Sometimes the stock market closes at a much different level than the futures were indicating in the pre-market earlier that day. Thus, the fact that the futures are trading much higher this morning does not guarantee that we’ll have a strong close in the stock market today. However, given that the S&P futures are trading higher by 23 points as we write, it sure looks like 2021 is going to be another year where the stock market rallies on the days surrounding the long Memorial Day weekend.

The yield on the U.S. 10-year Treasury note has popped back above 1.6% this morning. It has been trading around that range for a while now. In fact, it has been trading in the 1.5%-1.7% range for two months, but we might get a catalyst for a breakout of that range with this Friday’s employment report. Of course, the data could be right in line with expectations, so we don’t want to say that this week’s data is going to be critical for the bond market. (It could remain range-bound for many more weeks.) However, since the bond market has been so important to the tech stocks over the past nine months, if (repeat, IF) we get any significant move in yields based on the employment report, it should be important for the stock market as well.

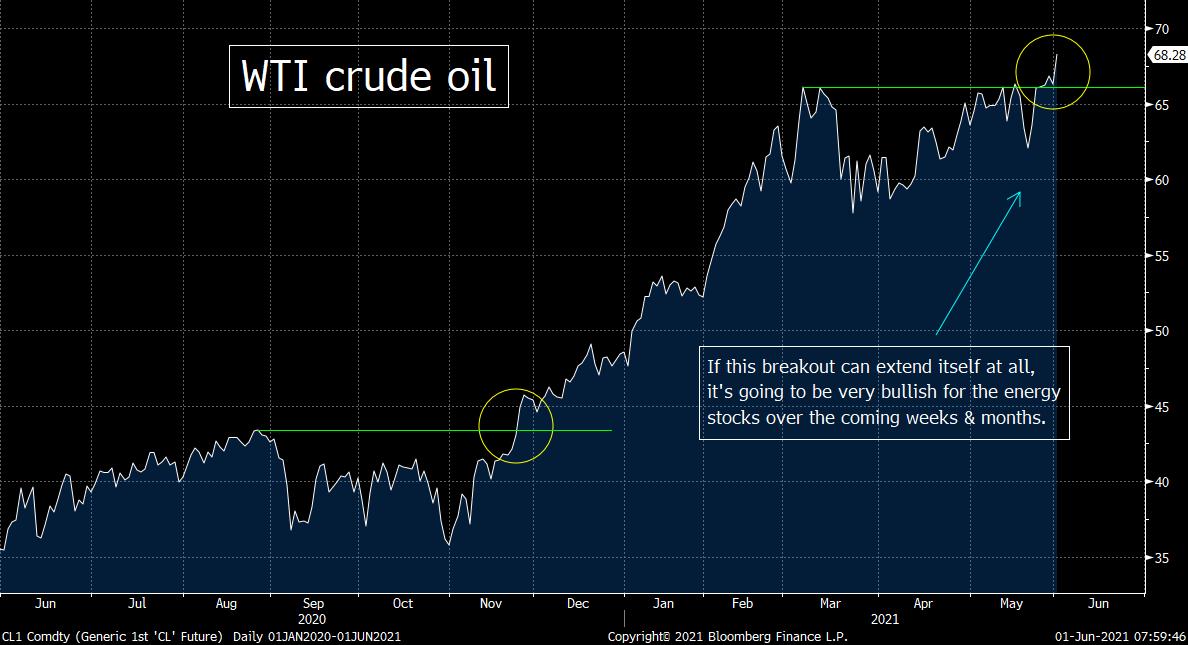

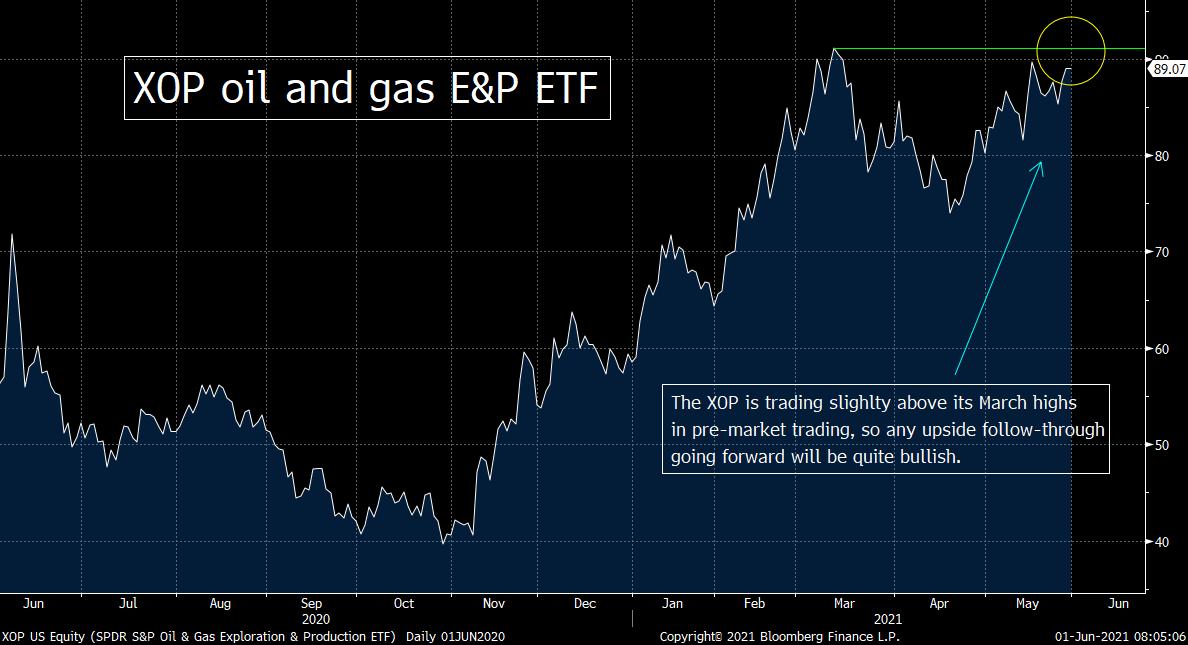

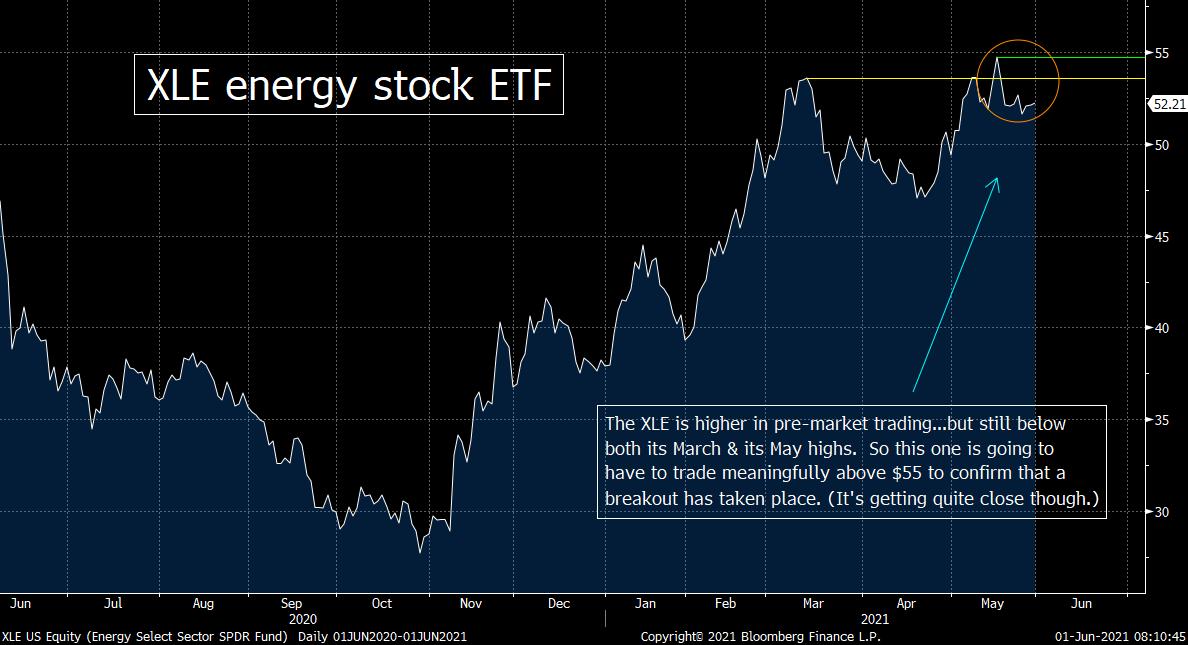

Crude oil is trading higher this morning and WTI crude oil now stands at its highest level since 2018. We’ll see how the black gold trades over the rest of the day (and in future days), but this move is taking crude oil above its highs from March, so this quite bullish for WTI on a technical basis. As for the energy stocks, the XLE energy ETF is trading just above $53 in pre-market trading, so it’s still slightly below its May highs of $55. However, the XOP oil & gas ETF is trading just above $90, so it IS trading slightly above its 2021 highs, so that is certainly bullish for those stocks.

We are still going to have to see WTI and the XOP trade more meaningfully above their 2021 highs (and the XLE will have to break above the $55 level in a significant way as well) before we can confirm that a renewed breakout in the energy sector. However, there is no question that the upside potential in this sector is becoming very strong. If we do indeed get confirmation of another breakout, it’s going to force a lot of institutions to “rotate” further towards this energy stock as we move through the rest of this year.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member