Our CEOs are lighting the growth match, see our updates below.

Specific Portfolio Updates:

AtmanCo: (Expanded Coverage)

Atman is moving forward with the arbitrage opportunity we described several weeks ago. The Voxtel acquisition is a nice twist we did not see coming, they own the dating website Atman's services are rolled out on (a revamped website too)

We reached out to management to discuss the acquisition and the private placement. Due to it being such a recent announcement (we called the day of the release) they couldn't share too much information, although the acquisition looks both synergistic and accretive. Management stated they would be able to share more in the coming weeks, including their revamped presentation covering the acquisition in 1-2 weeks which we can share with members.

Of course the acquisition is contingent on the private placement closing, which was our original arbitrage opportunity which is still in tact. Management doesn't have a set number on the share price for the private placement, but our target is 0.10 CAD to 0.15 CAD to allow for our short term arbitrage opportunity. This acquisition adds to the long term potential of the company.

AtmanCo: Brief Call With Management:

We are providing members with a few questions and answers we asked management in the interim while information on the acquisition becomes available. Below are a few quick facts we asked management about for some more color on the acquisition while we compile further data (limited right now since it was announced yesterday)

1) Voxtels revenues are north of 11.0M with a minimum EBITDA of $1.0M.

2) Synergies: derived from online dating, database to be used in our mass market products, geographic expansion, billing solutions and cross-selling.

3) Voxtel's cash flow positive nature would allow Atman to self fund the growth of their testing solutions. It would add financial flexibility to Atman to deploy its business plan moving forward.

4) Atman will continue expanding their psychometric testing solutions moving forward.

5) Q) Since voxtel owns the dating website you partnered with in the past (recontres) will you now expand your presence on the site?

A) We’re convinced we can do a better job in controlling the product and marketing and would launch immediately an English version and eventually a mobile version

6) The user base on the above website is stable for now.

7) Our revised investor deck with information on the acqusiton will be available in 2 weeks and I can share it with you then.

8) We’re paying a good price for a lot of sales growth opportunities out there while operating in growing markets (carrier billing, dating, gaming).

9) Voxtel is in a different business than simply psychometric testing, although their are numerous synergies (example see highlighted section of the PR below) and we can leverage Voxtel's relationships with larger telecom players and businesses to move Atman's business plan forward. Also, we have direct access to Quebec Recontre's 2.5M members (Atman's testing on their dating site) and the ability to self fund and grow in other areas.

The Press Release:

AtmanCo Announces Signature of a Letter of Intent for the Acquisition of VoxTel and a Private Placement of Up to $2.5 Million

MONTRÉAL, QUÉBEC--(Marketwired - June 9, 2016) - AtmanCo inc. ("AtmanCo" or the "Company") (TSX VENTURE:ATW), a leader and innovator in web psychometric test solutions for the corporate market and the consumer market, announces today the signature of a letter of intent with Oxil Invest S.A. for the acquisition of all of the outstanding shares of 9136-2897 Québec Inc. ("VoxTel").

VoxTel is a Canadian telecom company established in 1991 and a pioneer in the development of IVR applications, web applications and carrier billing for mobile and landline phones. Over the years, VoxTel has developed technologies to create a unique integrated mass communication platform. For the unaudited financial year ended December 31, 2015, VoxTel's sales were $13.4 million and its total assets were $2.6 million.

The letter of intent contemplates a purchase price of $3,400,000. Subject to certain adjustments, that price would be paid as follows: $1,500,000 cash at closing, $1,400,000 as a balance of sale payable over 5 years starting six months after closing, and the issuance at closing of common shares having a value of $500,000. No commission is payable and no change of control will result.

"There are strong synergies between the activities of AtmanCo and VoxTel. VoxTel's large database should allow us to accelerate the commercialization of our corporate and mass market solutions, including specifically online dating through the integration of Voxtel's Québec Rencontres website. AtmanCo should also benefit from improved payment solutions and cross-selling opportunities. In addition, VoxTel has a presence in markets where AtmanCo is absent, in particular Canadian provinces other than Quebec and in the United States. Finally, the acquisition of VoxTel should improve AtmanCo's financial flexibility, a pre-requisite for us to deliver on our business plan," said Michel Guay, President and CEO of AtmanCo.

The closing of this transaction between AtmanCo and VoxTel, which are dealing at arm's length, is conditional among other things on AtmanCo carrying out a satisfactory due diligence on VoxTel, obtaining all necessary regulatory approvals and the closing of the private placement described below. Closing of the transaction is expected on or about August 31, 2016.

Private placement

The Company also announces its intent to complete a private placement of up to $2,500,000. The net use of proceeds will be used to finance the acquisition of VoxTel and the Company's commercialization efforts.

Original Post: AtmanCo: Past Personality Is An Indicator Of Future Results

BeWhere Holdings:

BeWhere's CEO Owen Moore added 100k shares and Director O'Briain, Kieran added 50K shares, both between the prices of 0.115 and 0.14 CAD.

Insider buying, especially quickly after the price drops is a sign of an aligned management team who are eager to own more of the ship they are steering. We view insider buying as a very telling and bullish indicator.

We press released an updated version of our original post, and we plan to do a recorded CEO Video interview with Owen Moore in two weeks. Post any questions below.

Ivrnet:

We're up ~50% on our position in Ivrnet, and we are still long. See our recent updates on the company now, or our original post below.

Original Post: Ivrnet: Extremely Overlooked Nano-Cap, With Three Validated Initiatives To Drive Growth

Marathon:

Multiple Marathon Patent Group executives were named to the latest edition of IAM Strategy 300 this week. Invest in industry leaders (better like in this case before they are recognized!)

Reliq Health:

We have a recorded CEO Video interview with Lisa Crossley and a product demo on iUGO slated for a Monday release, stay tuned!Lithium:

Our member Ted is leading the run into the hot Lithium market, see his picks now!

Watchlist:

Ackroo closed their private placement for $587K. below the up to $2M they were hoping to raise.

The company did announce a new partnership as well!

First Data Canada, a division of First Data Corporation (FDC), a global leader in commerce-enabling technology and solutions, are pleased to announce that the two companies have partnered in order to offer Canadian merchants the opportunity to use Ackroo's gift card and rewards technology on First Data certified terminals, making it seamless for First Data Canada merchants to launch their own gift card and rewards programs.

Arkados Group, Inc. annouced the launch of their new M2M platform we are diving into. Our current, and a top holding of ours, in this space is Memex.

(AKDS), a global provider of scalable and interoperable Internet of Things (IoT) solutions focused on industrial automation and energy management, is pleased to announce the launch of the Arktic™ software platform, its new state-of-the-art, open and scalable machine-to-machine (M2M) data analytics tool designed for Industrial Internet of Things. The Arktic™ platform is integrated with hardware from the Company’s strategic product partner, Tatung Company (TWSE:2371), and is designed to drive wide scale industrial and commercial applications such as Energy Management, Measurement and Verification, Predictive Analytics and Machine Automation, enabling better decision making, reduced costs, increased efficiency and productivity, and ultimately, improved margins.

Intema saw 182% month over month growth in its eFlyerMaker platform. At the current time we cant see an overbearing reason to invest in the company when we have our solid marketing investments in AcuityAds (programatic marketing) and SharpSpring (marketing automation)

Our Latest Reports: (Released First To Pro Members)

Check out our latest articles:

- Reliq Health Technologies: New Leadership Driving a Recent Acquisition Offers a Potential Inflection Point

- BeWhereHoldings: A Pulsing, Immutable NanoCap Growth Story

- AtmanCo: Past Personality Is An Indicator Of Future Results

Eight Reasons Why Direct Insite’s Earnings Call Has Us Bullish

Reach An Audience:

Want to share your hard work and get exposure for yourself and your content? Watch this video now! See the exposure you can achieve!

Education:

View all of our educational content in one easy place , all of which is posted publicly on a delayed basis

Latest Premium Content: Long and Short Term Plays:

View all of our latest plays in one easy place!

Broader Micro-Cap Market:

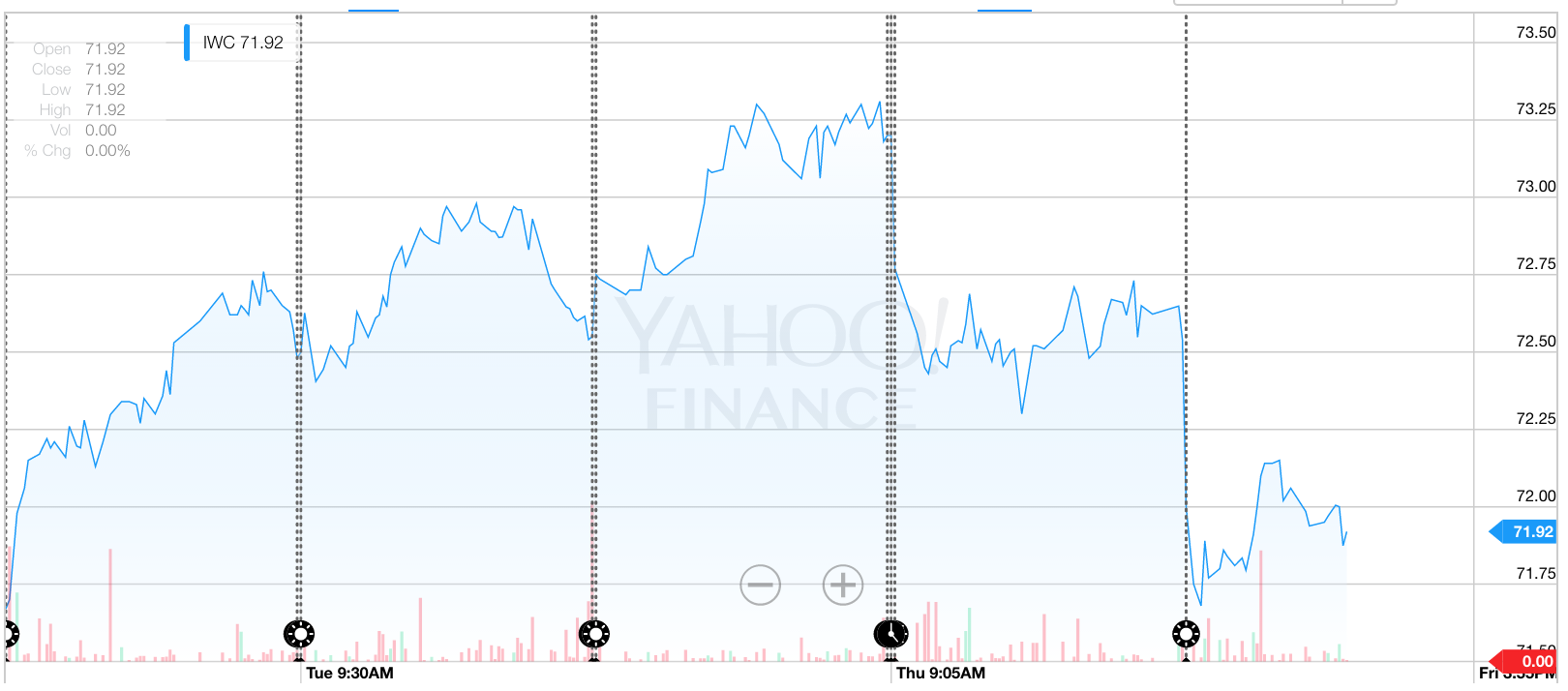

The IWC is up slightly on the week.

Lesson Of The Week:

If your CEO doesn't own a percentage of the company, then why do you?

Holdings Not Listed In Our Portfolio:

Memex (OEE.V), UrbanImmersive (UI.V), AcuityAds (AT.V), Spectra Inc (SSA.V), Ivrnet (IVI.V), RSI International Systems (RSY.V), AtmanCo (ATW.V), BeWhere Holdings (BEW.V or BEWT)

Submit A MicroCap Blog Post

Take full advantage of SecretCaps and submit a blog post on a company you are invested in. It will go on the homepage, help you build a track record and a following and get exposure for your idea!

You don’t have to be a PRO, submit a post today and we will work with you to make it work for our homepage!

Videos:

Following our successful MicroCap screening video , we are interested in doing another video lesson and are trying to pinpoint a topic. Have any ideas? share them below!

Disclosure: This content is strictly informational and educational. Do not invest or trade based upon this content. Always contact a financial professional before executing any trades or investments. By reading this post you agree to SecretCaps’ full TERMS OF USE and agree to and understand SecetCaps' Disclaimer.