Click Here for this Week's Full Letter - December 23, 2014

Greetings,

Over the next five years, film studios are scheduled to release 26 “comic-book” movies. At some point studios will run out of characters, and when they do, I think they should launch a new team of superheroes called “The Central Bankers.” Sent from planet Academia, The Central Bankers are here to protect financial markets from the ferocious Bears. The opening scene could be Janet Yellen’s press conference from last Wednesday.

All jokes aside, it’s remarkable how addicted asset prices have become to monetary stimulus. According to Bank of America, 83% of world equity market capitalization is supported by 0% interest rate policy. The US stock market had its best two-day rally since 2011 after the FOMC press conference, finishing +4.5% higher. In my opinion, it wasn’t so much that stocks rallied, rather the market simply cooled-off leading up to the press conference fearing Yellen would put a timetable on rate hikes. Once the Fed confirmed it was willing to be “patient,” stocks resumed their record-setting rally.

The S&P 500 continues to look bullet-proof, but other regions are struggling mightily:

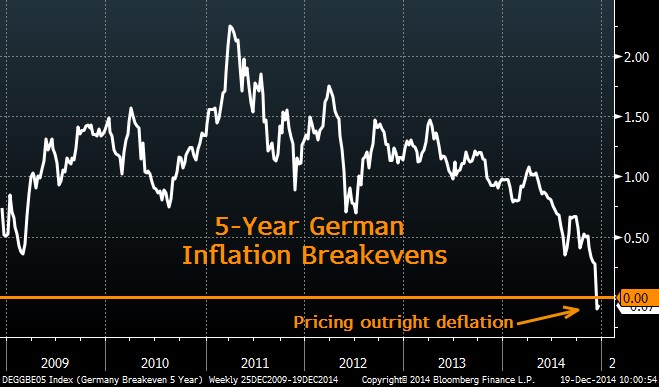

In Germany, Europe’s economic powerhouse, 5-year inflation breakevens have fallen below zero – pricing in outright deflation. Greece, Europe’s problem-child, failed to elect a President in their first round of voting last week. Early elections with the potential to destabilize the Eurozone will be called in January.

It’s the same story in Asia. December Manufacturing PMI in China fell below 50 for the first time since June – signaling a contraction. Australia, which was also hit by a lone-wolf terrorist attack last week, saw 3rd quarter GDP grow a measly 2.7% Y/Y, compared to economist expectations of 3.1%.

And then there’s Russia. While the developed world is desperately trying to combat deflation, Russia’s currency crisis will likely push CPI into double-digits early next year, despite a 6.5% rate hike last week. Food inflation is already a major problem, and there are fears of a nationwide food shortage. More on Russia below…

My Marketfy portfolio rallied ~3% last week. Very disappointing results, in my opinion. I had the Mon-Tues selloff followed by a Wed-Thurs rally called perfectly, but poor position sizing negated most of the gains. Frustrating, but it’s hard to cry about profits. We’ll get ‘em next time. Now that most December catalysts have passed, I expect the market to quiet down into year end. My December Investment Letter went out yesterday and it’s a very high-conviction bet – if you’d like to start receiving these letters click here. It’s $8.25/month, which would buy you more than 2 bushels of corn. Except that corn won’t improve your portfolio’s returns.

Today’s letter will cover several topics, including:

- Houston, You Have a Problem

- Saudi’s Get Slammed

- Russian Commie’s

- Chart of the Week

With that, I give you this week's letter:

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member