Stocks made another huge jump last week, sending SPX and the Dow to new all-time highs!

Markets were flat on Monday, but, by Tuesday's close SPX was testing resistance at above 1980. Wednesday saw some consolidation. Stocks pushed higher on Thursday with SPX ending above 1990. On Friday, markets jumped after Bank of Japan announced a huge, new stimulus program!

We had a huge winning week as well, with LNKD calls garnering +286% profit and TSLA calls returning intraday +124% gain! Besides 1 trade, all the other trades were profitable. Here were the closed trades for the week:

| FEYE Options Sell to close 10.00 (1.73%) of FEYE Nov 22 2014 Call 32.0 at 3.70000 | 23.33% ($700.00) Profit |

| GILD Options Sell to close 10.00 (1.76%) of GILD Nov 07 2014 Call 113.0 at 3.75000 | 39.93% ($1,070.00) Profit |

| LNKD Options Sell to close 5.00 (5.60%) of LNKD Oct 31 2014 Call 205.0 at 24.70000 | 285.94% ($9,150.00) Profit |

| CAVM Options Sell to close 10.00 (1.69%) of CAVM Nov 22 2014 Call 48.0 at 3.40000 | 44.68% ($1,050.00) Profit |

| CAVM Options Sell to close 10.00 (1.48%) of CAVM Nov 22 2014 Call 48.0 at 2.95000 | 25.53% ($600.00) Profit |

| GPRO Options Sell to close 10.00 (1.81%) of GPRO Oct 31 2014 Put 65.0 at 3.60000 | 2.86% ($100.00) Profit |

| GOOG Options Sell to close 10.00 (1.61%) of GOOG Oct 31 2014 Put 545.0 at 3.20000 | 18.52% ($500.00) Profit |

| STLD Options Sell to close 20.00 (1.40%) of STLD Nov 22 2014 Call 22.0 at 1.40000 | 47.37% ($900.00) Profit |

| TSLA Options Sell to close 5.00 (0.75%) of TSLA Oct 31 2014 Call 240.0 at 3.00000 | -52.38% ($-1,650.00) Loss |

| WDC Options Sell to close 10.00 (1.99%) of WDC Oct 31 2014 Call 92.0 at 4.00000 | 37.93% ($1,100.00) Profit |

| FSLR Options Sell to close 10.00 (2.48%) of FSLR Nov 22 2014 Call 55.0 at 5.00000 | 21.65% ($890.00) Profit |

| TSLA Options Sell to close 10.00 (2.98%) of TSLA Oct 31 2014 Call 235.0 at 6.00000 | 33.33% ($1,500.00) Profit |

| TSLA Options Sell to close 5.00 (1.87%) of TSLA Oct 31 2014 Put 225.0 at 7.40000 | 16.54% ($525.00) Profit |

| TSLA Options Sell to close 10.00 (4.21%) of TSLA Oct 31 2014 Put 230.0 at 8.30000 | 124.32% ($4,600.00) Profit |

For the week, the Dow was up +585.11 points; SPX added +53.47 points; Nasdaq gained +147.02 points. Gold took a huge drop, closing at below $1170/ounce. Oil barely stayed above $80/barrel. At the time of this writing, Asian markets were mixed. Let's see where the US markets closed on Friday:

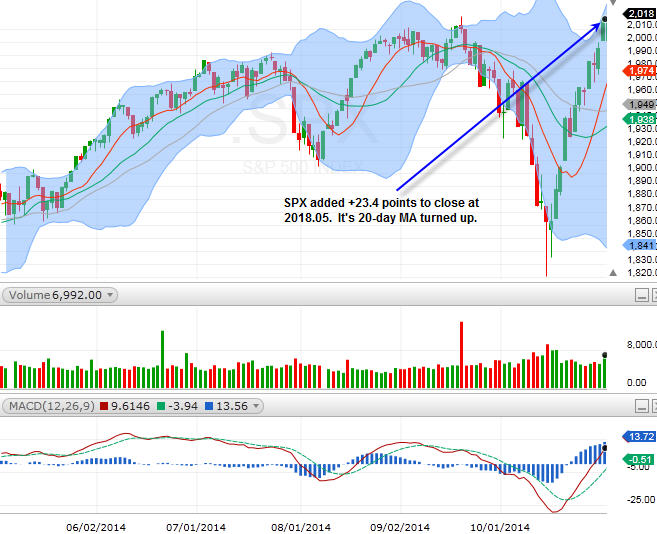

SPX

On Friday, SPX added +23.4 points to close at 2018.05. It's 20-day MA turned up.

Nasdaq

Nasdaq gained +64.6 points to close at 4630.74. It closed above the recent highs and made a new high since May 2000!

It is quite amazing how sharply the markets have bounced from the recent quick selloff. It does seem like, at least to a certain extent, that the central banks are collaborating and coordinated in their stimulus plans. For the new week, earnings will continue to come in:

Monday: (AM) SOHU, CYOU, VMC; (PM) Y, AIG, HLF, RNWK

Tuesday: (AM) AGU, AKS, BABA, DNDN, DISH, MWW, PCLN, REGN, TESO; (PM) COKE, DRYS, FEYE, JAZZ, PZZA, TRIP

Wednesday: (AM) CSIQ, M, YGE; (PM) CSCO, NTAP, OXGN, SINA, SCTY, TSLA

Thursday: (AM) AOL, APA, CSUN, FSYS, SFUN; (PM) JOBS, CLVS, FSLR, MNST, PCYC, RIG, ZNGA

Friday: (AM) ICPT, HUM, ISIS

I think the market will pause to consolidate to begin the week. Tuesday's election will likely affect the market. Lots of earnings are coming in. If the markets hold their levels after the election, the focus should be back on earnings. SPX 2010 should now be a support.

Sector Watch

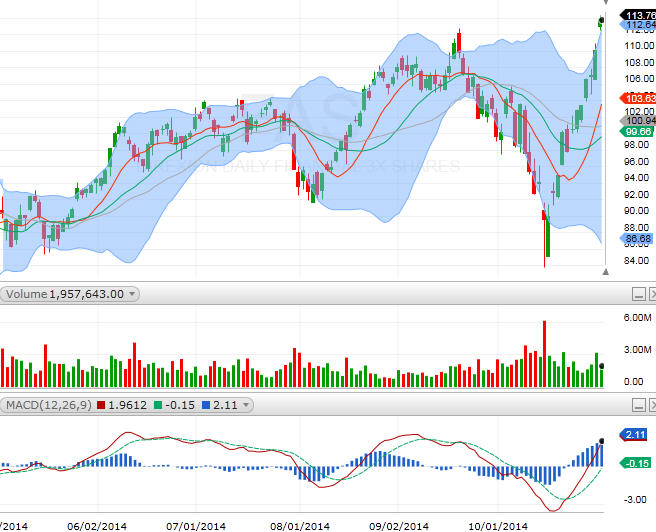

FAS (financial)

FAS went up so fast, I think it'll need to take a breather. GS looks really strong. WFC and JPM have some catching up to do. AIG reports after the market on Monday.

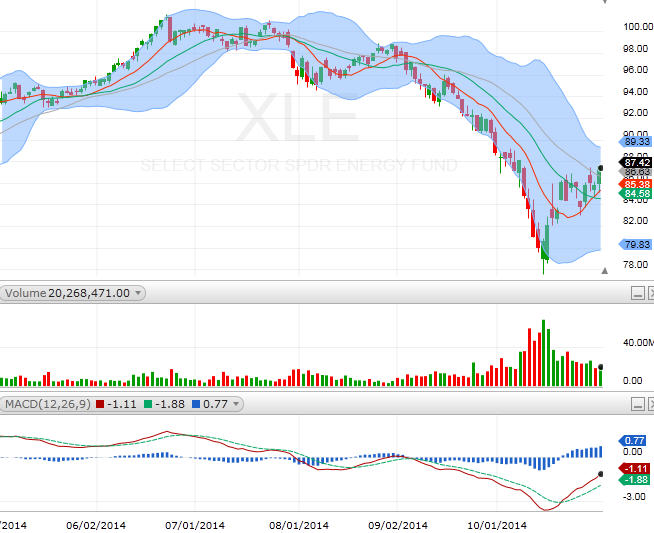

XLE (energy)

XLE closed above its daily MAs last week. XOM and CVX both reported well. We should see how APA reports on Thursday. APC looks fairly strong.

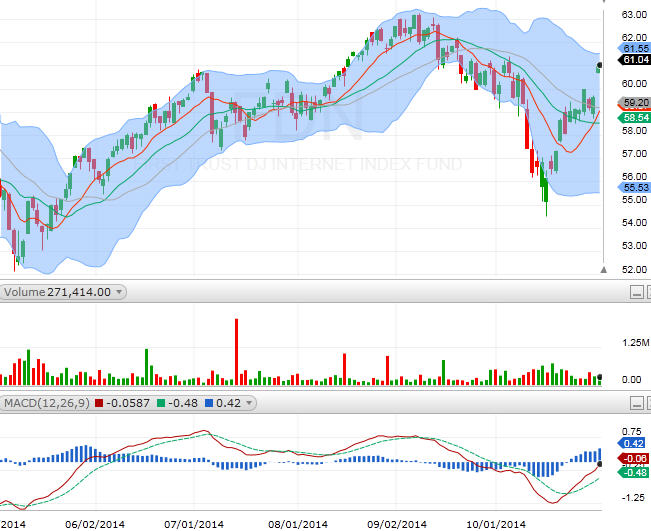

FDN (internet)

FDN got a good pop on Friday after LNKD's earnings. This week, we will hear from PCLN and TRIP. Chinese internet companies are reporting as well, including BABA, SOHU, and SINA.

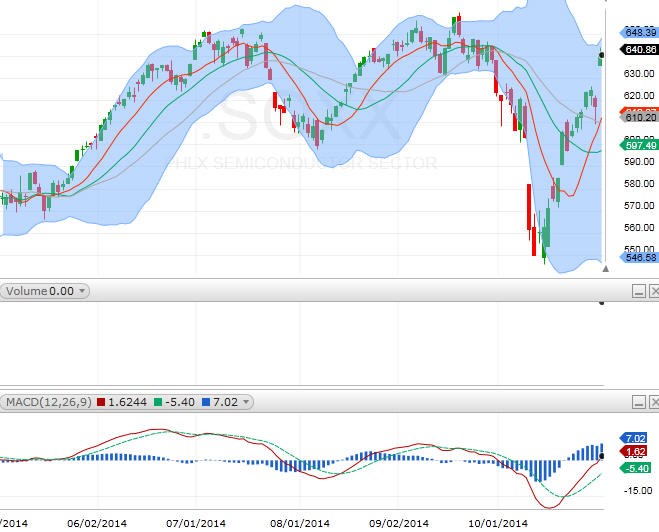

SOXX (semiconductor)

SOXX also got a good jump on Friday. BRCM continues to lead this sector. TXN and INTC are not bad either.

It's good to see semiconductor sector strong. Nasdaq needs this sector to push higher. So, we will be watching the semis.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member