Overview

Equity markets weakened further with the major indices finishing a holiday-shortened week at the lowest levels in 2 months. Longer term the uptrend remains intact, but near-term breadth has deteriorated, and sentiment is negative with measures such as the put/call ratio, and number of stocks above their 50-day MA, approaching levels where a short-term bounce is likely.

Here's the S&P on a daily chart showing a series of lower highs and lower lows, and this week's break of its 50-day MA:-

.

Longer-term however the uptrend is very much intact, with the S&P less than 3% from previous highs.

.

Short-term sentiment has become very bearish:-

Per @BluegrassCap the put/call ratio has only been higher than current levels seven times in the past five years.

.

Additionally, the percentage of S&P 500 stocks above their 50-day MA is approaching levels that have coincided with market recoveries, but not necessarily a final low.

.

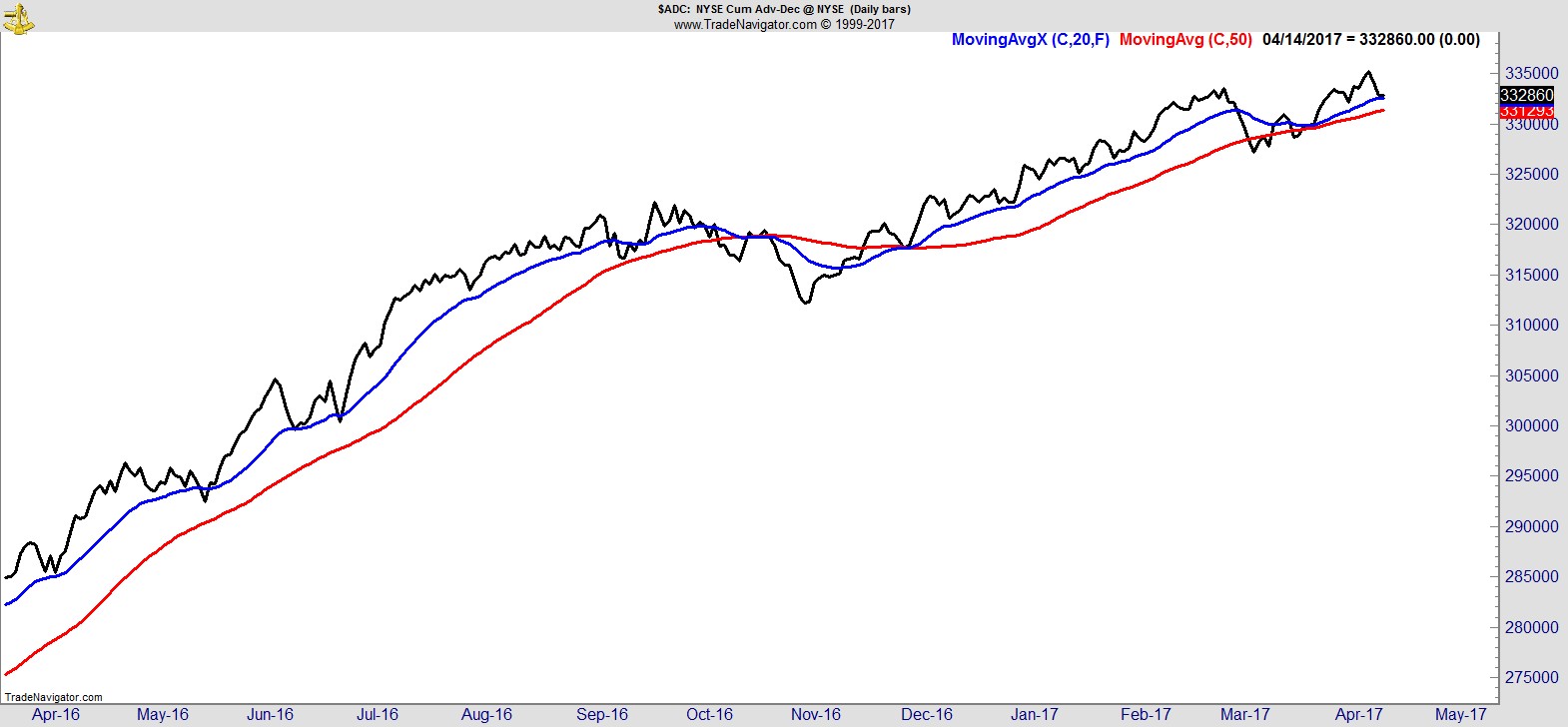

Breadth via the NYSE Cumulative Advance /Decline line has weakened, but not significantly, perhaps supported by the number of fixed income issues it contains.

.

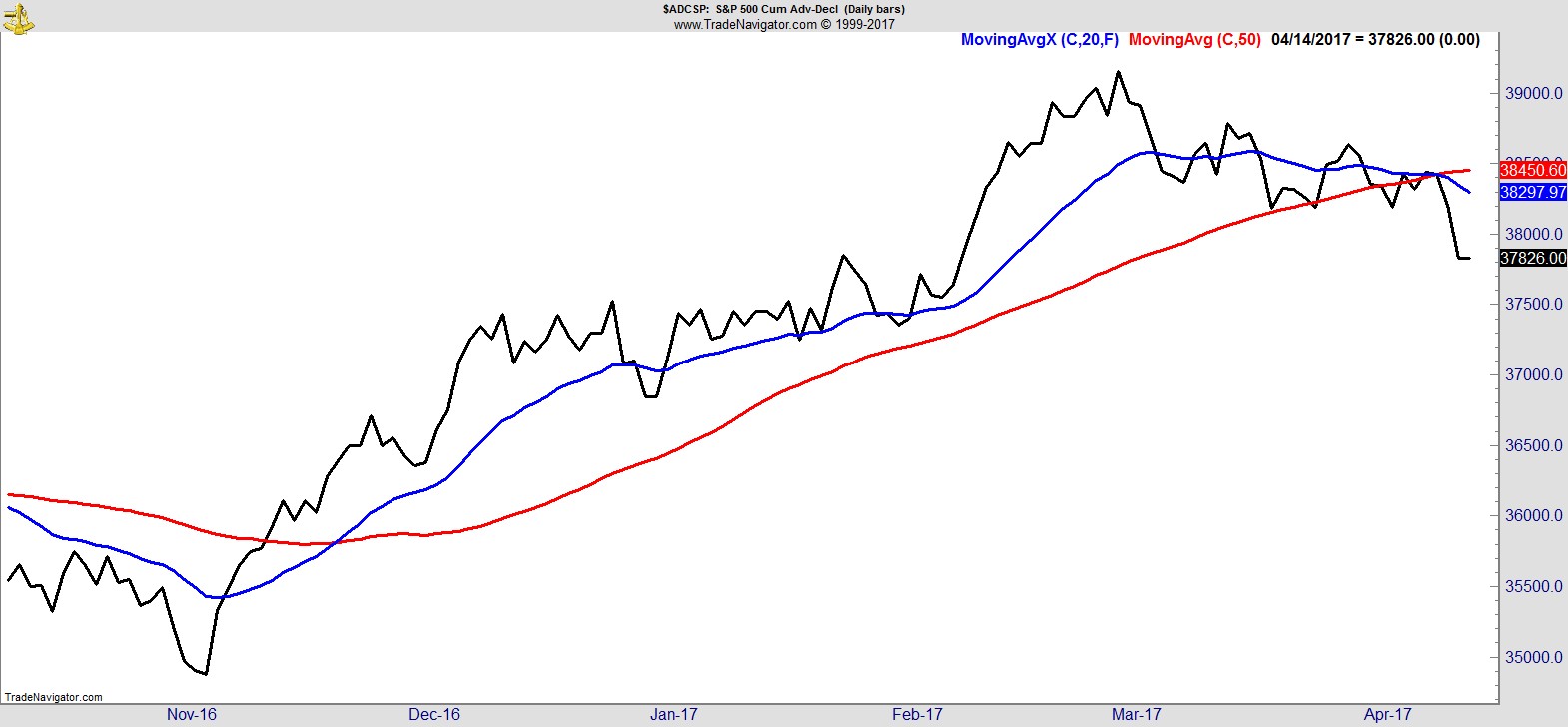

The NYSE common stock only A/D bears this out, and the A/D line for the S&P 500 does even more so:-

.

Sector Analysis

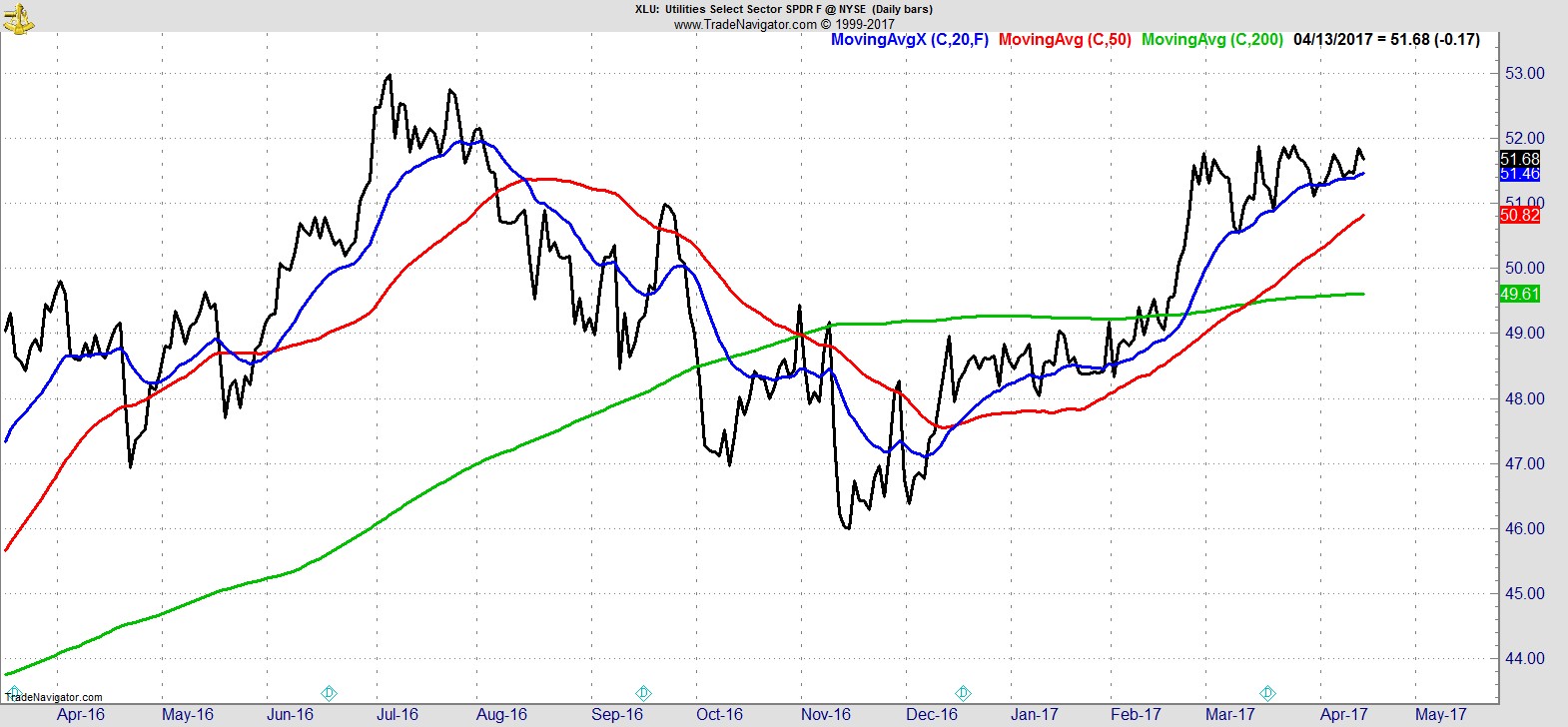

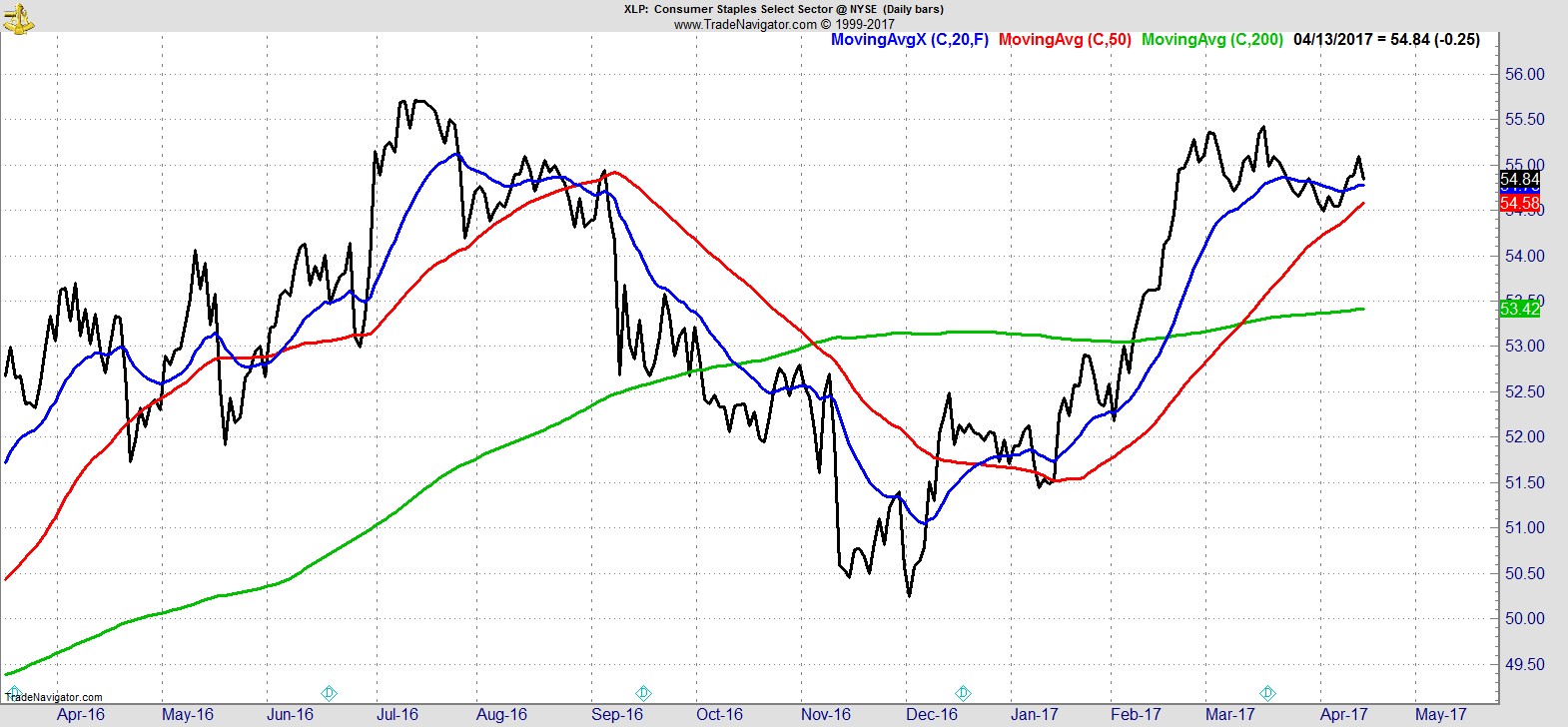

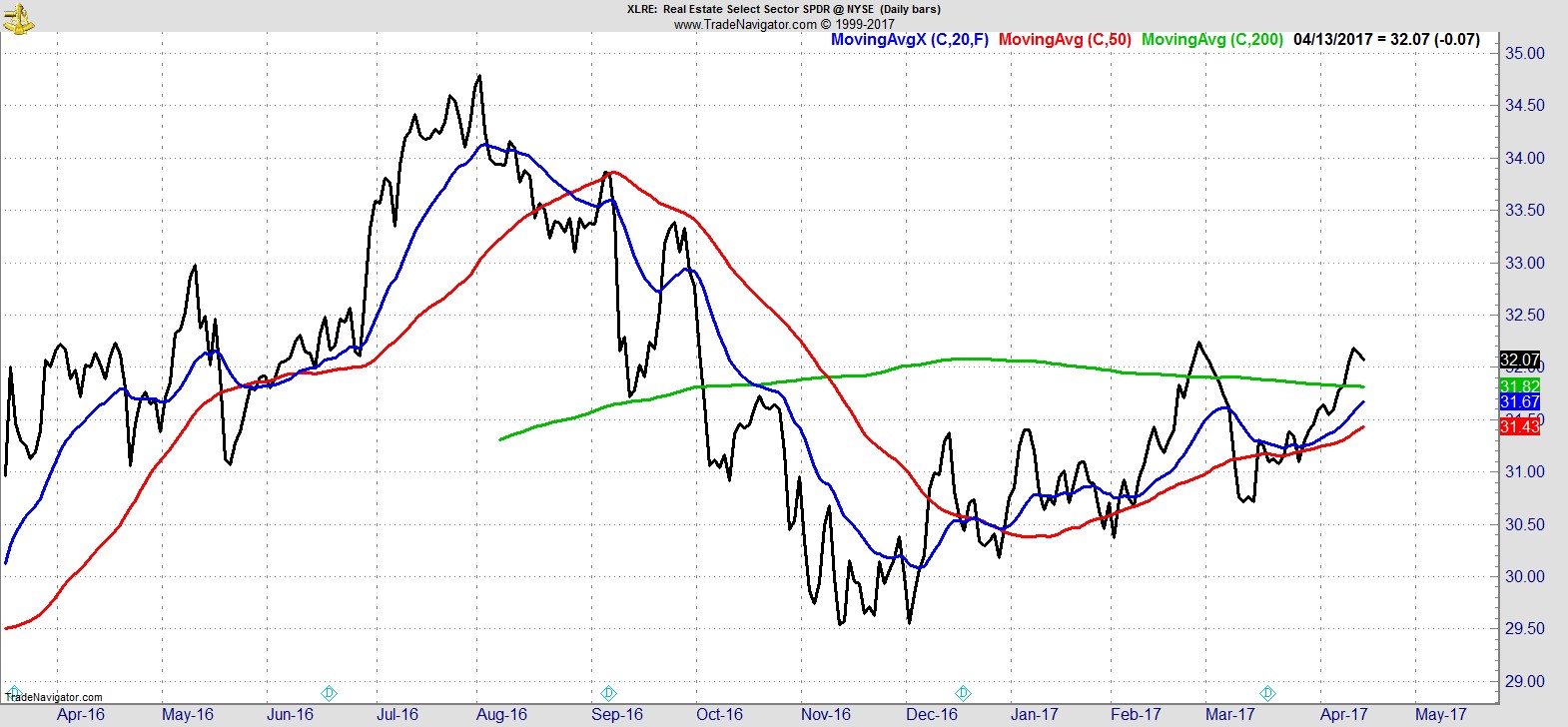

This is one of those weeks where one's ranking of the S&P Sector Spyders will vary more so than usual dependent on your timeframe. The recent weakness in the broader market has reached the stage where the only sectors currently above their 20, 50, and 200-day MAs are Utilities, Consumer Staples, and Real Estate, even though none of them are exactly tearing it up either:-

.

Beyond that I have Consumer Discretionary, Technology, Healthcare, Industrials, and Materials, all of which have led at some point this year, and are currently above their 200-day, but below their 20 and 50-day.

At the bottom remain Financials, which sank to 4-month lows this week, and Energy which failed to retake its 200-day.

.

Alpha Capture Portfolio

Having marginally outperformed for 3 of the last 4 weeks, our model portfolio slipped back this week -1.2% vs -0.5% for the S&P. We had one new entry, and have one exit this weekend that will leave us with 8 positions, open risk of 4.6%, and over 40% in cash.

.

Watchlist

This week we have a handful of Industrials, Materials, and Healthcare names, while Financials have disappeared, but the most dominant area is consumer-related names overtaking technology in our list.

Here's a sample from the full list of 25 names:-

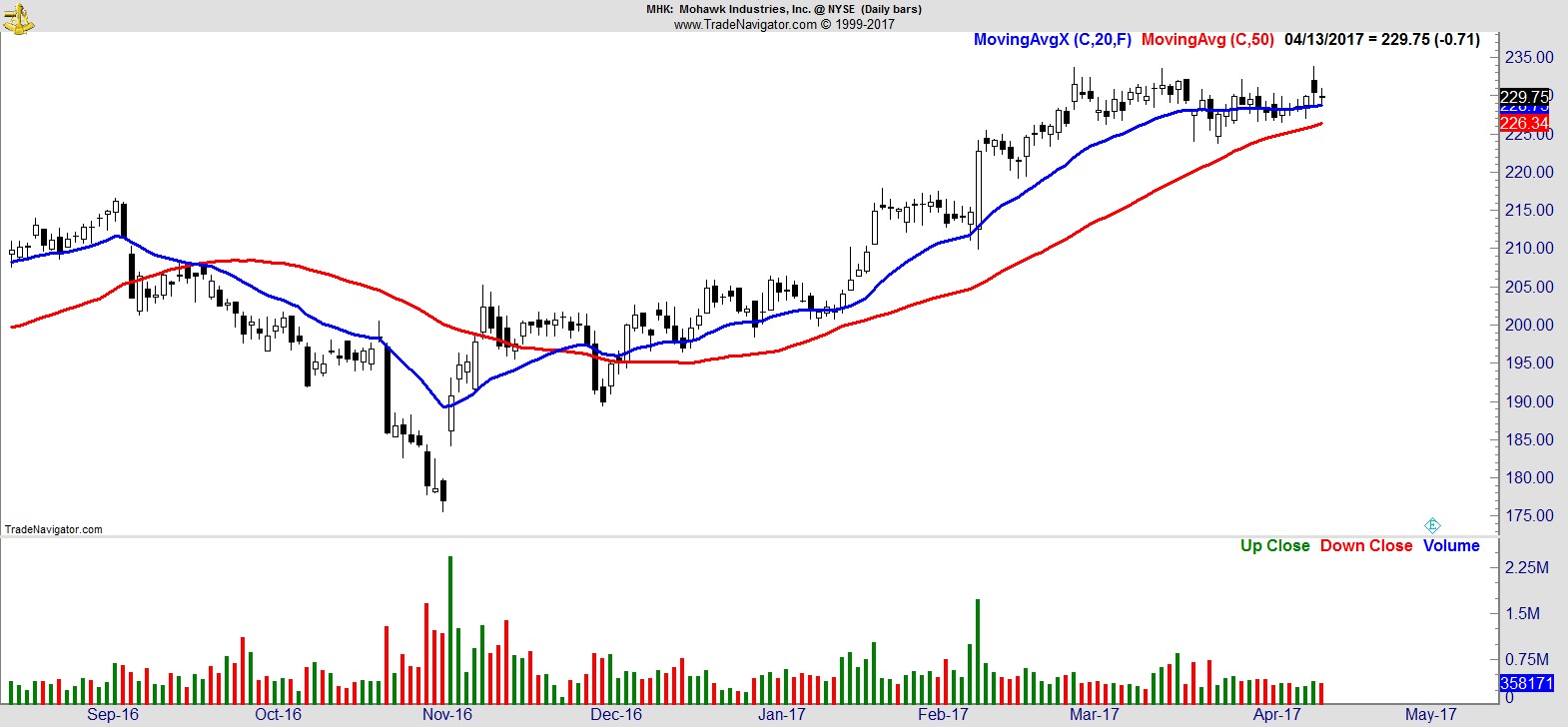

$MHK

.

$MON

.

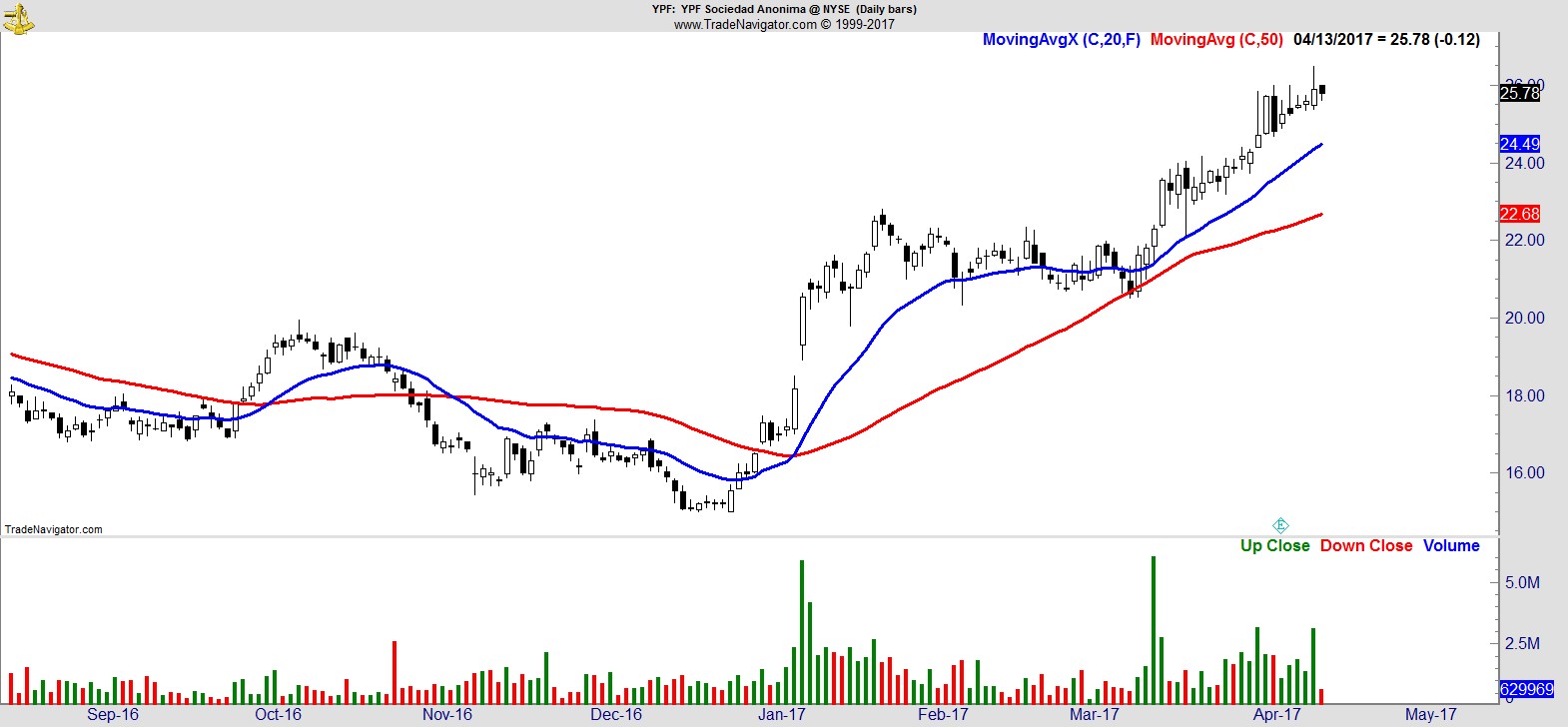

$YPF

.

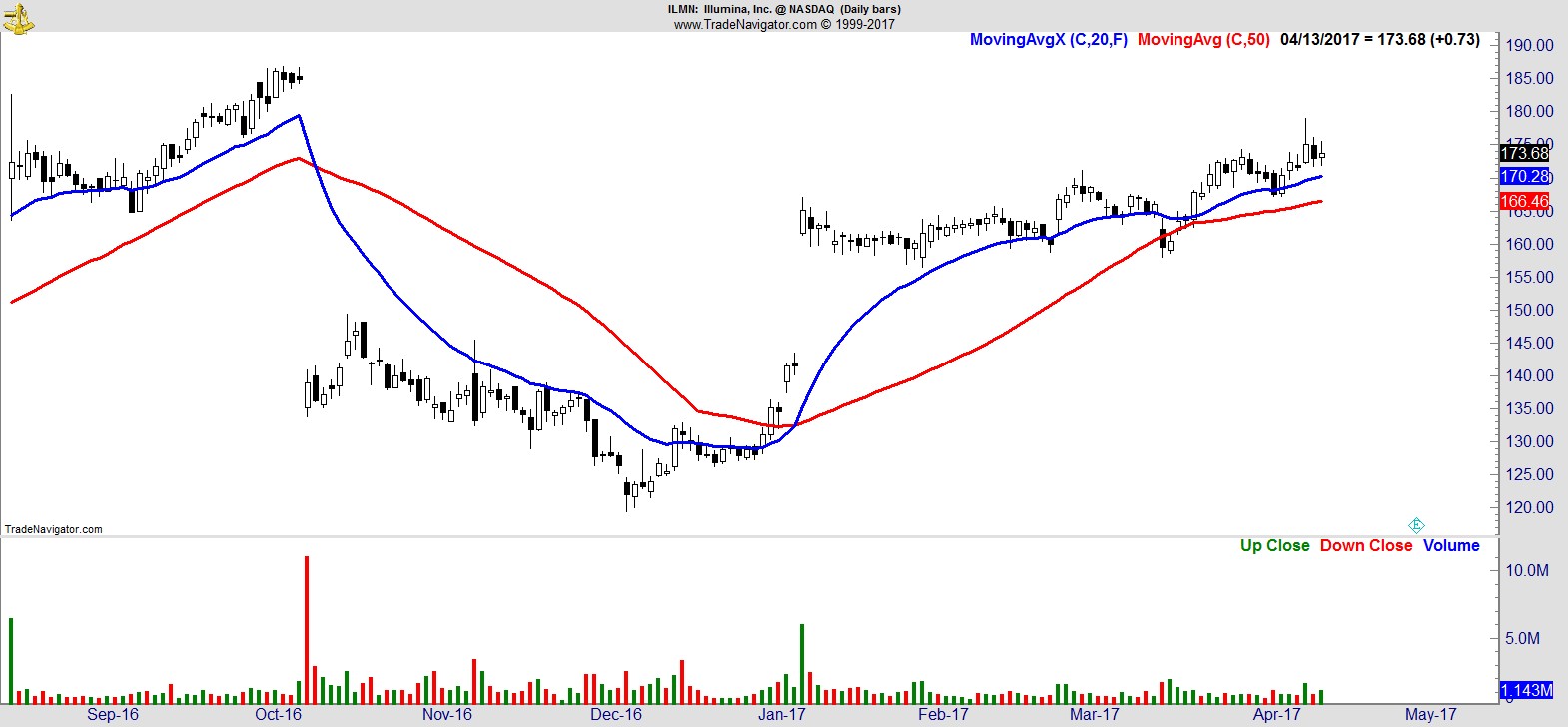

$ILMN

.

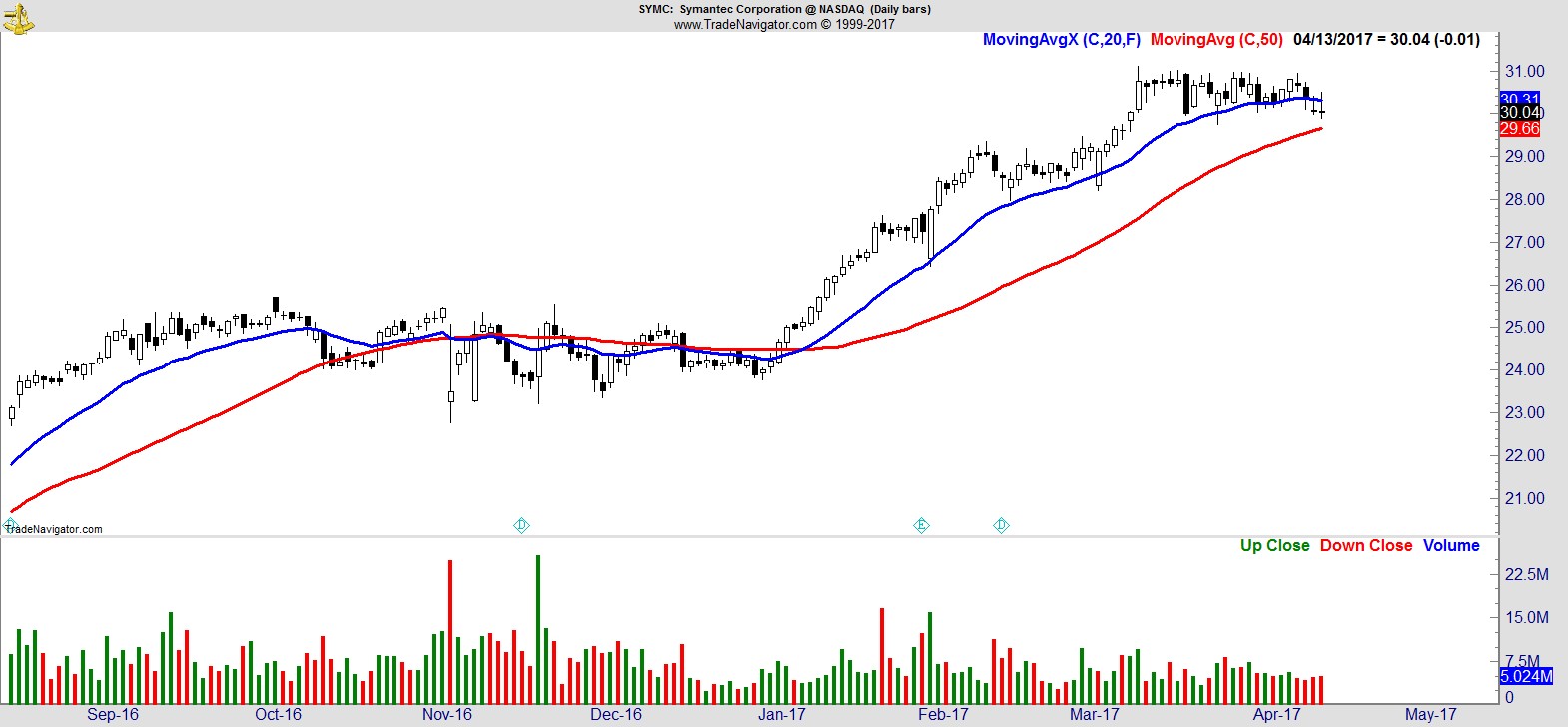

$SYMC

.

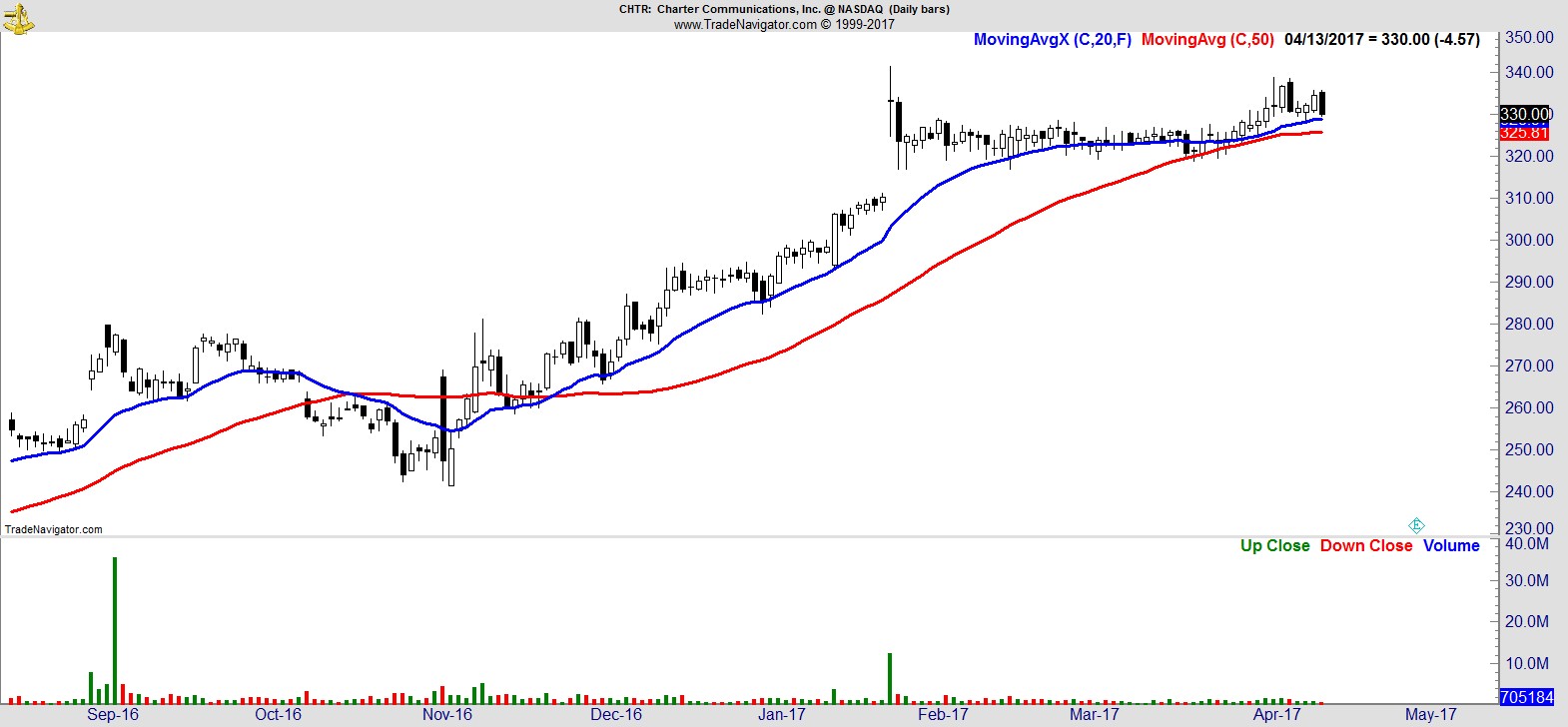

$CHTR

.

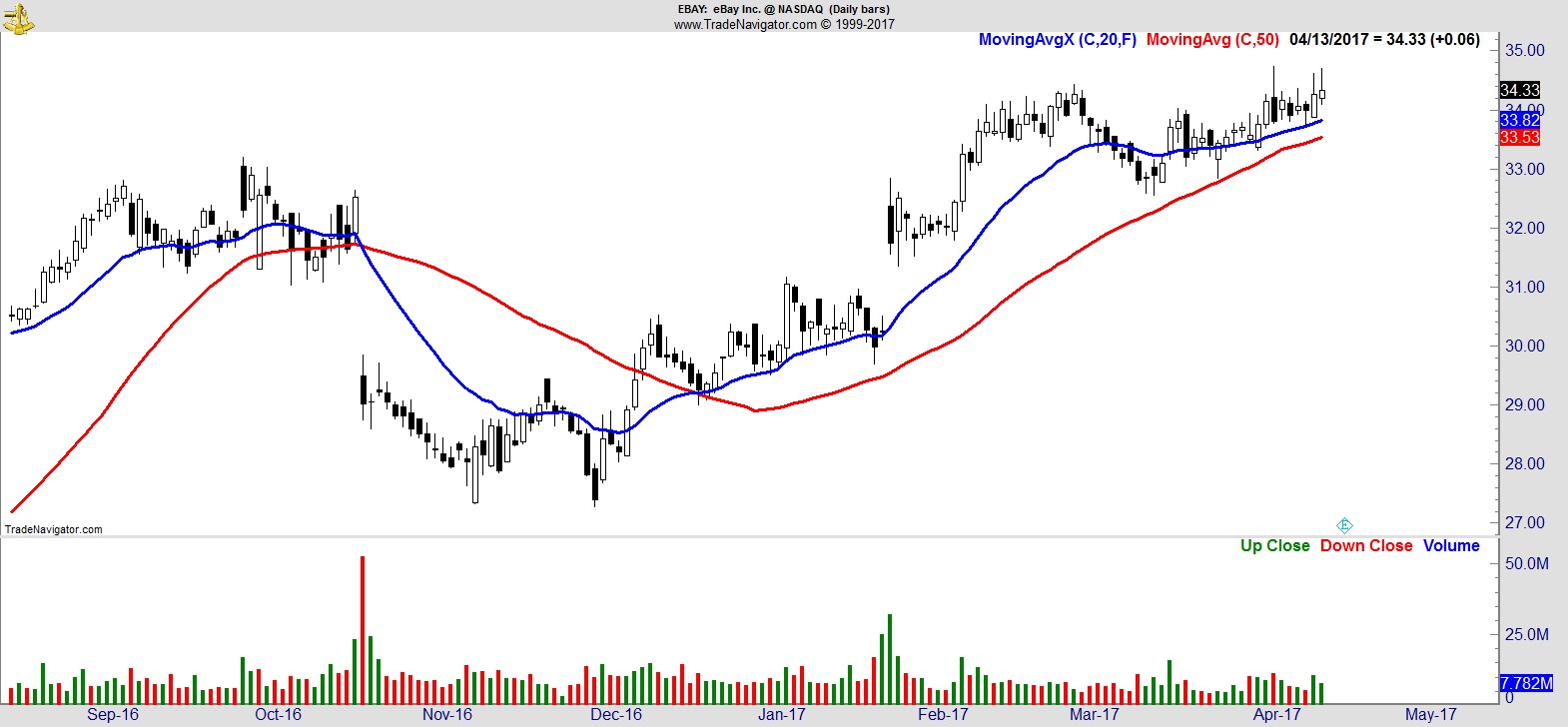

$EBAY

.

$CMG

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17