In the short transition week of 2014 into 2015, stocks slipped a bit. We didn't trade much and held on to mostly cash. On Monday, SPX pushed higher and topped 2090. But, the Dow was already showing weakness. The rest of the week was marked by slight and gradual descend, until some buying on Friday's afternoon that went into the close.

For the week, the Dow was down 220.72 points; SPX fell 30.57 points; Nasdaq dropped 30.99 points. Oil slipped further, closing just below $53/barrel. Gold went slightly down, trading around $1185/ounce. At the time of this writing, Asian markets were mixed. Let's see where the US markets stood after Friday's close:

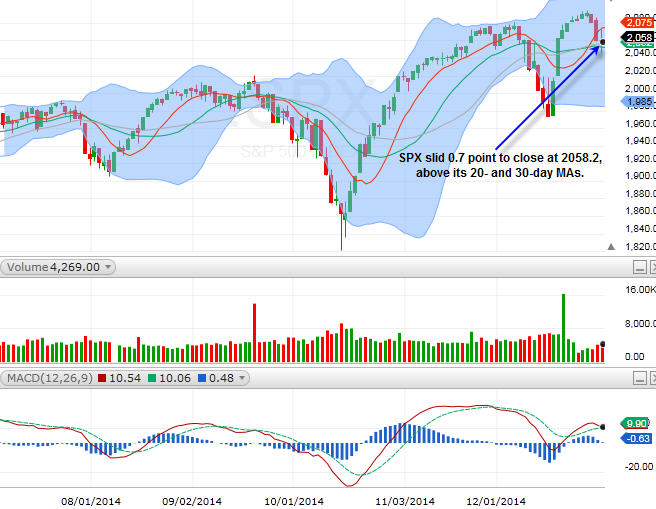

SPX

On Friday, SPX slid 0.7 point to close at 2058.2, above its 20- and 30-day MAs.

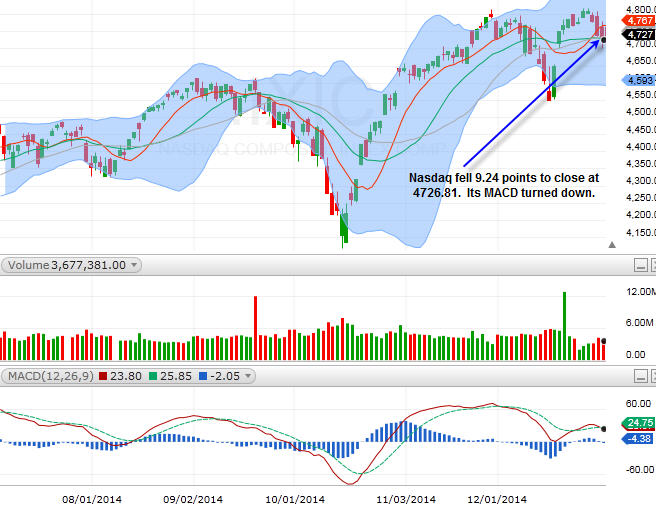

Nasdaq

Nasdaq fell 9.24 points to close at 4726.81. Its MACD turned down.

Both SPX and Nasdaq retreated to test their respective daily MAs, and both seemed to find some support at the end of last week. For the new week, SPX has resistance above 2080 and support between 2050 and 2040. However, if 2040 does not hold, we could see a deeper pullback to test 2020. Market seems to be consolidating as shown by most major sectors. So, we may be in a range-bound environment.

Sector Watch

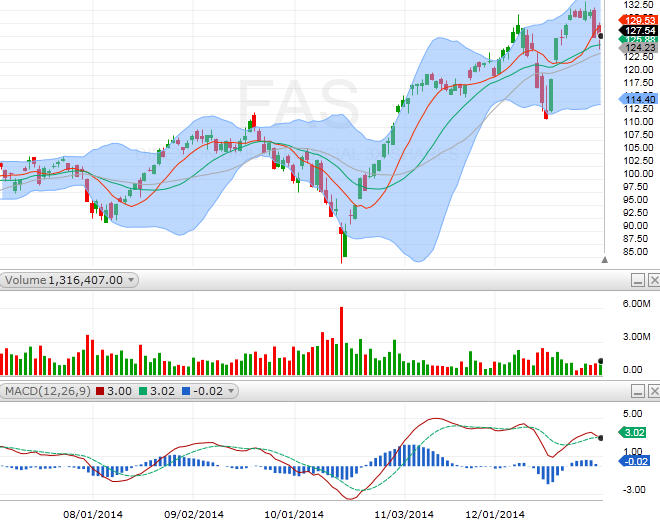

FAS (financial)

FAS also came down last week, but, managed to close just below its 10-day MA. There should be some support here, but, things do look precarious. Big banks (GS, WFC, JPM, BAC) all show similar developments. V still strong; but, MA faltered a bit.

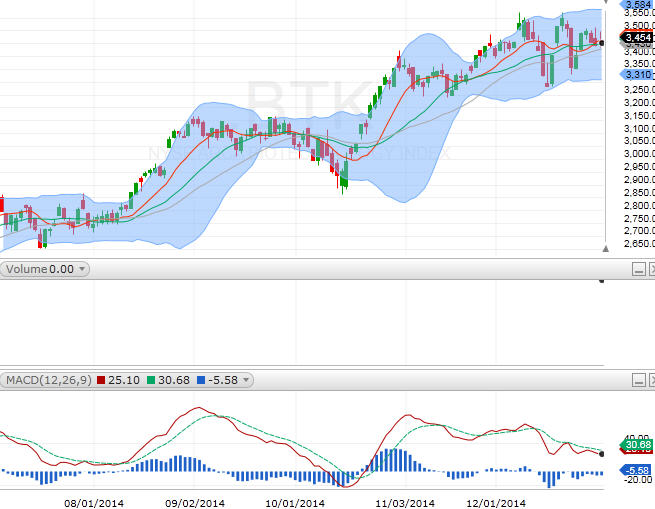

BTK (biotech)

Biotech has been consolidating for a month. This is getting interesting. The daily MAs are pinching together. However, the Bollinger Bands are still wide. But, soon, probably in the next couple of weeks, we should see bigger movements in this sector. Some popular stocks in this sector are: GILD, AMGN, CELG, BIIB, JAZZ, CLVS, ILMN. VRTX and GEVA still seem to be breaking higher.

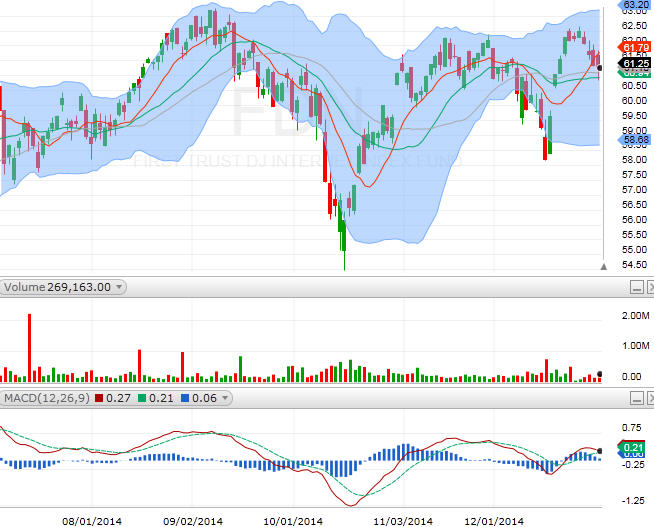

FDN (internet)

FDN seems to be back into neutral gear. Big names such as GOOG, PCLN, AMZN, NFLX, and FB are all consolidating. YELP, however, has just turned bullish.

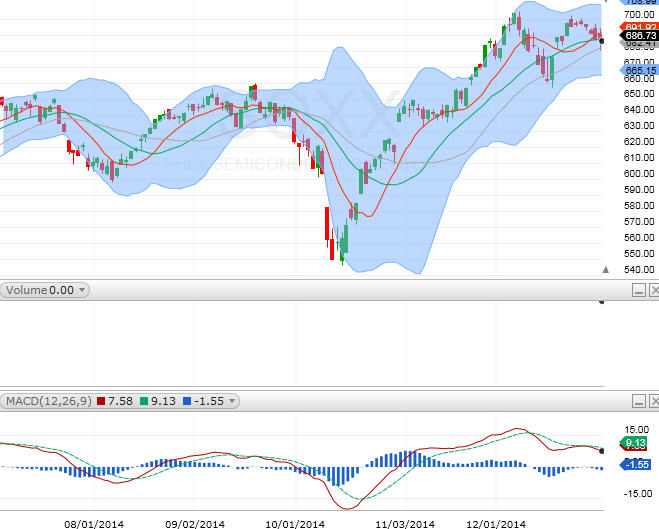

SOXX (semiconductor)

SOXX came down last week. It is also consolidating. BRCM, XLNX, ASML are all consolidating. ALTR and XLNX are a bit weaker.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member