Well, the stock market finally woke up to what the bond market (and energy markets) were telling it recently. As we highlighted yesterday, these other markets were screaming that the situation in eastern Europe is not a good one…as both to them were trading a much more extreme levels than the were last Thursday morning (when the shooting first started). While this was taking place, however, the stock market was still trading WELL ABOVE its lows from last Thursday…so it was only a matter of time before the stock market reacted in a negative way.

That said, even though stocks took it on the chin yesterday, the major averages are STILL well above those lows from last Thursday…so there could/should be some more weakness at some point going forward. Of course, this does not mean that the stock market will fall further immediately. One of the reasons why the stock market has held up so well is belief that the Fed will not be as aggressive in their new tightening policy as some were thinking they would be before the crisis in eastern Europe erupted. So if we get some positive reinforcement on this subject, the stock market could hold up (or even bounce) for a while.

There is no question that the market is no longer pricing-in any chance of a 50-basis point rate hike in March. The question now is whether the thought that Fed will not be EXTREMELY aggressive with their tightening policy will be enough to give the stock market a nice boost. In other words, if the Fed is still quite aggressive (25 basis points at most meetings this year)…will that be enough to keep investors from de-rising and de-leveraging their portfolios in this (still) expensive stock market…just because they’re not going with a 50-basis points hike this month?

Then again, the Fed might become very dovish…and not raise interest rates at all in March. THAT would certainly be a BIG change…and it could/should allow the stock market to stay disconnected from the bond market when it comes to its fears about the situation in Ukraine. However, we question how likely it will be for the Fed to become as dovish as the stock market seems to be assuming right now. Inflation is the big problem the Fed faces (and it’s certainly the reason they keep giving for their shift to a tightening move)…and the crisis in eastern Europe is only making this problem worse. Therefore, we do not believe the Fed will turn to a much more dovish stance…the way the stock market seems to be indicating right now.

Let’s face it, the Fed already lost a lot of credibility last year when the missed the boat…with their “transitory” opinion on inflation. In other words, they’re ALREADY very, very late in responding to this issue! Thus, if they put off fighting inflation in a meaningful way even further, it could create more problems than it solves!......What we’re saying is that the Fed will probably cause some problems in the stock market if they go ahead with a fairly aggressive tightening policy…BUT those problems will likely be smaller than the ones that would develop if they became very passive with their tightening. That kind of strategy would raise the odds that stagflation will become a much bigger problem for the economy!……..Put another way, the Fed is stuck between a rock and a hard place…and the lesser of two evils will likely be for them to tighten in a fairly aggressive fashion (although not as aggressive at Mr. Bullard has been indicating)…so that the situation does not get an even worse one in the months and years ahead.

We’ll get a lot of answers to this issue from Chairman Powell today when he testifies in Congress. Our understanding is that he prepared comments will be released at 8:30 this morning, so we’ll get some sort of idea about where Mr. Powell stands before the stock market opens today…..Based on what we just said above, we think the stock market could be a bit disappointed in what he has to say. However, if we’re wrong, the stock market should be able to avoid fully pricing-in the negative effects of the crisis in eastern Europe…the way the bond market and many commodity markets already have this week……….Therefore, as important as the war in Ukraine has become, the Fed will become the number one focus for the markets this morning.

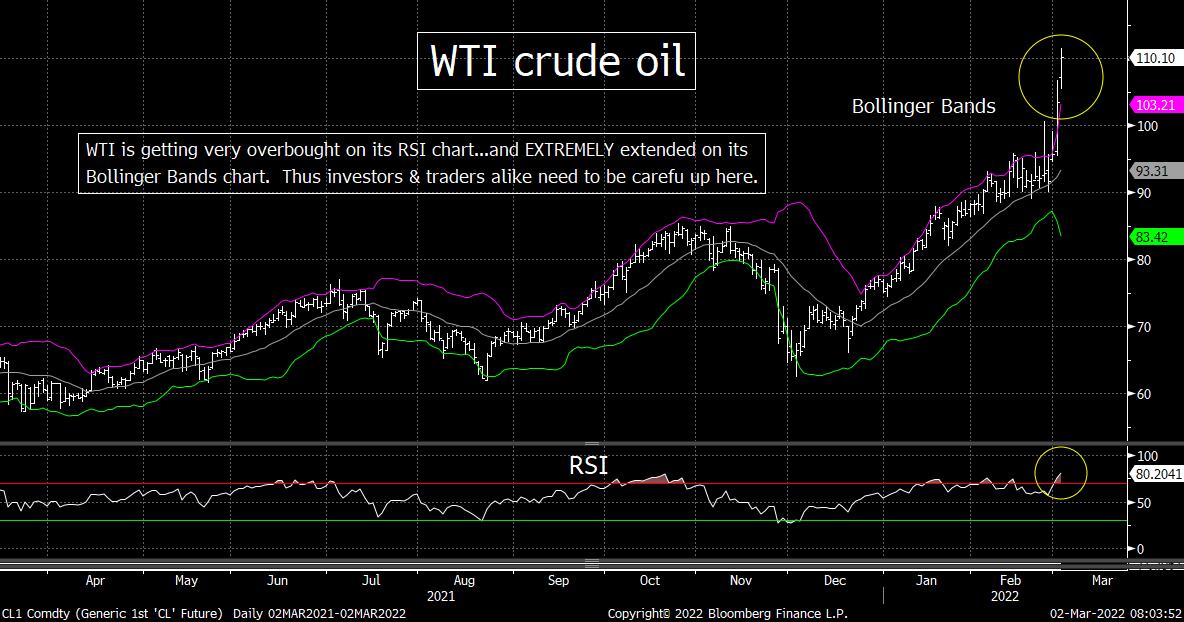

Speaking of commodities, crude oil is becoming quite overbought. Looking at the chart on WTI crude oil, it’s RSI chart has moved above 80…and it is extremely extended on it Bollinger Bands chart (so it is much more than 2 standard deviations above its 20-DMA). Therefore, it might be tough for WTI to rally a lot more over the very-short-term.

Having said this, we do need to point out that the XLE energy stock ETF and the XOP oil & gas ETF are not as extended as the underlying commodity. Yes, they ARE getting overbought, but their readings are not as extreme as they are for WTI. Also, as much as oil traders DO look at the charts, the situation on the ground in eastern Europe is going to be their primary focus (by a wide margin). Therefore, if the situation in that part of the world continues to deteriorate, crude oil could certainly rally a lot more going forward…no matter how overbought it has become.

However, given the technical situation, we do want to warn investors (and especially short-term traders) about being overly aggressive on the buy side in this sector near-term. We are NOT telling investors they should take profits on their existing positions. We are also not telling investors that they should stop buying the group altogether right now. We’re merely saying that the group is very extended on a technical basis…and thus if we get any positive news on the geopolitical front, crude oil and the energy stocks will almost certainly fall in a very significant way (VERY quickly). With this in mind, we believe a much less aggressive strategy should be used in the energy sector over the short-term...even though we remain quite bullish on a longer-term basis.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member