Overview

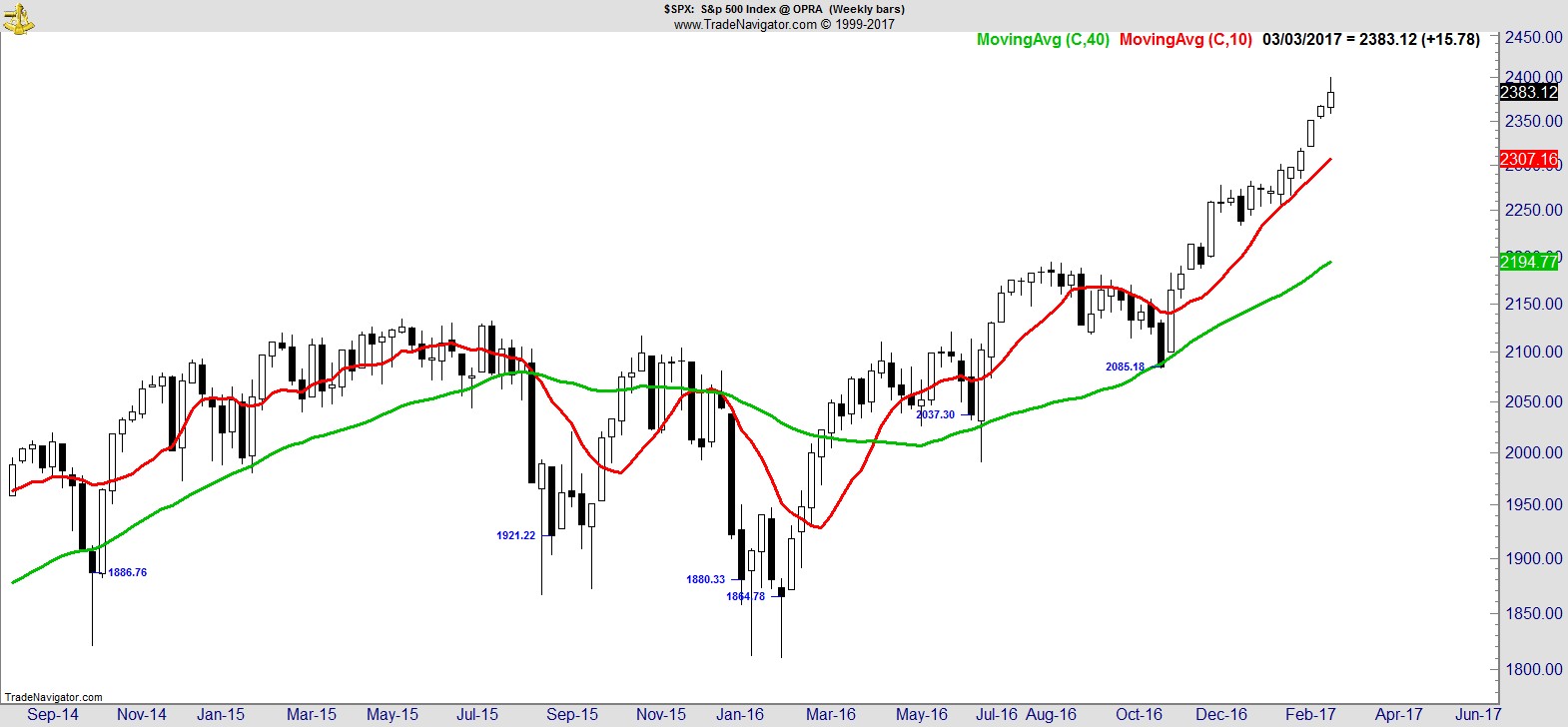

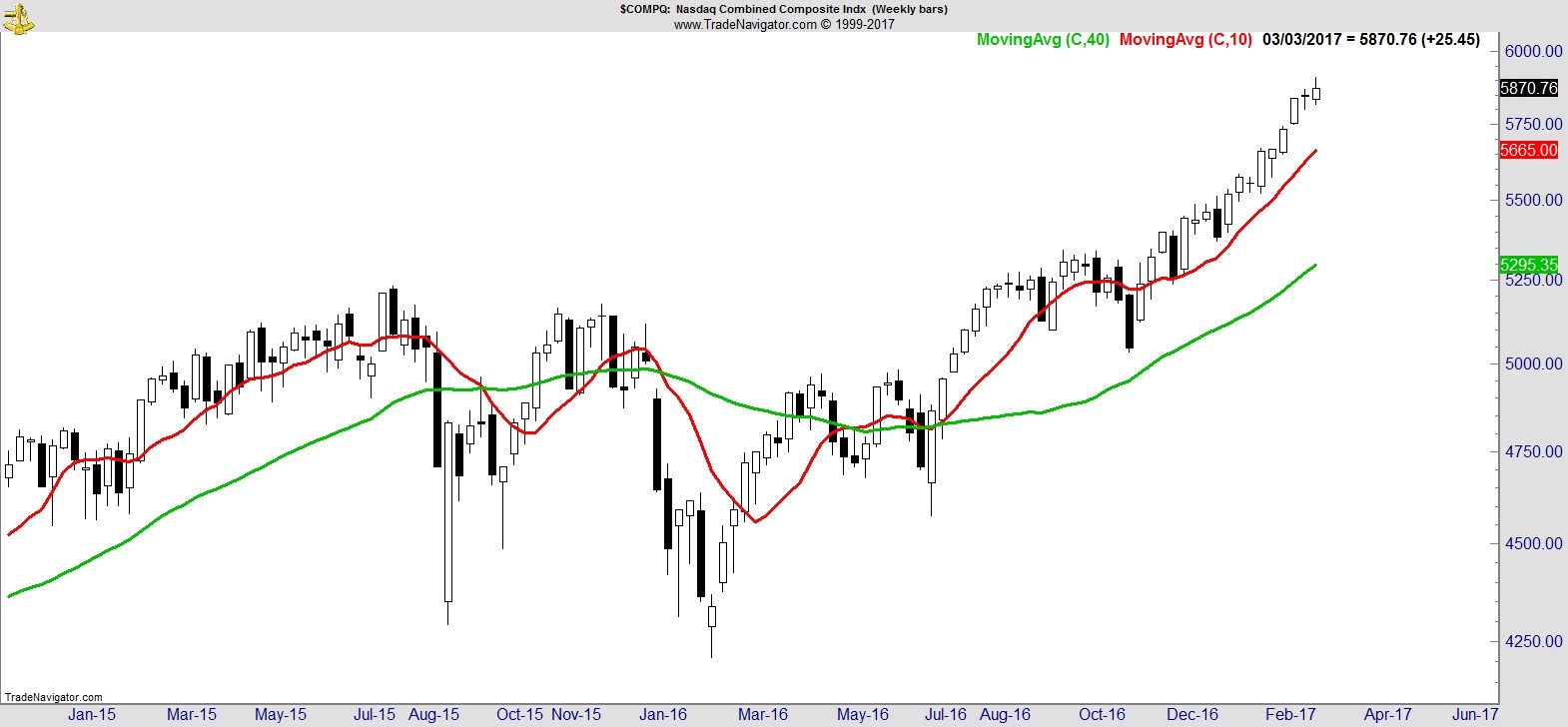

The major indices all made new highs this week, with the S&P and NASDAQ recording their sixth straight high on a weekly close basis, along with the NYSE Composite and MidCap Index.

.

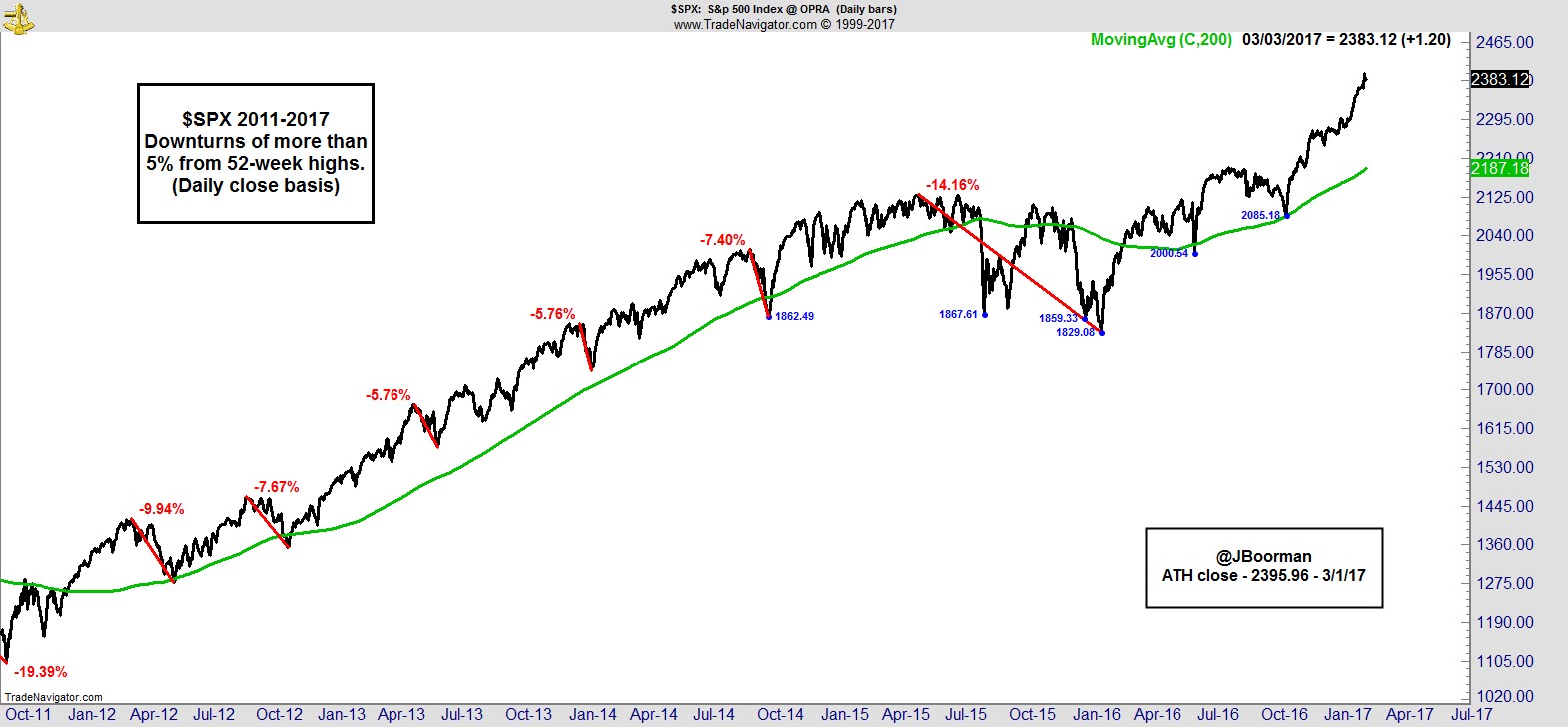

I know there have been a slew of stats about the lack of 1% moves recently, and the market wrong-footed many by ending that streak with a 1% move higher rather than lower, but of far greater significance in my opinion is the fact we are yet to have a 5% move lower from 52 week highs since the 2015/16 bear market ended.

I'm not in the business of predicting when these things happen, but in any event, if a >5% pullback were to occur, it would be something that could easily be accommodated and do very little damage to the long term trend given the S&P is currently 9% above its 200-day MA.

There are also signs that conditions are in place for such a move to occur, with many sentiment measures approaching historically extreme levels. Shorter-term, breadth is off its highs, and the midweek surge higher in equities produced more new highs in the S&P than any other day since December 2014 (@BespokeInvest).

That's about as far as I would go, as I think that's all you can realistically do. You can acknowledge that conditions are in place for something to occur, but it's still folly to attempt to predict exactly when it will happen or by what magnitude. And it's also entirely possible those conditions dissipate over time without a significant decline transpiring at all.

Bottom line, we can't predict, but we can prepare, and the way we prepare is NOT by positioning for a decline, but by managing our risk with stops and our position size, so we can safely navigate whatever path the market takes.

.

Sector Analysis

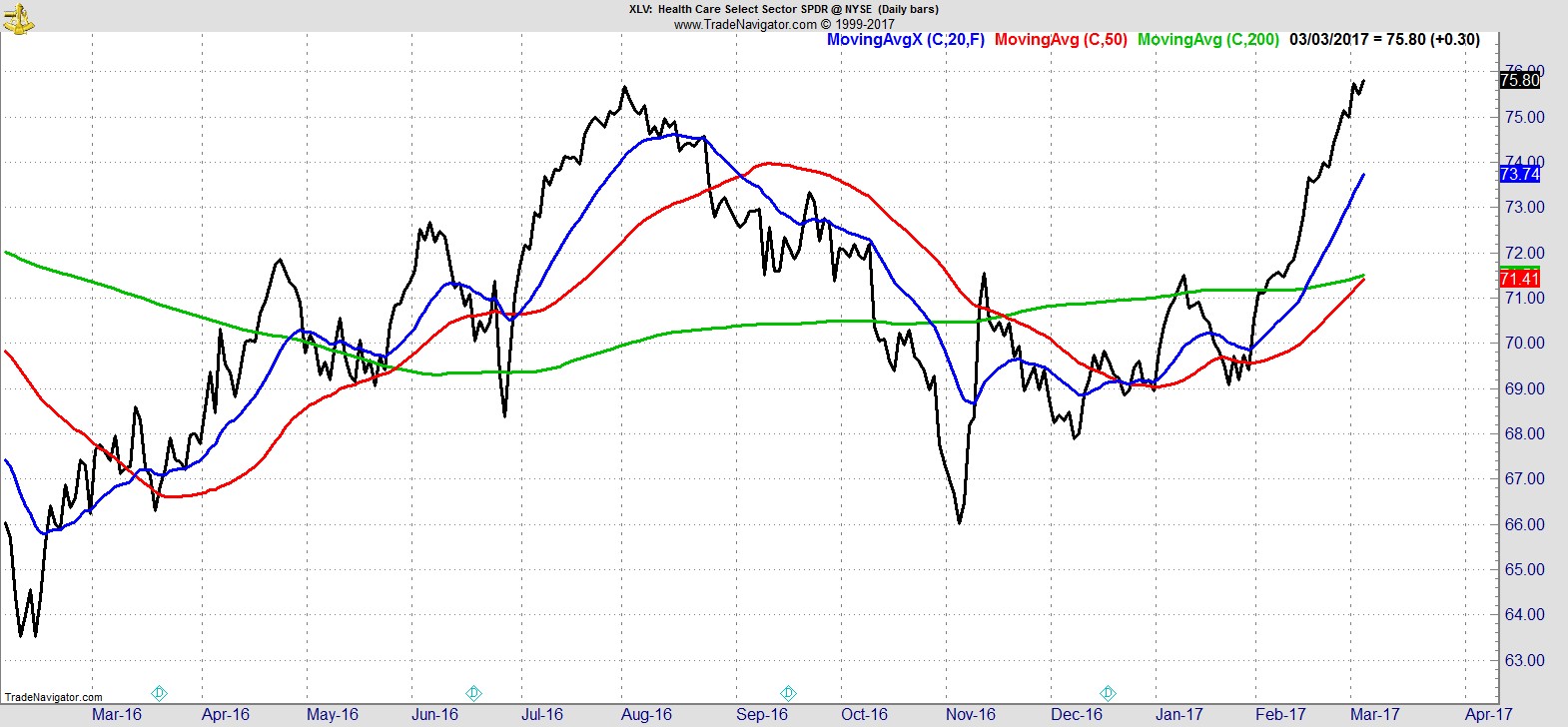

Healthcare continues to enjoy an incredible resurgence. It was one of the biggest gainers on the week along with Financials and Energy, and now overtakes Technology as the strongest sector YTD.

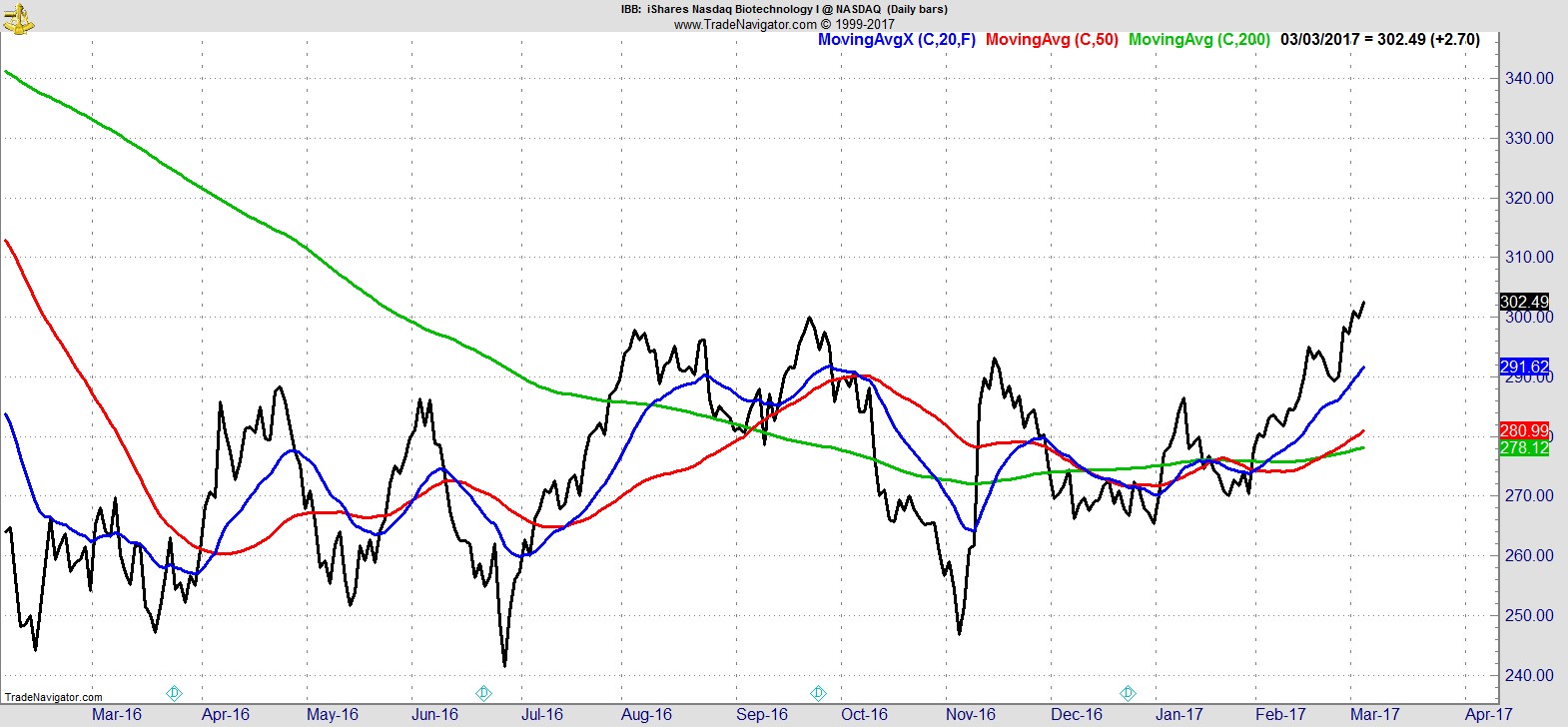

The strength in Biotech has obviously been a major factor in that, and this week it broke out to 52-wk highs.

.

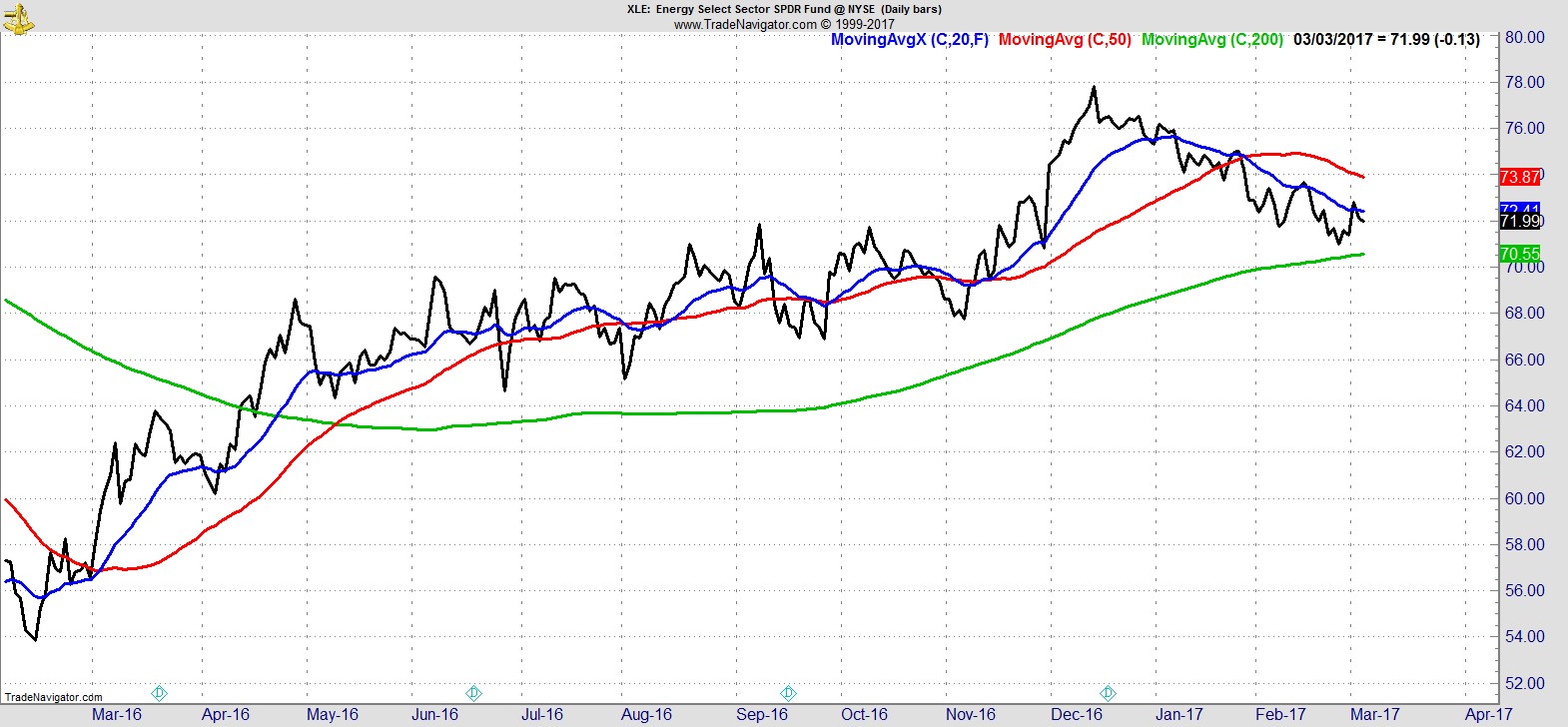

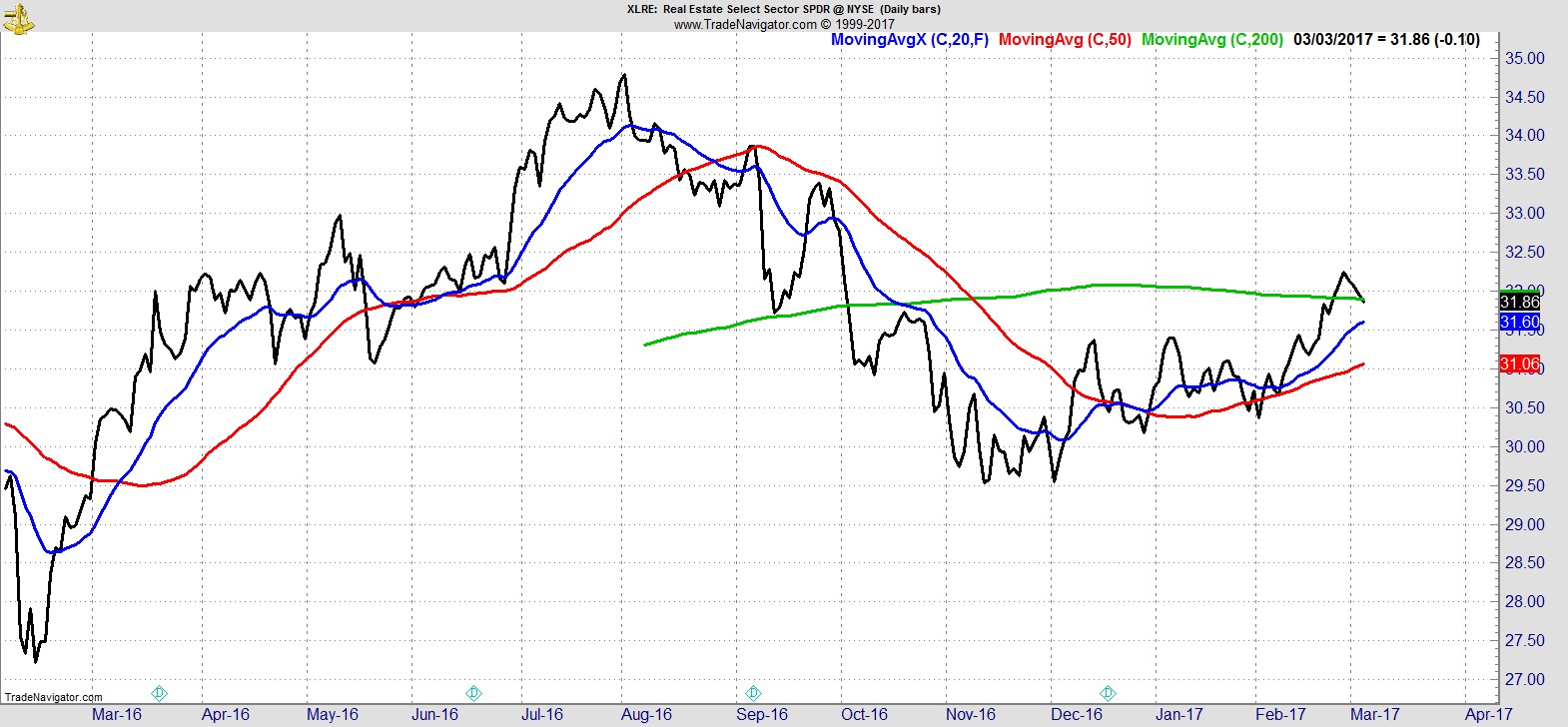

Despite recovering this week, Energy is still below its 20 and 50-day, and Real Estate weakened to close back below its 200-day.

.

Alpha Capture Portfolio

Our model portfolio improved +0.5% this week vs +0.7% for the S&P. We have another exit signal this weekend which will leave us with 8 names, total open risk of 4.3%, and 37% in cash.

Despite the market move to fresh highs, many of the names that performed well for us in previous weeks have started to fade, and the new names setting up aren't meeting our requirements for a compelling risk/reward entry.

Part of the appeal of a concentrated portfolio is that (for better or worse) it can perform very differently to the index. However, with the way we position size, when the invalidation point for a new entry is very far away, it results in a much smaller amount of capital being used for the same amount of risk, which if extended to many signals can end up giving you a portfolio of 30-50 names instead of a more optimal 12-15 names. If we wanted to perform like the index we could just buy the index. Instead, rather than taking sub-optimal entries we will just have to remain patient.

.

Watchlist

We have a healthy mix of names on our watchlist this week as although breadth weakened slightly, it's still in good shape and this has been a fairly broad advance with many of the lagging sectors of previous weeks continuing to recover well.

Here's a sample from the full list of 24 names:-

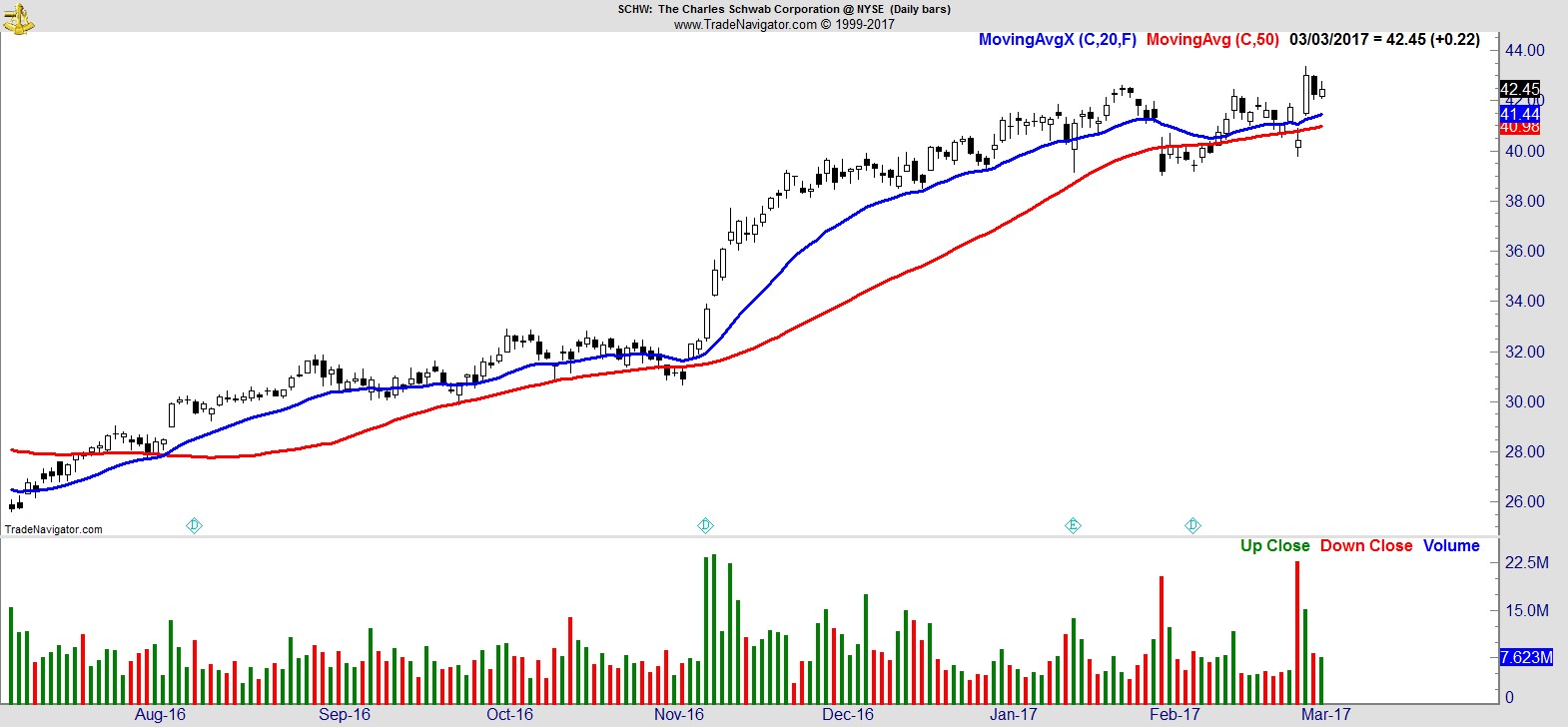

$SCHW

.

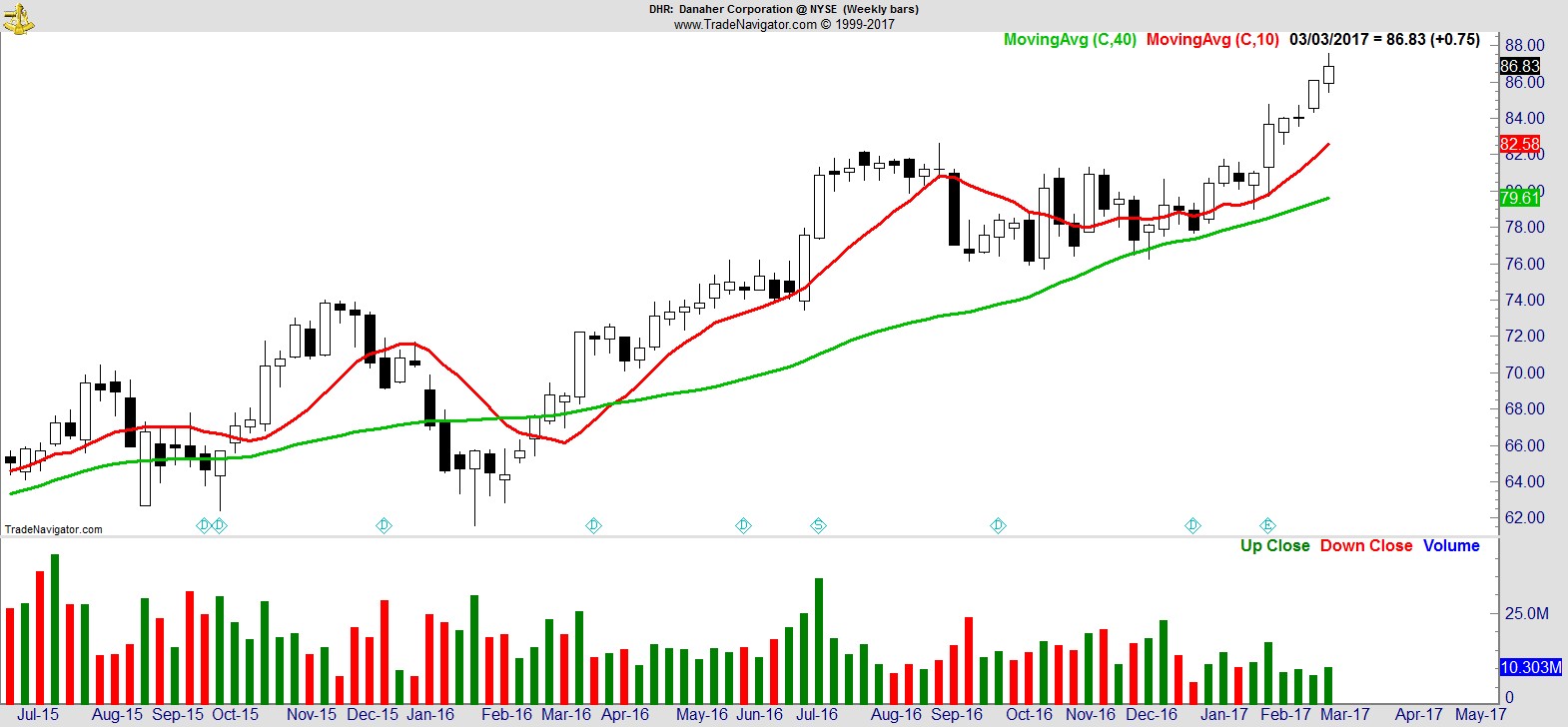

$DHR

.

$PCG

.

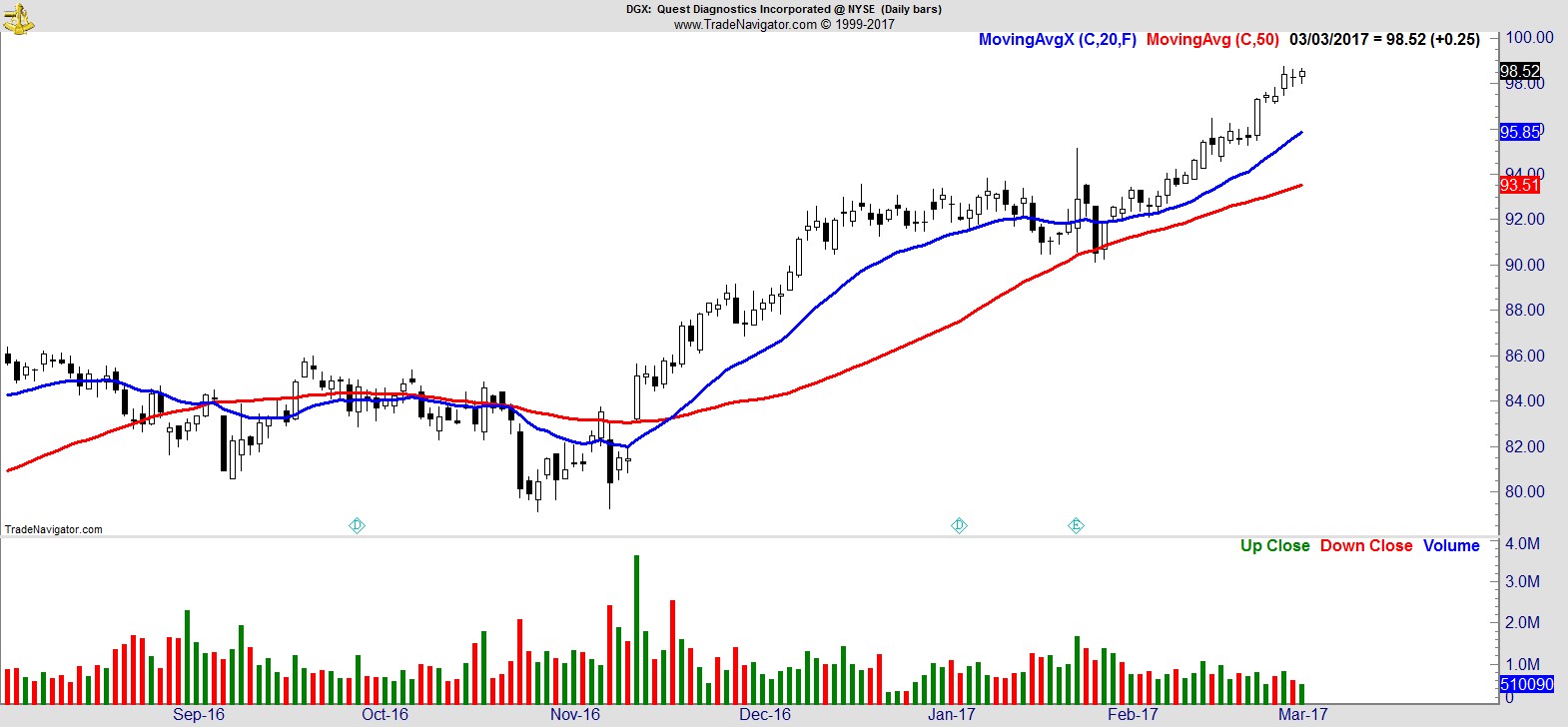

$DGX

.

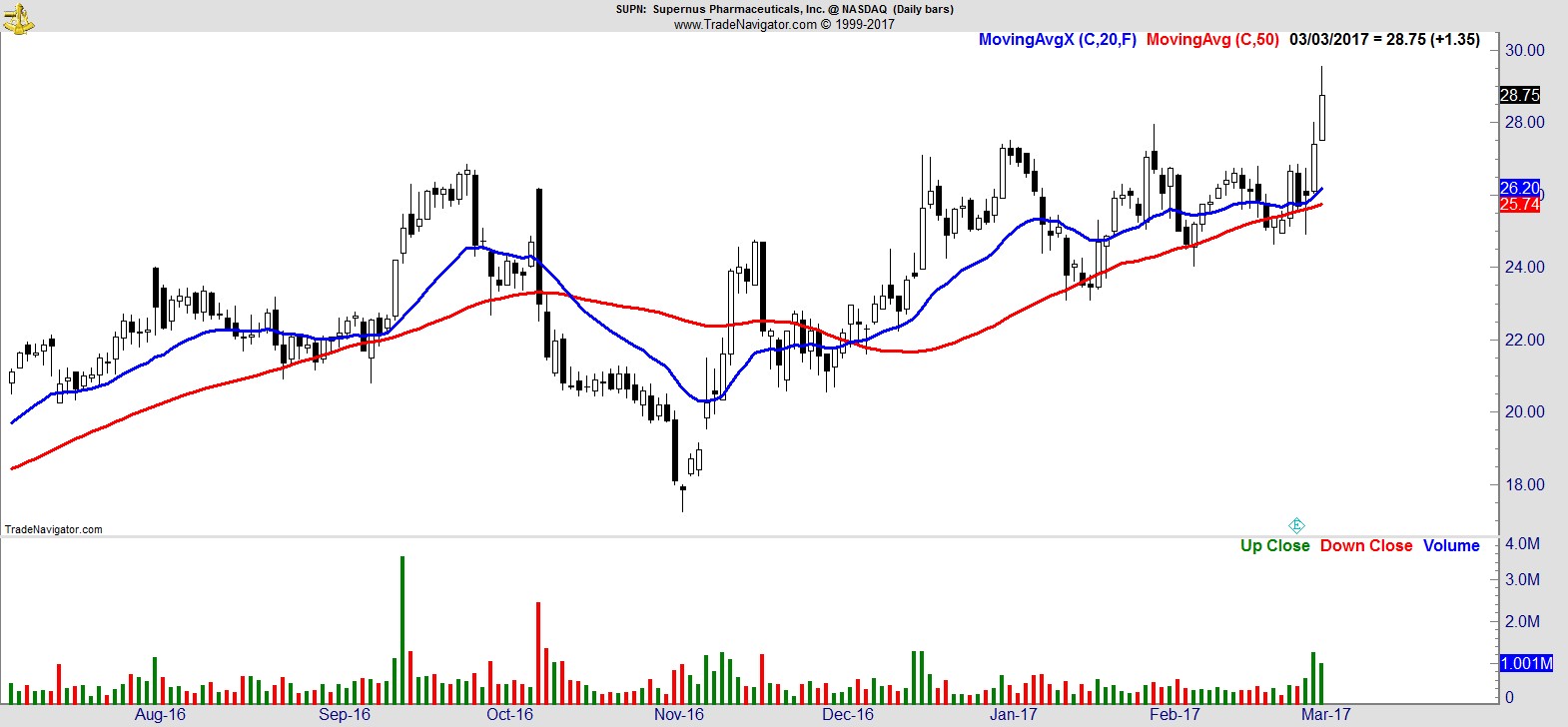

$SUPN

.

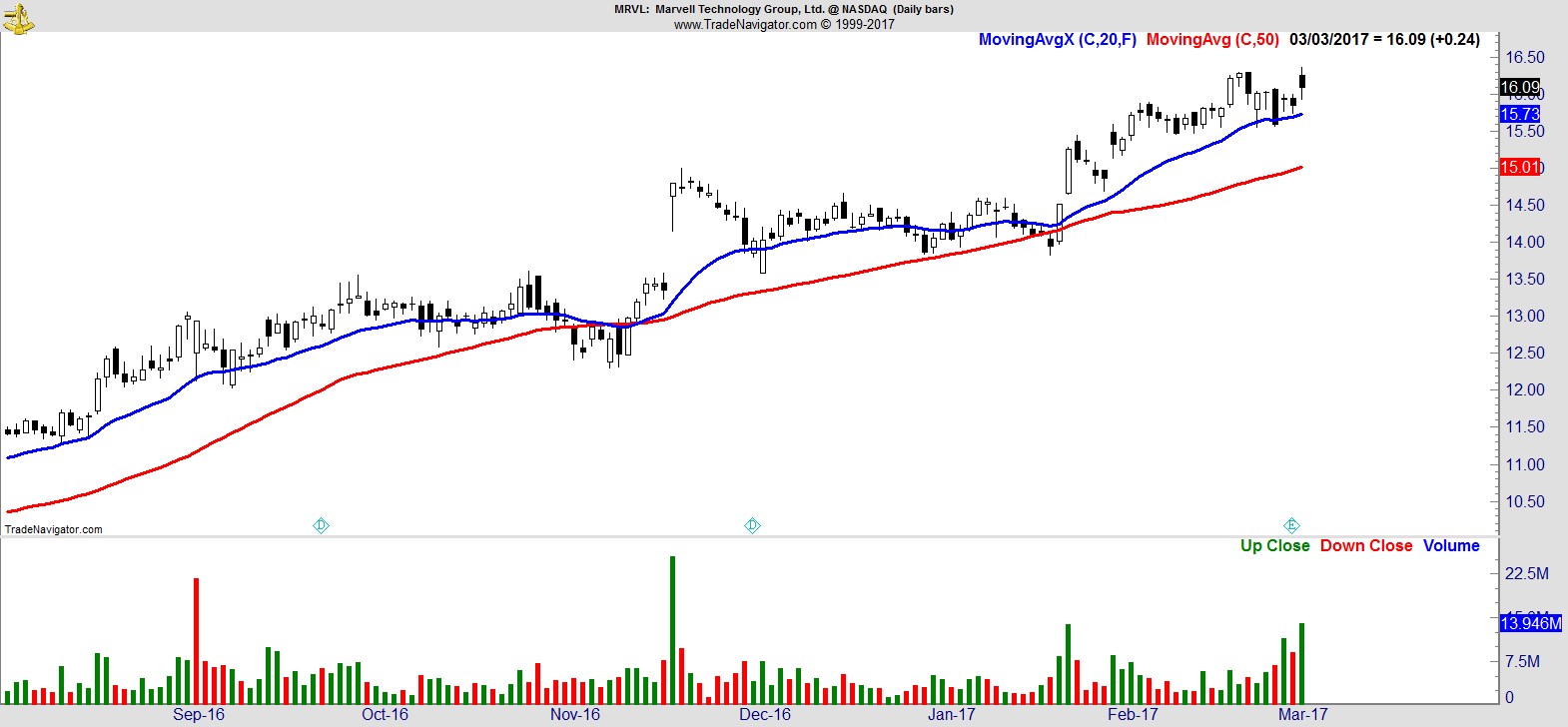

$MRVL

.

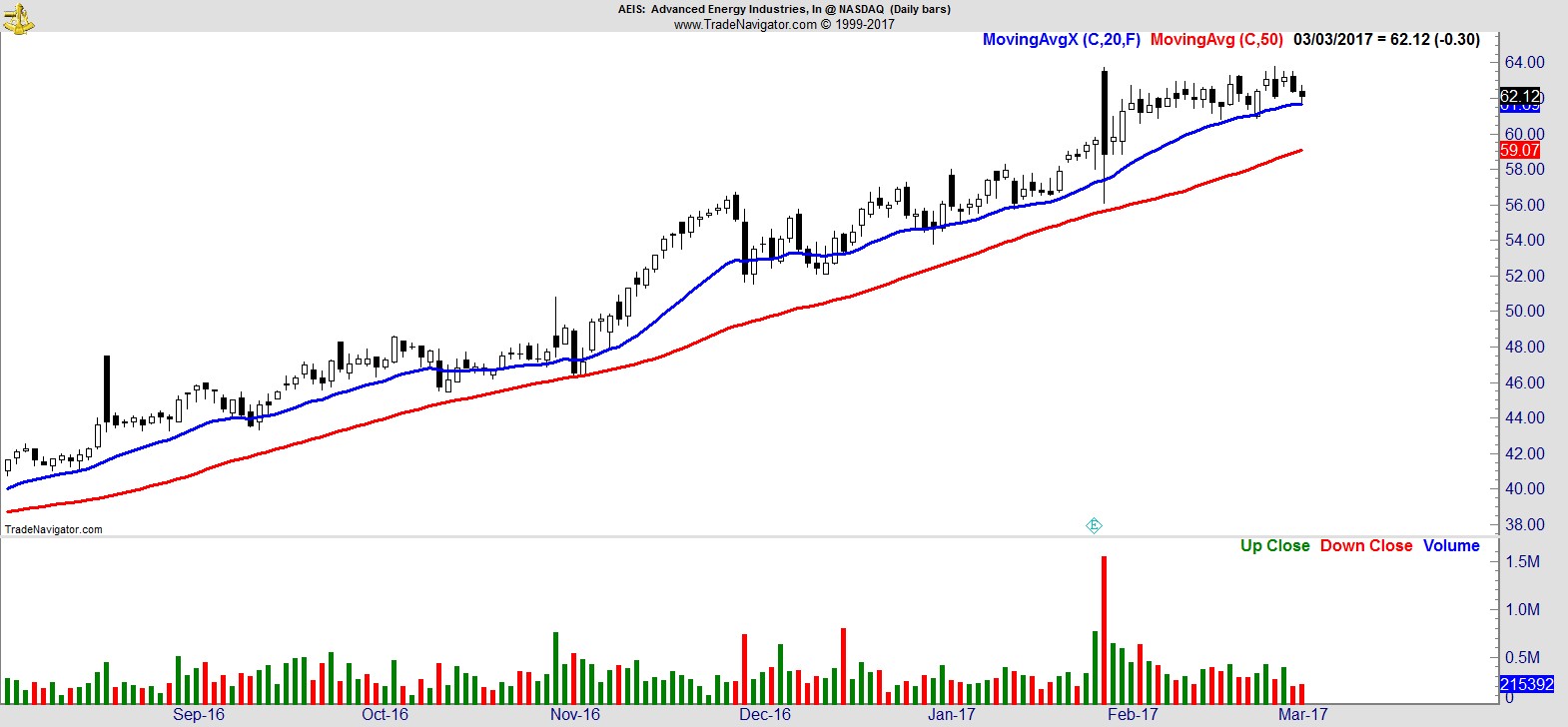

$AEIS

.

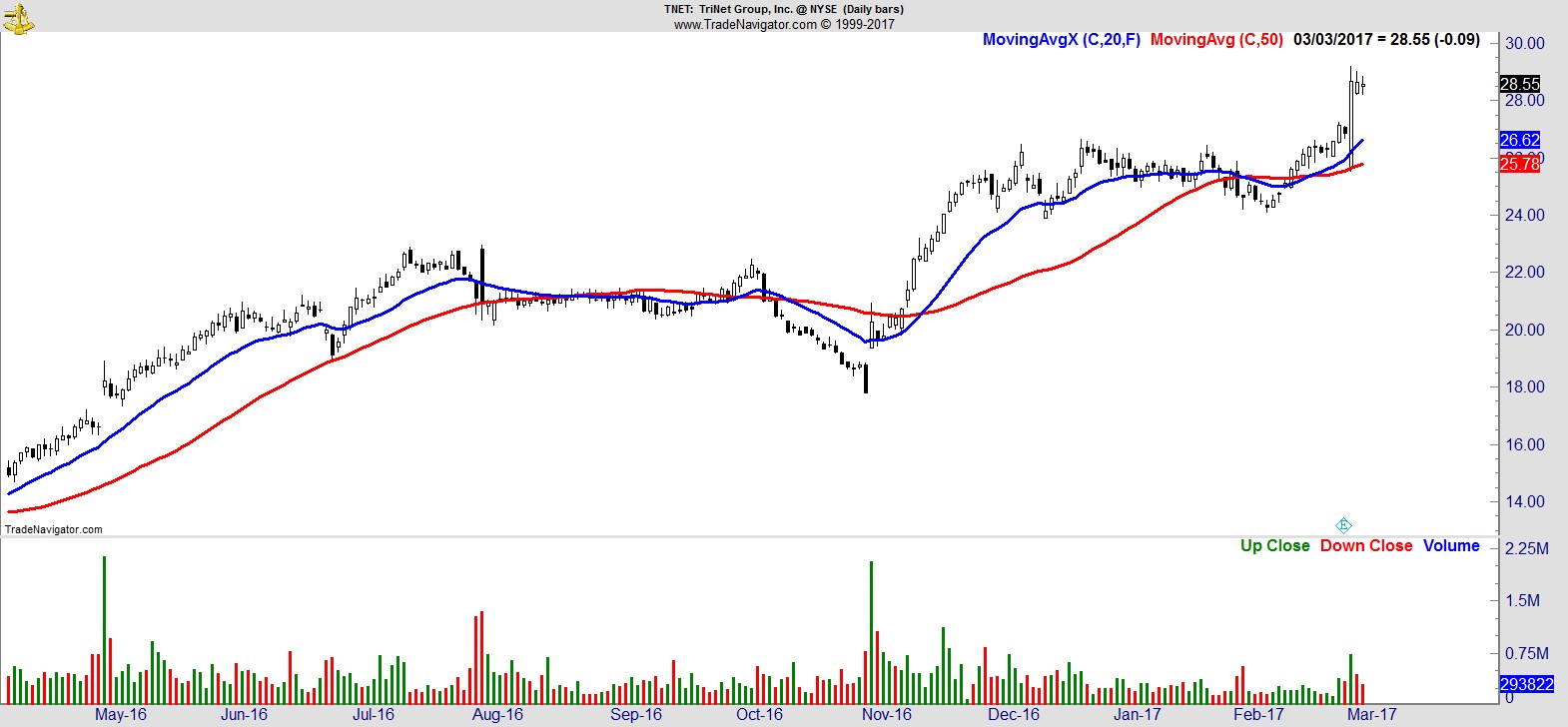

$TNET

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17