THE WEEKLY TOP 10

Table of Contents:

1) “Phase One” is little more than what the President has been offered by China all along.

2) The relationship with China has changed…and the 2020 election won’t change it back.

3) This means business executives and investors have to adjust to this new reality.

4) If we’re wrong, the semis should be the ones to tell us.

5) Believe it or not, European stocks are testing a very important RESISTANCE level!

6) Earnings stink.

7) Is the yield curve telling us that banks can finally outperform. (Not quite yet, but….)

8) Crude oil bounces off IMPORTANT support, but needs to rally further.

9) Steven Bannon thinks Hillary Clinton or Michael Bloomberg will be the Democratic nominee.

10) Summary of our current stance.

Short Version:

1) In our Morning Comment from Thursday, we said that President Trump could not afford to let the trade negotiations breakdown completely. Therefore, some sort of interim deal would be struck & the markets would see a short-term bounce. This is exactly what took place, but we do not think this was much of a deal at all. We got nothing more than what China has always been willing to give us…..However, the existing tariffs are still there, so it was not a major victory for China either.

2) The relationship with China has changed…and this is much more than just a trade war. It now includes issues like human rights, capital flows and currency issues (the verbal agreement not withstanding). The BI-PARTISAN shift in policy by the U.S. will create headwinds for growth around the world for a some-time…and that will make it hard for the U.S. stock market to rally much beyond its old highs….We’re at the beginning of a major shift in the way business is done around the world. Companies will have to adjust to this new reality…and investors will NEED to incorporate this into their long-term investment plans/strategies!!!

3) This shift will not end after the 2020 election…no matter who is elected!!! No we are NOT saying that since the relationship with China has changed…that global growth will remain subdued for decades. However, the global economy (and the global markets) need to adjust to these new realities...and that will take time! This, in turn, means that “passive investing” will not work as well as it has in the past decade…and stock/group/asset-class “picking” will be essential for a successful investment portfolio going forward.

4) What if we’re wrong about all this? Well, we’ll continue to look at the three leadership sectors we’ve been harping on recently: the Russell 2000 small-caps, the economically sensitive Transports…and the chip stocks. The semis will be of particular focus over the near-term. They’re chart right now looks very similar to what it looked like in 2018. Therefore, whichever way this group “breaks” in the next few weeks is going to be VERY important.

5) Another asset class that could/should do well if we’re wrong about the impact of the mini trade agreement is European stocks. That’s right, as crazy as it sounds, the STOXX Europe 600 Index is close to testing the “neck line” of an “inverted H&S” pattern. If (repeat, IF) it breaks above that line in any meaningful way (whether it be due to a bullish development to Brexit or something else), it’s going to be quite bullish for European stock on a technical basis.

6) Earnings for the 3rd quarter will beat estimates…like they do EVERY quarter. However, the earnings have BADLY underperformed the rise in the stock market this year, so unless Q4 earnings GUIDANCE is a lot better than expected as we move through earnings season, this key ingredient of stock market investing recipe is going to create some headwinds for the stock market.

7) The 3mos/10yr spread joined the 2yr/10yr spread by moving back into positive territory late last week. If it can continue to steepen…and if the yield on the 10yr note continues to climb (like it did late last week), it’s going to be bullish for the banks stocks. That’s a lot of IF’s, but we’ll also be watching to see if the KBE bank ETF can break some key resistance levels. If (repeat, IF) all of this takes place, the banks should finally outperform.

8) Crude oil…and the key energy stock ETF’s…all bounced off their vitally important support levels last week. However, none of them bounced so strongly as to indicate that the worst is behind them. We still believe the tensions in the Middle East are conducive to a further rise in. The fact that no serious retaliation has taken place YET means absolutely nothing….…..On a technical basis, the key for us will be whichever way crude oil finally breaks meaningfully out of the “symmetrical triangle” pattern is has developed.

9) Moving to the 2020 campaign, as we’ve said many times in the past, Hillary Clinton is still hopeful…..In fact, Steve Bannon predicted last week that should would likely be the Democratic nominee. He believes a centrist like Sec. Clinton or Mayor Bloomberg will emerge……For us, if Mr. Bannon is correct, we believe Mayor Bloomberg would have a much better chance than Secretary Clinton at beating President Trump.

10) Summary of our current stance……We do not believe “Phase One” of a trade deal is much of a deal at all. We got nothing that hasn’t been on the table for two years. However, China only got future tariffs delays. The existing tariffs remain…so it was not a major victory for them either……The relationship with China has changed. We are not in an “Economic Cold War” with China…that goes beyond trade. Therefore, until the global economy goes through the PROCESS of adjusting to this new reality, global growth will face headwinds. That makes the U.S. stock market more vulnerable to a correction…and gives it less upside potential. Therefore, investors will need to be good stocks/group/asset-class “pickers” to reach their investment goals……..If we are wrong, we should get the signal from the key leadership groups we’ve been harping on for months: the small caps, transports, and (especially) the chips.

Long Version:

1) In our Thursday morning piece, we said that President Trump could not afford to let the trade negotiations completely breakdown…and therefore, we said, “Some sort of short-term positive resolution this week is likely.” We went on to say, ”China will get a delay of the October tariffs and the U.S. will get an agreement from China to purchase a lot of our agricultural products. This is our best guess on what will happen over the next few days.” We also said it should lead to a nice short-term pop in the stock market……So things played out on Thursday and Friday almost exactly as we thought they would.

HOWEVER, when we made those comments, we ASLO questioned whether a partial/interim deal would be enough to help the S&P 500 index to finally break above the 3,000 level in a significant way (after failing to do that on several occasions over the past 21 months). In other words, we were VERY skeptical that a “partial”/”interim”/”mini” deal could help the stock market for more than a very, very short time frame.

After hearing the terms of this verbal agreement, we are even more skeptical. First of all, it’s only a VERBAL AGREEMENT…and it’s going to take at least 4-5 weeks to hammer out the details. However, we must admit, it is in President Trump’s interests to get something signed in the not-too-distant future. (It’s in China’s interests as well.) Therefore we do think this interim deal will become more than just a verbal one.

However, if people are honest with themselves, they’ll agree that it is not much of a deal at all!!! The Huawei issue is something that “will be dealt with separately.” Thus this sizeable elephant in the room is still a GLARING hurdle to overcome in the future. More importantly, China has agreed to do something they’ve been willing to do since the very beginning: buy more American agricultural products. Yes, there is very, very, very vague commitments from China on the issue of intellectual property. (So far there are absolutely ZERO specifics on the issue of IP.) In other words, the President got absolutely nothing that new…nothing that hasn’t been on the table since this entire trade war began! China has only agreed what they always agree to: buying more U.S. AG products. They’ve been doing this for decades.

Having said this, we cannot say that this is a major victory for China. (It IS a victory for them…just not a major one.) The existing tariffs are still in place! The only thing President Trump has agree to is to not increase or add-to the existing tariffs. Also, as we will discuss in the next point, “economic cold war” with China will not end with this “phase one”/”mini” deal. In the past, China has agreed to buy more ag products…and the this issue was settled. Everybody went back to what they had been doing for years. This is NOT the case this time around. (Again, as we will discuss in point #2).

Our point is that it has become quite obvious in recent weeks that President Trump would have to do an interim deal at some point soon. If he increased tariffs in both October and December, it would have weakened the global economy even more (obviously including the U.S. economy) and thus he chances for re-election would have disappeared. So it was obvious that a “phase one” deal was always going to happen at some point to anyone who was paying attention. Therefore, the deal that was verbally agreed to last week was already PARTIALLY priced into the stock market. With the 2.6% rally over the last three days of last week, a lot more of this “mini deal” has been priced-in.

Therefore, the question remains whether this tiny deal…where the Chinese did not give up anything more than they’ve always been willing to give up…will be enough to turn around the rate of global and U.S. economic growth. Yes, the fact that we’re not going to have an increase in tariffs this month IS positive…and it’s why we said the stock market would bounce on the news of ANY agreement. However, with the existing tariffs still in place, we question whether it will be enough to create a situation where the global economy moves from a situation where it’s growth is slowing…to one where its rate of growth picks up steam again in a powerful way. Without that, it’s going to be very tough for the broad market to rally in a substantially above its old record highs.

2) Even though we now have a “phase one” deal with China, It is becoming more and more evident that the theme we’ve been harping on all year is an accurate one. More and more pundits are moving towards our long-held contention that the Trade War with China is something that is now part of a deeply seeded change in U.S. policy….and that is will not be solved for a very, very long time. Therefore, those who have been saying, “As soon as we get a trade deal signed, everything will be fine”…are way off base…….Actually they’re correct, but they’d only be correct if we got a major trade deal (that included major concessions on IP, etc.), and that’s not going to happen any time soon. (In fact it’s going to happen at all.)

Anybody who thinks we’re going to get a major deal are out of their minds. However, as we said above, it’s also quite obvious now that anybody who think that we’ll get a minor/partial deal…and then everybody will go back to doing what they did a few years ago…are equally crazy.

The situation with China has become much more than just a trade war. It has also become a currency war…as China has allowed the yuan has moved above the magic 7.0 level…and stay there. On top of this, we are now learning that it might become a “capital flows” war…with the U.S. proposing to restrict U.S. investment in China. Finally, it is also becoming a “human rights” war with above-mentioned blacklisting of tech companies…and the situation in Hong Kong.

What we’re trying to do here is to reiterate that the U.S. is engaging in an “economic cold war” with China…and this is becoming more evident with the expanded scope of the differences between the two countries. As we have highlighted many. many times in the past, U.S. foreign policy has shifted away from the “War on Terror” (look what the Trump Administration has done in Turkey/Syria)…and shifted towards this economic Cold War with China. This is NOT a short-term issue that will be resolved during this week’s negotiations…nor in the next month…NOR in the next year!!! Therefore, this theme is something that people NEED to incorporate into their long-term investment plans/strategies!!!

It is our opinion that this BI-PARTISAN SHIFT in policy by the U.S. will create headwinds for economic growth…until the U.S. (and global) companies can shift the way they do business to this new reality. (Supply chains cannot be changed overnight!!!) Therefore, we also believe that it will be very tough for the broad stock market to rally in a substantial way going forward. This does not mean that that a bear market is right in front of us, but it does raise the odds of another correction….and it lowers the odds of an important new record high in the stock market for the foreseeable future.

3) In other words, this past week’s developments/agreement will not be the end of this story…NOT BY A LONG SHOT!!! Yes, the focus of investors could/should move to the earnings reporting season for a while (which we comment on in point #6)…and the markets won’t see the same kind of wild swings on every little comment or tweet from the Trump Administration and China. However, the prolonged economic cold war with China will continue to impact the markets in an indirect way for years to come. The uncertainty surrounding this issue will NOT disappear.

Again, the fact that the tariffs will not be increased in October (and we’re seriously doubt they’ll be increased in December) IS a positive development (even though we already knew the odds were very low that they’d be increased again). However, is this really something that is going to change the 2020 capital spending plans of the global corporate executives??? As we said above, the growing (and correct) realization that the relationship with China has changed…and thus the pressure will grow on China once again after the 2020 election (no matter who wins the 2020 election)…will leave the uncertainty surrounding this issue very high going forward.

No we are NOT saying that since the relationship with China has changed…that global growth will remain subdued for decades. However, the global economy (and the global markets) need to adjust to this new reality. Let’s face it, supply chains cannot be changed overnight.

More importantly, we believe this major shift in U.S. foreign policy will make “passive investing” a very poor strategy in the years ahead. Blindly buying an index fund or broad market ETFs for anything more than a short-term move will no longer help investors reach their investment goals. This has been the case for (almost) the last two years…while the stock market has done nothing. It could/should continue to be the case going forward. Therefore, investors are going to have to become much more nimble….either themselves or through active managers. They will have to invest in the stocks/groups/asset classes that will benefit from this major change in the global investment landscape…and avoid kind of mindless strategies that have worked so well over most of the past decade.

In other words, the investment landscape is changing in front of our eyes. Those who embrace this change will flourish. Those who don’t will struggle.

4) What if we’re wrong? What if the stock market IS going to finally break above 3,000 in a powerful way? One important indicator…the Russell 2000…was able to bounce off the lower line of its nine-month sideways range last week (as was another key leadership index, the DJ Transports). This was a positive development, but even though the Russell has seen a nice bounce, it is still well below the top-end of its multi-month sideways range…and a whopping 13% below its 2018 all-time highs!!!!

Therefore, we also have to keep a close eye on the third group we’ve been harping on in recent weeks: the chip stocks. The trade news helped the SMH semiconductor ETF rally very strongly on Friday…and has been able to move slightly above its July all-time highs. However, this “slight” break of the old highs is exactly what took place over the summer…only to have the group roll-over and fall more than 12% over the following few weeks. Therefore, we’ll be watching this ETF extremely closely over the next week or so…to see if it fails once again or breaks to a significant new high. Whichever way this group breaks over the next week or two should be vitally important for the chip sector….AND the broad market overall.

In 2018, we saw a similar move in the semis. The SMH got very close to…or just above…the $110 level on several occasions. However, it could never break above it in a significant way. Then, it finally rolled over…and we know what happened to the group (and the market) after that. We’re seeing a very similar situation on the chart this year. Instead of the $110 level, it’s the $120 level that is providing resistance this time around.

Of course, we’re facing a different back-drop this time around. Last year, it was higher interest rates…while this year it’s a trade war, slowing earnings growth, etc. However, it is still quite similar on the charts, so we’ll repeat that we think whichever way this group breaks over the next few weeks should be vitally important for the markets.

5) Okay, let’s take this a step further. We do not think this “phase one” deal is really the kind of definitive agreement that will help the markets in a powerful way. However, if we are wrong…and this the markets read this as something more bullish than we do (and the semis breakout)…one area that could surprise people to the upside would be the European stock market.

SAY WHAT???? No, that’s not a typo…and we readily admit that the there has been very, very little (if any) positive economic news out of Europe in recent weeks (or in recent months for that matter). We’re also NOT basing this comment on some sort of prediction on the Brexit issue (even though we ARE getting at least some positive reports on this front). Instead, we’re basing the potential (repeat, potential) upside move in European stocks is totally based on technical analysis. In other words, we do not a call we’re making with a high degree of confidence, but there is no question that the STOXX Europe 600 Index is getting close to testing some important resistance levels.

To be more specific, the STOXX Europe 600 Index is testing its highs from April, July and August…so if it can break above that level (of 393), it will give this broad European index an important “higher-high.” What’s even more bullish is that level is also the “neck line” of an “inverse head & shoulders” pattern going all the way back to the beginning of 2018! The STOXX is VERY close to testing that level, so the broad European stock market stands at a key technical juncture.

As always, we HAVE to wait for a meaningful break above this key level before we can get too excited. (We’d also note that the 393 level on the STOXX is still below its 2018 highs…and more than 5% below its 2015 all-time highs. So a breakout from here would not be an historic one. However, it should still be something that takes investors by surprise…and could/should have an impact on investment performance for 2019 if (repeat IF) a meaningful break above 393 takes place.

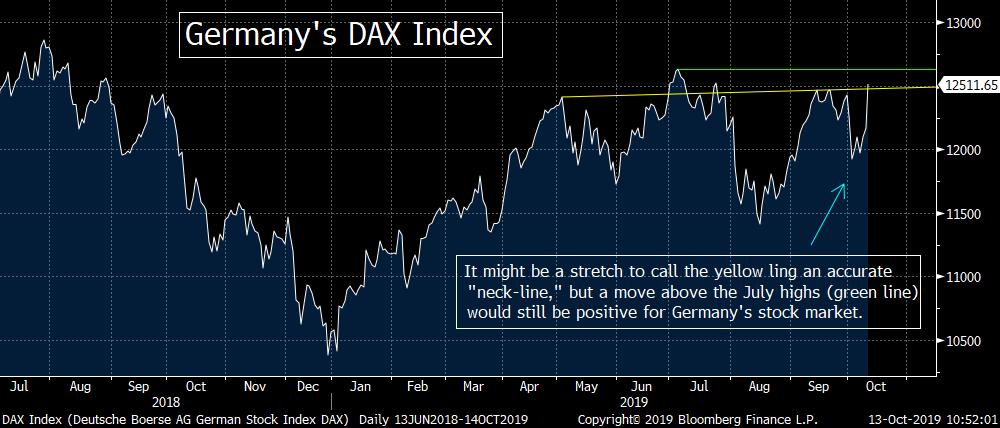

Ok, ok….this scenario is filled with some BIG if’s…and it’s hard to think that European stocks are going to rally in a powerful way over the 4th quarter, but the charts are definitively showing some upside potential. (We’d also note that the chart on Germany’s DAX index is quite similar…and a break above its 2019 highs of 12,530 would be positive as well.)

6) We’re going to go WAY OUT on a limb and say that the 3rd quarter earnings for the S&P 500 will beat the consensus estimates. Why not? They beat lowered estimates basically EVERY quarter, so why would the 3rd quarter be any different??? In fact, this year’s estimates have come down more substantially than usual. Just to give you a good idea of what we’re talking about, according to FactSet, Q3 estimates were +3.4%...and now the consensus has fallen to -4.1%. The estimates for Q4 were have come down much more substantially. Back in January (and throughout the spring), the consensus estimate for the 4th quarter was +11.4%...and now they stand at just +2.6%. If history is any guide, they’ll be lowered once again before the Q4 reported seasons takes place. (In other words, Q4 estimates could/should be flat to negative by the time they are reported). Finally, 2019 full-year estimates have fallen from +6.5%in January…to only +1.2% right now. (Again, this full-year estimate will most likely be cut before the Q4 numbers are announced…so that they can be exceeded).

Don’t get us wrong, these are not recessionary numbers, but given the 18% rally in the S&P 500 YTD, you have to question whether THAT kind of move is justified on earnings growth of just 1.2% for the entire year (and probably lower by the time the final 2019 earnings numbers are reported).

Therefore, business executives are going to have to become A LOT more constructive on the mini-trade deal that we have become…if the 2020 earnings guidance is going to be enough to make up for the big spread that has developed between earnings growth and the level of the S&P in 2019.

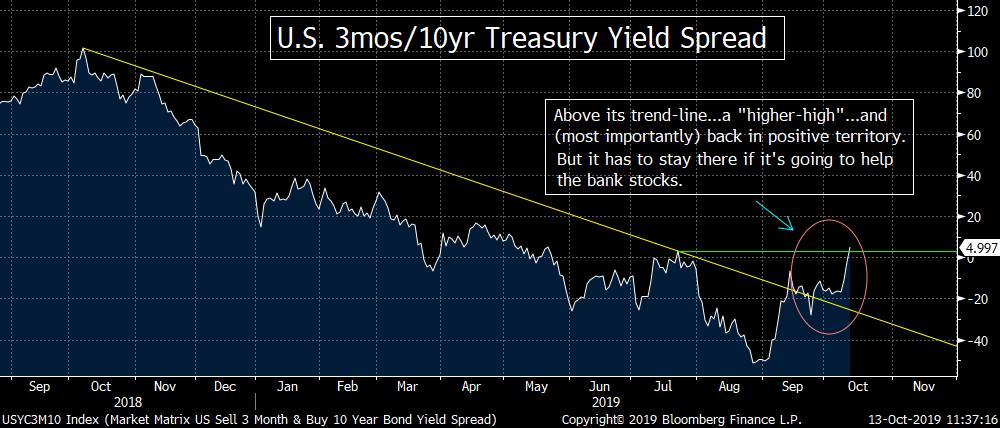

7) The 3mos/10yr yield spread turned positive on Friday for the first time since July. We have to be careful because it turned positive briefly (just 1 day) back at that time over the summer…only to roll back over in a serious fashion very, very quickly. So we need to be careful. (We also have to be careful because, as Jeff Gundlach likes to point out, it’s when the yield curve goes from an inverted stage…back to a normal positive position…that the stock market tends to get rocked.)

However, we now have a situation where both the 2yr/10yr and the 3m/10yr spreads have turned positive. This was one of the prerequisites for us to turn more bullish on the bank stocks. It was certainly not the only prerequisite…and we have to watch out for a head fake…but if (repeat, IF) the yield curve can continue on its recent steepening path, it should be quite positive for the banking sector.

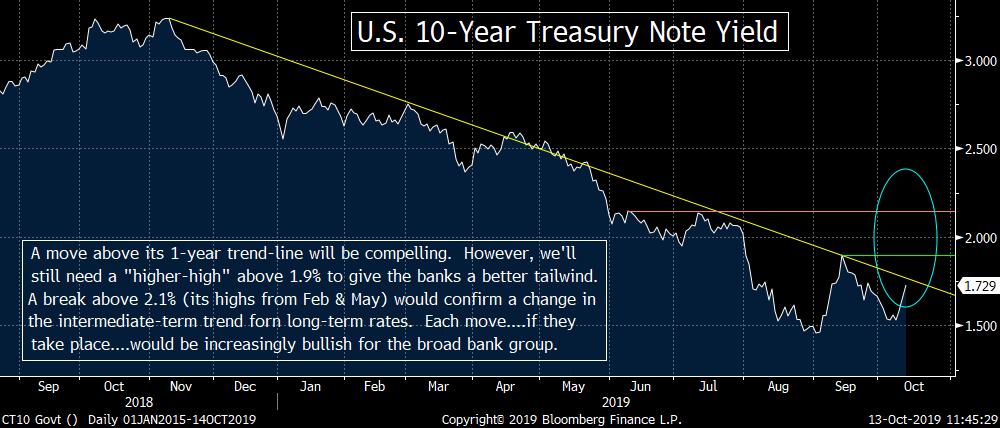

Having said this, we’ll still have to see the other two prerequisites met before we can raise a green flag on the group. First, the yield on the 10yr note will have to rise above its trend-line from late last year…and above its September highs of 1.9%. (A move above the July highs of 2.1% would confirm a change in the intermediate-term trend in long-term rates, but we still think a move above 1.9% would be enough to help the banks finally out-perform the S&P 500 on a broader basis.

Second, and most important, we need to see the KBE and KRE (regional) bank ETFs break above its key resistance levels. The first one is the top line of a “symmetrical triangle” pattern that the KBE has developed over the past 19-20 months. That comes-in at about $44.25 right now. It would also have to see its first “higher-high” since February…with a break above its July highs of $45. (A move above its highs from February & May of $46 would be even more bullish, but a rise above those two other levels would still be quite bullish.)

Most people believe a breakout in the banks will be very bullish for the broad market. Yes, that certainly could be the case. However, there have been plenty of examples in history where the banks & the S&P 500 diverged from one another for extended periods of time. (Let’s face it, the KBE is still down 3% from where it stood one month after the 2016 election…while the S&P has rallied 35% over that time frame. Even if you use Election Day 2016 as a starting point, the KBE is up 25% since then…while the S&P is up 42%.) Therefore, there is no guarantee that a rally in banks will cause the broad market to rally. However, if we come up with a situation where long-term interest rates rise, banks should do well whether the broad market breaks-out or not.

8) Crude oil saw a 3.5% rally last week…and the energy equities bounced late in the week as well. Therefore, WTI was able to hold its key $50 support level…and energy equities (as measured by 3 ETFs…the XLE, XOP & OIH) were all able to bounce off their August lows as well. This is certainly a positive development, but none of the bounces in these assets were enough to signal that this crude oil and the energy equities are going to see an extended rally or a lengthy period of outperformance. They still remain relatively close to the above-mentioned important support levels.

However, we do believe that the situation in the Middle East is a growing powder keg after the strike on the Saudi oil facilities. That said, we’re not sure that the attack on the Iranian oil tanker in the Red Sea is something that is a sign that the situation in the Middle East is about to explode. The attack took place far from the Straits of Hormuz and there are the details of what really happened are still quite vague.

However, to think that the lack of an immediate response to the attacks in Saudi Arabia means that there will be no retaliation is ludicrous. Why would anyone retaliate when their opponent’s guard is up? We’re not in a hot war (at least not yet), so an immediate retaliation is not essential by any means. Iran is getting desperate. Their economy is in shambles. The strike on the Saudi oil facilities are just the start of what will become one of the biggest global issues of 2020.

On the technical side of things, the key for our bullish scenario for crude oil is the “symmetrical triangle” pattern in WTI. It broke above that pattern after the attacks…but only for two days. WTI is going to have to break above the top end of this pattern…and the $60 level…AND STAY THERE…for our bullish scenario to playout. If THAT can take place, the energy equities should follow it higher. In fact, it should outperform crude oil…given that it has underperformed it for most of this year!

As we said last week, any meaningful break below $50 in WTI and all bets are off. Until then, the geopolitical issues will keep us on the bullish side of the bull/bear ledger on this group. However, if (repeat, IF) crude oil can breakout…the energy stocks (which are over-hated and VERY under-owned) will be a GREAT group to “rotate” towards for those who are looking to improve their 2019 investment performance.

9) Moving to the 2020 campaign, one thing we’ve mentioned from time to time this year is our belief that Hillary Clinton has not given up hope on becoming President. We highlighted it again more recently when she went on a book tour after publishing her latest book (along with her daughter, Chelsea). The reason we are highlighting it once again this weekend is due to a prediction Steve Bannon made last week. He said on Thursday that he believes there is a very good chance that Hillary will be the Democratic nominee…and that the 2020 election will be like another “Ali/Frasier fight”.

Mr. Bannon thinks that it is likely Joe Biden will continue to fall in the polls in the key early primary states (Iowa, NH and Georgia). Once that takes place, it will leave an opening for someone from the center to step-in and challenge Elizabeth Warren. He says Elizabeth Warren’s stance on several subjects are too extreme for the Democratic party and the party will move towards a centrist candidate. Kamala Harris looks to be unable to fulfill that role, so Mr. Bannon thinks it will be filled by a new candidate…either Hillary Clinton or Michael Bloomberg.

We believe Mr. Bloomberg would be a much, much more formidable candidate. The last thing in the world Donald Trump wants to do is run against Mayor Bloomberg. Secretary Clinton has run two times. Both times she was the odds-on favorite to win. (In 2008, she wasn’t just the odds-on candidate to win the Democratic nomination…but to win the general election as well.) Both times, she lost…..It’s very, very hard for a two-time loser to win the big one……It’s not impossible, but it hasn’t happened since Richard Nixon (who lost in 1960…and then lost again in the gubernatorial election in CA of 1962). Besides, the rise of the Me Too movement is not as favorable for Secretary Clinton as some people might think. President Trump will hammer her in a general election campaign over the way she enabled her husband in such an outlandish way for so many decades.

If Steve Bannon is correct…and a new centrist candidate will emerge to become the Democratic nominee…the Democrats should beg Michael Bloomberg to jump into the race. He, not Hillary Clinton, will give them their best chance at victory in our humble opinion.

10) Summary of our current stance…..The Trade War issue will die down to a certain degree after this week’s developments. However, it will not go away by any means. It will not even become a secondary issue. It will remain the number one issue facing the economy & the markets over the long-term, but it will not be the ONLY issue the markets are focused on from day to day on a shorter-term basis.

Even though we now have a outline of a partial deal, this is not going to be like the other deals we’ve seen over the decades with China. It’s not going to be one where the U.S. sells

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22