Overview

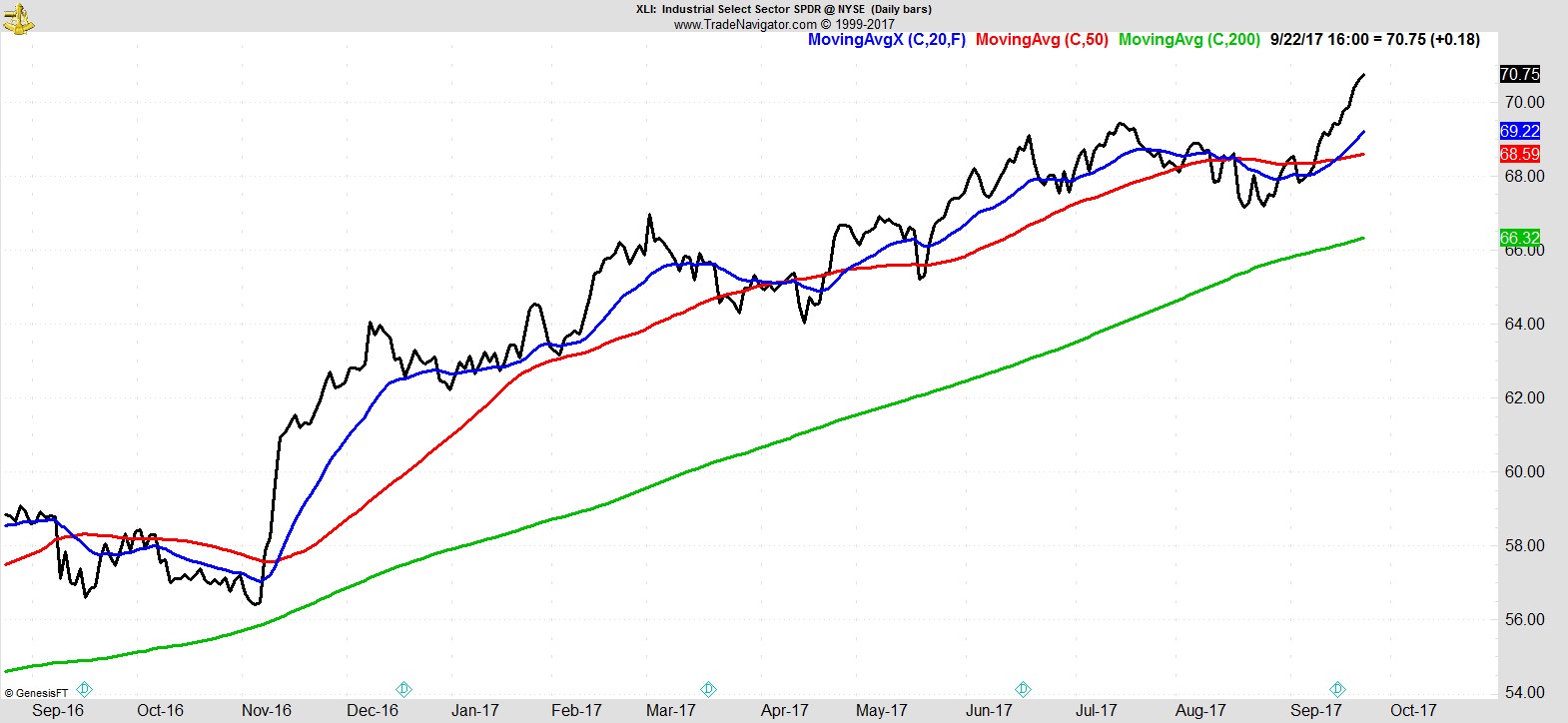

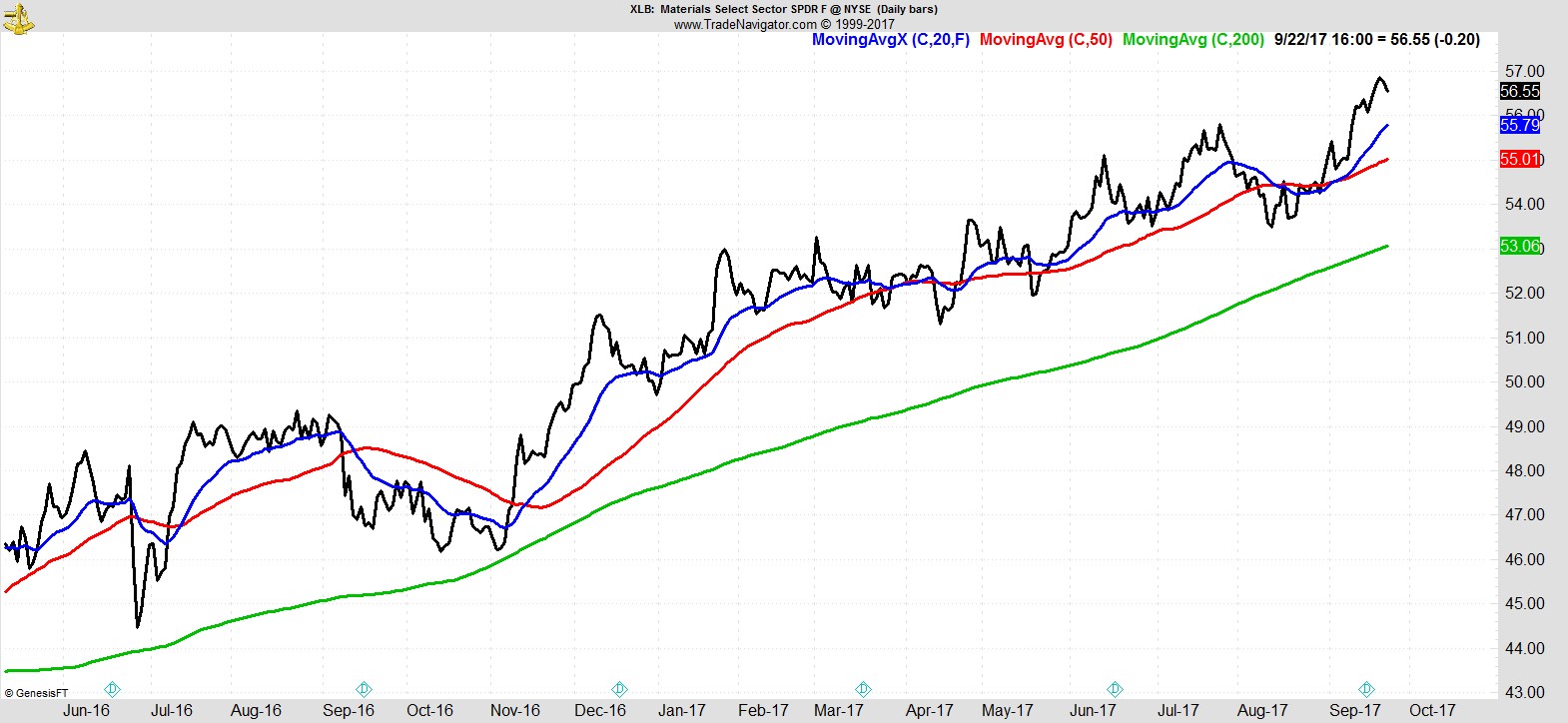

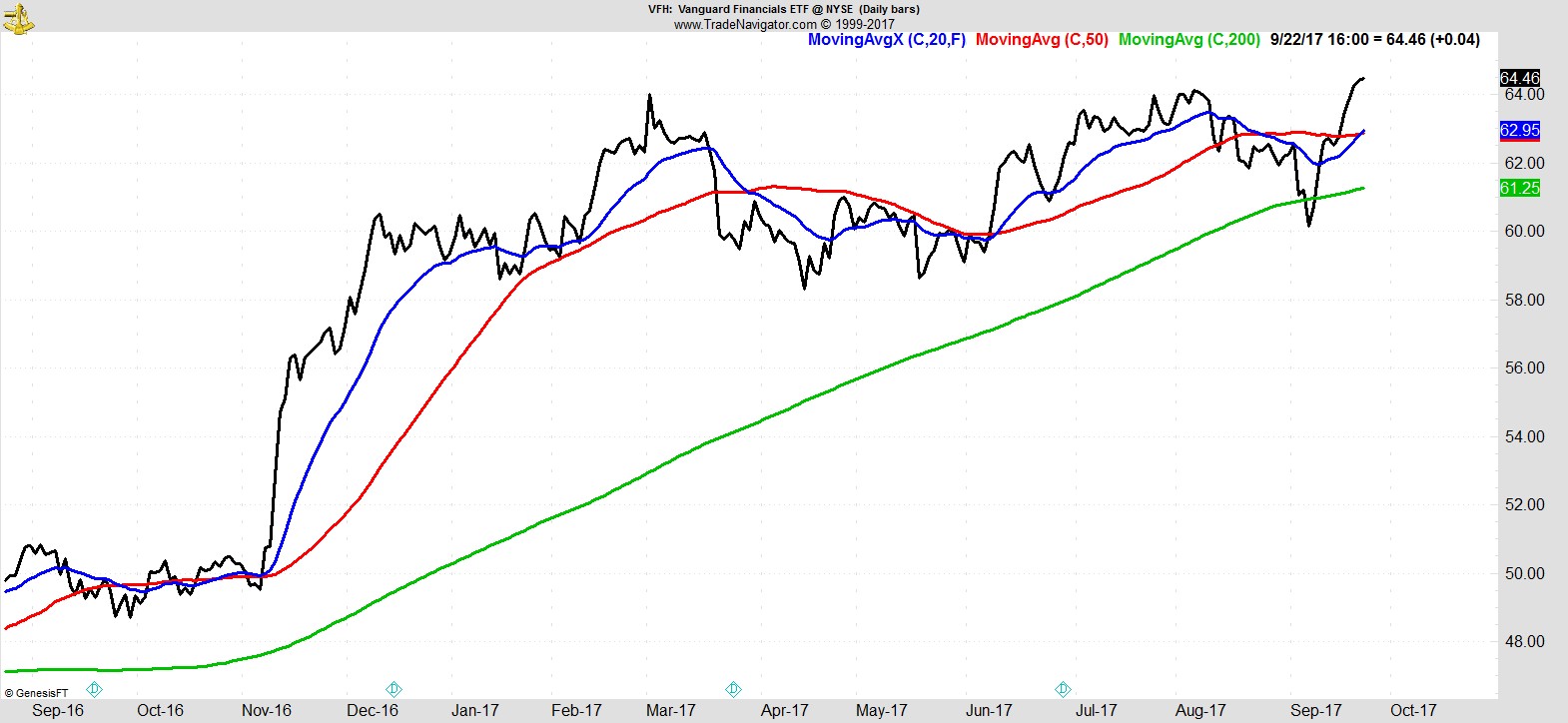

US equities moved to new highs, with the S&P maintaining its ground above the 2500 level achieved last week. The Transports and Russell, which had lagged the previous move, were more dominant this week. Sentiment is elevated, but breadth remains strong with Industrials, Materials, Financials, and Energy leading, while the traditionally defensive high-yielding sectors of Utilities, Real Estate, and Staples came under pressure.

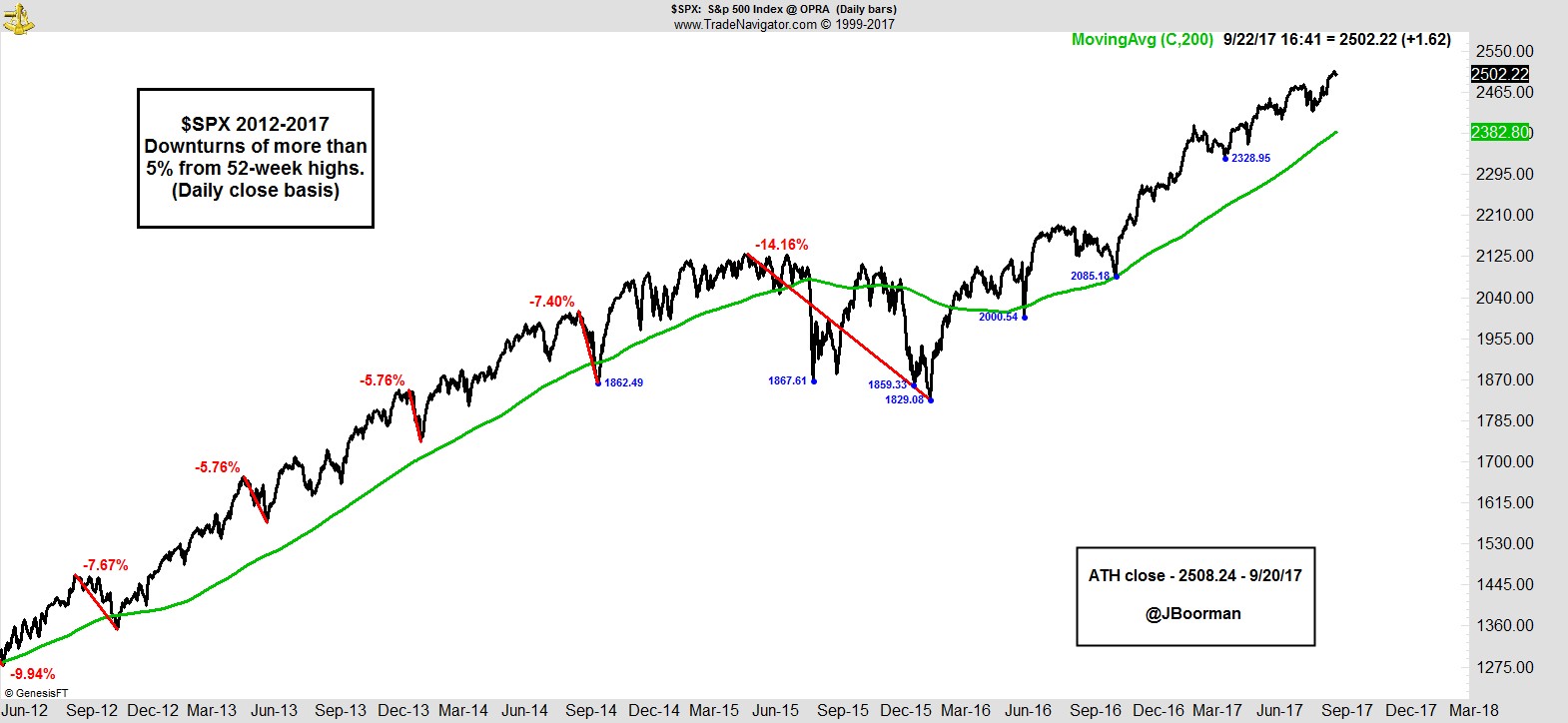

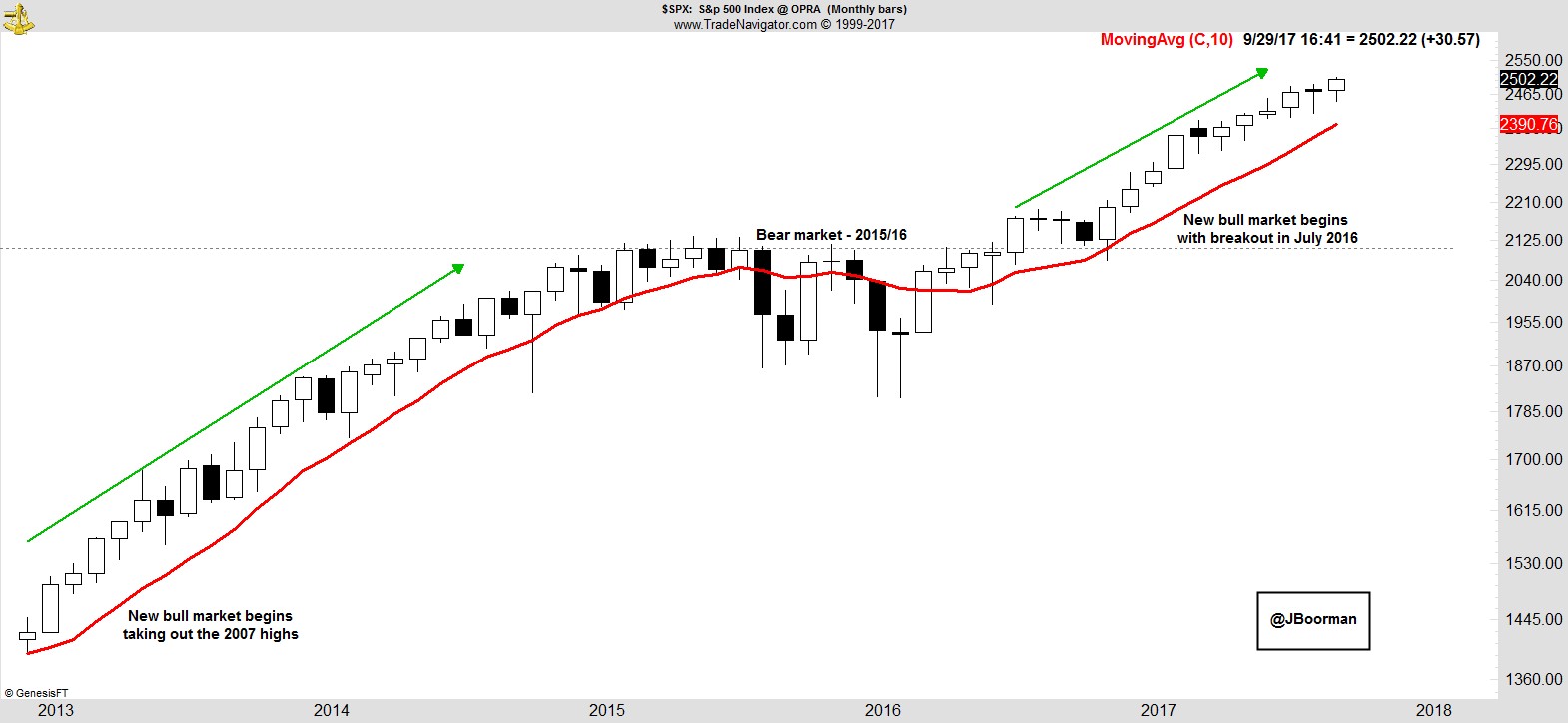

The S&P is yet to have a pullback of 5% on a closing basis since the new bull market began in 2016. As we enter the last week of September, the stair-stepping trend of higher highs and higher lows on the monthly chart continues.

.

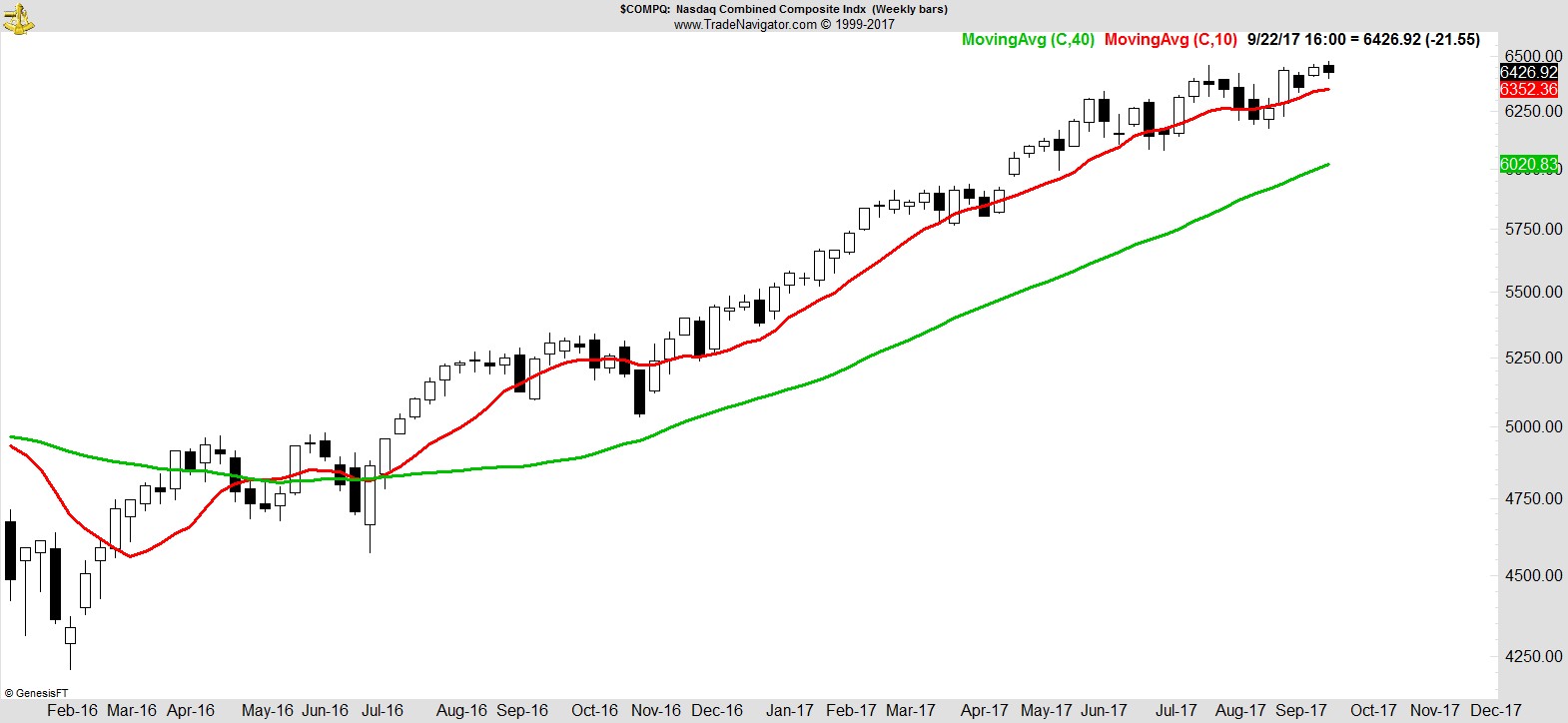

The S&P, Dow Industrials, NYSE Composite, Russell, Midcap, and Microcap all finished at all time highs on a weekly close basis. Only the NASDAQ was modestly lower this week, and the Transports is just shy of new highs.

.

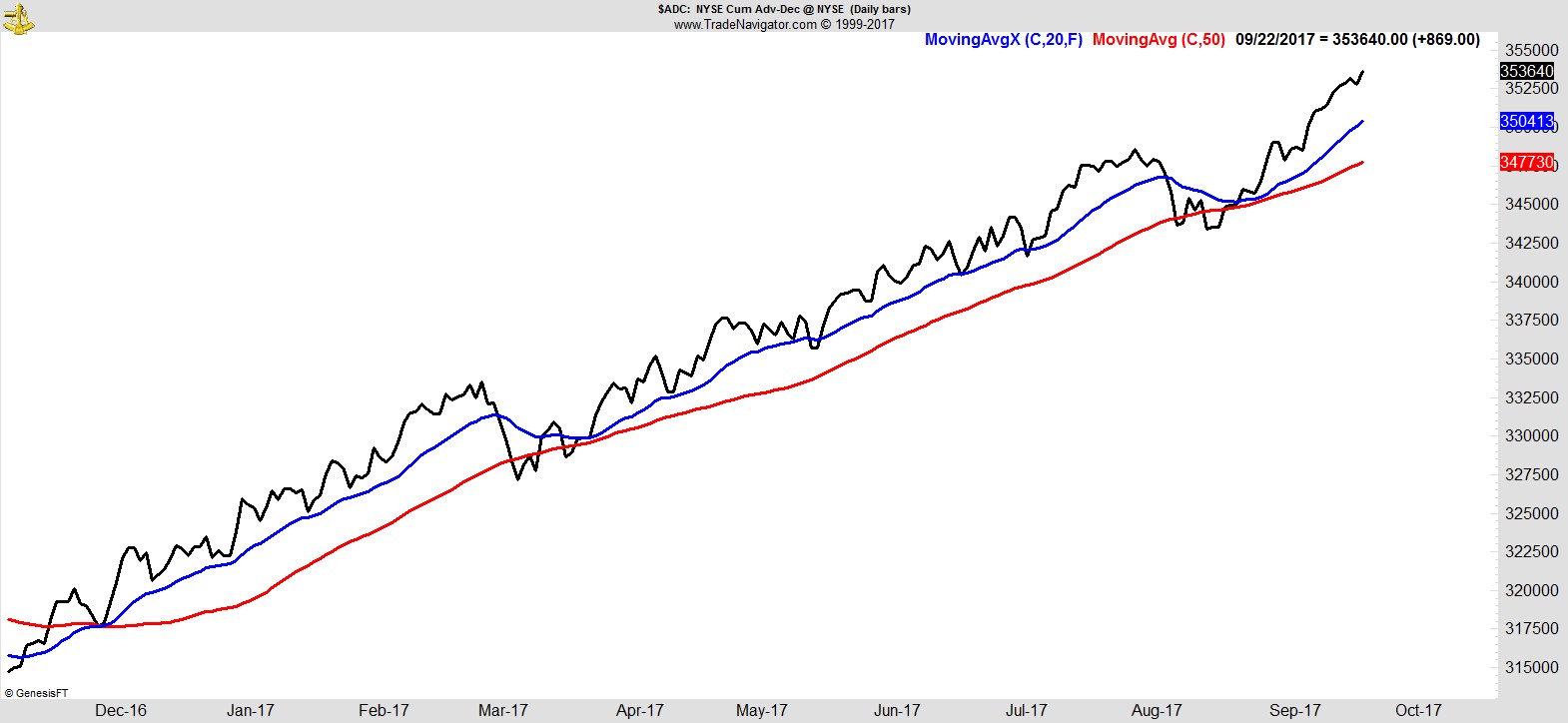

Breadth also continues to improve, with the NYSE Cumulative Advance/Decline at all time highs.

.

Sector Analysis

Of the ten S&P Sector SPDRs, Industrials and Materials lead the way, and were joined at the top this week by a resurgent Financials sector.

.

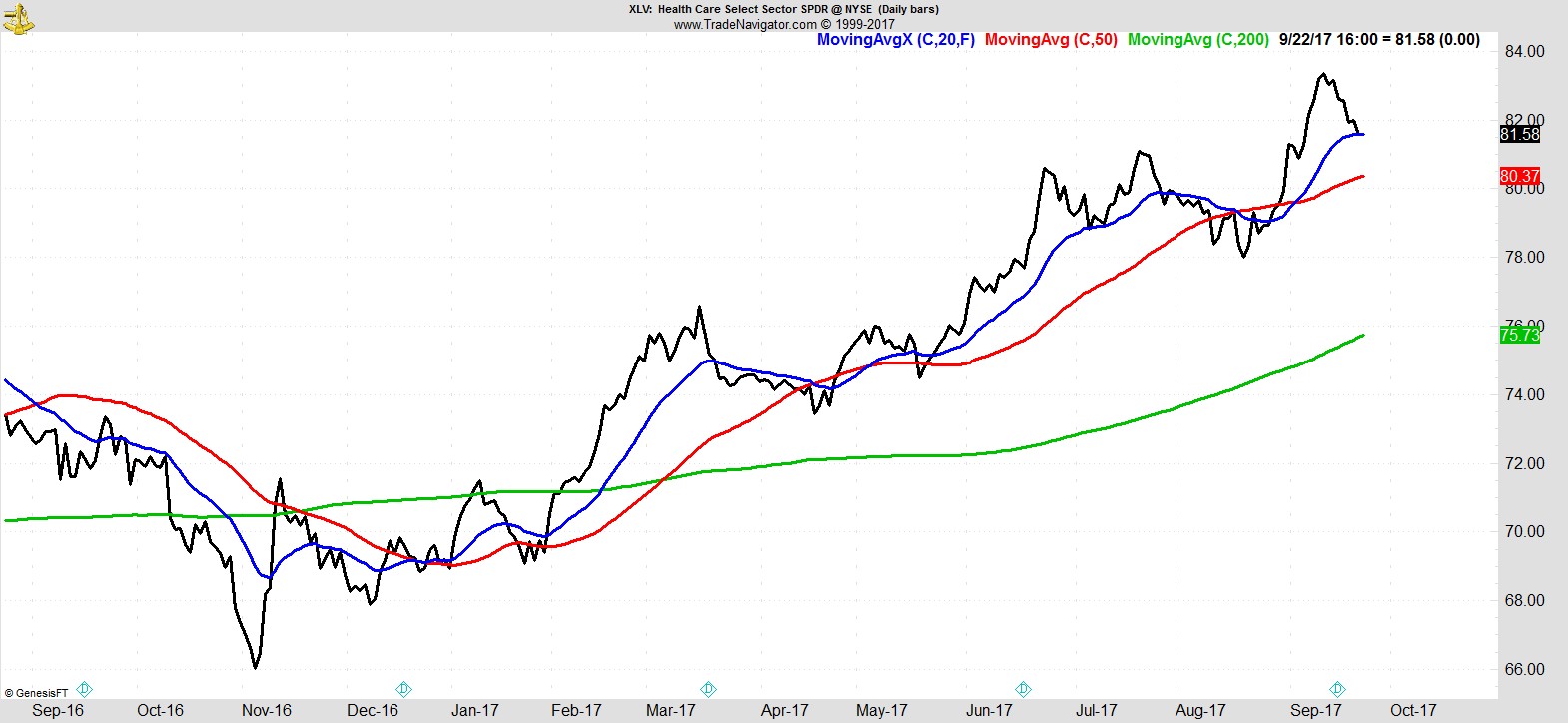

They're followed by Technology and Healthcare, which eased back from their recent highs to test their 20 EMA.

.

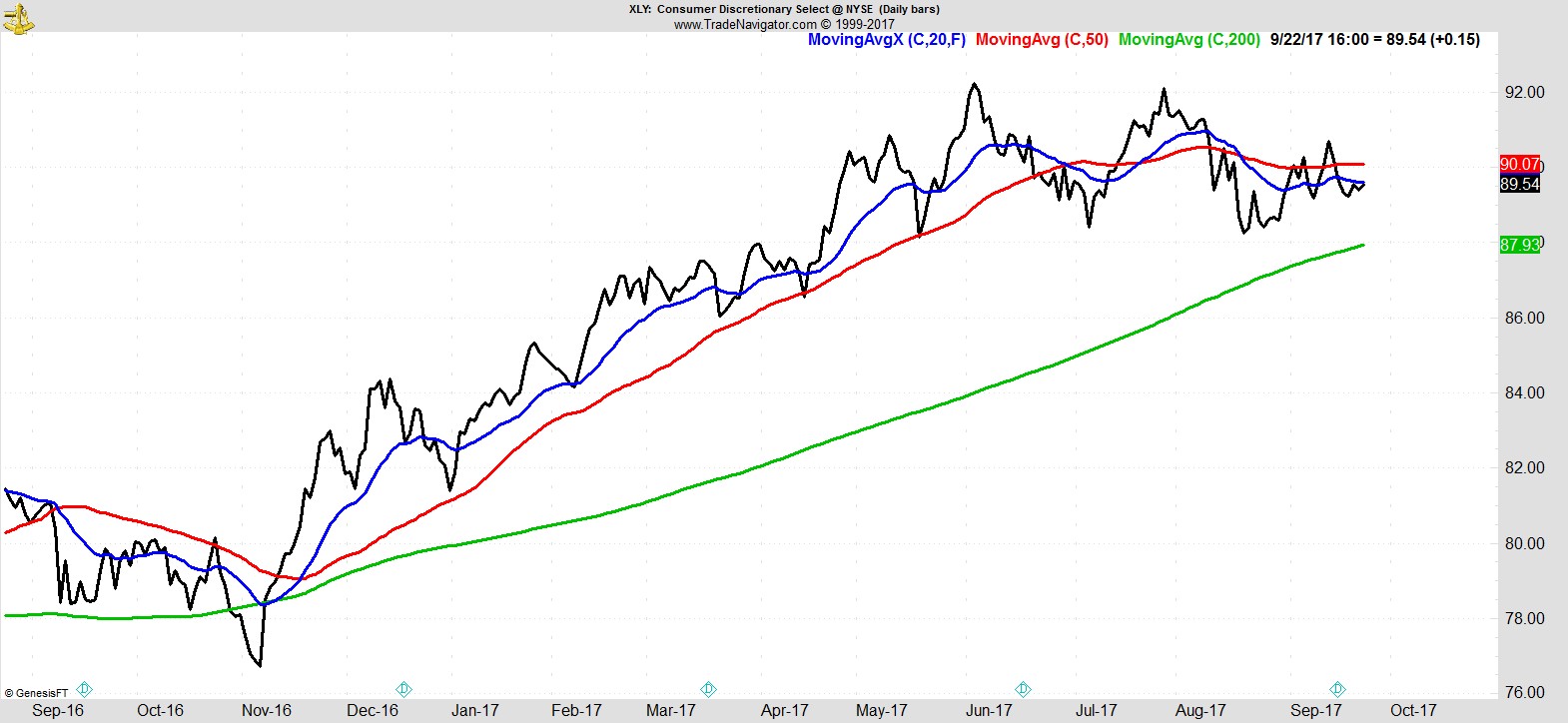

Then comes Consumer Discretionary, which remains held under its MAs, and Energy, which despite still being under its 200-day, has now improved considerably and is making multi-month highs.

.

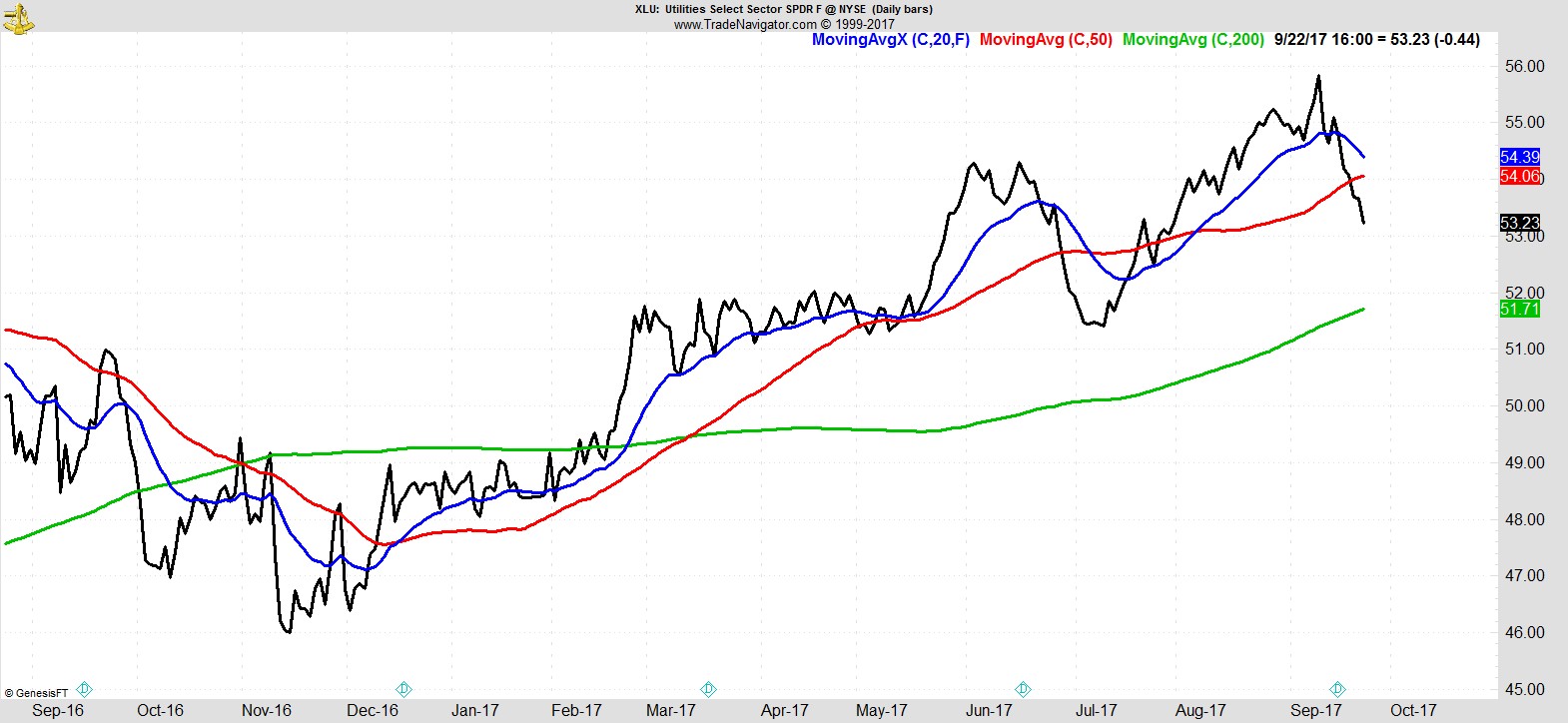

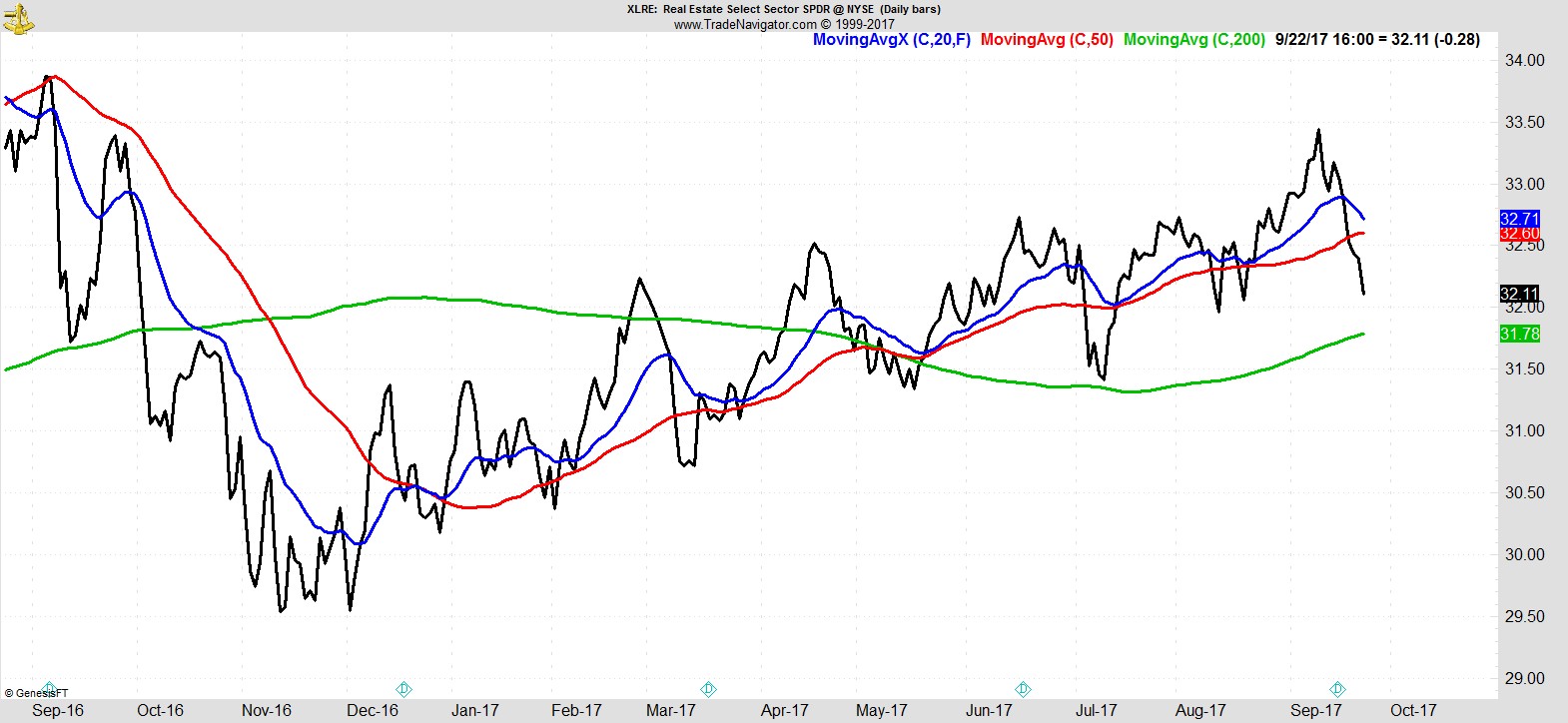

Below that I have Utilities and Real Estate, which moved lower for a second straight week, slicing through their 50-day MA.

.

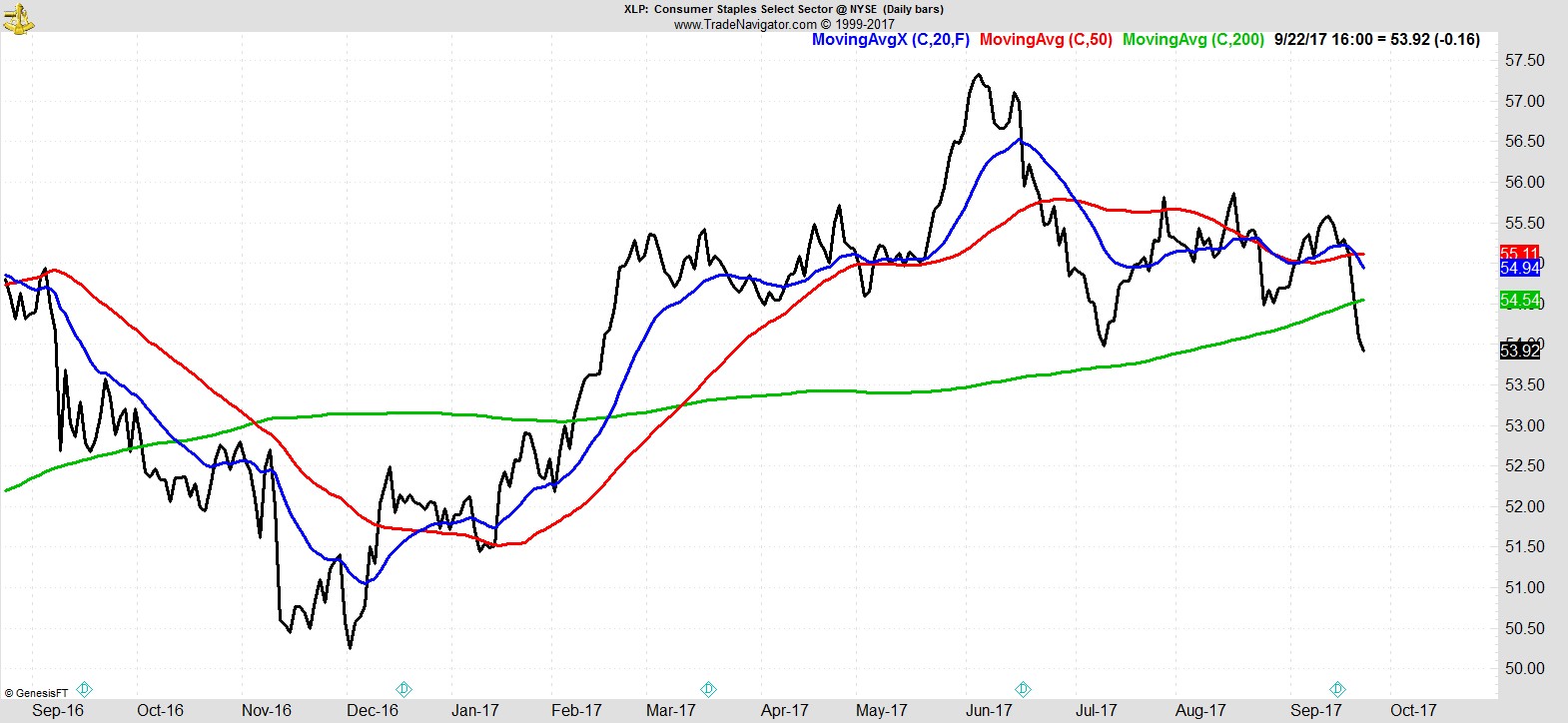

Last of all is Staples, which had an ugly week, plunging through its 20, 50, and 200-day MA in the space of four days, to end the week at 7-month lows.

.

All told, this appears to be a very healthy market environment. The major indices are at all time highs. Bullish sentiment is elevated, but breadth is strong, and with former laggards of small caps, Financials, and Energy now picking up, while the bond proxies of Utilities, Real Estate, and Staples come under pressure, we could easily see a sustained move higher into year-end.

.

Alpha Capture Portfolio

Our model portfolio was -0.1% on the week vs +0.1% for the S&P. Despite being more or less in line with the market this was actually quite a disappointment, as we took a hit in $SUPN which slumped -25% on Tuesday, impacting our portfolio by 1.5%, negating what otherwise would have been a strong week.

These kind of events always help underline the importance of risk management and position sizing. This was a position that had been profitable, and that move took it well below our stop on a closing basis to trigger an exit for the next day.

A couple of things to note here: Your stop isn't the price where you get out, it's what triggers your exit.

Position size accordingly.

Having a stop 8% away for a loss of 0.50% to the portfolio doesn't mean you will only lose 0.50%. In this case the total impact (including open profit) was 1.5%. It happens. It will happen again. When it does you need to be able to brush it aside and move on. How?

Position size accordingly.

Consider also in a crash scenario it could happen to all of your positions, all at once. Every single position.

Position size accordingly.

This is why I monitor my open risk for every position and for the total portfolio every day. You should almost think of it as a 'best-case loss'. It's the minimum you would lose if you got stopped out of all your positions that day.

I've found that a position size with initial risk of 0.50% works well for me. Others do 1% or 2%, or even more. Think what those numbers would have translated to in our earlier example. You need to find what works for you.

Heading into next week the portfolio has 10 positions, total open risk of 6.0%, and cash of just under 10%.

.

Watchlist

A resurgence in Financials this week makes its way into our watchlist with many of the major banks screening, as well as a strong showing for industrials, while the number of healthcare and technology names eased slightly.

Here's a sample from the full list of 24 names:-

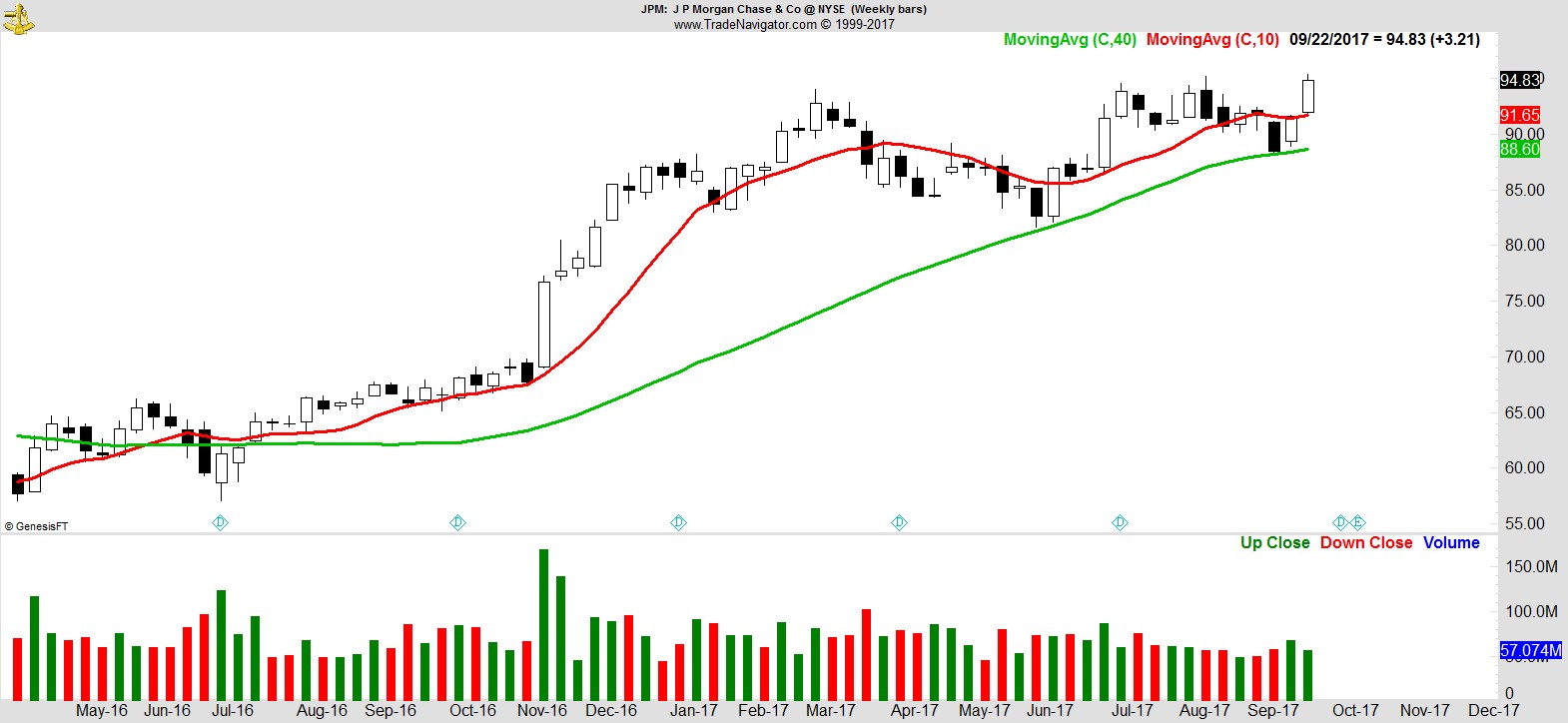

$JPM

.

$BAC

.

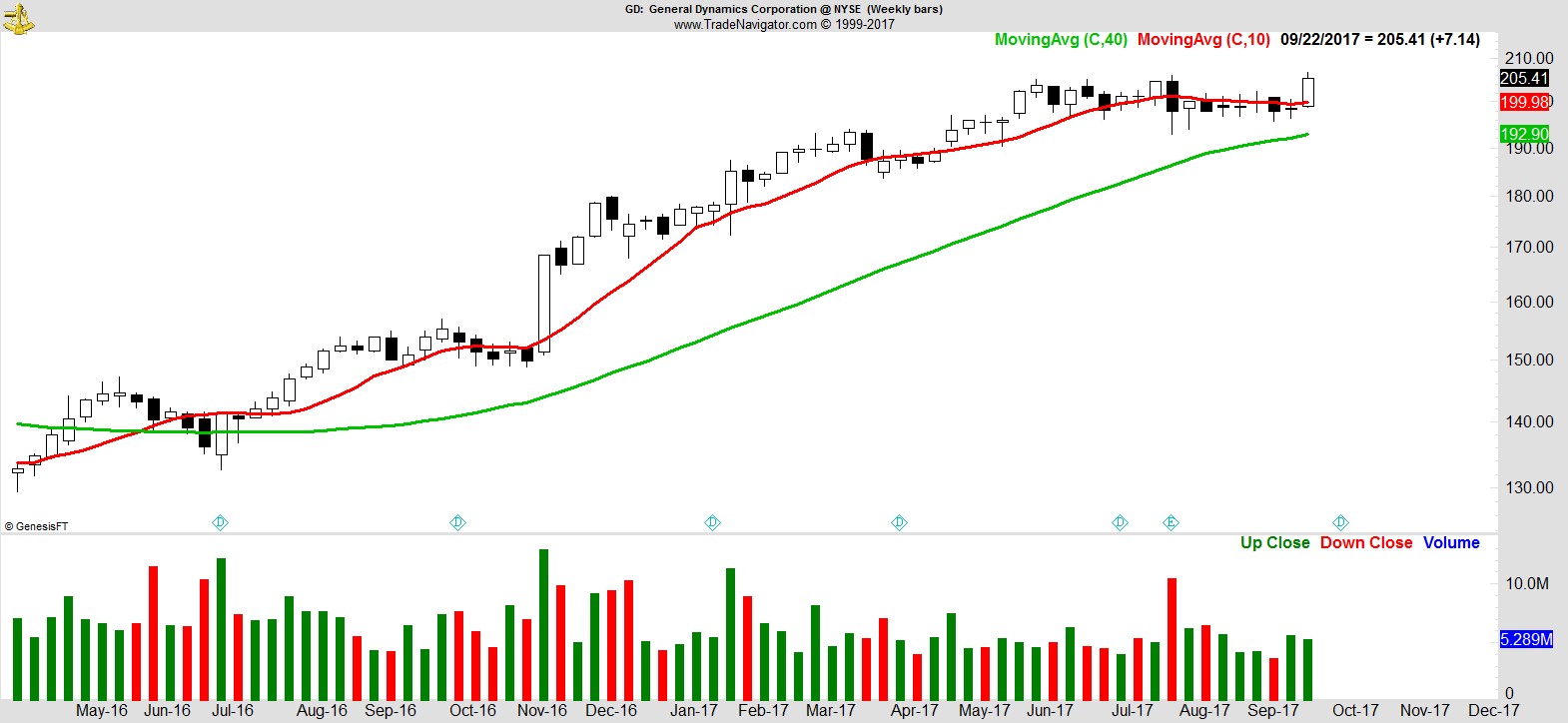

$GD

.

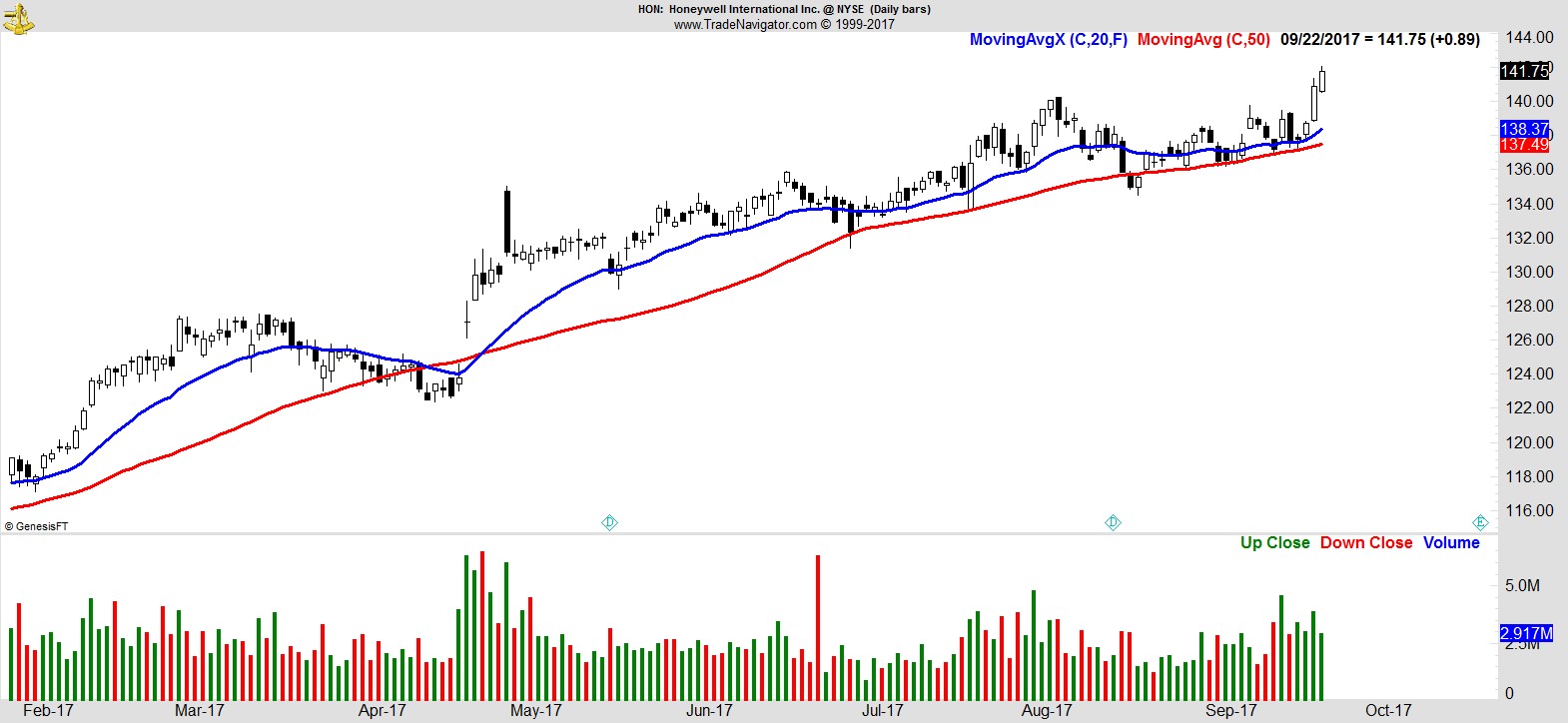

$HON

.

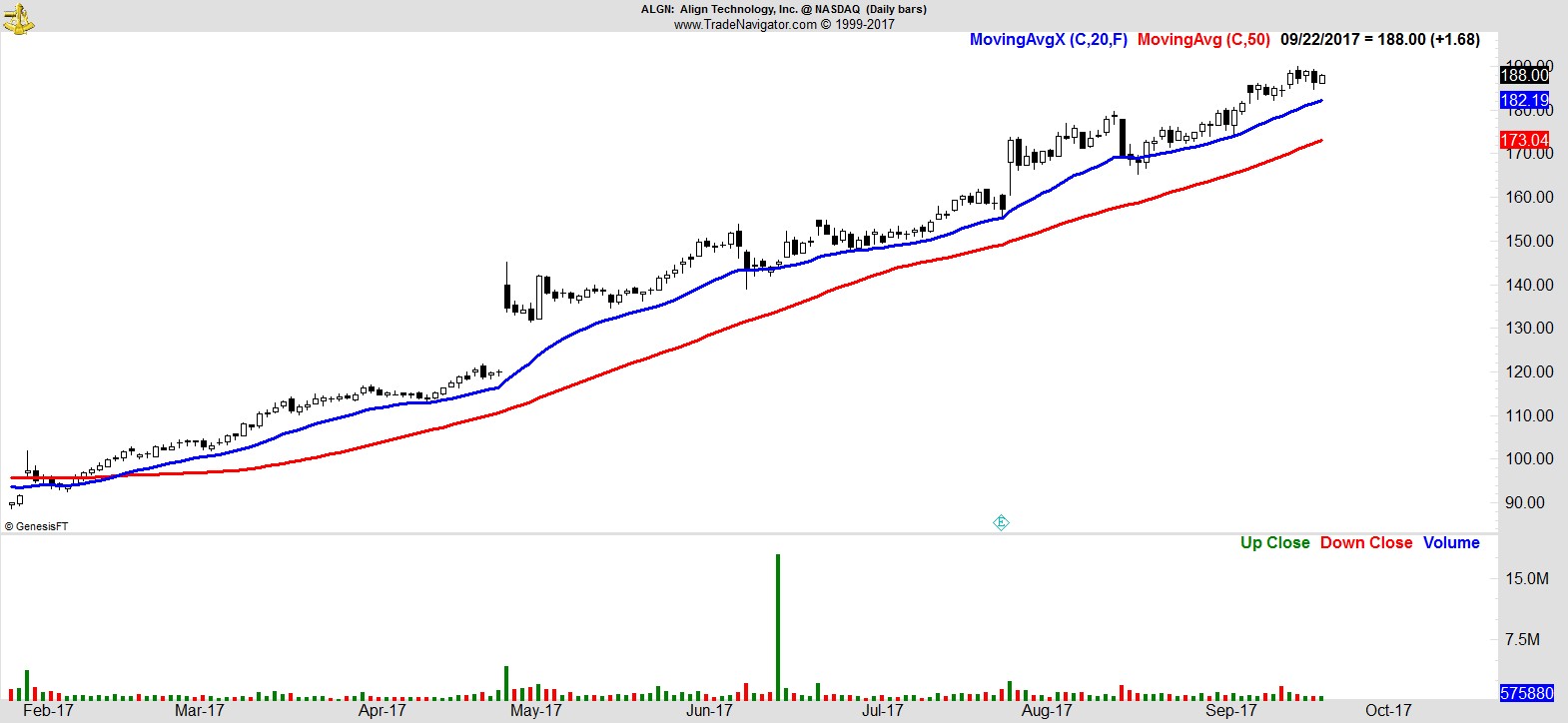

$ALGN

.

$SKYW

.

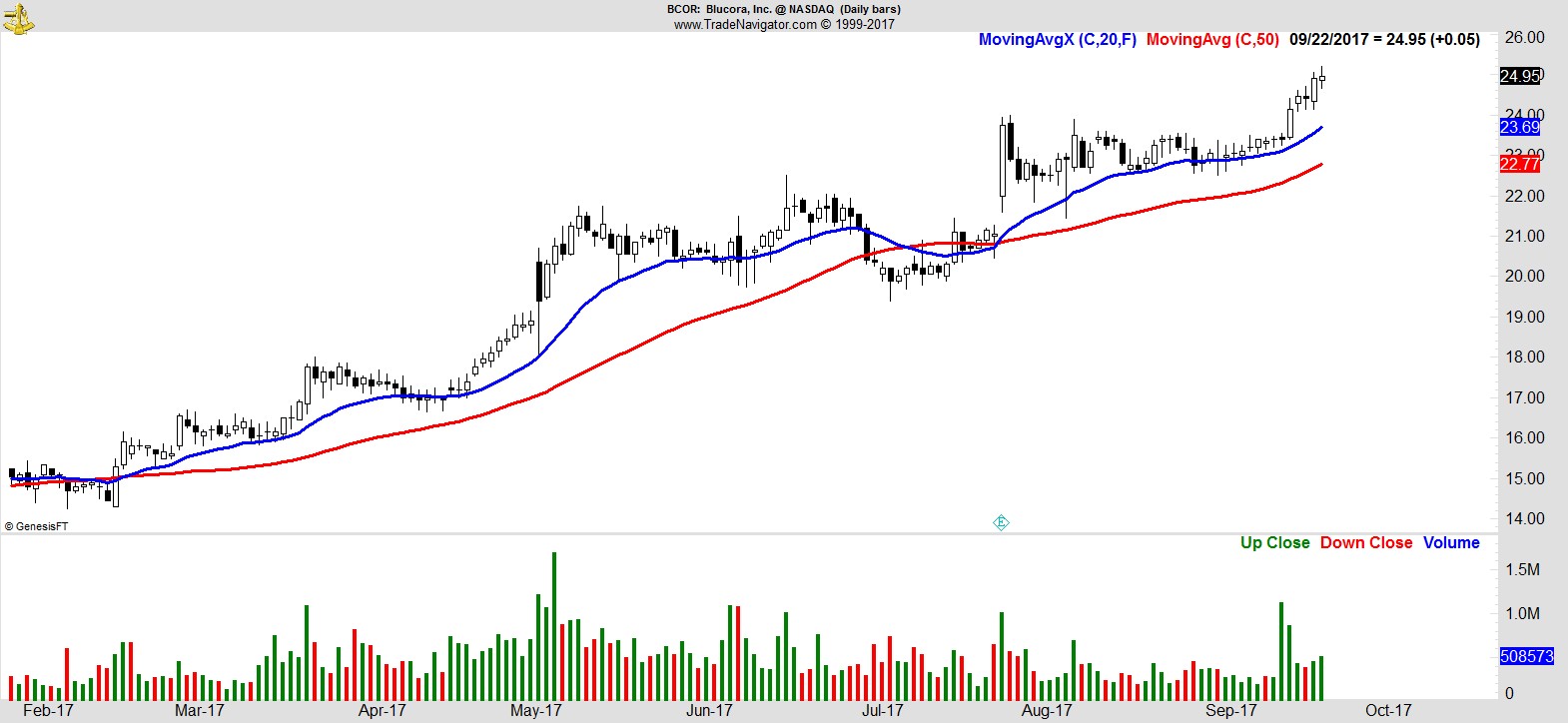

$BCOR

.

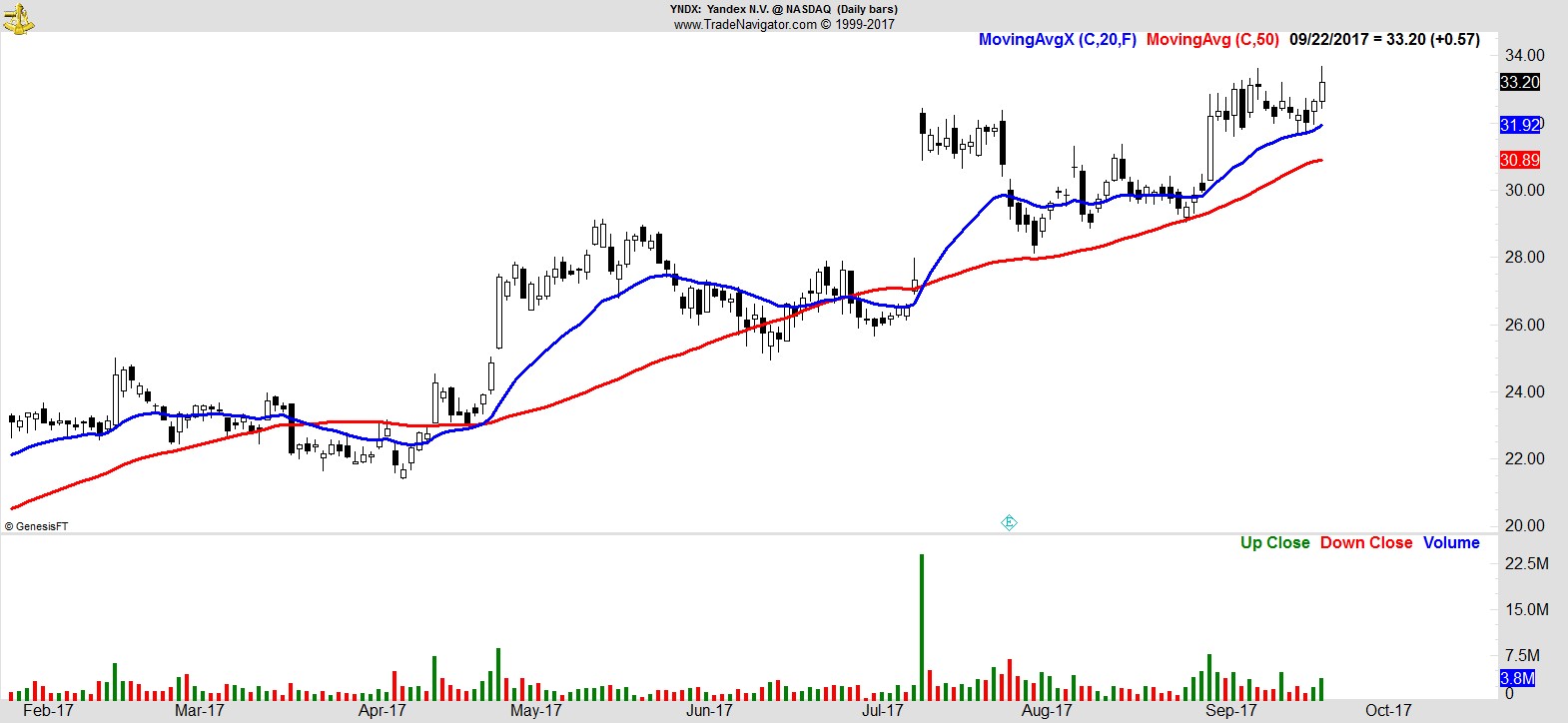

$YNDX

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17

-

Weekend Review and Watchlist

— 8/26/17

Weekend Review and Watchlist

— 8/26/17