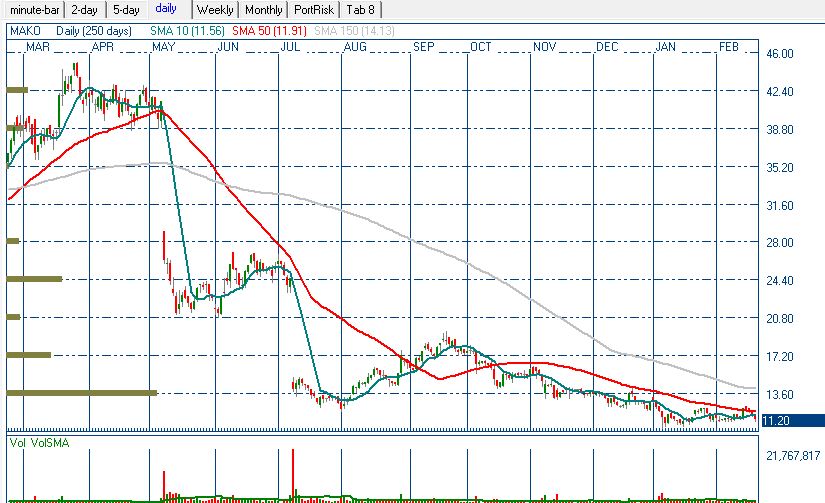

This isn't too different from the set-up we had on 2/1, a trade we exited profitably on 2/15 though short of our target. We are buying at 11.20 with a target of 12.99 and a stop-loss of 10.88, with an expiration of two weeks (3/7). This is 5.6X reward-to-risk. You can refer back to the posting from before for some more background. Here are some updated charts:

Nice bounce off of 11! To the left, you see the large volume distribution near 11.15, and the trade is above that very near-term support.

The target technically may as well be set at 13.50 and not 12.99, but let's be conservative. Again, one of the technical factors driving my long bias here is the fact that the 10dma has been below the 50dma since mid-October. As a reminder, I think that this heavily shorted-stock could double over the next year - my target is 22.50 currently. From a technical perspective, this would be a 1/3 retracement roughly from the all-time high set last March.

Recent free content from Cannabis Analyst

-

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

Trading Takeover Candidates for Big Gains [Webinar 9/9/2013]

— 9/09/13

-

Long Trade 08/14/13

— 8/14/13

Long Trade 08/14/13

— 8/14/13

-

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

3 Earnings Season Disasters and How to Trade Them (webinar 7/29/2013)

— 7/29/13

-

Short Trade 07/03/13

— 7/03/13

Short Trade 07/03/13

— 7/03/13

-

Webinar Slides

— 6/21/13

Webinar Slides

— 6/21/13

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member