Overview

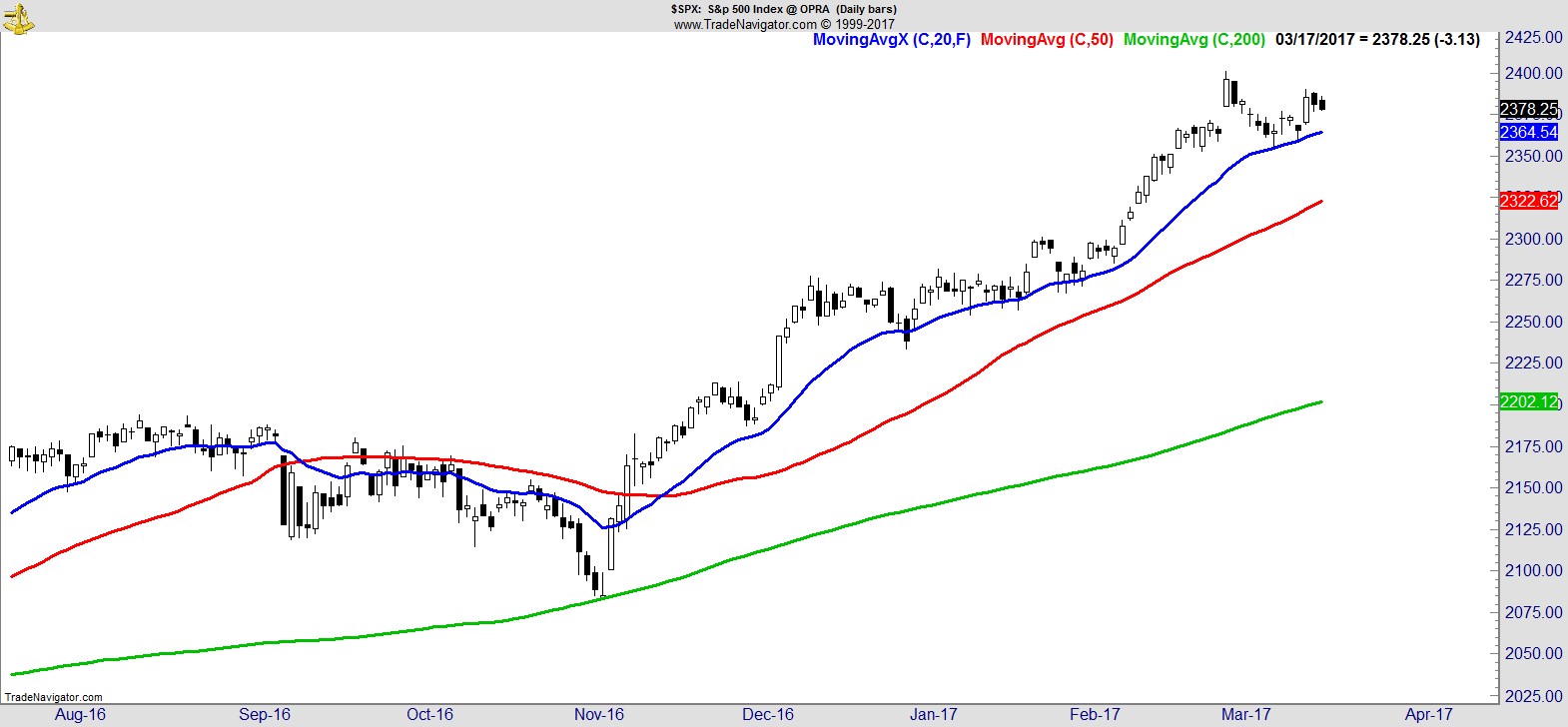

Last week was a whole lot of noise for very little progress in either direction. Longer-term the uptrend in equities remains intact, but it's clearly mixed in the short-term for specific indices and sectors.

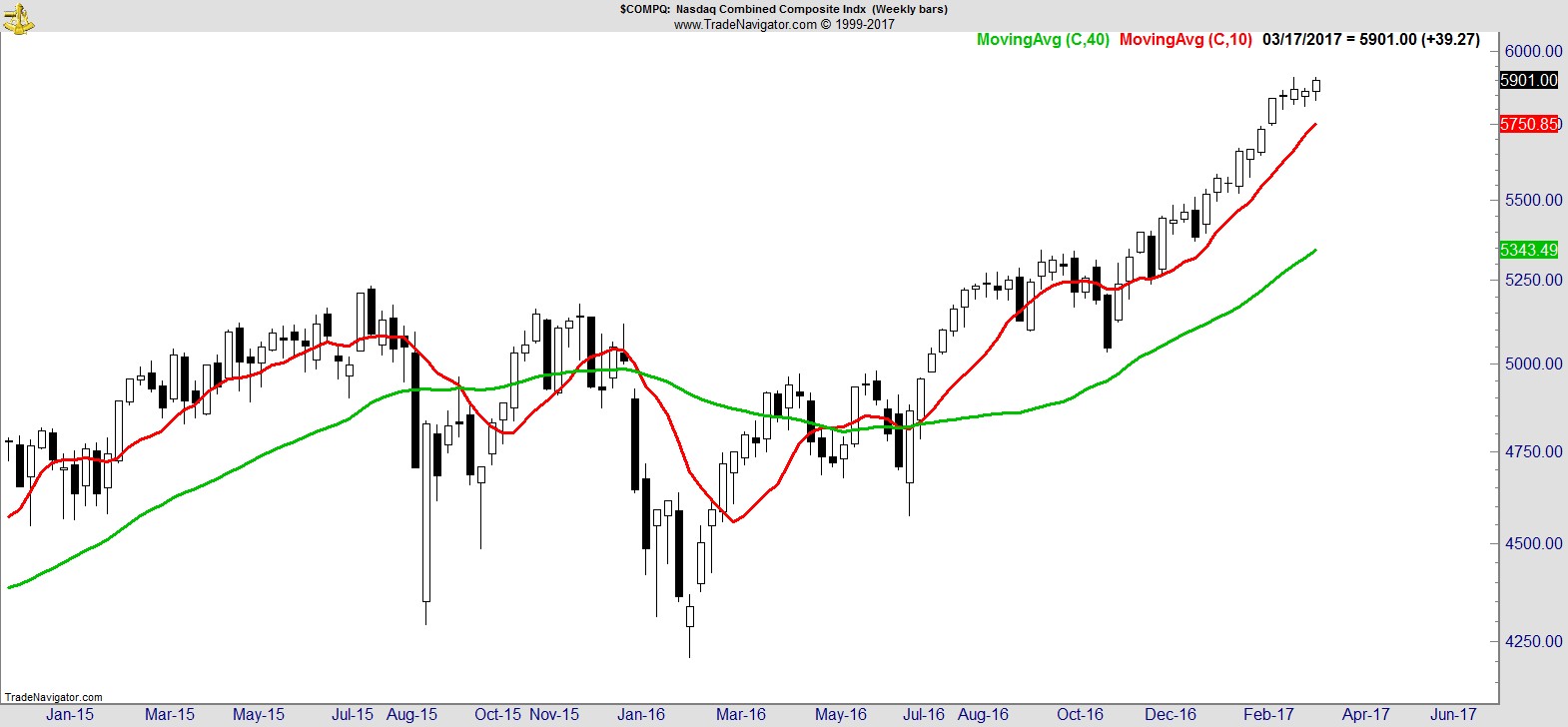

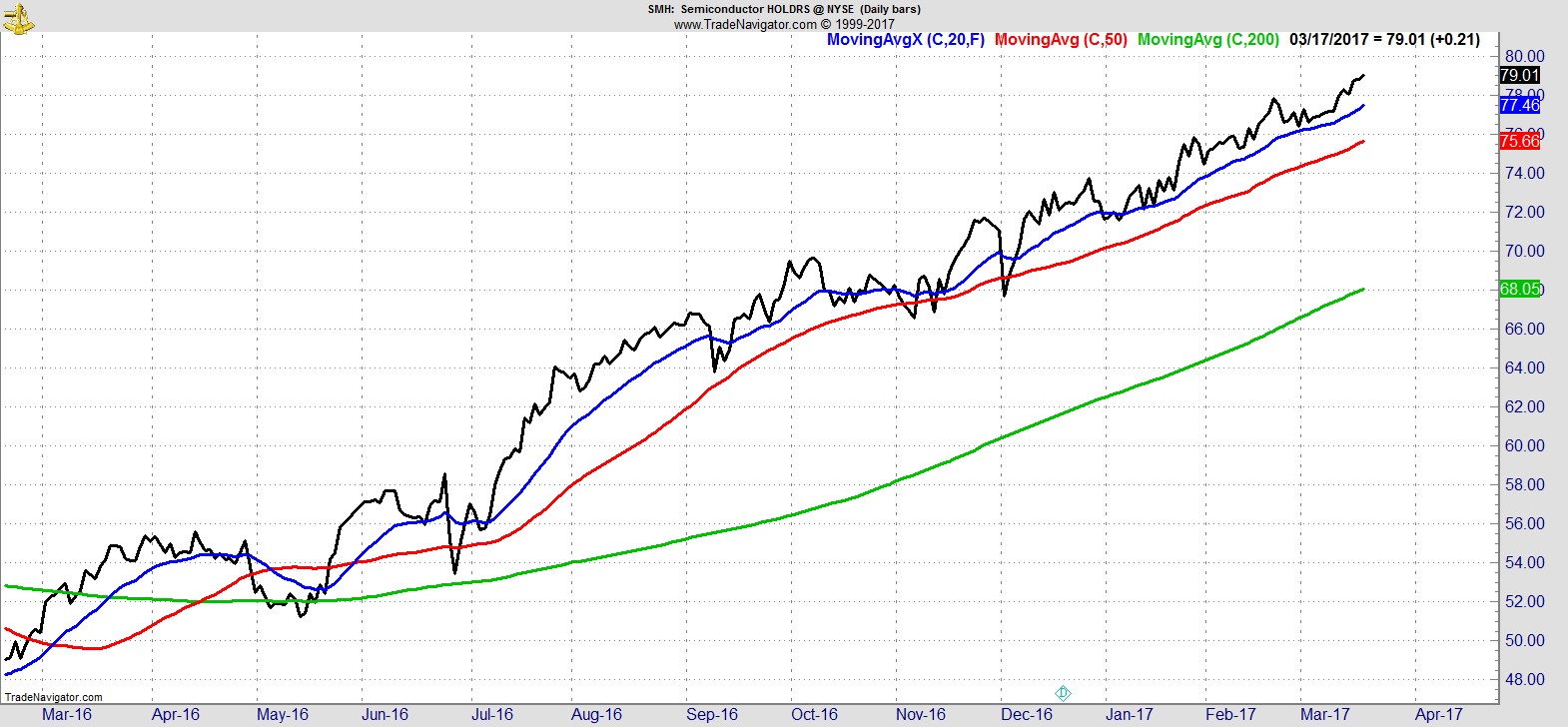

The S&P improved modestly on the week, while the NASDAQ made it to new highs as technology, and semiconductors in particular, led the way.

.

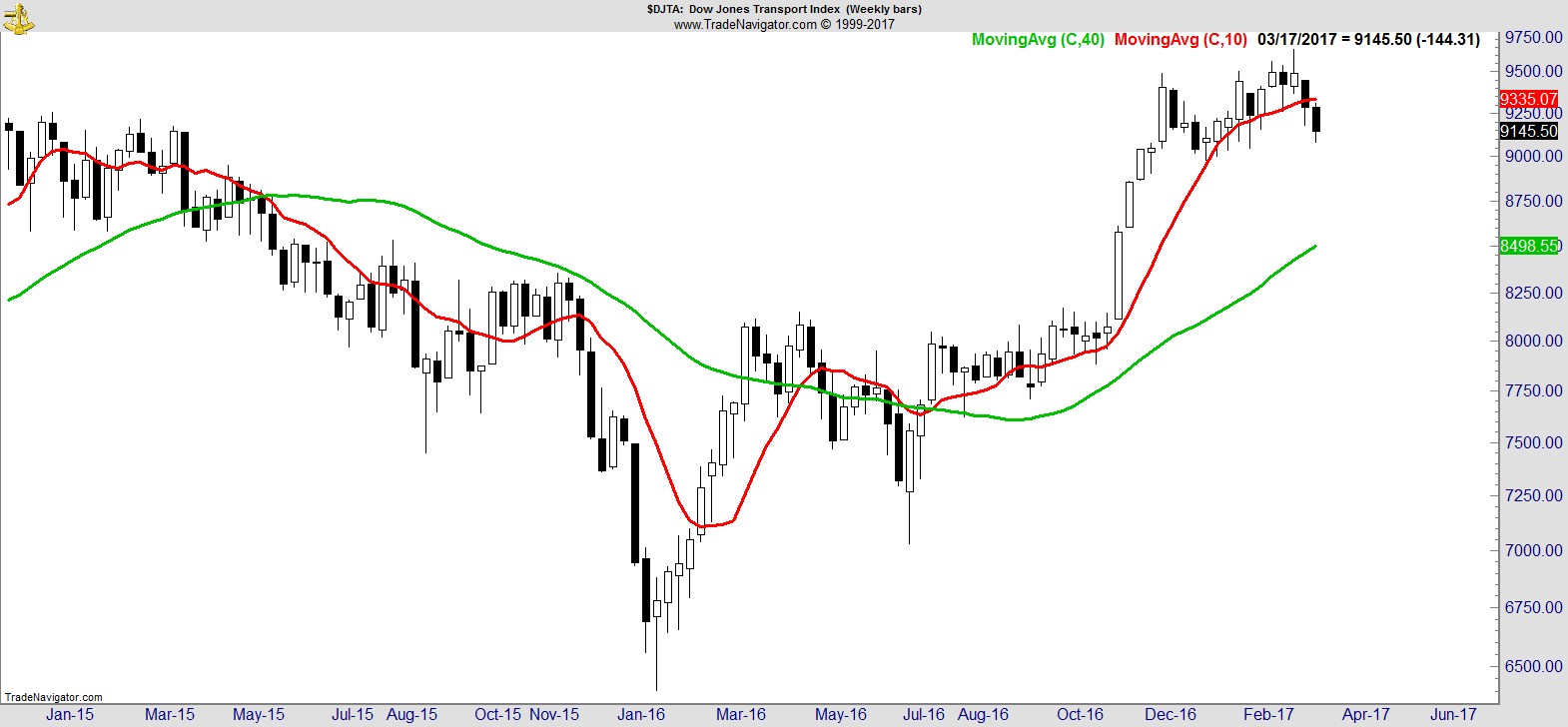

By contrast, the Dow Transports followed through to the downside and now sits at 10-week lows. The Russell along with midcaps in general rebounded.

.

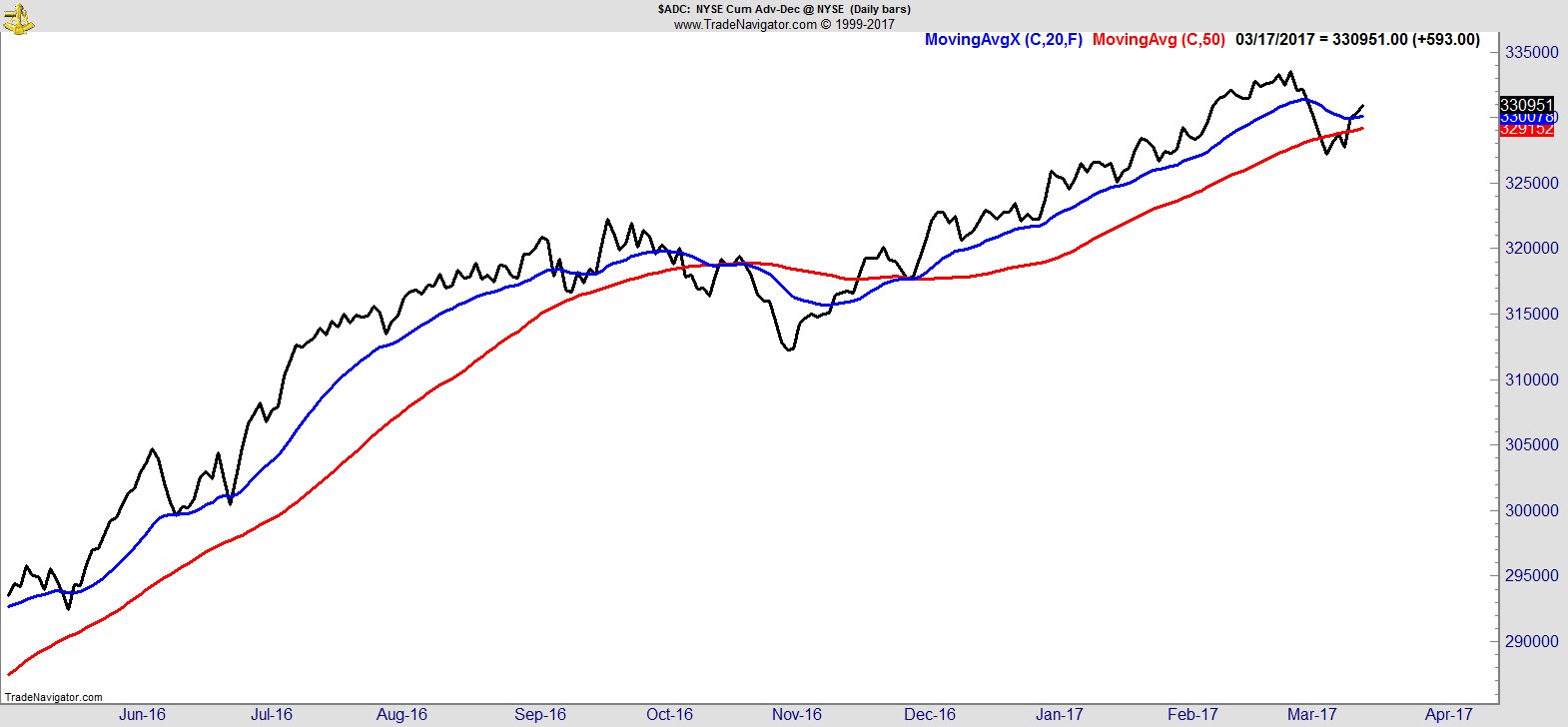

Breadth, via the NYSE Cumulative advance/decline also improved, reclaiming ground above its MAs.

.

Sector Analysis

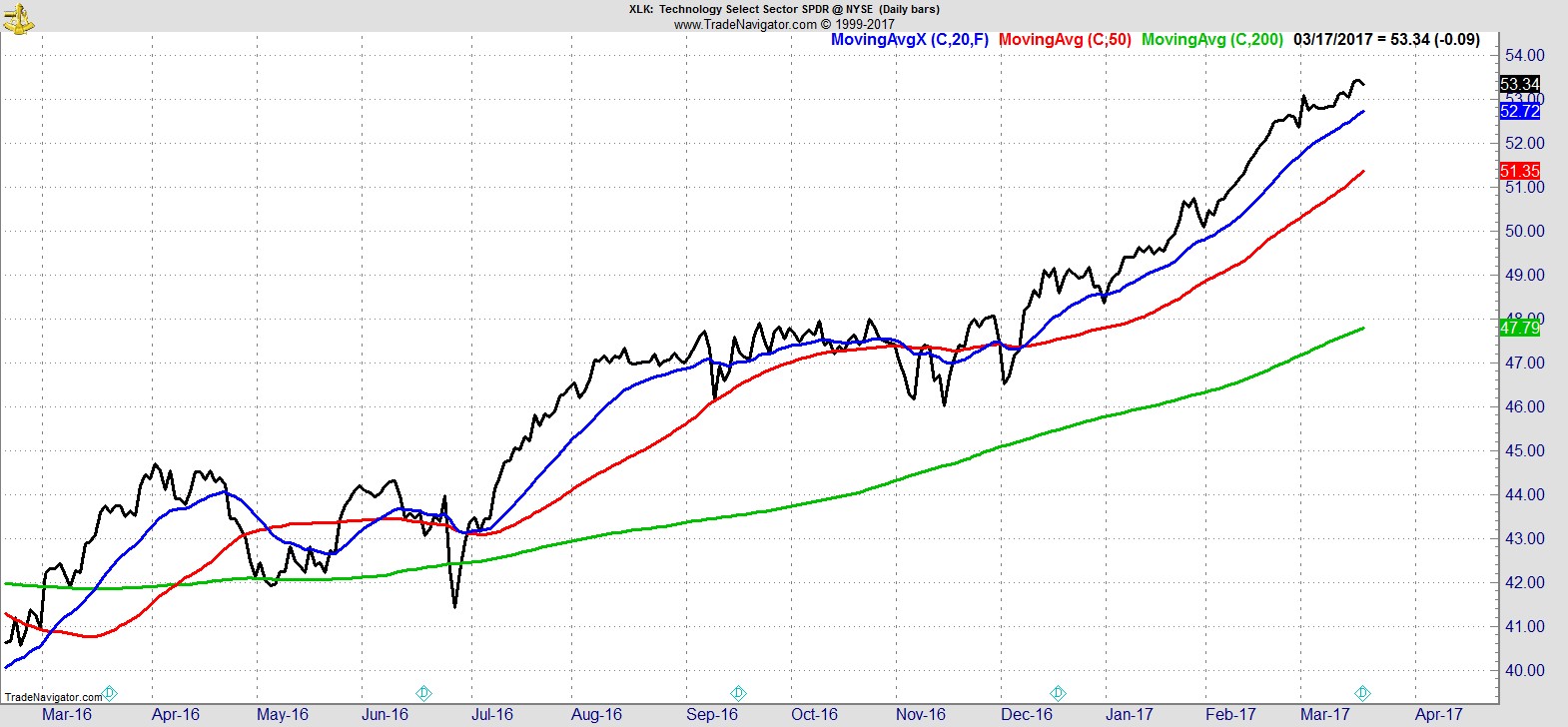

Technology ($XLK) is the clear Sector SPDR leader, making new highs, fueled by the strength in semiconductors ($SMH).

.

Then comes Consumer Discretionary, Materials, and Industrials, which are off their highs but all still above their 20 EMA. They're followed by Financials, Healthcare, Staples, and Utilities which have all cooled off after recent gains.

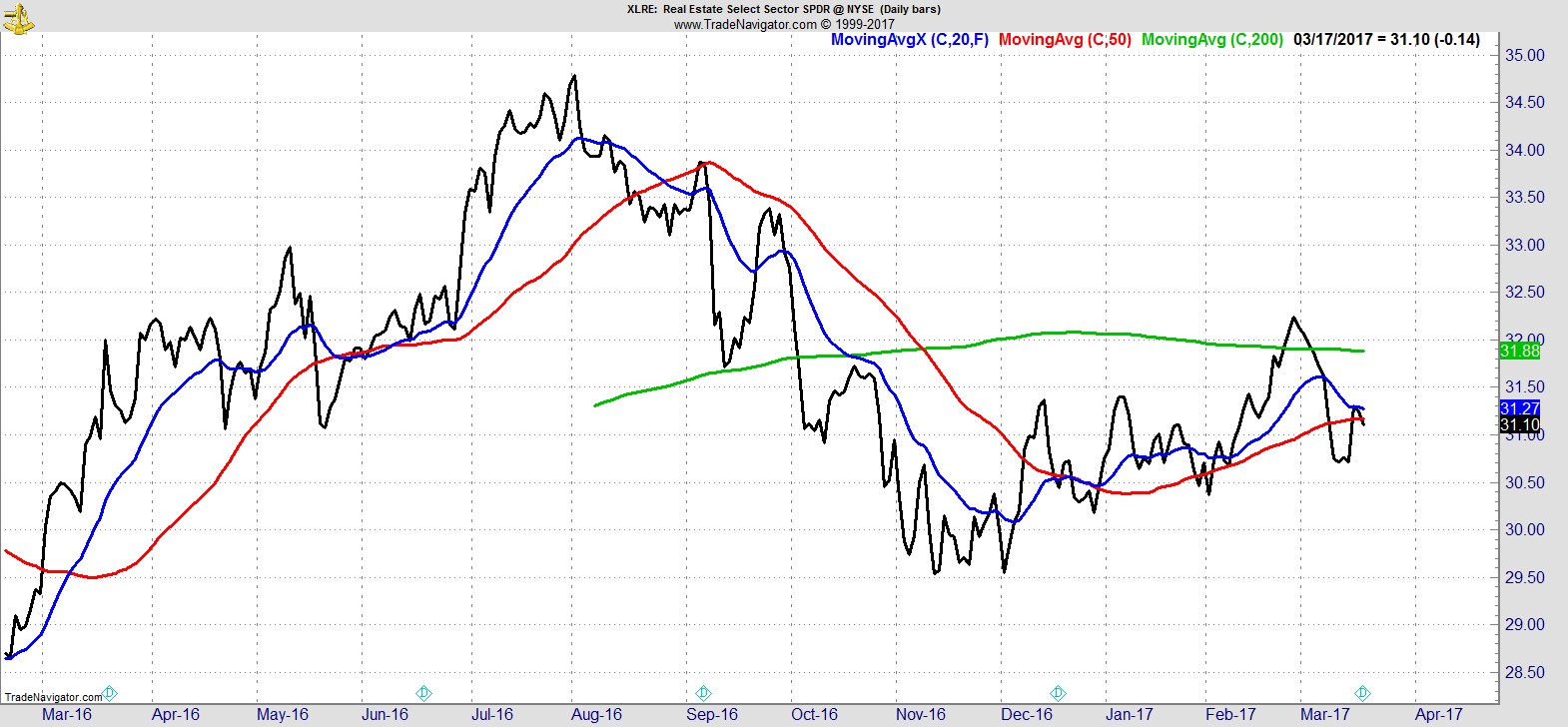

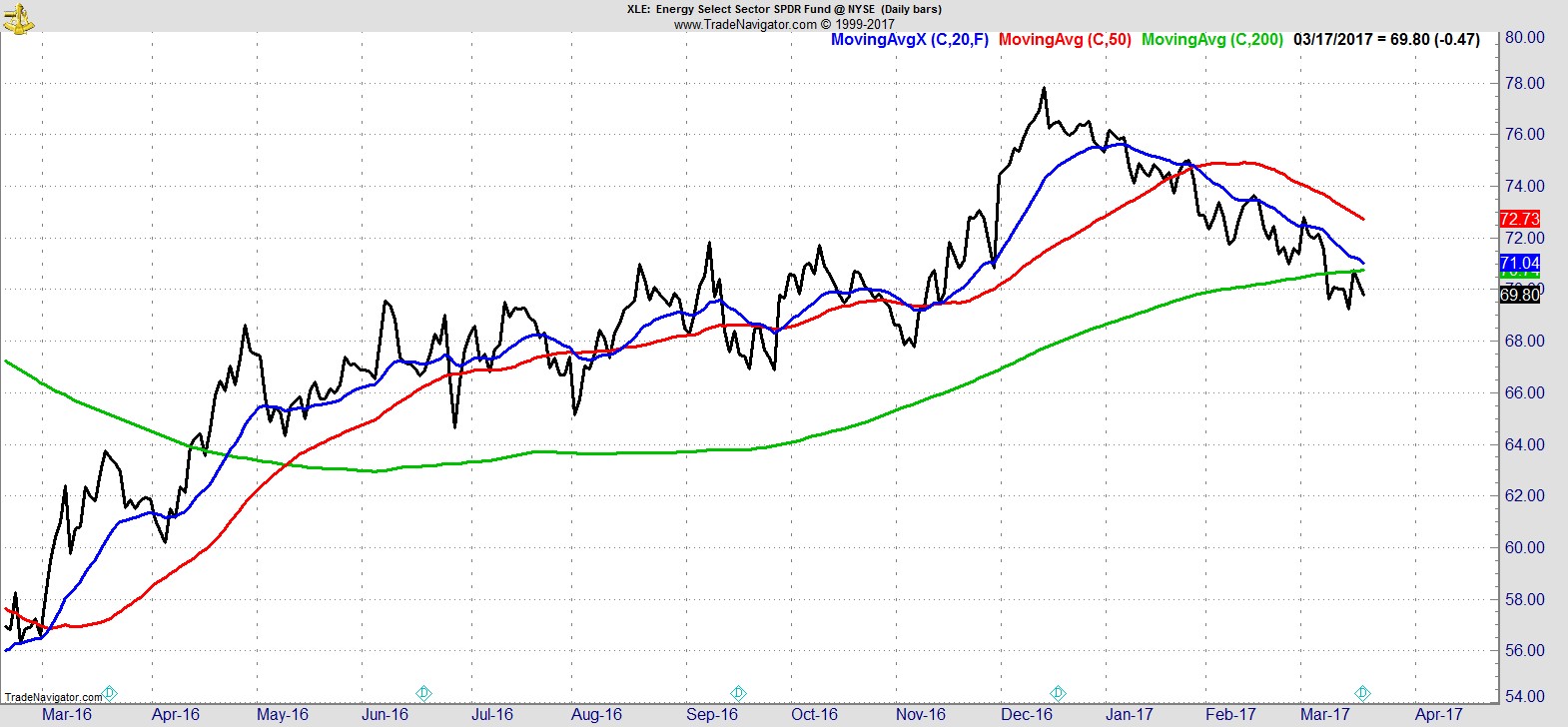

At the bottom we have Real Estate, and Energy, which have turned negative on an intermediate-term basis, and are below their 20, 50, and 200-day MAs.

.

Alpha Capture Portfolio

A quiet week for our model portfolio edging +0.3% vs +0.2% for the S&P. We have one exit this weekend and one new entry signal that will keep us at 7 names with total open risk of around 4%, and over 45% in cash.

.

Watchlist

Tech, along with healthcare, and consumer-related sectors dominate the list this week. Some industrials and materials remain, but financials have completely faded from view.

Here's a sample from the full list of 28 names:-

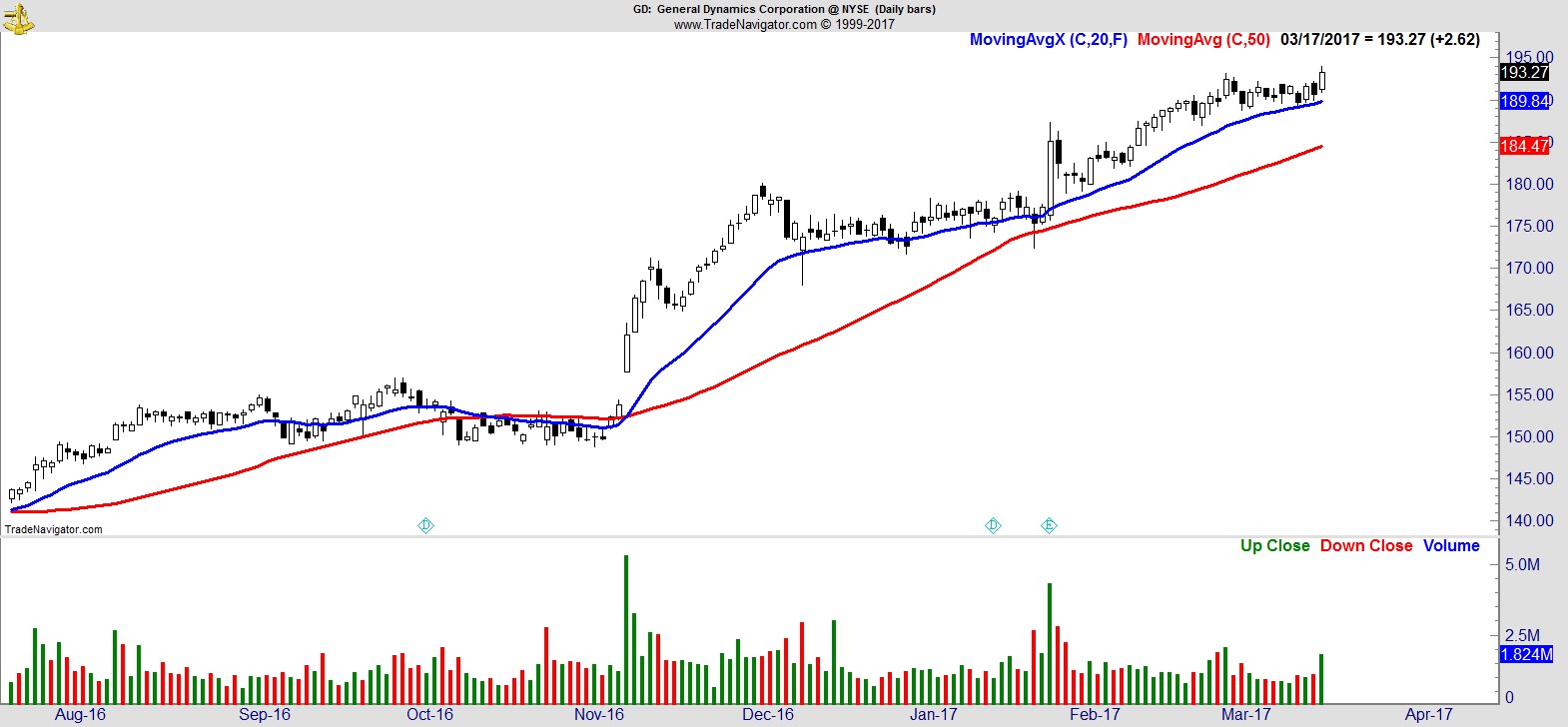

$GD

.

$RPM

.

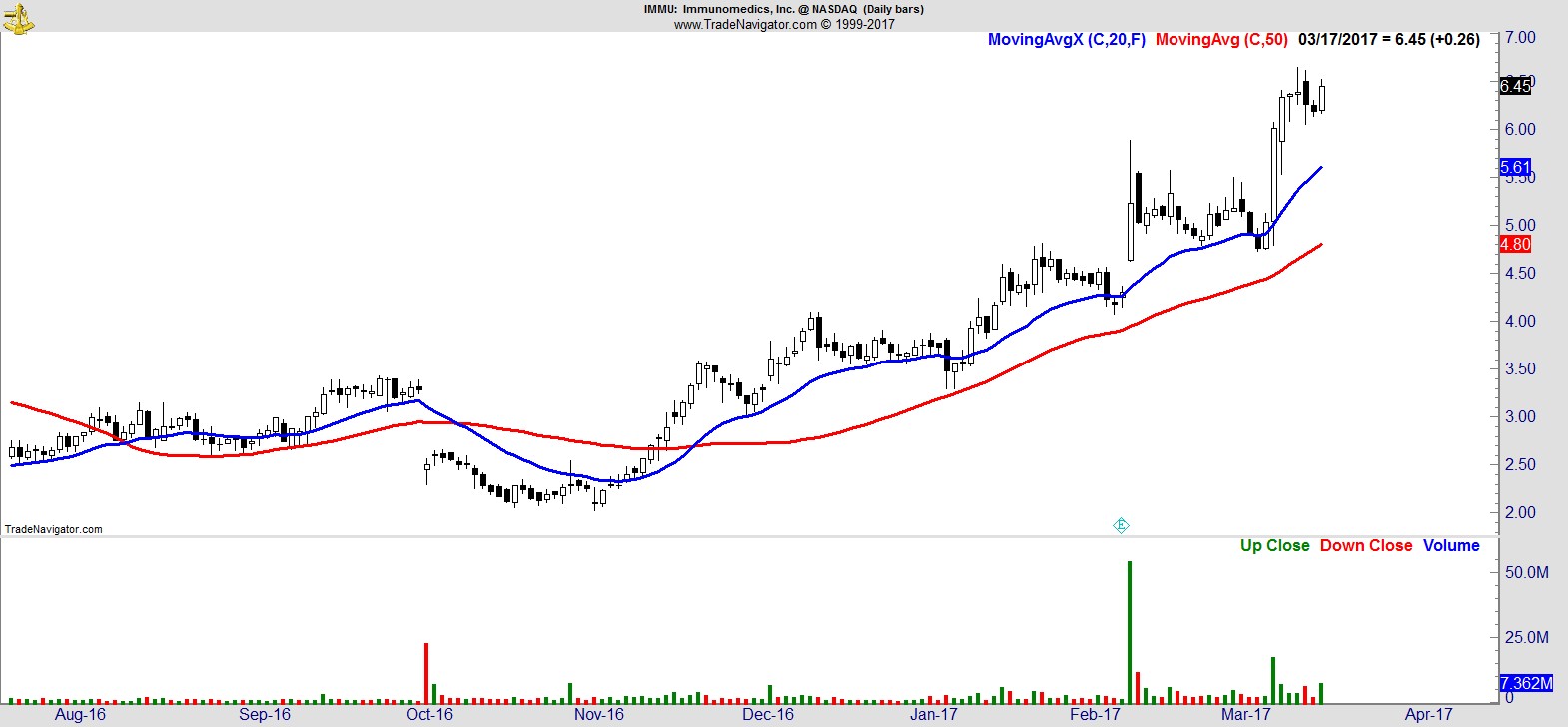

$IMMU

.

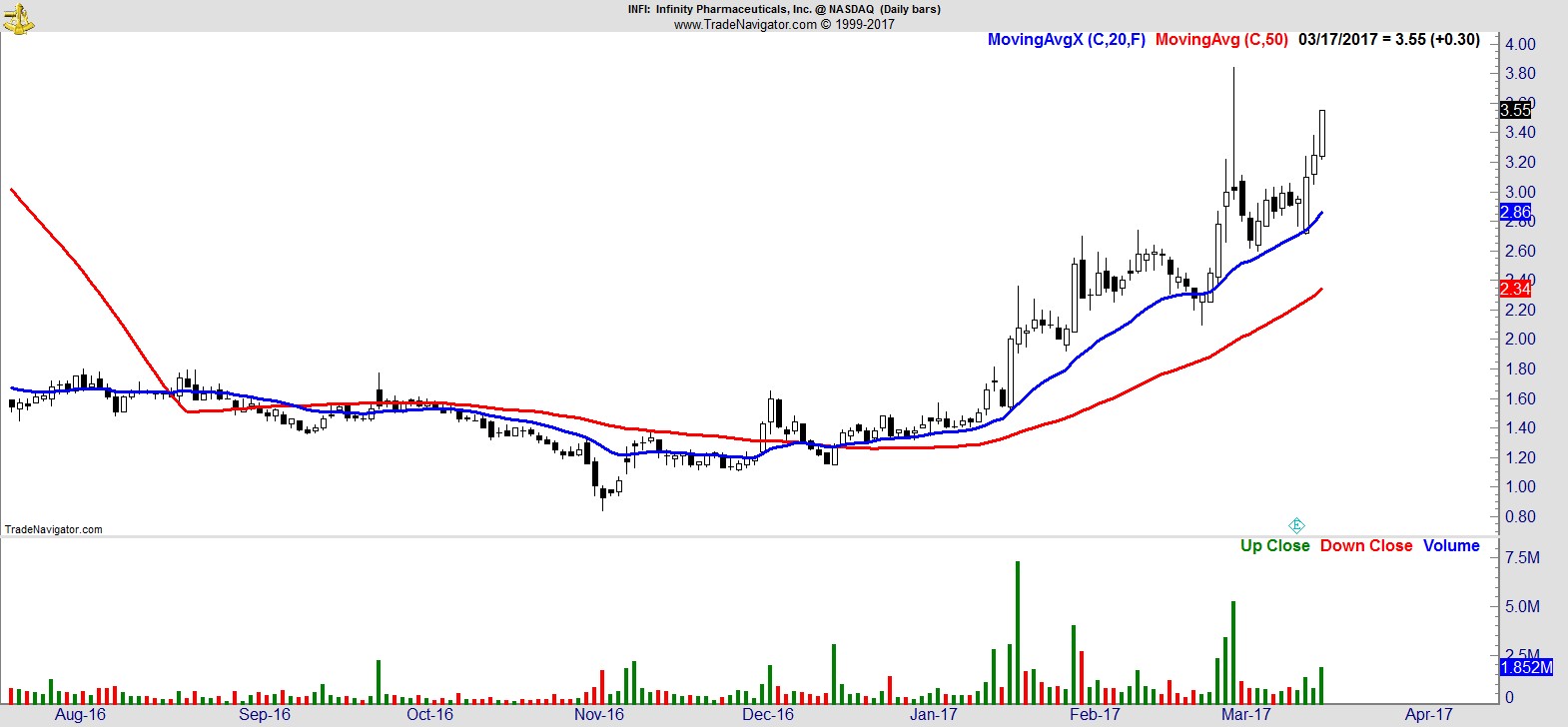

$INFI

.

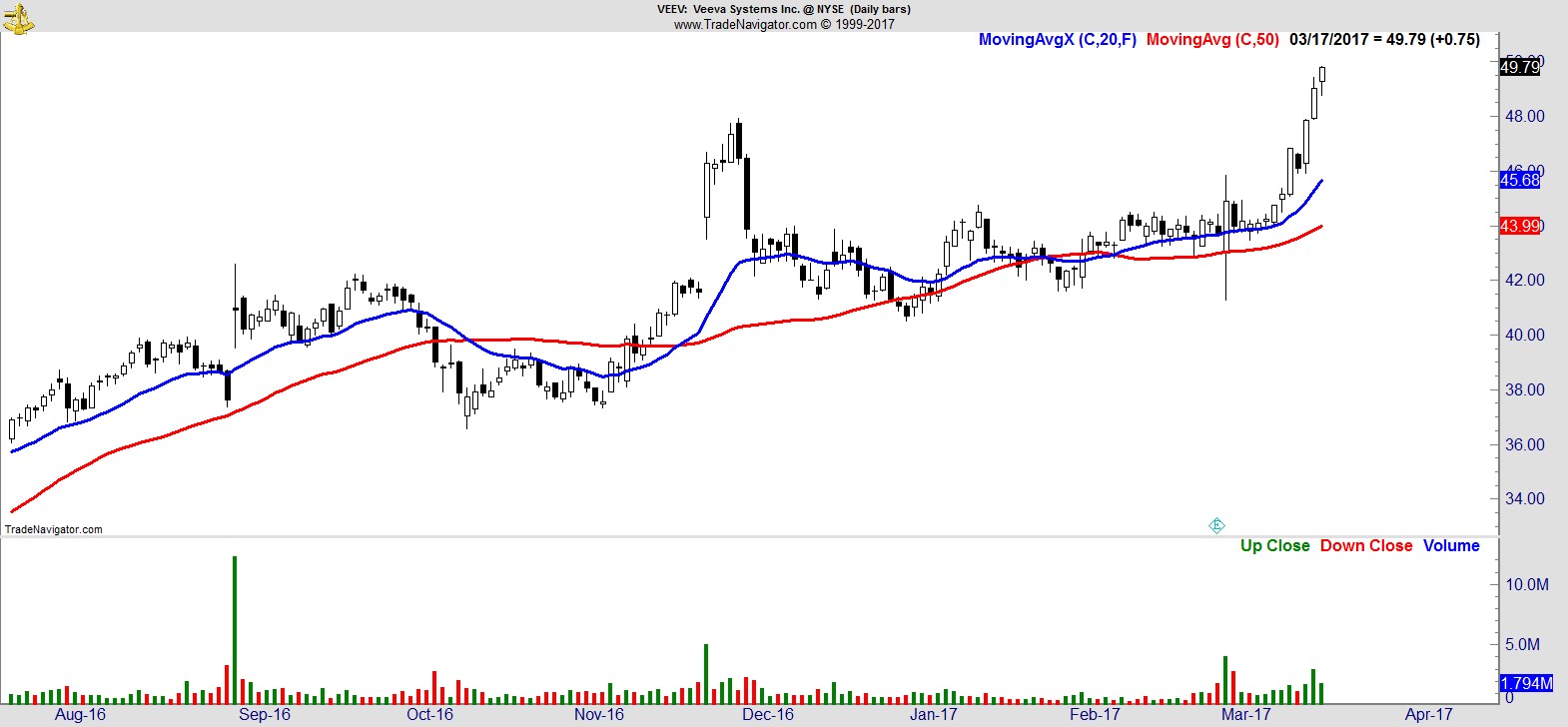

$VEEV

.

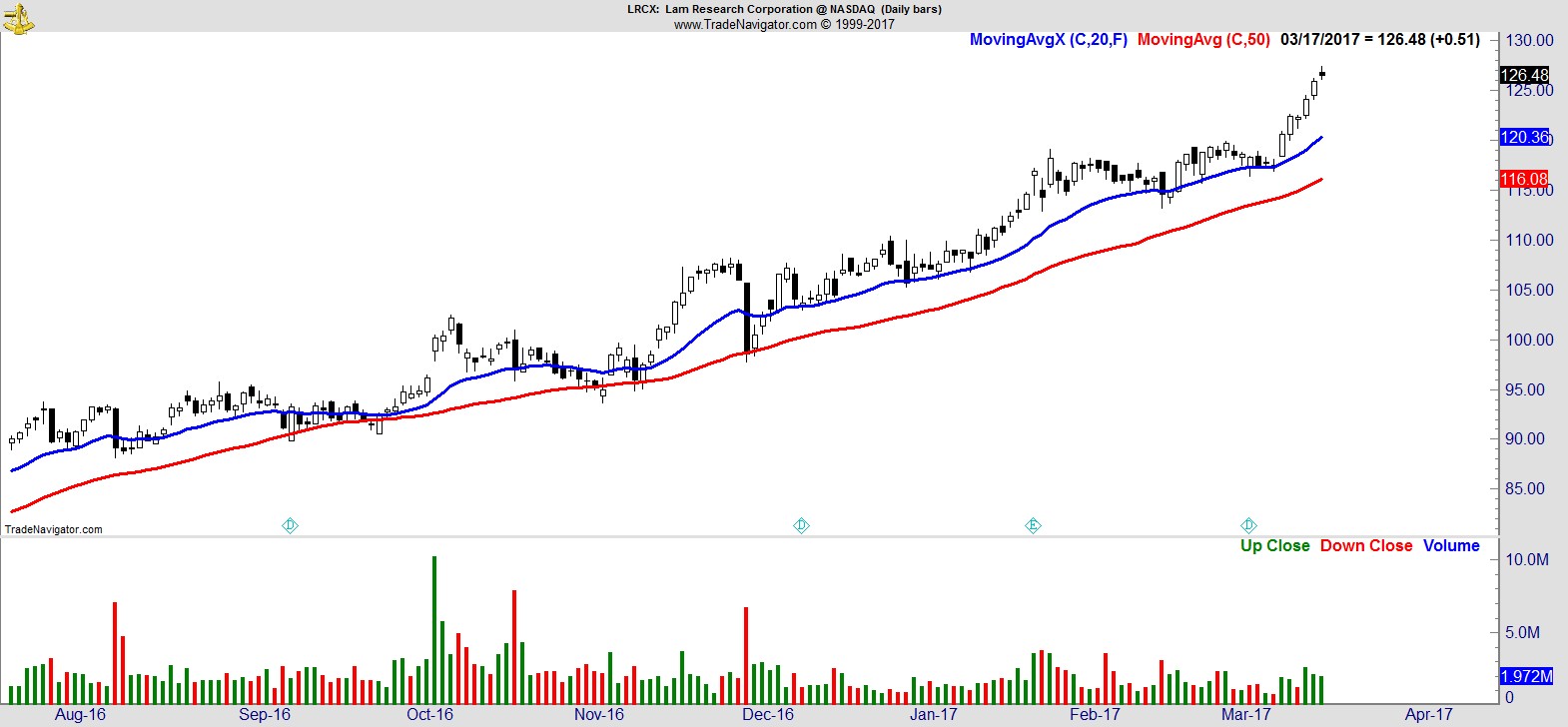

$LRCX

.

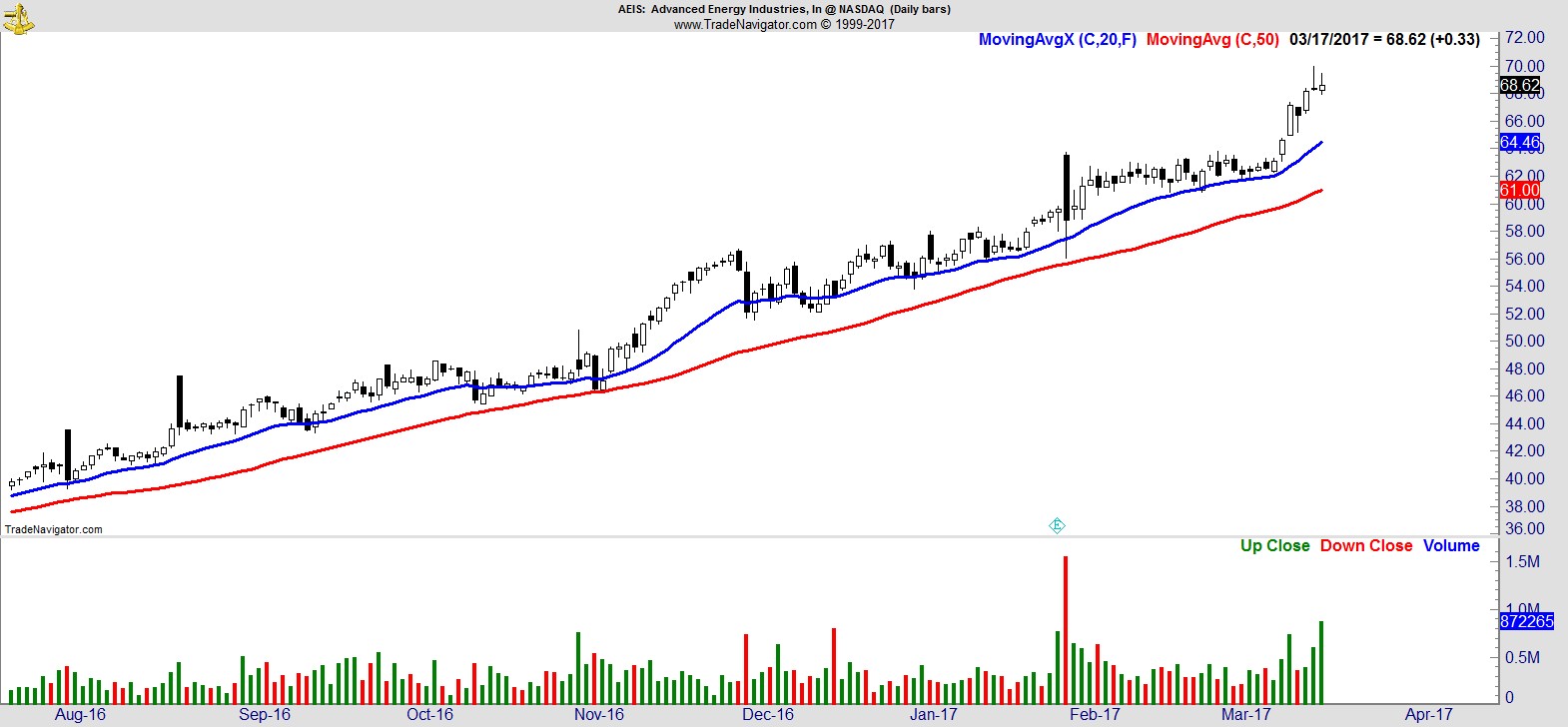

$AEIS

.

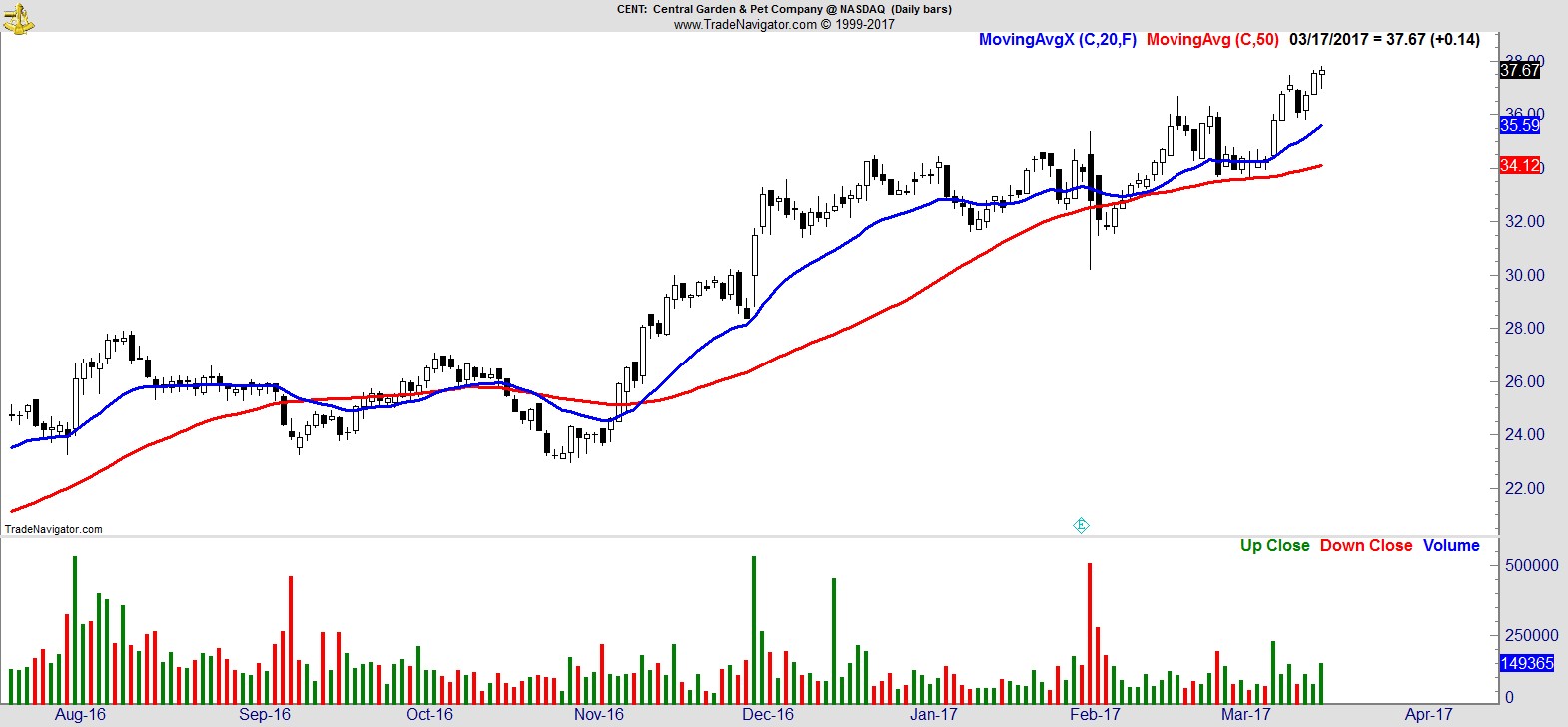

$CENT

.

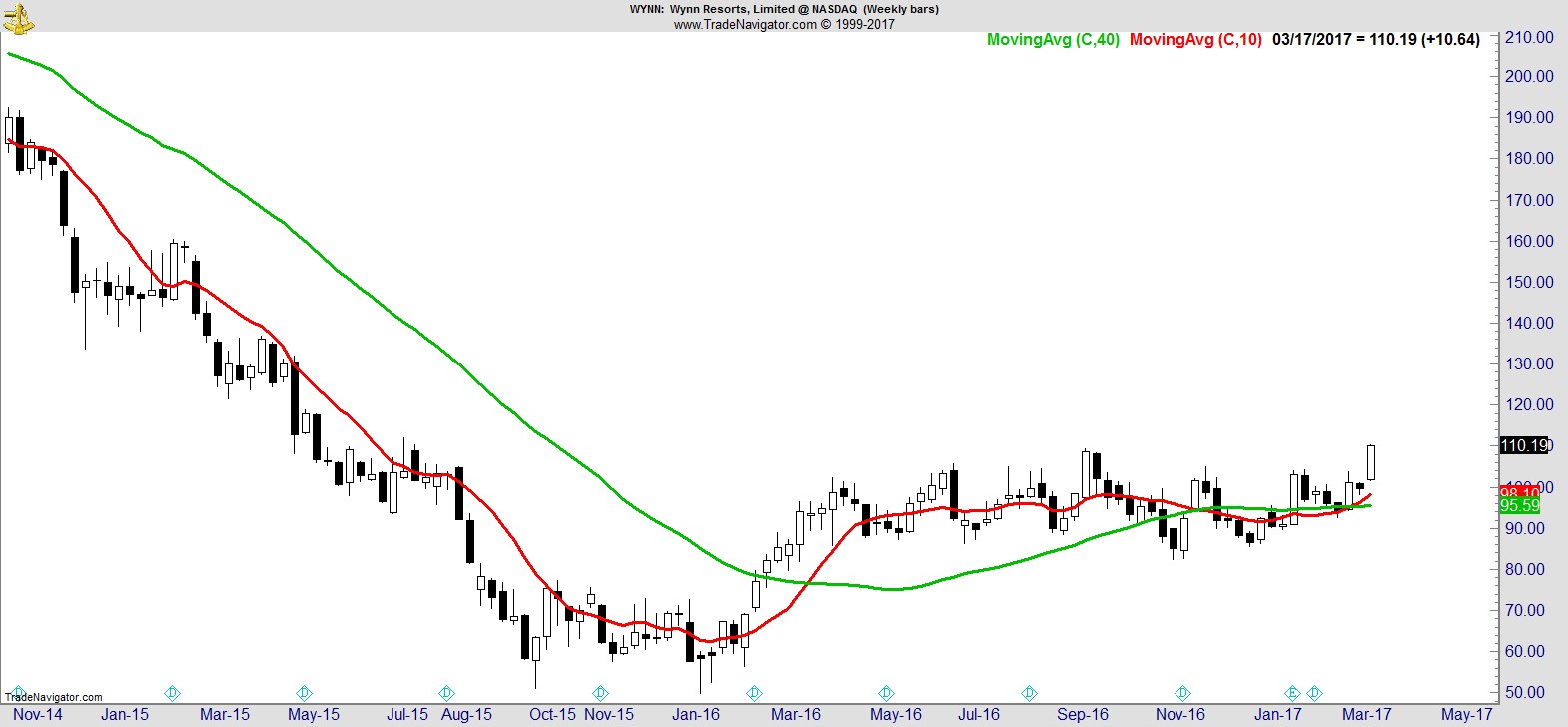

$WYNN

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17