Overview

It feels like I'm having to say the same thing each week, but the fact is very little has changed for some time now. The S&P 500 continues to consolidate the breakout from July and remains in a holding pattern just below its 50-day.

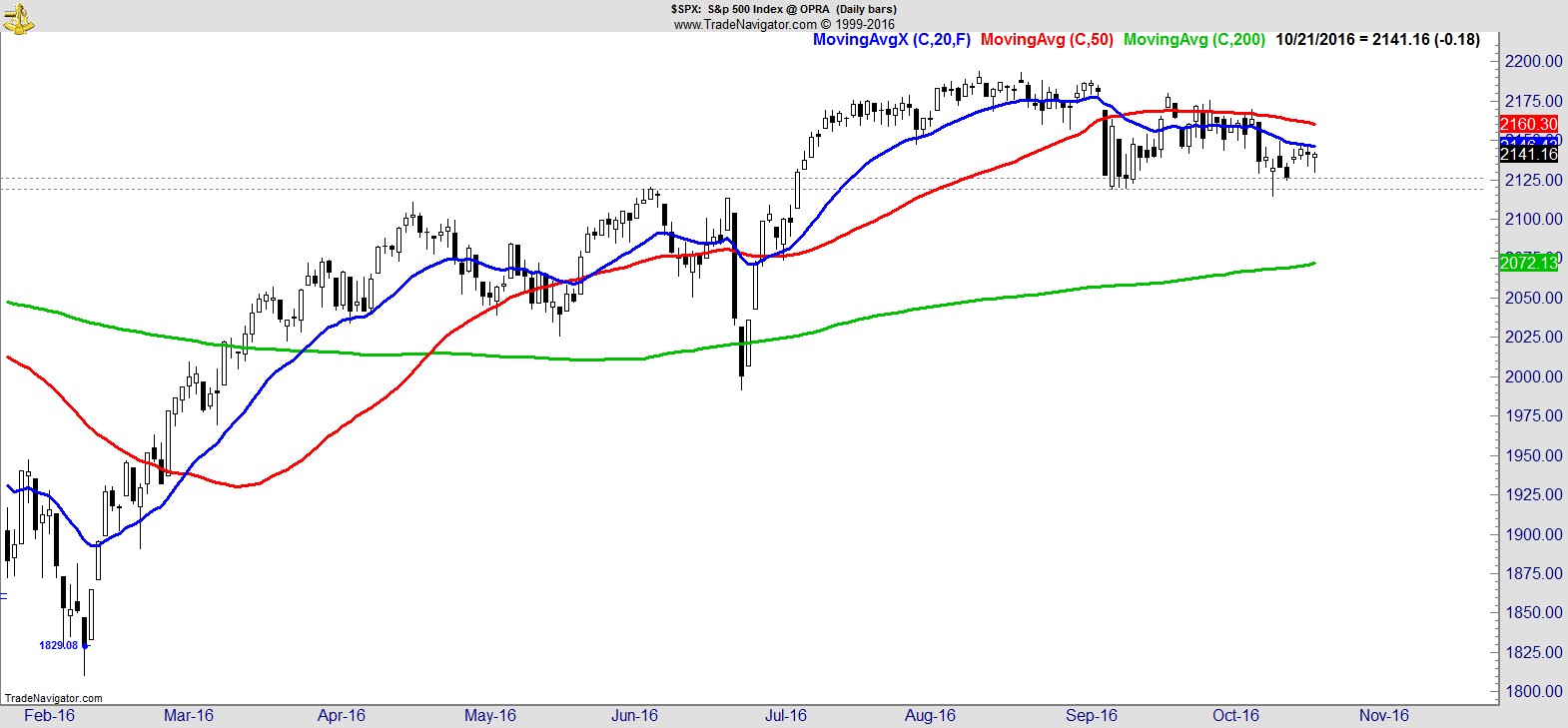

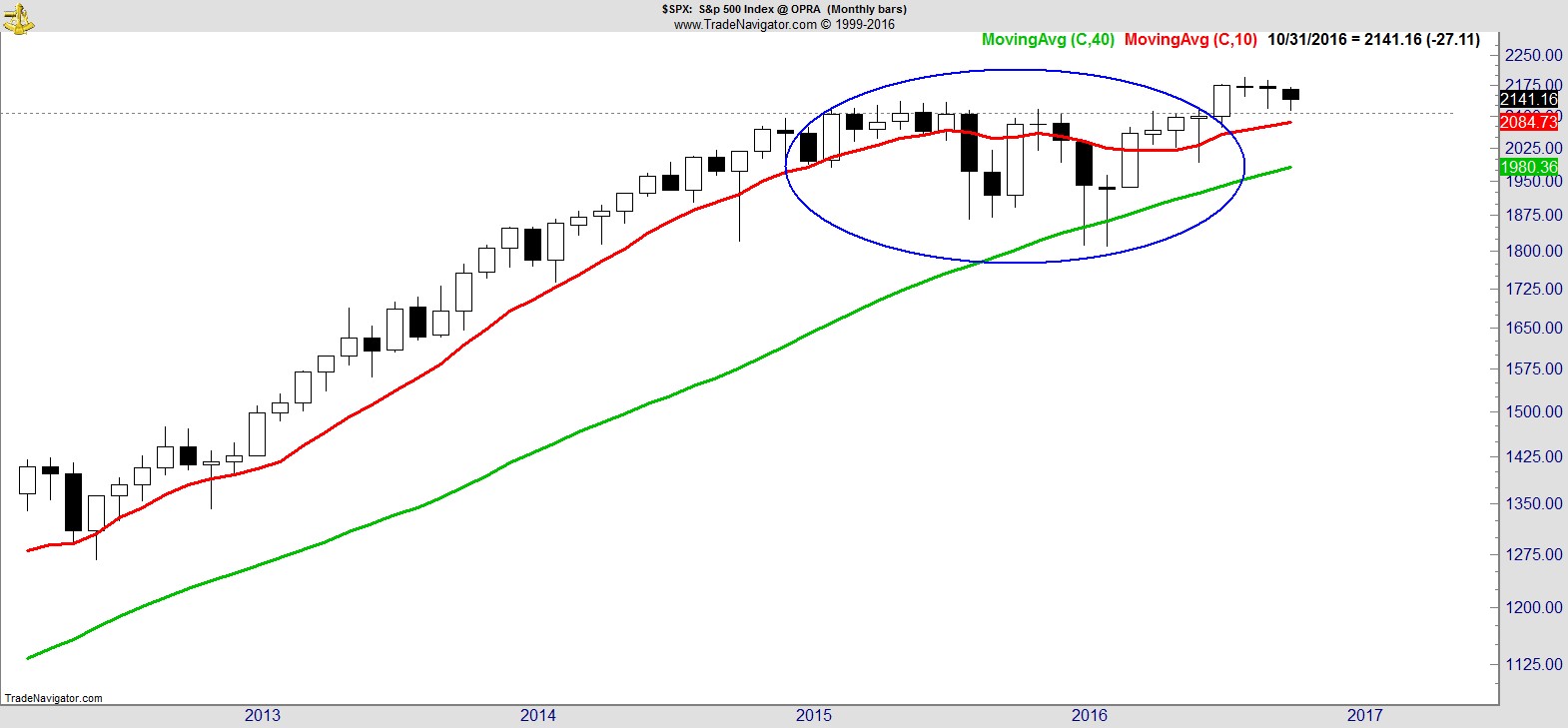

For some context, here's the S&P ($SPX) on a daily and monthly chart:-

The breakout to all time highs in July brought the 2015-16 bear market to an end, and marked the start of a new bull market. It has since been in a tight range just below its highs, while breadth remains healthy and sentiment very negative.

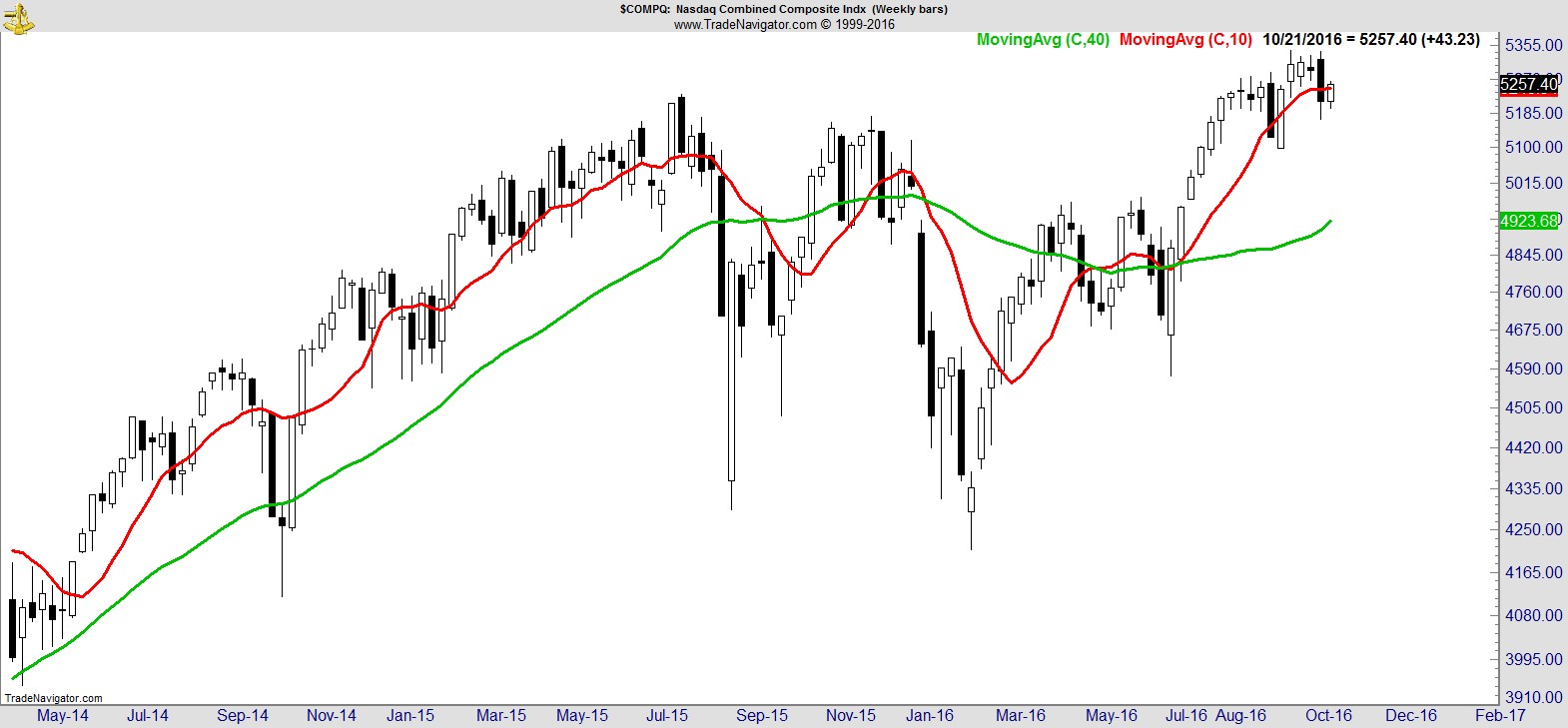

The NASDAQ made back some of last week's losses and is less than 2% from an all time high.

.

The Transports ($DJTA) continues to trade in a narrow range since testing its April highs.

.

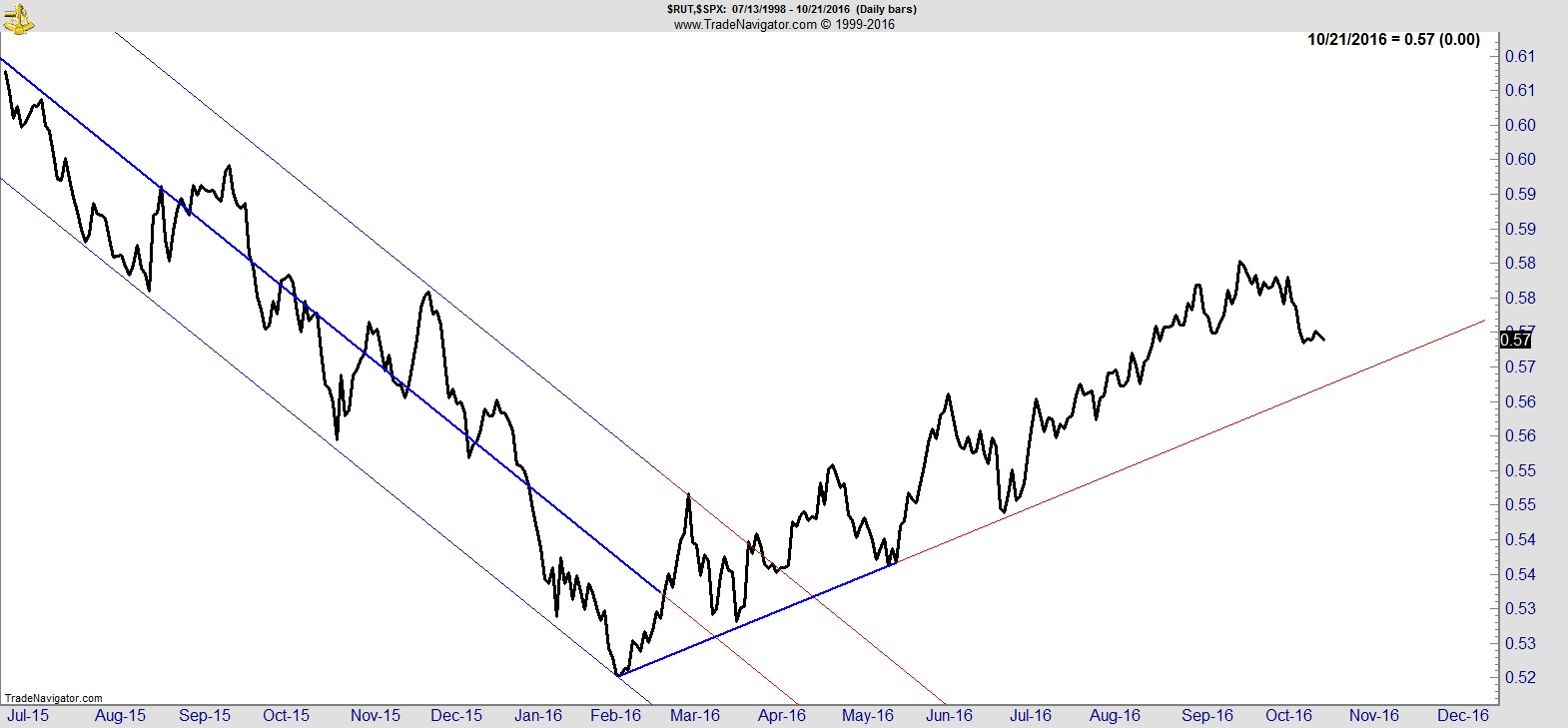

The Russell ($RUT) finished slightly higher but gave back further ground relative to the S&P:-

.

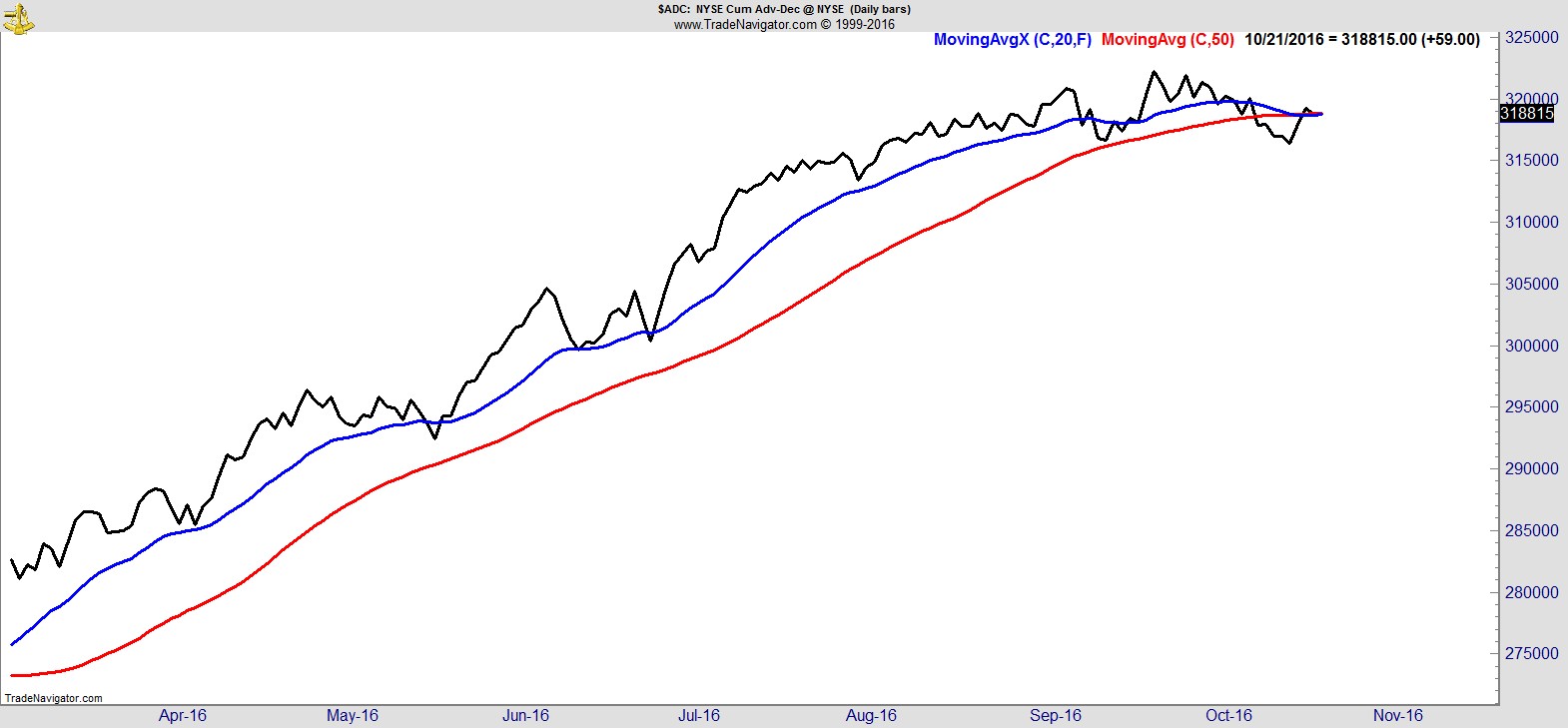

Breadth is healthy with the NYSE Cumulative Advance/Decline improving after some recent weakness.

Sentiment remains negative. AAII bulls are at 23.7%, the lowest level in four months, while bears are 37.8%, and neutral 38.4%. NAAIM exposure dropped from 86.5 to 63.7, and Consensus bulls are at 60% down from 74% in June.

.

Sector Analysis

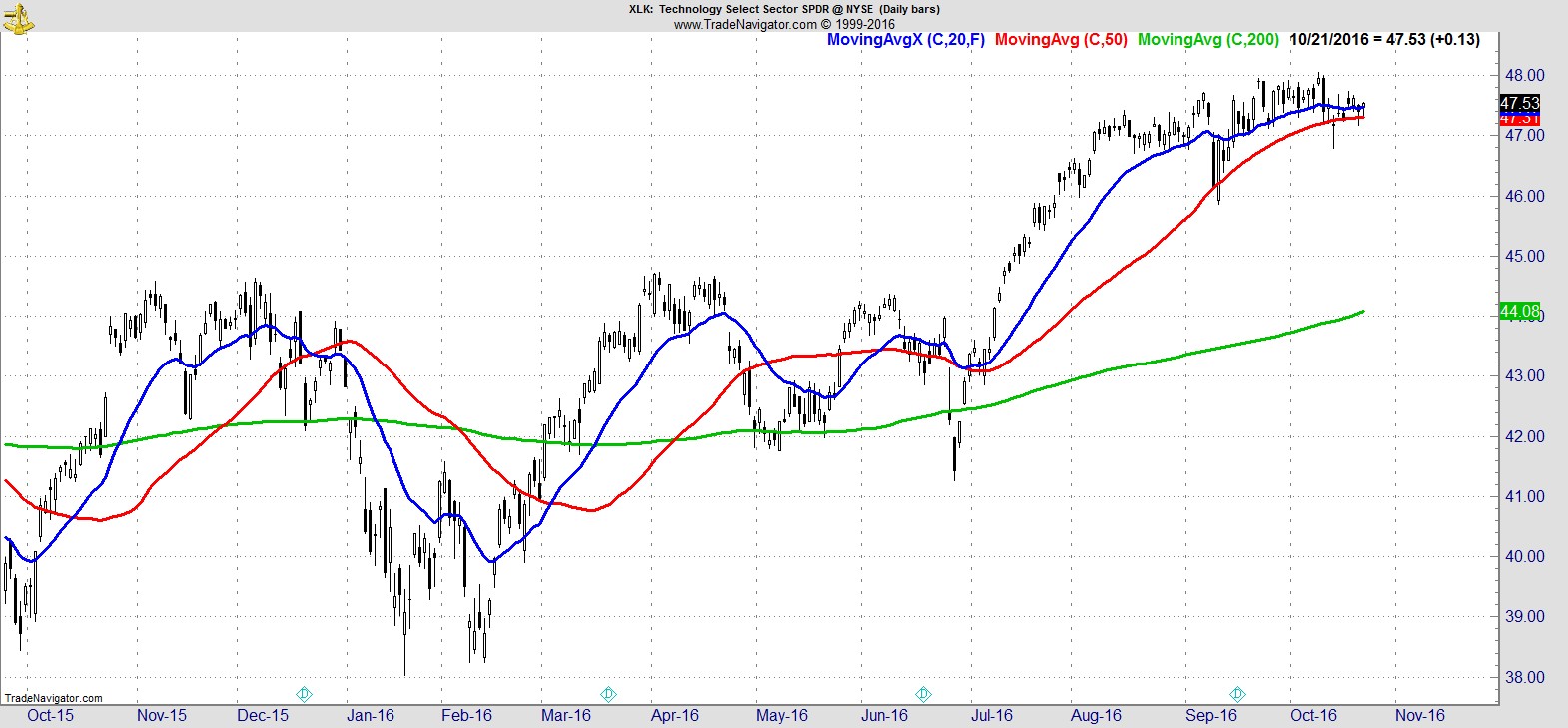

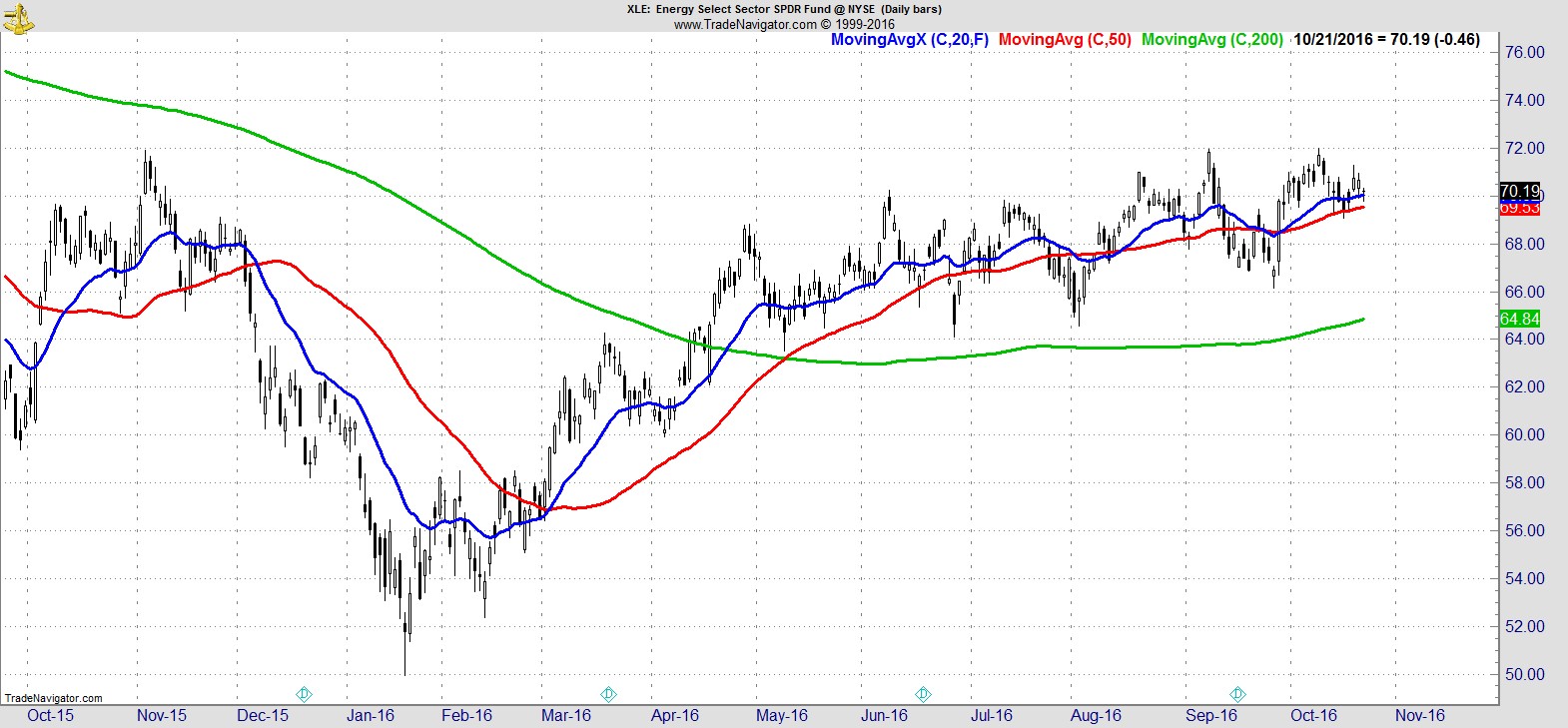

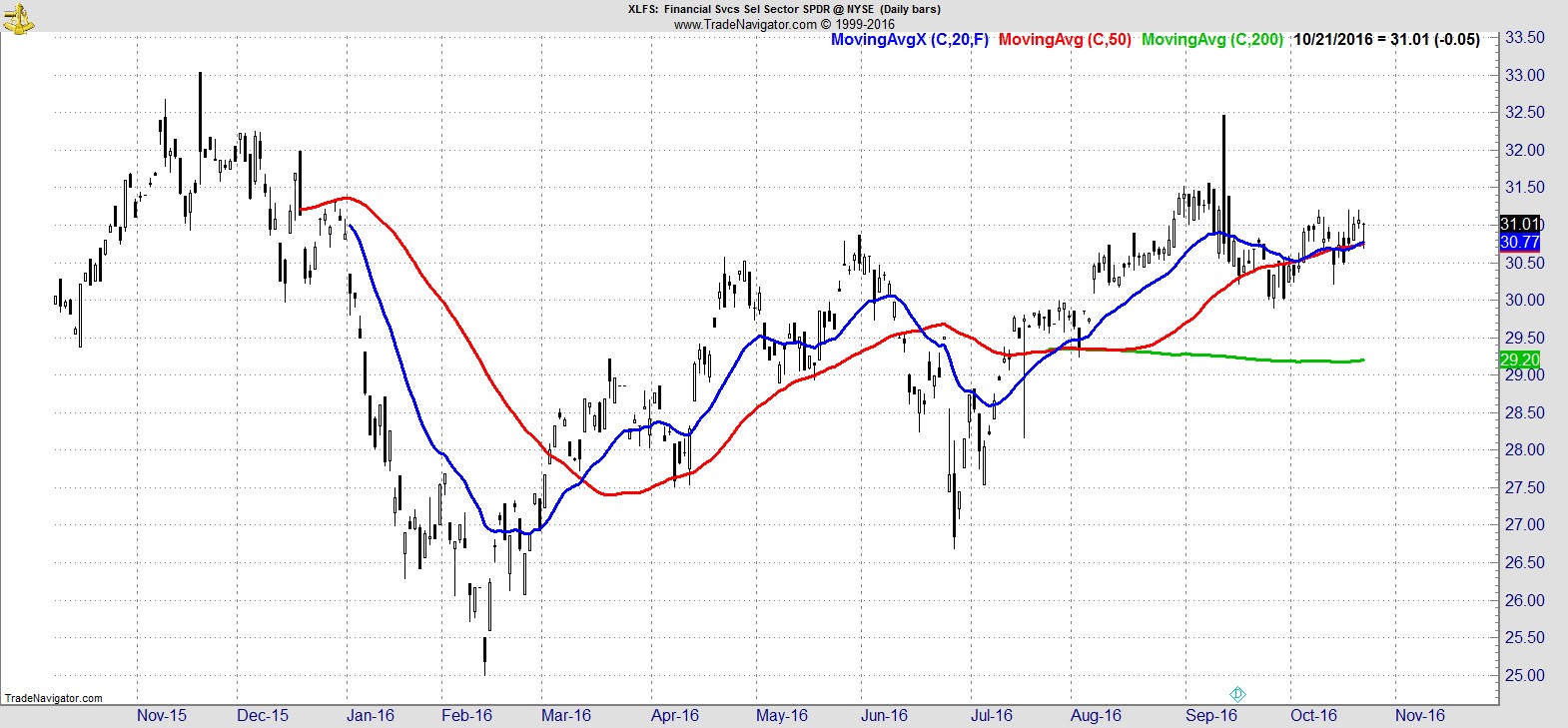

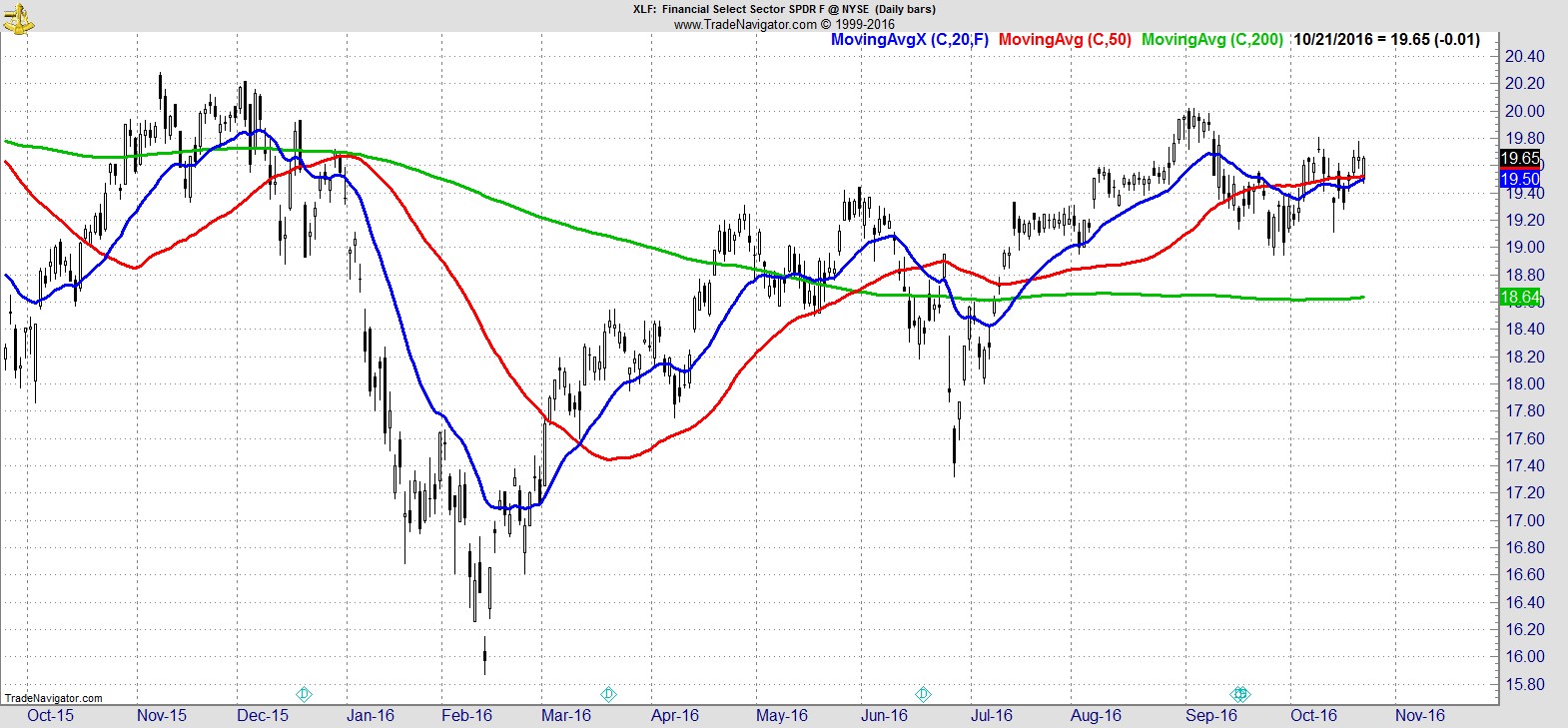

There's no change at the top. The leading sectors remain Tech ($XLK), Energy ($XLE), Financial Services ($XLFS), and Financials ($XLF), all of which are above their 20, 50, 200 day MAs.

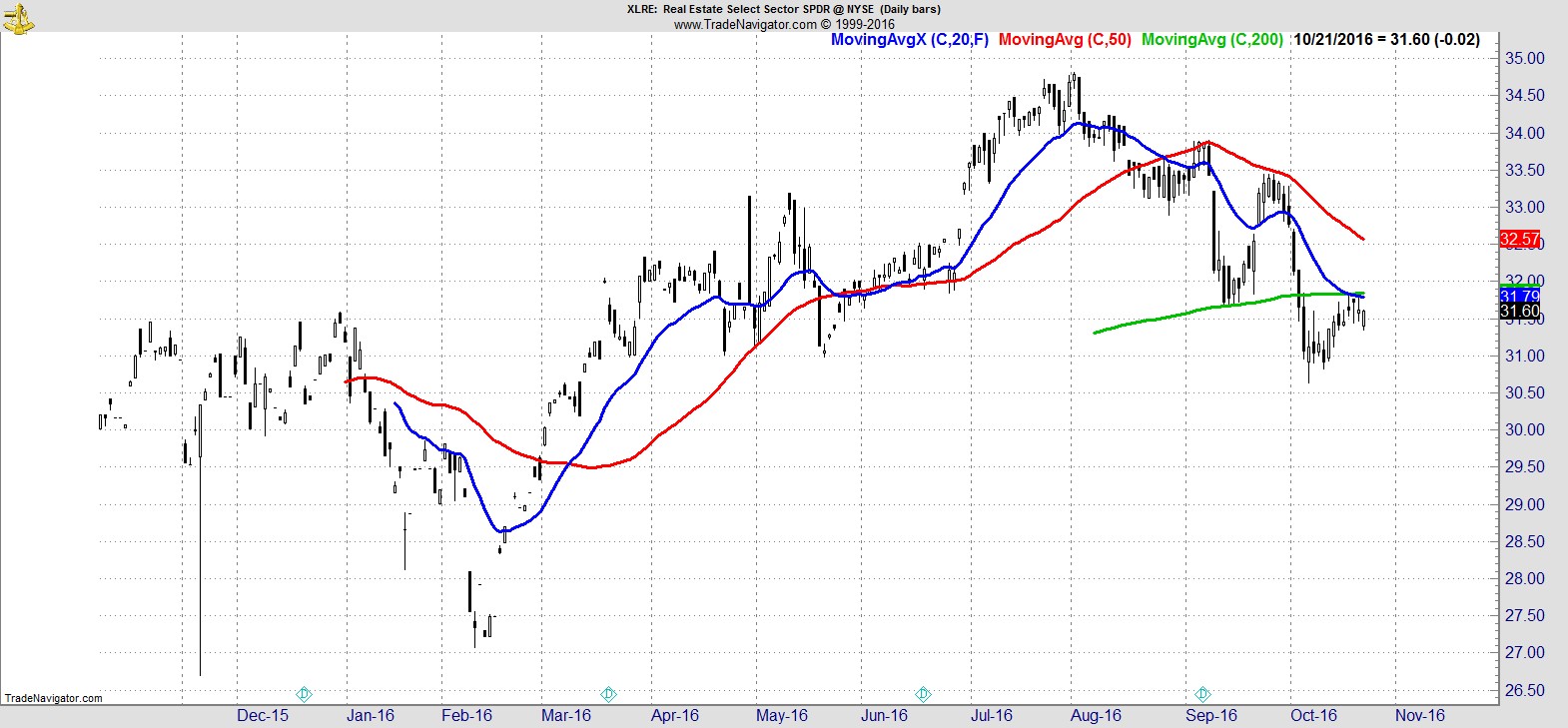

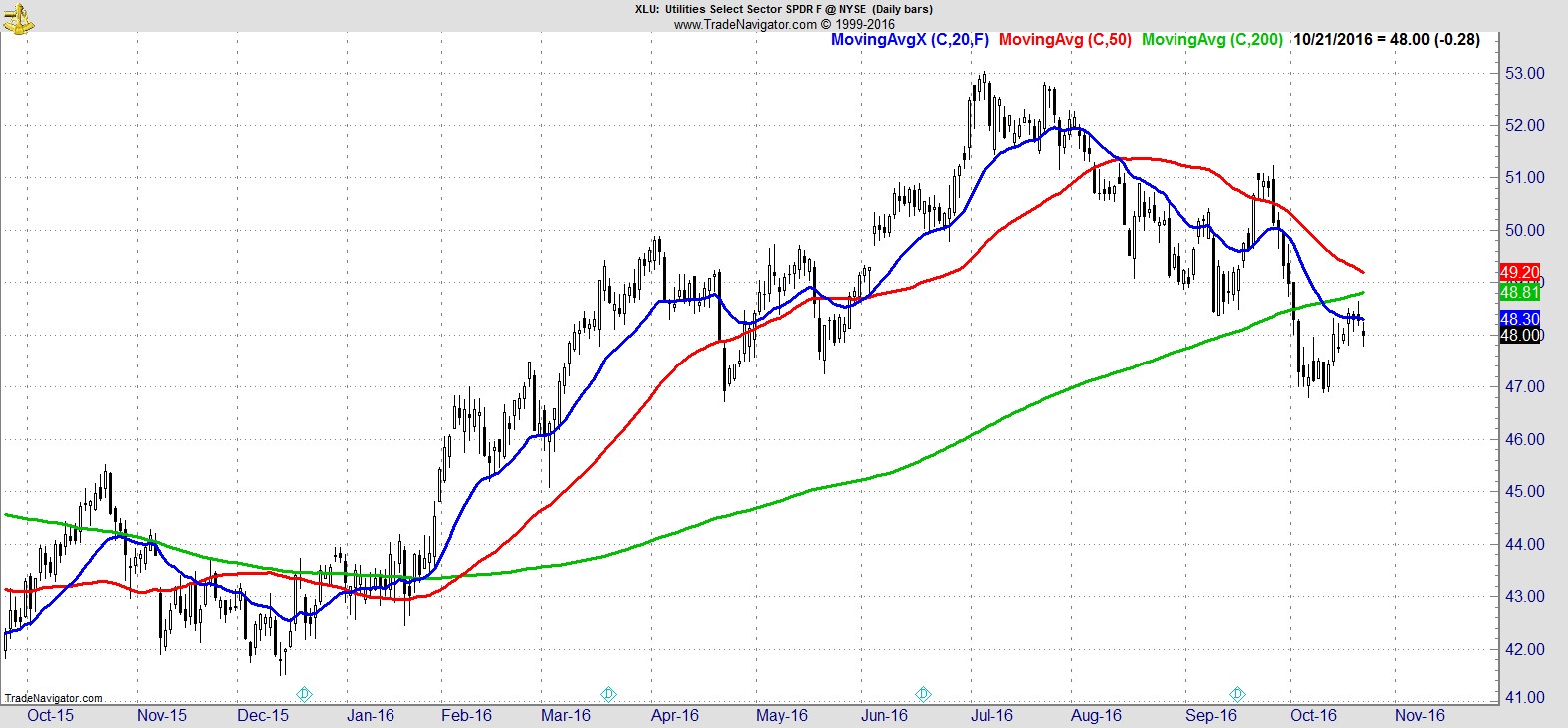

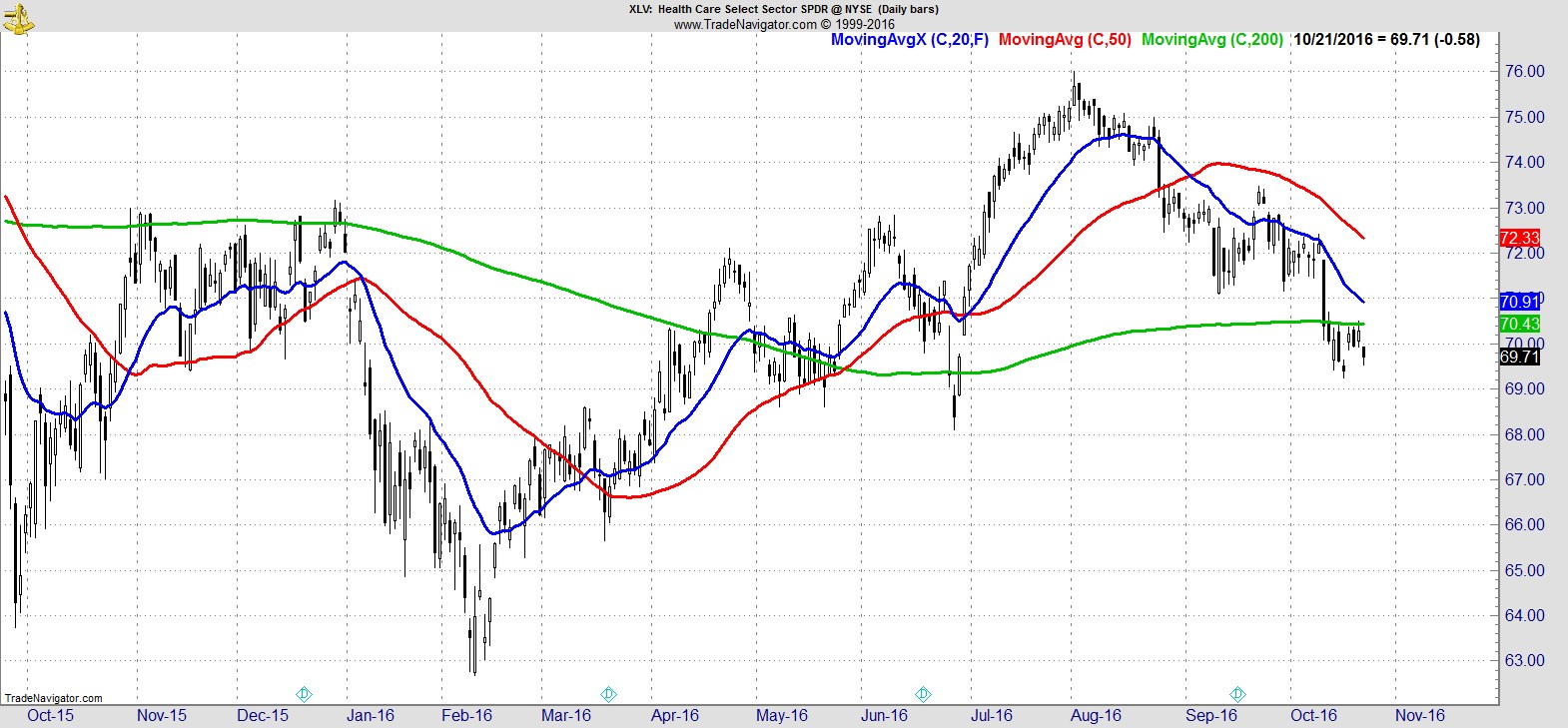

.

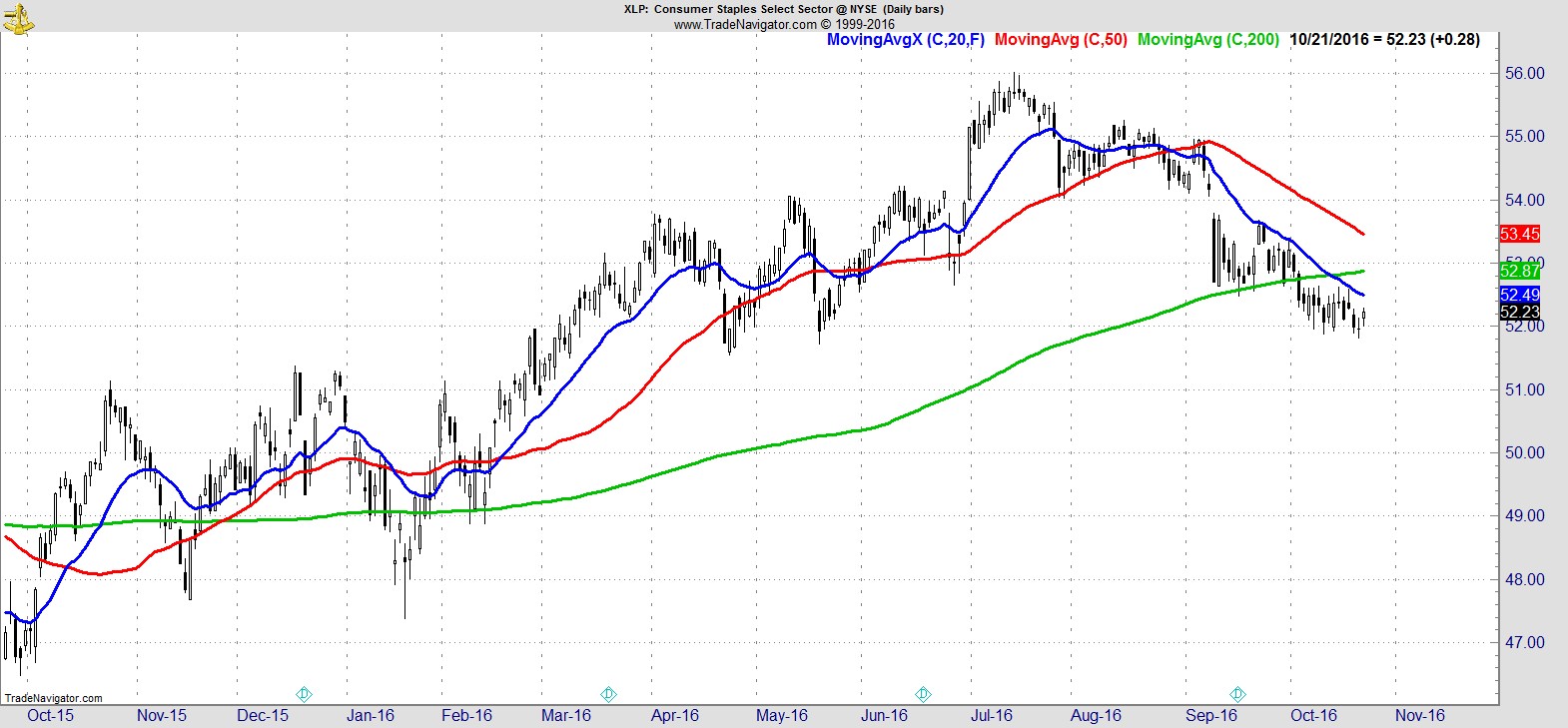

They're followed by Consumer Discretionary ($XLY), Materials ($XLB), and Industrials ($XLI), which are all above their 200-day but below their 50-day. The bottom four remain Real Estate ($XLRE), Utilities ($XLU), Healthcare ($XLV), and Consumer Staples ($XLP), which are all below their 200-day MA.

.

Alpha Capture Portfolio

The recent underperformance of our portfolio continued this week. It was -0.1% vs +0.4% for the S&P, and over the last three weeks is now -4.8% vs -1.3%. That takes it to an ugly -8.5% YTD.

We all know the importance of risk management through cutting losses and position sizing, and having a systematic, rules-based methodology, but another under-appreciated aspect is the return profile of your chosen methodology.

With trend and momentum we know what to expect in terms of strike rate, avg win/loss ratio etc, but when you have the added dynamic of a highly-concentrated portfolio you need to be aware just how different a return profile you will have compared to an index, and even to other portfolios of similar construction.

I see this myself within my own two businesses. The portfolio I run for clients is very similar in construction to the AC portfolio, but with slightly different risk parameters and timeframe. Last year it was down while the AC portfolio was flat. This year the roles have been reversed. The best that can be said for both is that when they haven't made money they haven't lost too much either, in what has clearly been a difficult and frustrating two years for intermediate trend/momentum players.

For many people, that won't be enough, and it's a case of 'What have you done for me lately?' At the end of the day however, the key question is 'Are the results within your expected parameters?' to which the answer is 'Yes'.

Winning systems will have losing days, weeks, months, quarters, and even losing years. Sometimes several. So do long-term successful traders and investors.

As my friends at Alpha Architect point out in this excellent post, "Sometimes even the best evidence-based active management strategies can create a formidable challenge to investors seeking to exploit them... In order to access the potential gain, you must be willing to accept the potential pain."

We have to keep on keeping on.

Or as Winston Churchill said "If you're going through hell, keep going."

.

Watchlist

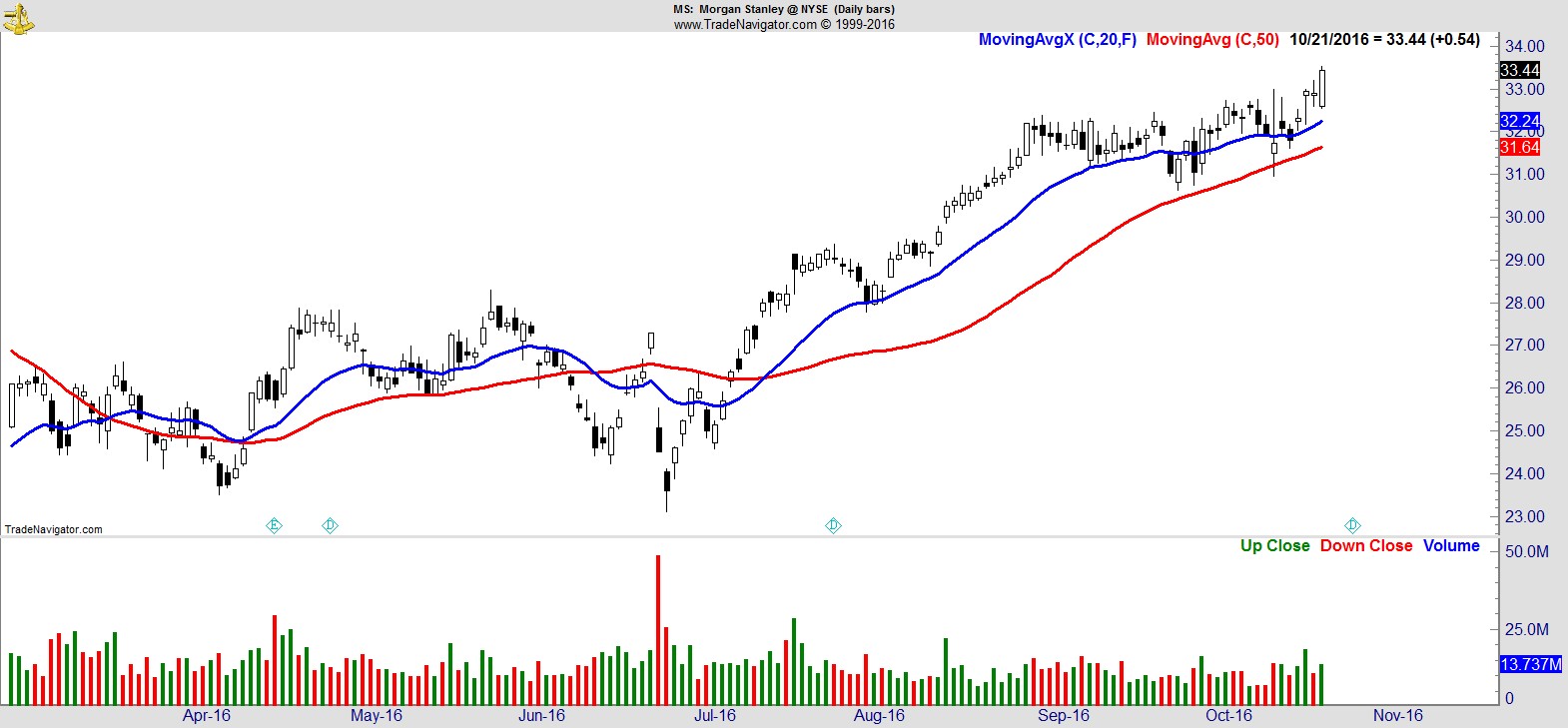

Tech remains a leading sector, but we already have several names in our portfolio and trade ideas so there's few remaining on our watchlist. The sector that's showing up strongest in terms of setups and potential entry signals is Financials. There has also been improvement in consumer-related names.

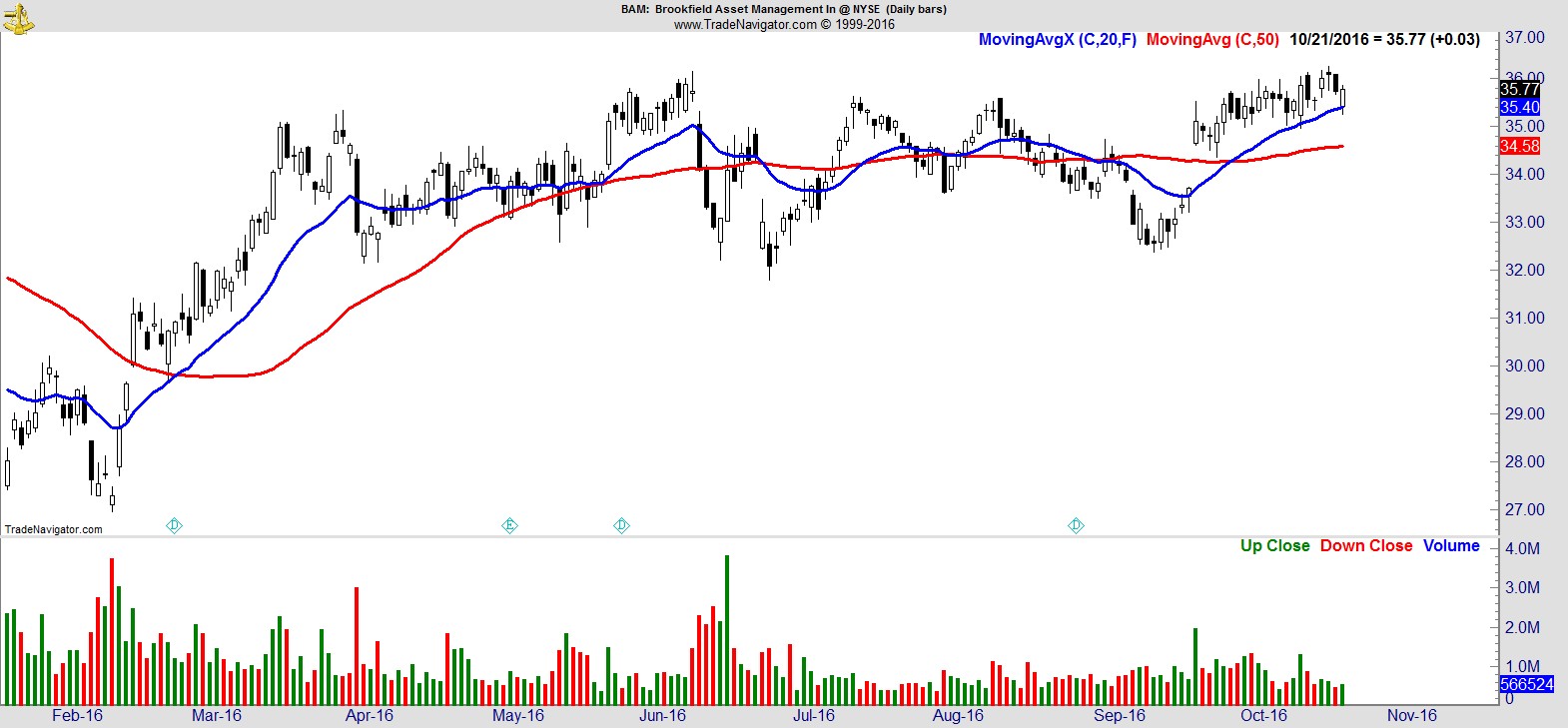

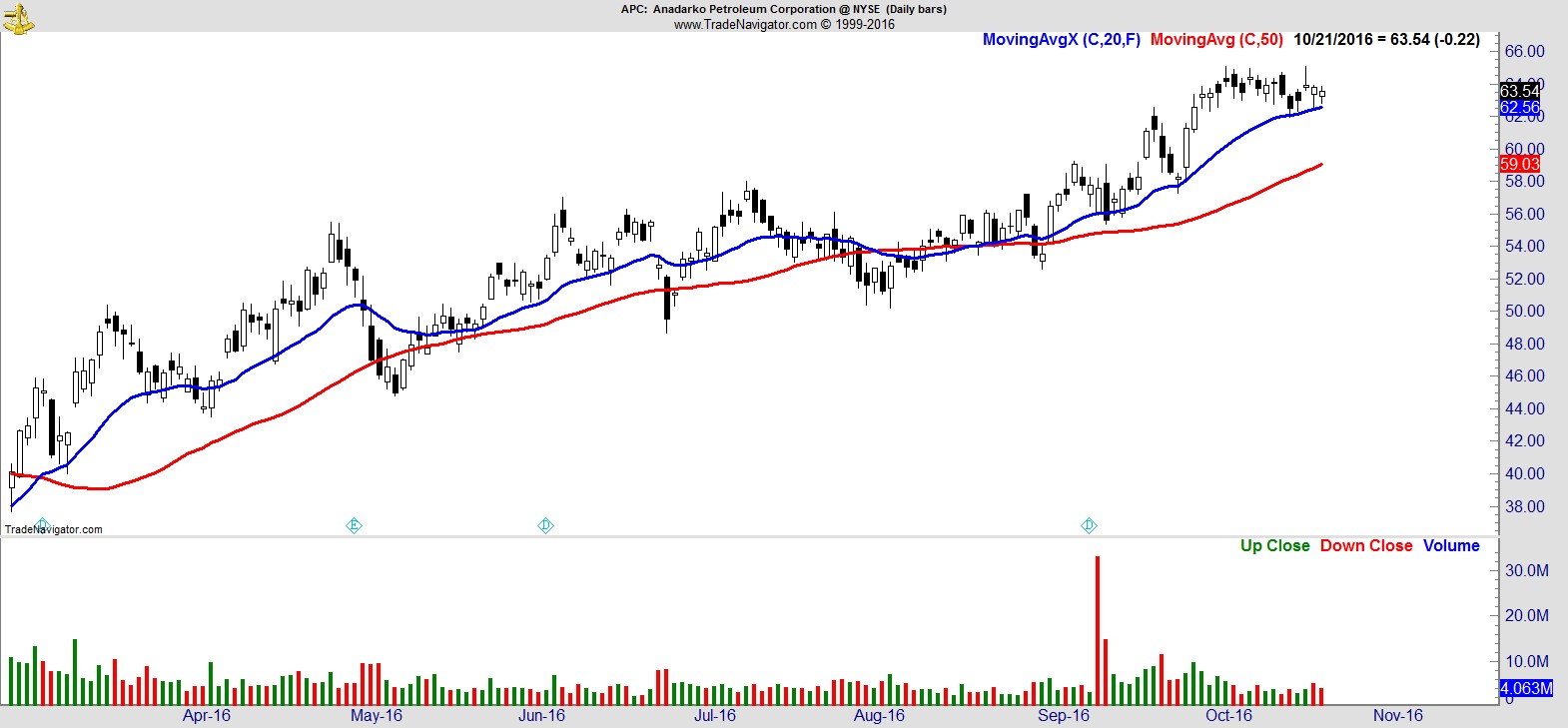

Here's a small sample from the full list of 25 names:-

$MS

.

$BAM

.

$APC

.

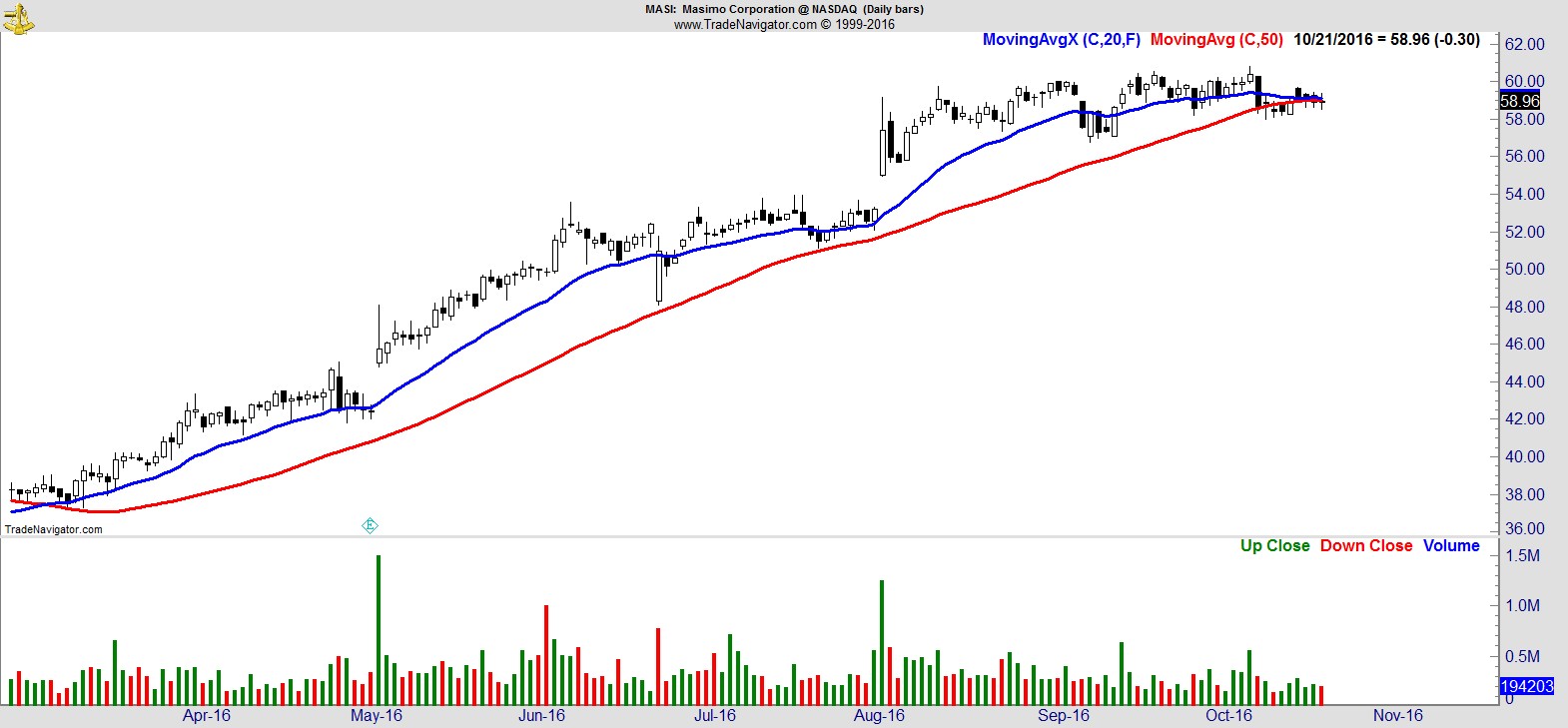

$MASI

.

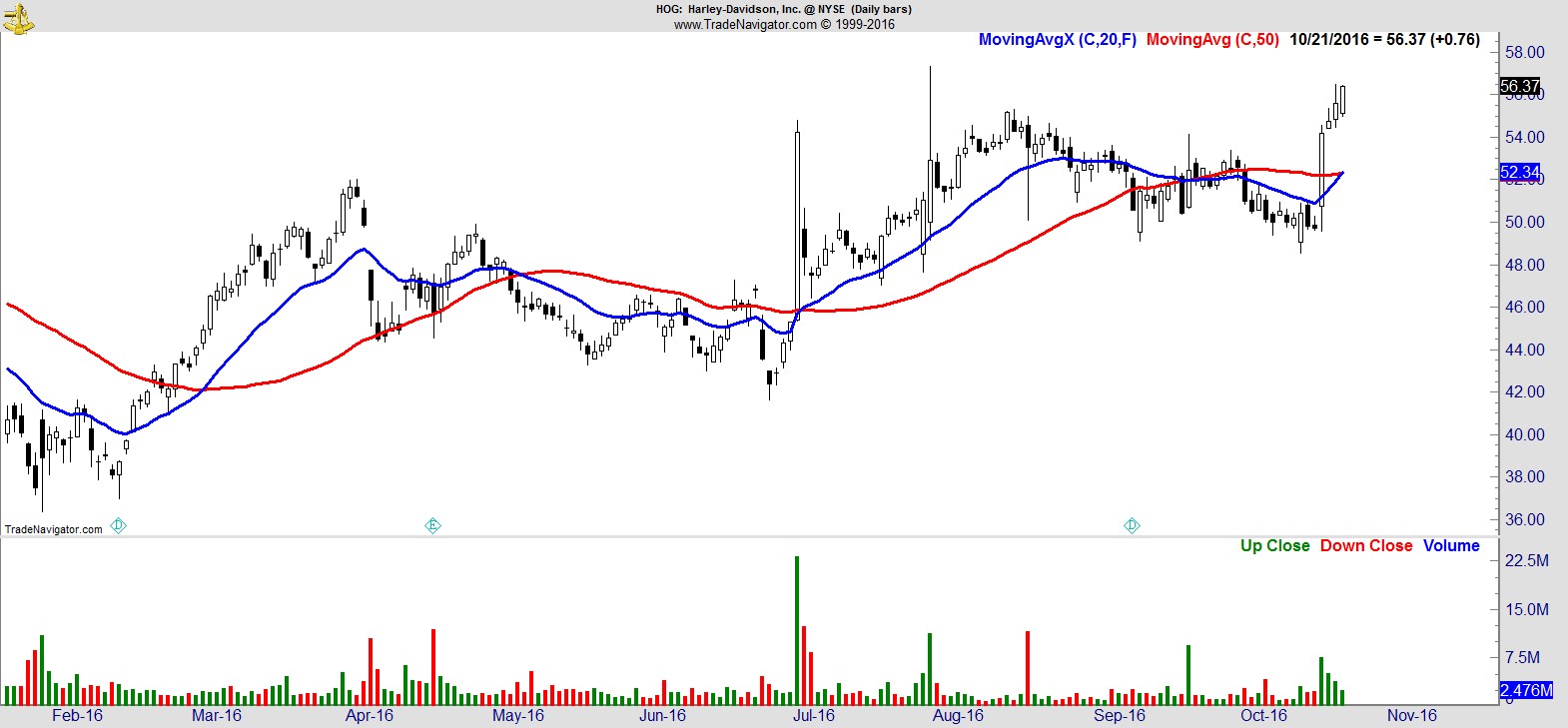

$HOG

.

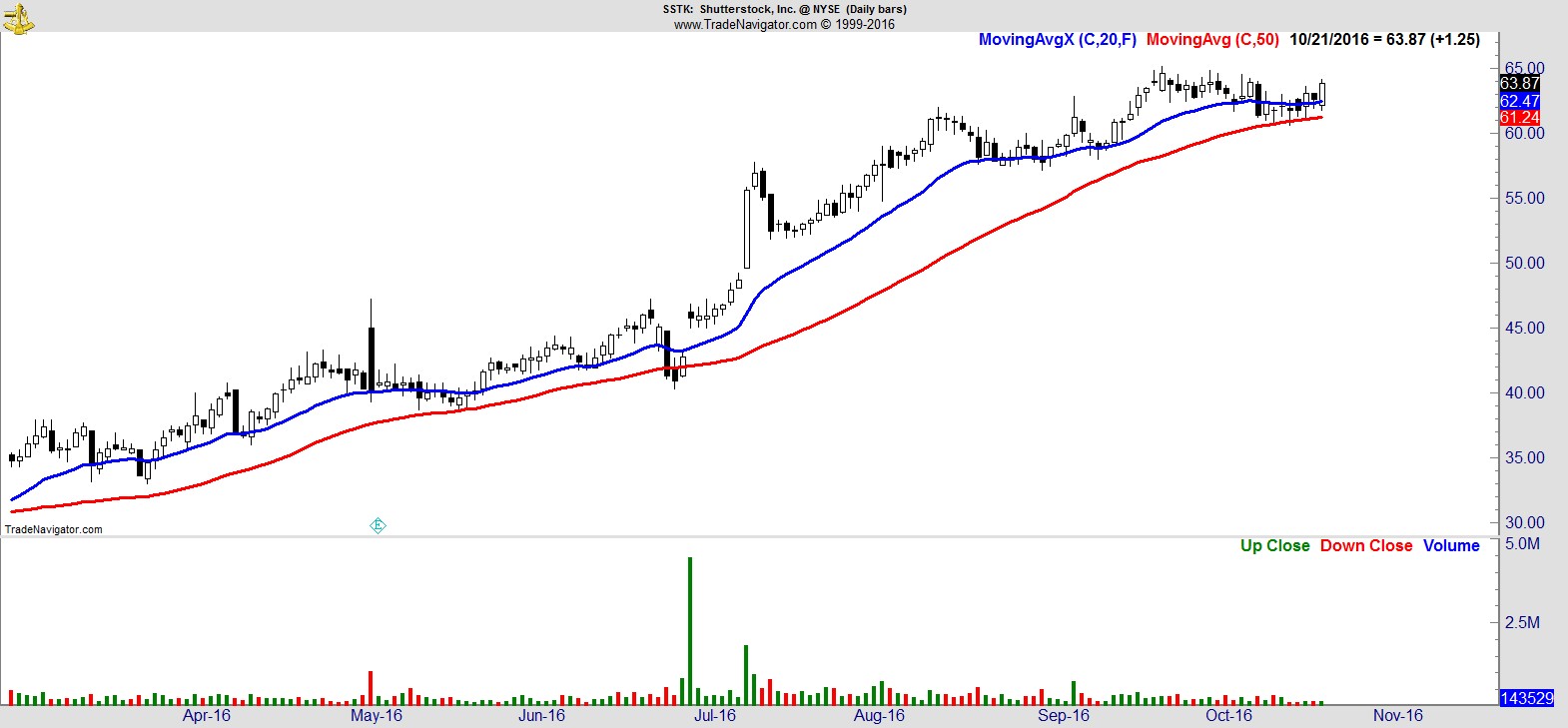

$SSTK

.

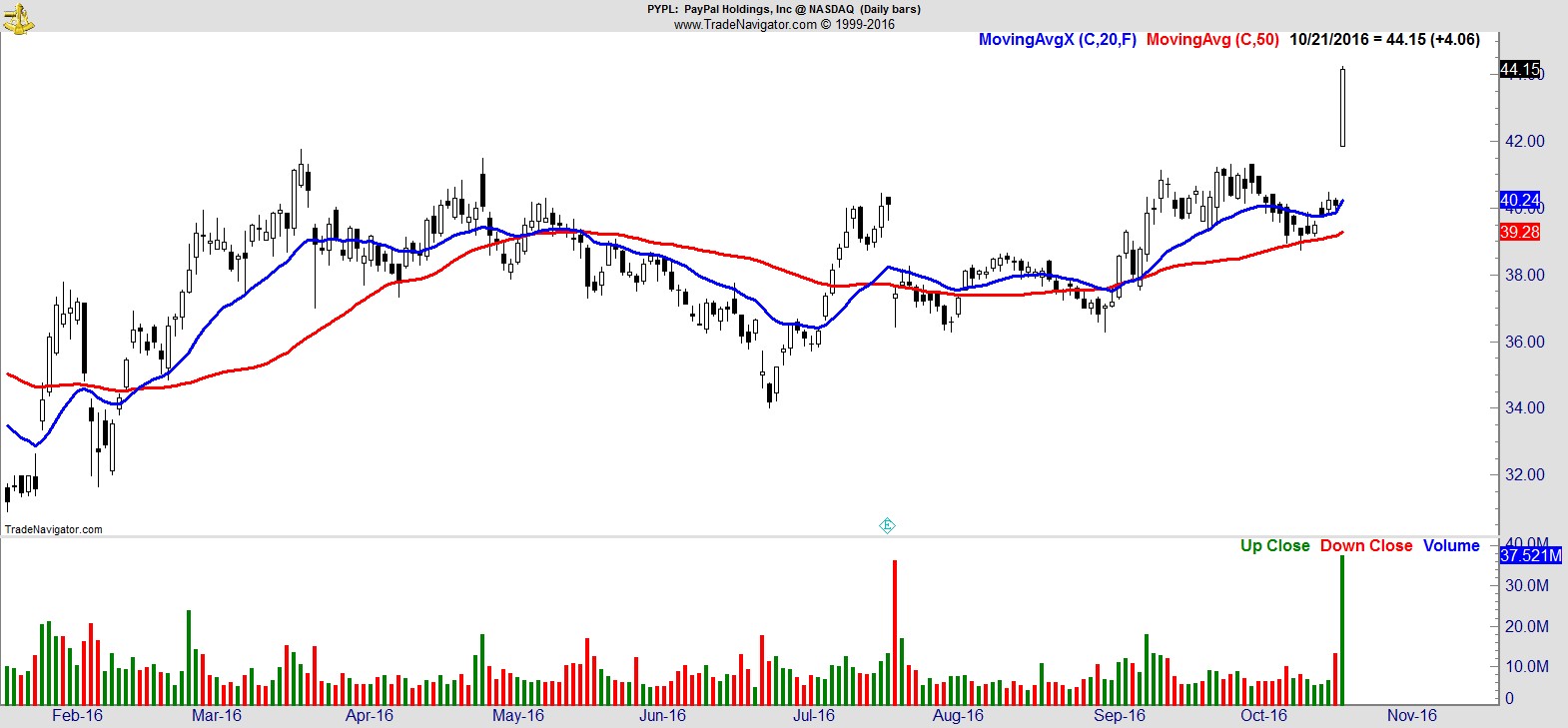

$PYPL

.

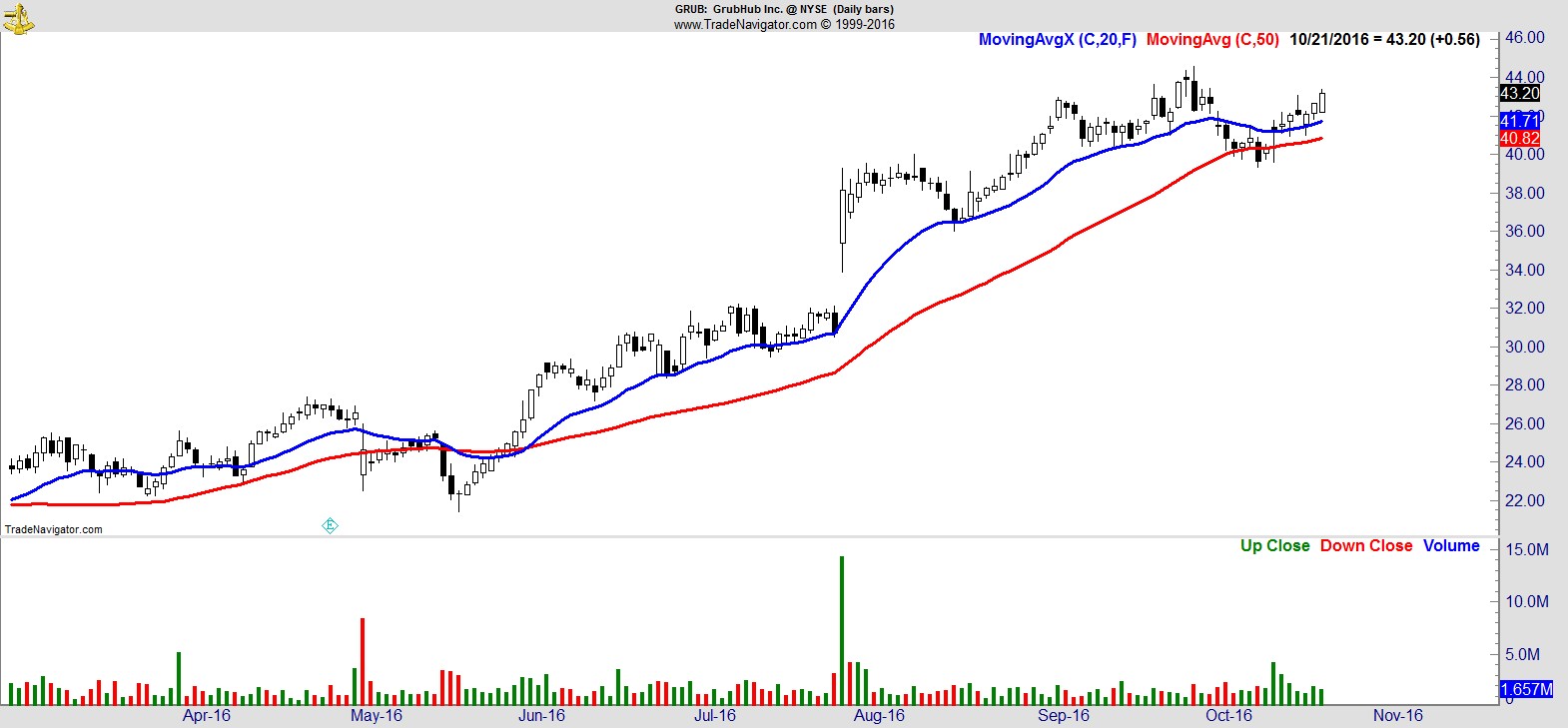

$GRUB

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17