Click Here for this Week's Letter

Greetings,

It’s tough to poke holes in the October jobs data. The +271k gain in non-farm payrolls appears to have sealed the deal for the first Fed rate hike in 9.5 years. The market is now pricing in a 70% chance of higher benchmark rates in December, but the real action is taking place further out on the yield curve. Since July 1, the spread between 10Y and 2Y US Treasury yields has dropped from 1.75% to 1.45%, currently. If the US economy is so healthy, why is the yield curve flattening? Because the US dollar looks like a wrecking ball destined to destroy global demand.

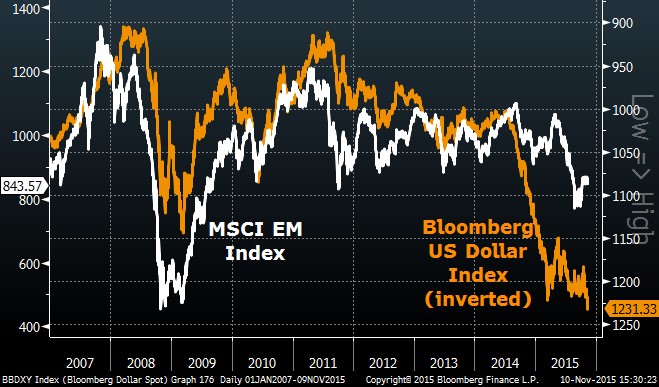

At 1.70%, the spread between 2Y rates in the US and Germany is the highest it’s been since 1989 – when the Berlin Wall came down. Rate differentials indicate EUR should re-test 1.05 against USD within the next month or two, which is a nightmare for China. The Chinese compete against Germany in the export market, and the weaker EUR gives a boost to Deutschland. The currency effect takes a few months to appear in economic data, but, even before this latest USD surge, Chinese exports were alarmingly weak at -6.9% Y/Y in October. Even though a stronger currency should boost consumption, Chinese imports were similarly disastrous at -18.8% Y/Y. The trade balance is improving, just for the wrong reasons.Dragged down by weak performances in China, emerging markets and Europe, the global economy is this year set to post its deepest US dollar recession since records began in the 1960s, according to the IMF. They project global GDP to be $73.5tn in 2015, down $3.8tn from last year. In percentage terms, this year is set to show a fall of -4.9% Y/Y, not quite as deep as the -5.3% contraction in 2009. Adjusting for purchasing power, which strips out the USD impact, the IMF forecasts global GDP to grow +3.1% Y/Y this year, although that’s down from their +3.5% forecast in April.

According to Factset, a blended rate of reported results and estimates shows third-quarter revenue for companies in the S&P 500 with less than 50% of sales in the US fell -13% Y/Y compared with a rise of about +1% for those with more than half of sales in the US. At the end of the day, in today’s globalized world it doesn’t matter that the US economy is strong if the rest of the world is in freefall. And a freefall is what we should expect if USD keeps rallying.

In her FOMC statement on September 17, Janet Yellen noted, “Developments since our July meeting—including the drop in equity prices, the further appreciation of the dollar, and a widening in risk spreads—have tightened overall financial conditions to some extent.” Since then, the stock market has improved but risk spreads remain wide and USD is plowing higher, which directly tightens monetary conditions for 35% of global GDP (US and China). Yellen needs to smother the December rate hike with dovish language, or risk watching the USD sink financial assets.

The Cup & Handle Fund is up around +4.0% YTD, and +11% Y/Y. We made some pretty substantial changes to the portfolio this week. Some relative value bets, and different expressions of existing themes. Still have a decent amount of cash to deploy, so we’re waiting patiently for some solid risk/reward opportunities. The November investor letter went out two weeks ago. If you’d like to start receiving these letters click here.

With that I give you this week's letter:

November 12, 2015

As always, if you have any questions or comments or just want to vent, please send me an email at mike@cup-handle.com.

Until next time, tread lightly out there,

Michael Lingenheld

Managing Editor – Cup & Handle Macro

Recent free content from Michael Lingenheld

-

The Finale - April 21, 2016

— 4/20/16

The Finale - April 21, 2016

— 4/20/16

-

The Spring Freeze - April 6, 2016

— 4/05/16

The Spring Freeze - April 6, 2016

— 4/05/16

-

Dependent on Friday's Data - March 30, 2016

— 3/29/16

Dependent on Friday's Data - March 30, 2016

— 3/29/16

-

Money For Less Than Nothing - March 23, 2016

— 3/22/16

Money For Less Than Nothing - March 23, 2016

— 3/22/16

-

Avoid the Crowds - March 16, 2016

— 3/15/16

Avoid the Crowds - March 16, 2016

— 3/15/16

-

{[comment.author.username]} {[comment.author.username]} — Marketfy Staff — Maven — Member