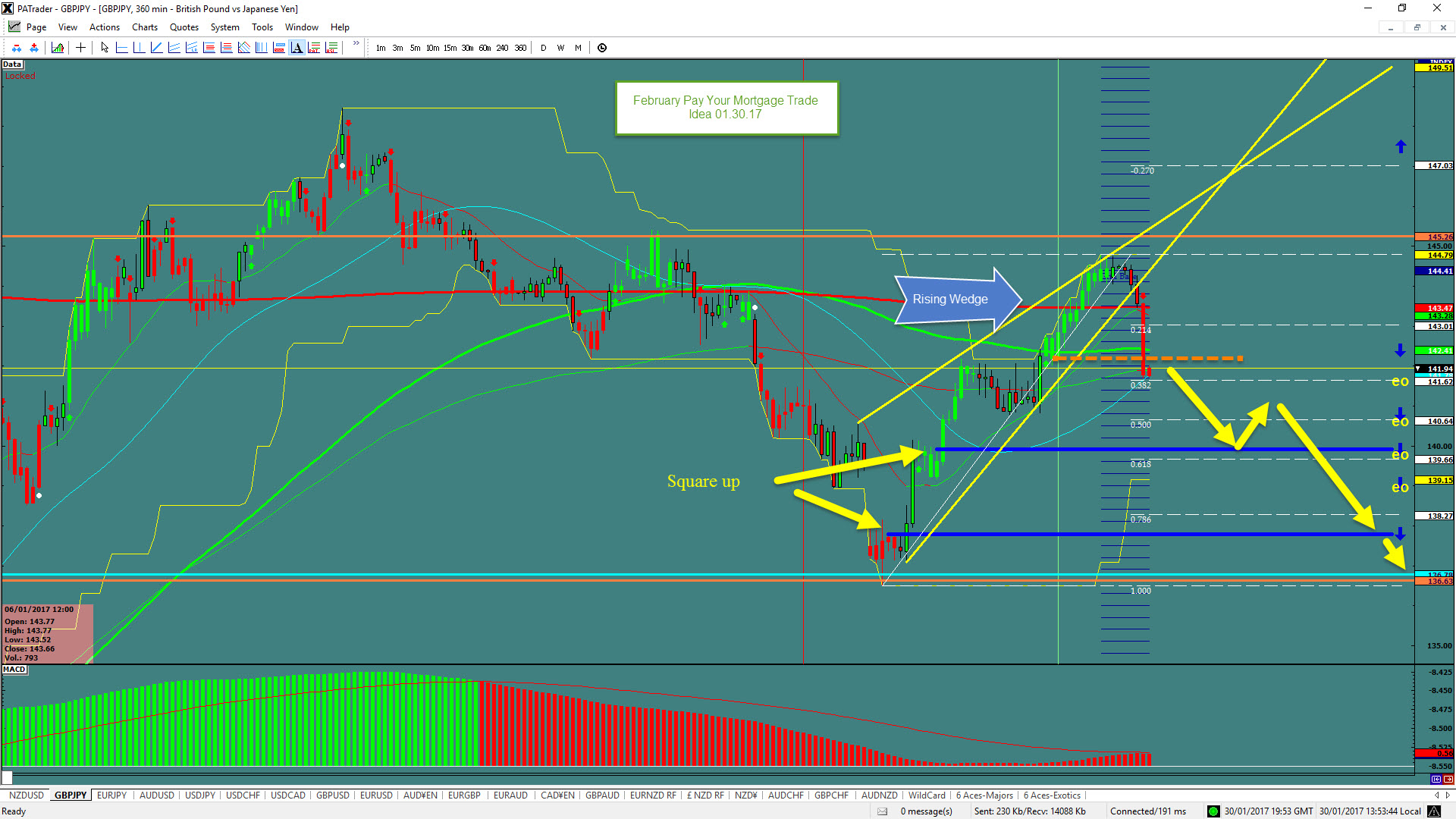

This month's ProAct Traders “Pay Your Mortgage Trade” idea is found in the GBPJPY pair.

We see that we have broken out of a rising wedge to the downside inside a very large range. We are potentially underway if we can open and close the candle below the support @ 142.00. The size of the range (145.26– 136.63) is 863 pips, of which we have already traveled 285 pips. It may correct a little here to the 0.214 Fibo @ 143.01 before moving downward. The first move should teak it to the square up @ 140.00 and we should expect a bounce there. A 50% pullback would target the 141.00 before resumption again which is a great place to add.

How to trade it? You will need to wait for your set-up to show up, for London & New York traders, that will mean waiting for the open and close or if a correction @ the 143.01. Take your first entry and use the respective risk reward ratio to start trading this currency pair. We have preplaced entry orders (sell stops) on the break of each Fib and any rally should be considered an area to add to the position. DO NOT TRY AND CROWD THIS PAIR WITH TIGHT STOPS until the first square up. Remember the “pullback is your friend” in route so use those to add to the position. The pair typically has pullbacks in the 250 pips range so every pullback could add an additional 250 pips to the trade with another position. Currently the ATR (180 Day - Average True Range) of the currency is 176 Pips per day, so this might take about 2 - 3 weeks with pullbacks!

Our trading methodology is based on proprietary technical indicators. We pay attention to what the big banks are doing in the markets (the Big Boys) and specifically look for opportunities that have a high opportunity and low risk. We always identify our target before entering a trade, and we focus on the risk of the trade instead of the reward. We have (and follow) rules, and we press our winning trades without exception.

Remember that we recommend that you always trade with stops. And if you don't trust yourself or think you'll get cold feet in a long trade like this, then place the trade and walk away. Better to get taken out by a stop or target than to second guess an active trade and take yourself out. Do your research before you place your own trade. Trust your research.

Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange you should carefully consider your investment objectives, level of experience and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

Recent free content from Pro Act Traders

-

GBP/USD – Targets the range top

— 11/21/24

GBP/USD – Targets the range top

— 11/21/24

-

NZD/JPY – Showing bearish signs

— 11/20/24

NZD/JPY – Showing bearish signs

— 11/20/24

-

GBP/USD – Falling Wedge Breakout

— 11/19/24

GBP/USD – Falling Wedge Breakout

— 11/19/24

-

GBP/USD – Rectangle Breakout https://www.proacttraders.com/blog/

— 11/18/24

GBP/USD – Rectangle Breakout https://www.proacttraders.com/blog/

— 11/18/24

-

GBP/CHF – In A Breakout

— 11/13/24

GBP/CHF – In A Breakout

— 11/13/24

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member