The domestic stock futures are trading higher this morning. A lot can change between now and the opening, but if they can remain elevated, it will mean that the S&P 500 will open very near the key 3,900 resistance level we’ve been talking about over the last week or so. Therefore, if it can see some upside follow-through to this morning’s pre-market gains in the coming days, it’s going to be bullish for the stock market over the short-term. Of course, it has to move more than just a few dollars above that 3900 level. It’s closing high from June was 3911…and its intraday high was 3945…so we’ll certainly have to see more than a slight break of that round number to indicate we’re definitely going to see more upside follow-through. However, the potential is certainly there this morning.

Another big move that is taking place in the markets this morning is in the currency market. The dollar is seeing some meaning downside follow-through from Friday’s sell-off…and the euro is seeing just the opposite from Friday’s gains. As we have highlighted recently, the dollar has become extremely overbought and sentiment has reached extreme levels of bullishness (and the exact opposite is true for the euro). Therefore, we could/should be in for a “tradable” reversal in the currency market…even if they revert back to their 2022 trends several weeks from now.

Needless to say, we’re going to have to see more than two days of downside movement in the dollar (upside in the euro) to confirm that a counter-trend decline is taking place in the greenback. However, given the extreme technical readings we were looking at late last week, the odds that the dollar’s will see a tradable decline are quite high. This could/should have a positive impact on the commodities market. Many/most commodities have fallen significantly since early June…and thus they have become oversold. In other words, many commodities are already ripe for a bounce…but if the dollar sees any kind of a material decline over the coming days and weeks…it should give commodities an even bigger boost.

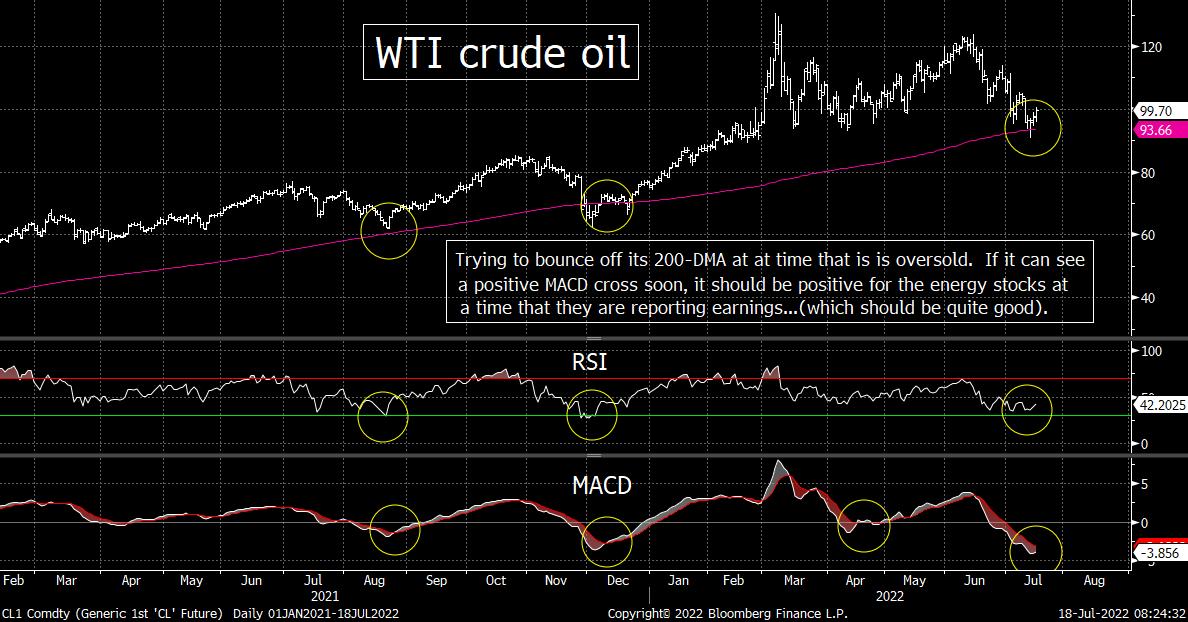

With this in mind, we want to point out that WTI crude oil is trying to bounce off its 200-DMA. If you’ll remember, the 200-DMA provided nice support for WTI in the second half of last year. It bounced 40% off that line in August…and after breaking slightly below that line in December (just like it did last week), it more than doubled over the next four months.

No, we’re not looking for another doubling of oil prices if WTI can bounce more significantly off the 200-DMA once again. (The invasion of Ukraine by Russia was obviously a big catalyst for that outsized rally in crude in Q1.) However, the bounce off this key moving average was already more than 30% before the war in Ukraine began. Thus, the odds are quite high that this most recent bounce off the 200-DMA will be a strong one…if (repeat, IF) the dollar sees some material weakness over the coming days/weeks.

It will be very interesting to see how much the energy stocks can rally if crude oil does indeed see another rally in the weeks ahead. These stocks have been hit hard over the past 6-7 weeks…and many/most of them have become quite oversold. ALSO, if there is one group that everybody expects to report GOOD EARNINGS, it’s the energy group. Therefore, if these energy stocks start reporting very good earnings…as the same time that their underlying commodity is seeing a nice bounce-back rally…it should be the kind of one-two punch that allows these stocks to regain the outperformance they experience during the first five months of the year.

We turned cautious on the energy stocks at the beginning of June. However, this was only in response to the group’s technical condition…which had become very overbought. We’re now becoming much more bullish once again…and if we see more weakness in the dollar, we’ll start pounding the table on the group. This will be especially true if WTI can see a positive cross on its MACD chart. As you can see (below), a positive cross on the MACD chart for WTI in the last year has been a very bullish development for the commodity and for its related stocks. Therefore, this is something we’ll be keeping a very close eye as we move through this week.

Matthew J. Maley

Chief Market Strategist

Miller Tabak + Co., LLC

Founder, The Maley Report

TheMaleyReport.com

275 Grove St. Suite 2-400

Newton, MA 02466

617-663-5381

Although the information contained in this report (not including disclosures contained herein) has been obtained from sources we believe to be reliable, the accuracy and completeness of such information and the opinions expressed herein cannot be guaranteed. This report is for informational purposes only and under no circumstances is it to be construed as an offer to sell, or a solicitation to buy, any security. Any recommendation contained in this report may not be appropriate for all investors. Trading options is not suitable for all investors and may involve risk of loss. Additional information is available upon request or by contacting us at Miller Tabak + Co., LLC, 200 Park Ave. Suite 1700, New York, NY 10166.

Recent free content from Matt Maley

-

THE WEEKLY TOP 10

— 10/23/22

THE WEEKLY TOP 10

— 10/23/22

-

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

Morning Comment: Can the Treasury market actually give the stock market some relief soon?

— 10/21/22

-

What Do 2022 and 1987 Have in Common?

— 10/19/22

What Do 2022 and 1987 Have in Common?

— 10/19/22

-

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

Morning Comment: Which is it? Is stimulus bullish or bearish for the stock market?

— 10/17/22

-

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

Morning Comment: Peak Inflation is Becoming a Process Instead of a Turning Point

— 10/13/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member