The U.S. futures are trading significantly lower this morning as the tech stocks (especially the mega-cap tech names) are under pressure once again. Our stance on this situation is a lot different than most. Many people are saying that it’s merely a “technical/artificial situation” where one options player...or many Robinhood options traders...or both...are knocking down these high flying tech stocks. Therefore, they say, once the dust settles...these stocks and the stock market in general will bounce back nicely and everything will be hunky dory.

Our argument says that these “technical/artificial” issues were the main reason why the market kept rallying after its initial bounce from March to June. That original bounce was definitely justified...because the economy was starting to bounce-back at least somewhat as it came out of its full lock-down...AND because the Fed was able to de-freeze the credit markets. However by June, a lot of the improvement in the economy...as well as 2021 earnings estimates...had already become priced-into the market. And yet, the market kept on rallying...and it did so in pretty much a straight line.

As we had been arguing for quite a while, a lot of this rally had to do with the combination of the Robinhood trader buying stocks...then getting more daring and buying options as we moved through the summer...which made the market makers buy more stocks. When you combined these buyers with the momentum-based algos, the entire situation fed on itself...and we got a rally that took the stock market much higher than its underlying fundamentals would have justified. THEREFRORE, the market is now just working-off the unjustified/technical/artificial rally that took place...and this should take the market back down to where it SHOULD be given its underlying fundamental back-drop. If we are correct about this, the decline that began last week will last more than just a few days...and it will take the market down more than the consensus thinks right now.

This is something we’ve been harping on for many weeks. We were a bit early, but the rally we saw in August was NOT fundamentally based. It had taken the stock market to a very overvalued level...and made the market very overbought. Therefore it was indeed ripe for a correction...and we’re finally starting to see this scenario playout.

It does not matter that many of the companies that rallied so strongly are great companies with very good long-term prospects. Sometimes the stocks of these kinds of fabulous companies move well beyond any potential they have for the next couple of years...and they then have to come back to earth. This is exactly what we’re seeing now in the mega-cap tech world.

This does not mean that the stock market will not or cannot see a nice bounce once this decline has come to an end. The market tends to over-shoot in both directions now-a-days, so a downside overshoot could easily be followed by a nice bounce (especially if the Fed gets involved even further). However, since the stock market...and even these fabulous mega-cap tech stocks...got way too far ahead of their fundamental values...it’s hard to think that they will all bounce-back to the degree that the bulls think they will right now and go back to new all-time highs quickly.

Of course, everybody wants to know if these options players have unwound their positions...and if they haven’t, when will they??? Well, there is actually evidence that the on a net basis, very little of this “call buying” activity subsided. In fact, some reports say that the call buying in stocks and ETFs last week actually continued to be very strong...with over 20 million calls purchased...and it was not offset by an equal amount of put-buying. If this is accurate, there is still a lot of hedging activity that needs to be reversed. (One also has to worry that some hedge funds will try to compound the situation. Remember when Lehman Brothers couldn’t catch a breath in 2008 because of all of the short sellers? What if those hedge funds try to do the same thing to Softbank...which was down 7% yesterday while the U.S. market was closed yesterday?)

We are not trying to portray a situation where the stock market will fall 30%-35% like it did in the first quarter. The S&P 500 Index rallied 15% from the end of June until its recent highs. Therefore, we believe that a 10%-15% pull-back...that works-off the technical/artificial buying we saw over the summer...is quite possible. Besides, if/when things get that bad, we expect the Fed to step to the plate to at least calm things down.

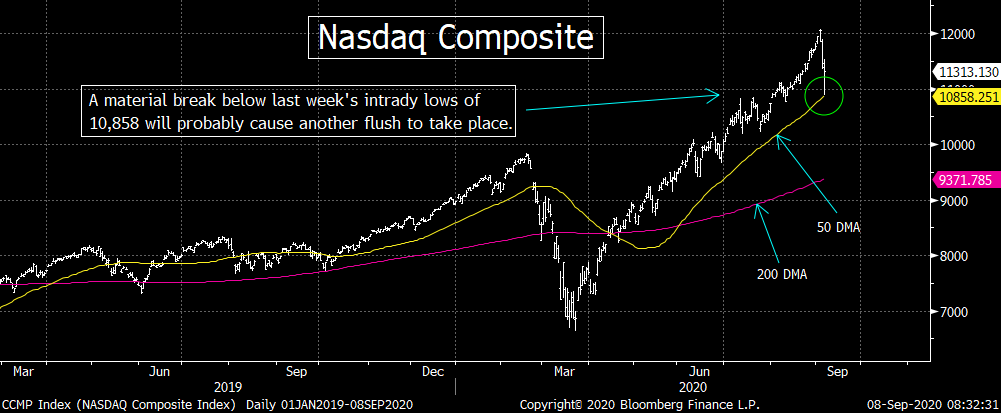

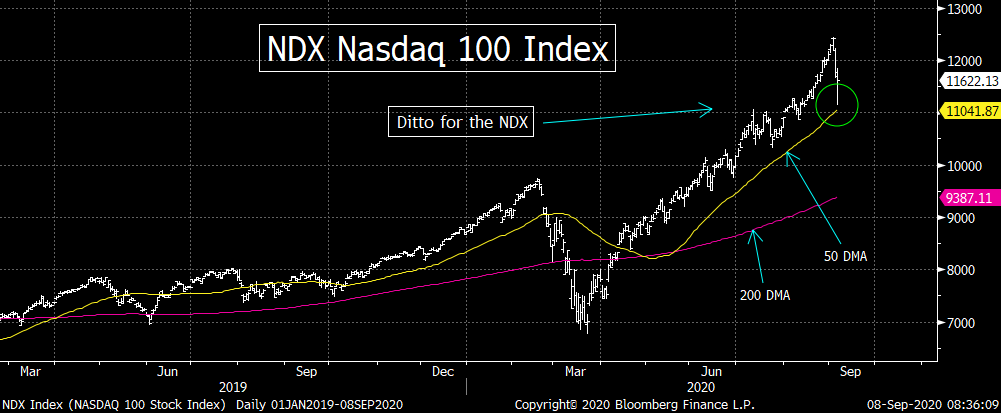

We’ll be watching two levels very closely today...and as we move through the week. The first one involves the Nasdaq Composite and the second one deals with the NDX Nasdaq 100 Index. For the Nasdaq Composite, the 10,858 level is the first key support level. That was the intraday lows from last week (Friday) and it is also where the 50 DMA comes-in.....As for the NDX, its lows on Friday were a bit above its 50 DMA...and those lows come-in at 11,146...so that’s the level we’ll be watching VERY closely on the NDX. (We’ll also be keeping a close eye on the intraday lows from Friday on the S&P 500...of 3350.) If those lows from Friday are broken in a meaningful way, it could/should cause another material decline...lead to a full-blown correction...and the targets we highlighted in our weekend piece will quickly come into focus.

We’ll finish by saying something we’ve been saying for several weeks now: Pull-backs and corrections are NORMAL and HEALTHY...and more importantly, they create opportunities!!! Good luck!

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member