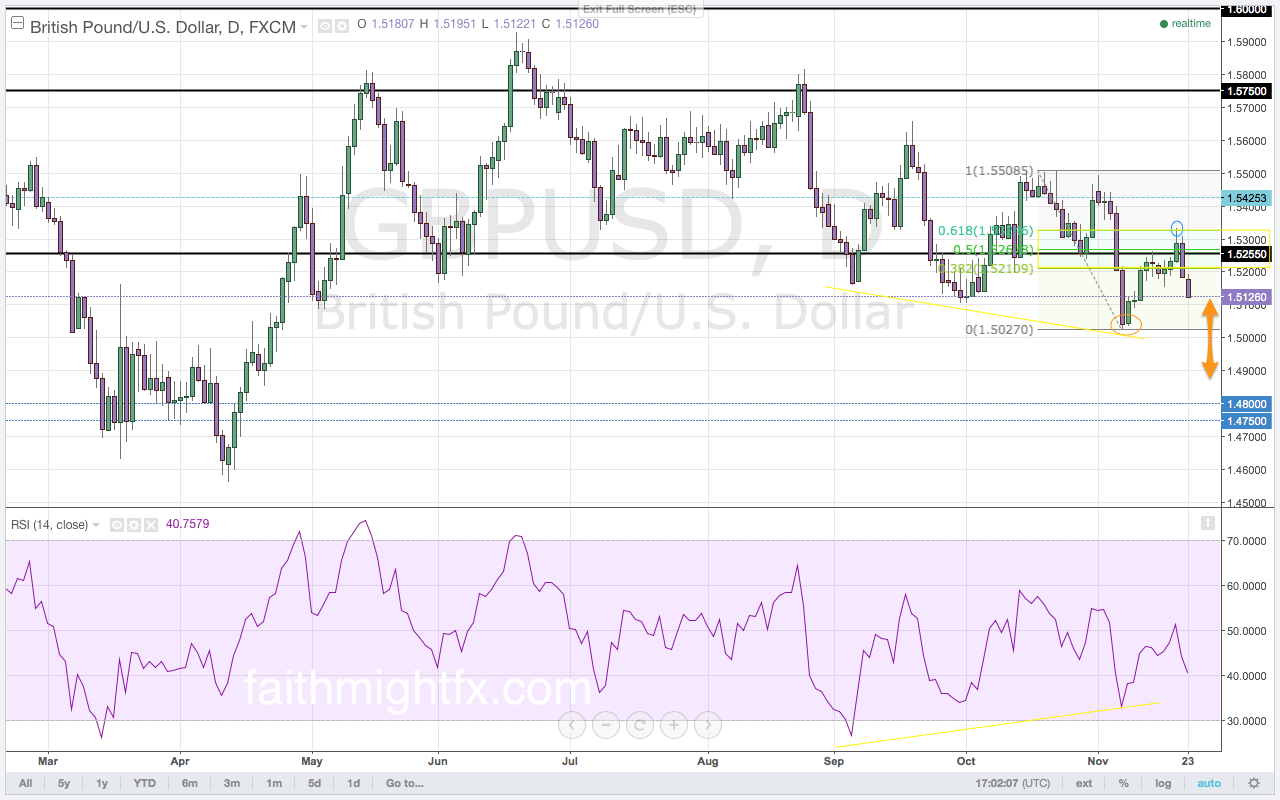

The U.S. dollar opens the new trading week with another bout of strength. The move below the 1.5162 support zone signals further losses in the GBP/USD. Further declines in the GBP/USD from here moves price to the 1.5000 major psychological and support level. As the market prices in the first Federal Reserve interest hike for December and a series of interest rate increases thereafter, the GBP/USD should continue to move lower as the December meeting approaches. The minutes from the October Federal Reserve meeting revealed a central bank that is looking to start the normalization of interest rates sooner rather than later. In fact, there was one vote in favor of an interest rate hike in that October meeting. Though the GBP/USD started last week with strength, the inability to close the week above the 1.5250 support level provides confirmation on the weekly chart for a sustained move to the downside.

A surge of GBP/USD strength off the recent new lows moved price right to the 61.8% Fibonacci level at 1.5325 last week. While it breached the Fibonacci level, the GBP/USD moved significantly lower off the highs back below the 1.5250 support level. The break back below the 1.5250 level sparked a selloff to the support zone between the 1.5162 and 1.5100 levels. A break below this zone of support sees the GBP/USD move to the downside for a break below the 1.5000 support level. A break of the major support level signals a move to the 1.4800 support zone. A close below the 1.5000 level would mark a major technical shift for the GBP/USD. An interest rate hike in December from the Federal Reserve could be the catalyst for that shift. However, it is been widely reported that in the last three cycles of interest rate increases the U.S. dollar weakened rather than strengthened. As bond prices fall in such an environment, investors sell U.S. dollars. This sentiment drives bond prices down further creating a vicious cycle of USD weakness. And as the BoE downgrades its economic forecasts, the GBP/USD stands to weaken further. Momentum confirms the bearish bias in the GBP/USD as it remains squarely in selling territory.

Outlook for the week: ...

Subscribe now for immediate access to the outlook for the week which includes trade setups with defined stops and targets. This is an excerpt from this week's QUID REPORT.

Recent free content from Lydia Idem Finkley

-

USD Leaves Markets in Suspense

— 6/15/16

USD Leaves Markets in Suspense

— 6/15/16

-

ECB Keeps Euro Happy

— 6/02/16

ECB Keeps Euro Happy

— 6/02/16

-

Cable is Breaking but Not Really

— 4/19/16

Cable is Breaking but Not Really

— 4/19/16

-

Remember, The Euro is a Safe Haven

— 4/17/16

Remember, The Euro is a Safe Haven

— 4/17/16

-

NEW: The Monday Morning Calls

— 4/11/16

NEW: The Monday Morning Calls

— 4/11/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member