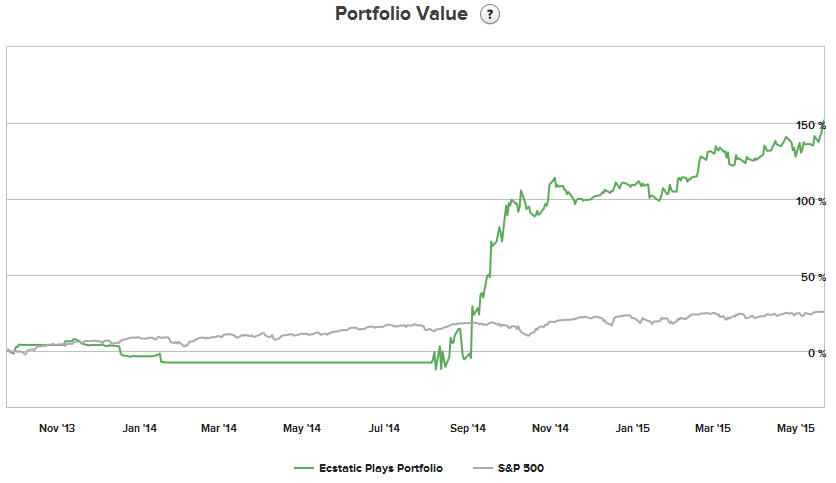

The broader market held its ground last week, still ending in record territory. We traded well and my Ecstatic Plays Portfolio's value continued to increase.

Marketfy is having a $10 for the 1st month coupon for this year's Memorial Day. The coupon code is "Memorial2015". Please click here to check out my services and see which one is right for you. To take this advantage and try out my Ecstatic Plays for only $10 over the next 30 days, please click here!

We had a lot of nice plays last week. Our YOKU and NFLX calls were among the top gainers. Here are the closed trades for the week:

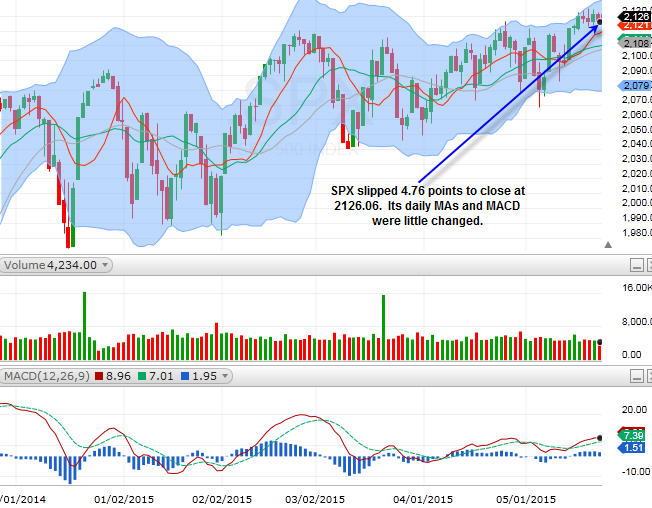

SPX

Nasdaq

Nasdaq slid 1.43 points to close at 5089.36. Its daily MAs and MACD were a little higher.

The broader market seems to be stuttering again, attempting to find a direction. But, still, there is no lack of nice movements as the market is teeming with mergers and acquisitions. Today, financial pages are filled with reports that CHTR is ready to close a $55 billion deal to buy TWC! For the new week, Greece/EU is still troubling European markets. However, the booming markets in Asia could balance out the sentiment globally. We will be watching financials to see how they react. Surprisingly GS broke out higher on Friday! Energy stocks will also be important. If they at least hold their grounds, the broader market should be fine. Tech stocks could continue to draw buyers as M&A activities heat up.

We might see some weakness in the broader market to start the week. We will have to see if sideline buyers are ready to jump in once again. SPX has support between 2120 and 2100. If SPX breaks above 2130 again, watch out bears!

Sector Watch

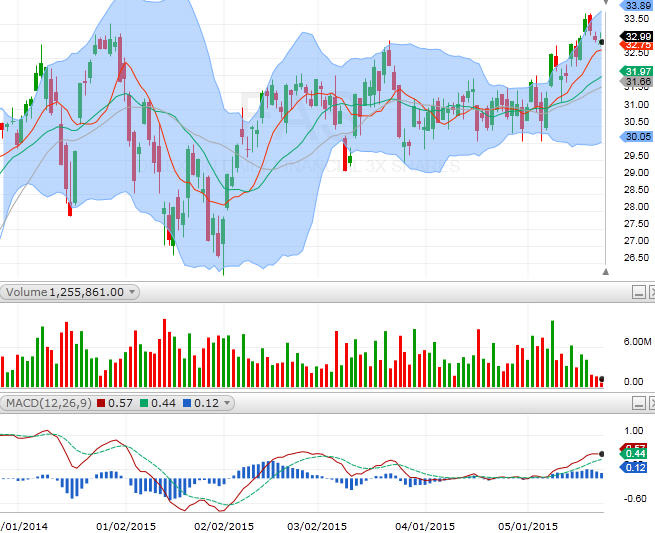

FAS (financial)

FAS started last week strongly, but, pulled back to end the week. Still, it closed above its daily MAs. As mentioned above, GS pushed higher on Friday. MA and V are neutral. WFC, JPM, and BAC all look healthy.

XLE (energy)

XLE is still quite weak, even though oil has bounced. XOM and CVX are both bearish. APC, OXY, and APA are attempting make a bounce. EOG is still on the weak side.

FDN (internet)

SOXX (semiconductor)

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member