What an impressive day. I propose we relabel Wednesday from "Hump Day" to "Trump Day."

- After falling over 800 points overnight, the DOW finished +256 points.

- The S&P fell closed + 24points after falling over 100 points overnight.

- Most impressive were the small caps closing +3%!

- Eyeball: I count 377 S&P points traveled overnight: Crash then zigzag recovery.

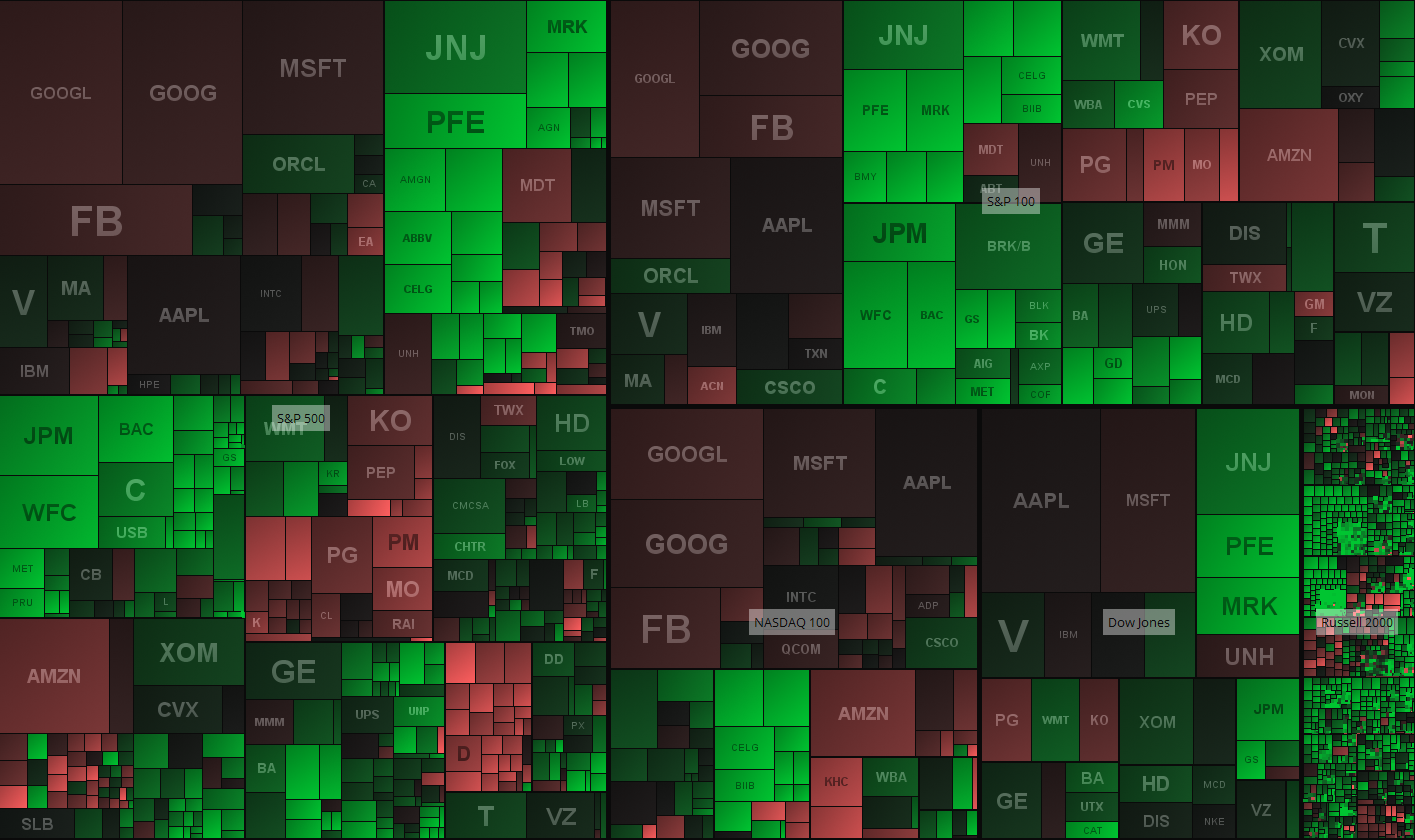

- The heat map gives us a picture of how the mega caps lagged while specific industries soared

Why the rally? Markets were forced to face the Evil they had created and the world didn't end. Now they see Trump as being good for the economy since he promised +3% growth which usually means he will be spending money into our economy.

THERE ARE NO BLUE PRINTS FOR THIS! But I know 1 thing for sure 100%: The bull appetite for risk is alive and well as traders have zero fear for now. This makes the long trade easier to manage than the bearish one. Caution shorting. Remember my statement about being "dangerously bullish."

>>>>>> Caution in either direction until we get clarity. <<<<<<<

What stood out today: There is a lot to study but here is a start

- Biotech: Massive +9% rally where the ETF. They have been sold on fears of Clinton as president.

- Banks: +5% rally. MS for example +8% wow. They rallied on a massive spike in rates (and crash in bonds). Perception is that they profit on higher rates.

- Mega caps lagged (money has to come from somewhere). IF they join the green party tomorrow we could have new all time highs in days across markets.

LEVELS:

- S&P e-minis: Notice the candle today is of the same size as the whole BREXIT drop and recover. Only this one happened in hours.

- Nasdaq: Lagged a little on the account of the lag in FANG and AAPL

- Small caps: This is the largest candle I see for miles. This is most impressive. But they still need to show follow through. Remember the orange line from which they broke down? Here they are back at it from below. Resistance?

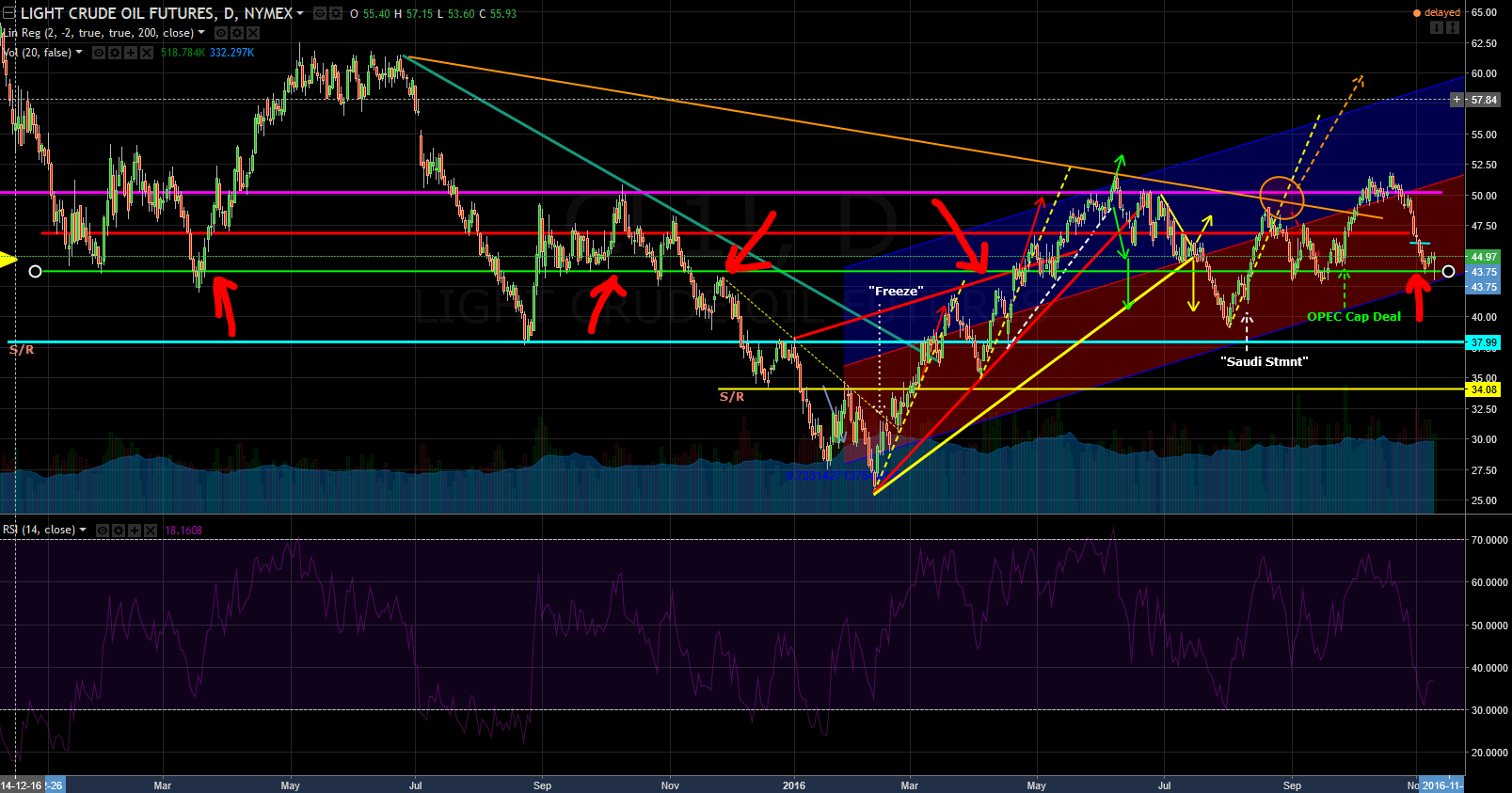

- Crude Oil flipped from red to a nice rally. Oil bulls needed it as they were fighting for important level: A long term pivot point. Losing could bring the 40.25 fast. This is not a forecast but I have to recognize the possibility.

OTHER NOTABLES:

- Transports IYT violent last few days. They are at a breakout point from the lower high trend (descending green dashed line). The potential target from this would be close to 158/160 if they can follow through.

- Bonds TLT -4.2% reaction to Trump. Short-term, an important line was breached today and technically could target 120 area. But more importantly, the long term chart shows a point of contention. Experts have long argued that Bonds are in a bubble so at some point there should be a massive breakdown. I don't catch this falling knife just in case this is the start of something sinister.

- CAT +7% I have a love/hate relationship with this one. We correctly predicted the last two spikes. Today's spike is event-driven so now I ask: Will the Trump trade hold? So I wait out a candle or two for clarity. Notice how this spike puts it at the top of my arrow I drew a while back. Also note the range out of which it's trying to breakout. This is a 5year chart so the lines are like rubber bands not solid walls.

- CELG +11% gives you an idea of the massive relief rally in biotech off the Clinton loss. She had promised to attack their Pricing models hence their P&L. From here, I would have to evaluate each situation on its own merit. For example, CELG is now challenging levels that have been difficult in the past. So Clinton or not, the onus is on the bulls to prove their deserve this valuation.

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member