Click Here for this Week's Letter

Greetings,

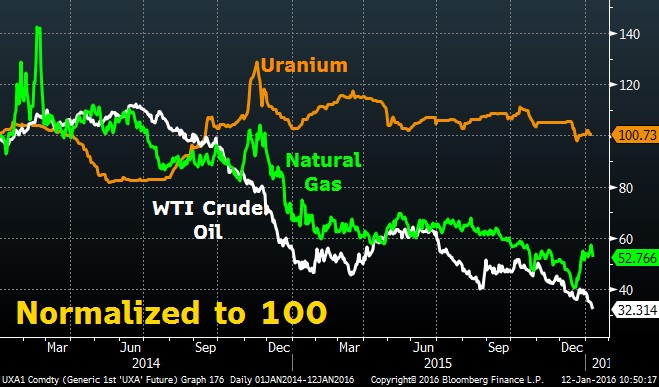

The average gasoline price nationally is now below $2/gallon for the first time since 2009. It’s been a mild winter thus far, but home heating oil prices are the lowest they’ve been since 2004. The collapse of oil has dragged prices lower for almost every product in the energy market, except uranium. Since January 1, 2014, the spot price of uranium has actually risen, versus a -78% drop in oil and a -48% decline in natural gas, with valid reasons to be bullish going forward. Sentiment is still incredibly negative due to the Fukushima disaster in 2011, but the COP21 climate meeting in Paris subtly endorsed nuclear as a way to meet emission targets.

It also doesn’t hurt the bull argument that China loves nuclear power. Mainland China has 26 nuclear power reactors in operation and 25 under construction, with almost 100 more planned by 2030. India is also in the midst of a major expansion of nuclear-power generation. The country’s installed capacity is now at 5.7 GW, but that is set to grow to 10 GW in just the next four years. Even Saudi Arabia, the country that killed OPEC to protect its oil business, plans to construct 16 nuclear power reactors over the next 20 years at a cost of more than $80 billion.Decisions to build nuclear power plants don’t hinge on uranium prices, because fuel is such a small part of nuclear’s total cost. Uranium has few uses other than nuclear, so its price is heavily influenced by the supply/demand fundamentals. And the fundamentals look very strong with a supply deficit looming in the next five years. The spot price of uranium is currently $34, but the break-even cost of production is closer to $50. So why haven’t prices moved higher? Japan.

Idling Japan’s reactors after Fukushima left utility companies with 120 million pounds of uranium since they still had to honor their existing supply contracts. Japan restarted nuclear reactors at the Sendai power plant a few months ago, and about 40 of Japan’s 54 nuclear plants will likely be restarted, but it will still take a while to work through that inventory. However, at a global level, utilities will need to secure roughly 20% of their uranium needs sometime between 2017 and 2018.

The breakeven costs for planned uranium mines are $70-80/lb. Those mines will not begin production until the price is north of that range. Mines won't be built so they can break even; an incentive price is needed. Analysts believe $80/lb. is the breakeven required for global supply and demand to meet over the long term. “Long-term” is the key phrase in that sentence. The global economy is on shaky ground now, but if it stabilizes and nuclear projects go on as scheduled, expect uranium to move much higher over the long-term.

The Cup & Handle Fund is up around +0.5% YTD, and +5.0% Y/Y. Our core positions really haven’t changed much. Of course, I would like to have been directionally short over the past few weeks, but the relative value bets that provided stability in the portfolio through November and December have kept it more balance. Hence the lackluster start to this year, but it’s still early. As I said before, the blank returns on Jan 1 are always a little daunting, but once we get a profit cushion we’ll start to push things a little more. 2016 is shaping up to be a year of huge opportunities, so we’ll be patient and wait for a big one. The January letter was sent out on Monday, and it was actually a long recommendation – unlike the past few. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

January 13, 2016

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member