THE WEEKLY TOP 10

Table of Contents:

1) The “artificial” moves actually started in Q4 of last year (after the repo debacle).

2) When the market reaches the kinds of extremes it did in Aug, it takes time to work them off.

3) The mega-cap tech stocks are still overbought and overvalued.

4) Our targets for the S&P 500 and Nasdaq Composite.

5) No decline in high yield! But that might mean the Fed will not react as quickly.

6) The odds are high that the dollar will rally further.

7) The chip stocks are testing key support. (So is AMD.)

8) Quick comments on a potpourri of topics.

9) The Presidential election results will likely NOT be the ONLY ones that are contested.

10) Summery of our current stance.

Short Version of point #5:

5) When it comes to the high yield market, we have some good news...and some bad news. The good news is that it has not been disturbed very much during this decline in the stock market......The bad news is that probably means that the Fed will be happy to sit on their hands during this stock market decline...and not necessarily support the stock market...at least not yet. (In recent years, the Fed seems to have become “credit market dependent.”)

Long Version of point #5:

5) When it comes to the high yield market, we have some good news...and some bad news. The good news is that it has not been distributed very much during this decline in the stock market. The bad news is that probably means that the Fed will be happy to sit on their hands during this stock market decline...and not necessarily support the stock market...at least not yet.

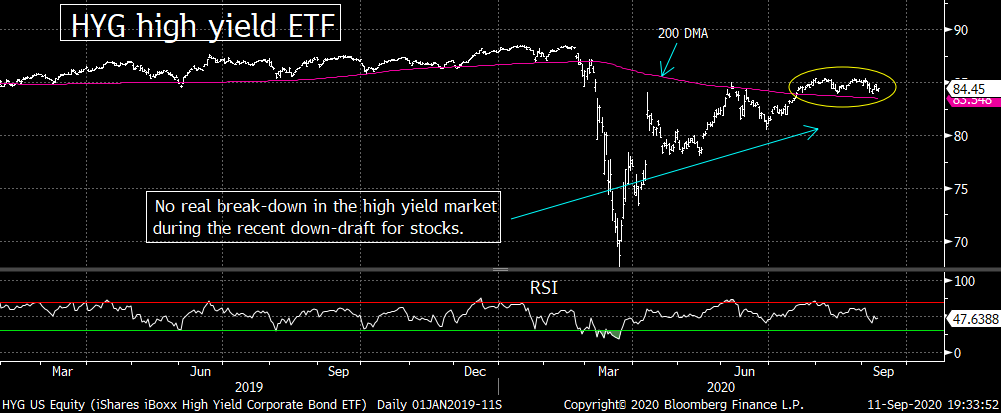

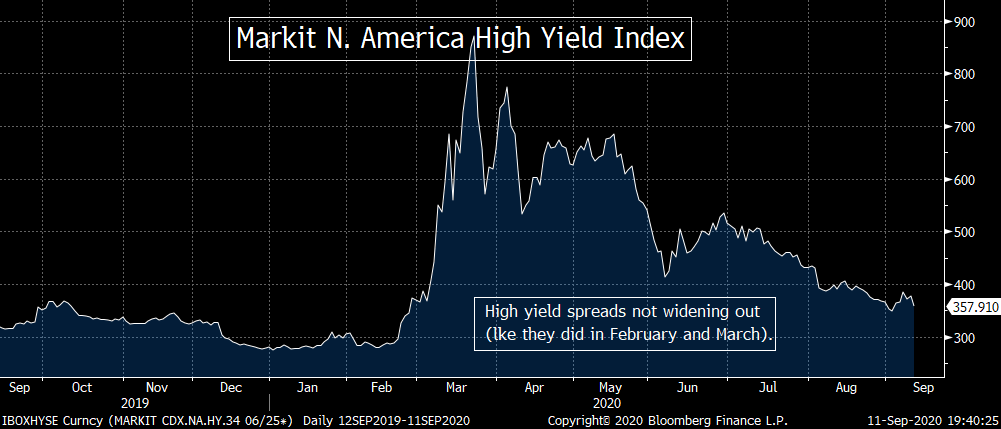

Look at the action in the HYG high yield ETF. It has been stuck in a sideways range. That’s not great in-and-by itself, but it IS good when it’s taking place during a stock market sell-off. On top of this, high yield spreads remain quite subdued, so that’s quite positive as well. It tells us that the pull-back in the stock market is not causing problems for the financial system or the credit markets. In other words, as we’ve been saying throughout this weekend’s piece, the stock market decline is merely something that is working off the extremes we reached in late August...and not due to a big change in the fundamental outlook.

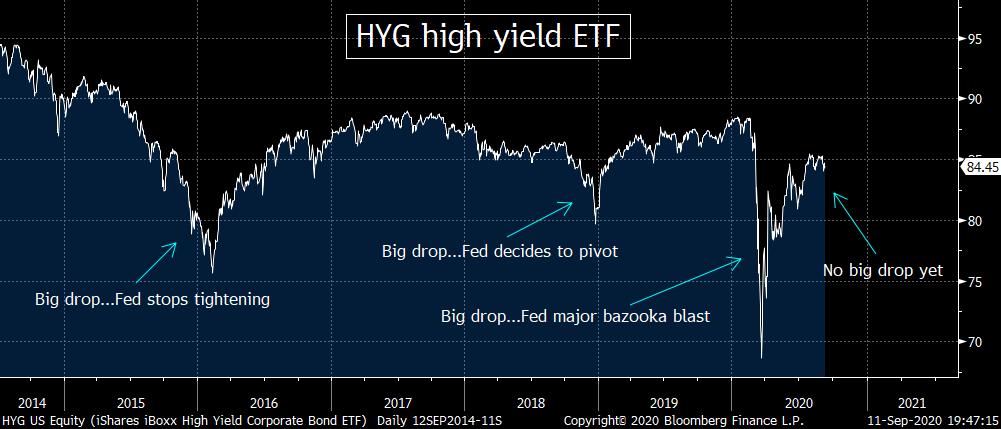

Again, that’s great. HOWEVER, this also actually means that the stock market CAN fall further. Remember in late 2015 when the Fed first raised rates? They only did it once...and did not raise them again for a year! So they really did not get involved in a full tightening cycle until 2017. The reason the Fed had to hold-off in late 2015 (and early 2016) was because the price of oil crashed from over $100 in 2014 to less than $30 in early 2016. Since the high yield market had so much exposure to the oil industry, the Fed to shift gears. They had to make sure that the high yield market didn’t completely implode (and ruin our energy industry). Thus, they stopped raising rates immediately...and didn’t raise rates further until the HY market had calmed down (a year later).

The same thing happened at the end of their tightening cycle in late 2018. As the stock market was falling during the 4th quarter of that year, the actually Fed kept raising rates...even in December of that year! I wasn’t until some wide cracks began to suddenly form in the high yield market in late December of 2018 that the Fed “pivoted” and reversed their course (in 2019)...and a few months later started cutting rates once again.

Of course, they did something similar this year. Only this time, they shot their bazooka(s) when the ENTIRE credit market started to freeze up. So our point revolves around something we’ve been saying for many years: The Fed is just as much “market dependent” as they are “data dependent”...BUT they have become much more “credit market dependent” than “stock market dependent” over the last five years or so.

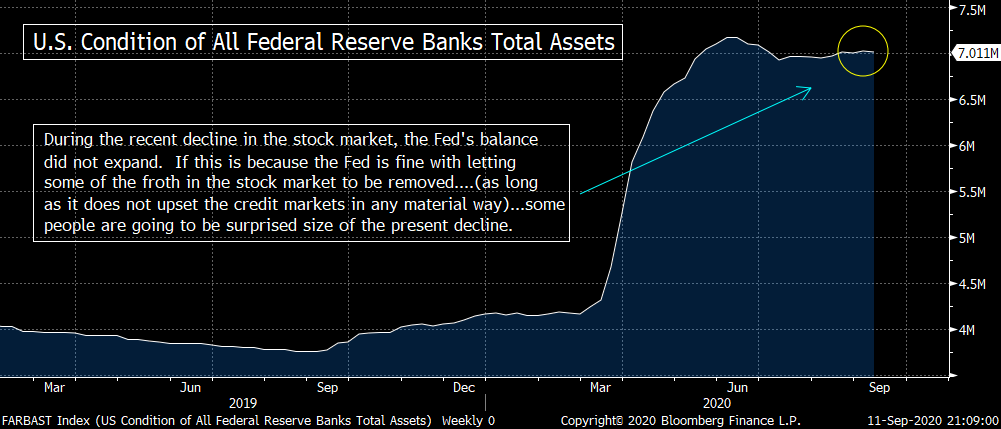

Therefore, the Fed may not have the “stock market’s back” to the degree that many people have thought this year. Yes, they’ll step to the plate if the decline in the stock market has an impact on the credit markets (like they high yield market). But as long as those credit markets remains stable, the Fed just might be willing to let the stock market continue to slide (and work-off some of the froth that was created by their most recent QE program in March). This certainly seems to be the case...as the Fed’s balance sheet was flat once again during the most recent reporting period...which was right in the middle of the recent decline.

For the details on the other nine bullet points from this week's edition...and to get my daily "Morning Comment," please click here to subscribe to "The Maley Report(TheMaleyReport.com)

https://marketfy.com/secure/buy/beyond-the-fundame...

Thank you very much.

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member