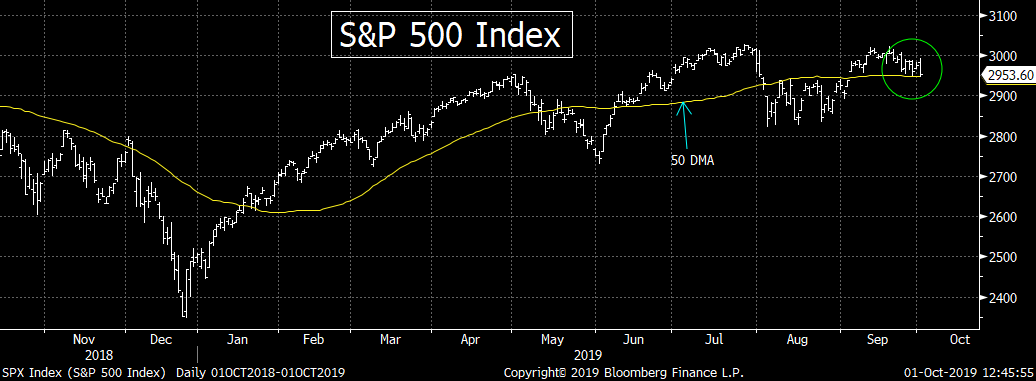

For the second time over the past three trading days, the stock market is seeing fairly steep midday sell-off. It’s obviously not a major decline, but 1% is still a meaningful move. However, also for the second time in three days, the S&P 500 is stabilizing at its 50 DMA (just like it did Friday afternoon).

I don’t mean to state the obvious, but if it breaks below that line, the algos will almost certainly hit the sell button.

In other words, today’s ISM data WAS very disappointing (and we cannot find anything that would suggest it was distorted by anything)…so the decline so far today IS justified. However, traders should know that it could get worse (whether it’s justified or not) due to technical reasons. So keep a close eye on that 50 DMA.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22