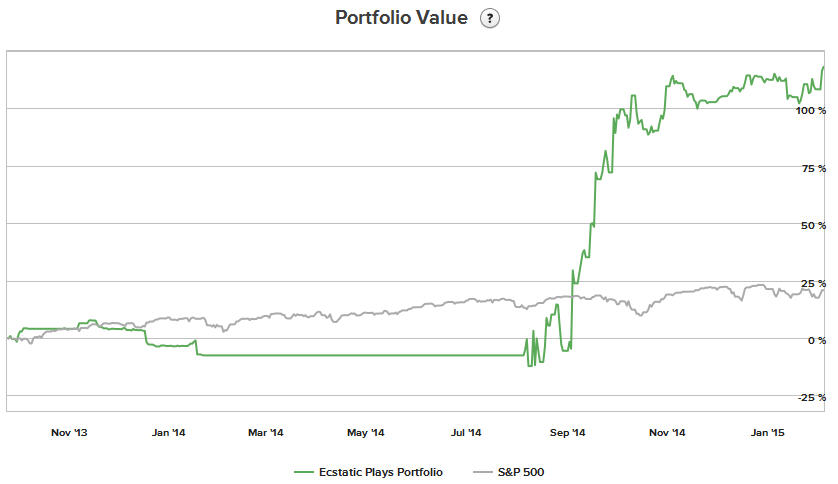

This market has been really volatile, and, we have been finding winners on both sides! Today, my Ecstatic Plays portfolio reached a new all-time high, up +136% in the past 365 days:

If this was a chart for a stock, today would be a "breakout BUY" signal! To find out more, please visit my product page by CLICKING HERE!

There certainly have been big movers on both sides.

NFLX has been pushing higher after its recent earnings. Today it came down $8, and we caught a quick play on the puts.

WYNN reported earnings last night and missed its estimates. Its stock dropped $9.69 today. CMG reported solid earnings, but, still weren't enough to keep investors in its stock, which fell 7% to $676. CMG traded as low as $667 today. I don't think you can buy this dip right now. I'd wait for it to test $650. RL also took a beating, down a whopping 18%, as the company cut its outlook. GILD was another big loser today, down more than 8%, as the company placed a discount on its hepatitis C drug. We hung on to our puts on GILD and sold them this morning. Disney (DIS) reported a blowout quarter, as its blockbuster film "Frozen" helped its consumer products unit earn a $626 million profit, up 46 percent from a year earlier. DIS stock soared over +7% today!

After the market, DATA popped more than +14%, as the company delivered a strong quarter and forecast. GMCR tumbled more than $9 after reporting a disappointing quarter and outlook.

The market hugged the flat line for most of the day today. But, in the last 30 minutes, it took a sharp dive, as ECB said that it would no longer take Greek government debt as collateral for loans. SPX ended down 8.52 points at 2041.51. On the other hand, biotechs have been falling for 3 days. If biotechs continue to fall, it could spell more trouble for the broader market (please see my article on "Watching Biotechs").

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member