Recap: The word of the day is Whipsaw! First we open upfrom yesterday. Then we quickly fall off a serious cliff on Russia/Syria/USchatter. Then within minutes we recover for most of the day only to lose steamgoing into the close. The only part that didn’t surprise me today was the fadeinto the close. I had said that traders will want to book profits before theweekend especially that we’d had three up days in a row and were working on afourth one. Although we closed flattish, this was definitely a win for the bears!An important note is that the market seemed to have ignored the interestrates during market hours. I suspect that this won’t last long.

NextOpen: With alight economic early part of the week, I anticipate that Monday’s open will beheavily influenced by the Asian and European overnight sessions. It would beinteresting to see how they will interpret our Friday chain of events. As for the Syriaissue, I want to assume that we will have the proverbial blue elephant in theroom until Obama gets his way. NOTHING ISPRICED IN! If Fed tapers tomorrow or if Obama strikes Syria we willfall precipitously. Conversely, if Bernanke flat out says no taper on his watchor if Obama said no strikes then we rip to the moon… NOTHING IS PRICED IN!

Trades: Nice day for the folio.

- New positions: You saw the two new positions with the write up that preceded them. Nice going.

- AAPL: Headline stock so sidelined for now. Next week it has important events which in my opinion will be sold.

- GOOG: Those of you who sold the credit call spread this week you are breathing a little better today. Although I bet that you lost your breath a few times on Google strength ;-)

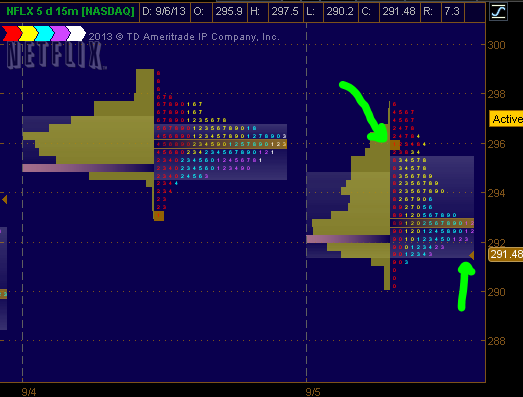

- NFLX: Nice position price action today. The stock had terrible market profile and it was literally saved by the bell. Had it lost the 291 level it had the potential of falling into an abyss. You also saw my mid-day write up.

- NDX: Good performance in the trade at 54% of max profit. At one point price showed a .05 to close but my order didn’t trigger.

- RUT: Good performance in the trade at 59% of max profit.

- PCLN: I am personally still short it as it continues to demonstrate that it can’t hold its green. Although I most definitely have protection and my finger on the trigger.

- BIDU: had an amazing turnaround today. I still can’t touch it here. It has the potential of a bullish pattern forming (yes, even at this altitude) BUT I don’t make decisions based on technicals but rather use them to verify my thesis.

- IMP NOTE: Don’t take trades I post in the blog area, unless you know exactly what you are doing. If you are not sure what to do, message me.

See you all soon.

NicolasChahine,

Create Income with Option Spreads / MaximumProfit Spreads

to Create Income with Credit Spreads on marketfy.com

Recent free content from Nicolas Chahine

-

Crypto Update Via Ethereum.

— 6/30/22

Crypto Update Via Ethereum.

— 6/30/22

-

Update on the Oil Trade.

— 6/25/22

Update on the Oil Trade.

— 6/25/22

-

Bitcoin Update

— 6/19/22

Bitcoin Update

— 6/19/22

-

SPX Magic Late in the Day

— 6/14/22

SPX Magic Late in the Day

— 6/14/22

-

Options Tables Are Full of Clues

— 5/27/22

Options Tables Are Full of Clues

— 5/27/22

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member