Overview

Equities recovered well this week led by gains in Industrials, Consumer Discretionary, Materials, and Technology. Energy slumped to six-month lows, and was joined to the downside by Healthcare. The leaders of the last few weeks - Utilities and Consumer Staples - were relatively weak.

This was a good week for transports, small / mid-cap, and growth names, and offered the first sign in several weeks of some improvement in breadth and price action. Sentiment measures also show optimism at a new low since the election (a positive).

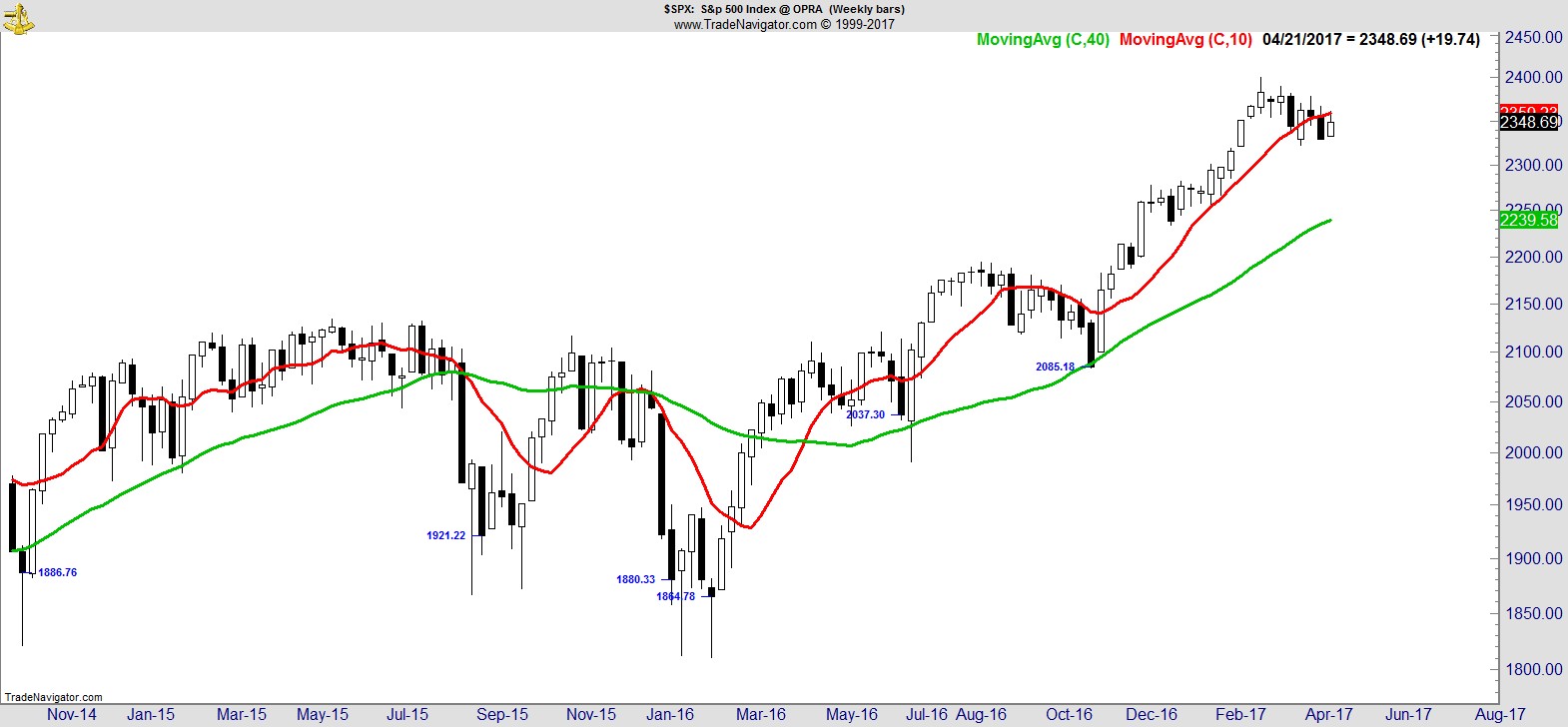

Here's the S&P on a daily and weekly chart:-

This week's gains saw the S&P test the underside of its 20 and 50-day MAs, and while it was encouraging progress, it has further work to do to break the current sequence of lower highs and lower lows over the last 7 weeks.

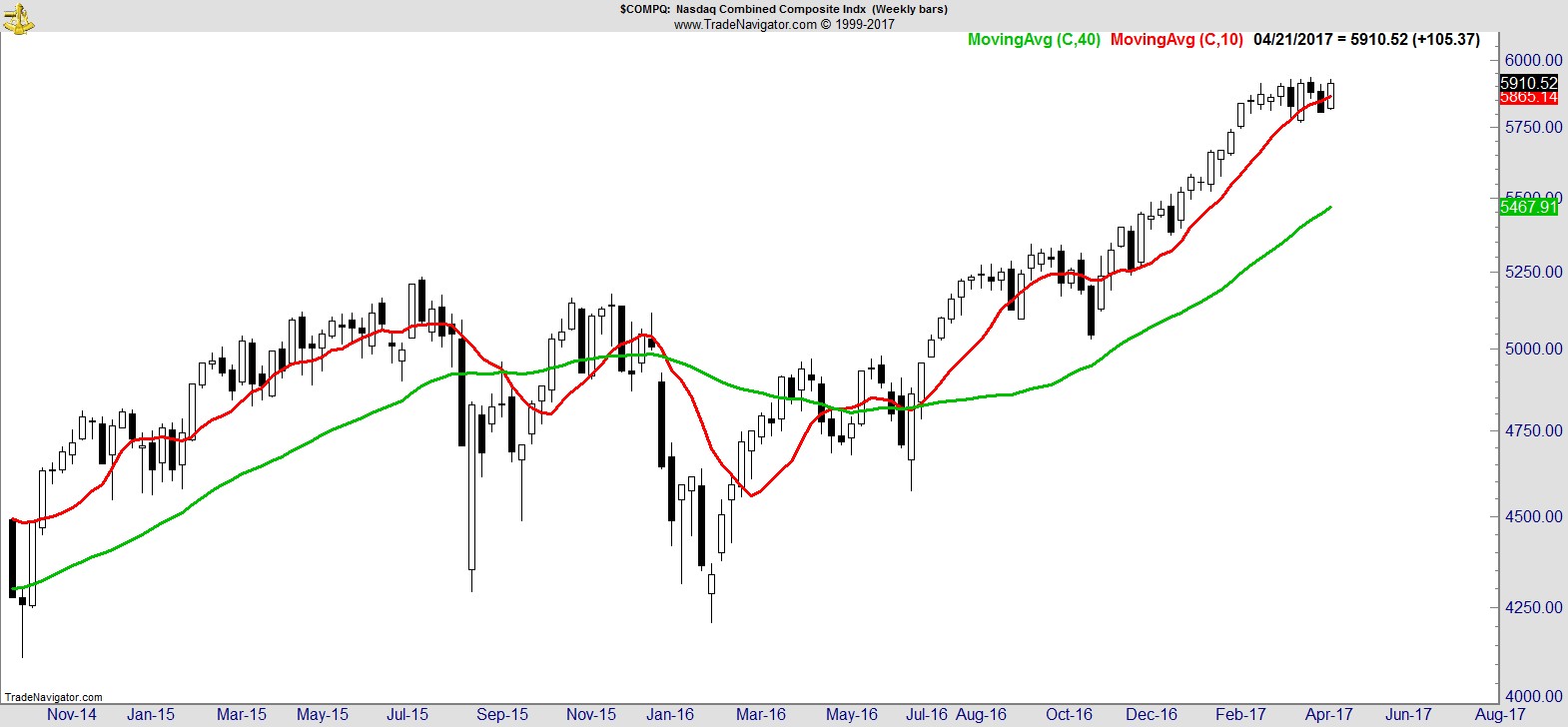

The Dow and NYSE Composite are in a similar situation, but the Russell 2000 and NASDAQ (below) both managed to climb back above their 10-wk MA, while the Transports posted its highest weekly close in 5 weeks.

.

Sector Analysis

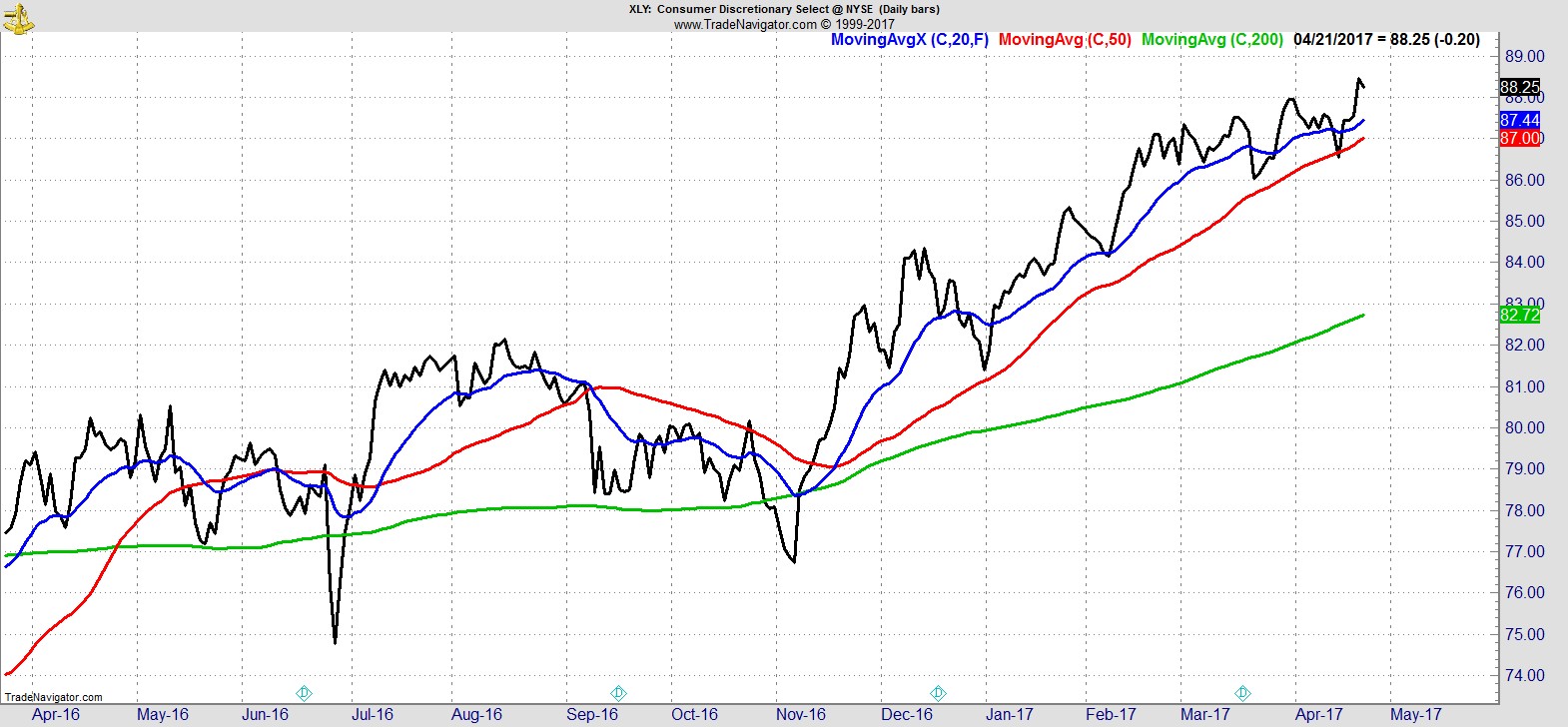

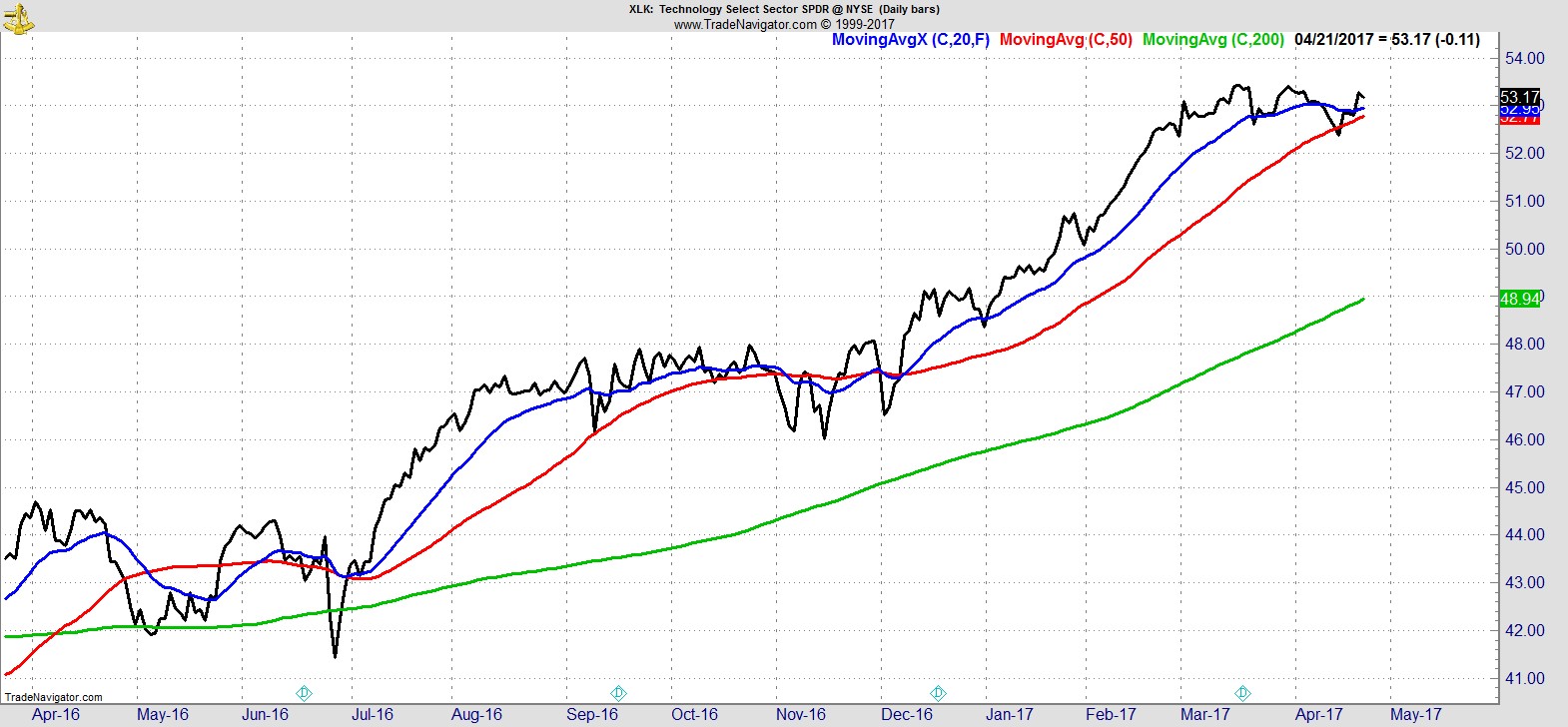

There's a welcome change at the top this week with Consumer Discretionary and Technology taking back the lead roles.

.

They're followed by Industrials, Utilities, Staples, and Real Estate which are all above their 50-day MA. Then comes Materials, and Healthcare, below their 50-day, but above the 200-day.

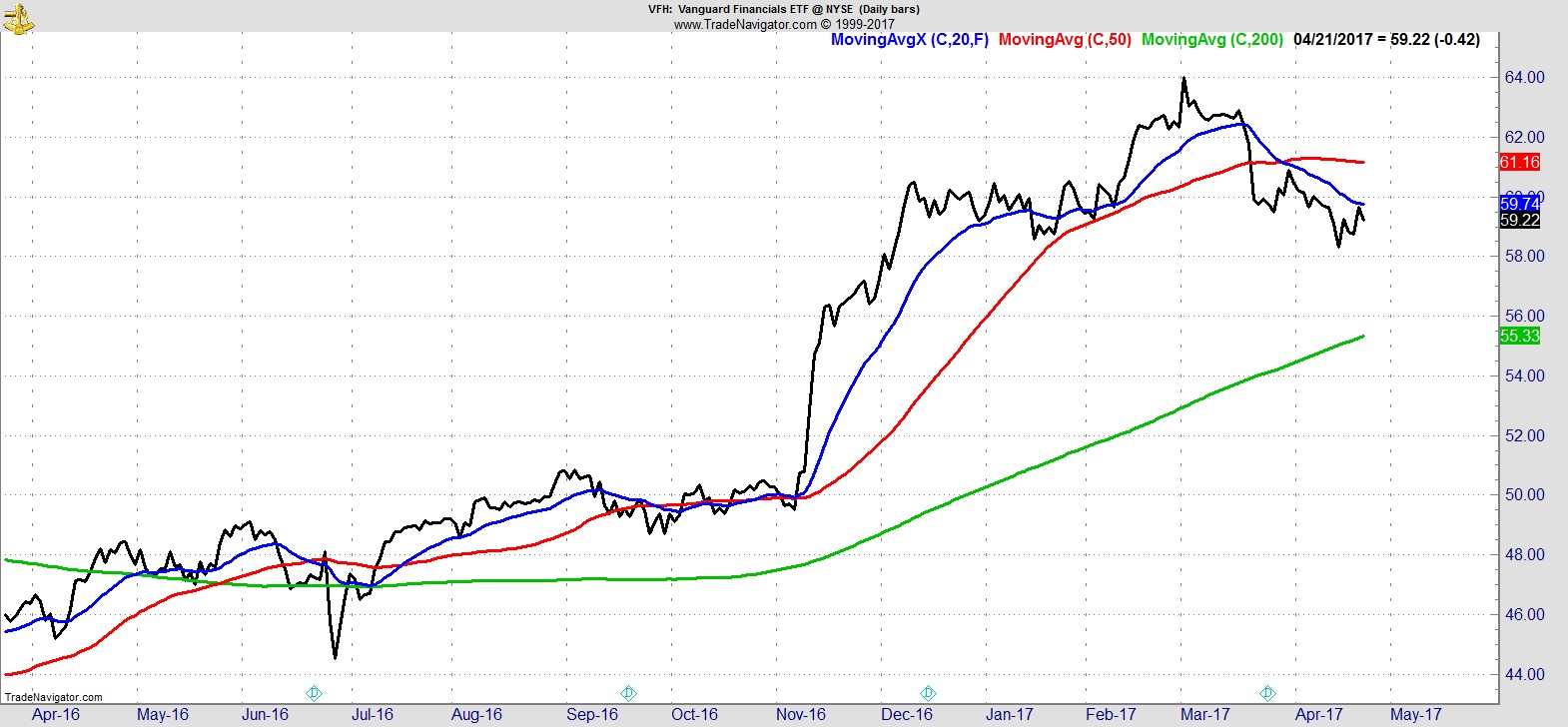

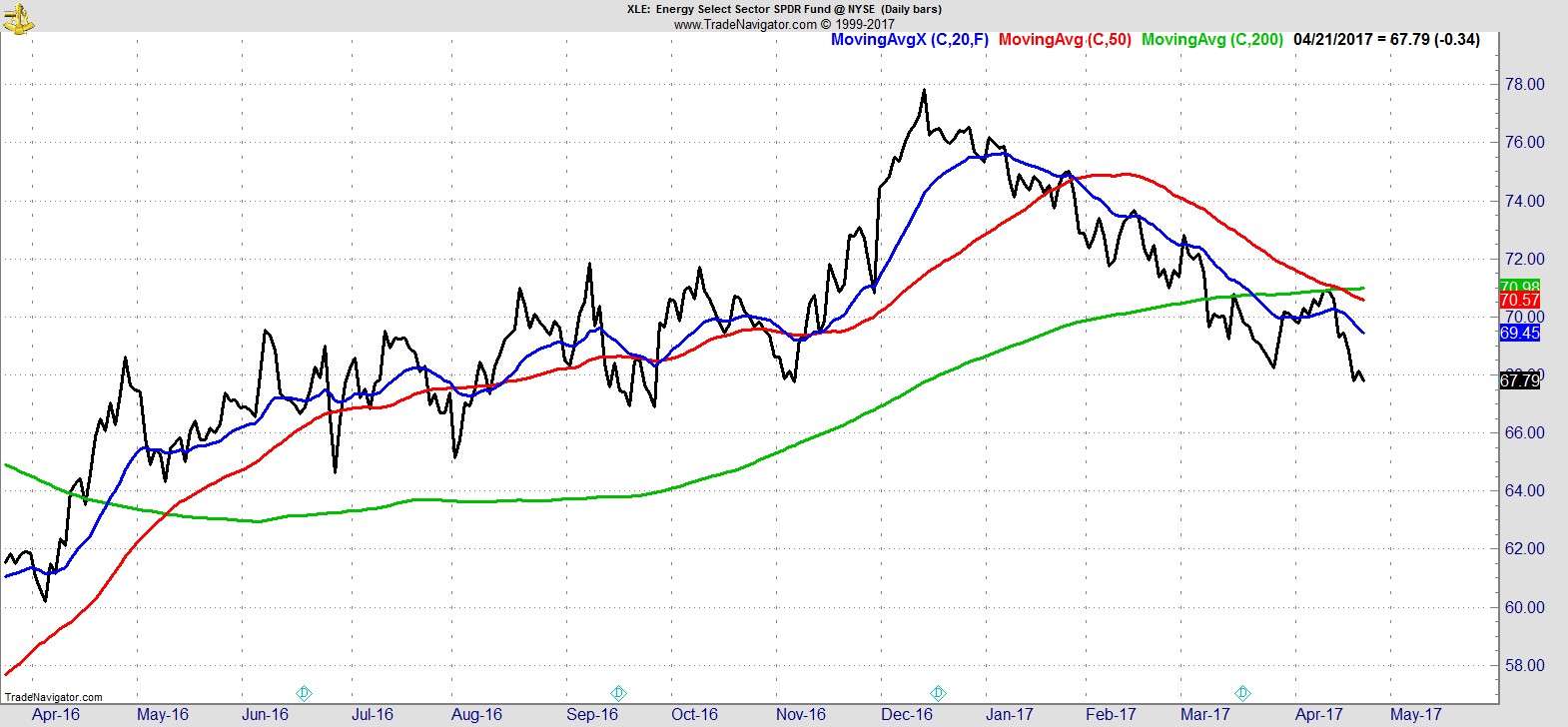

At the bottom remain Financials, which recovered but still has much work ahead, and Energy, which slumped back to its pre-election levels of early November, and is the only sector below its 200-day.

.

Alpha Capture Portfolio

Much like the market, our model portfolio made back all of last week's losses, climbing +1.31% this week vs +0.85% for the S&P. We had four new entry signals across different sectors to bring us back up to 12 names, and around 7% open risk. Our cash is now down to 15%, having been over 40% this time last week.

This reflects the price action and opportunities we've seen, and although ideally I would have preferred to see some follow-through in the indices Friday and a stronger session to end the week, it was noticeable we saw exactly that in 5 of our 12 names, in a session where the major indices all finished lower.

.

Watchlist

Reflecting the renewed strength in the market this week our watchlist is again dominated by technology and consumer discretionary stocks. Here's a generous sample from the full list of 30 names:-

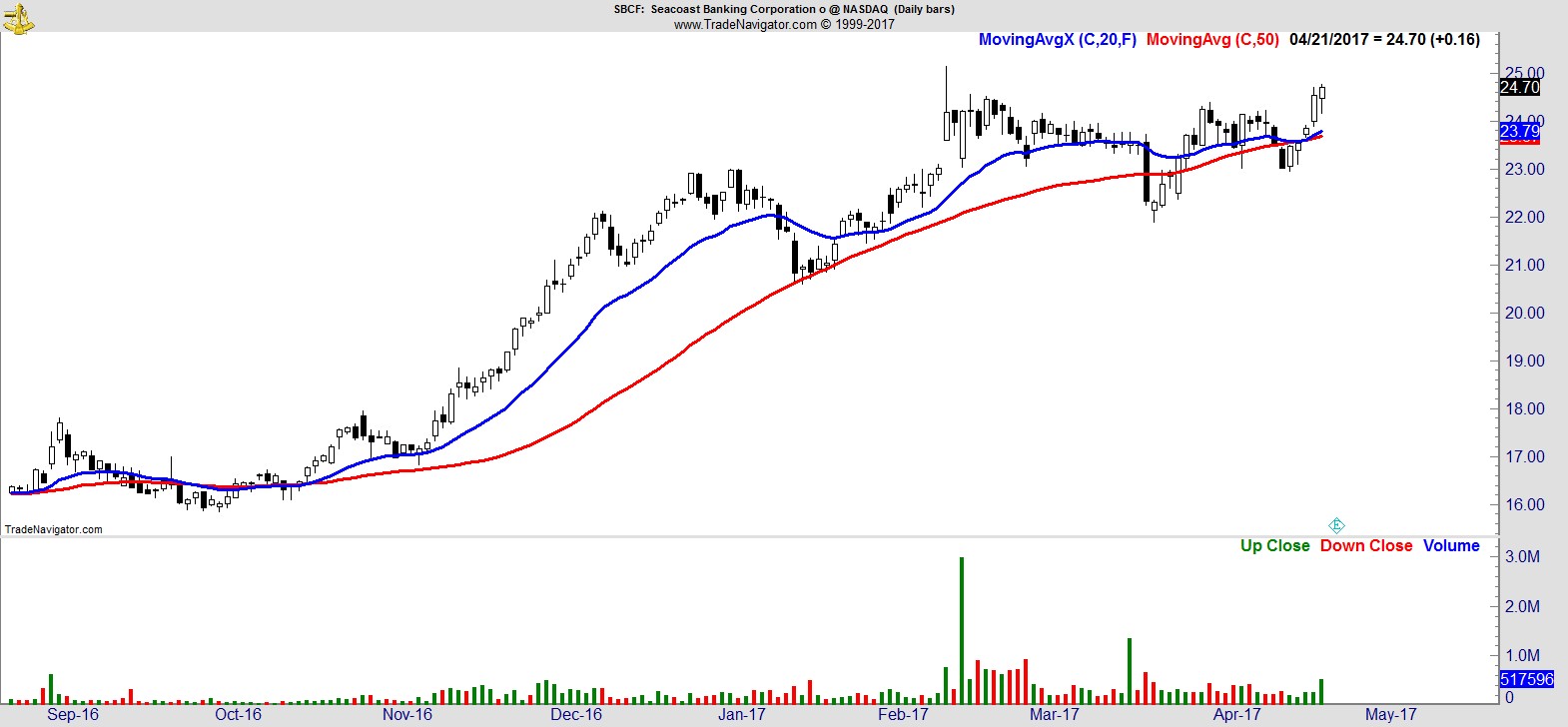

$SBCF

.

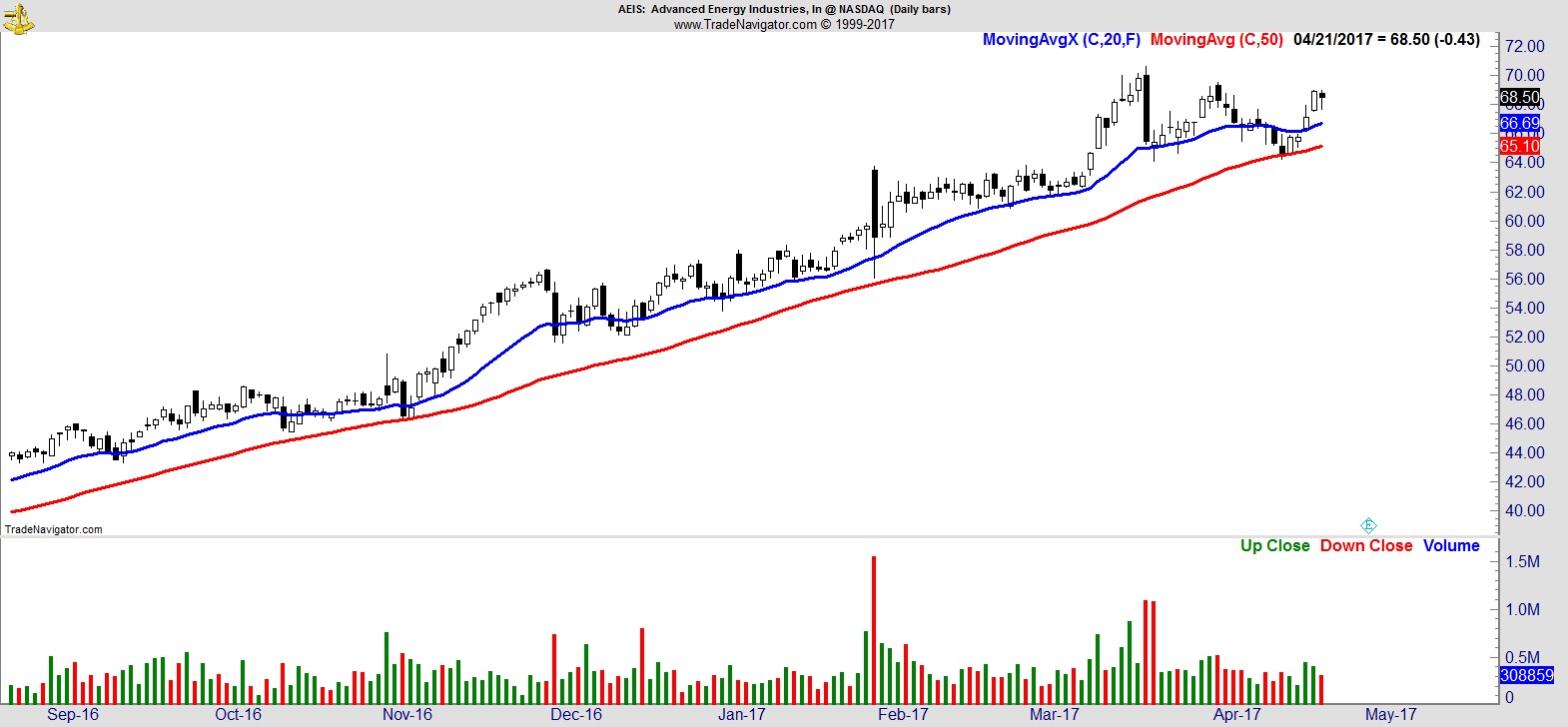

$AEIS

.

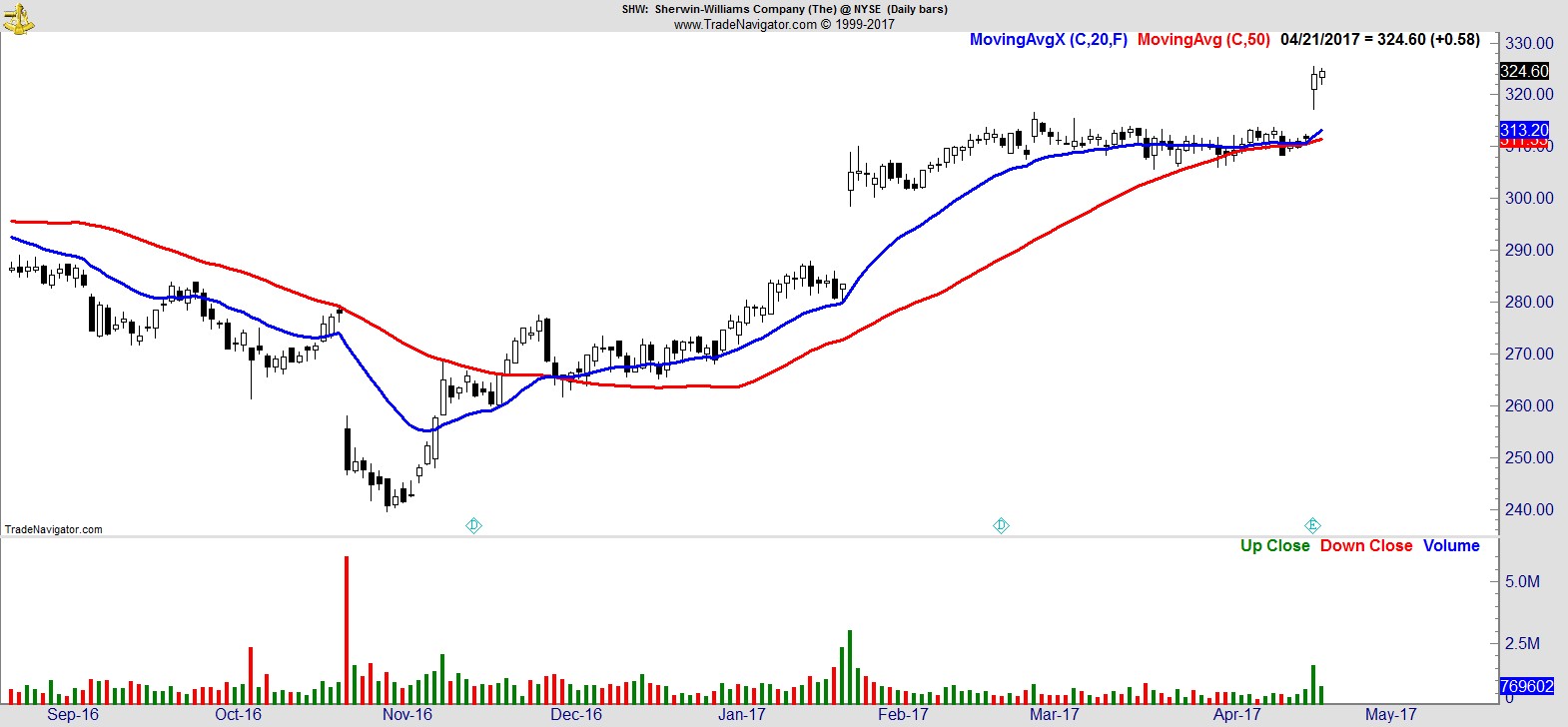

$SHW

.

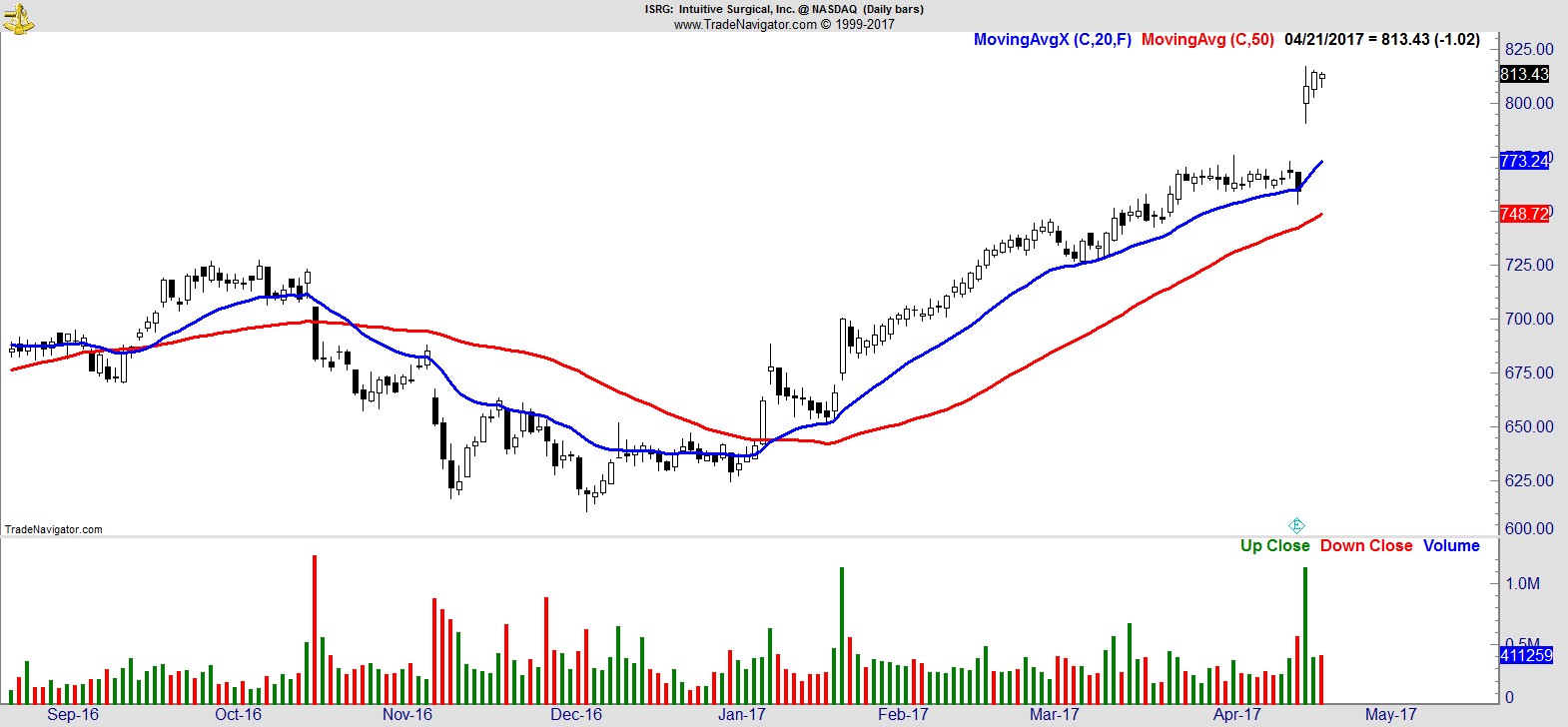

$ISRG

.

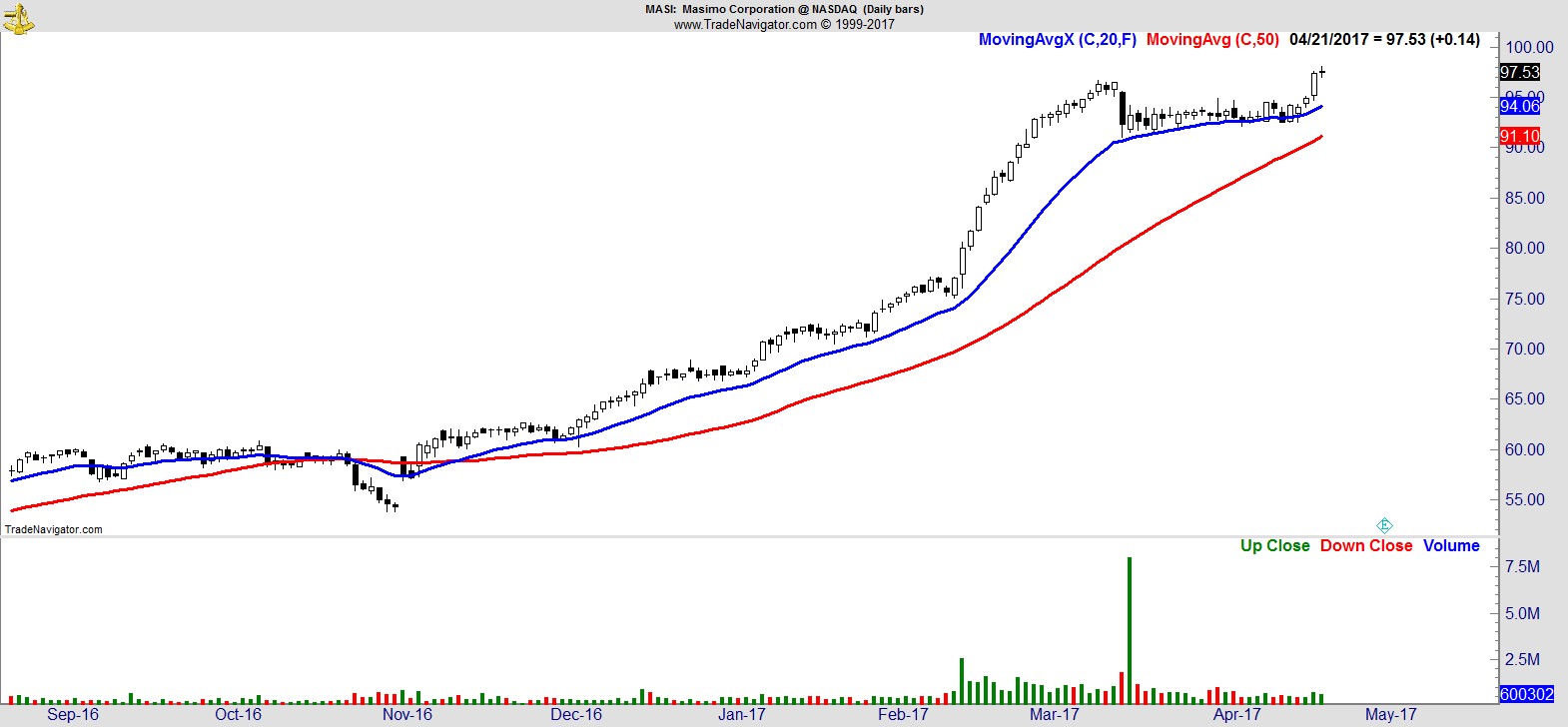

$MASI

.

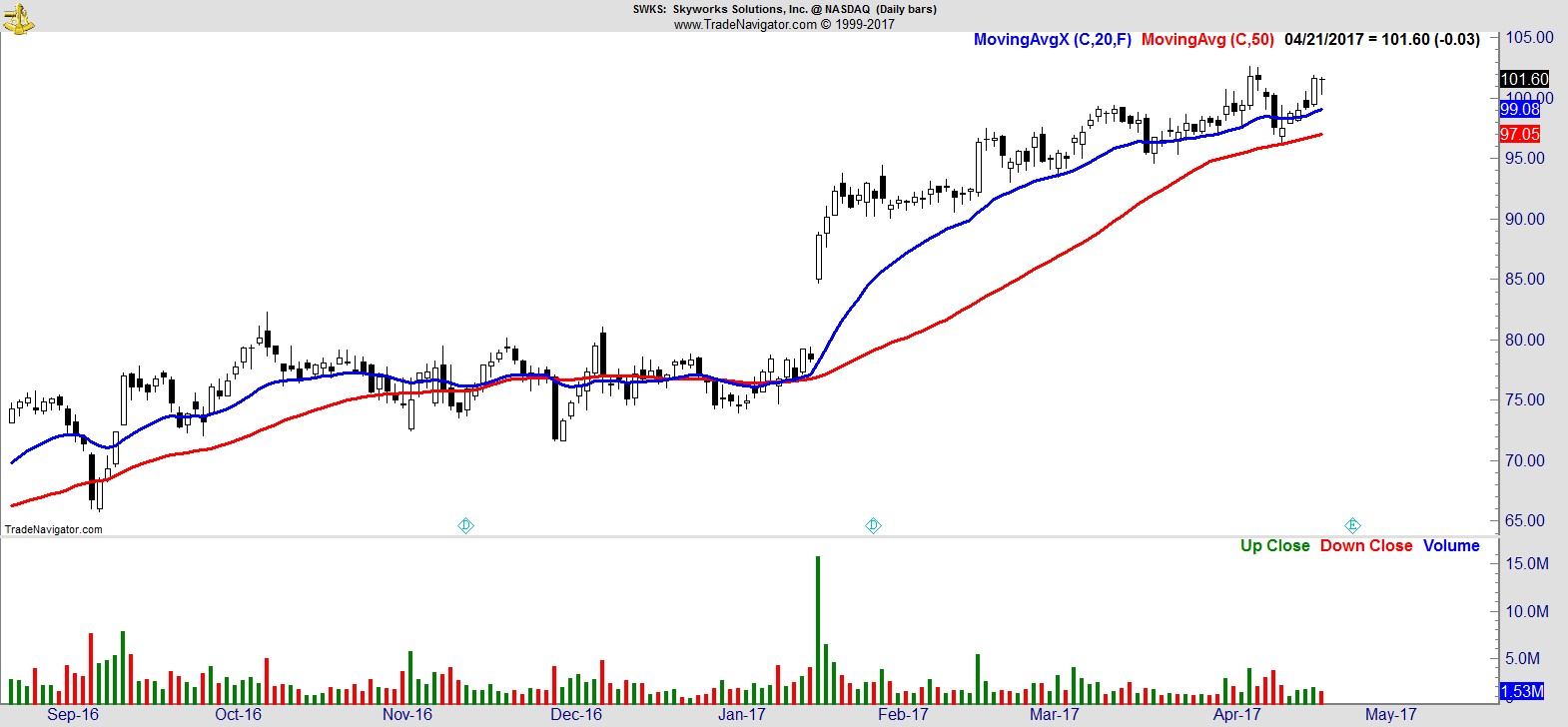

$SWKS

.

$SNPS

.

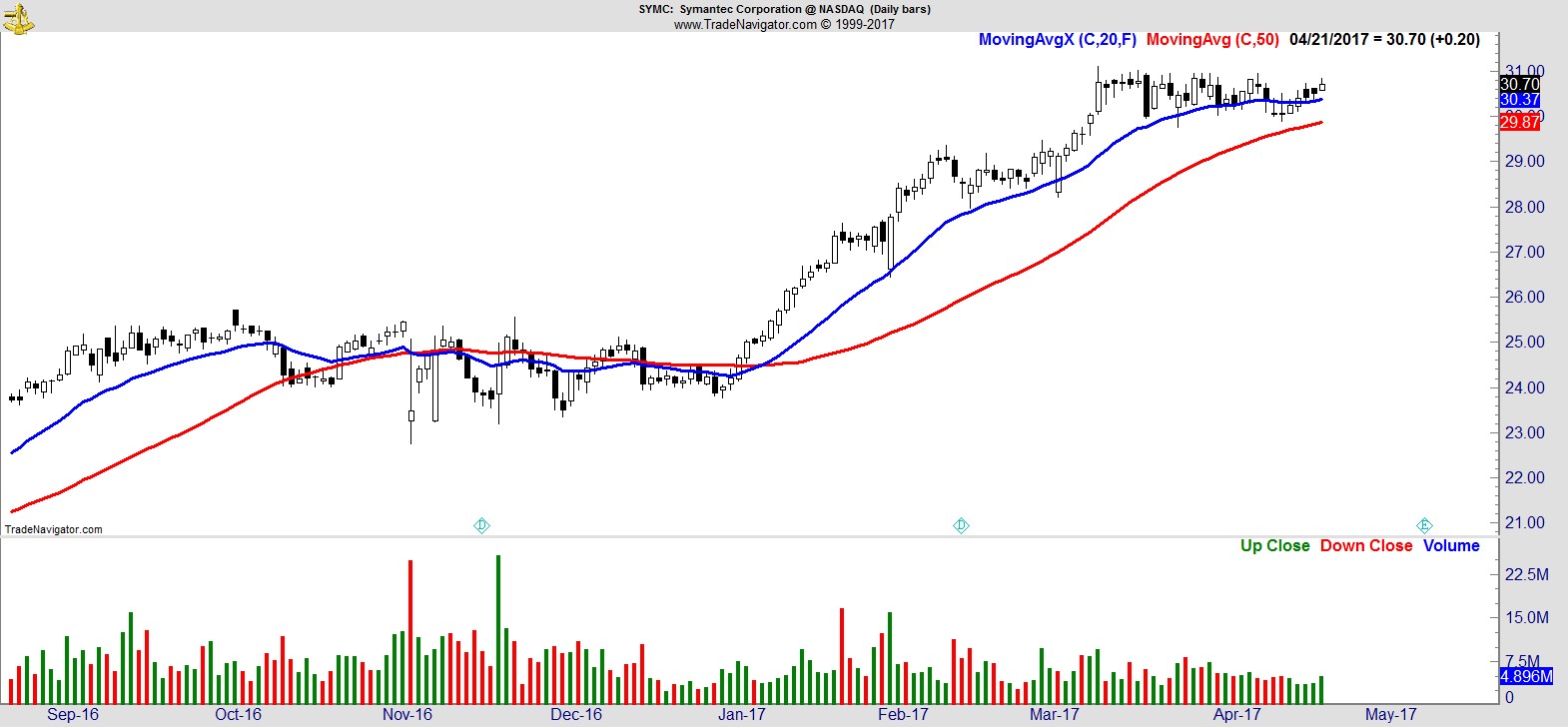

$SYMC

.

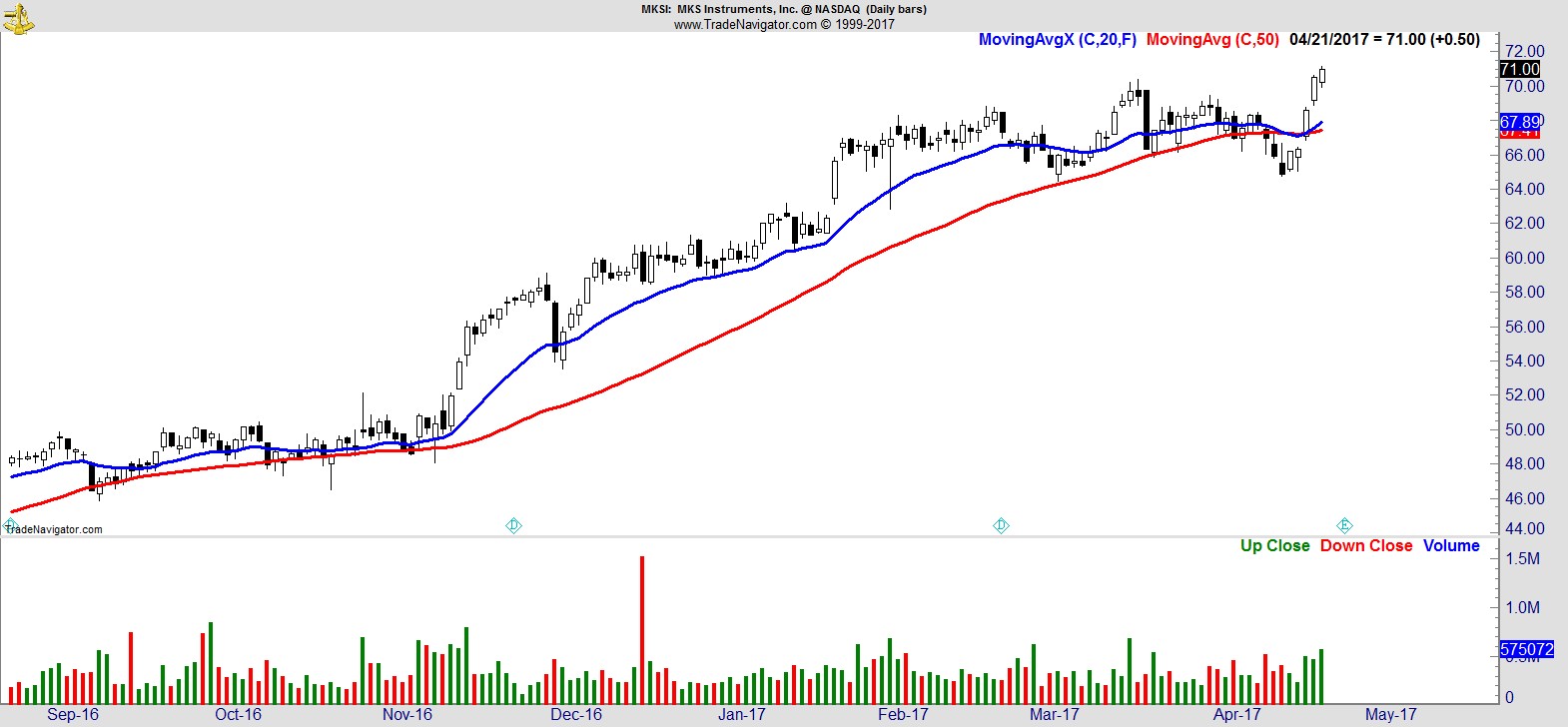

$MKSI

.

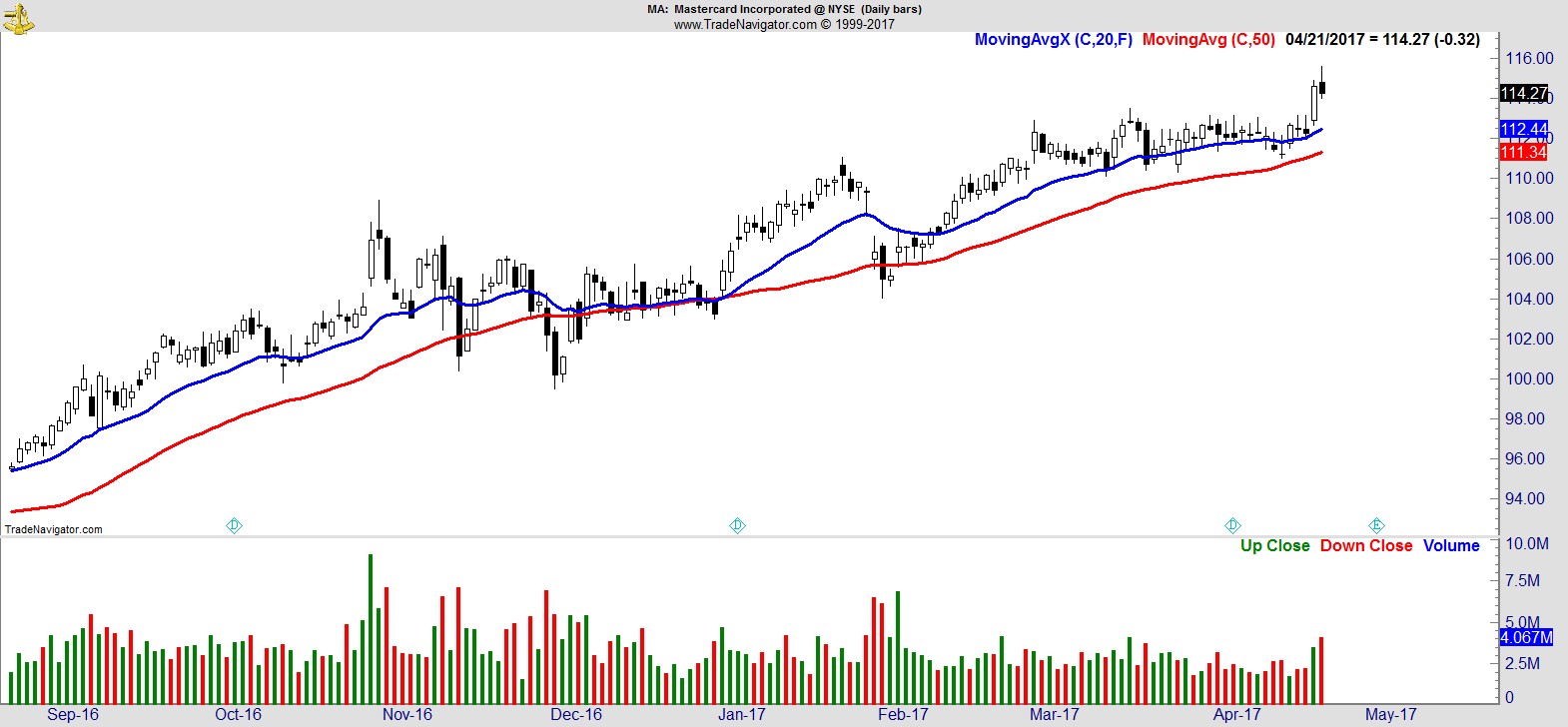

$MA

.

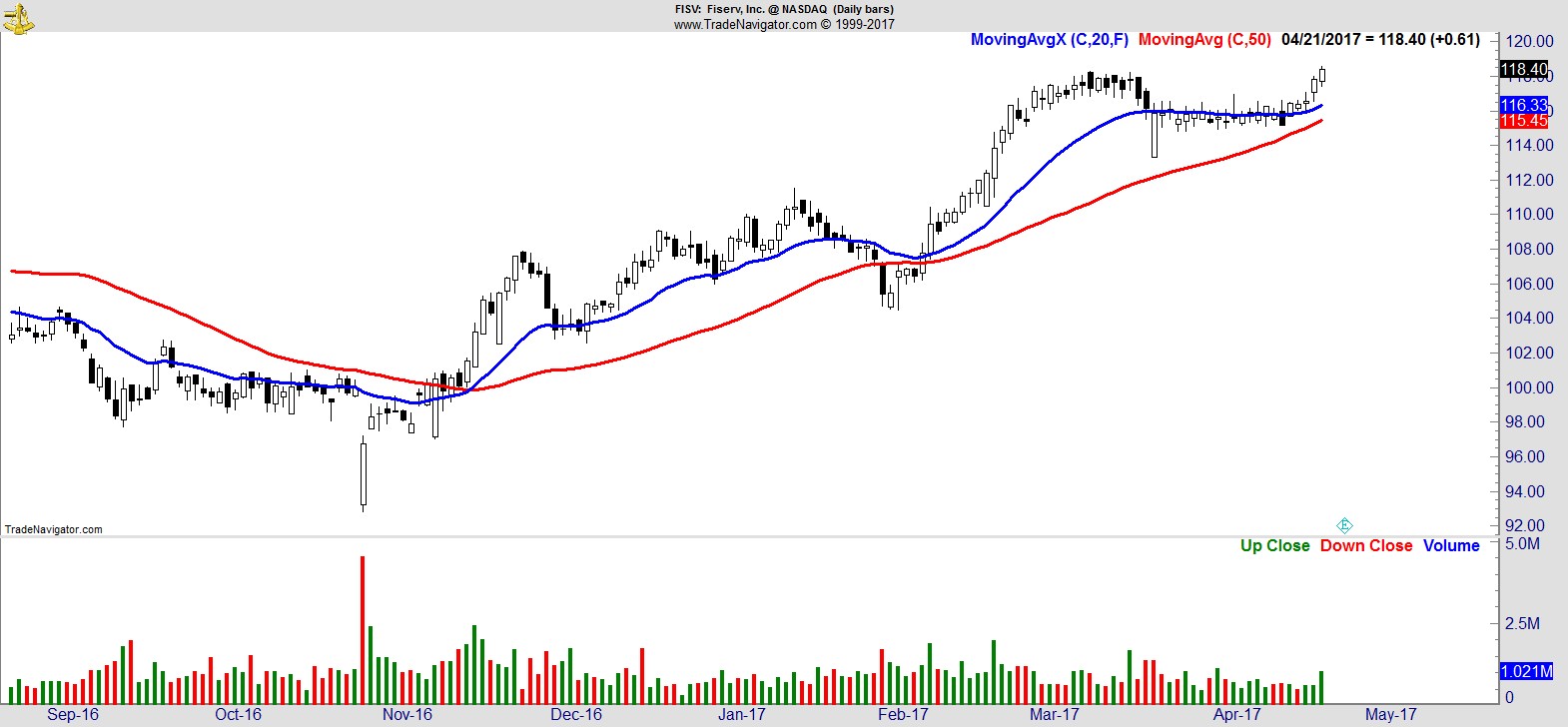

$FISV

.

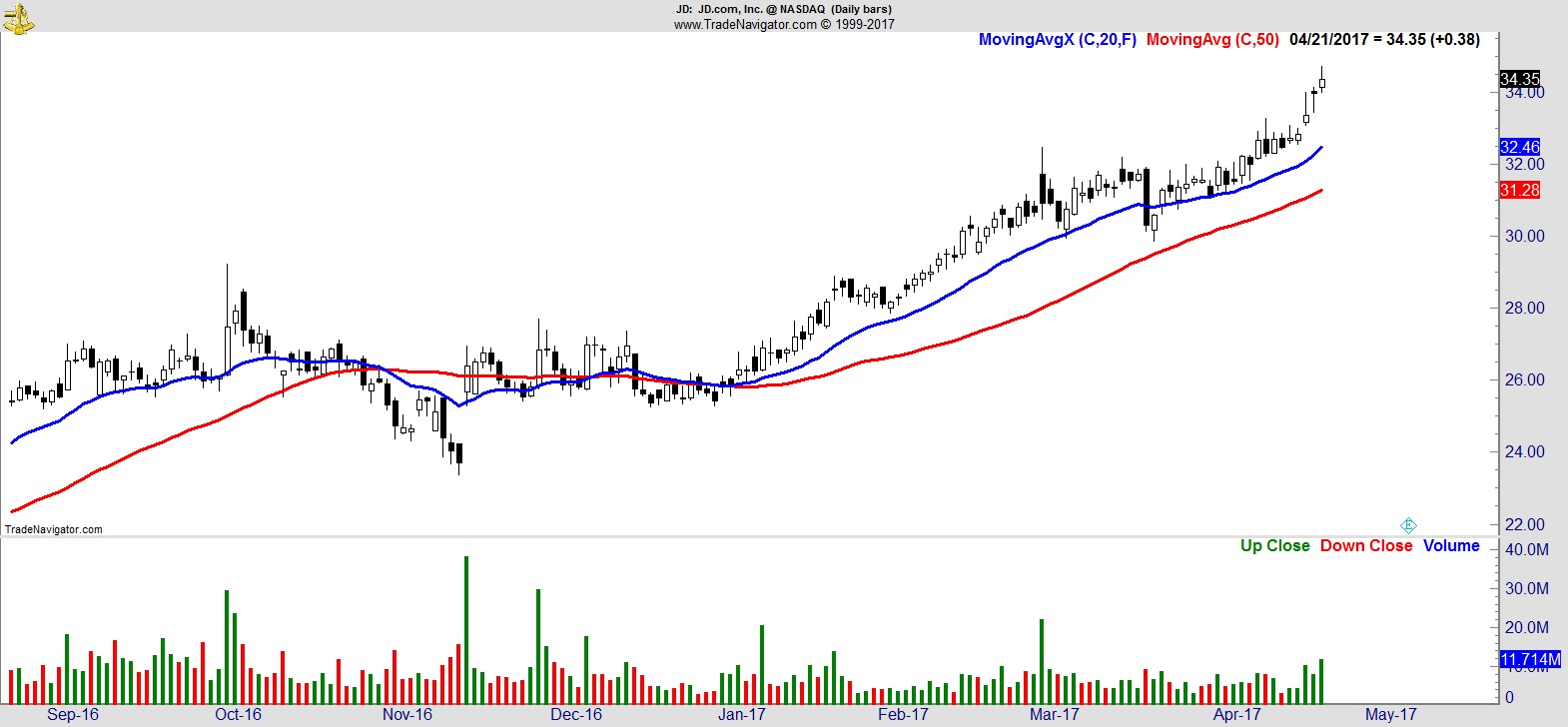

$JD

.

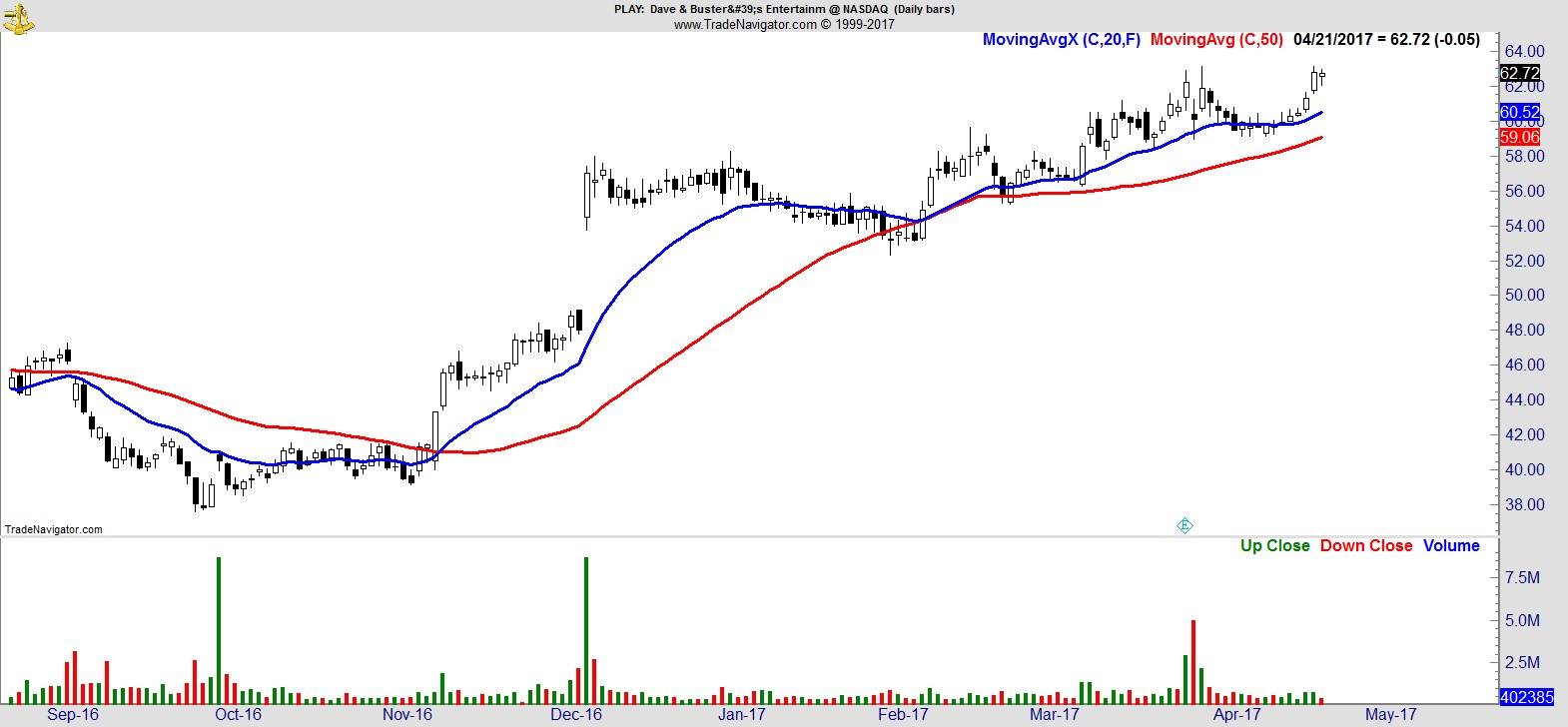

$PLAY

.

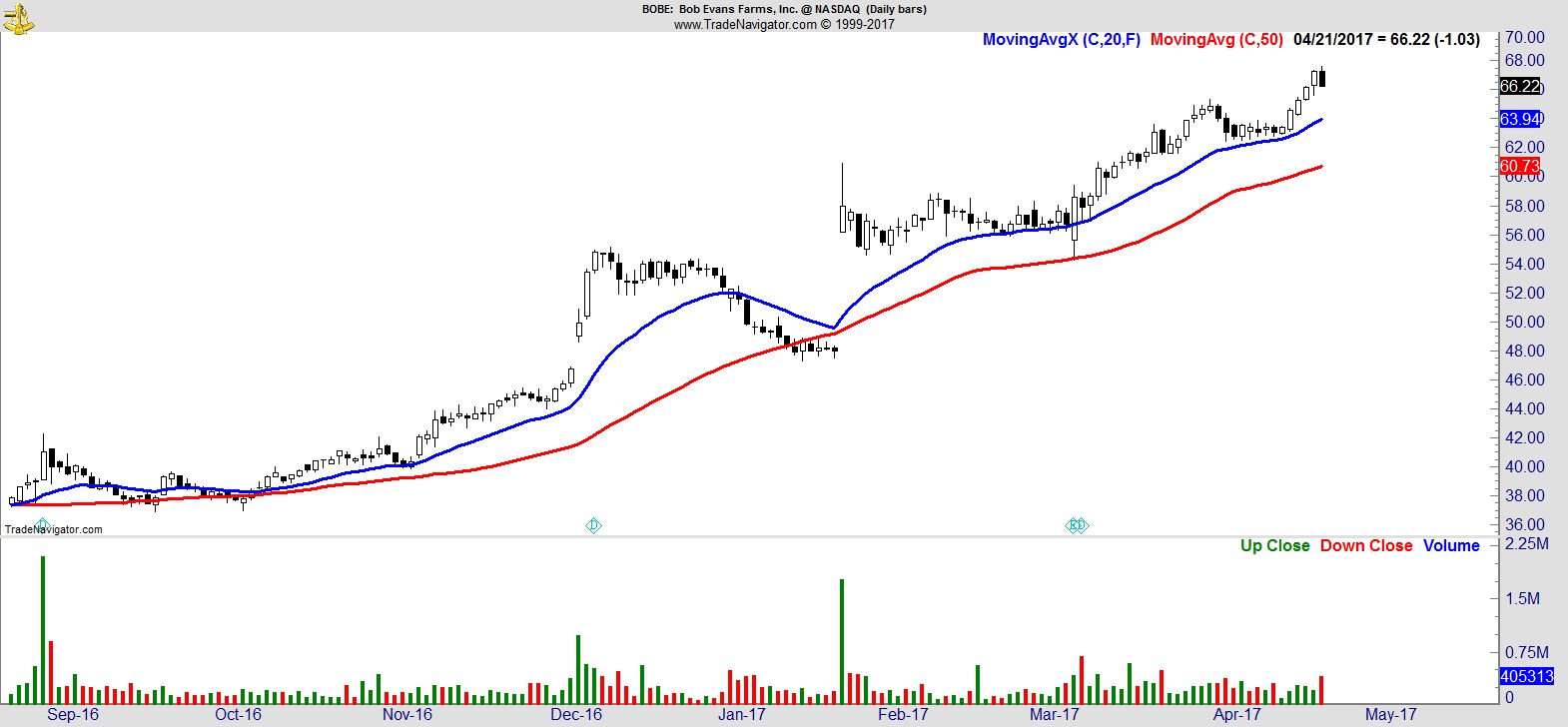

$BOBE

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17