If you follow news or internet memes this was probably a very busy week for you. If you follow price it was a snoozefest. And that's just fine by me, I like my sleep.

As a trend follower, if you have your risk down to the sleeping point and you let your winners run, having nothing to do is usually good news for your P&L. As a result, this is probably going to be one of my shortest weekly updates in some time. Sometimes there genuinely isn't much to say, and there's nothing to do. Recognizing that can serve you well in my experience, so embrace it.

The market appears to be doing some backing and filling in what so far looks like a modest consolidation of the healthy gains that made February such a strong month, with a 5.5% gain for the S&P.

If you have an eye on global markets you will have noticed the theme I've talked about for several weeks now continues, that of European markets ramping higher while we worry about one of their own.

The $DAX rallied every day this week, extending its run to eight straight days, and seven straight weeks at new all time highs. I'm showing it here on a relative basis to the $SPX.

.

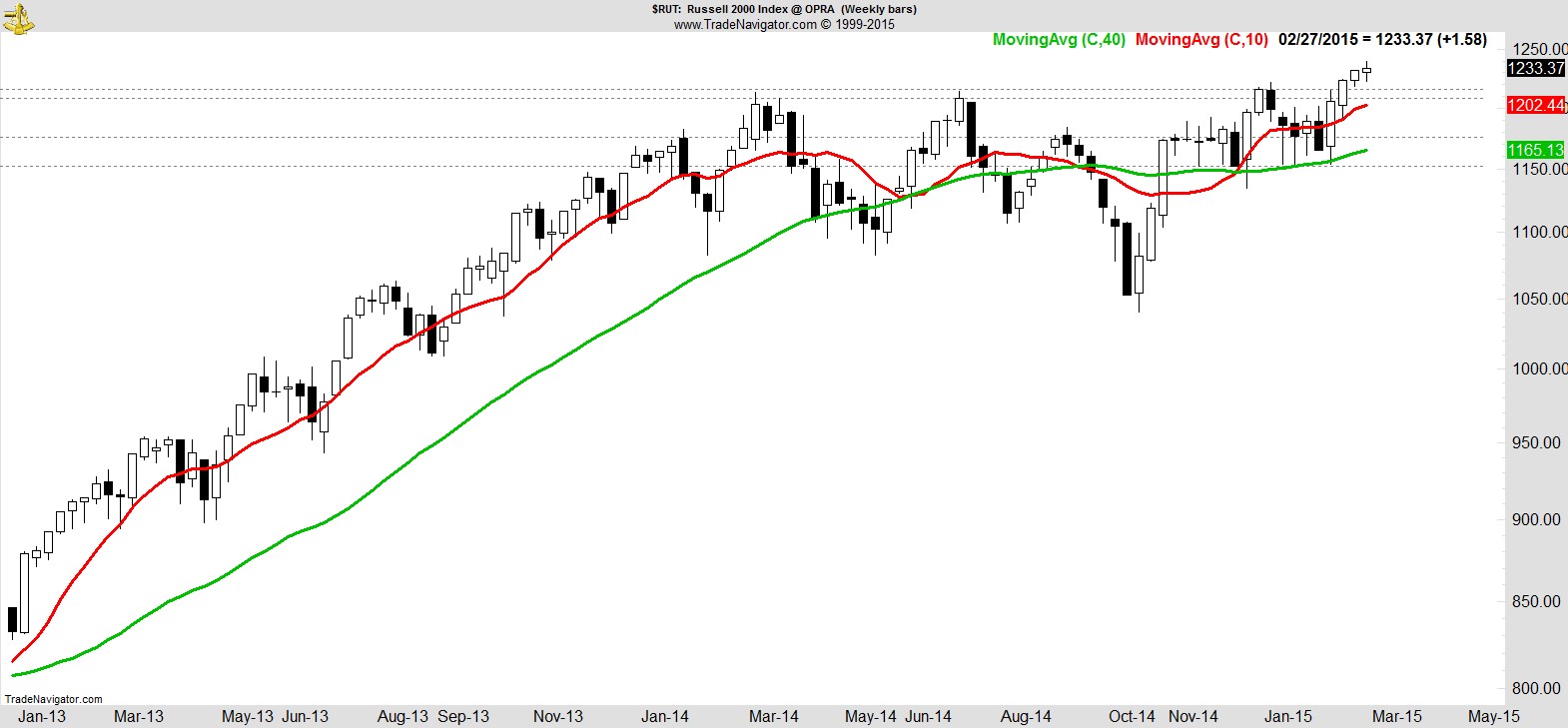

The other continuing theme is the relative outperformance of small caps, shown here via the $RUT, making new highs while other areas of the market stalled this week.

.

Our Marketfy portfolio performed well this week gaining over 2% to finish off a huge month with an 8.5% climb in February and is now +7.4% YTD vs +2.2% for the S&P.

Friday's late sell-off did trigger one exit signal, our first in the portfolio for a month, but the vast majority of our names remain at or just below their highs. It's the same story with our additional trade ideas.

Similar to our portfolio and trade idea names, our watchlist continues to be dominated by consumer discretionary, technology, and healthcare, but it's noticeable to me their number and quality has deteriorated this week. Not by a significant degree, but enough that the open slot in our portfolio might not be filled straight away.

Here's a sample of just 8 names:-

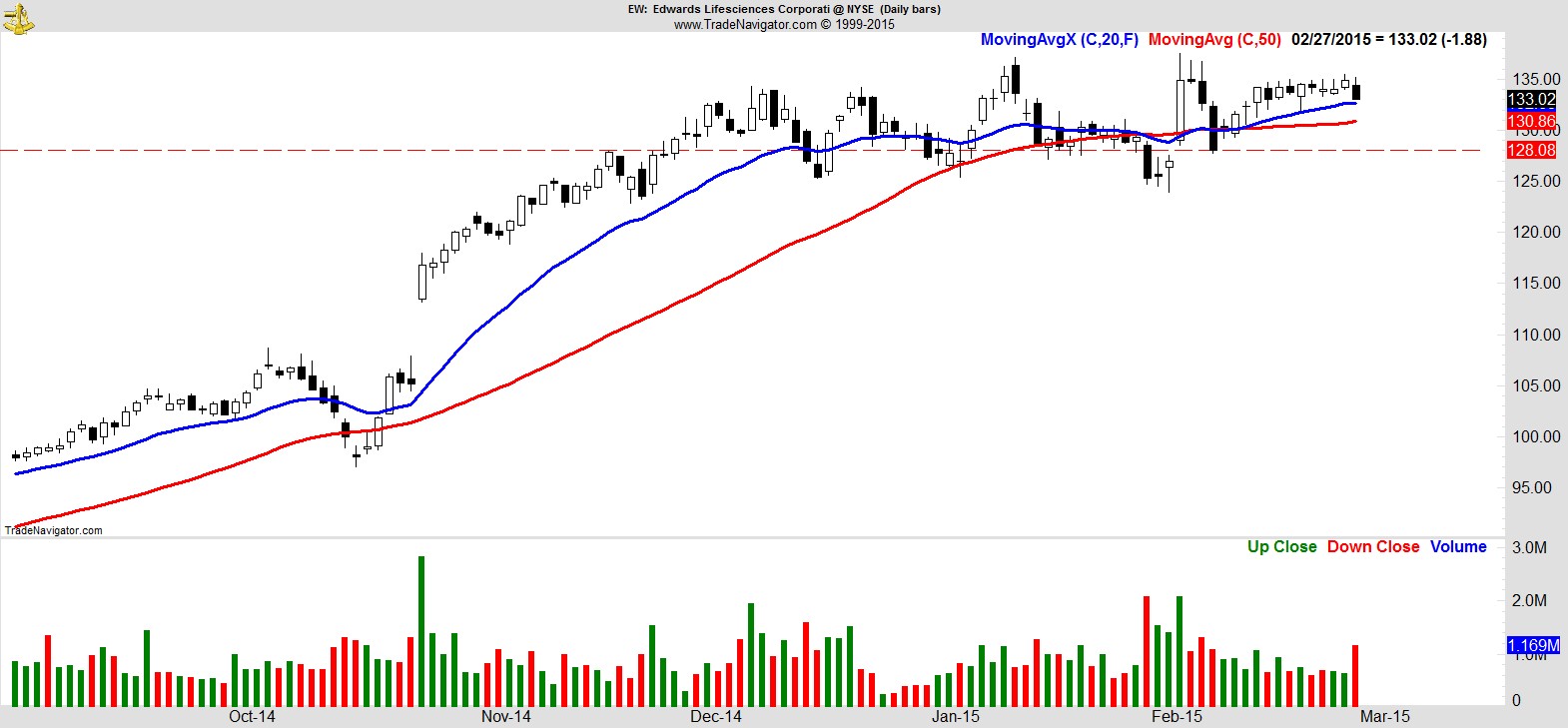

$EW

.

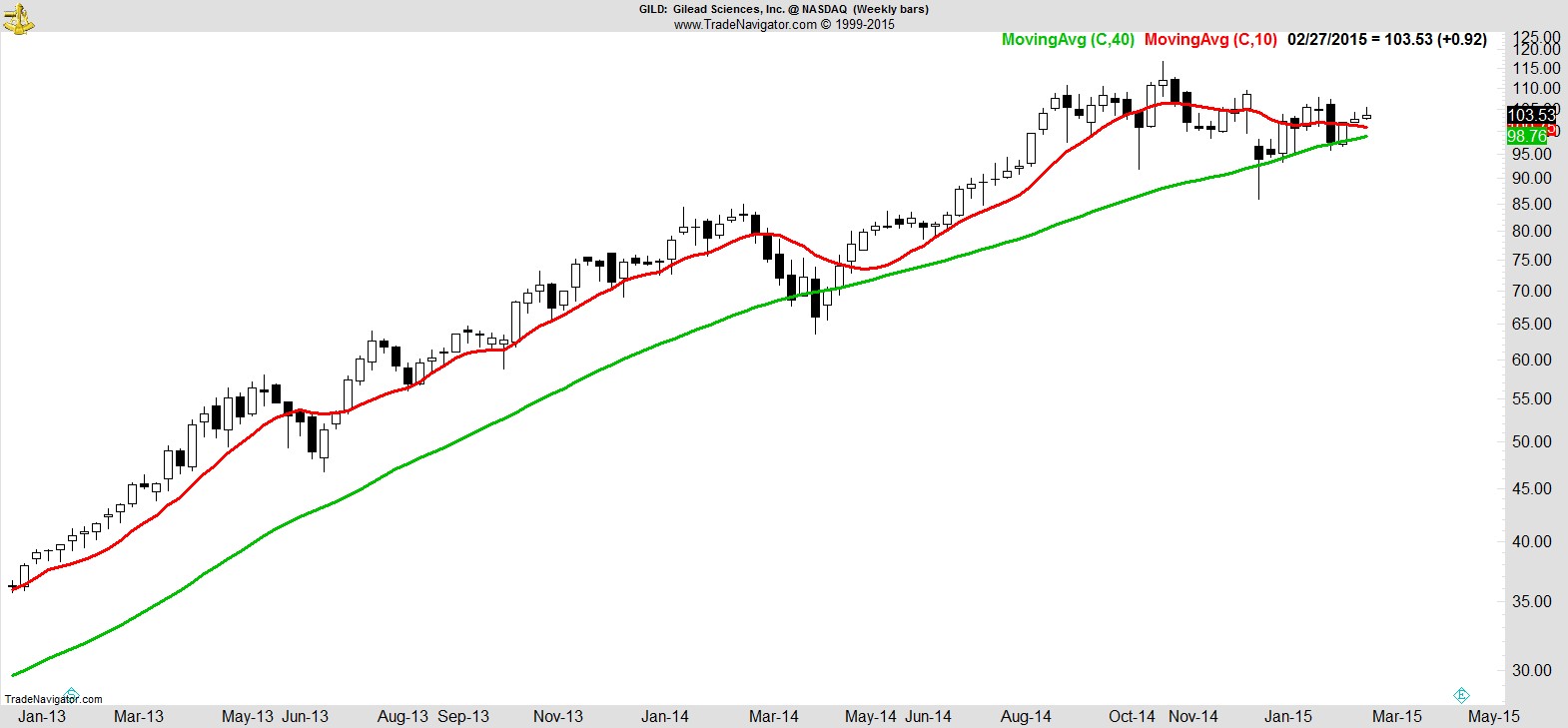

$GILD

.

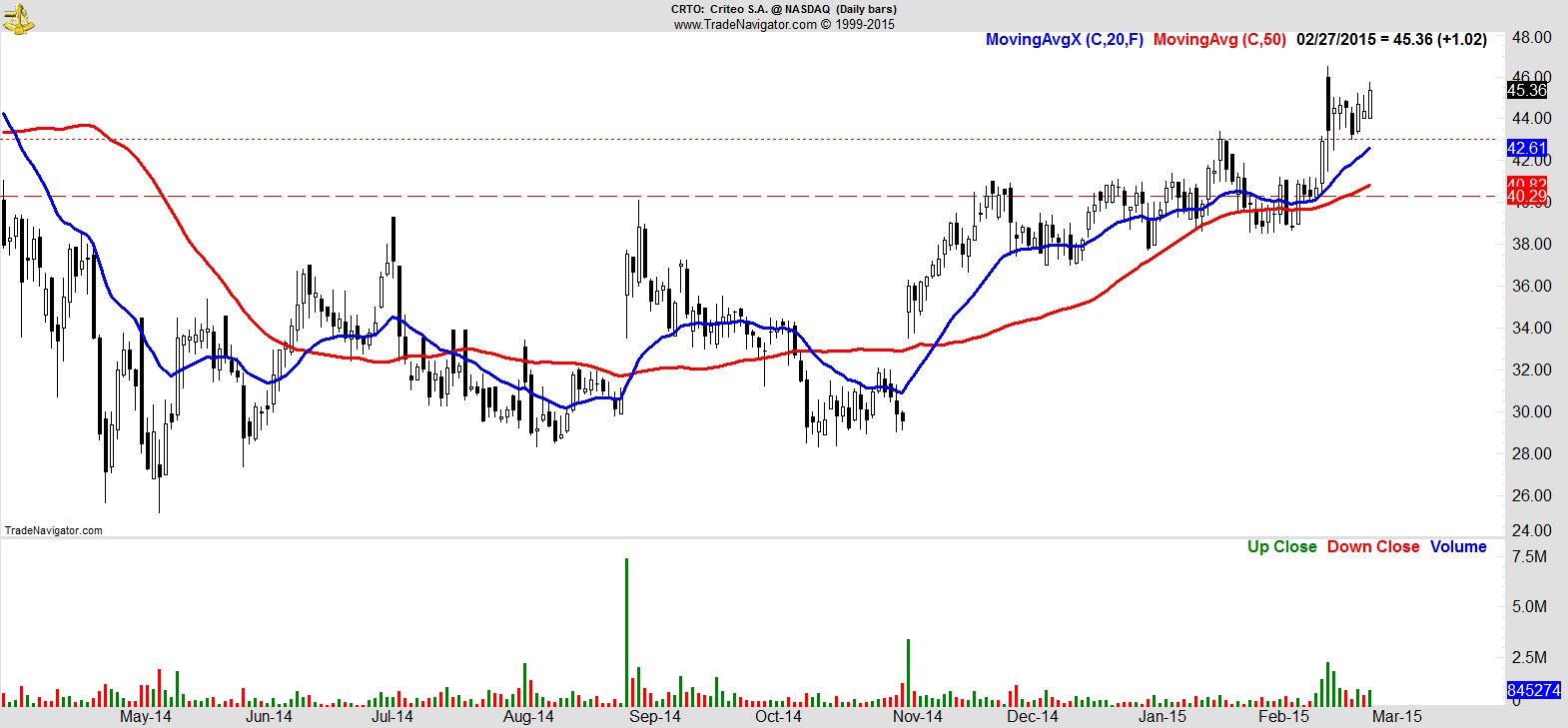

$CRTO

.

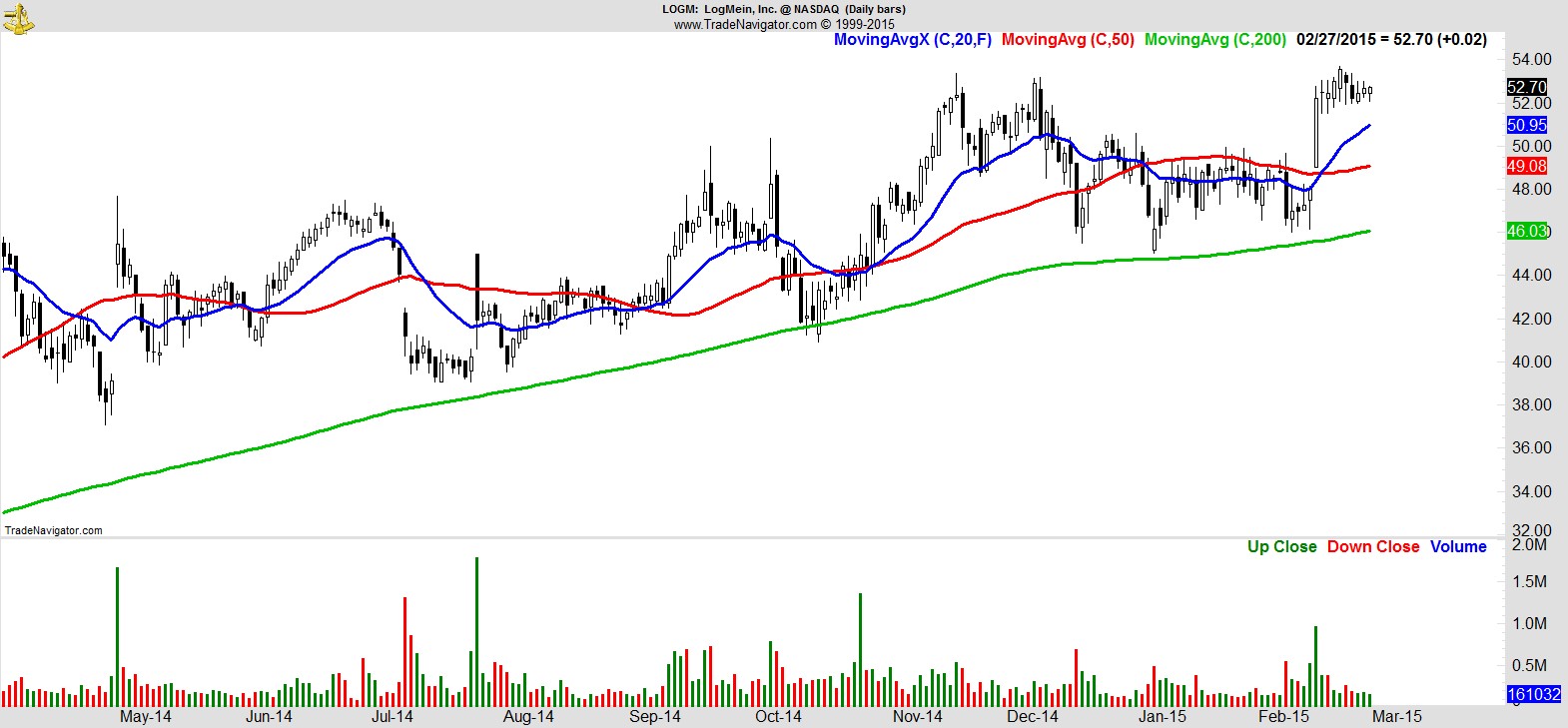

$LOGM

.

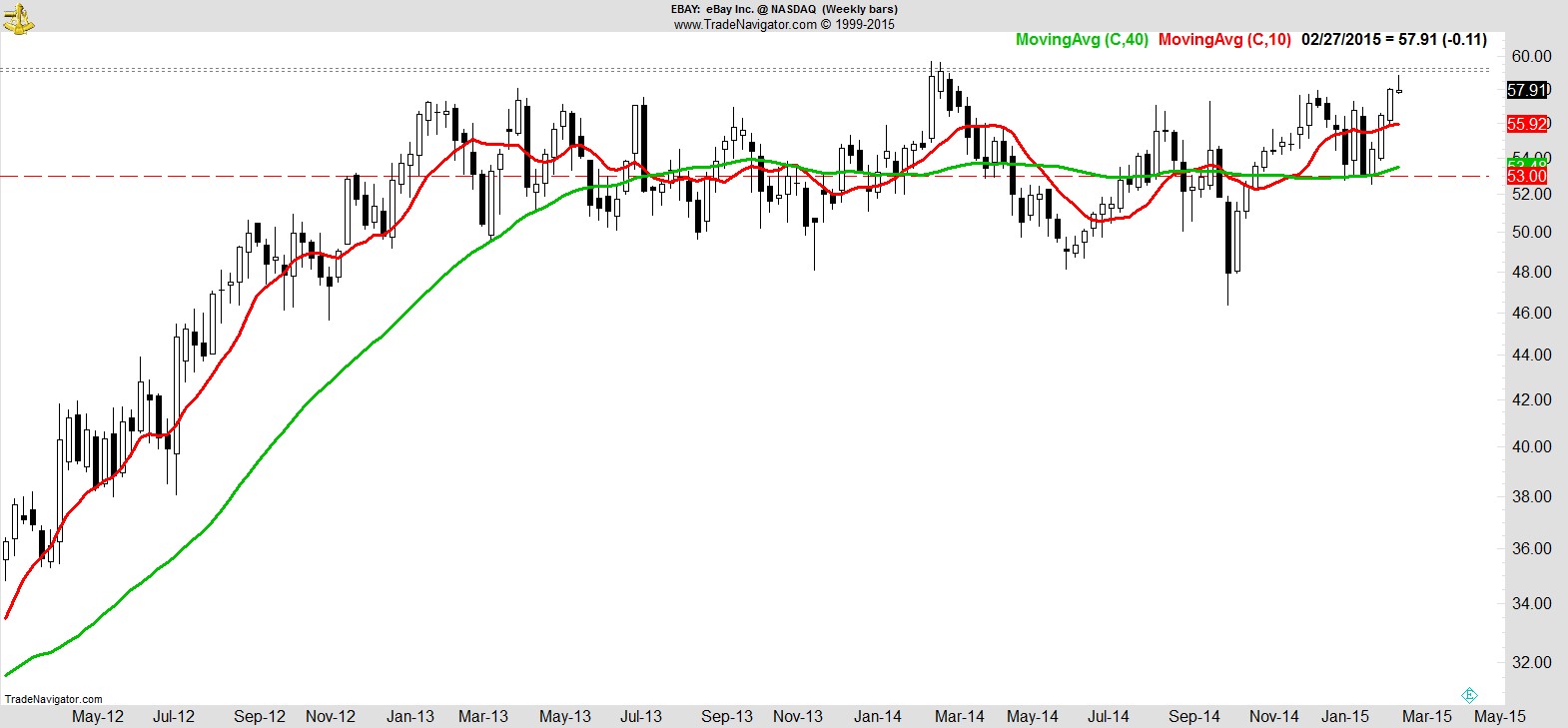

$EBAY

.

$NKE

.

$JWN

.

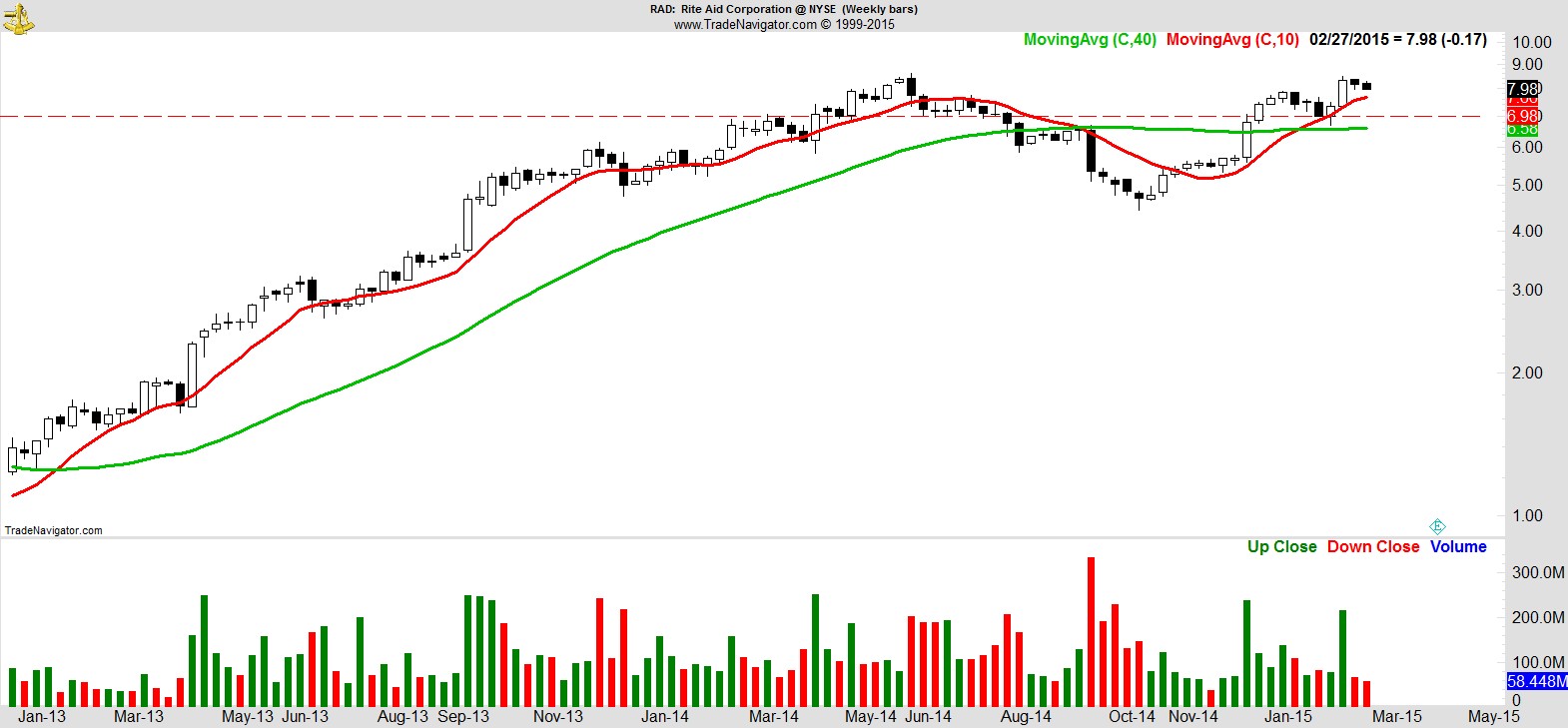

$RAD

.

Recent free content from Jon Boorman

-

Weekend Review and Watchlist

— 9/30/17

Weekend Review and Watchlist

— 9/30/17

-

Weekend Review and Watchlist

— 9/22/17

Weekend Review and Watchlist

— 9/22/17

-

Weekend Review and Watchlist

— 9/17/17

Weekend Review and Watchlist

— 9/17/17

-

Weekend Review and Watchlist

— 9/10/17

Weekend Review and Watchlist

— 9/10/17

-

Weekend Review and Watchlist

— 9/02/17

Weekend Review and Watchlist

— 9/02/17