Overview

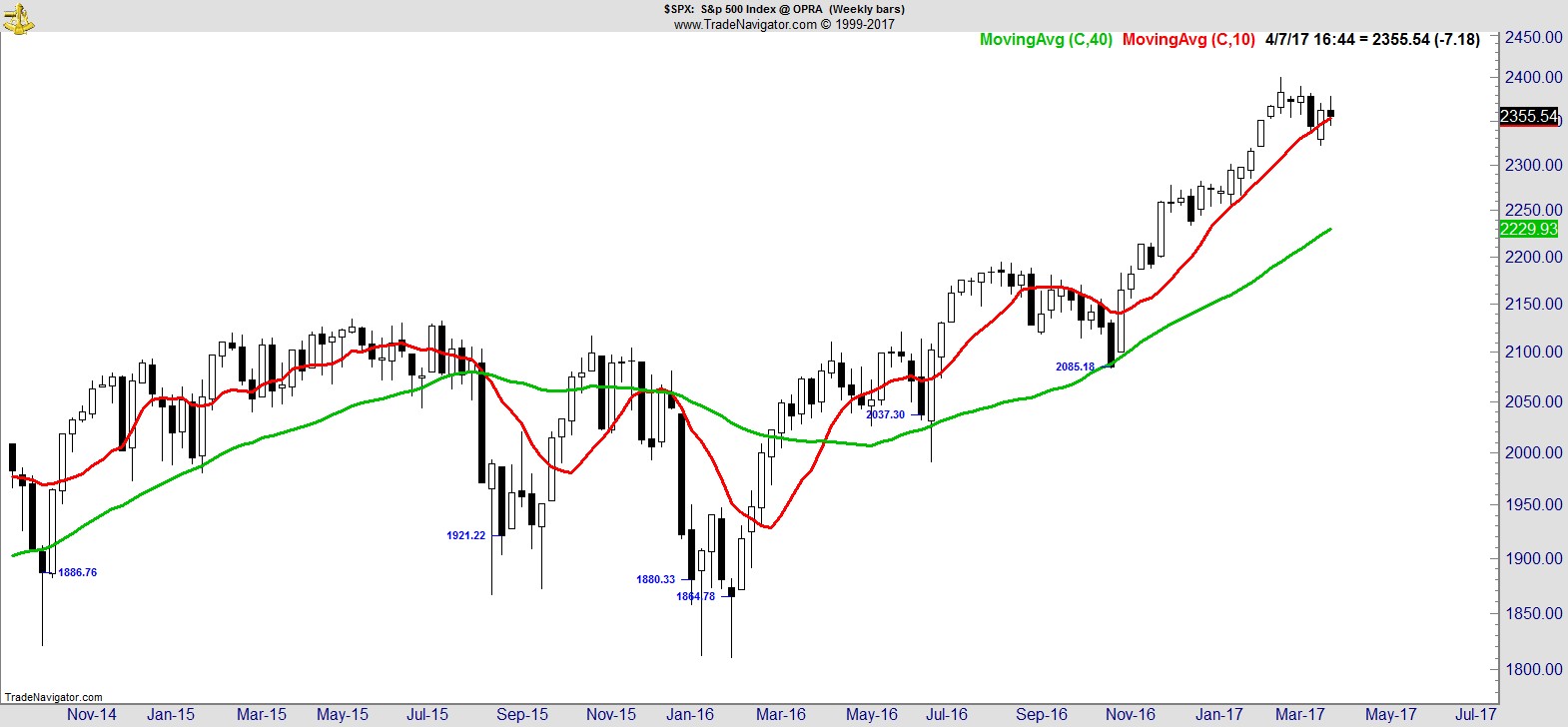

It was an eventful week if you're into economic numbers, Fed watching, and geopolitics, but for the stuff that actually matters - price and its trend - it was deadly dull, with the major indices all finishing slightly lower on the week.

Here's the S&P on a daily and weekly:-

.

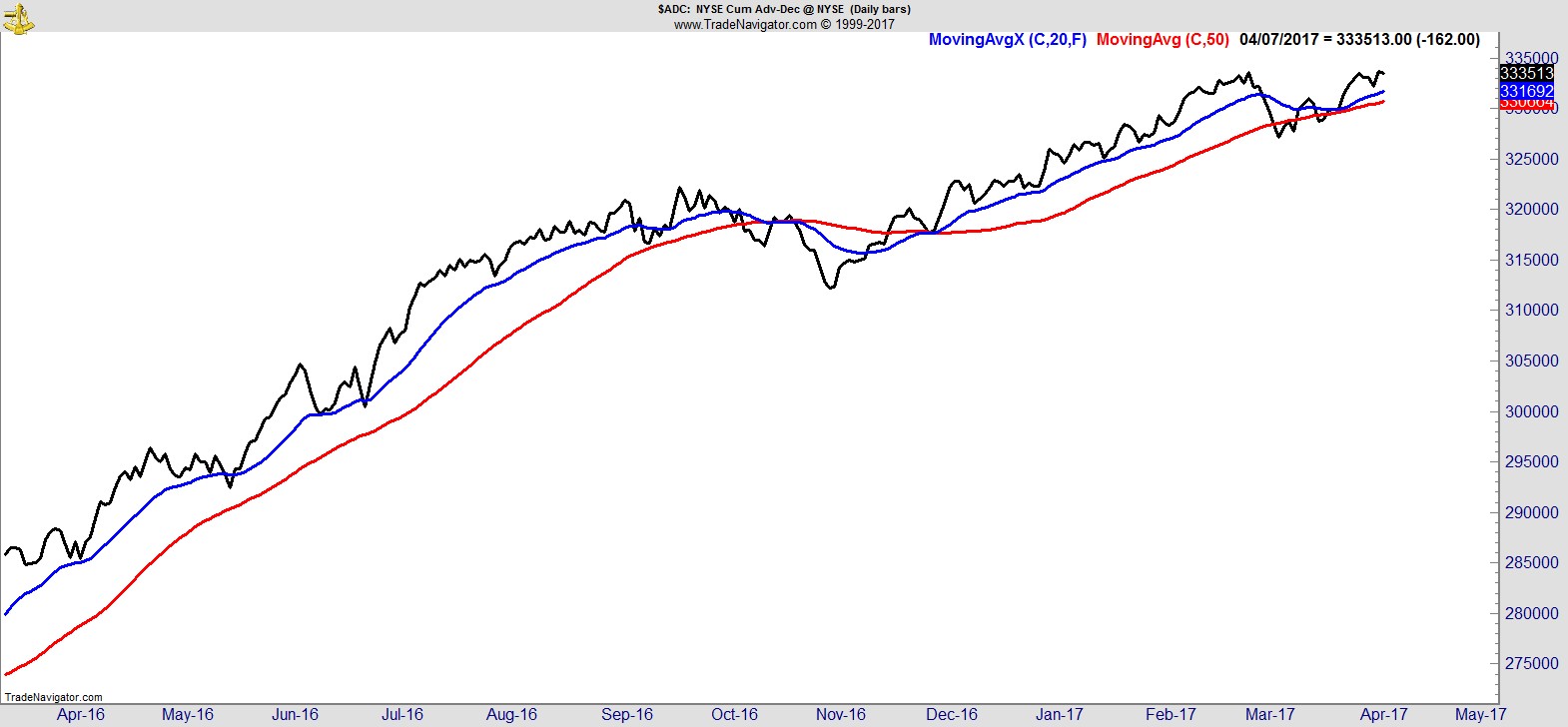

The one positive development this week was that bullish sentiment continued to ease back from its elevated levels, and breadth improved to fresh highs, shown here via the NYSE Cumulative Advance/Decline:-

.

Sector Analysis

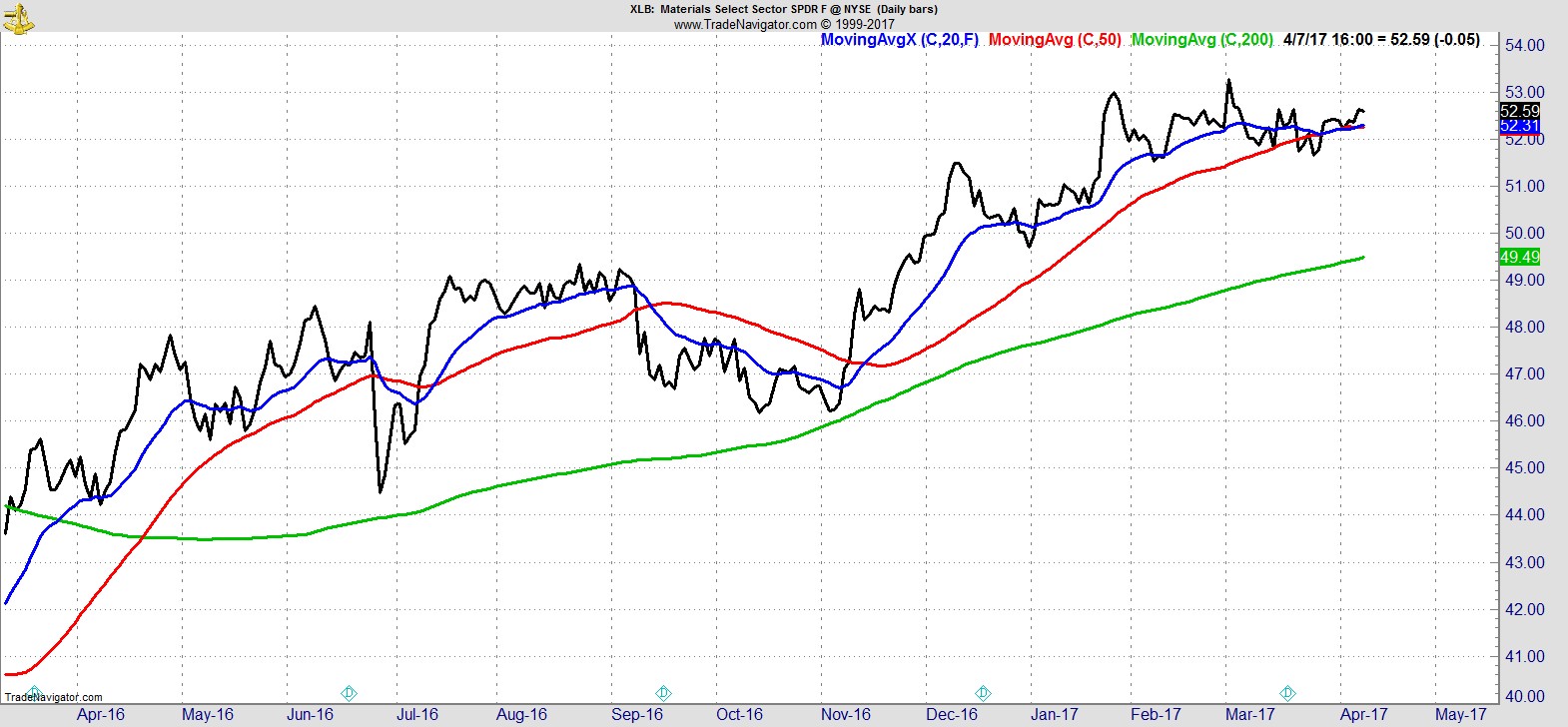

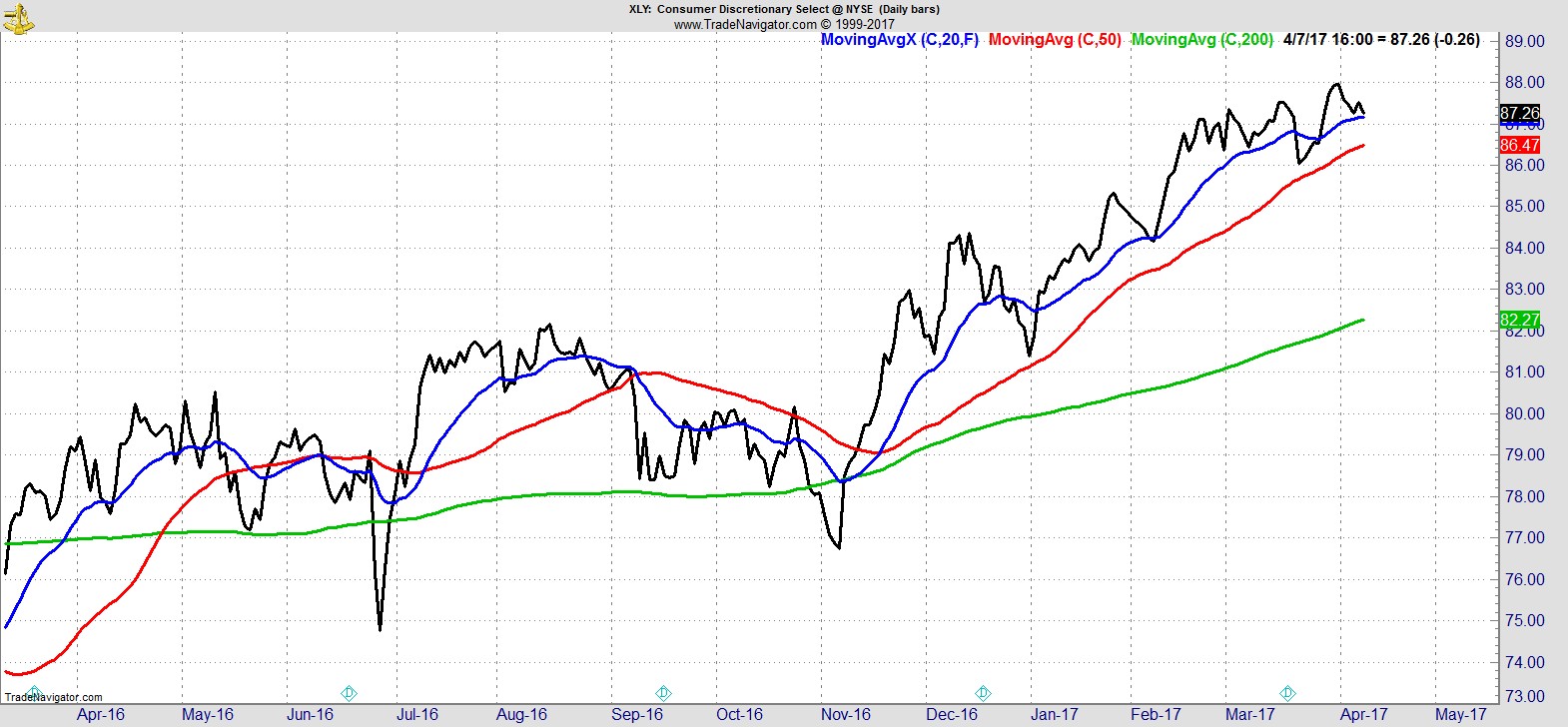

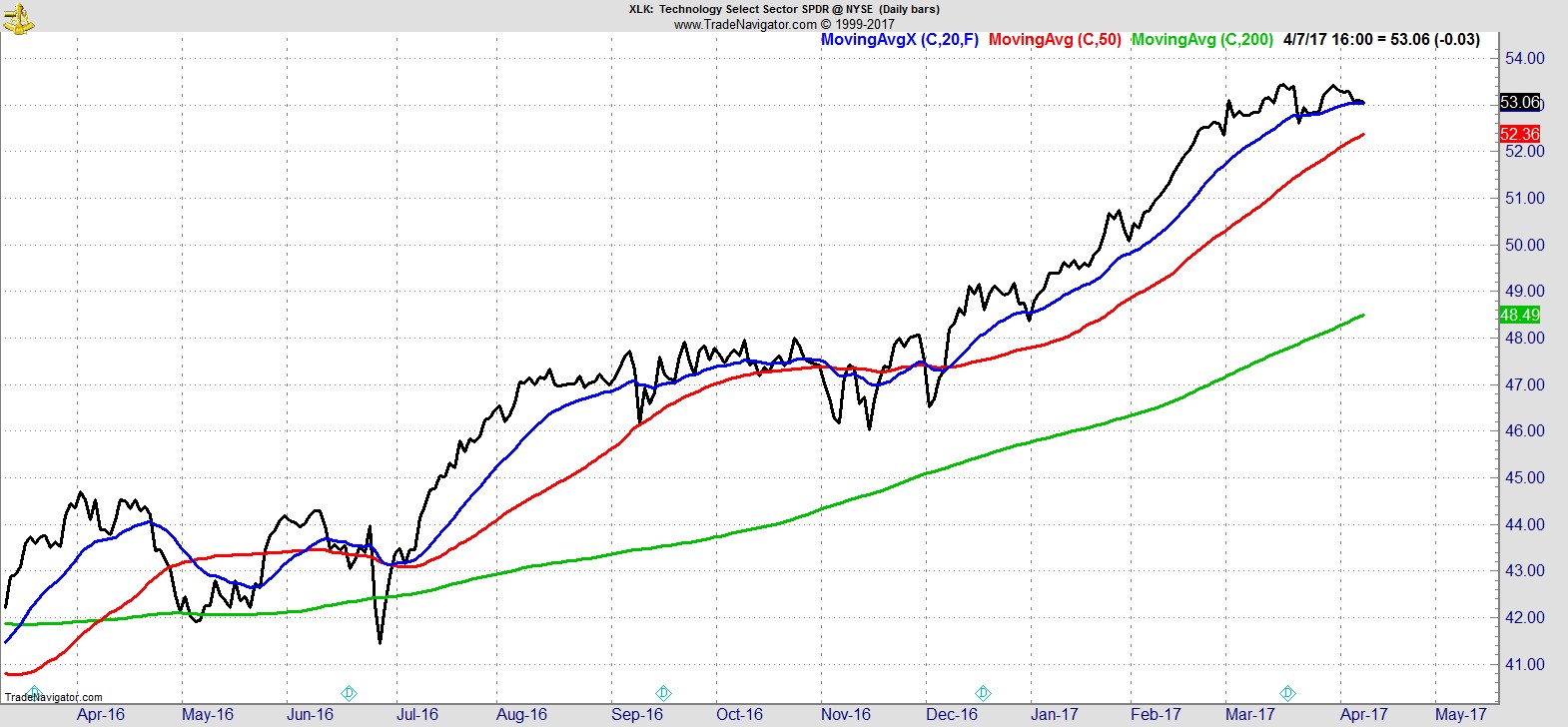

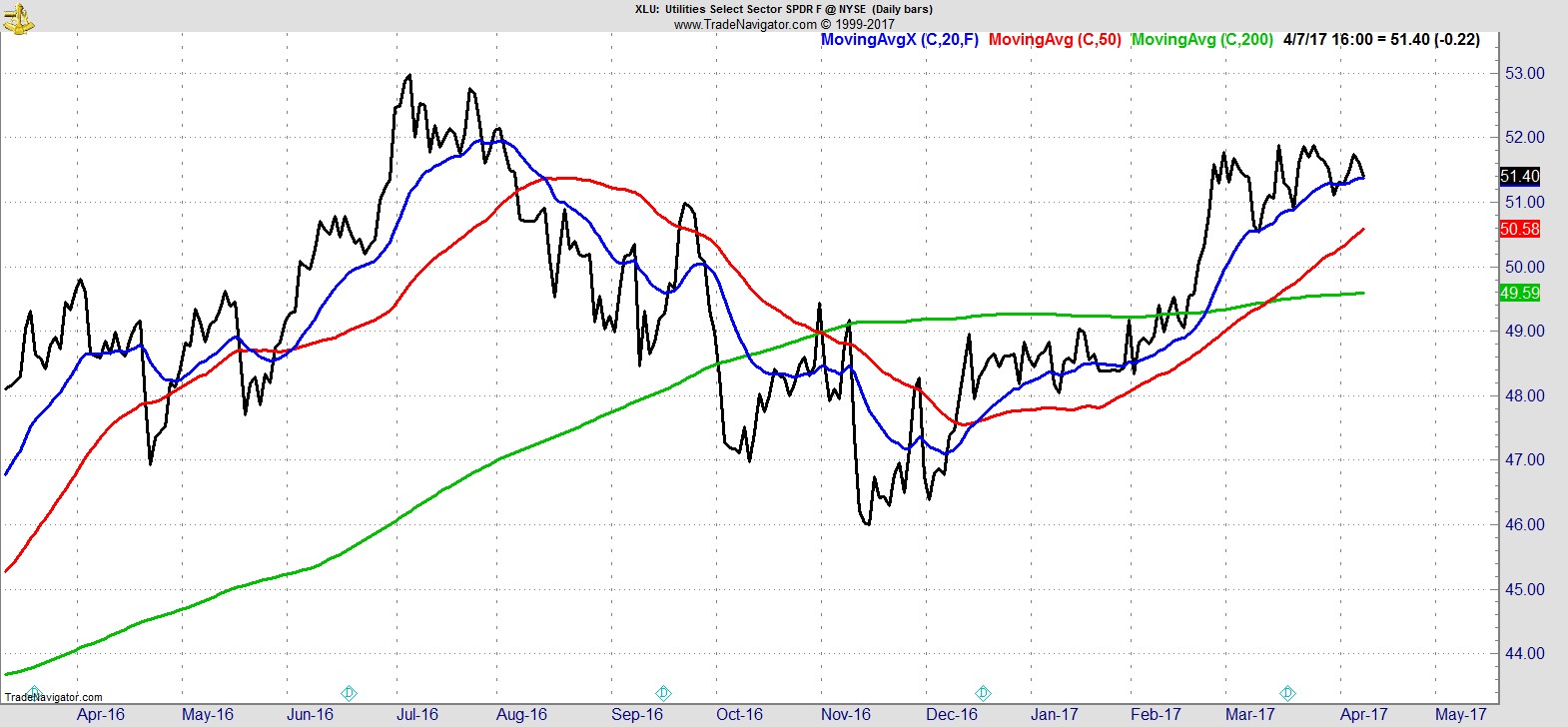

This week there's a somewhat unusual combination of sectors at the top; Materials, Consumer Discretionary, Tech, and Utilities:

They're followed by Industrials, Staples, and Healthcare. At the bottom end I have the trio of Real Estate, which despite a valiant recovery remains below its 200-day, Energy, which is just starting to show signs of life, and Financials, which did nothing this week to suggest its recent pullback is over.

.

Alpha Capture Portfolio

This week our model portfolio was barely changed, finishing -0.1% vs -0.3% for the S&P. We had no new signals and maintain 8 positions with total open risk of 5.2%, and around 40% in cash.

.

Watchlist

Still plenty of technology and consumer-related names on our watchlist, and we now have some materials/energy, and industrials showing up too.

Here's a sample from the full list of 24 names:-

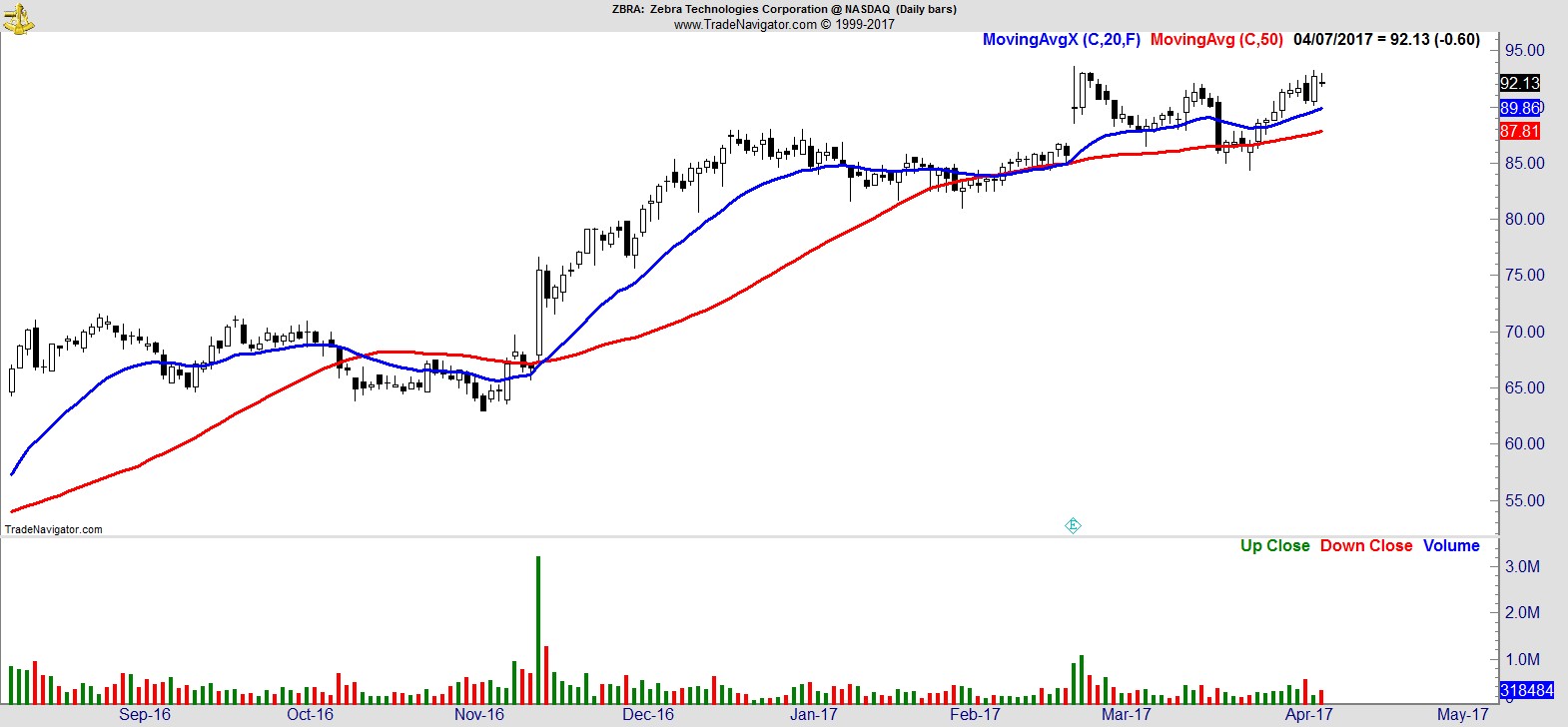

$ZBRA

.

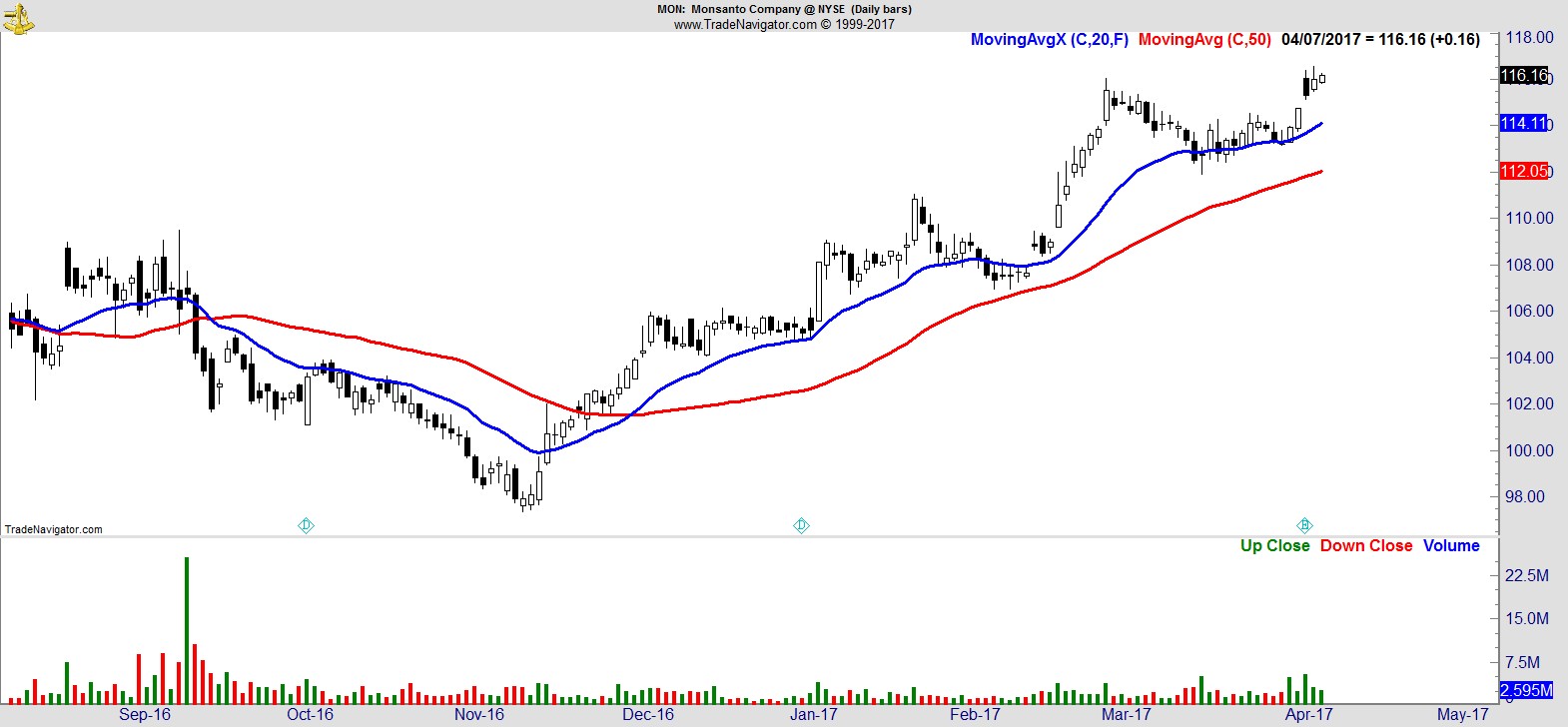

$MON

.

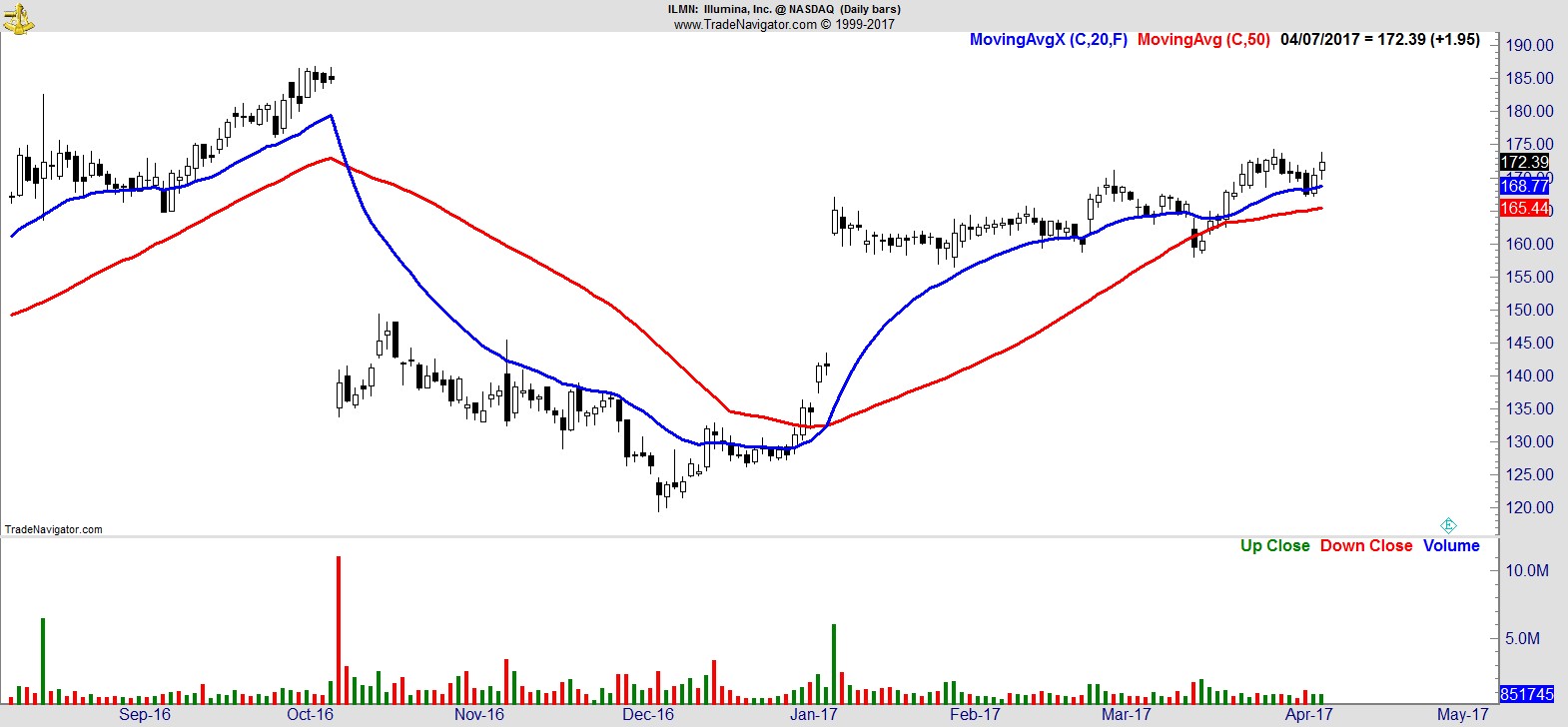

$ILMN

.

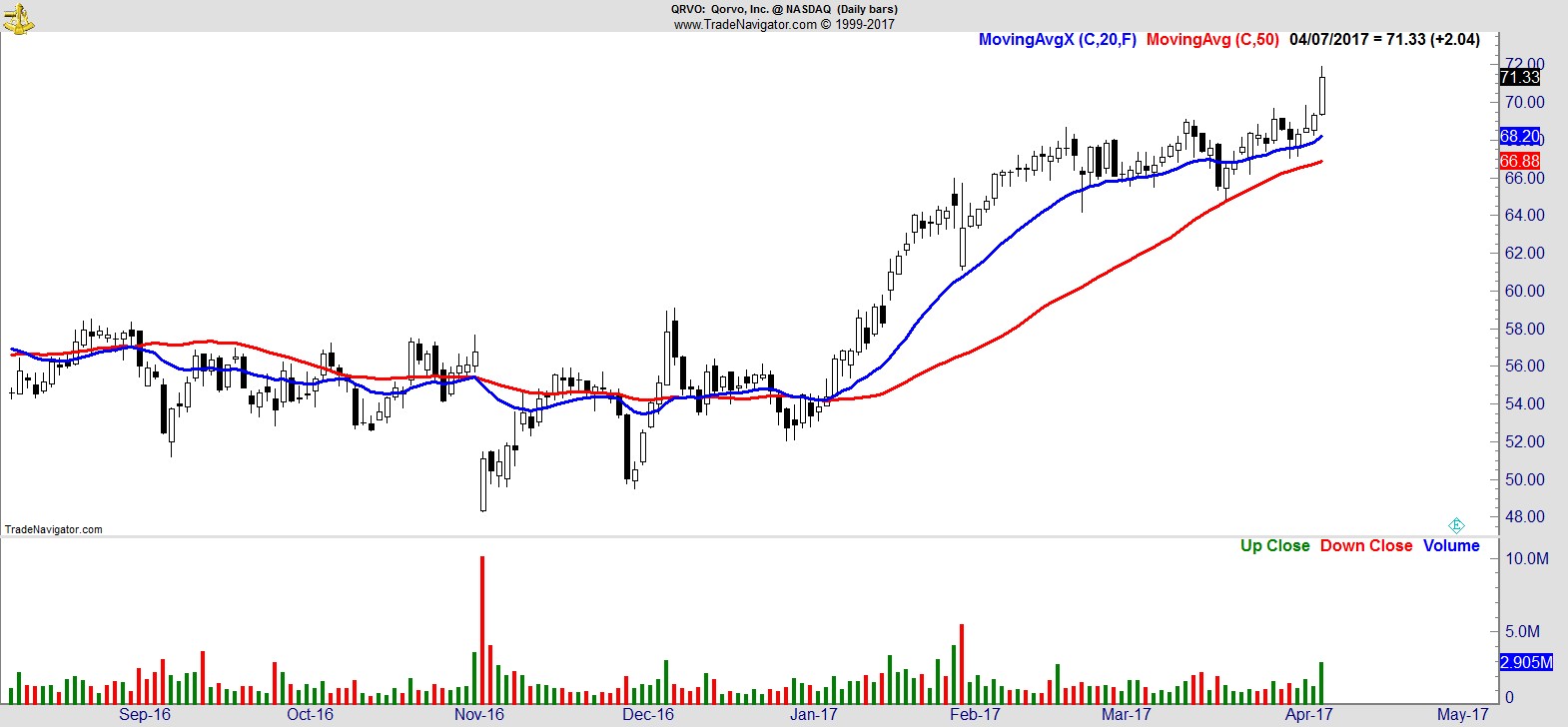

$QRVO

.

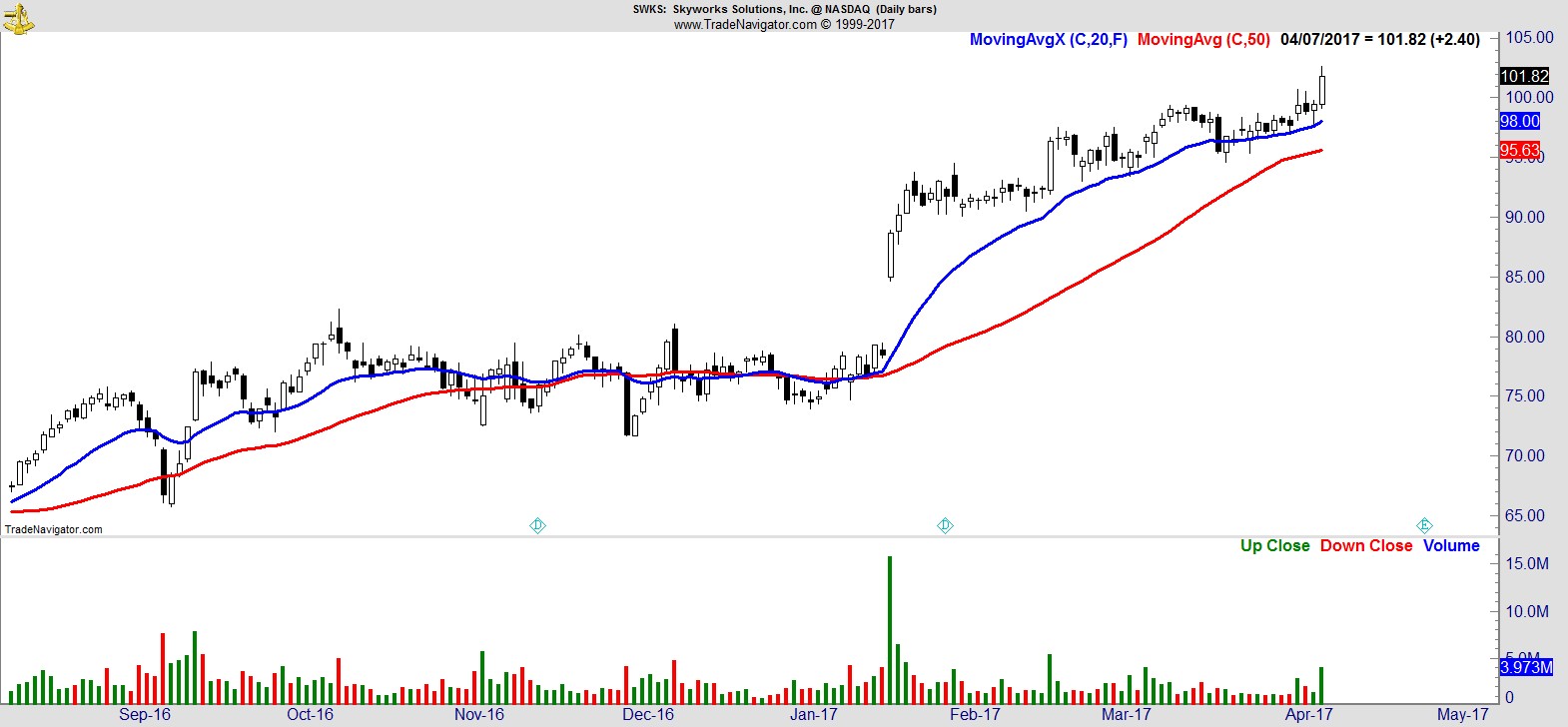

$SWKS

.

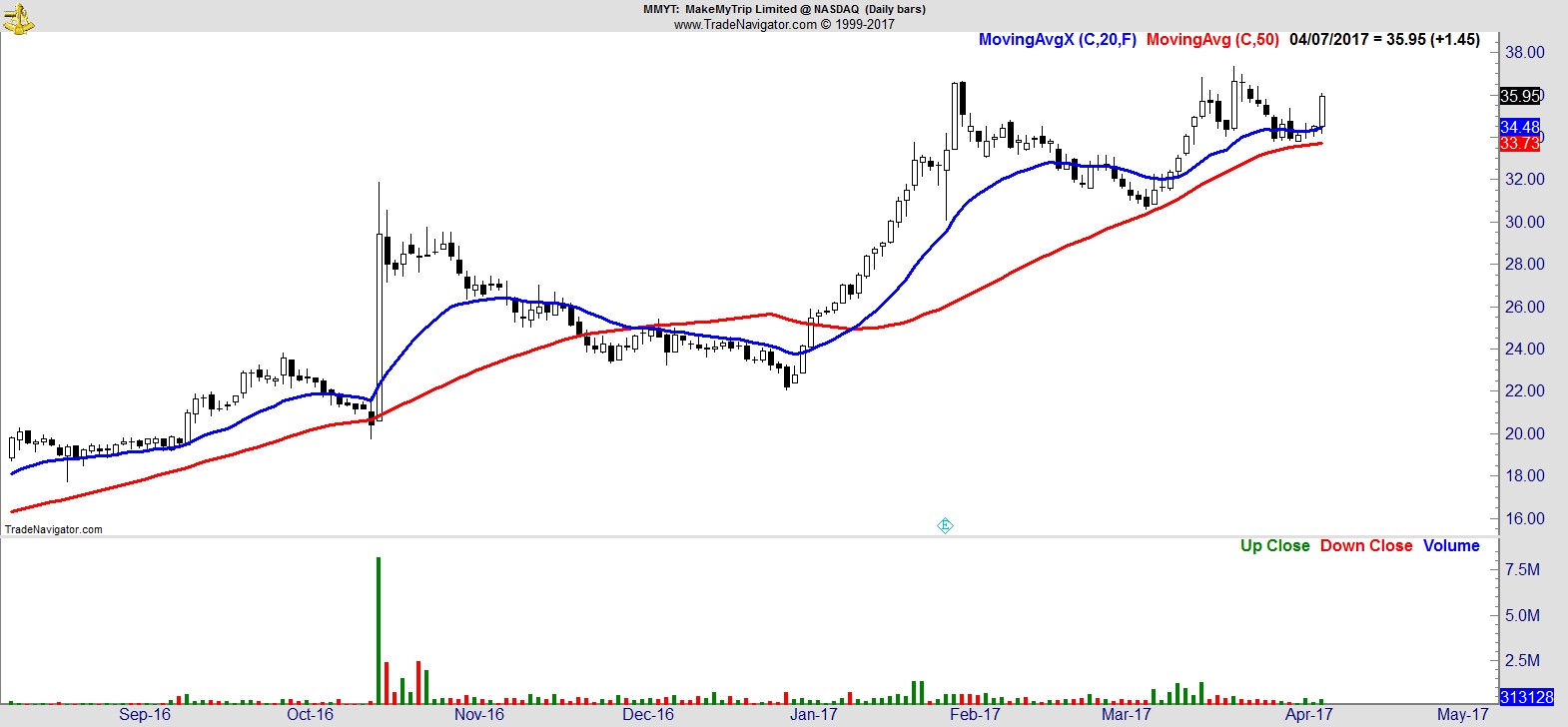

$MMYT

.

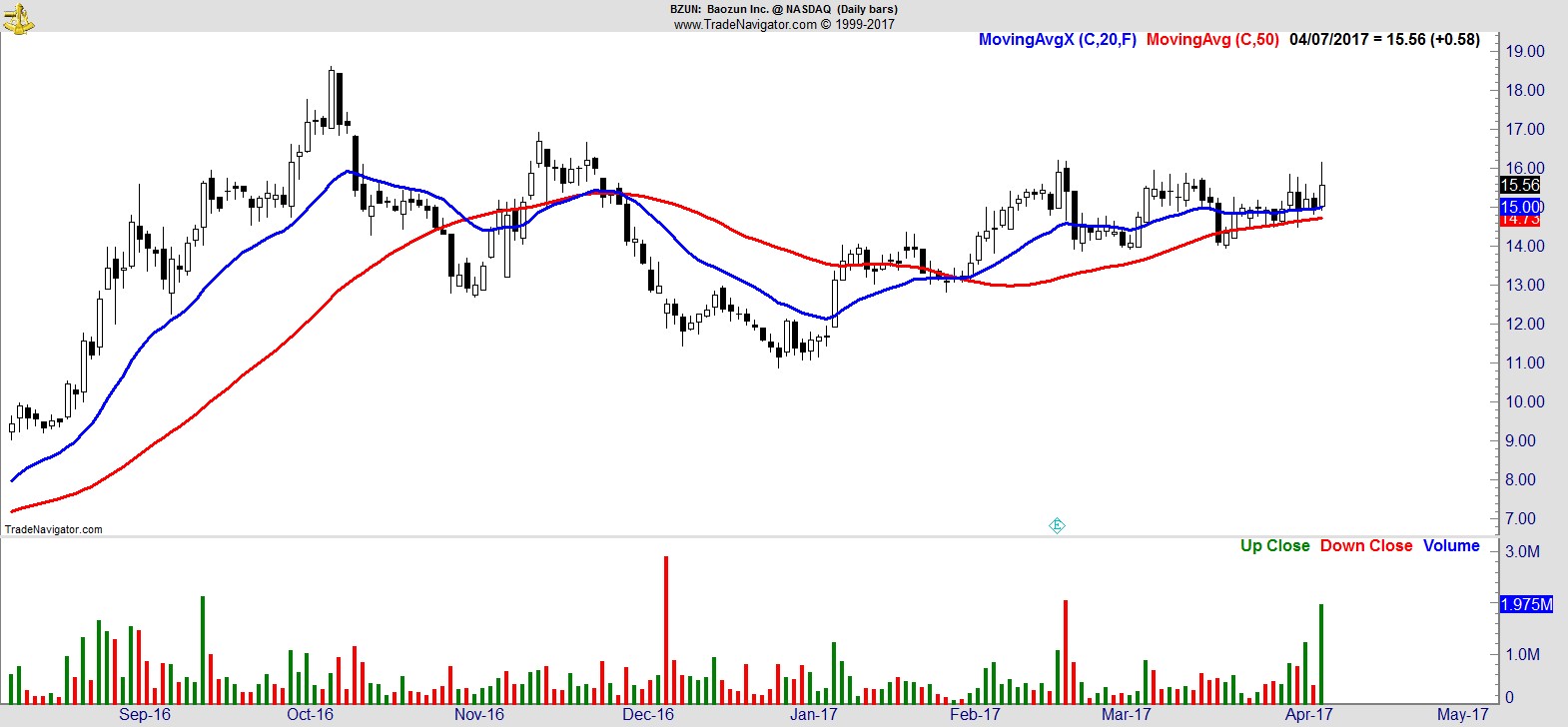

$BZUN

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17