THE WEEKLY T0P 10

Table of Contents:

1) The stock market was (and is still) ripe for a further decline...no matter what the Fed said this week.

2) However, the Fed’s actions of the past decade HAVE put us in the position we’re in right now.

2a) Six months after the bottom...but valuations are much different than 6 mos after the 2009 bottom.

3) There’s still plenty of froth left in the stock market. So we're still looking for a full 10%+ correction in the SPX and 15%+ correction for the NDX.

4) The “lower-lows” in the mega-cap tech names last week was quite bearish.

5) The lack of decline in the high yield market is actually bearish for stocks!

6) However, the action in the materials and railroads is a bullish development.

6a) Rotation.

7) Great earnings for FDX, but it is VERY overbought.

8) Hodgepodge.....Another Covid wave?...Biden’s cap gain tax is bearish....USDJPY testing key support.

9) We’re more worried about the developments in Taiwan...than TikTok.

10) RBG: Great American. Will she have an impact on the election?

11) Summary of our current stance.

Long Version:

8) Hodgepodge......A) One theme we have been harping on for many, many weeks is our concern that we’d experience another wave of the coronavirus as we move into the colder months. This is what they saw in the southern hemisphere during THEIR summer months (in places like Australia and New Zealand), so it seemed quite obvious to us that another “wave”...and thus another “lock-down” (even if it was only a partial one)...would create a significant headwind to the economic recovery we’ve experienced over the past six months......Well, now we’ve moved into the middle of September and the temperatures are beginning to fall a bit. In Europe, this has led to a big spike in Covid-19 cases in places like Great Britain and Spain. In the UK, they have begun to resume at least part of their lock-downs. No it’s not a full-fledged one like we saw in many places around the world this past spring, but it does raise concerns that they’ll become more extensive...and more wide spread...as the weather keeps getting colder (and people spend more time indoors).

B) It was interesting to hear Biden supports try to claim that a rise in the capital gains tax will actually be positive. They argue that it would raise much needed revenue...as investors take profits this year (before the tax rates go up). They also highlight how the market has not gone down for very long when the last two times capital gains taxes were raised. That is true, but we’d also note that the last two times those tax rates were raised, the S&P was trading ag 16x and 14x stated earnings respectively...vs. 26x earnings today. Don’t get us wrong, there is no question that the selling that derived from an increase in the capital gains tax would be short-lived. However, when you combine it with Mr. Biden’s proposed corporate tax rate hike, it’s hard to think that his tax plans would not have an extended impact on this expensive stock market....given that almost 100% of the earnings gains in the S&P 500 since President Trump took office has come from the President’s corporate tax cuts, not from improving operations.

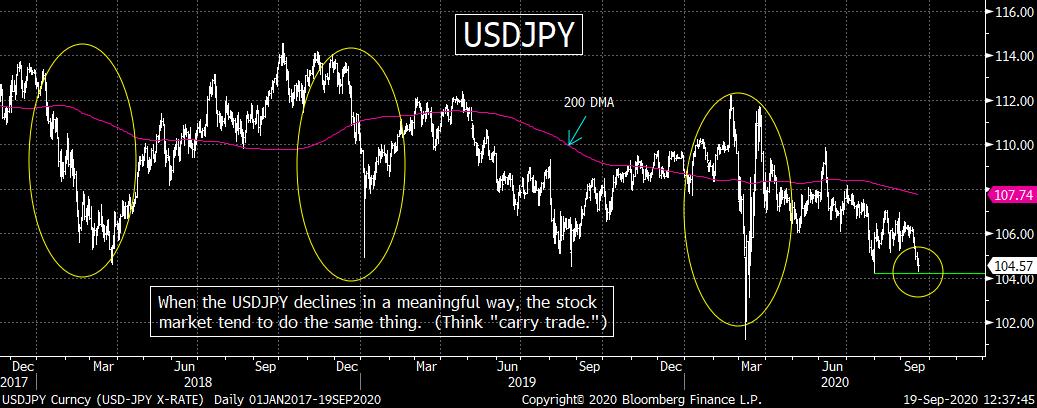

C) The Japanese yen has been a great indicator for the “carry trade” over the years. Just look at the attached chart. It shows that the substantial decline in the USDJPY coincided with deep corrections in the stock market in Q1 2018, Q4 2018 and Q1 of this year. It is now testing its July lows, so any further decline will give it a key “lower-low” and raise questions about how much juice the carry trade can give the markets over the near-term......Having said this, the decline in the USDJPY during the summer of 2019 only coincided with a sideways move in the S&P, not a decline. However, it’s still something we’ll be watching closely in the days and weeks ahead.

For the details on the other 10 points....and to get my daily "Morning Comment" piece...please click here to subscribe to "The Maley Report".

https://marketfy.com/secure/buy/beyond-the-fundamentals-now-btfnow/1115/

Matthew J. Maley

Managing Director

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member