I hope you have been enjoying the “Morning Comment” and “The Weekly Top 10”.....We will be ending our extended free trial of the newsletter on March 1st, so if you want to continue to get these unique insights during these fascinating times in the investment world, please click here to subscribe to “The Maley Report.”......Thank you!

THE WEEKLY TOP 10

Table of Contents:

1) There are definitely many reasons to be bullish on stocks right now (but we’re cautious).

2) How much longer can institutions hold large positions in the “dead money” FAANG stocks?

3) A look at the chart of each FAANG stock.

4) What’s next for COVID? A “Category 5 hurricane”...or “heard immunity”?

5) Commodities (especially copper) have become very overbought and over-owned.

6) Rising LT yields should not be brushed-off.

6a) Rising LT yields & rising oil prices are frequently very bearish for stocks.

7) The Fed’s strategy on the upcoming “tapering” of their massive QE program.

8) Consumer Confidence (especially for the future) is actually falling.

9) A quick review of the charts on Bitcoin, Tesla, and gold.

10) Summary of our current stance.

Long (and only) Version:

1) About a month ago, we turned more cautious on the stock market. It has rallied a bit more, but the gain in the S&P 500 since then has been less than 1.5%. Since we called for a strong year-end rally coming out of September...and we turned bullish on the banks & energy stocks at that time (when everybody else was bearish on those groups), we’re not concerned yet that we might have turned cautious way too early. That said, there are certainly some reasons to think the stock market can rally further going forward. Therefore, we thought we’d cover the bullish side of the bull/bear first this weekend...before we highlight the reasons why we’re going to stick with our cautious stance right now.

First and foremost, the Fed and other central banks are still engaged in their massive liquidity programs. In fact, the Fed’s balance sheet expanded to it largest level ever last week...and it has been rising steadily since early August (after it shrunk for two months at the beginning of the summer). Also, even though the Fed has started laying the ground work to taper-back on their bond purchases, they have also indicated that this tapering move is not at all imminent.

Speaking of stimulus, it seems quite evident that we’re going to get a fiscal stimulus relief package passed in the next few weeks. Based on Treasury Secretary Yellen said last week, it is also quite evident that the Biden Administration wants to move forward on some VERY large FURTHER stimulus programs...led by infrastructure...which is a nice bi-partisan issue. (We strongly believe that those “further” fiscal programs will be back-end loaded, but we should get something on infrastructure by the end of the year. So would still be a positive development.)

We’re also seeing signs that the economy is beginning to improve even more in the new year. Last week, we got better than expected data on the Empire Manufacturing data, PPI, Retail Sales, Industrial Production, Capacity Utilization, NAHB Housing data, Phili Business Outlook and Existing Home Sales. It has been these kinds of numbers that now has the Atlanta Fed’s GDPNow estimate for GDP growth for Q1 up to 9.5%!.......On top of all this, The consensus earnings estimate for the S&P 500 in 2021 have also risen...from about $166 to about $174 in recent weeks. That $174 estimate (if it is reached) will mean that earnings will rise about 25% over 2020 earnings! (Of course, the economy will still be growing at a slower pace than before the pandemic...and earnings will be only slightly better than the pre-pandemic levels...and yet the stock market is trading significantly higher than it was back then...but there is no question that growth is improving.)

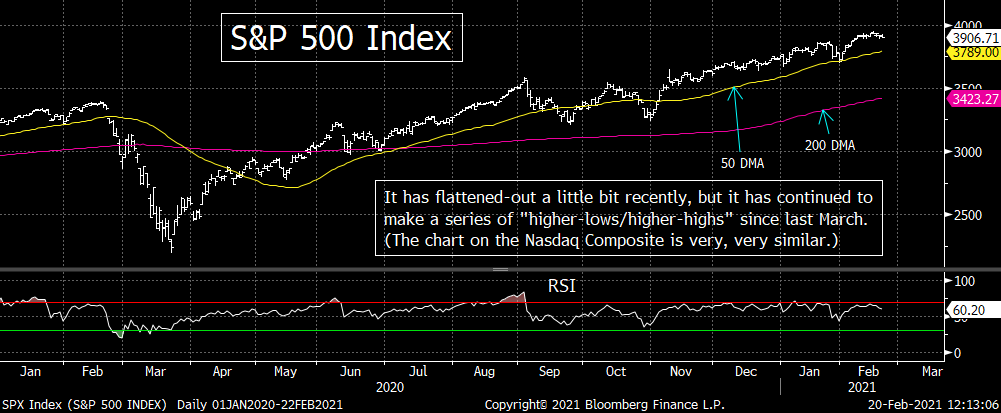

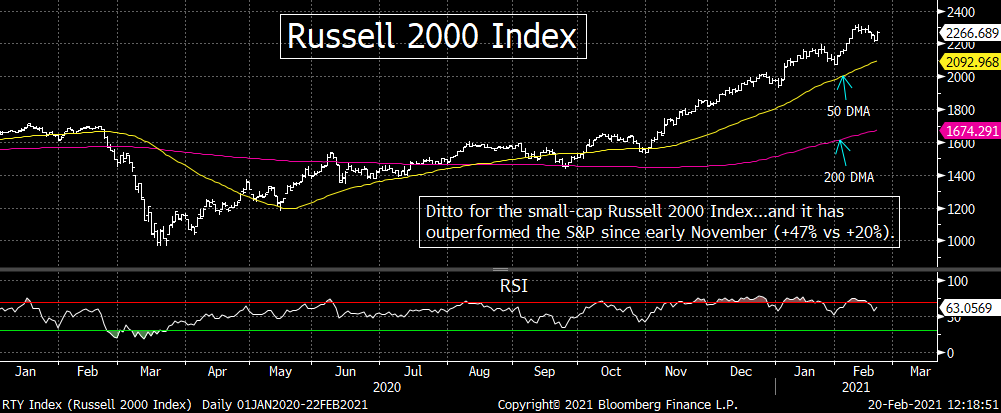

As for the stock market itself, even though the S&P has lost a little bit of momentum over the past two weeks, it has still been making a series of “higher-lows/higher-highs” since March. Yes, we had some pull-backs along the way (in June, September and late October), but none of them gave us a “lower-low”...so there is no question that the momentum for this market remains solid. (The exact same thing can be said about the Nasdaq Composite Index)......The same is also true for the Russell 2000 Index, but this small-cap has the added kicker of outperforming the S&P since the election. When the small-cap stocks (which are highly correlated to domestic growth) outperform, it tends to tell us the path of growth in the U.S. economy going forward remains positive.

Of course, we are now at the one year anniversary of the when the stock market topped-out in Q1 2020 due to the coronavirus. (If the market rolls-over in a material way next week, it’s going to be a Twilight Zone moment. As we mentioned last weekend, the market’s action so far this year has been EXACTLY like it was last year, so if it starts to decline in the last week of February once again, it’s going to be really weird.) Therefore, the market could turn on a dime...just like it did last year. (In fact, as you will read in our following points, we worry that the market is getting ripe for a correction.) However, as we have just shown, there are certainly reasons for people to remain bullish as we move through the rest of the first quarter...and beyond.

2) The next few weeks should be pivotal for the FAANG names. Back in January, they had shown some signs that they could finally regain some of the momentum they had throughout much of 2020. However, most of them have rolled back over this month. If they can regain their footing and bounce-back to finally take-out their August/September highs, it’s going to be quite bullish. On the flip side, if they keep falling, it’s going to lead some very big investors to lighten up on these names even more than they have since Labor Day.

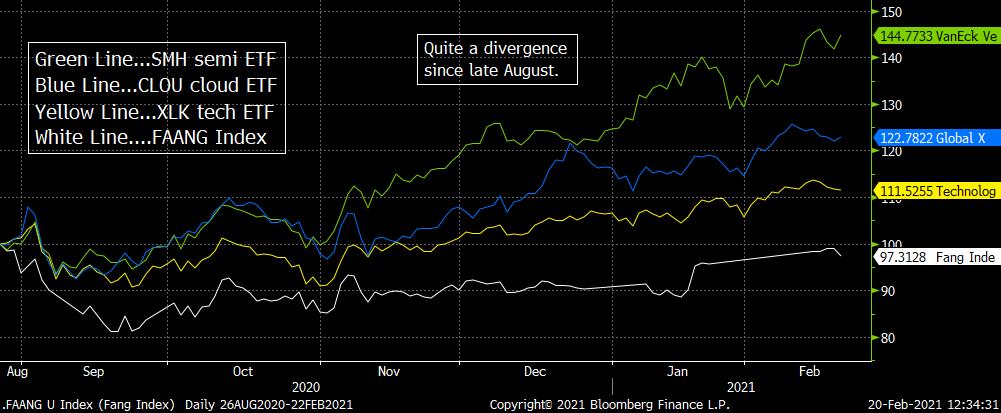

With the exception of GOOGL, the FAANG stocks have been dead money for the past six months. In other words, not only have they underperformed the rising broad stock market (and much of the rest of the tech sector) since late August, but they have also not rallied at all either. (If a group is “underperforming,” but still rallying...just to a lesser degree...that’s still not good. But when a group of stocks is doing nowhere while the market is rallying strongly, that’ really, really bad.)

In fact, some of these names are actually down from their late August/early September highs. FB is still 12% below its August highs...AMZN is more than 6% lower...while AAPL and NFLX are basically unchanged. And even though GOOGL is 21% above ITS August highs, an equal weighted index of these names has still been unable to break above those summer highs.

We’d also note that the poor performance is these big cap tech names has weighed-down the XLK tech ETF. Since the August highs for the FAANG’s, the XLK has rallied 11% while the S&P has rallied 12%. HOWEVER, the SMH semiconductor ETF has rallied 44% and the CLOU cloud computing ETF has gained 23%! In other words, many tech stocks continue to act VERY well, so the stock market continues to be a “stock pickers” market (and in the case of the tech sector, a “sub-sector” picker’s market!).

This brings us to the current situation. These big cap tech names are still heavily weighted in many institutional portfolios. This is a problem. Believe it or not, holding a big position in AAPL for an institutional investor has actually hurt their relative returns over the past six months!!! Of course, VERY FEW institutional investors (if any) are going to reduce their AAPL holdings to an under-weighted level. However, if AAPL and some of these other names continue to badly underperform the broad market (and other tech stocks/groups), it’s going to cause them to lighten up on their exposure to APPL and these other names to a level that is more in-line with their market weights.

Therefore, the action in these FAANG names over the near-term should be important. If they can bounce...and finally breakout above their 2020 highs, it will give them the kind of renewed momentum that will attract a lot of money once again. If they fail...and ESPECIALLY if they fall below the lows since August...it’s going to cause a lot of money to shift away from those names. (Again, these big funds won’t dump these names whole sale, but when so many of them begin to move at once, it can (and likely will) still have a negative impact on those names.) THAT will be quite negative for these stocks.

Of course, this should create more “rotation” WITHIN the tech sector...so it should provide some further opportunities in these other “sub-groups” of the technology sector......Therefore, this is a long-winded way of saying that good “stock picking” and “group rotation” are going to be essential to maximize returns going forward (in the tech sector....AND in the broad stock market in general) as we move through the rest of 2021.

3) So let’s look at the charts at the specific FAANG stocks...so we can see what the key near-term support/resistance levels are right now. If these levels are broken in the coming weeks, it should create important moves in these names (in the direction of the “break”). We’ll even touch on GOOGL...even though its chart looks quite good and thus would have to reverse substantially before it would raise any concerns on a technical basis. (BTW, instead of listing all of the charts at the end of the bullet point like we usually do, we’re going to provide the chart for each stock right after the written commentary on each name. Each one is pretty simple & straight forward.)

FB.....We provided the chart on this name just a couple of weeks ago, but we want to update that chart. (The key levels haven’t changed, but we cannot talk about the charts on the FAANGs without including an updated chart on FB!).....The stock has formed a “descending triangle” pattern...and the bottom line of that pattern (which comes-in at $248). So any meaningful break below that level will be quite bearish for FB. However, we also want to point out that its 200 DMA has provided support on each of the last two pull-backs in the stock, so a move below that moving average (of $258 right now) will raise a minor (yellow) warning flag. However the $248 level is the much more important level to keep an eye on......The top end of that pattern comes-in at about $283 right now, so a break above THAT level will be positive. However...like it’s going to be for all of these FAANG names, the August highs is the level that we should all be focused-on. That August high was $304...and any significant break above that level will be quite bullish for FB.

AMZN......This stock has been in a relatively tight range since August. (Actually, it could be said that the stock has been in a sideways range since early July.) We do need to note that it has formed a “symmetrical triangle” pattern in recent months, but the more important support/resistance levels for AMZN are low and high of its sideways range. In other words, the 3000 and 3500 levels are the key once to watch. To be more specific, a meaningful drop below the 2960 level will be quite bearish...while a material rise above the 3530 level will certainly be bullish for AMZN.

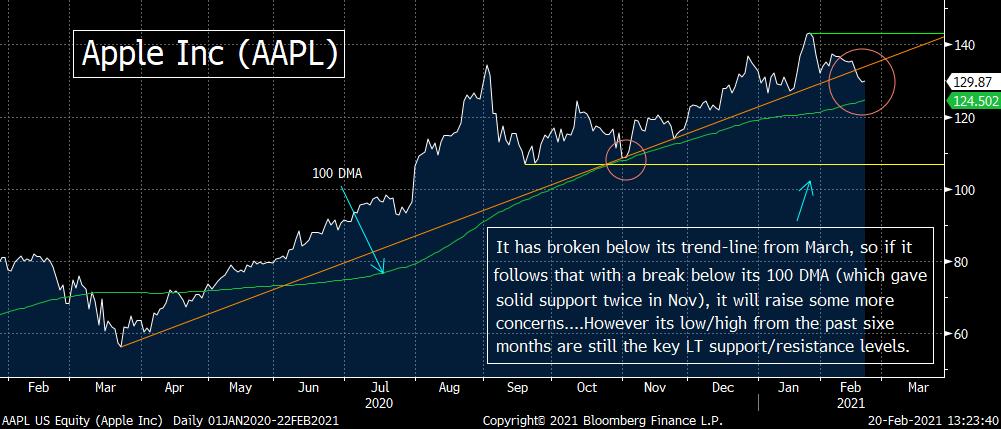

AAPL......As much as AAPL is still one of the most respected companies in the U.S. and around the world, it’s stock is trading at the same level it was in late August! Therefore, AAPL has actually been dead money for investors for quite a while now. Yes, it did move very slightly above its early September highs late last month, but not enough to confirm a breakout. Also, over the last four weeks, the 9% decline has taken it below its trend-line from March. Therefore, if it rolls-over further from current levels, it would raise some concerns.

AAPL fell below its 50 DMA last week for the first time since November, but that was not a very big deal in our minds. The 100 DMA is more important to us...as that line provided rock-solid support on two occasions in November. Therefore, any break below that line will raise a yellow warning flag. This will be a bigger yellow flag than the one we mentioned in FB (IF it takes place)..because it would also take it well below its trend-line from last March......The good thing about AAPL is that it will take a break below its September los of $106.75 to confirm a change in its long-term trend. However, that level is 18% below where it closed on Friday. Therefore, some big holders are probably not going to wait THAT long to lighten up a little bit more on the stock...if the stock falls a lot further (and becomes worse than just “dead money”).

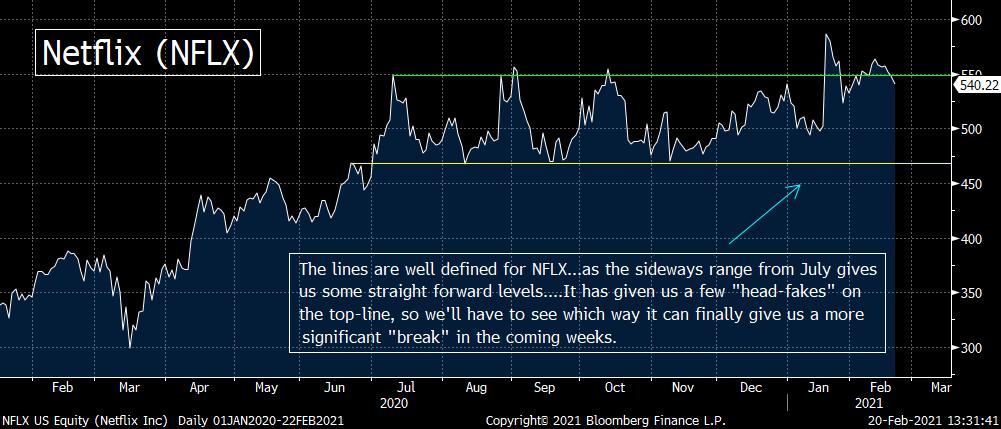

NFLX......The chart on NFLX is a very easy one to analyze. Like AMZN, it has been stuck in a sideways range since July. It has been a wider range (especially in recent months), but it has been range-bound none-the-less. The lower line of that sideway range is $458...and the top line comes-in at about $575. Any meaningful break below or above those levels should create a big move in the direction of the “break.” It’s as simple as that for NFLX right now.

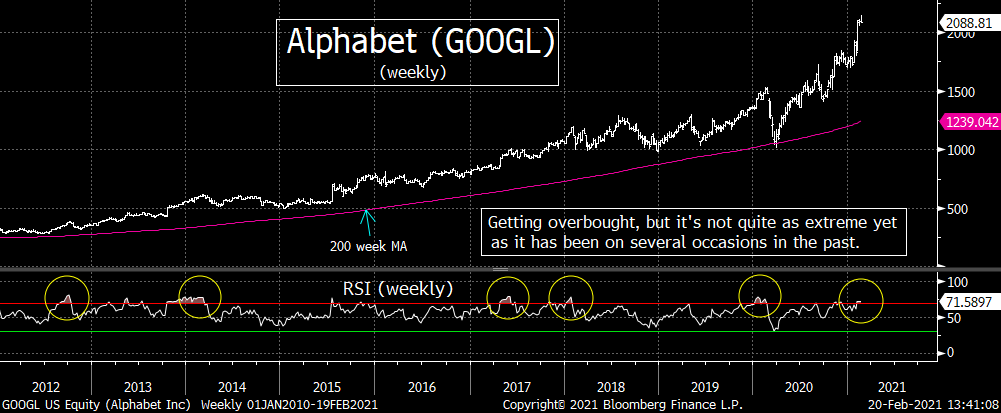

GOOGL......This stock has been acting incredibly well since its September lows. Unlike the other FAANGs, it has rallied well above its early September highs...and now stands 23% above those highs (and 100% above its March lows).....We do admit that GOOGL has become quite overbought on both a short-term and intermediate-term basis, so it’s no surprise that its rally has flattened out over the past two weeks. It would not be a surprise if the stock saw a pull-back at some point soon as well. However, given the rally it has experienced, any pull-back would be normal and healthy......If GOOGL did fall below $2000, it would risk “filling the gap” down to $1950 quite quickly, but it would take a break below its trend-line from March to raise any serious concerns. That comes-in at $1725 right now, so GOOGL is the least vulnerable of these names at the moment (although it could become a “source of cash” if we get another round of “forced selling” for some reason anytime soon).

4) We cannot get over our concerns about another big wave of the coronavirus (due to the variants)...for the simple reason that several experts (including the Head of the Center for Infectious Diseases at the U of Minnesota, Dr. Michael Osterholm) keep telling us that things are going to get much worse in the weeks ahead (and that the hospitalization rates will surpass last year’s peak).

There is no question that the number of cases and the number of hospitalizations in the U.S. have continued to decline recently. (They’re declining for a very high level, but they ARE declining.) However, since certain experts (ones who were early...and spot-on last year) keep telling us that the worst of the pandemic is still dead ahead, we remain worried that a new round of lock-downs will hit us before long...and that will cause the economic and earnings growth estimates to reveres and come-down for this year. Given that the stock market is already pricing-in growth that is better than the consensus estimates for growth in both areas, that kind of development will almost certainly have a negative impact on the broad stock market in the not-too-distant future.

As we’ve said many times before, we are not doctors or scientists. We would also note that there are some experts who are now saying that we’ll reach heard immunity by April.......However, following the warnings from Dr. Osterholm and a few others...enabled us to come to the conclusion that the stock market...which was priced for perfection...would see a significant decline early last year. It helped us tell investors and traders alike that they should raise cash in January and early February of last year...and that worked out very, very well. Therefore, since these particular experts were SO spot-on last year, we are concerned that a similarly strong wave of the virus could still be in front of us. This means that there is a serious risk that another decline will take place once again (even if the drop is not quite as bad as last year’s Q1 drop).

If the stock market was not incredibly expensive (like it WAS this time last year)...and there was not some serious signs of froth in certain parts of the market (which did NOT exist last year)...we’d be much less concerned. However, since these issues do exist, we think that the stock market is quite vulnerable right now...even if any new lock-downs are not as dramatic as they were last spring.

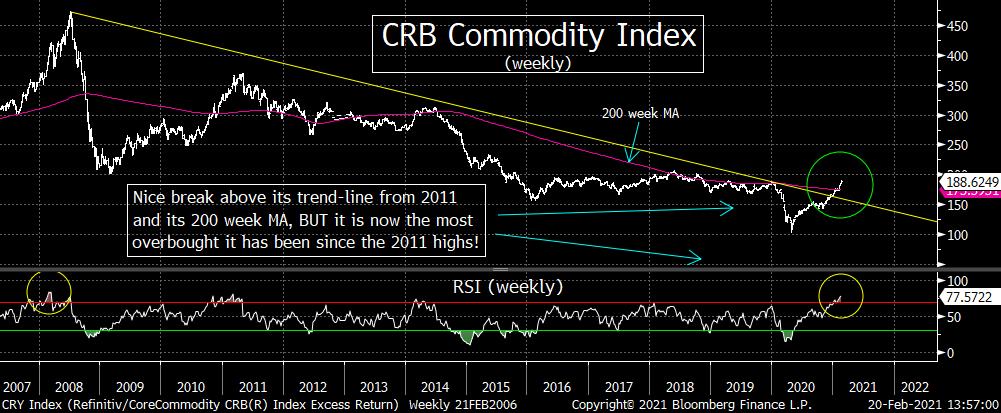

5) Our concerns about a new wave of the pandemic also coincides with our concerns about the commodities market over the near-term. We have been VERY bullish on commodities since early last summer, but they are getting quite extended on a near-term basis. If we get a new wave of the pandemic (and thus a renewed wave of lock-downs)...at a time when commodities have become very overbought, it’s going to lead to something more than a mild correction...EVEN IF the long-term prospects for this asset class remain quite positive!

We turned a bit more cautious on the commodity space over a week ago, so we were a bit early. However, given the fact that we turned bullish and called for the end of the nine-year bear market in commodities when basically everybody else remained bearish on the asset class, we’re not too worried about being a little early with this more cautious (short-term) call.

The reading on the weekly RSI chart for the CRB Commodity index has not been more overbought since the 2011 high! Yes, we suppose the CRB could keep rallying until it reaches that 2011 extreme, but that might be difficult given that the CRB was 150% higher than it is today back then! We do admit that its daily RSI chart was slightly more extreme back in 2014...after a short-term rally to start that year), but it was only very slightly more overbought. Either way, a reading well above 80 on the daily RSI chart shows that it is very extended as well.

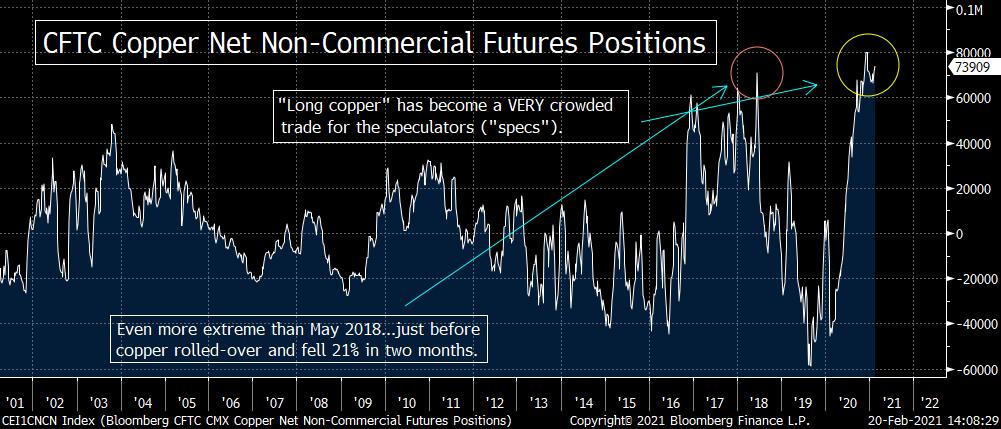

As for our old friend, Dr. Copper, it is also extremely overbought...as its weekly RSI chart recently gave us the most extreme reading it has seen since 2006! Also, the Daily Sentiment Index survey of futures traders shows that bullishness for “The Doctor” has reached the very extreme level of 93% bullishness. On top of all this, the COT data shows that the “non-commercial” futures traders (the speculators or “specs” as they are called...who are usually wrong at extremes) have a HUGE net long position in copper. In fact, it’s even more extreme that it was in 2018 (the old record for the most extreme positioning for copper)! Back then, its extreme reading was followed by a 21% drop in copper over the following three months!.....So there doesn’t seem to be many people left to buy the commodity...at least in the futures pits.

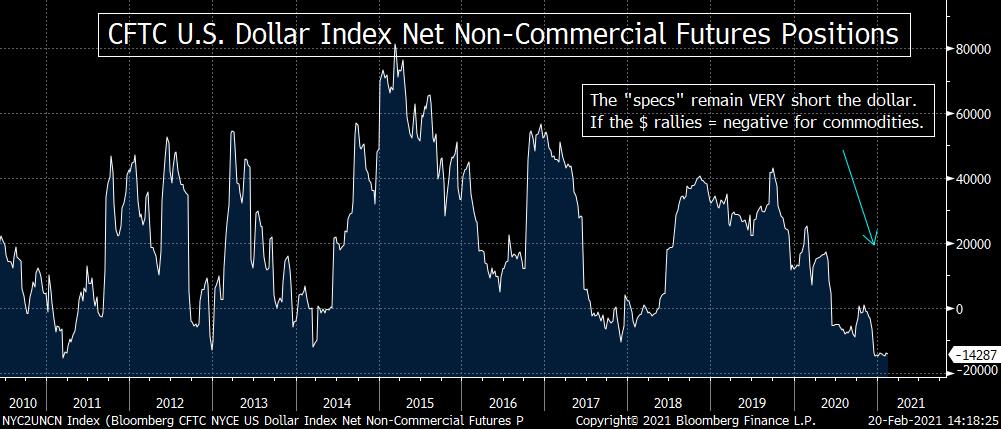

On top of all this, we still have a very crowded trade in the currency market...as everyone seems to be short the dollar. The greenback has bounced off of its early January lows, BUT its bounce has not been a strong one so far. However, since SO MANY people are on one side of the boat in this trade (as we have shown with the COT data in recent weeks)...it won’t take a lot of movement back towards the other side to create a decent sized “tradeable” rally in the dollar. If (repeat, IF) the dollar DOES start to bounce in a more meaningful way, it could/should be another reason for commodities to see a pull-back (especially if it happens at the same time that a renewed wave of the coronavirus shut-down the global economy once again to one degree or another).

Therefore, we are going to stick with our recent (short-term) stance on commodities. This means that we are also sticking with our opinion that the energy stocks (and other commodity-related equities) should not be chased at current levels. Yes, they could rally a bit more from here, but the next compelling move should be a pull-back...and we want some dry powder on hand to take advantage of that situation when it develops.

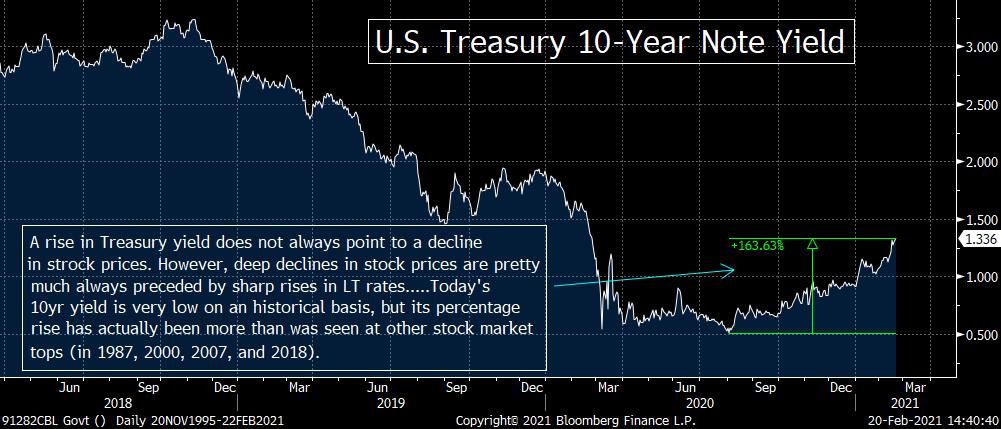

6) The yield on the U.S. 10yr note pushed higher again last week...and there is no question that Wall Street pundits are starting to wonder out loud a lot more about whether the rise in long-term yields above 1% will be enough to throw a wrench into the works of the stock market rally. Most pundits say that long-term interest rates are so low on an historical basis that a rise in yields will not have an impact on the stock market. However, they said the same thing about the rise in short-term yields in 2018...and they were dead wrong.

When yields were below 1%, most Wall Street pundits were saying that a rise in the 10yr yield would not create a problem until it got well above 2%. (Some even said it would take move above 3%.) Now that the yield on the 10yr note has indeed broken well above 1%...and has thus confirmed that there has been an important change in the multi-year trend in long-term yields has changed (see chart below)...some pundits are starting to lower their levels. Some are now saying that a move above 1.5% would be enough to disrupt the stock market.

Of course, none of us really knows what level of interest rates will do the trick...and cause some meaningful problems for the stock market. However, there is one thing that we are confident about. Just because LT rates are ultra low on an historical basis, we do not believe that they will have to rise as far as most pundits think they do...before they will negatively impact the stock market.

First of all, the consensus said the same thing back in 2018 about short-term rates...and they were dead wrong. When the Fed was in the middle of his first tightening cycle in over a decade, the consensus kept saying that short-term rates were too low on an historical basis for rise in those rates to have a negative impact on the stock market. (We totally disagreed.) Sure enough, even though the Fed Funds rate only moved slightly above 2% (which was still ridiculously low on an historic basis), it was enough to clobber the stock market...and create a deep (20%) correction in the S&P 500 index.

Second, another problem is that both public and private debt have risen to all-time high levels. So the cost of servicing this debt will create problems as rates rise...even though they’ll be rising from a very low level. This is especially true given that so much of the government and (especially) the corporate debt that has been raised in recent years has NOT gone to projects that will create income to service that debt!.....Sure, if they don’t need to raise any more debt, these higher interest rates won’t be a problem until the debt needs to be rolled-over...but how many of these corporate and government entities will be able to avoid issuing more debt in the future?????

None of what we have just highlighted means that the 1.5% level will definitely create problems for the stock market (much less the 1.3% level that exists today). However, given that valuations are very stretched...junk bond yields give a whole knew meaning to the term complacency...options volume for individual investors is off the charts...equity mutual fund cash levels are at record lows...short interest for the broad market is near record lows...Bitcoin has gone parabolic...the HUGE increase in blank check SPACs, etc., etc....this move in yields SHOULD be something that investors keep a close eye on.......Our point is that just because long-term interest rates are very low on an historical basis, this issue should also be on the list of things to worry about right now.

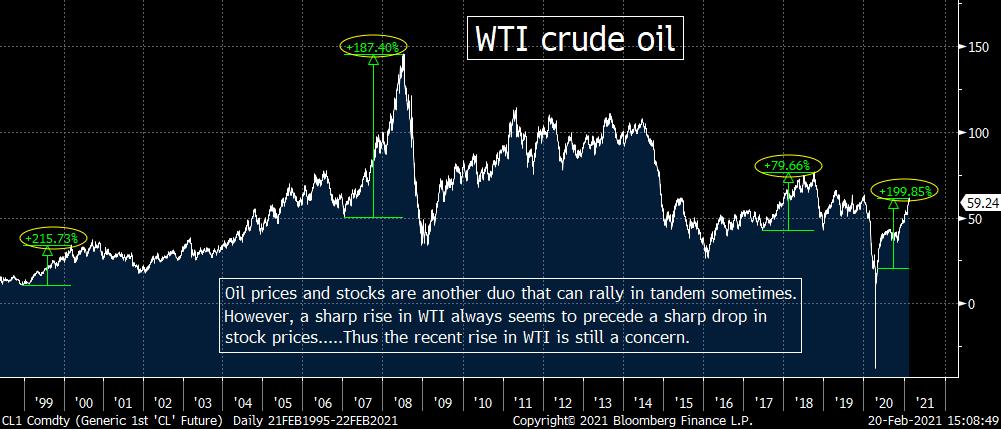

6a) Having said all this, we still have plenty of global central bank liquidity...and we’ll all but assuredly get more fiscal stimulus as well...so this rally in the stock market could certainly go a lot further before it tops-out. However, we just want to mention one last thing: There are two developments that always seem to take place just before an important top in the stock market. First is an outsized rise in long-term interest rates...and the second one is a strong rise in oil prices.

We readily admit that a rise in long-term rates does not always signal a top in the stock market. Sometimes long-term rates and stock prices can rise in tandem. However, that usually only takes place when the stock market is coming from a very cheaply valued level (like it was in 2003, 2008/09, 2012/13)...not an extremely expensive one (like it is today).

When long-term rates rise in a material way on a percentage basis (like they have recently)...and at time when the stock market is quite expensive (1987, 2000, 2007, and 2017/18)...it is usually followed by a sharp decline in the stock market. Thus we need to be careful about the rise in interest rates since the summer lows.

There is no question that the 1.3% yield on the 10y Treasury note is very low on an historical basis...and that $60 on WTI crude oil is far from being extreme. However, the rise in both of these assets on a percentage basis is still in-line with what has taken place just before an important top in the stock market. The 10yr yield has risen more than 160% (which is MUCH more than it did just before the tops in the stock market in 2007, 2000, 1987, etc.)...and the price of WTI crude oil has risen over 210%, which is in-line with the rise just before other important tops in the stock market in the past.

Again, the market could continue to rally in the coming days and weeks, but there is NO QUESTION that the risks have jumped SIGNIFICANTLY in recent months...and therefore investors should act accordingly.

(BTW, when we measured the 200%+ rally in oil, we started at $20. That was the level it traded at just before (and just after) that crazy move into negative territory last year. Needless to say, the move from those ridiculous levels was even bigger (a lot bigger), but it would be quite mis-leading if we used a starting point that was anything below $20.)

7) What does the Fed think about long-term interest rates? (They DO impact them...due to their massive QE program.).....We believe that the Fed has definitely decided to “taper”...so the timing of that “taper” should be important for the stock market in 2021 and the first half of 2022. The consensus believes that it won’t take place for a long-time, so it is nothing for investors (especially equity investors) need to worry about right now.....We believe it will impact the stock market sooner than the consensus thinks...even if the “tapering” doesn’t begin until next year.

There is absolutely no question in our minds that the Fed has decided to taper back on their existing massive QE program...and that they are currently involved in setting the stage to “taper” in the future. Of course, this would make total sense. Why would they need to keep such a colossal level of liquidity flowing into the system if the economy is no longer shut down by the pandemic (like it was when they initiated the program)??? In other words, it would be crazy to think that the Fed would not be already setting the stage to pull-in their horns when it comes to their ultra-accommodative policy of the past 11 months........The question is whether this tapering move will come far enough in the future to have a negative impact on the stock market any time soon.

(If we do get another big wave of hospitalizations, the Fed won’t taper for a quite a while....but it’s hard to think that another meaningful lock-down won’t hurt the stock market at these levels...no matter how much liquidity there is in the system.)

So what is the strategy the Fed is following right now? Well, we have to look at what took place in 2013. We have...and this is our opinion of what strategy the Fed is following today:

When the Fed first made their “taper” comments back in 2013 (in May of that year), the bond market fell out of bed (and rates obviously shot-up). The Fed was shocked by this move in the bond market. It took them a little while to walk things back, but by the end of June they started talking out of both sides of their mouths. (We don’t mean that in a bad way...it was actually a smart way to proceed.) They had some Fed members talking publicly in a hawkish manner...while others talked in a more dovish manner (while they all said the decision would be “data dependent”). As we moved through the summer, the number of Fed members who were speaking in a hawkish manner moved slowly higher...while those who spoke dovishly became less prevalent. This was a nice set-up for their “taper” move in the fall. By the time they actually tapered, the change in policy had been GRADUALLY priced into the market.

BTW, the trajectory of the data never changed. It did not improve at all....but they STILL tapered in in the fall. They always had every intention of tapering in the fall of 2013...no matter how strong the data was or wasn’t (as long as it didn’t turn down in a significant way). However, they needed to “set it up” better than they had in the spring of that year. Again, they did this by sending out mixed signals until the markets became comfortable with the eventual tapering move.

Don’t get us wrong, LT rates DID continue to rise that summer, but the move was not as dramatic as it was in May & June. ALSO, the stock market got hit initially (in May & June), but the mixed signals that the Fed was sending out over the summer of 2013 created a situation where the stock market was able to stabilize by late June...and it actually rallied a bit high

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member