Although I frequently like to send out notes that give both sides of the bull/bear ledger on a given situation, I almost always take a definitive stance on which side of that ledger I stand at any that time. I thought I was going to be doing that today…with a bearish very-short-term call on AMD. HOWEVER, as I looked at it more closely, my tone quickly changed…from a bearish one…to one of confusion.

Usually I would step-back at a time like this and re-assess the situation…and establish a strong opinion before I sent out a note. However, since BOTH the bearish developments and the bullish developments on AMD are SO extreme, I thought I’d share them with you and….and let you can make your own conclusions.

Let’s start with the bad (bearish) news. The RSI chart has moved well above 88 today. There has only been one other time in the last 25 years when the RSI reading was higher than this…and it has only moved up near this level six other times. (So it’s a total of 7 times. Once when it got slightly above the 88 level and hit 90….and seven times when it rose above 85 and got close to today’s reading of 88.)

Every time it has reached this level (as well as the one time it exceeded it), AMD dropped immediately and fell by an average of 5% over the next few days. (In several cases, the move was a one-day move.) It’s funny, the smallest move was the one when the RSI reading did indeed move above 90. The other moves ranged from a decline of 3.5% to 12% over just 1-3 days.

With this knowledge, I thought I’d be writing a quick note in which I pounded the table telling short term traders to take profits…and suggest that some of the more risk tolerant ones to short the stock (with a tight stop). However, upon looking at the charts more closely, it showed that the AMD rarely saw much downside follow-through after its initial sharp decline after an extreme reading like we’re seeing right now. It either bounced back rather sharply & somewhat quickly…or traded sideways for a week or more.

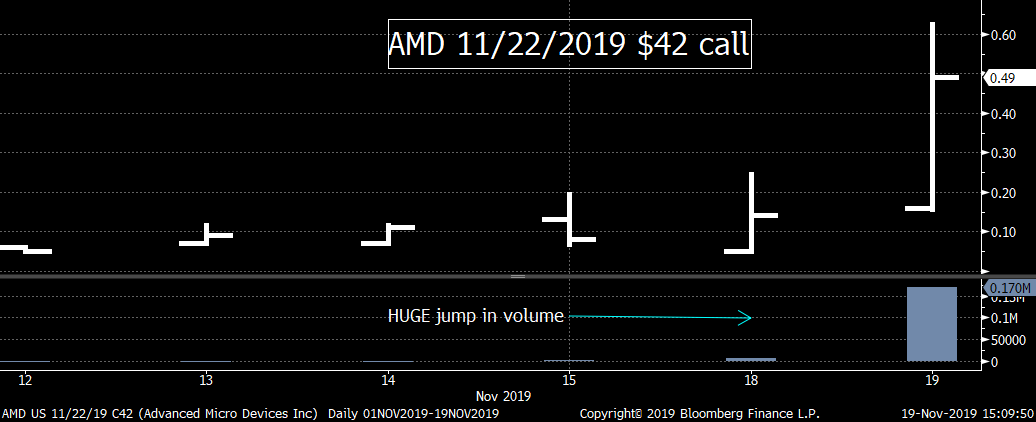

This led me to do a little more work….and it didn’t take long to realize that there has been some HUGE “call buying” in the options market today. Over 160,000 of the $42 calls that expire THIS Friday have been purchased today. The open interest in this option was only 4,800 contracts coming into today, so a lot of this volume has been buying of new positions….However, there has not been a “big print.” The biggest print has been 6,000 contracts. In other words, there has not been ONE big buyer who “knows something.” (Yes, it actually could be a small # of buyers…who “know something”…and are buying all of these options in small lots, but the whole thing is very odd. Cowen is a good firm, but does a price target increase really justify this kind of call buying???)

Like I said at the beginning, I don’t know what to make of the situation. When a stock gets as overbought as this one has become, I would usually suggest investors take some chips off the table….avoid chasing it….maybe even short the stock…or a combination of all three. However, we also know that when options players buy huge amounts of short-dated options, it rarely pays to bet against them

The one conclusion we can draw is that if the call buyers are correct…and AMD does indeed rally even more over the next few days…it’s going to become even more overbought. Therefore, unless we see some more strange developments in the options market, this stock is going to be as ripe for a pull-back as you have ever seen at some point late this week or early next week…once these options expire on Friday. (It could be a candidate for a options “straddle” strategy as well.)

Again, we hate to point out some new development(s)…and avoid providing a strong opinion on what they mean. However, since the developments are SO extreme on both sides in this case, we though it was worth while to point them out…even though we do not have a strong opinion on what they mean.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member