Overview

Equities recovered this week with the NASDAQ leading the way and posting all time highs on a daily and weekly basis, but the other major indices remain mostly rangebound and just below their highs.

The S&P rebounded from a brief test of its 50-day MA this week, to finish +0.8% on the week, flat on the month, and just 1.4% below its all time high.

.

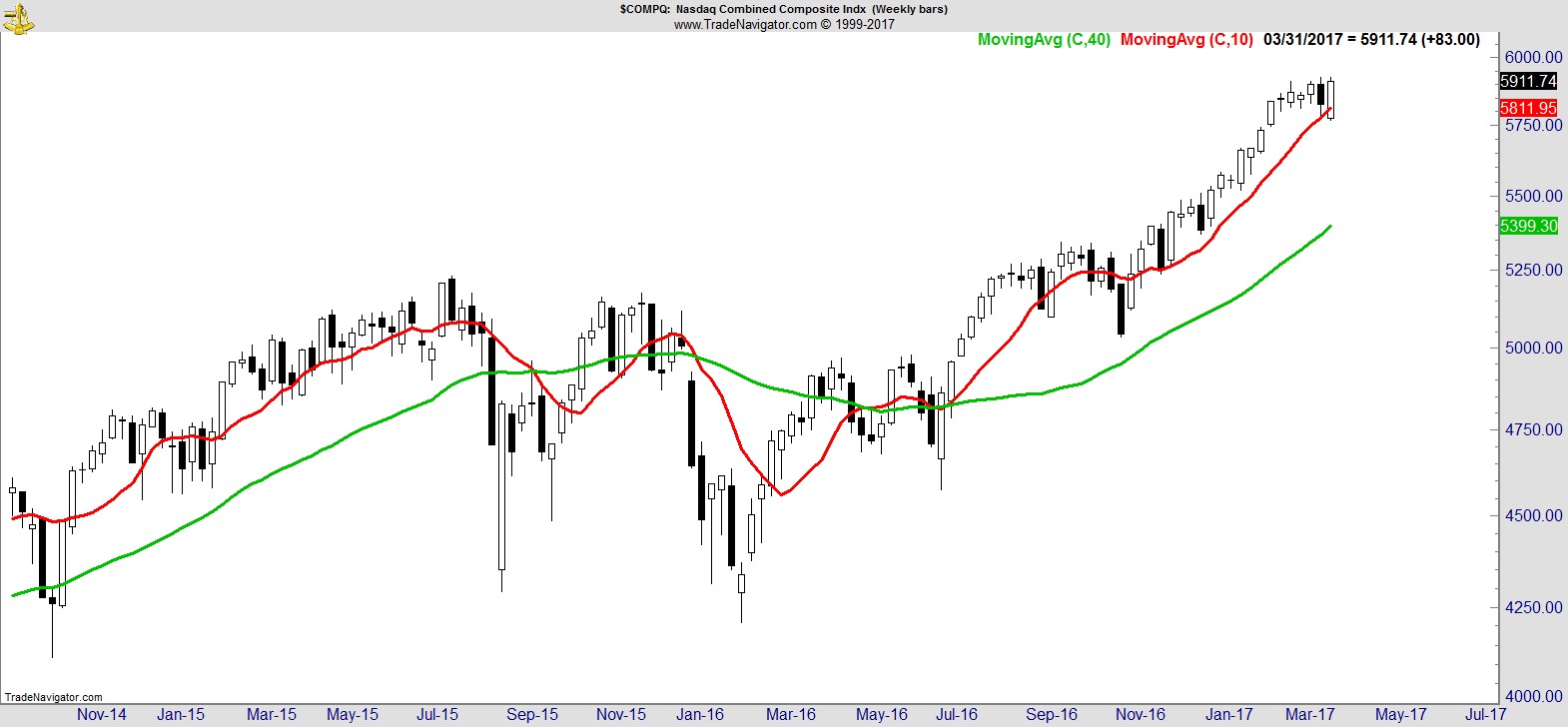

The NASDAQ's recovery, shown here on a weekly, was much stronger making it to fresh highs.

.

The pullback in the Transports has been much deeper and it remains below its 10-wk MA despite rebounding this week.

.

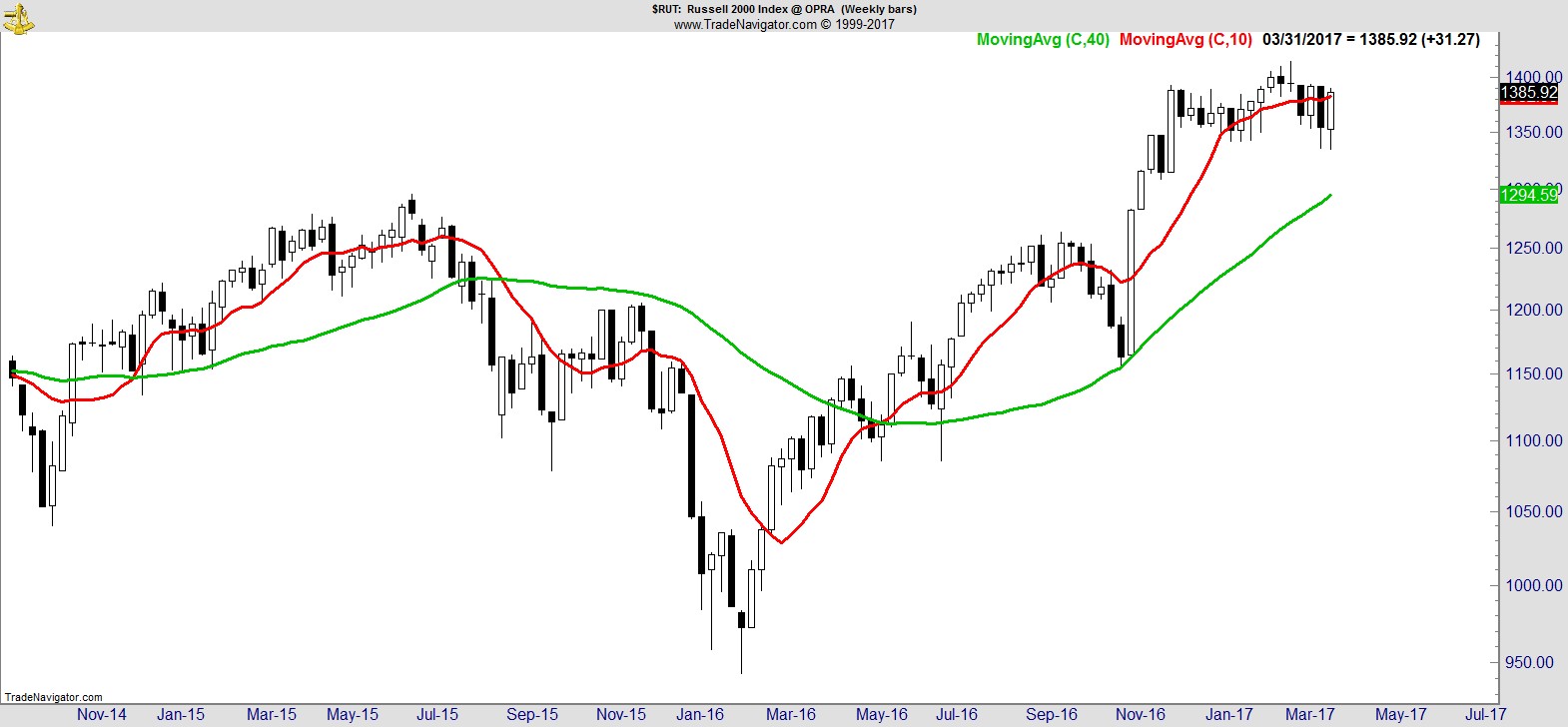

The Russell also recovered well to reclaim its 10-wk MA but remains rangebound and unchanged over 4 months.

.

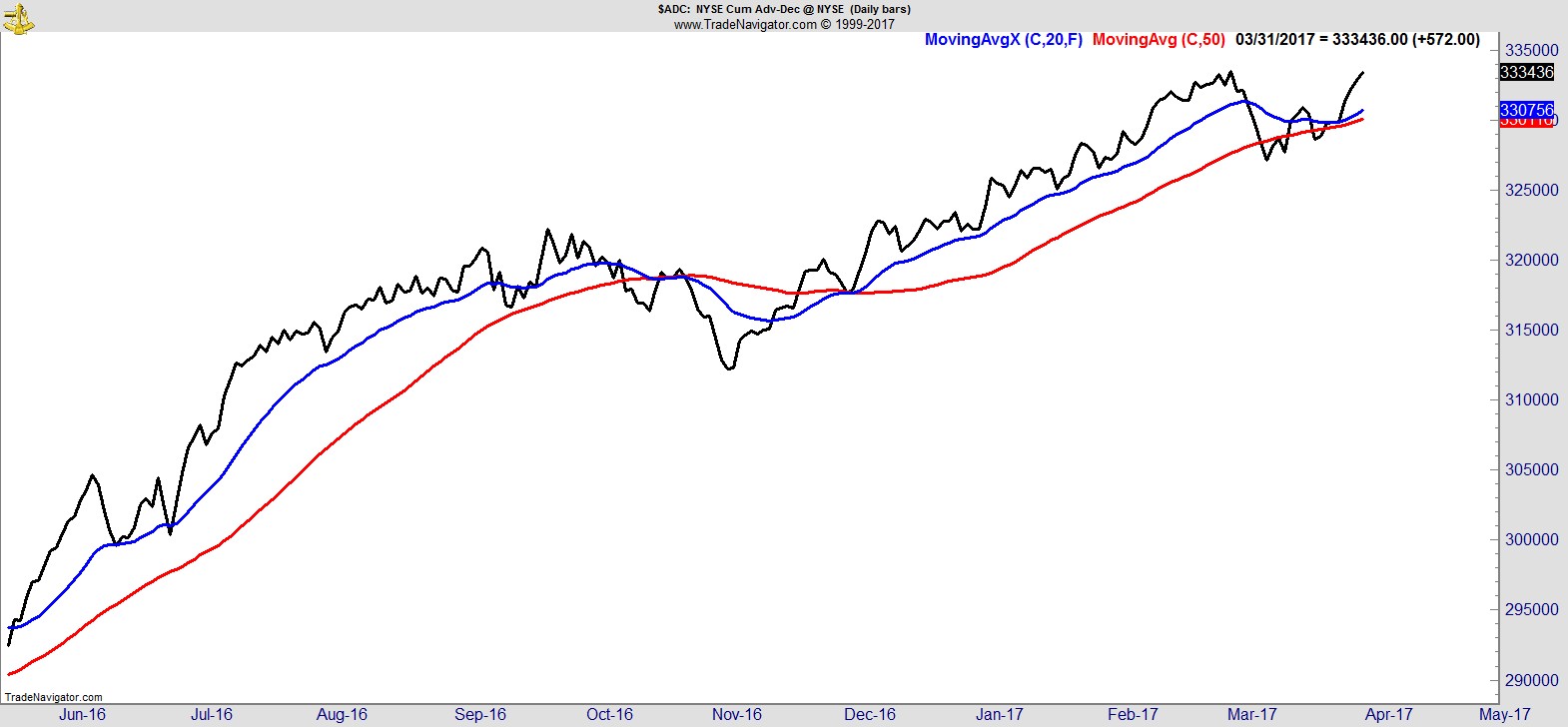

Breadth shown here via the NYSE Cumulative Advance/Decline improved to just below its previous highs.

.

Sector Rankings

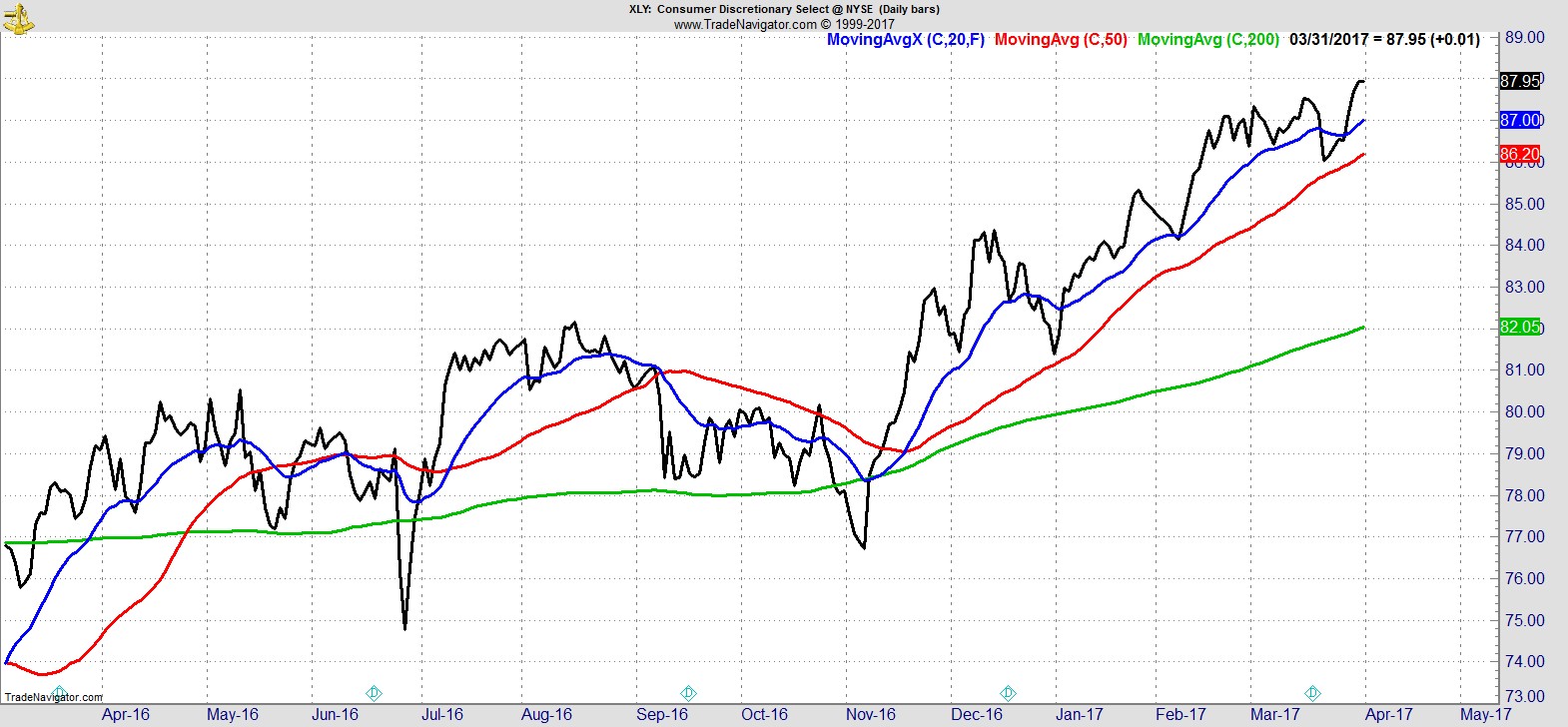

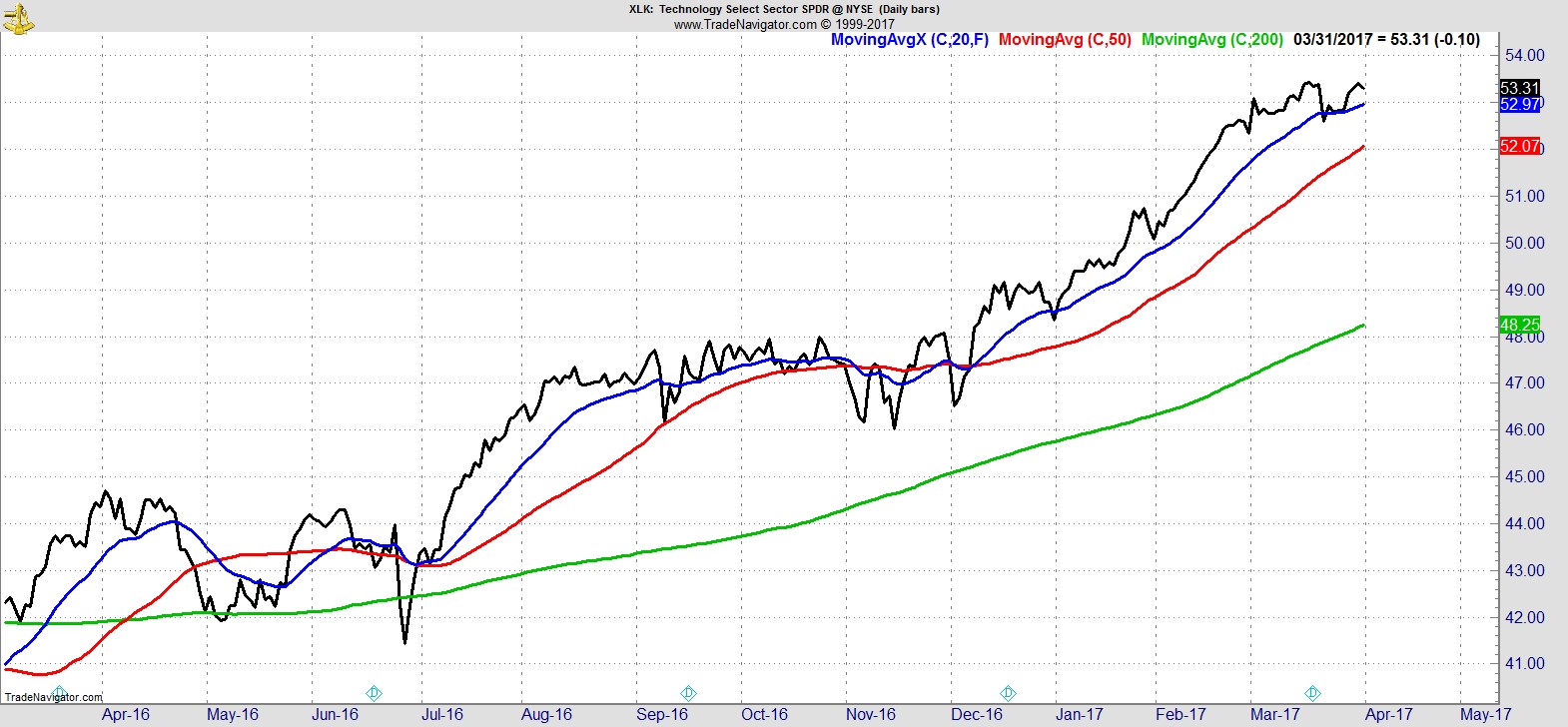

Consumer Discretionary ($XLY) joins long-time leader Technology ($XLK) at the top this week, clearly helped by the new highs in the respectively heavily-weighted $AMZN and $AAPL.

.

They're followed by Materials, Utilities, Industrials, Healthcare, and Staples, which all remain above their 50-day MA.

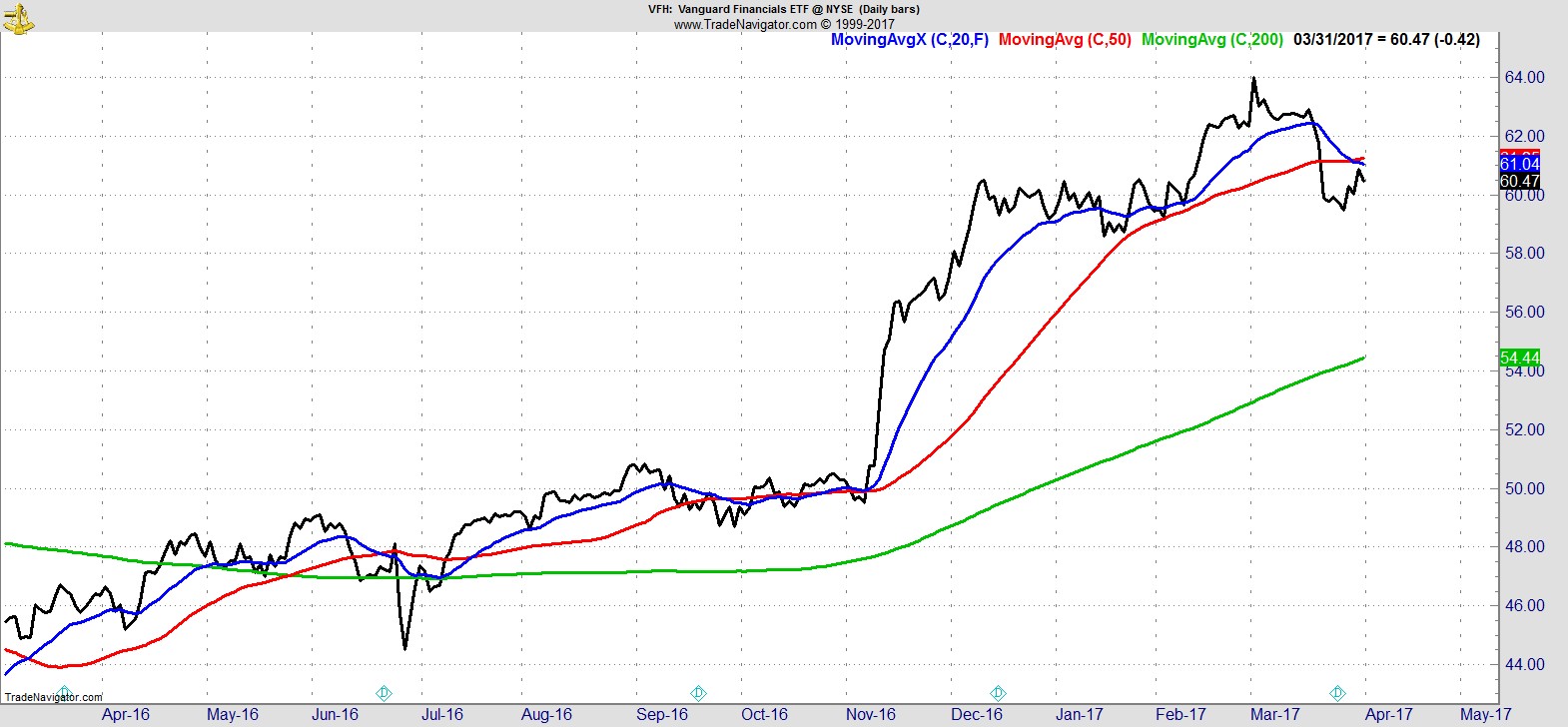

Then comes Financials which despite a reasonable recovery off the lows this week still appear to be rolling over longer-term.

.

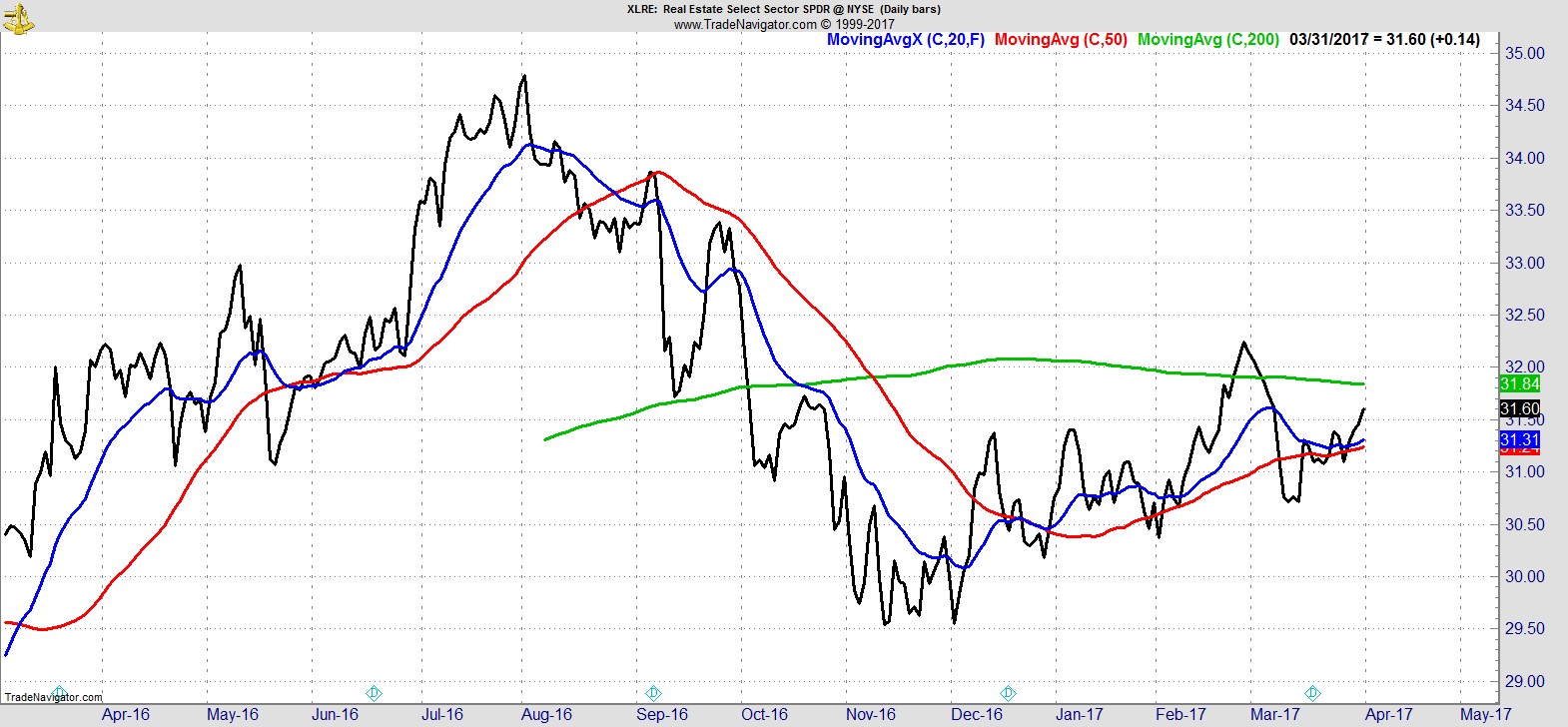

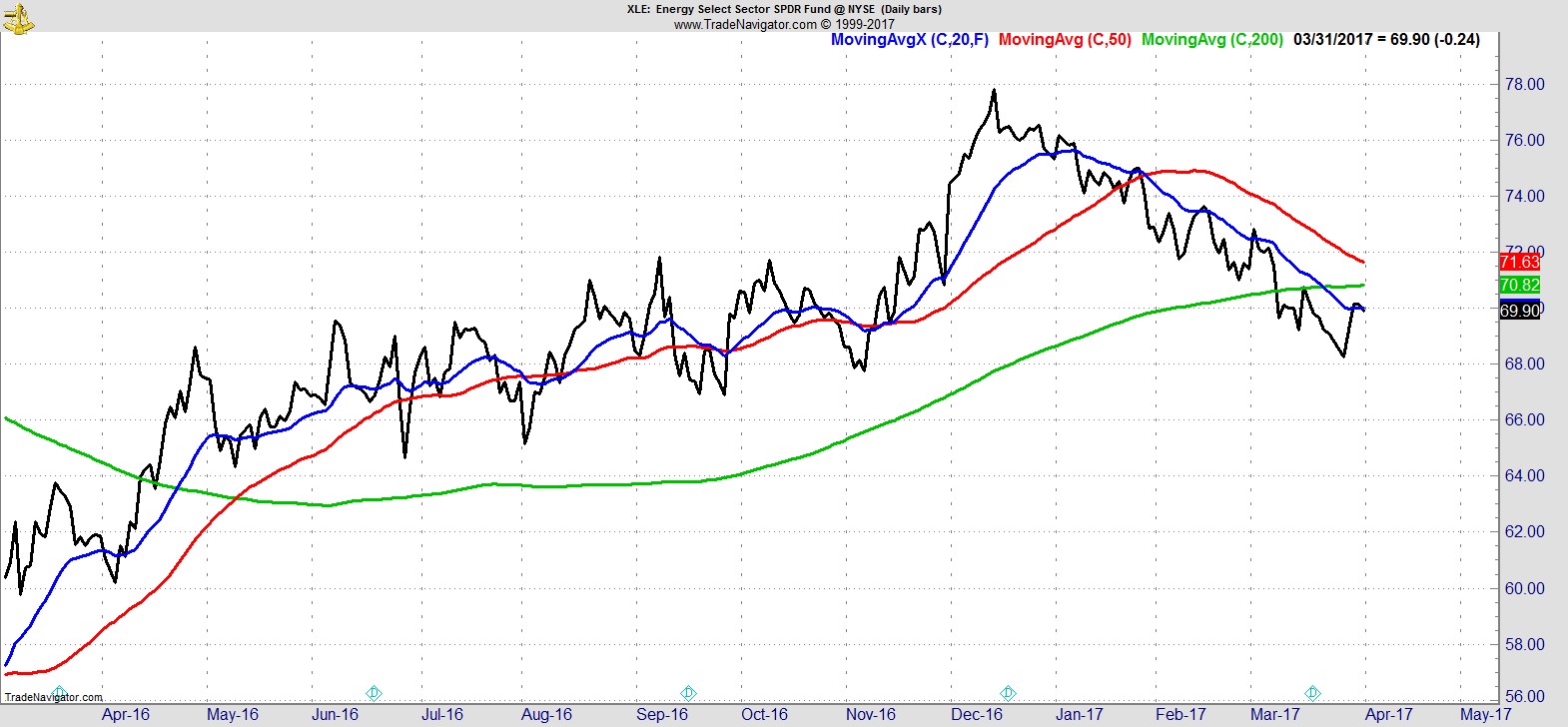

At the bottom I have Real Estate ($XLRE), and Energy ($XLE), which remain below their 200-day MA despite recent strength.

.

Alpha Capture Portfolio

Our model portfolio recovered from a weak start to finish marginally higher on the week vs +0.8% for the S&P. It had three exit signals and three new entries, and heads into next week with open risk of 5.2% across 8 names, and around 40% in cash.

.

Watchlist

Our watchlist continues to be dominated by technology, consumer discretionary, and some healthcare/biotech.

Here's a sample from the full list of 25 names:-

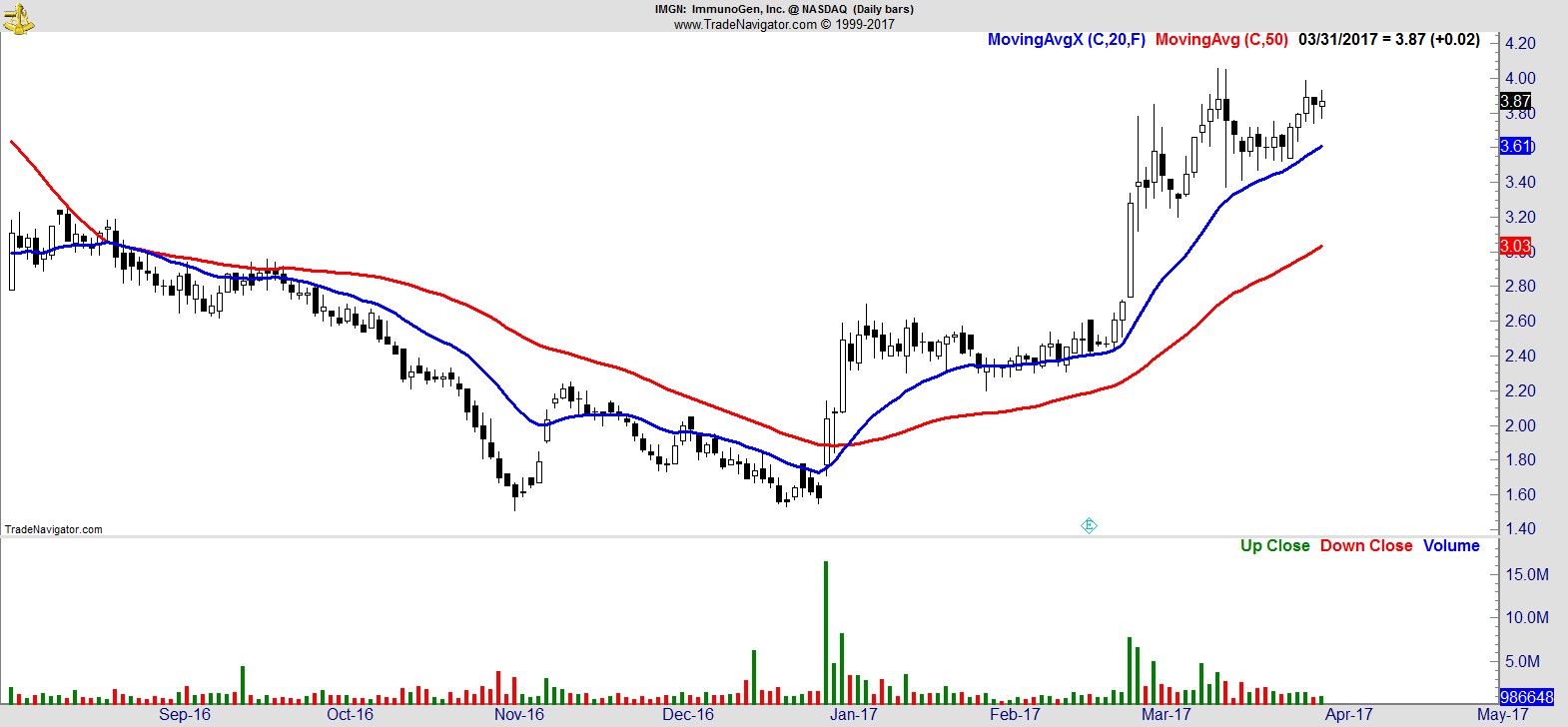

$IMGN

.

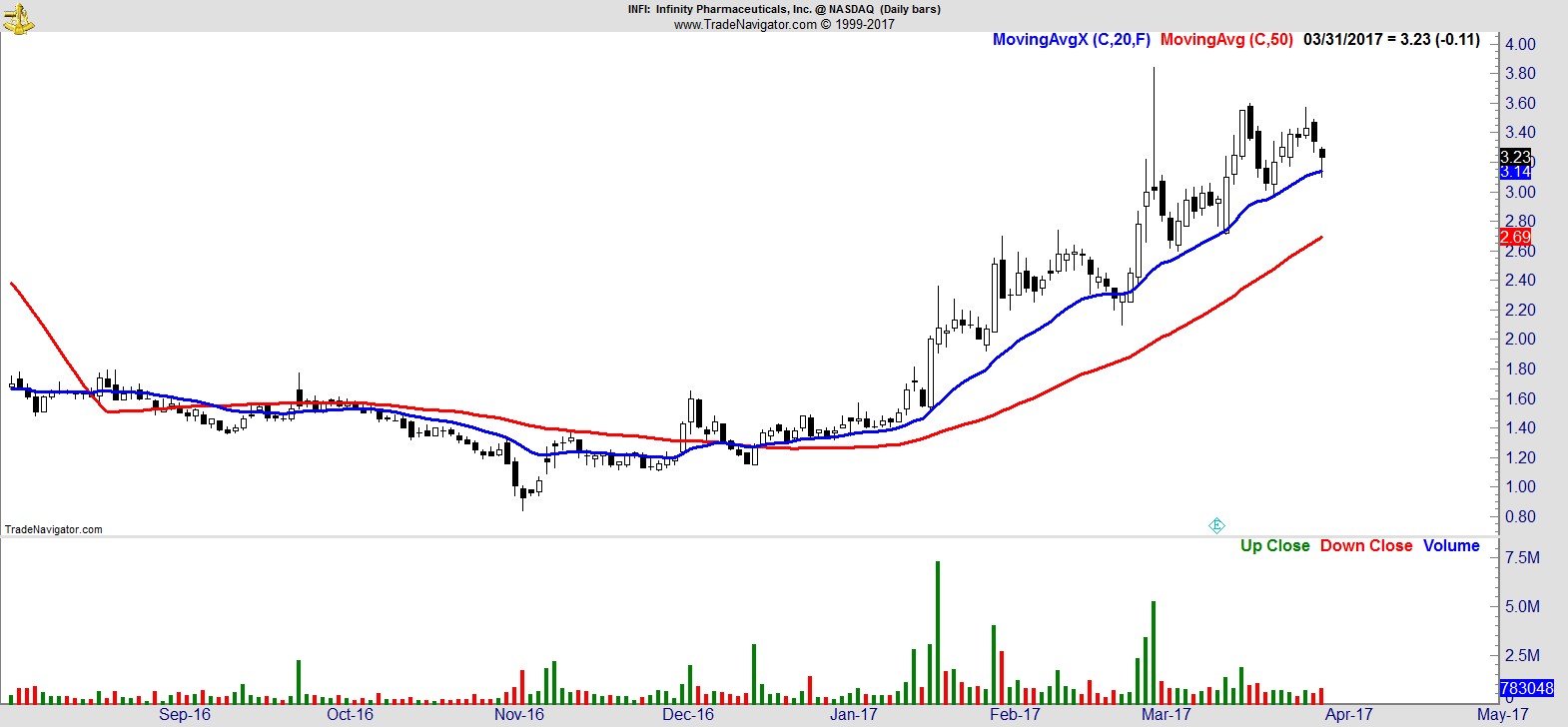

$INFI

.

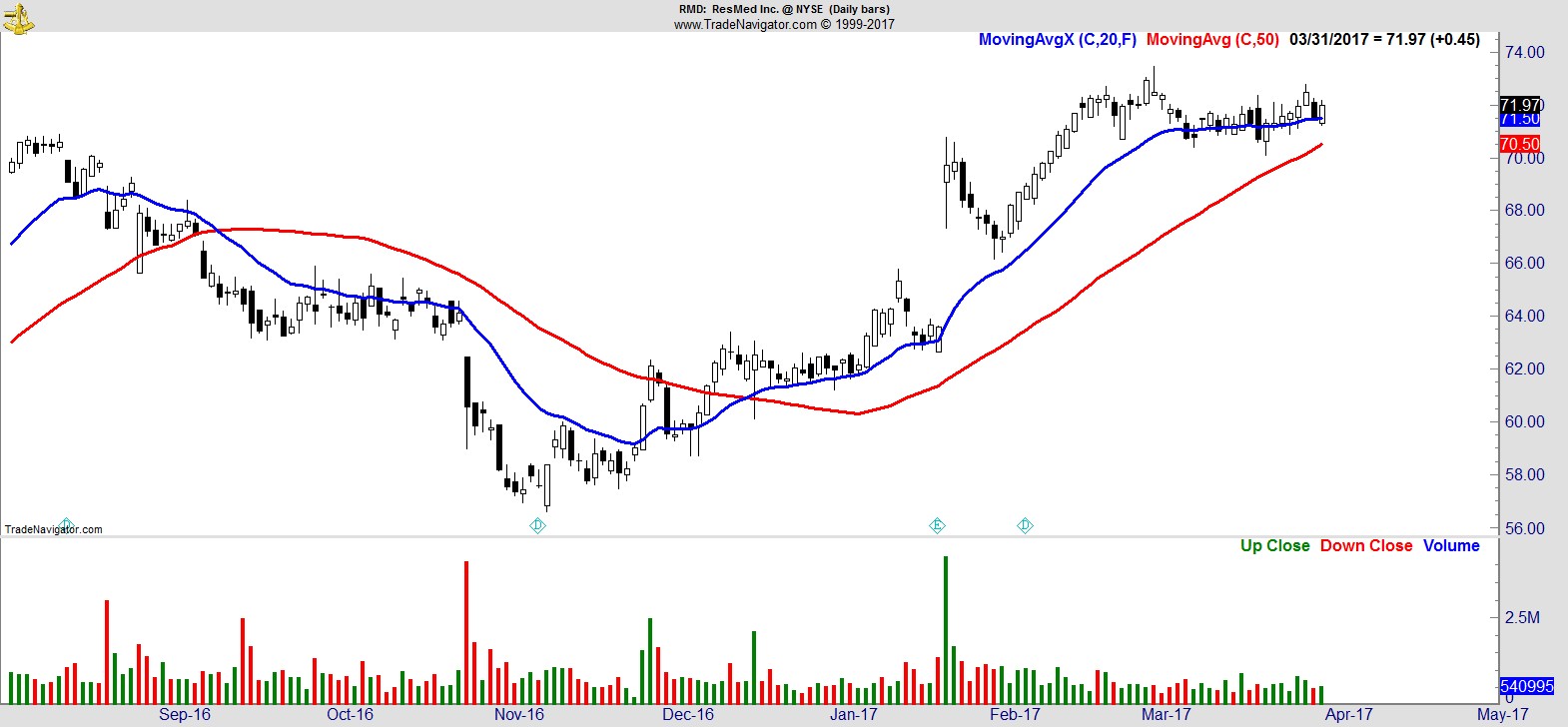

$RMD

.

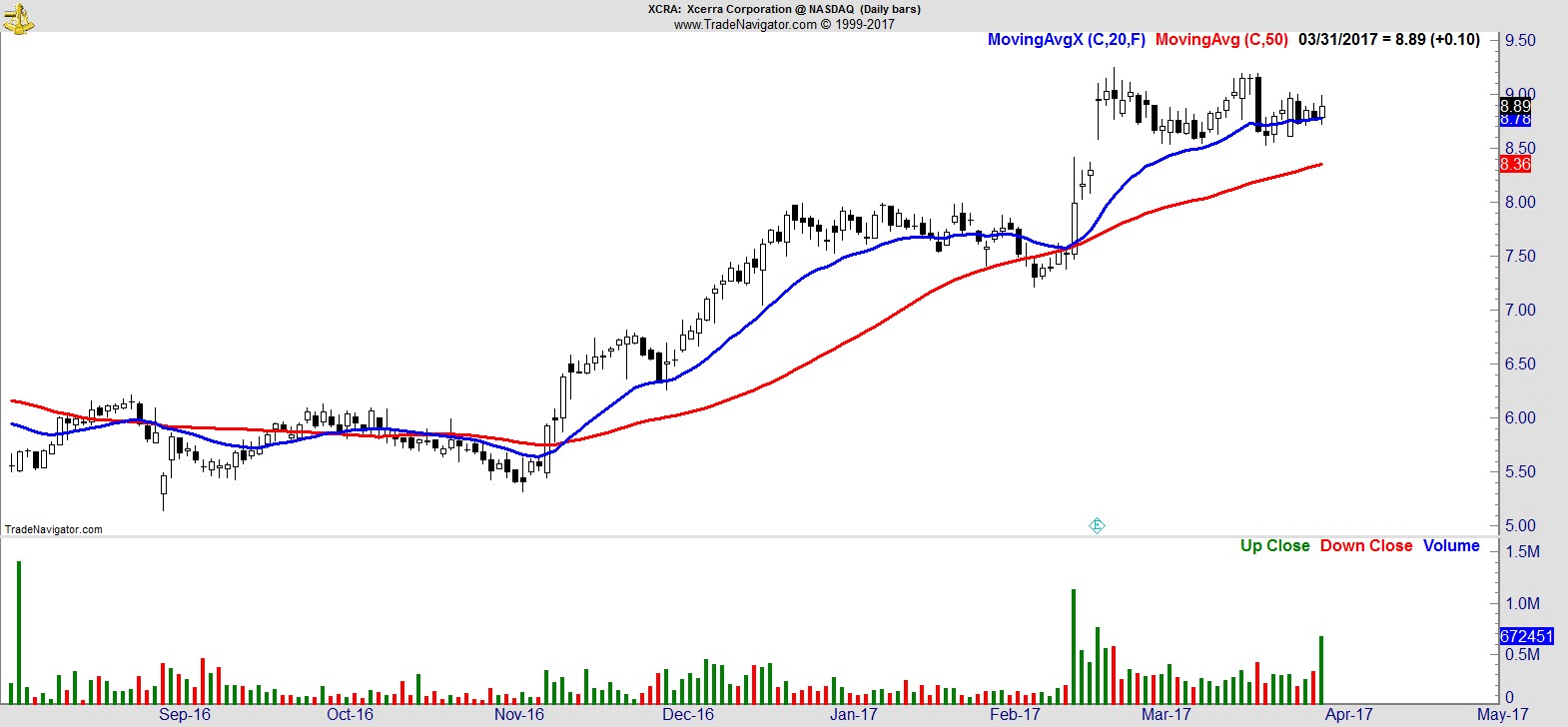

$XCRA

.

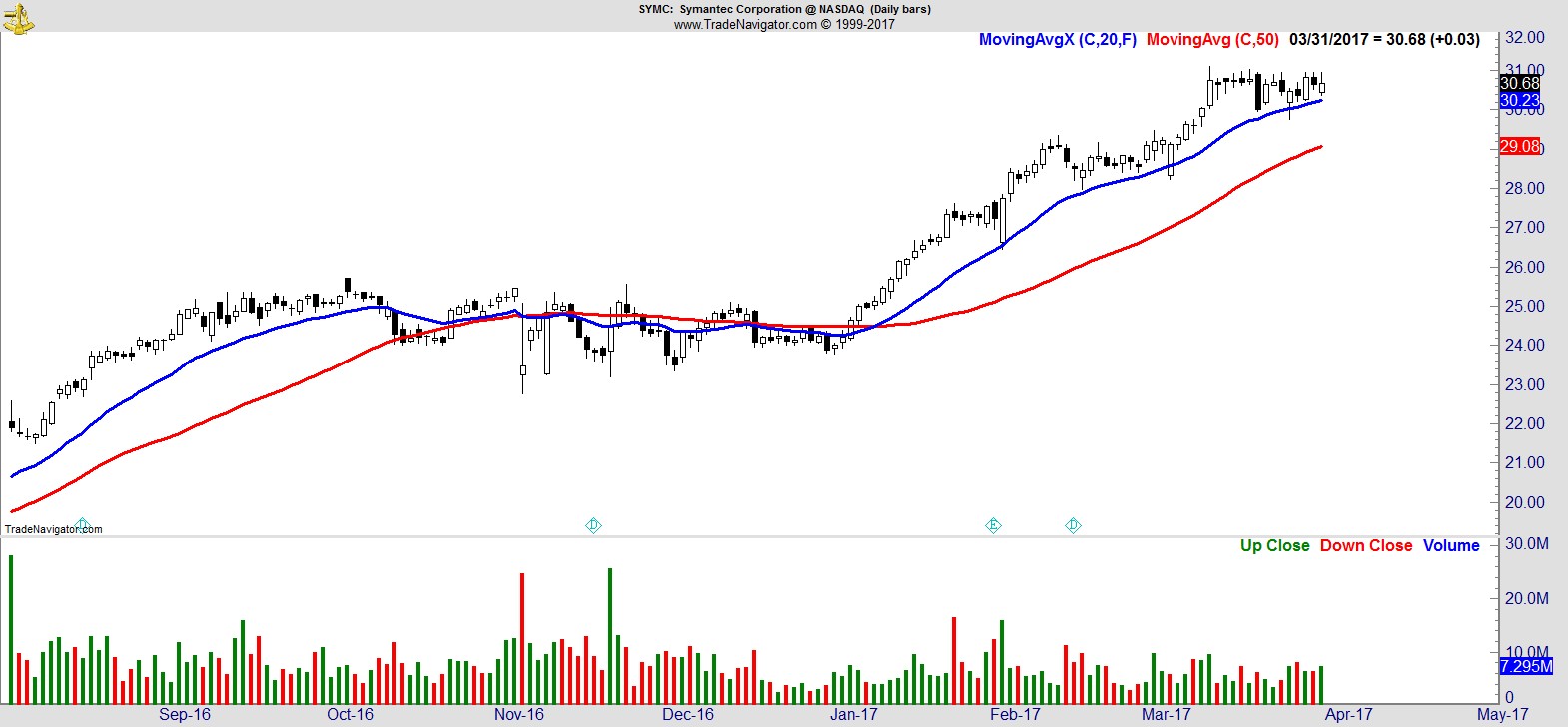

$SYMC

.

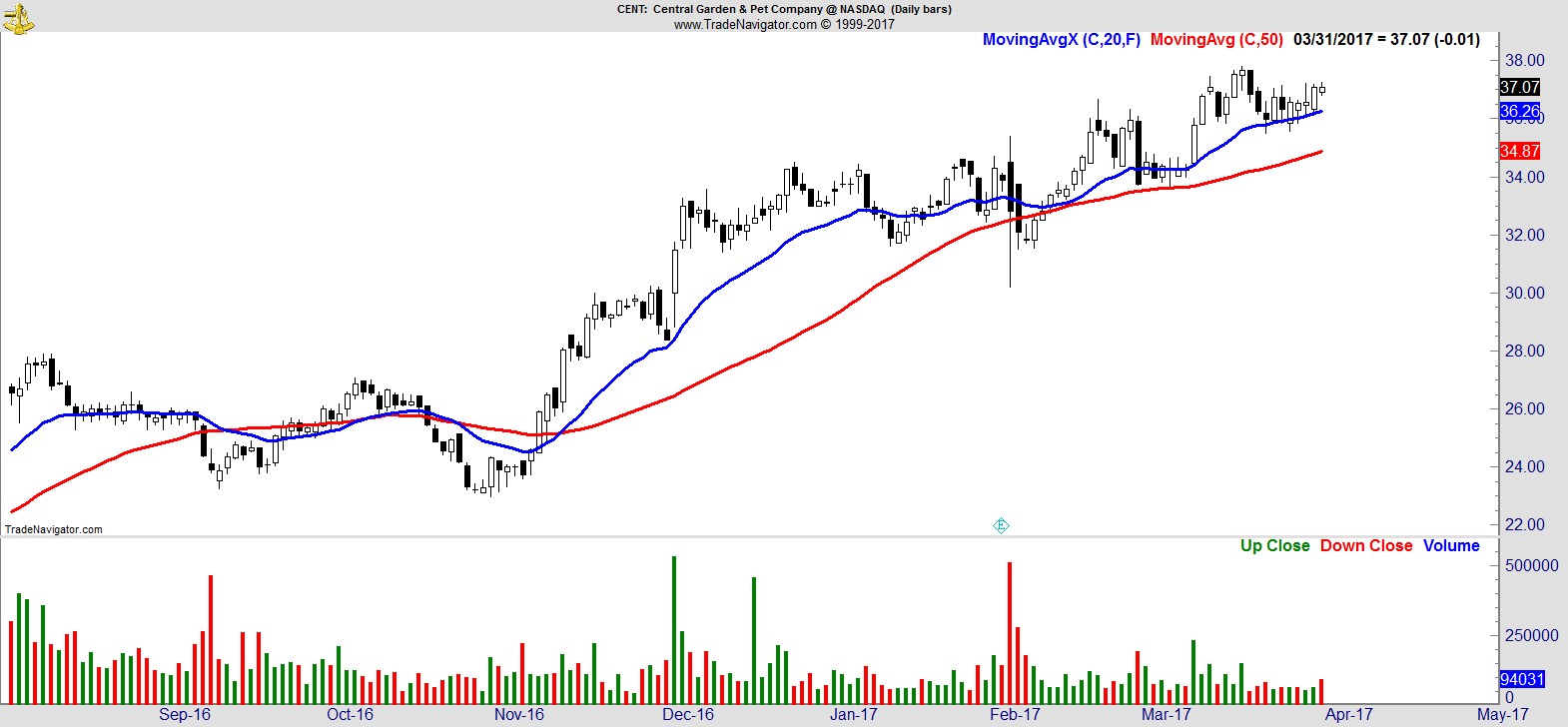

$CENT

.

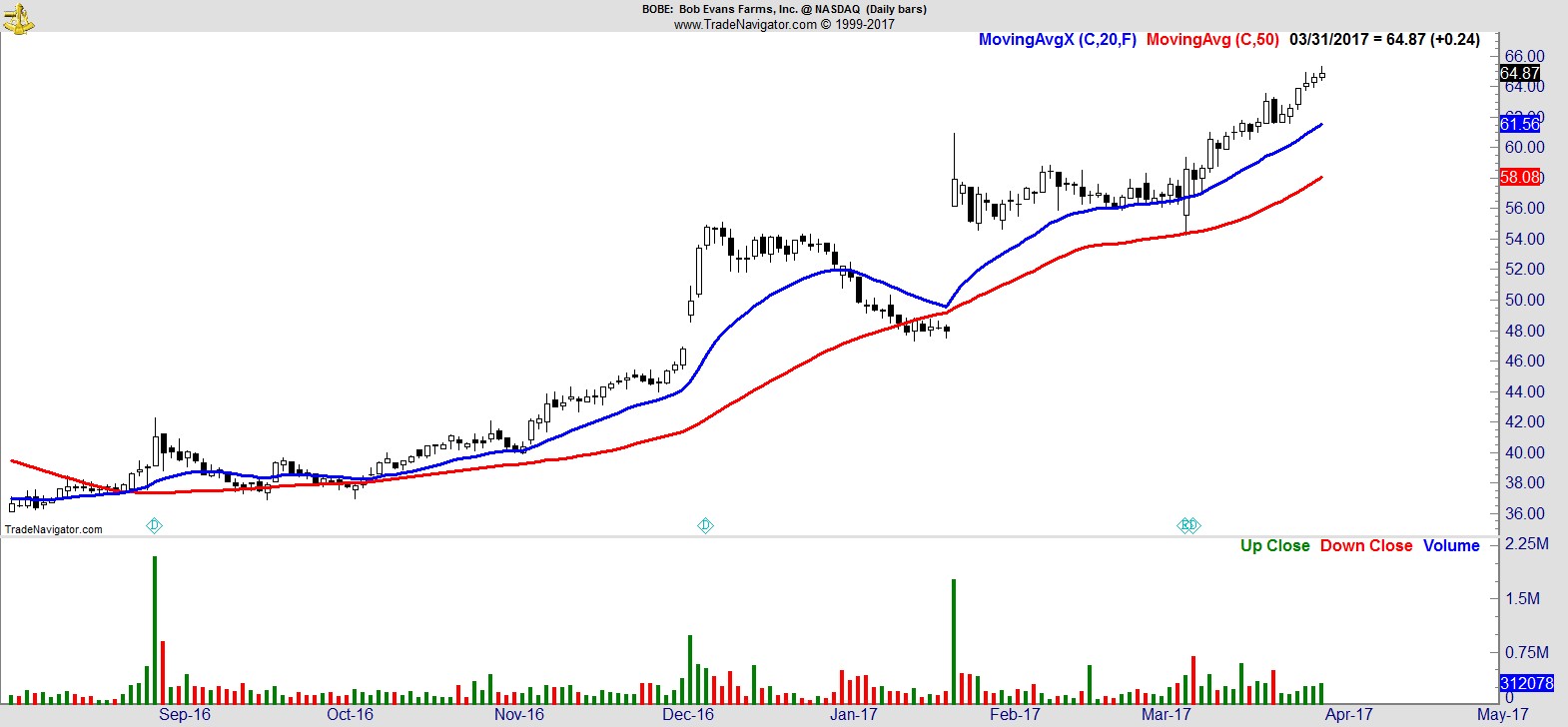

$BOBE

.

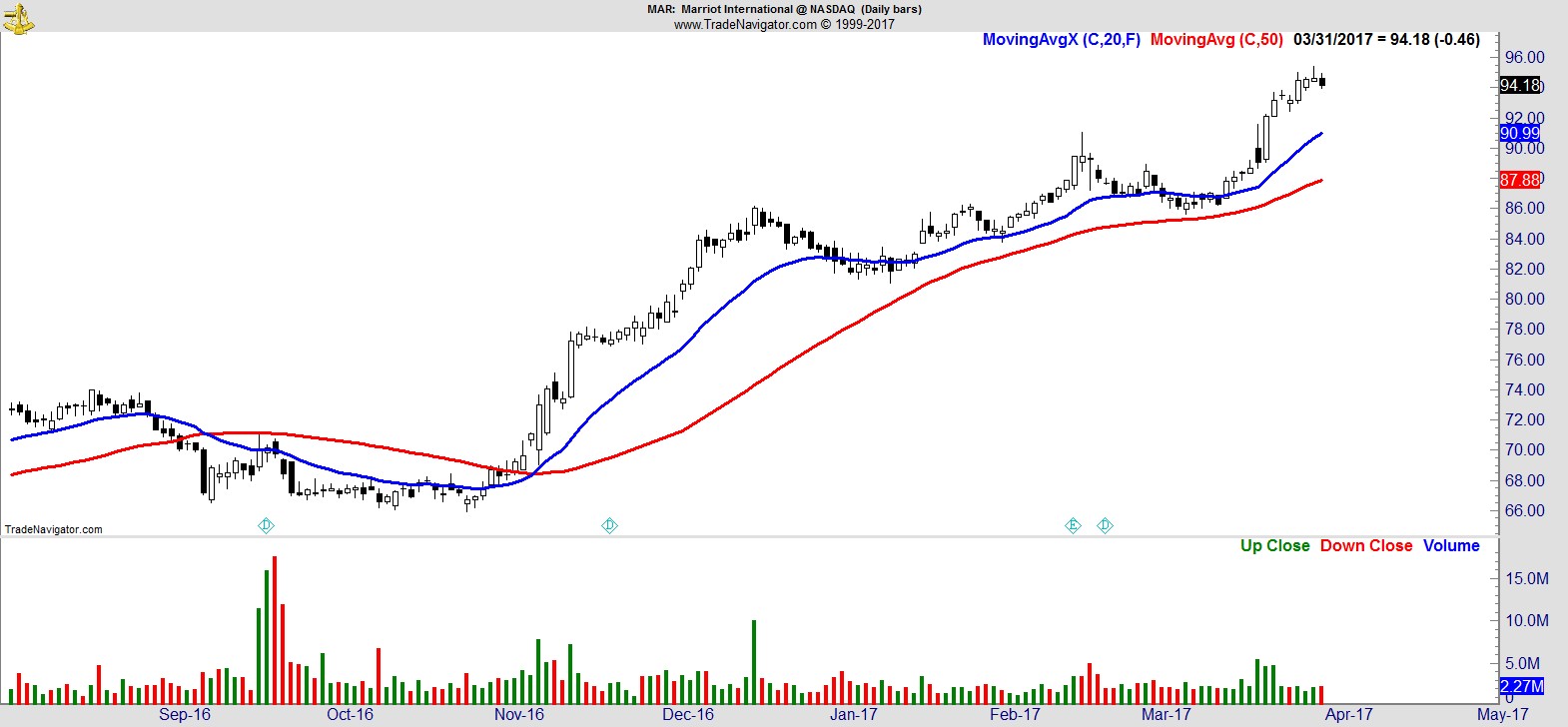

$MAR

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17