Overview

A similar report to last week, because quite frankly not a lot changed. Short-term, the major indices have weakened further, but longer-term remain in strong uptrends. Defensive sectors are leading, along with technology.

The tumble on Tuesday that finally brought an end to the near-record streak of days without a 1% move perhaps felt worse than it looked (don't they always?), and after a lackluster rally attempt those lows were revisited late in the week, with the backdrop of a dog and pony show over healthcare legislation.

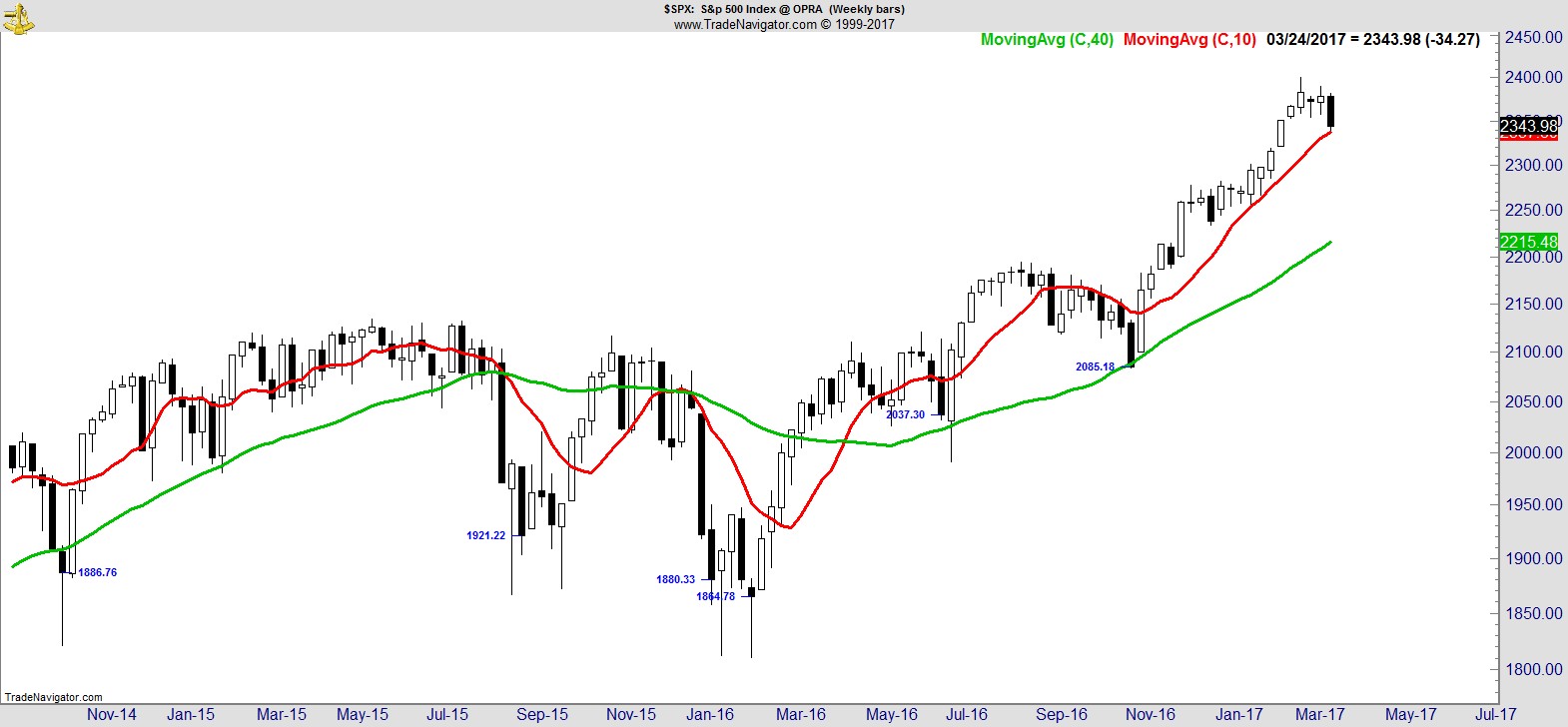

The S&P finished -1.4% on the week. Let's keep some perspective on where that leaves things. Here's the S&P over the last 5 years:-

We're a couple of percent below the highs, and could comfortably accommodate a pullback of 5% before the 200-day MA would start to come into view. That doesn't completely tell the story however, as it's fair to say we're seen damage far greater than 2% in the sectors that had previously led the move higher over the last few months, as we'll see later when we look at the sector rankings.

Here's the S&P on a weekly. It tested its 10-week MA for the first time since the election. As per last week, the NASDAQ and Dow look fairly similar.

.

Greater damage however appears on the Dow Transports and the Russell 2000, which have spent most of this month below their 10-wk MA, with the Transports posting the lowest weekly close since November:-

.

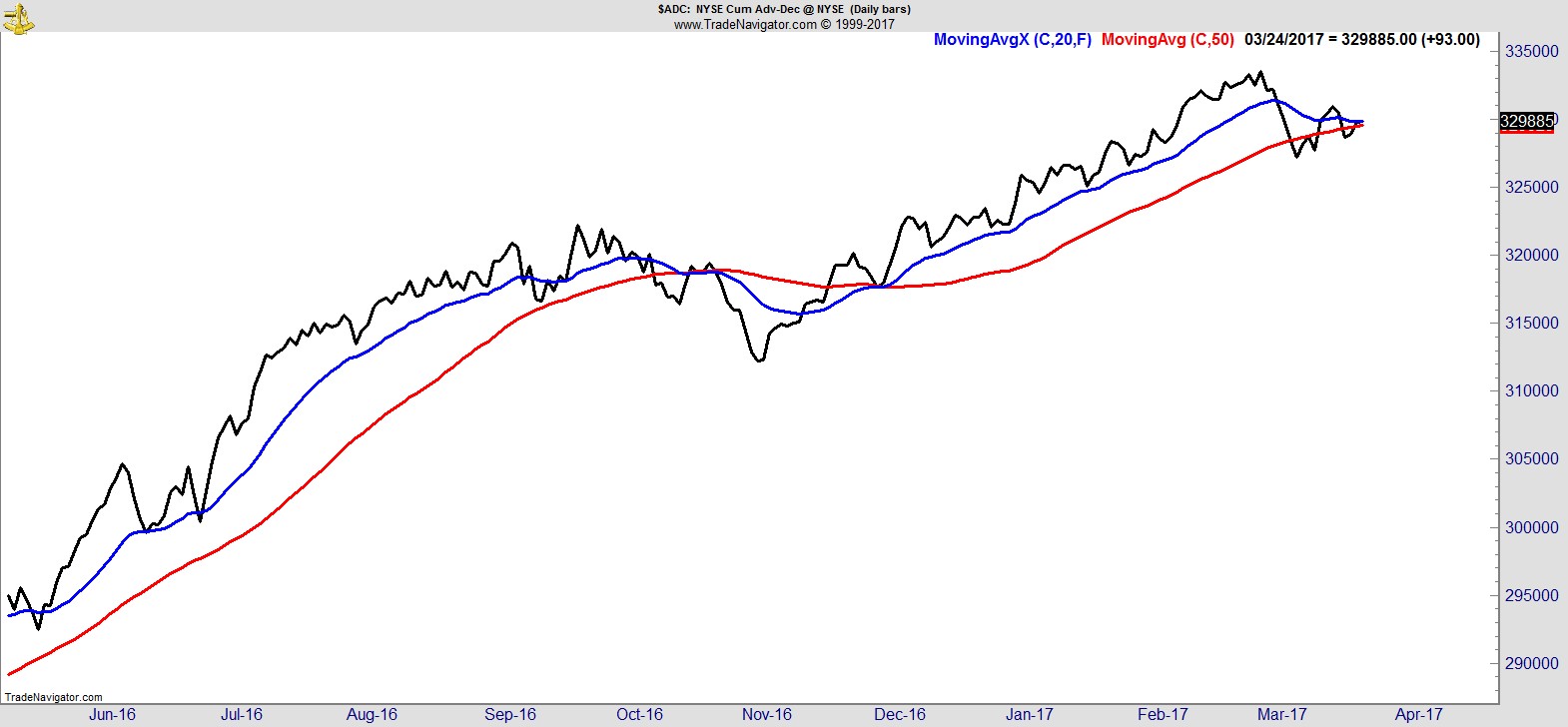

Breadth is still in good shape overall, but short-term is still recovering from the initial downdraft following the 3/1 high.

I'm actually encouraged by the longer-term picture here given that breadth and the S&P both peaked on the same day (3/1). Ordinarily it's been my experience that for major tops you could expect to see some form of divergence either with momentum or breadth as leadership thins out, weeks and months ahead of when the index does. Here both breadth and the market itself have moved more or less in tandem, which lends more weight to this current move being corrective in nature rather than signalling a final top.

.

Sector Rankings

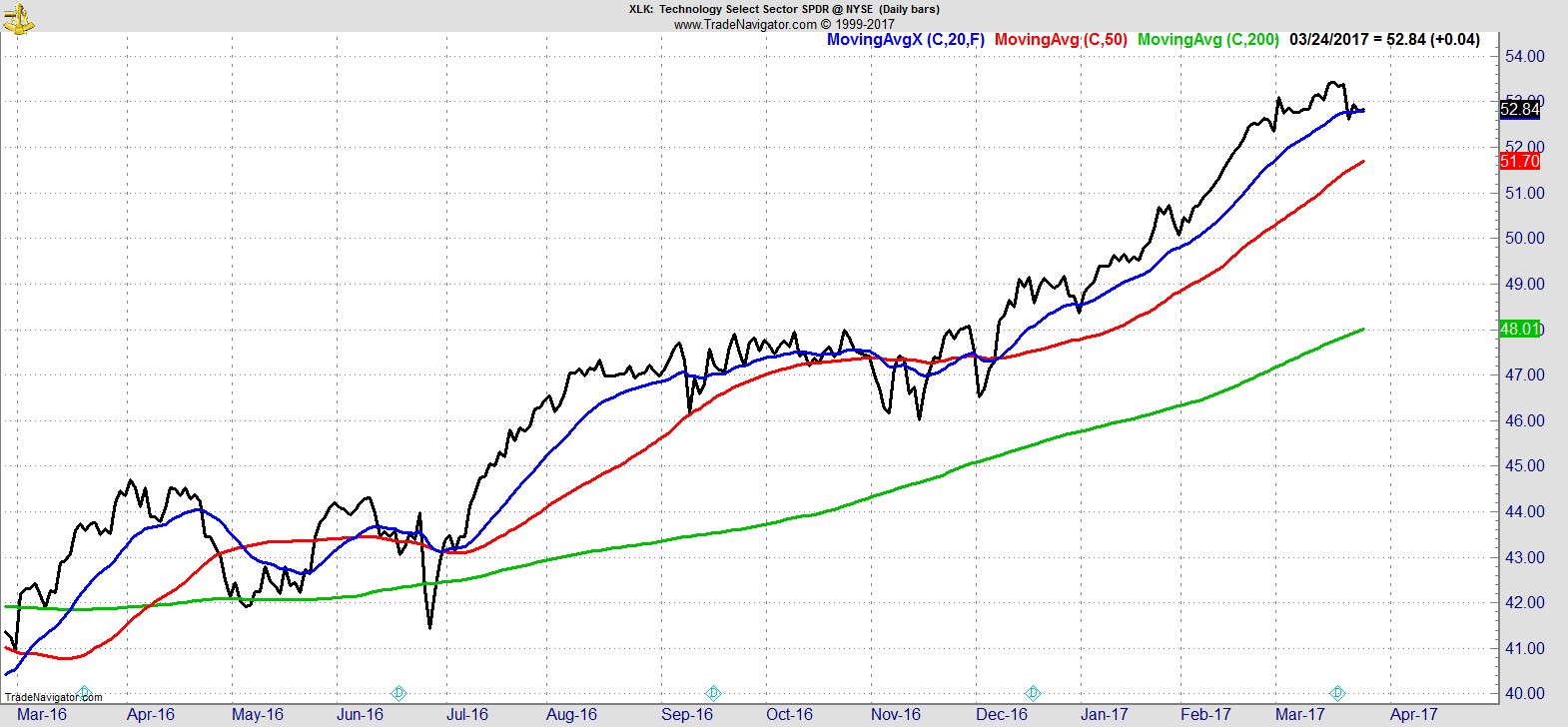

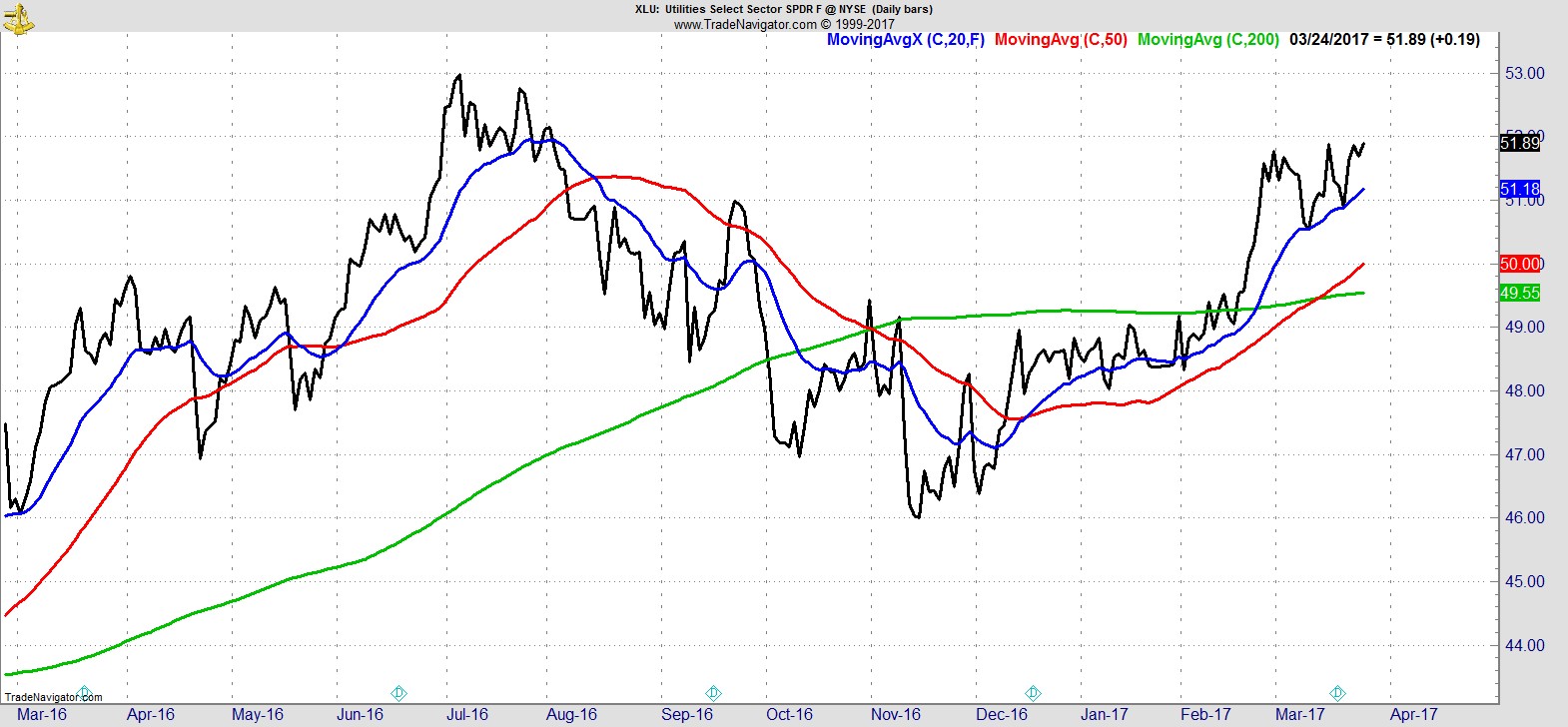

Tech is still the clear leader, just below its highs and above its 20, 50, 200-day MAs. That's closely followed by Utilities which recorded its highest close in nearly 8 months:-

Those two are followed by Consumer Discretionary, Consumer Staples, and Healthcare, which are all below their 20-day EMA but above their 50-day.

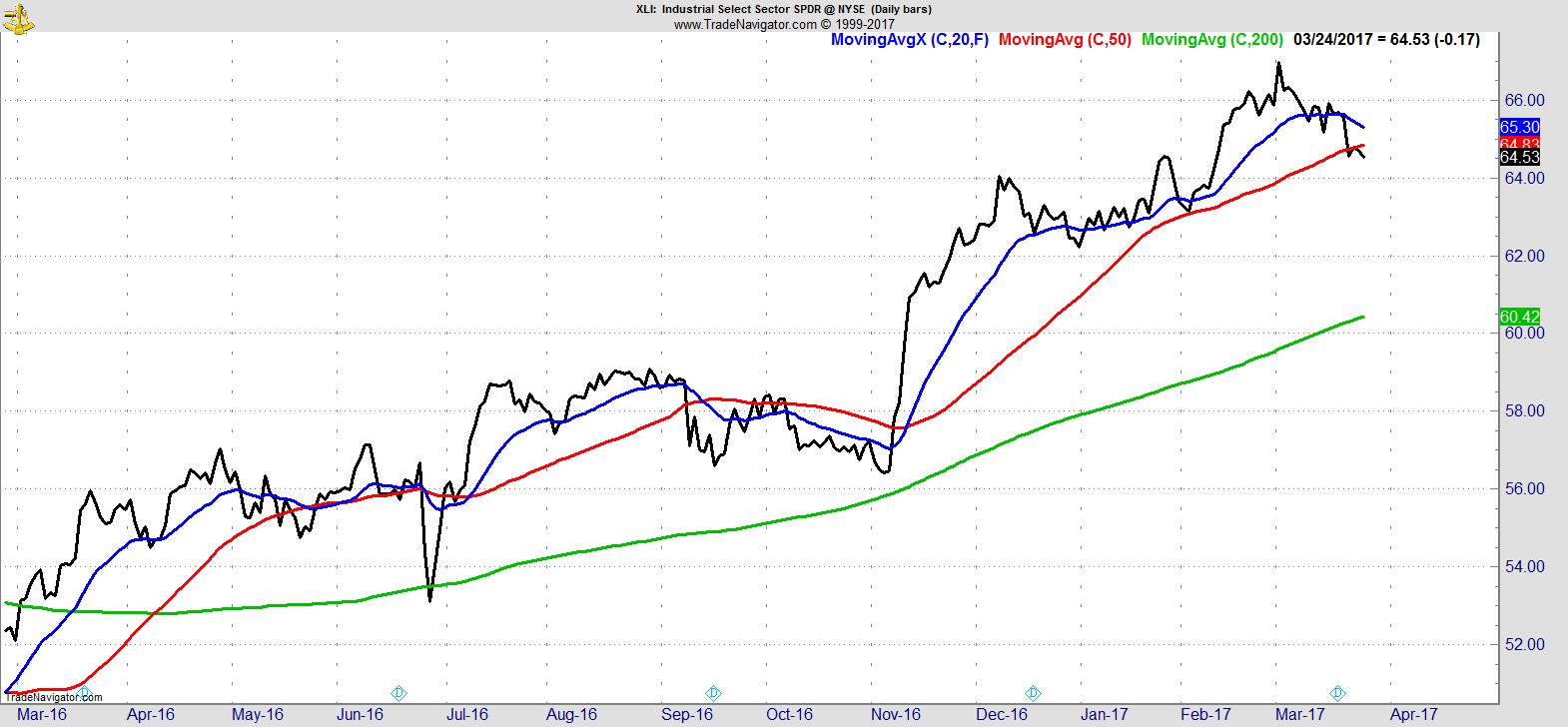

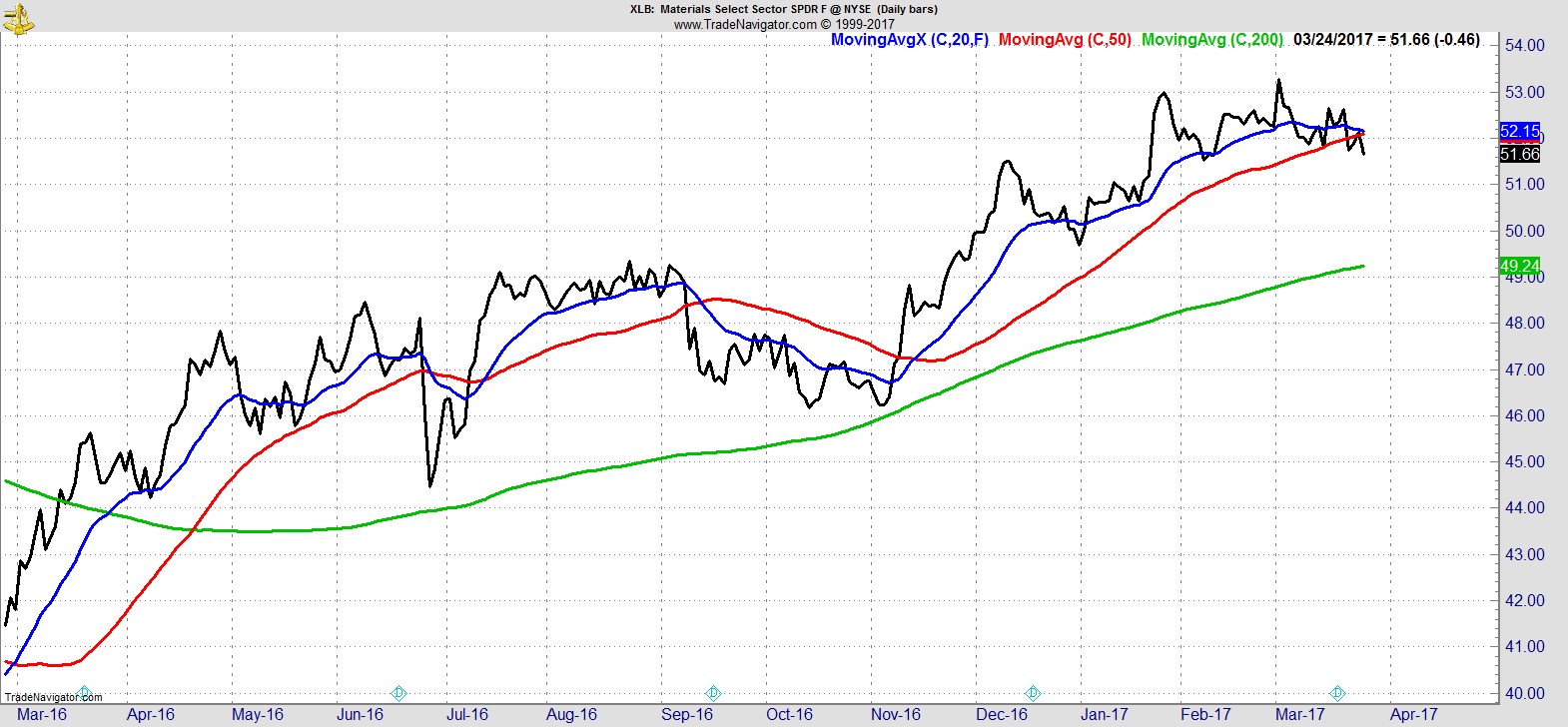

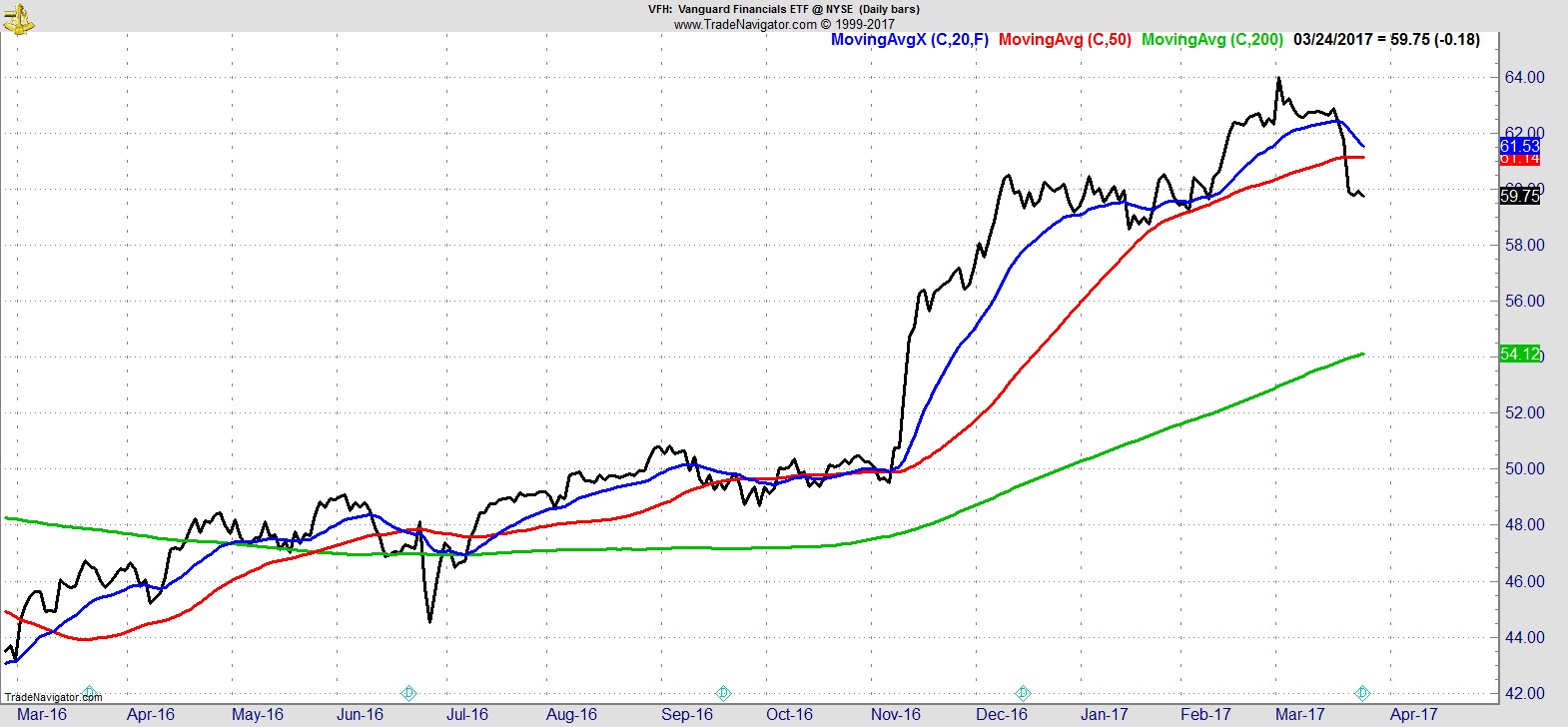

Industrials, Materials, and Financials all weakened further and finished below their 50-day MA. Financials are now down 6.5% from their high 3 weeks ago:-

.

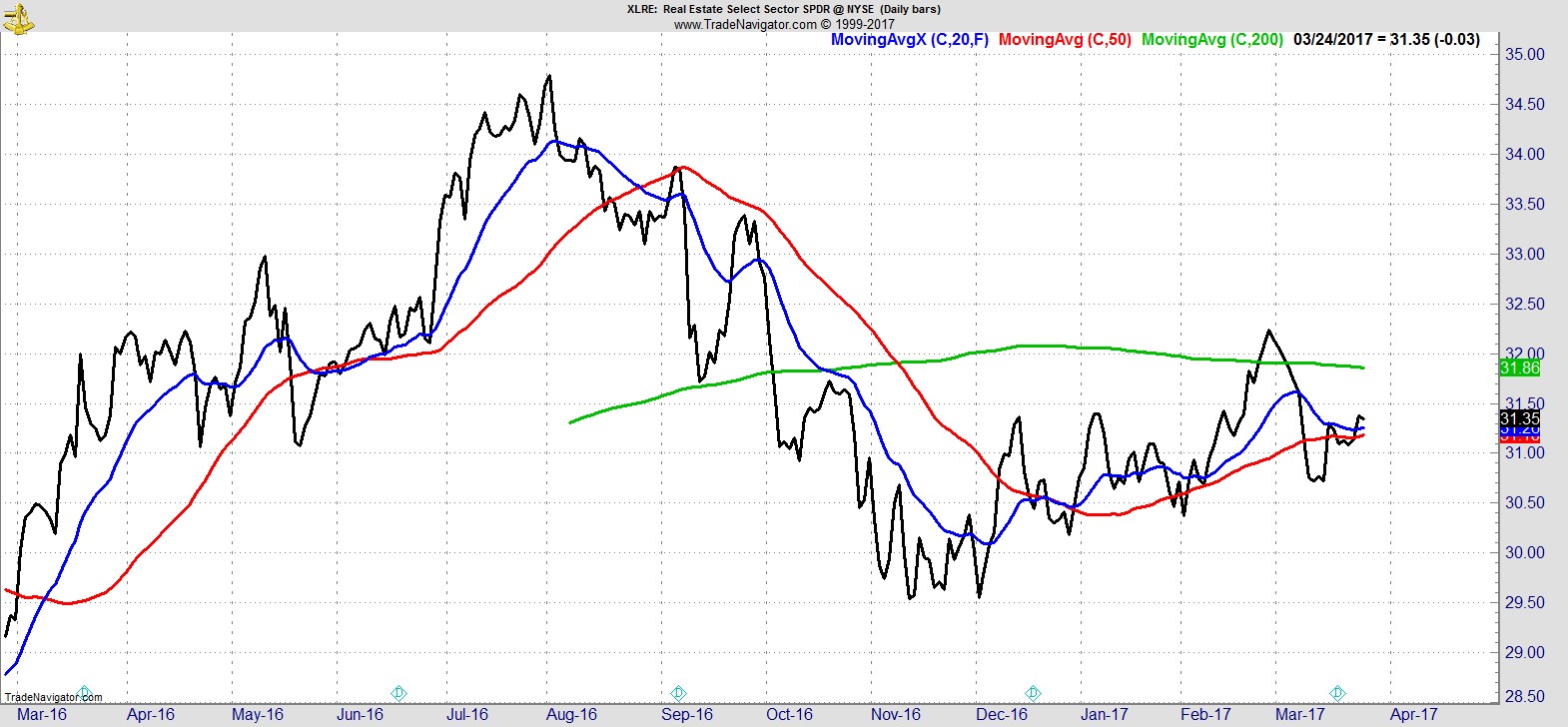

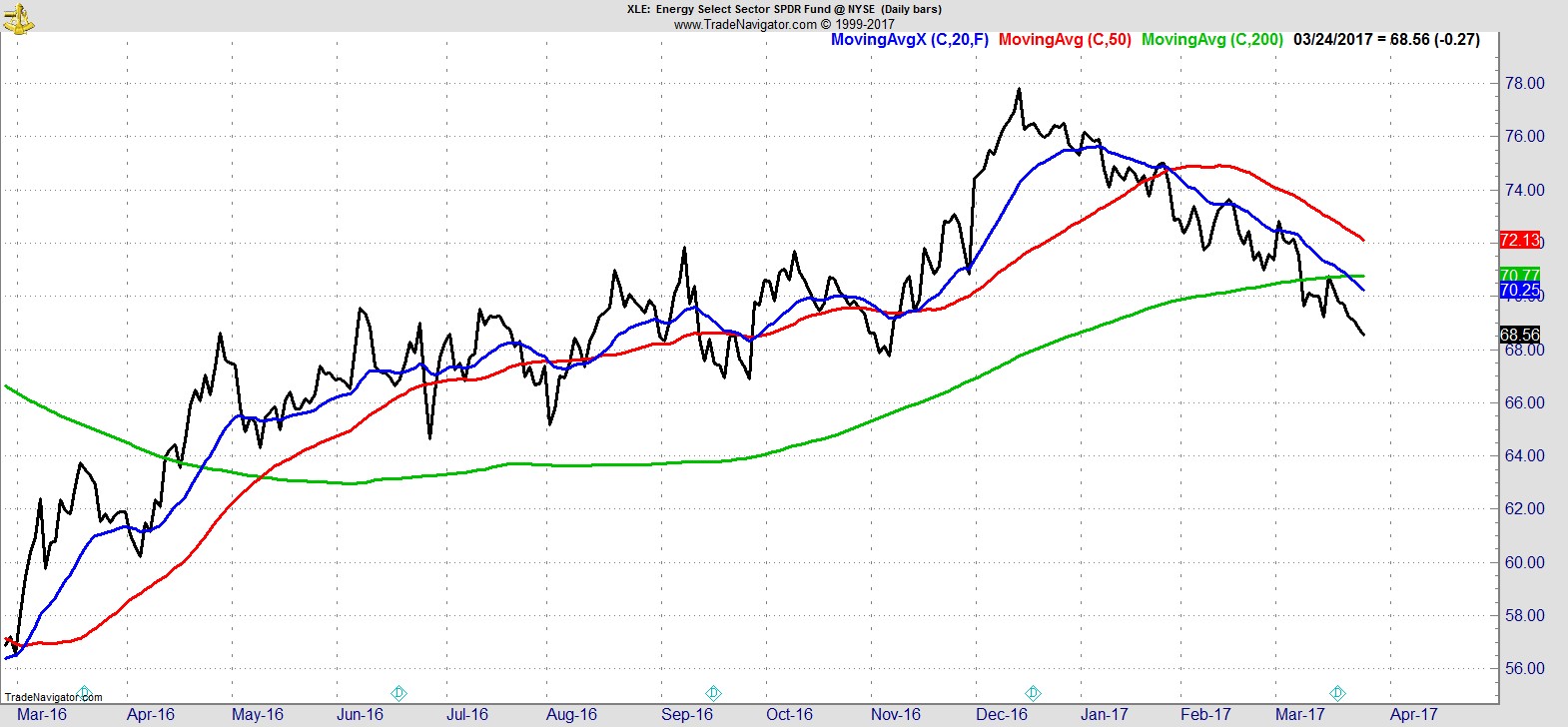

At the bottom, Real Estate recovered for a second straight week but remains below its 200-day MA, while Energy has now given back all of its post-election gains, and fallen 12% from its 12/13 high close.

Alpha Capture Portfolio

Our model portfolio slipped -0.9% for the week vs -1.4% for the S&P. We had one exit and two new entry signals to bring us up to 8 names, total open risk of 4%, and around 45% in cash.

.

Watchlist

This week our list still has a large number of technology stocks as well as a generous dose of healthcare/biotech names. Consumer Discretionary also features strongly.

Here's a sample from the full list of 30 names:-

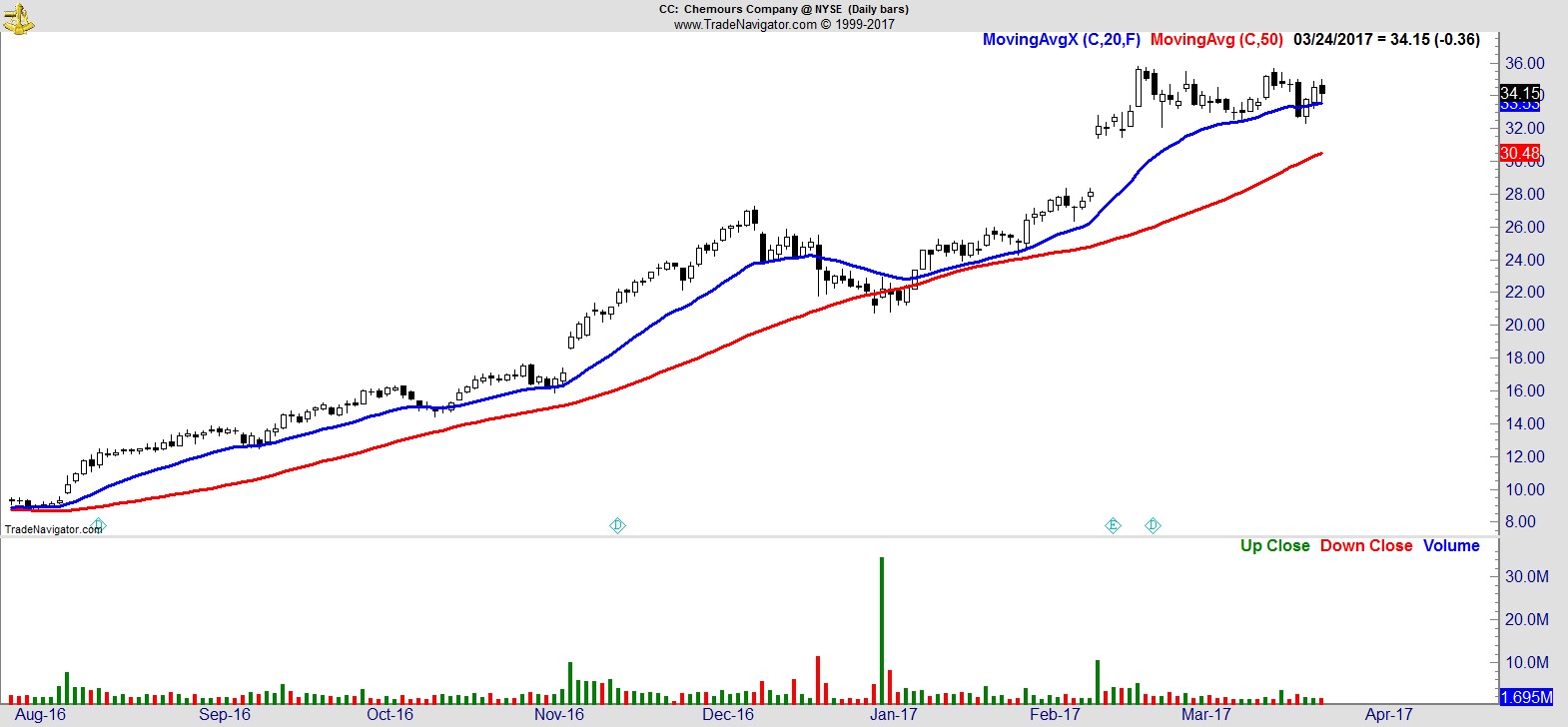

$CC

.

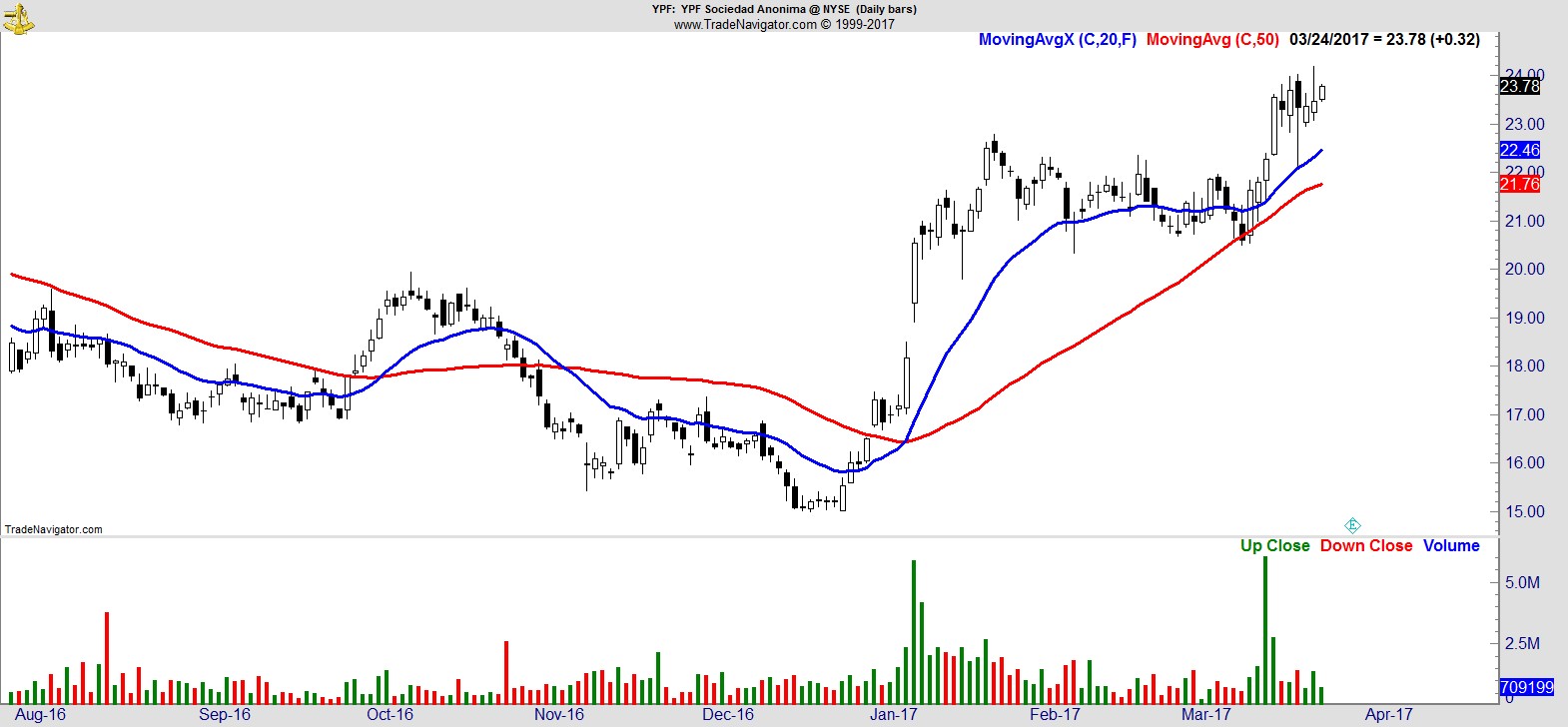

$YPF

.

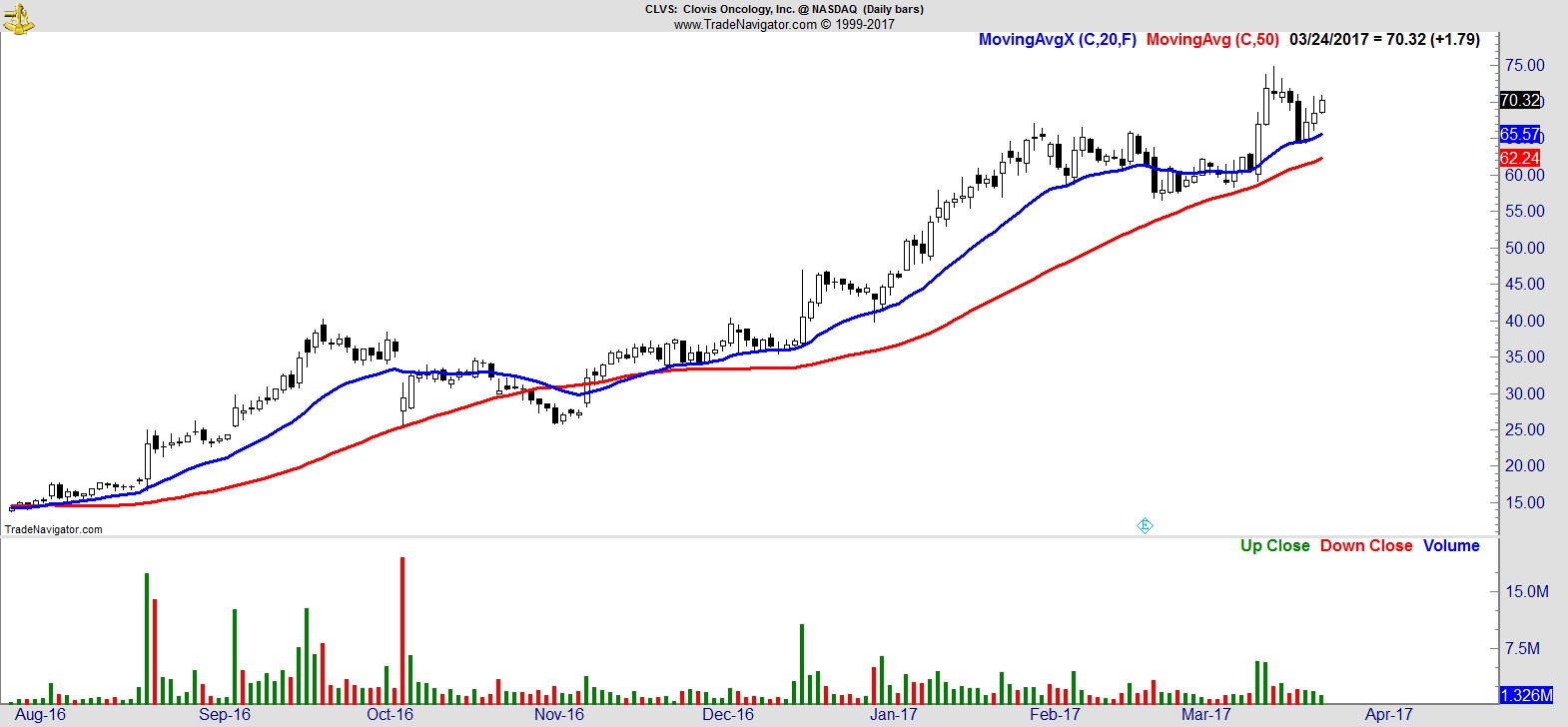

$CLVS

.

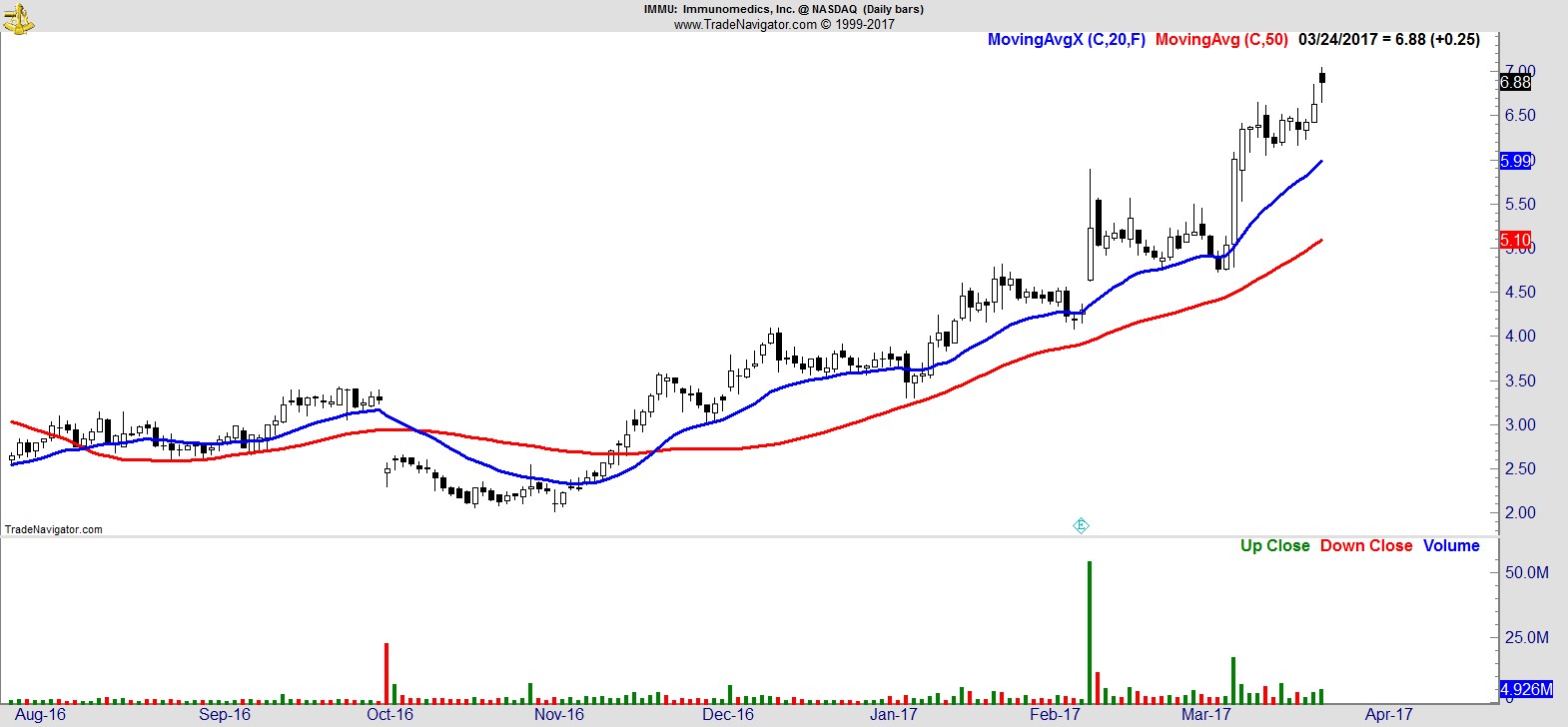

$IMMU

.

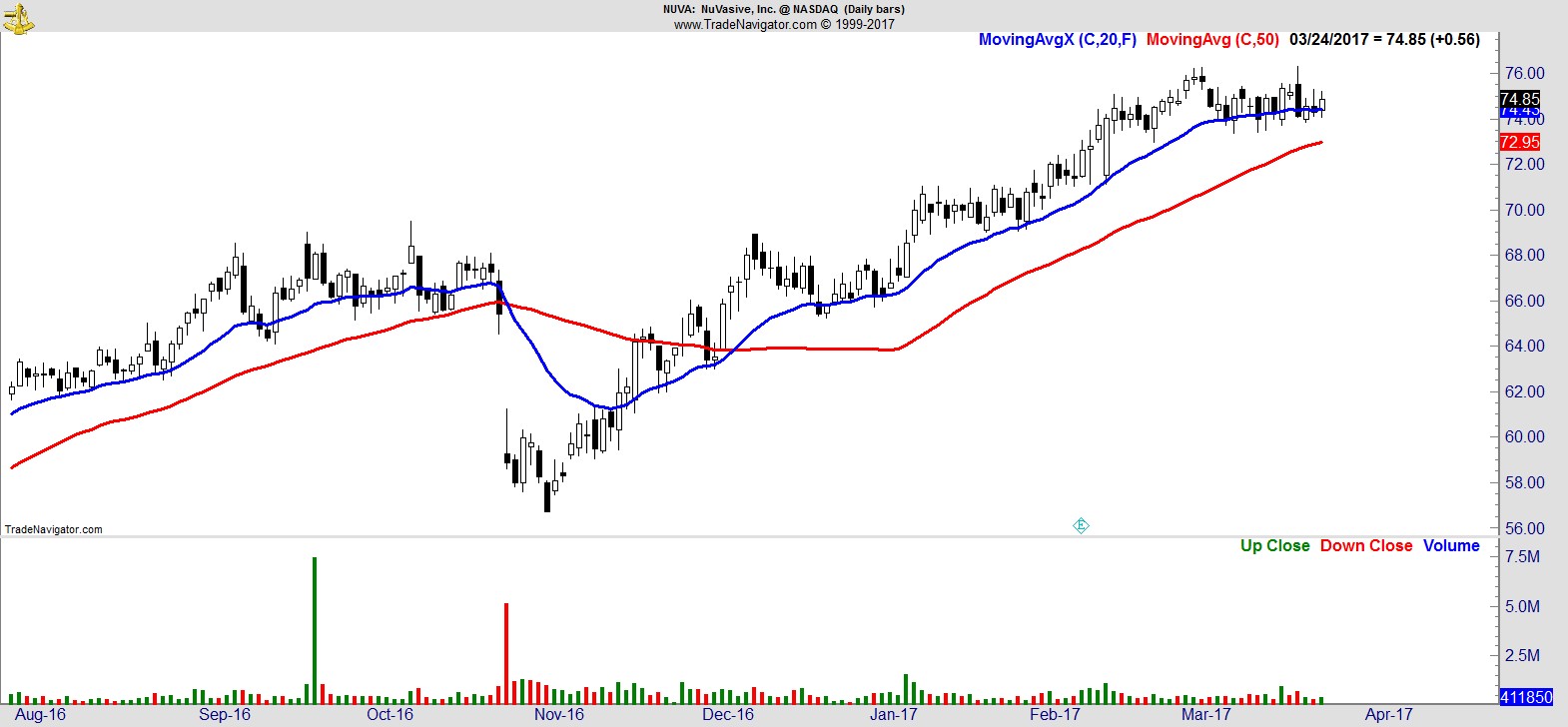

$NUVA

.

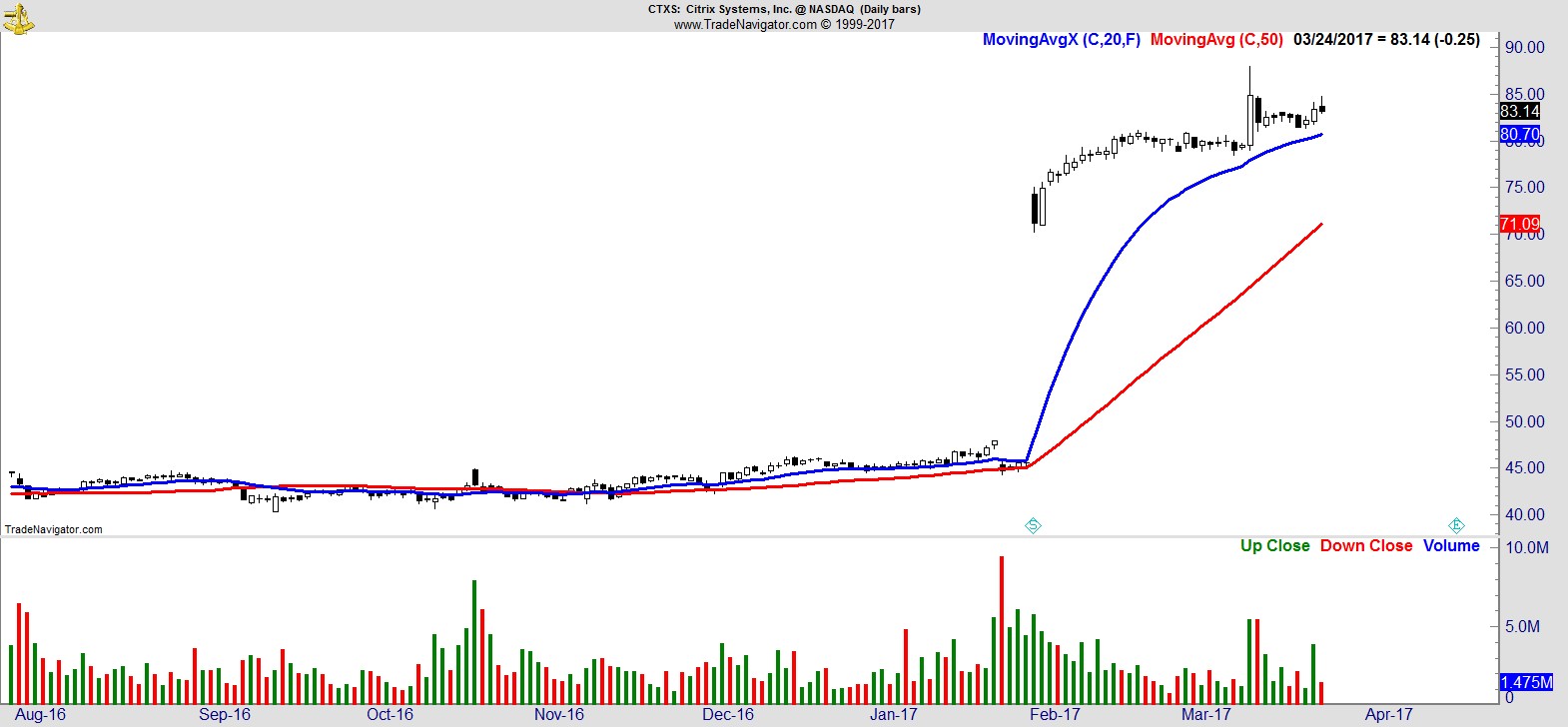

$CTXS

.

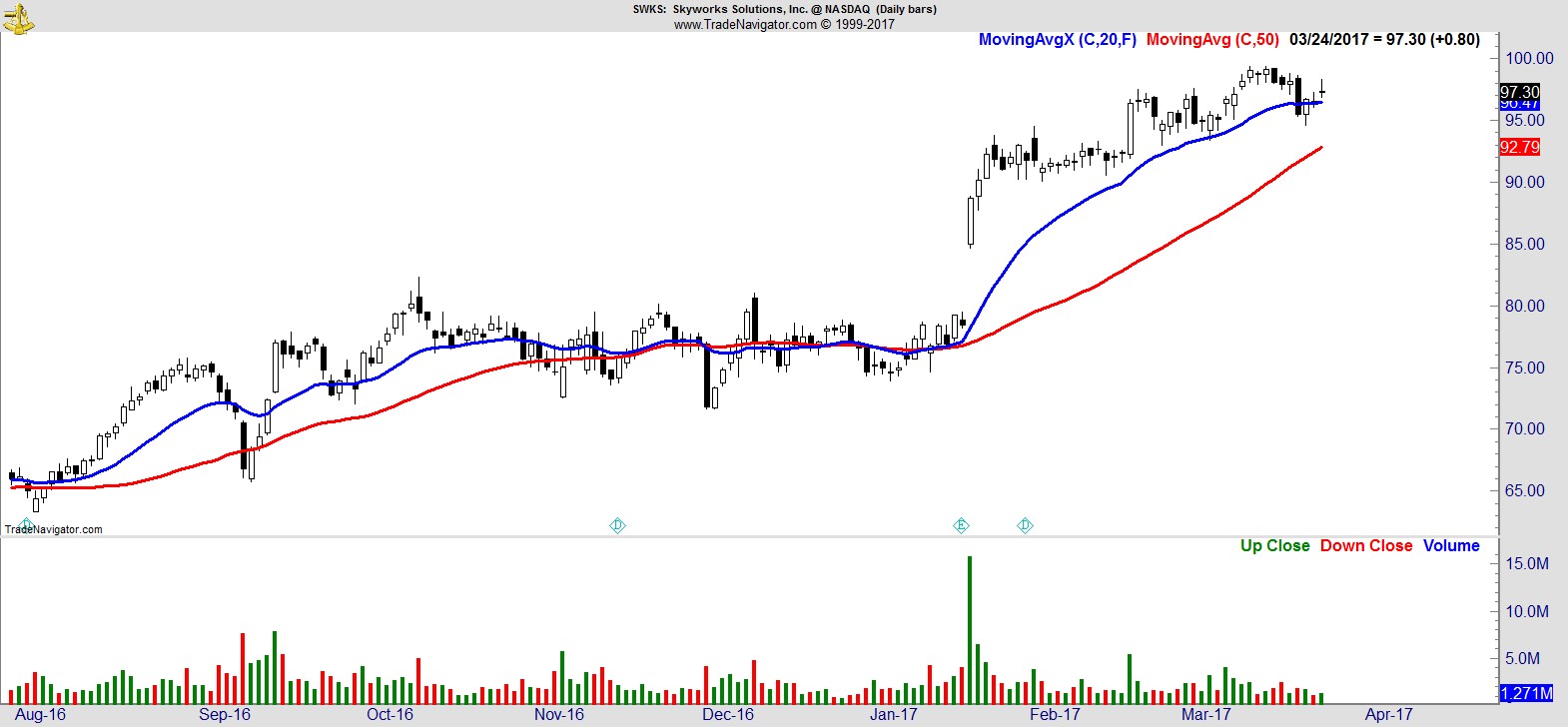

$SWKS

.

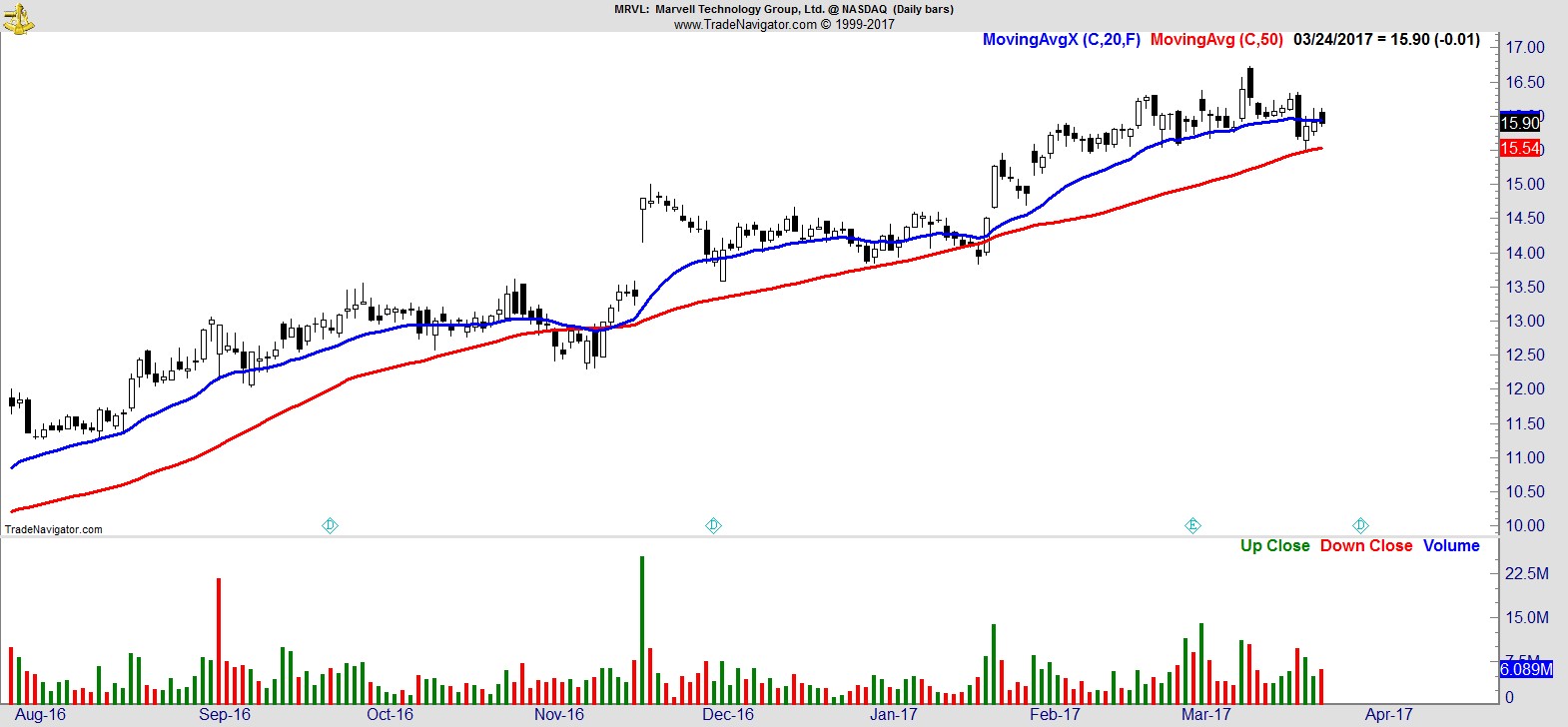

$MRVL

.

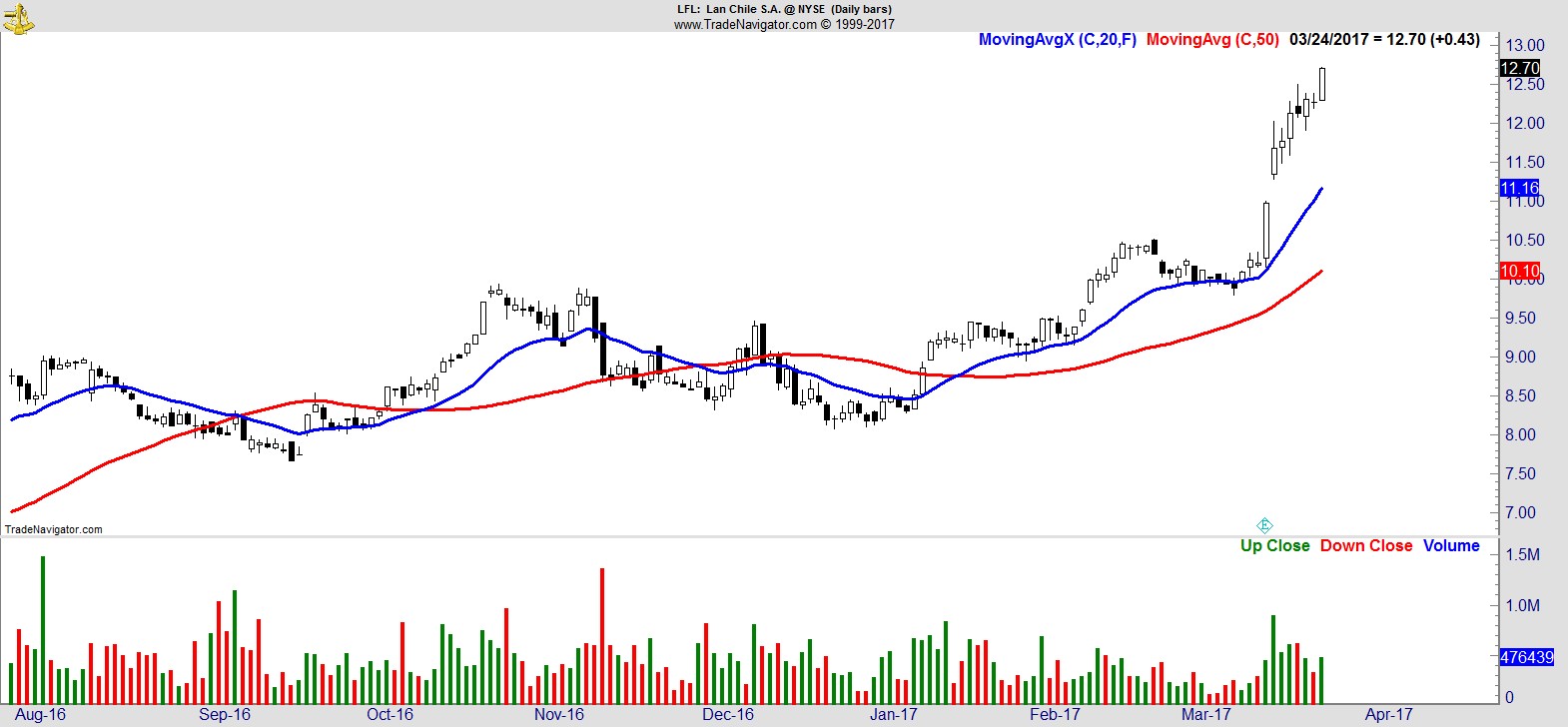

$LFL

.

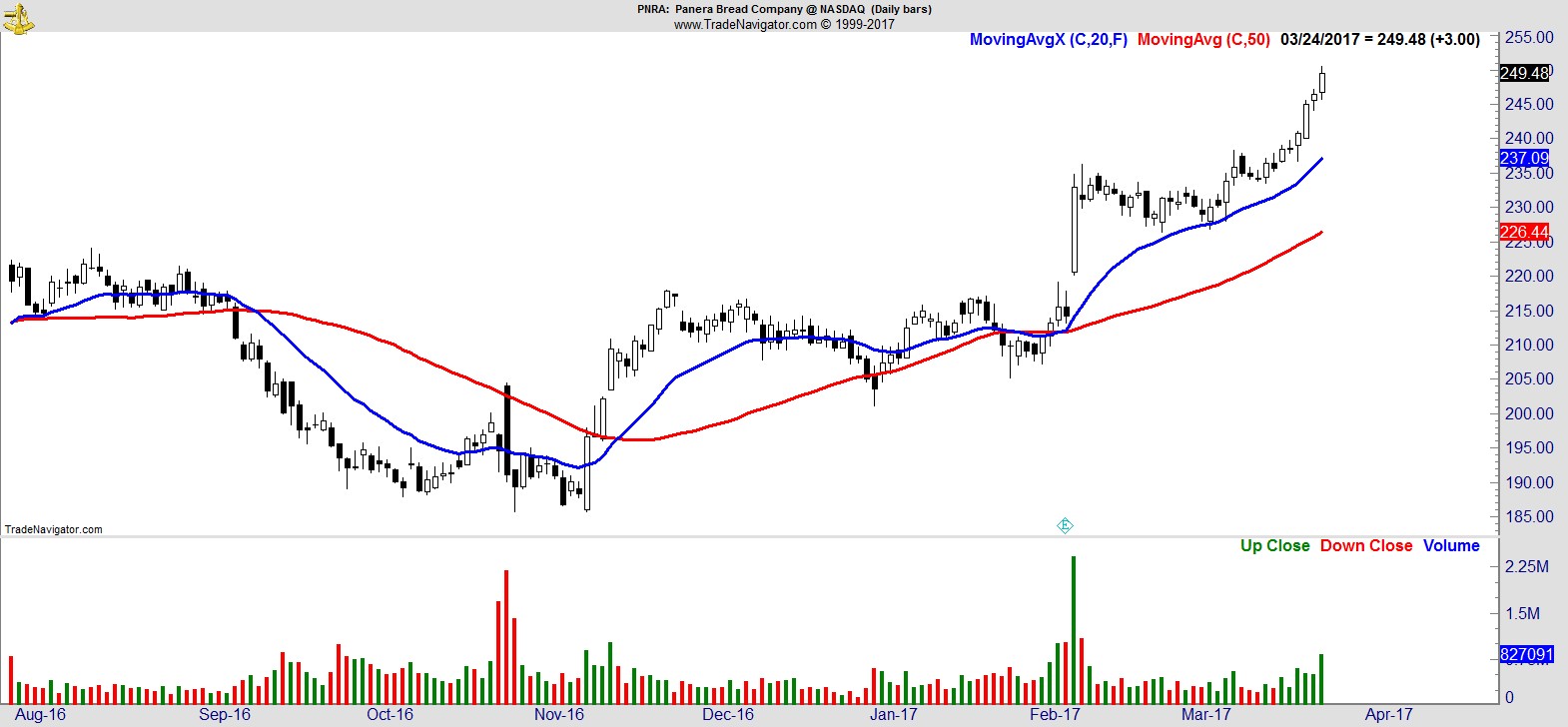

$PNRA

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17