Markets enjoyed solid gains last week. Thanks to strong earnings from AMZN, GOOG/GOOGL, and MSFT, which inspired a rally on Friday. The market started out undecided, as stocks traded in a narrow range on Monday and Tuesday. On Wednesday, a quick drop in the afternoon shook out weak holders. Buyers returned strongly on Thursday, ahead of the earnings reports of the three tech giants. After market on Thursday, all three stocks jumped after their earnings were reported with AMZN and GOOG/GOOGL up more than +10%! Ironically, at the close on Friday, it was MSFT that held a +10% gain. Both AMZN and GOOG trailed off after the opening pop. But, still, AMZN closed up +6.23% and GOOG was up +7.7%.

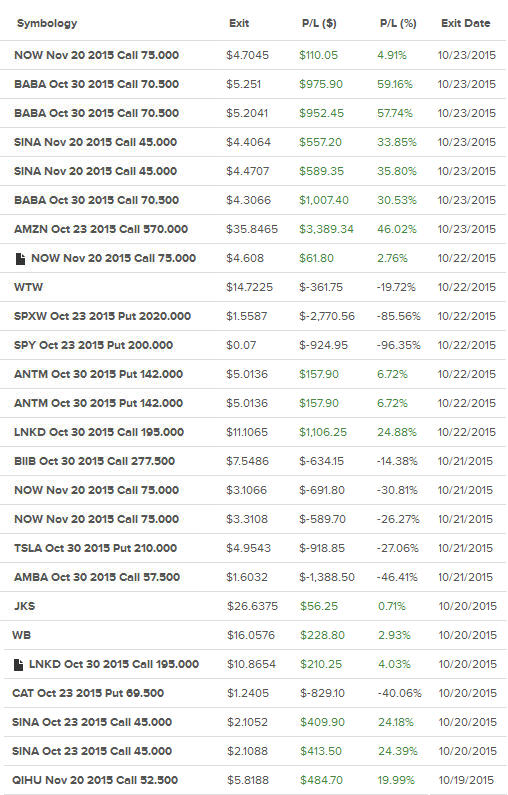

We caught Friday's rally with AMZN calls and BABA calls, which gave us profits as high as +59% overnight! Here are the closed trades for the week:

To subscribe or to find out more about this product, please CLICK HERE. Come see what Ecstatic Plays offers and what we are trading next!

For the week, the Dow was up 430.73 points; SPX added +42.04 points; Nasdaq gained +145.17 points. Gold slid, but, keeping above the $1160/ounce mark. Oil fell back to below $45/ barrel (WTI). Here's how the US markets looked after Friday's close:

SPX

On Friday, SPX added +22.64 points to close at 2075.15. Its daily MAs and MACD went up.

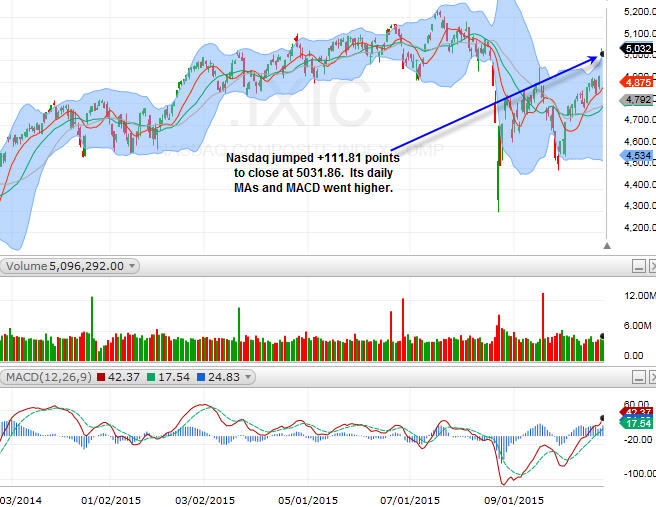

Nasdaq

Nasdaq jumped +111.81 points to close at 5031.86. Its daily MAs and MACD went higher.

With Nasdaq popped +2.27% on Friday, it has now caught up with SPX and the Dow. Small caps (Russell 2000), however, are still lagging. For the new week, earnings continue to pile in:

Monday: (AM) CYOU, SOHU, CHKP; (PM) BRCM, CAKE

Tuesday: (AM) BABA, UPS, CMCSA; (PM) AAPL, TWTR, GILD, VDSI, AKAM

Wednesday: (AM) VLO, LVLT, SNCR, GRMN, NOV, HES; (PM) GPRO, NXPI, YELP, AMGN, BWLD, CRUS, FFIV, SPWR, VRTX, ATML, EQIX

Thursday: (AM) MA, AET, ALXN, SHW; (PM) SBUX, BMRN, FSLR, OUTR, DECK

Friday: (AM) XOM, CVX, STX, PSX

Financials rallied with the broader market on Friday, which was impressive. Energies now look neutral. Biotechs seem to be turning the corner. But, retails are weak.

SPX has resistance from 2080 to 2100, while support between 2050 and 2040. Monday may be a shaky start, as the market has jumped quite far in just two days.

Sector Watch

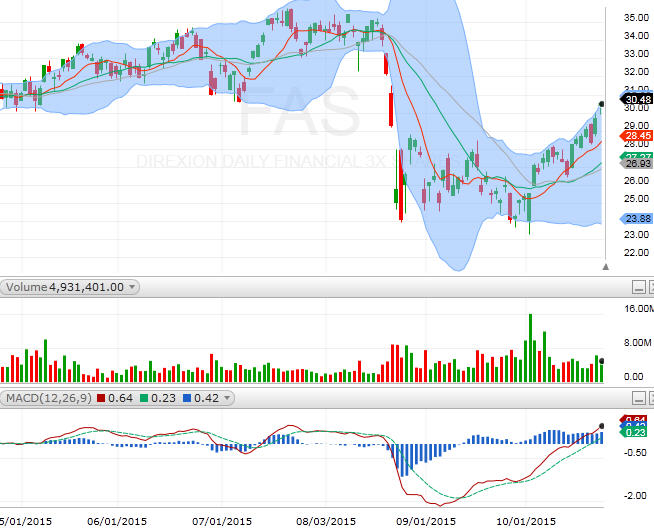

FAS (financial)

FAS propelled upwards last week, led by WFC, JPM, and BAC, Small banks also rallied (PNC, STI). MA reports on Thursday morning.

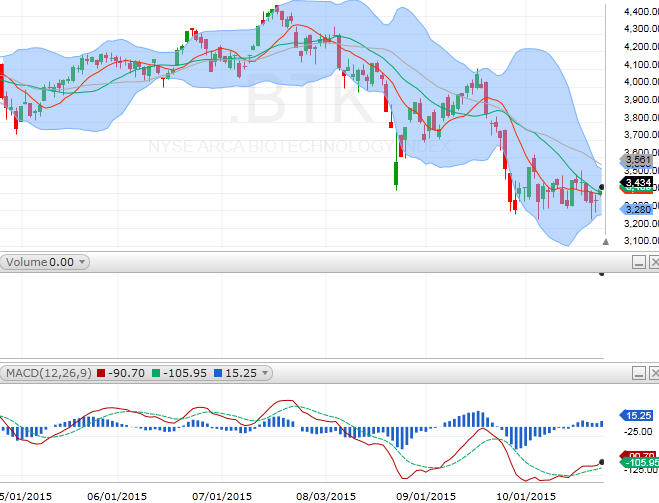

BTK (biotech)

BTK managed to close above its 20-day MA. VRX's quick drop gave the sector another good pullback, testing the bottoms. Although it looks like the sector may be stabilizing, I think investors will be much more careful here. GILD reports on Tuesday afternoon, followed by AMGN on Wednesday afternoon.

XLE (energy)

XLE has been consolidating for a couple of weeks now. Wtih XOM and CVX reporting on Friday morning, this sector may finally decide whether it has found a bottom or not this week.

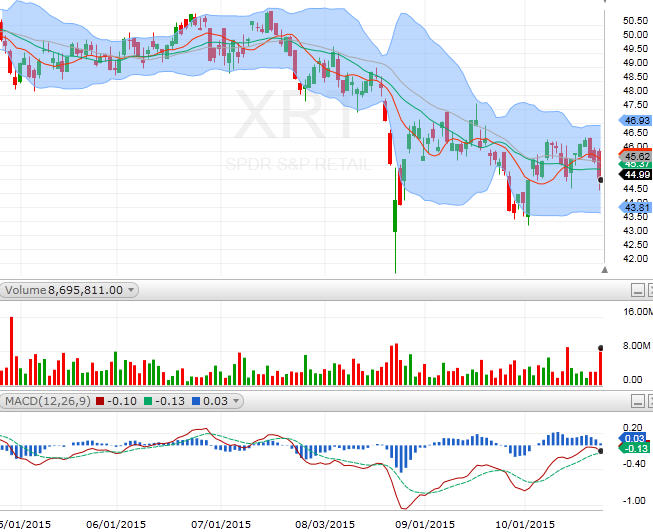

XRT (retail)

XRT is looking weak, especially with the broader market rallying. SKX dropped a whopping 31.5% on Friday, dragging the rest of the sector with it. WHR fell 8.7 %. LULU tumbled 7.34%. DECK fell 6.71%. DECK reports on Thursday afternoon, which could plummet again!

Lots of opportunities this week. Stay tuned and ready!

Good night and HappyTrading! ™

Recent free content from Andy Wang

-

Still No Global Warming?

— 8/01/22

Still No Global Warming?

— 8/01/22

-

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

SILVER Is Breaking Out! SLV, AGQ, GBTC, TLRY, GME, AMC, MRNA, BNTX, NVAX

— 2/01/21

-

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

Bitcoin Trades Above $18k Intraday; Market Is About To Sink

— 11/19/20

-

Bitcoin Is About To Breakout! GBTC

— 8/10/20

Bitcoin Is About To Breakout! GBTC

— 8/10/20

-

US Stock Market Futures Tumble!

— 1/20/16

US Stock Market Futures Tumble!

— 1/20/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member