Last weekend, in my Market Forecast, I was very cautious about the market. On Monday and Tuesday, stocks took a nosedive, sending SPX down to test the 2000 mark. But, on Wednesday and Thursday, things bounced back up. On Wednesday night, I wrote another article, cautioning that the selling may not be over. Indeed, on Friday, market was weak again and SPX fell back to just below 2045, the resistance area that I discussed in last week's Market Forecast.

We traded last week's volatility pretty well. Here are the closed trades:

| RL Jan 17 2015 Put 175.0 | 10.0 | $2.45 | $325.00 | 15.29% | 01/09/2015 |

| CLVS Jan 17 2015 Call 55.0 | 5.0 | $4.35 | $175.00 | 8.75% | 01/09/2015 |

| BIDU Jan 17 2015 Call 225.0 | 5.0 | $7.375 | $1,175.00 | 46.77% | 01/08/2015 |

| TSLA Jan 17 2015 Put 205.0 | 5.0 | $3.275 | $-1,912.50 | -53.87% | 01/08/2015 |

| BIDU Jan 17 2015 Call 225.0 | 5.0 | $6.625 | $800.00 | 31.84% | 01/08/2015 |

| CLVS Jan 17 2015 Call 55.0 | 5.0 | $4.35 | $175.00 | 8.75% | 01/07/2015 |

| TSLA Jan 17 2015 Put 205.0 | 5.0 | $4.125 | $-1,487.50 | -41.90% | 01/06/2015 |

| FSLR Jan 17 2015 Call 45.0 | 10.0 | $0.335 | $-1,325.00 | -79.82% | 01/06/2015 |

| GMCR Jan 17 2015 Put 130.0 | 10.0 | $4.60 | $1,425.00 | 44.88% | 01/06/2015 |

| GOOG Jan 17 2015 Put 520.0 | 5.0 | $11.20 | $350.00 | 6.67% | 01/05/2015 |

| AMGN Jan 17 2015 Put 160.0 | 10.0 | $5.40 | $1,950.00 | 56.52% | 01/05/2015 |

| BITA Jan 17 2015 Call 75.0 | 10.0 | $5.25 | $950.00 | 22.09% | 01/05/2015 |

We got out of BITA calls a few days early. AMGN puts gave us a nice +56.5% return. GMCR puts rendered a solid gain. BIDU calls also worked well.

For the week, the Dow was down 95.62 points; SPX lost 13.39 points; Nasdaq fell 22.74 points. Gold had a good week, rising to about $1220/ounce. Oil fell again, with WTI trading just above $48/barrel. At the time of this writing, Asian markets were mixed. Let's take a closer look at the US markets:

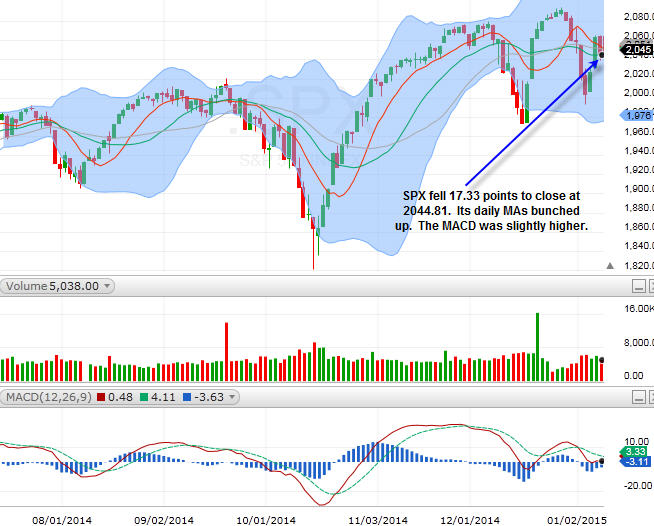

SPX

SPX fell 17.33 points to close at 244.81. Its daily MAs bunched up. The MACD was slightly higher.

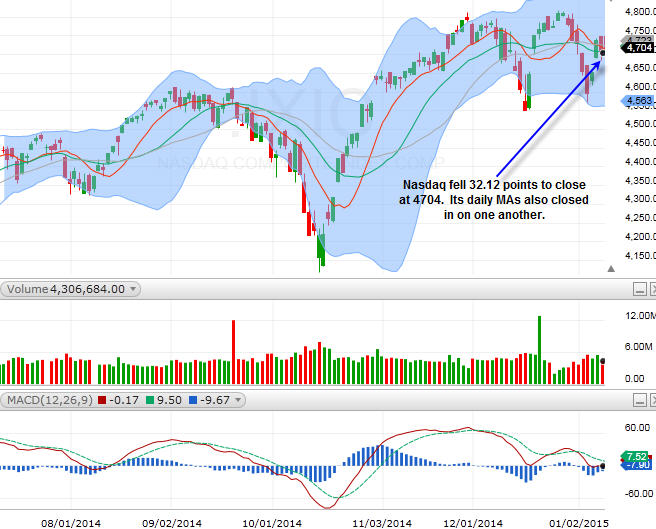

Nasdaq

Nasdaq fell 32.12 points to close at 4704.06. Its daily MAs also closed in on one another.

Both SPX and Nasdaq closed at where their respective daily MAs seemed to be converging. Their respective MACDs were still in the bearish area, although they were flattening. For the new week, earnings season will commence. As usual, AA will lead things of after the market on Monday. On Tuesday, after the market, CSX will report (watch CP, KSU, and UNP ahead of the report). WFC and JPM's earnings come on Wednesday before the market opens. Thursday morning will bring reports from C, BAC, BLK, and PPG; we should pay attention to TSM as well. These are followed by INTC and SLB in the afternoon. GS, PNC and STI will continue on Friday morning.

It's going to be a busy week! We will definitely get a feel from the financials, which could drive the broader market one way or the other. We have support at SPX 2000 and resistance at 2080.

Sector Watch

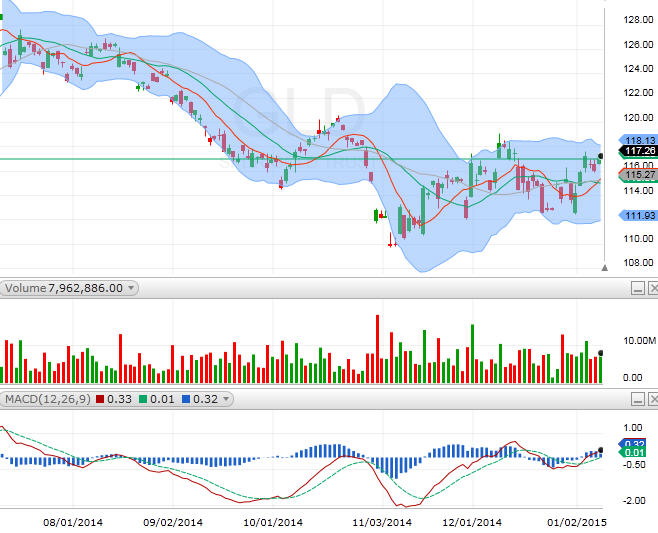

GLD (gold)

GLD got a good pop this past week, closing just above the resistance at $117. GLD could be setting up for a breakout. I think we can see a quick test to $120.

XLE (energy)

XLE is desperately trying to establish a bottom. This could still go either way.

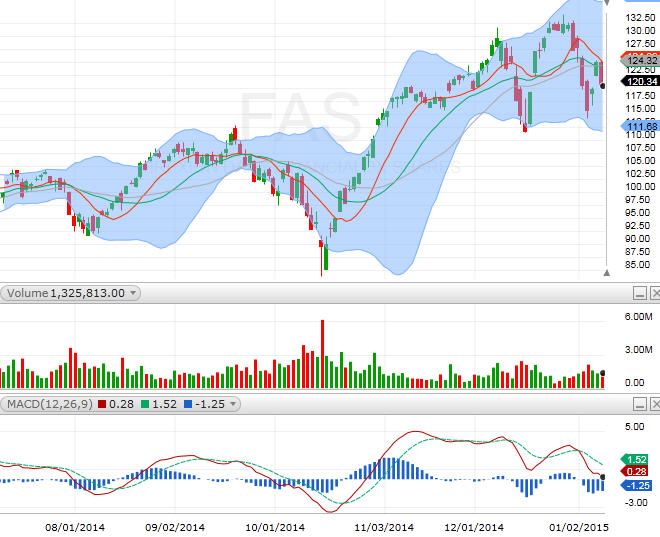

FAS (financial)

FAS fell on Friday and closed below its daily MAs. It has a pretty wide trading range now ($110-$132). We will hear from most of the the big banks in the coming week.

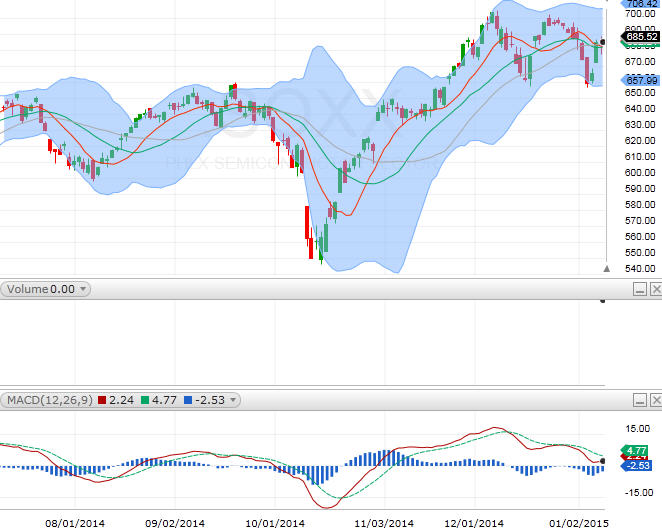

SOXX (semiconductor)

Reports from TSM and INTC will give us a pretty glimpse on the semiconductors. SOXX has been consolidating for a month now and it closed last week at a neutral position. We'll have to wait and see what happens, but, with a long climb from mid-October to now a flattening top, things could be at best range-bound.

We are trading small and keeping lots of cash. Let's be patient and see what this first week of earnings will bring.

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member