Overview

This week was more proof if it were needed, that prediction in markets is futile. Possibly in politics too. I'm not going to pretend I have any valuable insight into the political consequences of what transpired. The more I don't understand something, the more it reinforces my need to follow a process that allows me to safely navigate all market scenarios (following price), and concentrate my actions only on what I can control (managing risk).

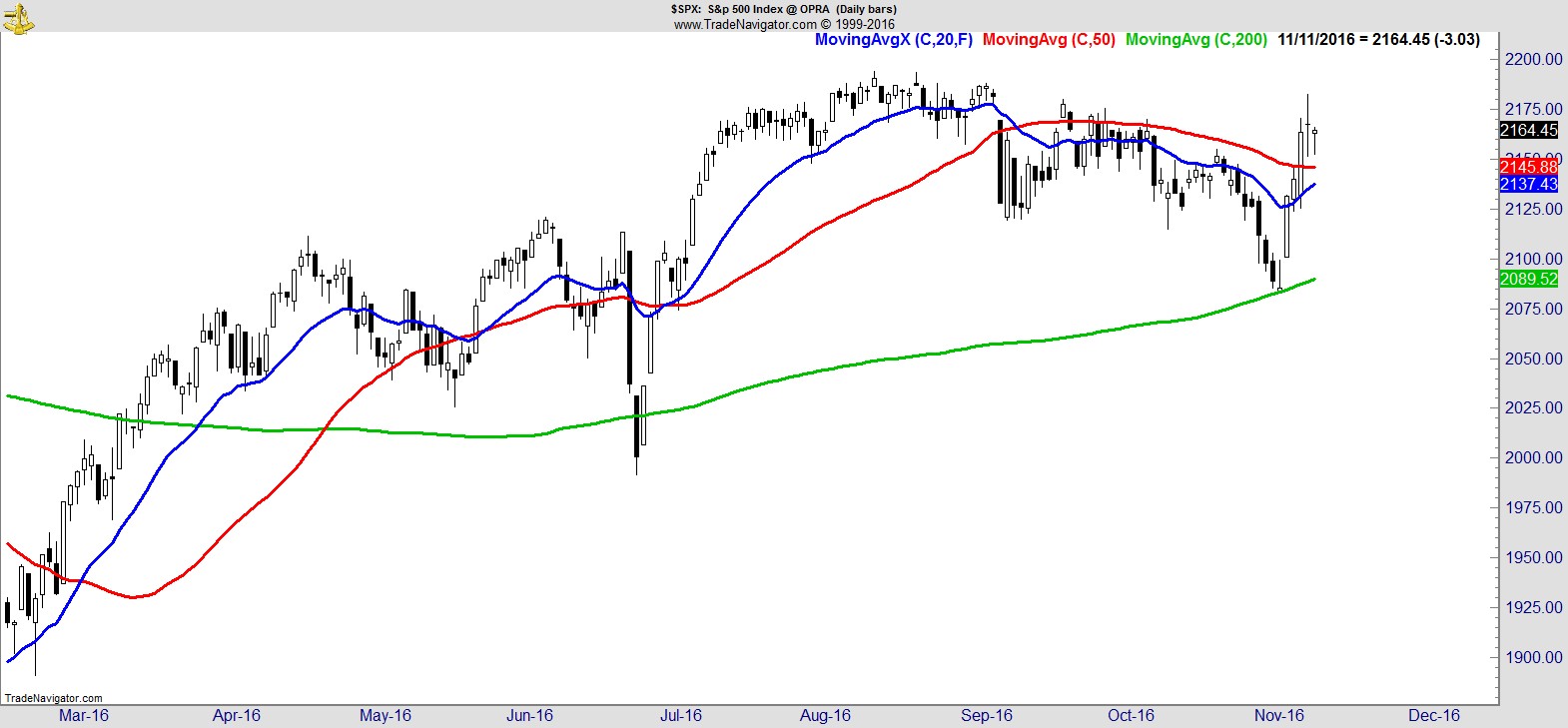

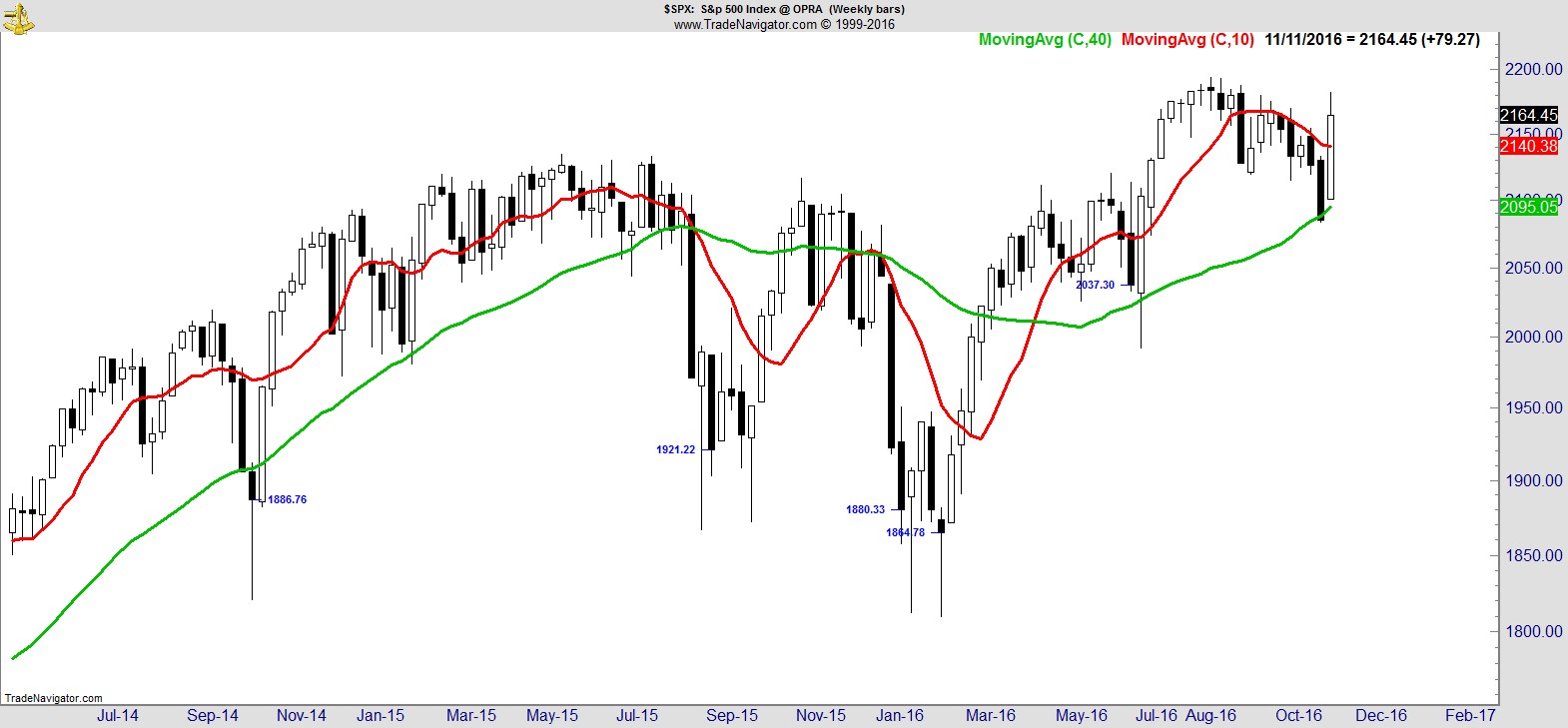

Here's the S&P on a daily and weekly:-

It underwent a deep retest of that breakout level, going as far as its 200-day and 40-week MA, before being swiftly rejected and catapulting higher, to once again be within striking distance of all time highs.

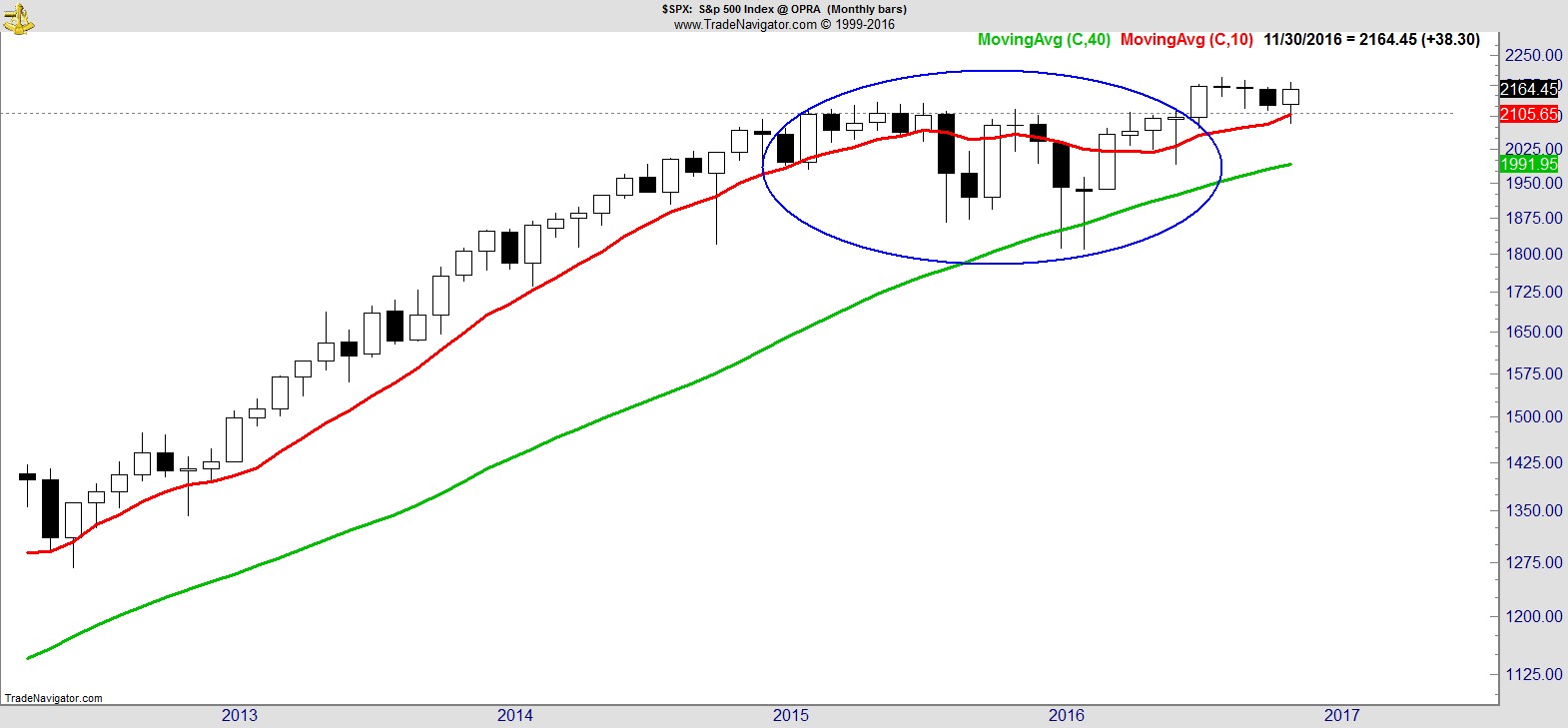

Here's the S&P on a monthly:-

I know people struggle to accept the idea that the July breakout was the beginning of a whole new bull market, and that what preceded it was a 18-24mo bear market, but I still believe that's the case. July was a clean breakout that has since been consolidated very tightly and is currently shaping up as if it's about to resume higher.

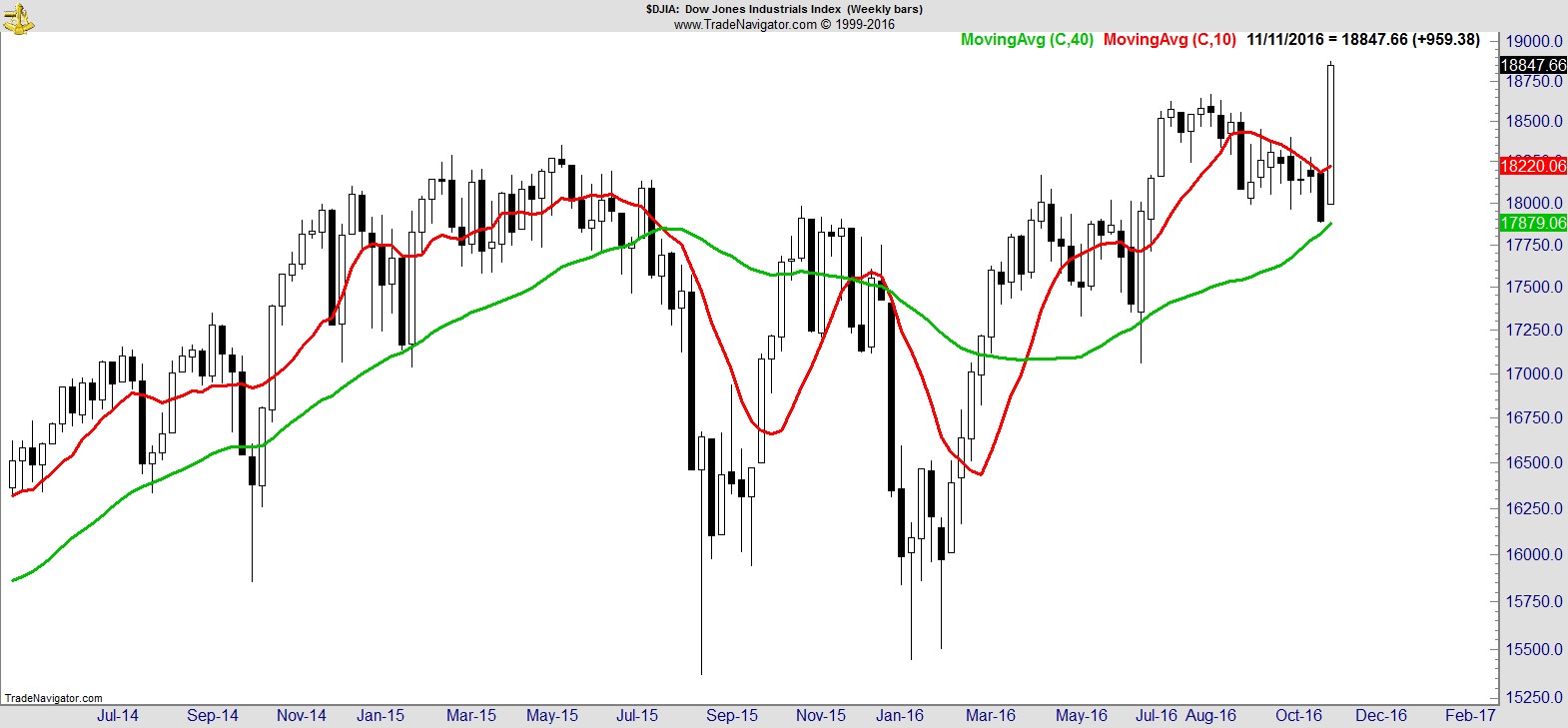

On the Dow it's already happened. Sure, the month isn't over yet, and a lot could happen, but I just don't know how you can call a market at all time highs anything other than a bull market.

.

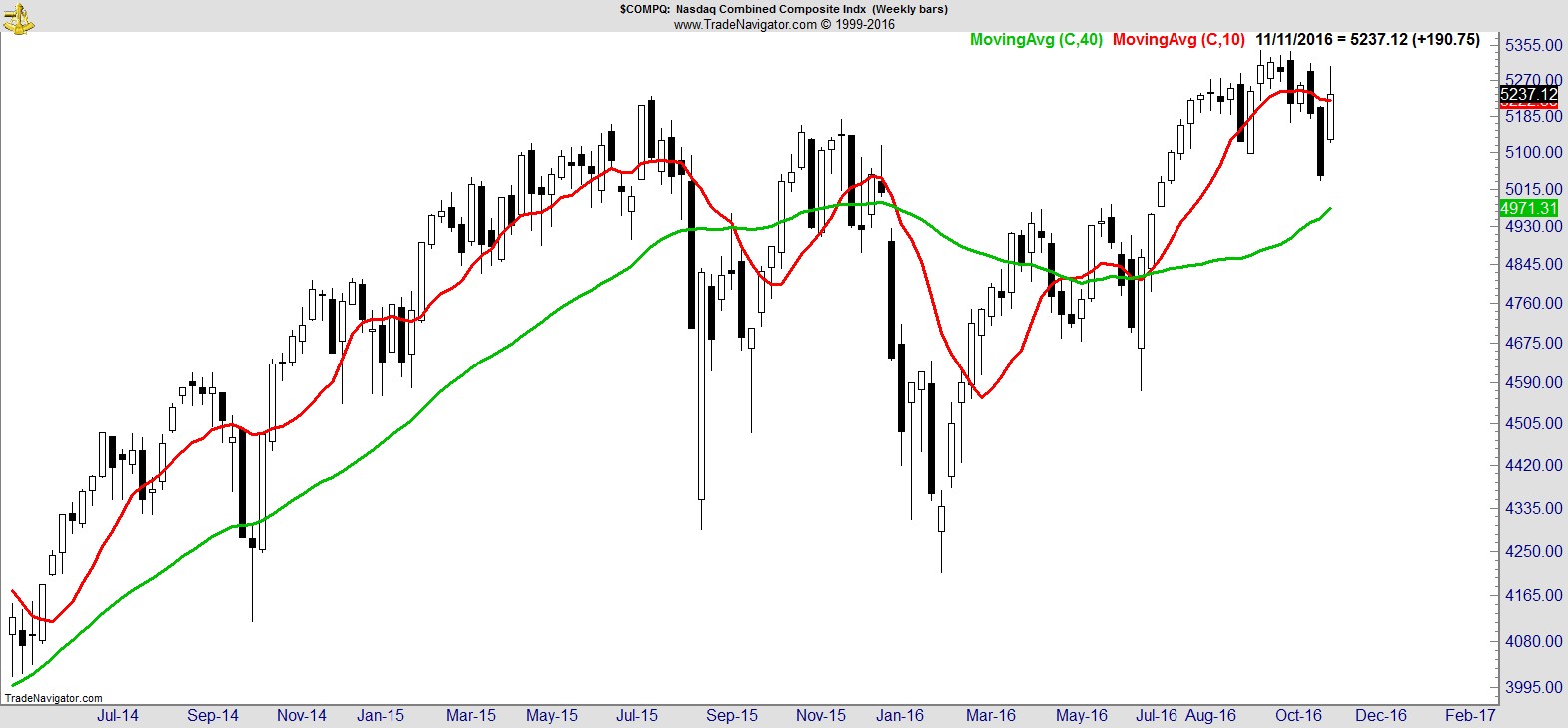

Although there were some huge sector-specific moves in both directions this week, the overall strength was enough to benefit all the major indices. The NASDAQ recovered its 10-wk MA level, and the Transports finally broke out in convincing fashion above its April highs it had been toying with for several weeks:-

.

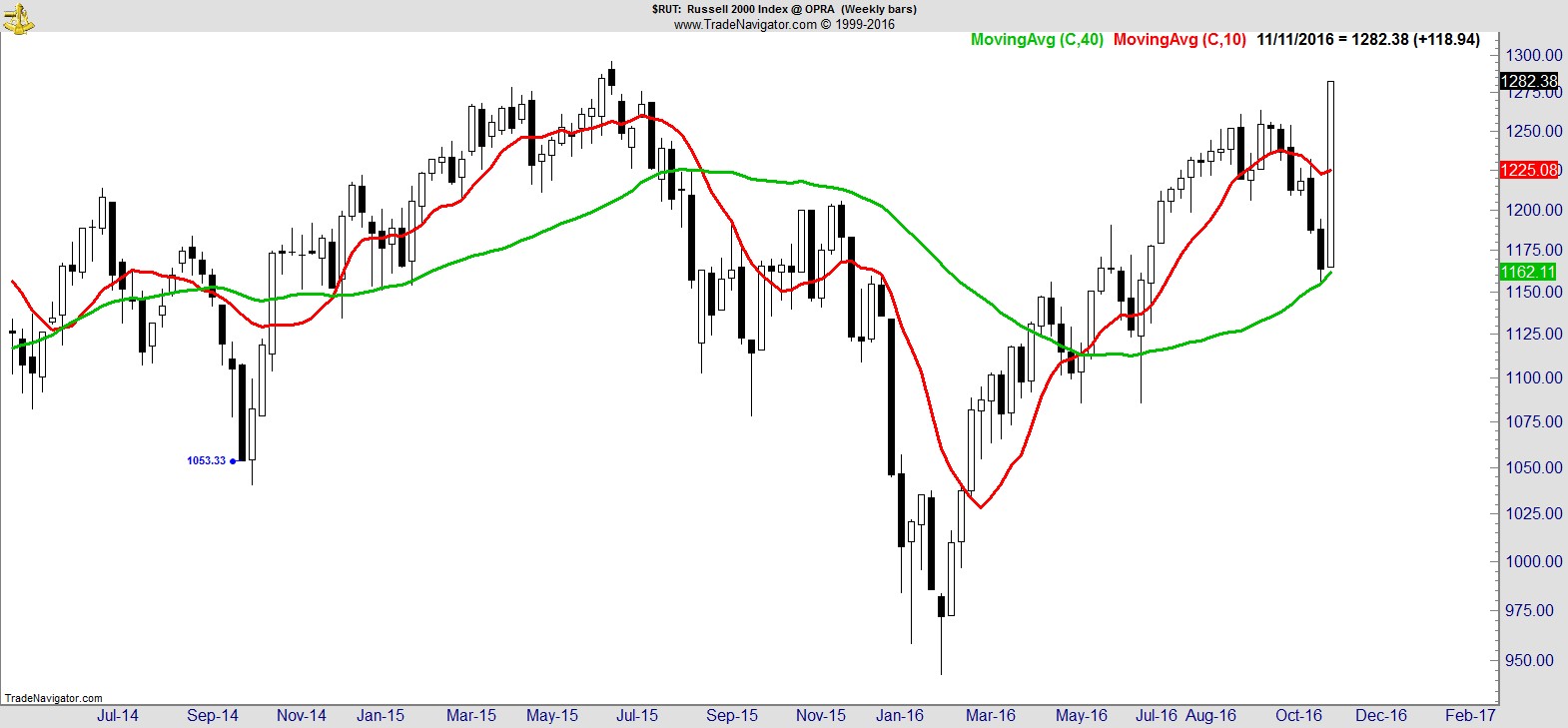

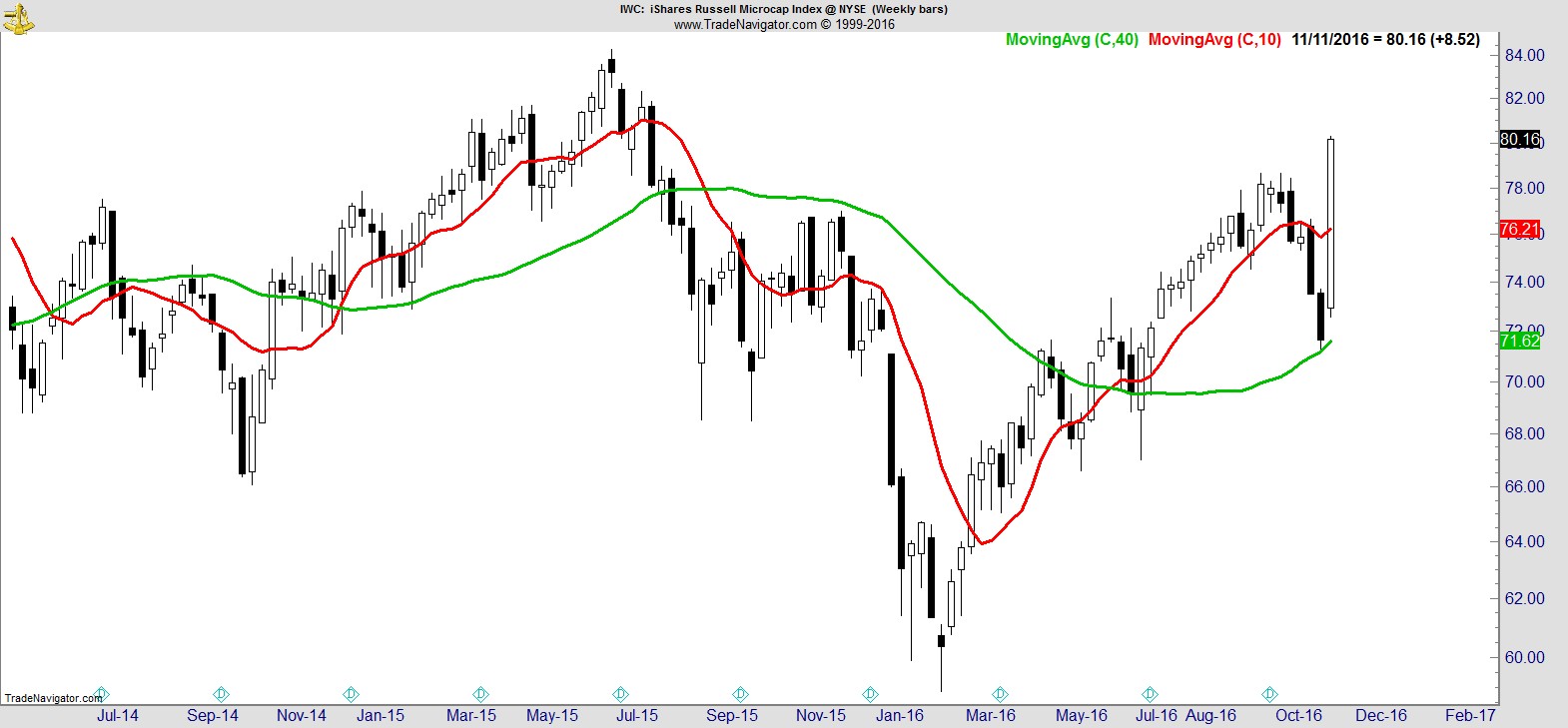

One of the highlights of the week however was the resurgence in small caps seen via the Russell 2000 and Microcap Index:-

.

It was strong in absolute and relative terms too. Here's the Russell relative to the S&P. As you were.

.

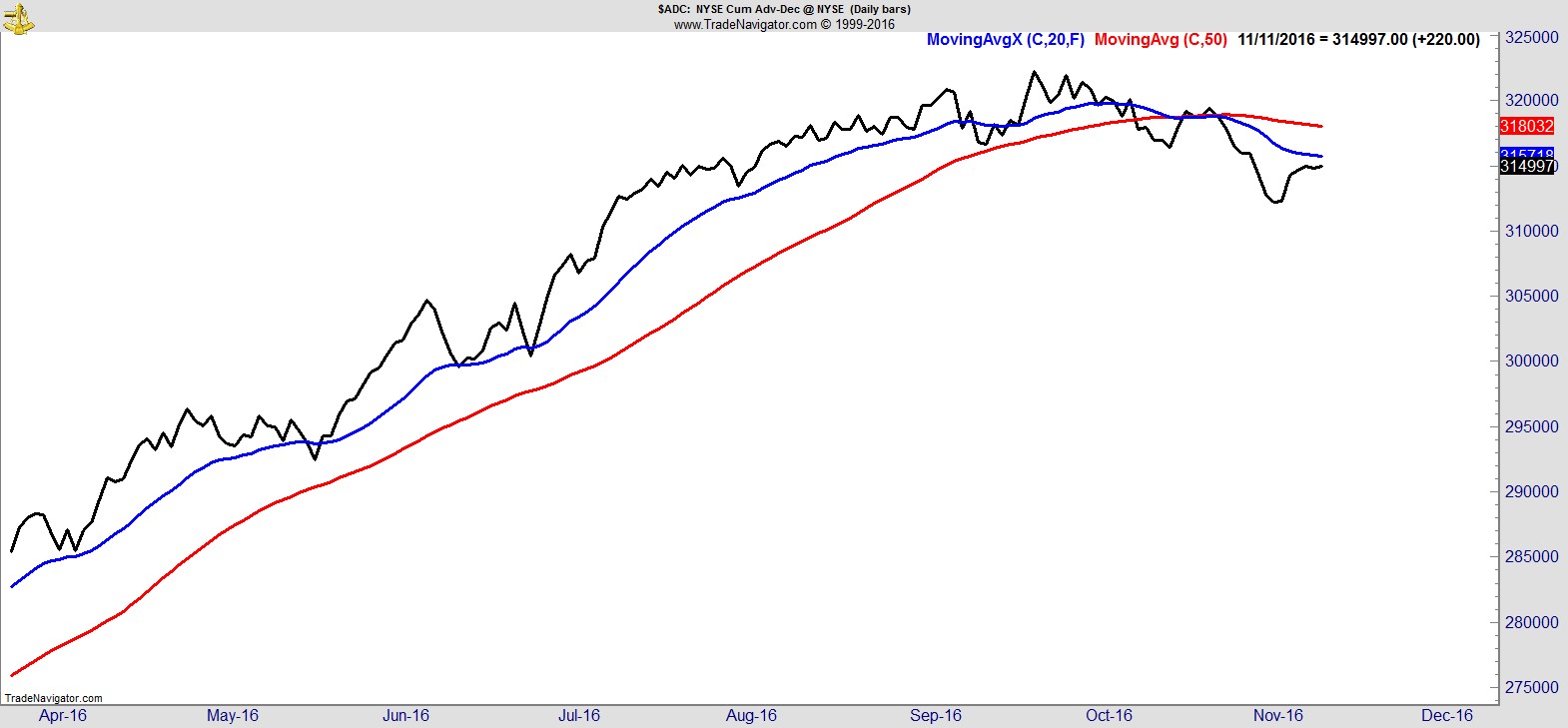

For all the headline-grabbing moves this week, the fly in the ointment is perhaps breadth, which improved only modestly:-

.

Sector Analysis

This was one of those weeks where if you are an active stock picker rather than a passive index holder, you absolutely had to be in the right stocks to have done well. Financials, Industrials, and Healthcare were up 11%, 8%, 6% respectively, while Real Estate, Staples, Utilities were down 1%, 2%, 4%.

I've read so many articles explaining the moves behind each and how it relates to a Trump presidency. Some elements may be true, but in the majority of cases these sectors and stocks were already showing respective strength and weakness. This week's events simply accentuated it.

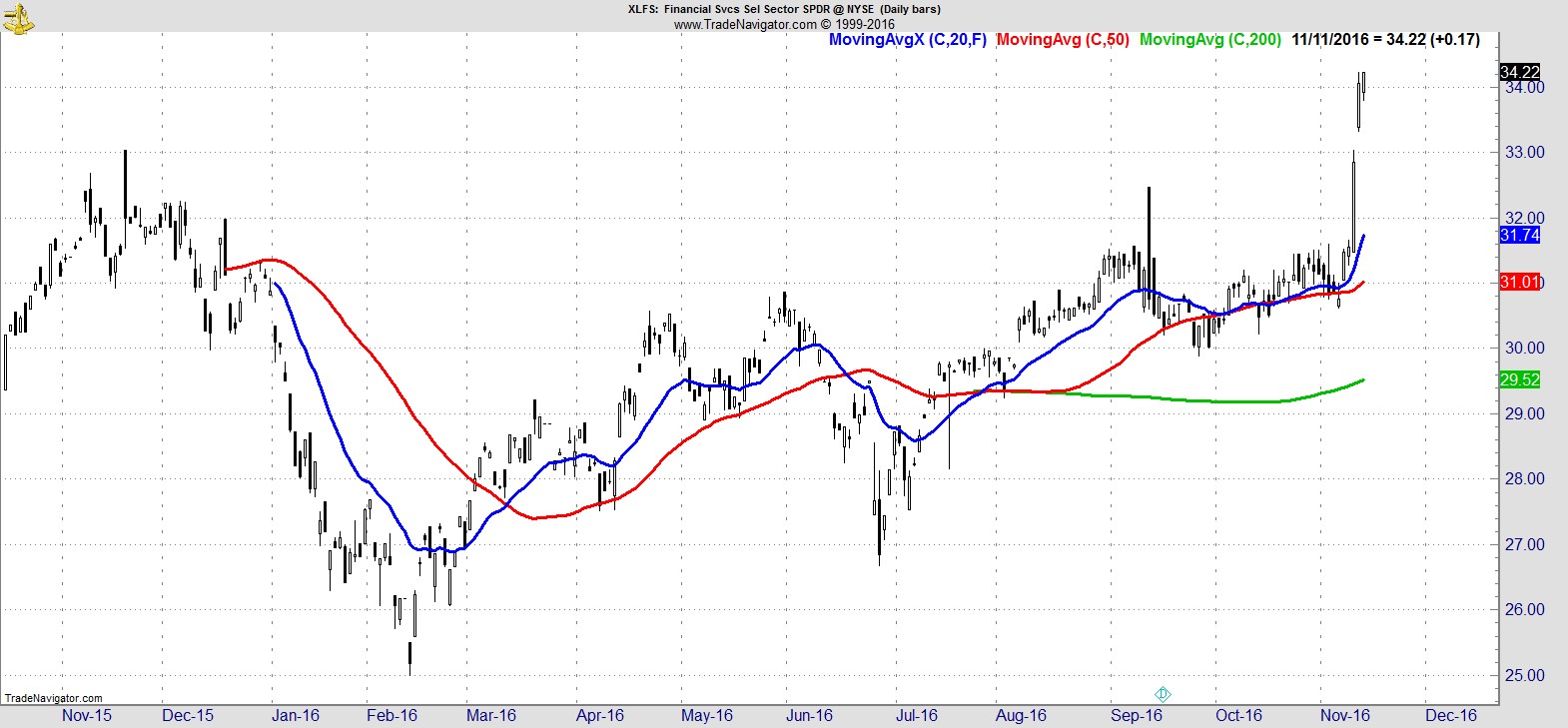

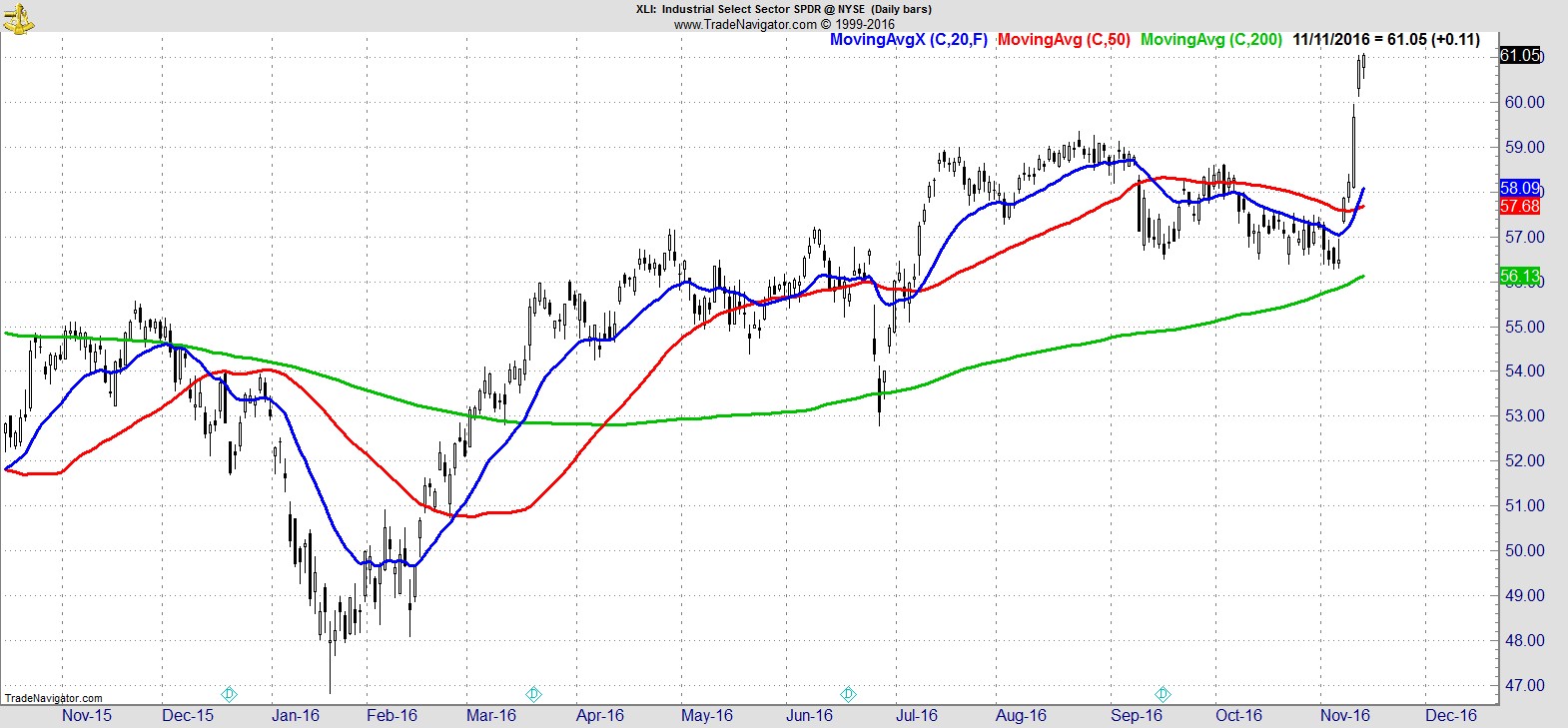

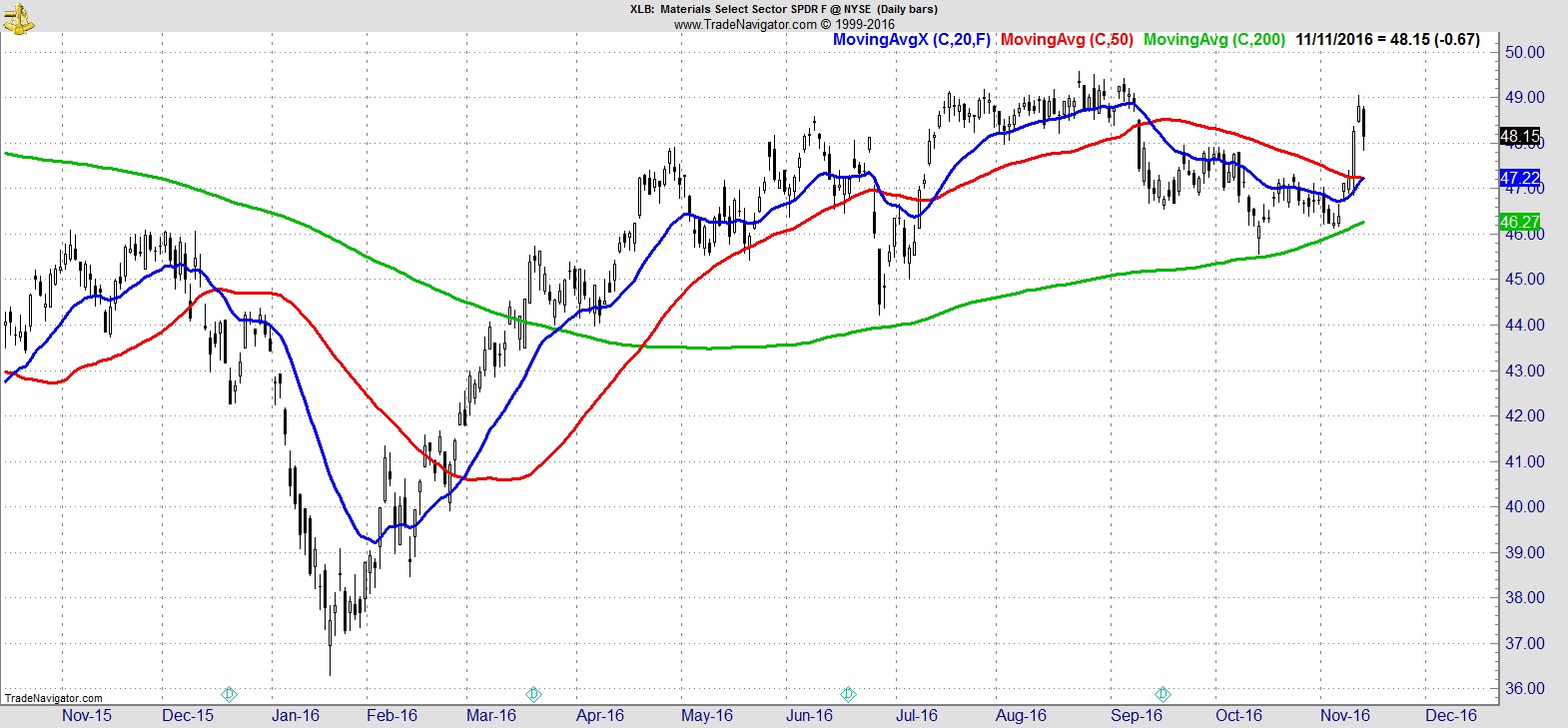

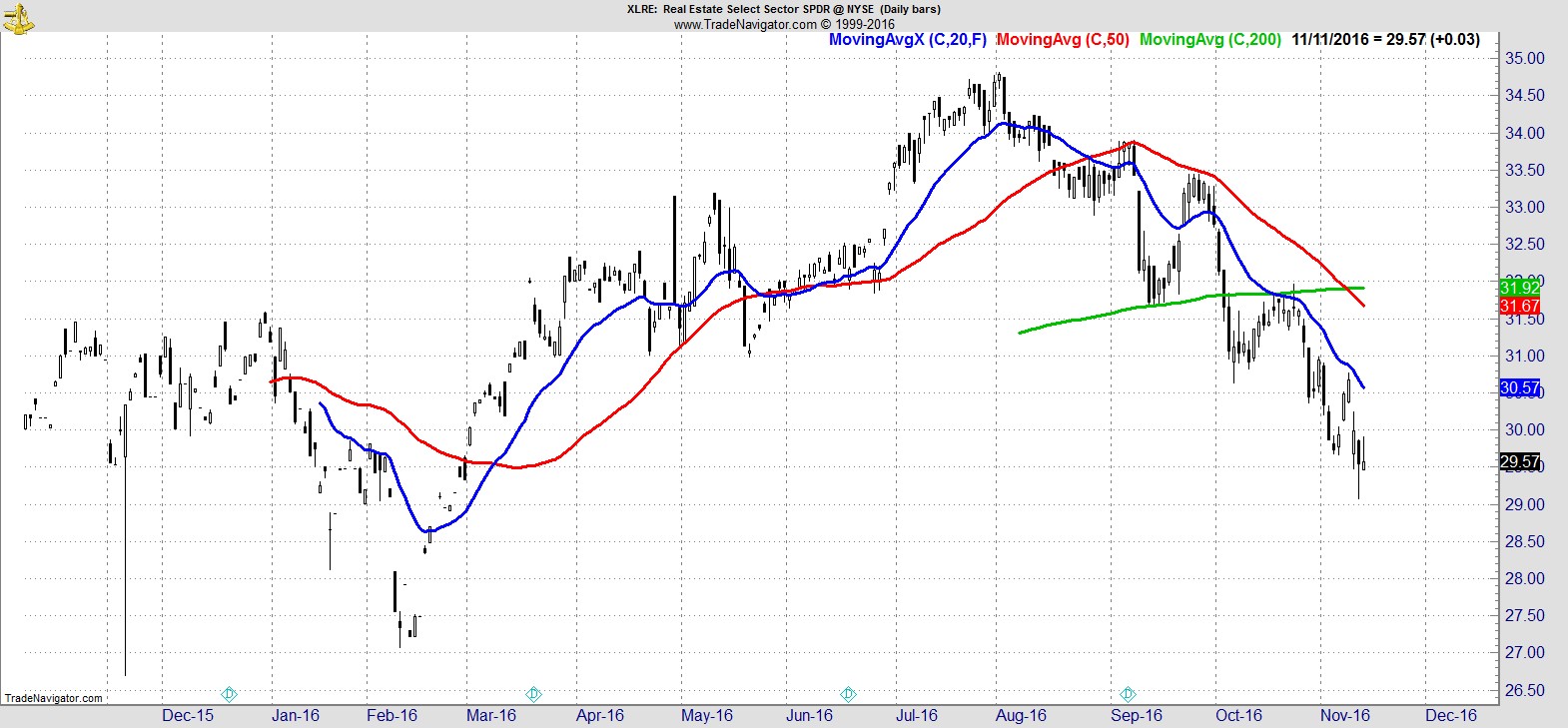

Financials were already the leading sector and continue to be. Industrials and Materials improved further. Energy and Technology weakened. And Real Estate, Staples, and Utilities were already in downtrends and weakened further. The only significant changes this week to my eye, were the bounces in Healthcare and Consumer Discretionary.

Leaders - Financials Services ($XLFS), Industrials ($XLI), Materials ($XLB).

.

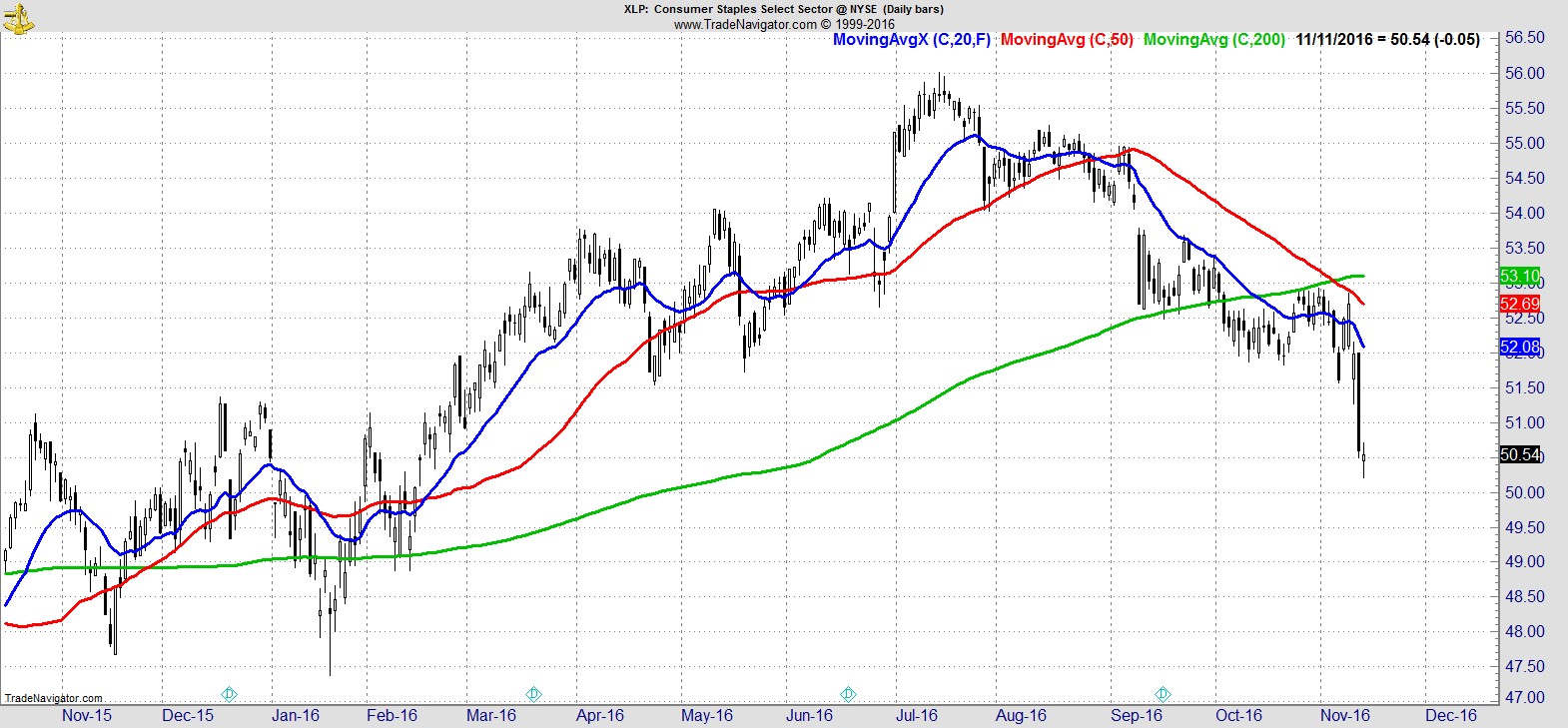

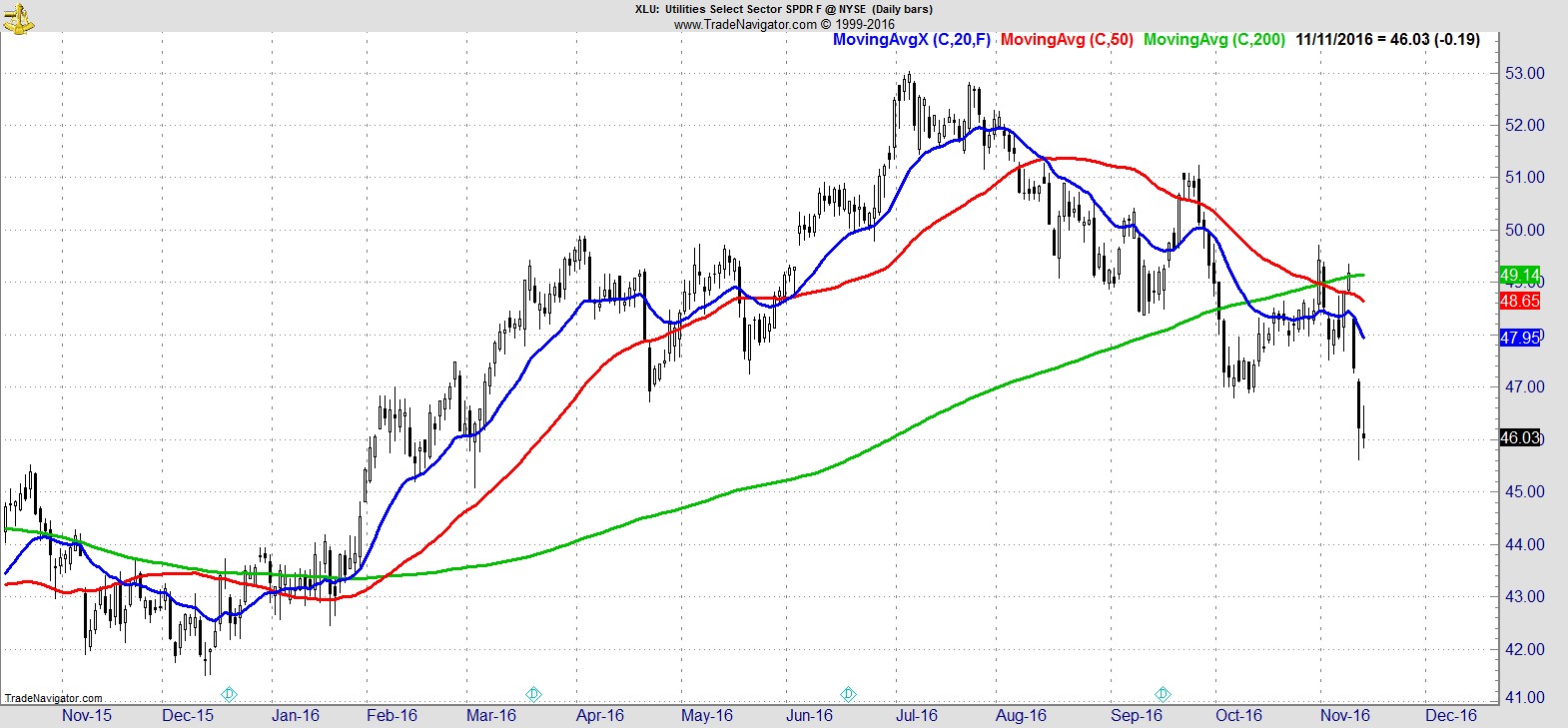

Laggards - Real Estate ($XLRE), Consumer Staples ($XLP), Utilities ($XLU).

.

Alpha Capture Portfolio

Our portfolio had a great week +5.1% vs +3.8% for the S&P, which is even more remarkable considering we started the week with just 7 names and 50% cash.

That's the third straight week of outperformance but it's well overdue as it's still negative -5.7% YTD. With the addition of 4 entries we ended the week with 11 names and 30% cash, and have 4 additional entries for Monday.

.

Watchlist

Last week it was a struggle to come up with enough names for a watchlist. This week it's a struggle to get it down to something manageable. We already had a healthy weighting in financials, tech, materials/energy, and highlighted the relative strength in Transports too, so the continued strength in many of those areas is really nothing new, and not something we need to increase our exposure to beyond our current signals. To that end, many of the names that appear here can perhaps now be useful in gauging continued strength in their respective sectors, rather than as potential setups for additional signals.

Here's a sample from the full list of 30 names:-

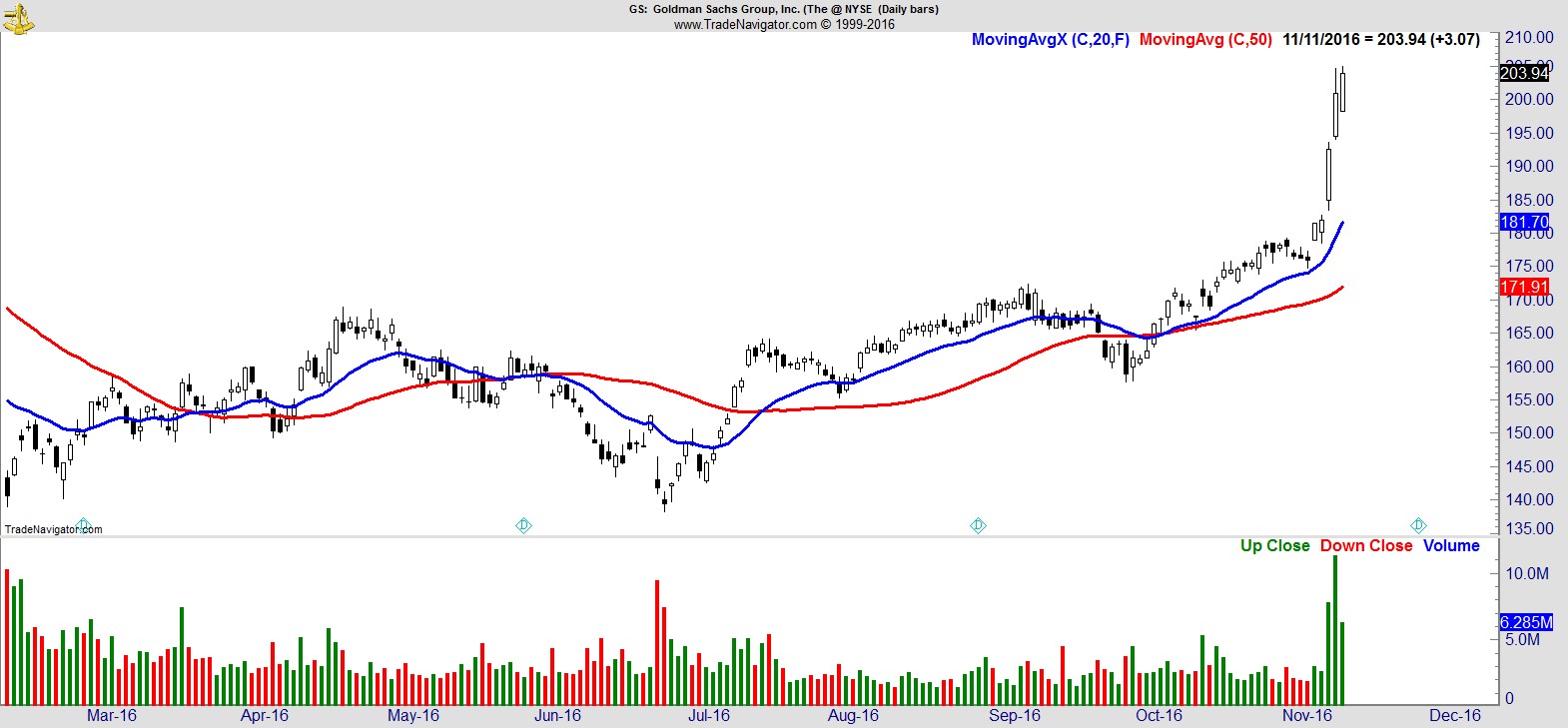

$GS

.

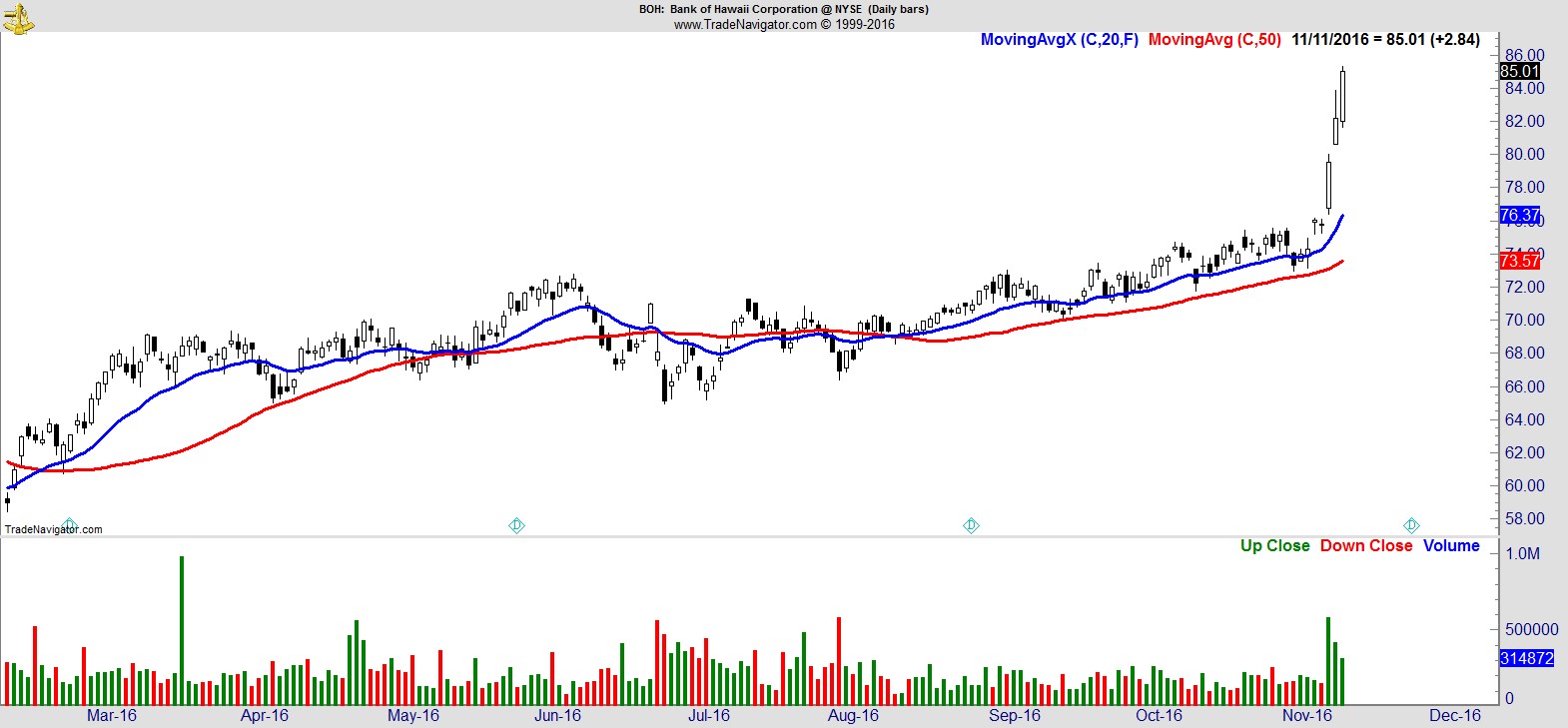

$BOH

.

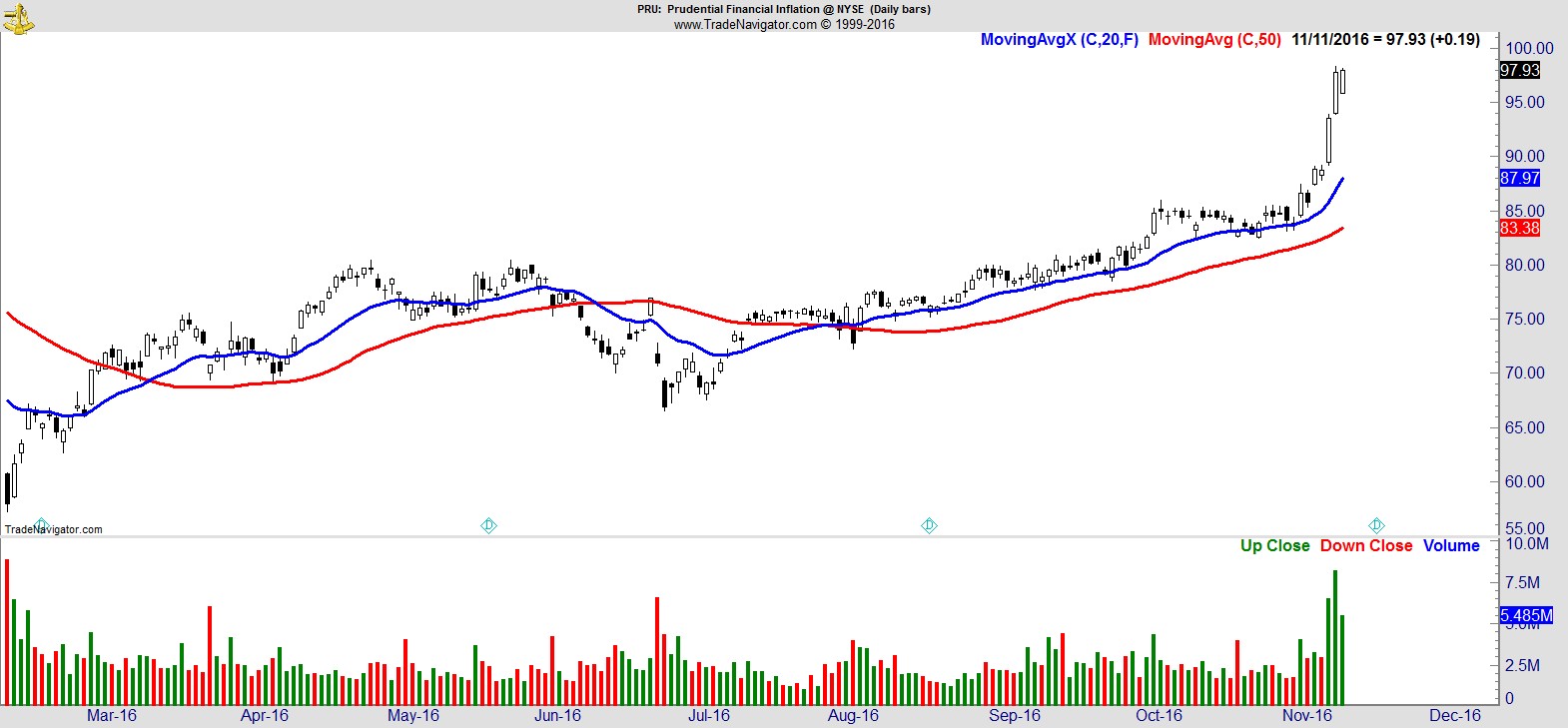

$PRU

.

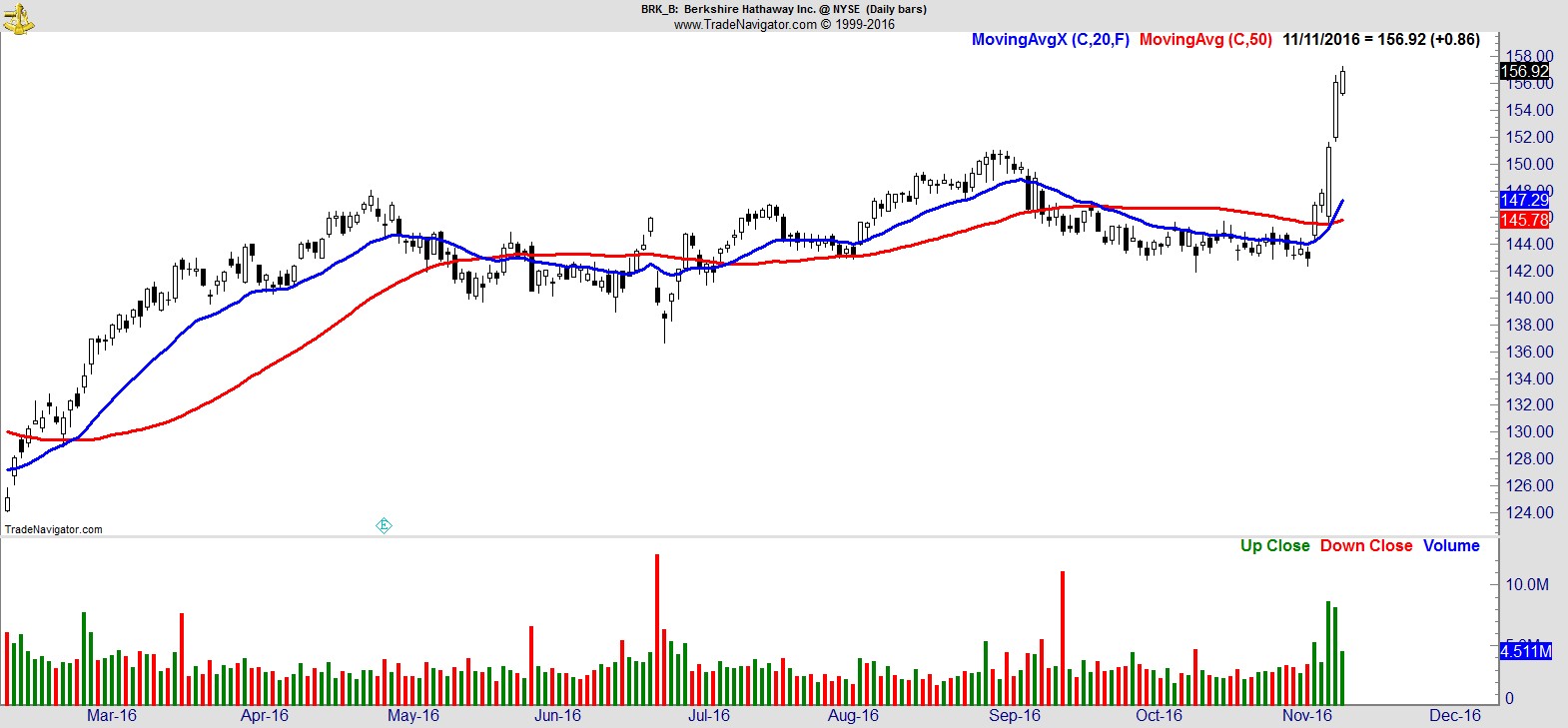

$BRK_B

.

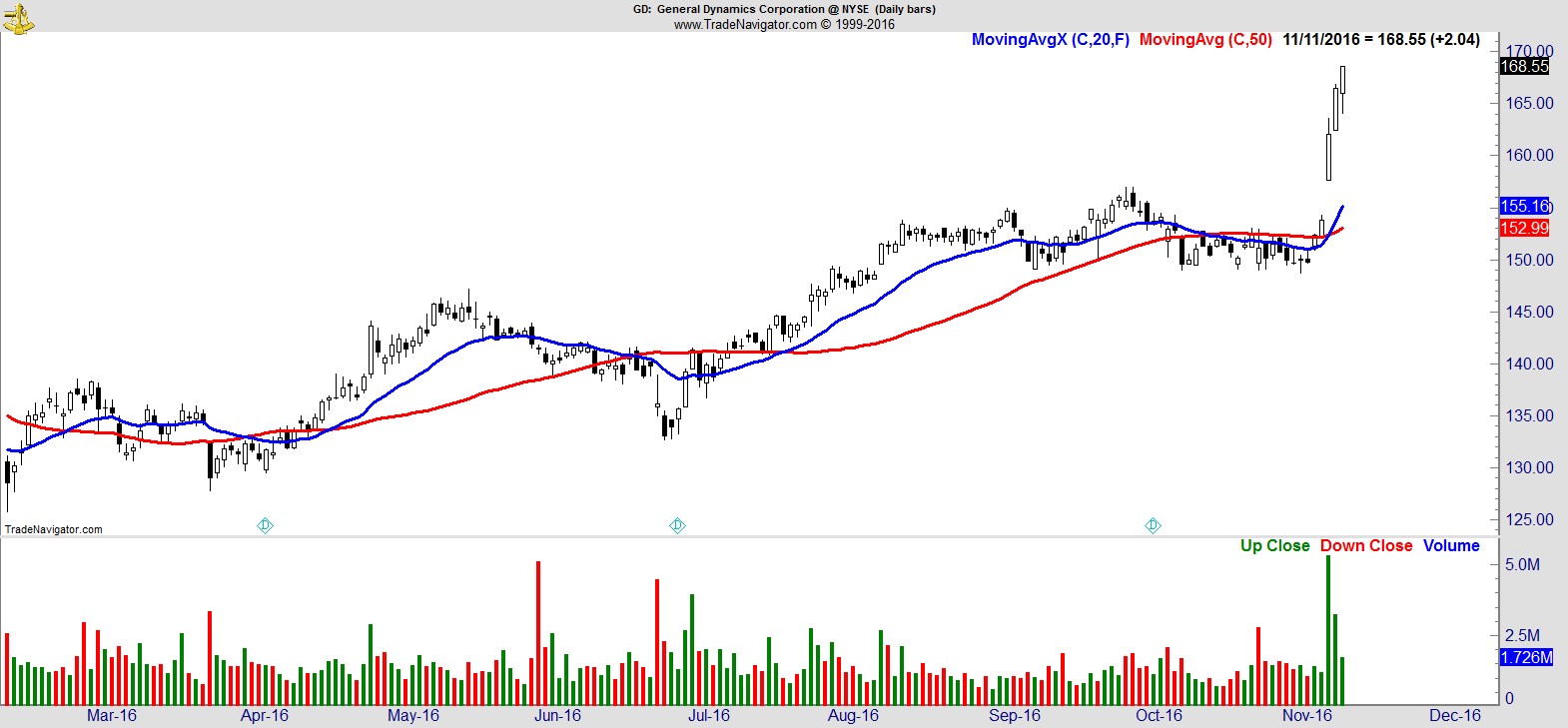

$GD

.

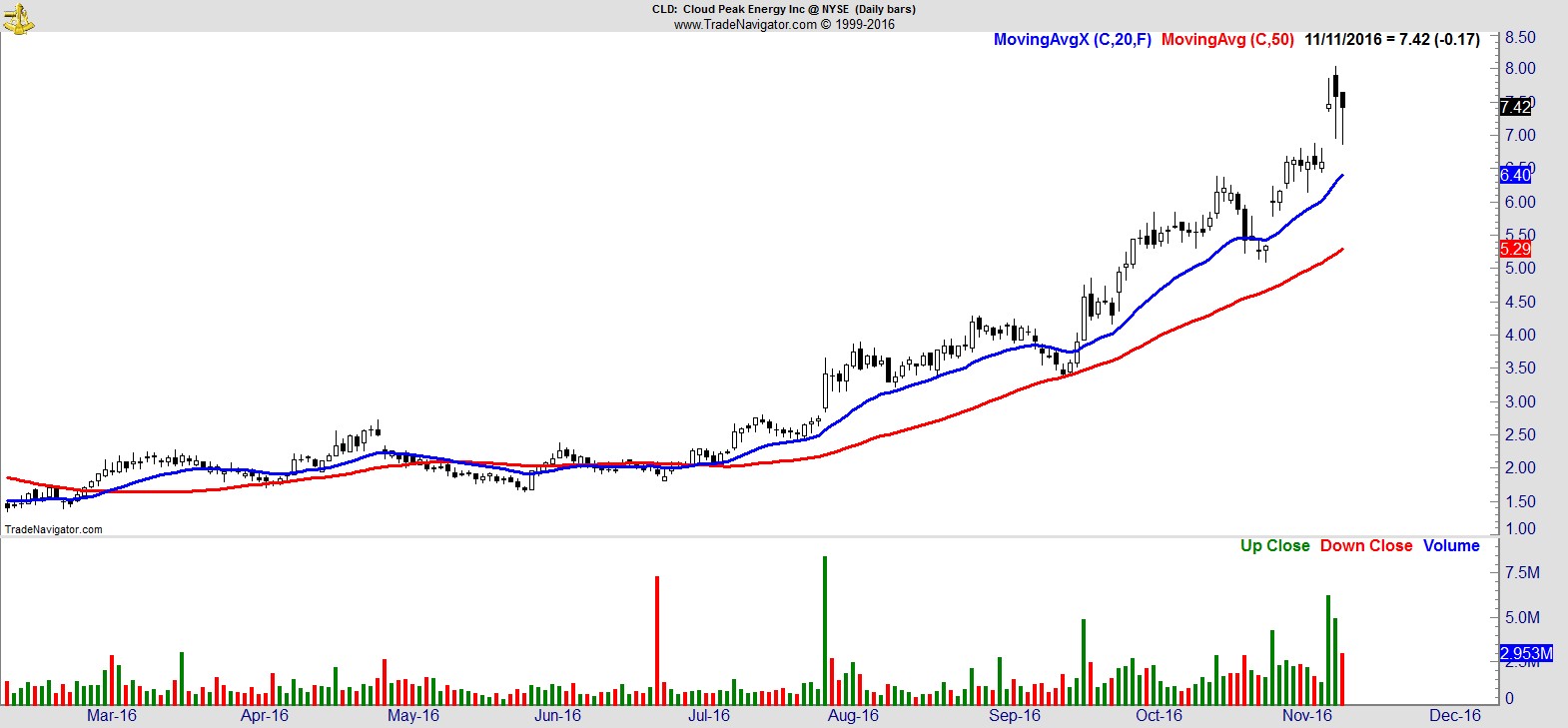

$CLD

.

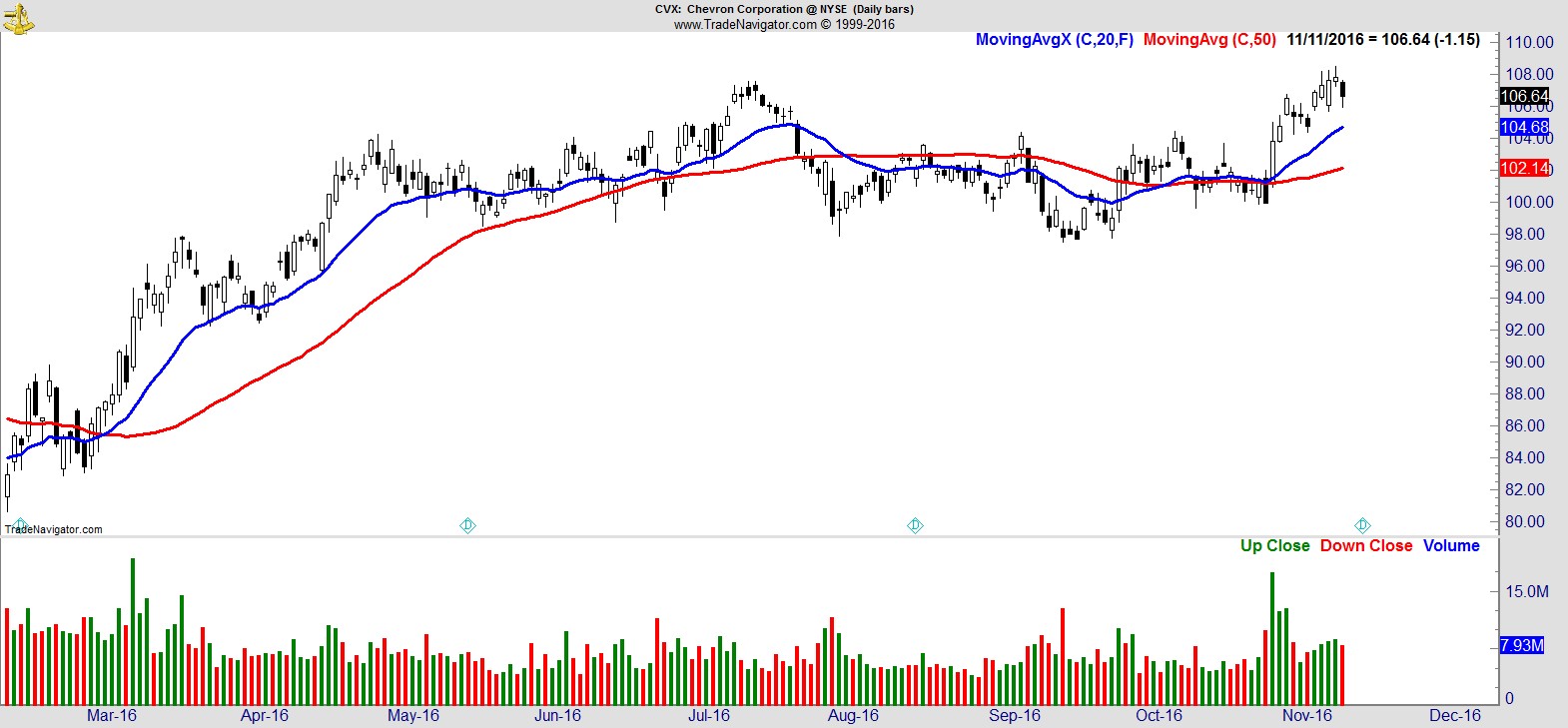

$CVX

.

$NBL

.

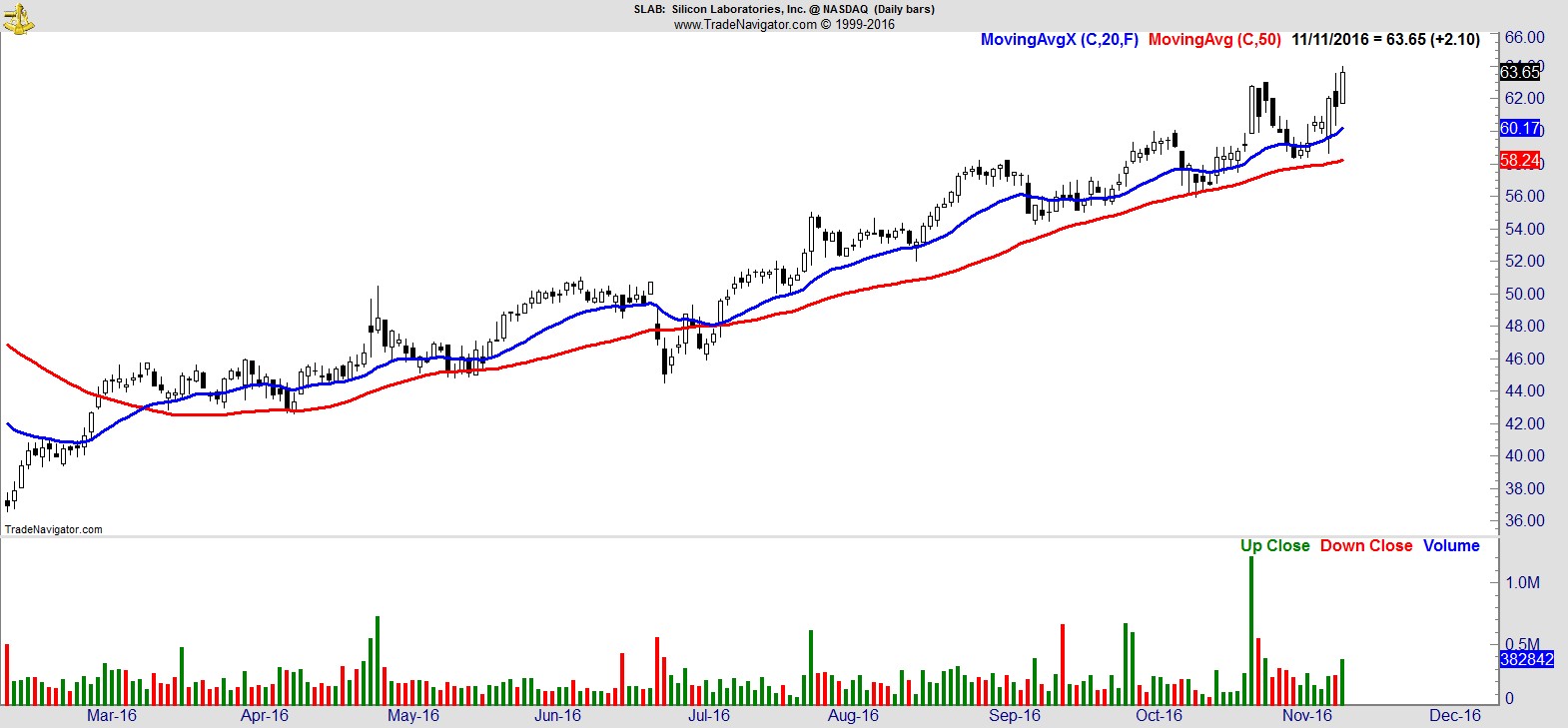

$SLAB

.

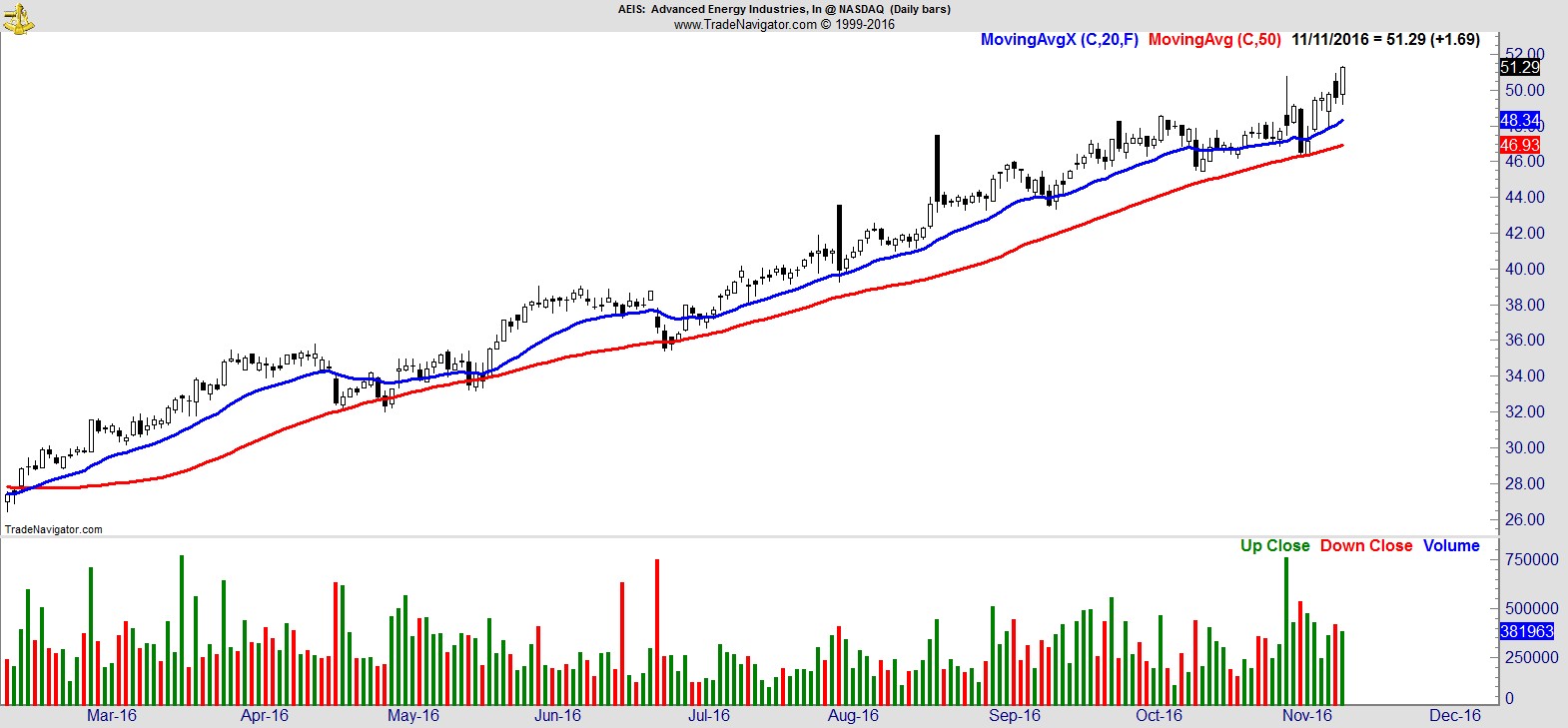

$AEIS

.

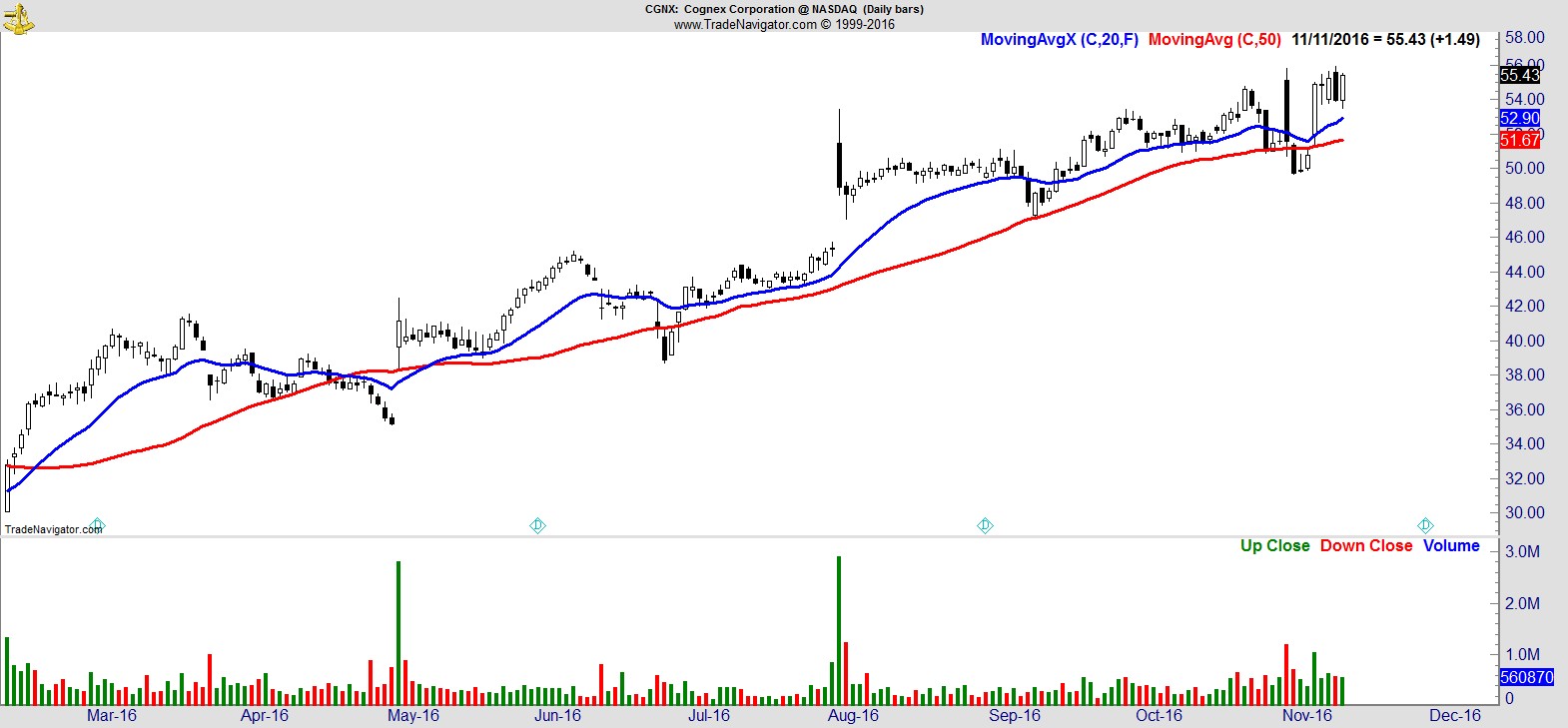

$CGNX

.

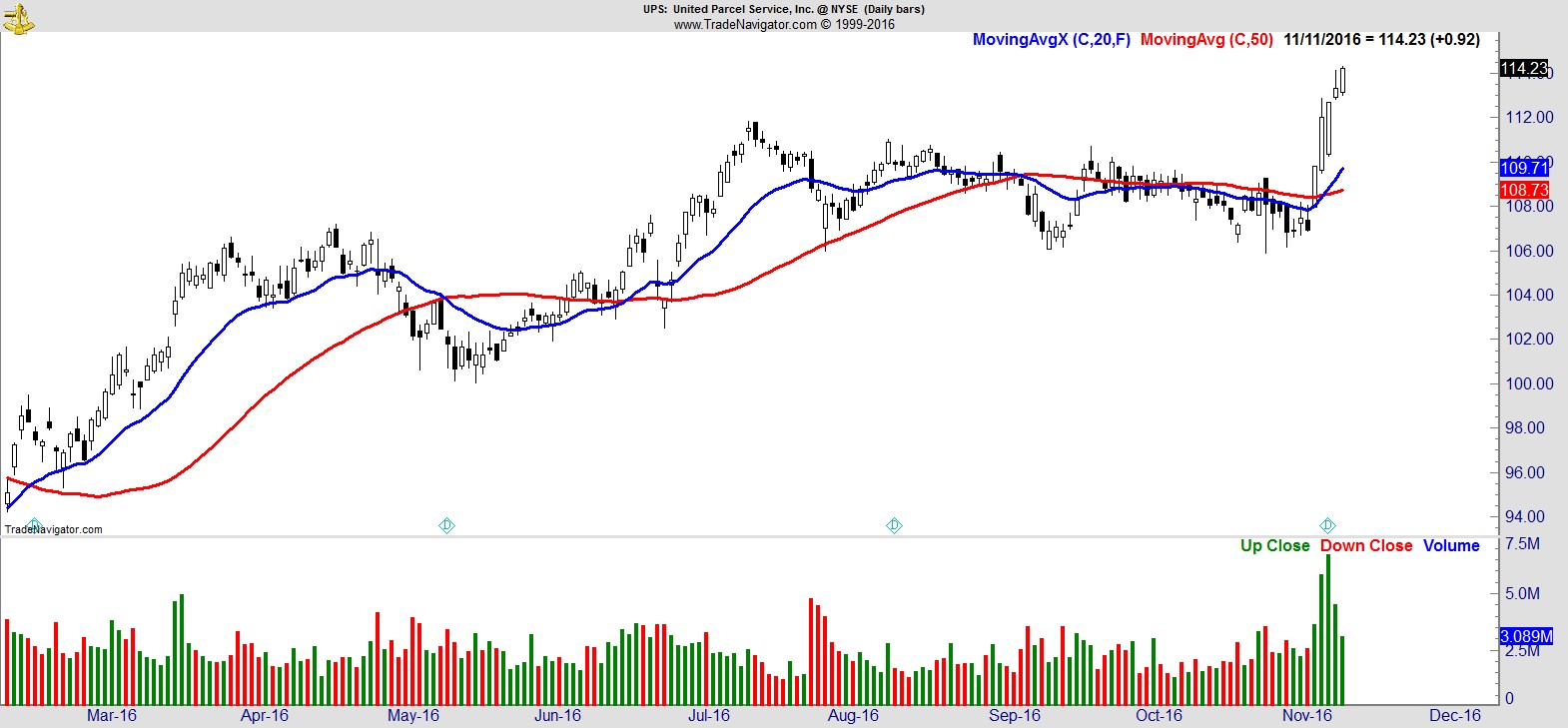

$UPS

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17