD, RMBS

Tuesday: (AM) UTX, HOG, CP, SAP, ATI; (PM) CMG, YHOO, VMW, ILMN

Wednesday: (AM) BIIB, BA, KO, ABT, PII; (PM) EBAY, SNDK, ATI, TXN, TSCO, NOW, MLNX, CTXS, CA, ALGT

Thursday: (AM) UA, LUV, CAT, FCX, CY, UNP, ALK, MMM, NUE; (PM) AMZN, MSFT, GOOG, SKX, P, JNPR, SWN, QLIK

Friday: (AM) AAL, PG, COG, STT

Many in the metals and mining are reporting: STLD, ATI, CAT, NUE, FCX.

Airlines are also reporting: ALGT, ALK, LUV, AAL

The heavyweights are coming in on Thursday afternoon: AMZN, MSFT, and GOOG/GOOGL.

SPX has resistance between 2040 and 2060; support is at 2000.

Sector Watch

XME (metals and mining)

XME was down last week. It is at support right now. STLD kicks things off on Monday afternoon. FCX has been weak on lower copper prices. CAT is not doing very well as a company.

XLE (energy)

XLE managed to close higher, even though the outlook from SLB was not so good. We'll continue to eyes on this sector. EOG, APA, APC, and OXY are neutral. CVX and XOM have been strong.

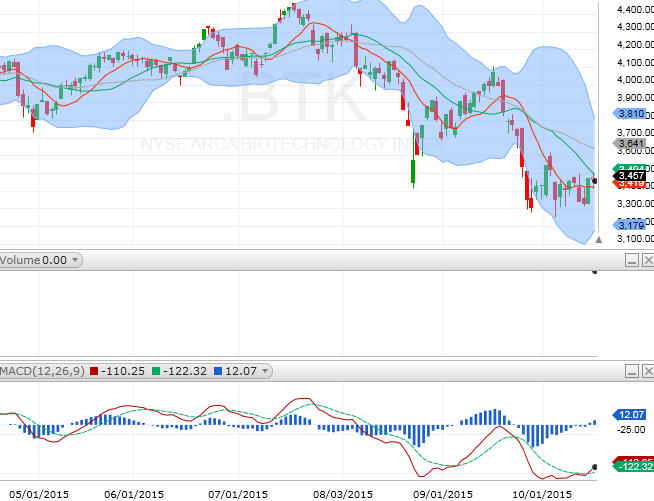

BTK (biotech)

BTK has been working really hard to establish a bottom. It closed above its 10-day MA last week, and its MACD has turned bullish. BIIB reports on Wednesday morning. We'll also being watching CELG, AMGN, and GILD. Biotechs have have an overall effect on the broader market in recent months.

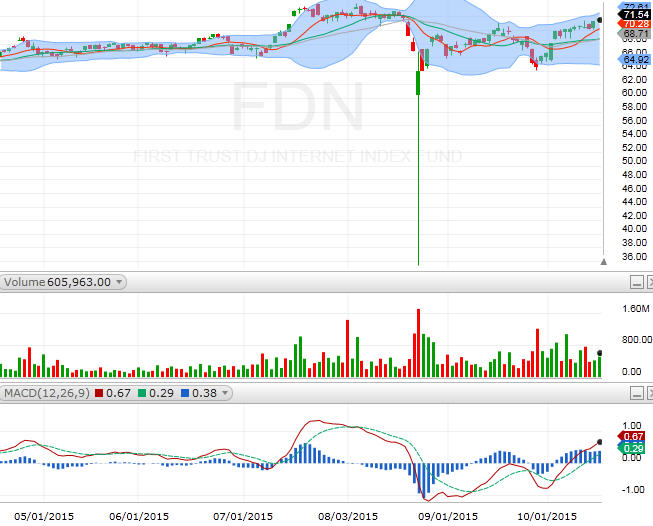

FDN (internet)

FDN gilded up last week. NFLX report was not received well. This week, YHOO will come up to the plate first on Tuesday afternoon, followed by EBAY on Wednesday afternoon, and the rest on Thursday. EBAY has been quite weak and is slowing fading into the background, as AMZN takes over the e-commerce scene. Both AMZN and GOOG have been strong, and the options are expensive. I don't see the need to take the risk ahead of the reports, even though their businesses seem to be doing really well.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member